|

市場調查報告書

商品編碼

1851788

碳捕獲與儲存(CCS):市場佔有率分析、產業趨勢、統計和成長預測(2025-2030 年)Carbon Capture And Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

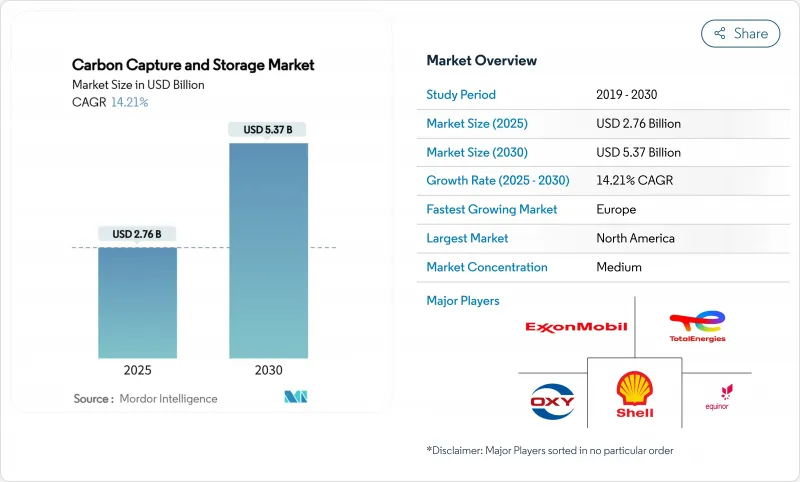

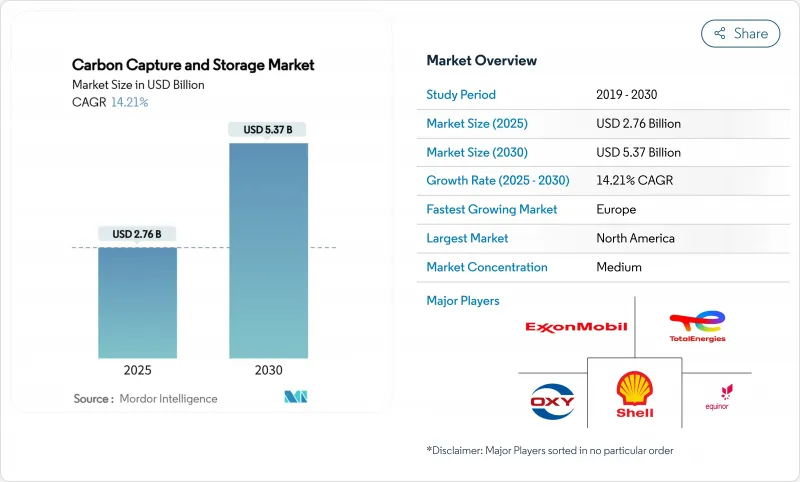

預計到 2025 年,碳捕獲與儲存(CCS) 市場規模為 27.6 億美元,到 2030 年將達到 53.7 億美元,預測期(2025-2030 年)複合年成長率為 14.21%。

監管壓力不斷加大、碳捕集技術日趨成熟,以及人們逐漸意識到重工業若不採取專門的減排措施就無法履行淨零排放義務,這些因素共同推動了碳捕集與封存(CCS)技術的擴張。各國政府正在收緊排放法規、擴大碳定價機制並增加稅收優惠,這些價格訊號將推動CCS技術從試點階段走向商業化部署。扶持性政策與技術成本下降的雙重作用也吸引了大型石油公司和工業集團等私人資本的湧入,他們將CCS視為應對未來碳排放責任的有效手段。然而,對於水泥、鋼鐵、化工和煉油等產業而言,CCS的替代方案寥寥無幾,使其成為一項結構性需求,而非過渡性選擇。

全球碳捕獲與儲存(CCS)市場趨勢與洞察

對二氧化碳驅油計劃的新需求

由於提高採收率(EOR)技術能夠創造雙重收入來源,因此重新受到關注:既能延長成熟儲存的產量,又能將捕獲的碳變現。在早期應用階段,大型石油公司正將枯竭的油田與化肥、鋼鐵和石化排放結合,將碳捕集點轉化為獲利資產。這種方法縮短了投資回收期,確保了固定客群,並加速了已擁有龐大管網地區的基礎建設。此外,它還能提供處理大量二氧化碳的實務經驗,隨著EOR需求的逐漸下降,為過渡到純粹的儲存計劃搭建橋樑。不斷成長的石油產量所帶來的收入可見性,有助於投資者證明分離和捕集裝置以及注入井所需的高額初始資本的合理性,從而平穩過渡到獨立的碳封存服務。

碳定價與排放權交易機制的擴大

碳市場如今已從總量管制與交易擴展到包括邊境調節和行業徵稅,這改變了出口到受監管地區的製造商的經濟考量。歐盟的碳邊境調節機制對進口的排放密集型商品實施影子價格,迫使外國生產商投資碳捕獲與封存(CCS)技術,以避免市場佔有率流失的風險。加州已將總量管制與交易延長至2030年,並收緊了排放分配,使CCS更多地成為一種規避合規成本的工具,而非企業社會責任策略。自願碳市場正在日趨成熟,已檢驗儲存噸位的二級貨幣化途徑仍在形成,儘管關於額外性的問題仍然存在。所有這些政策工具都提高了減排的最低價格,縮小了減排成本與市場獎勵之間的經濟差距。

碳捕集與封存(CCS)工廠的資本支出和營運成本都很高。

工業規模的碳捕集設施通常需要5億至8億美元的前期投資,在政策不確定性較高的情況下,股權定序十分困難。即使是像Carbon Clean公司的CycloneCC這樣將碳捕整合本降低至每噸30美元的創新溶劑系統,也尚未在商業規模上展現出規模經濟效益。能源罰款進一步加重了營業成本,使工廠基準效率降低15%至30%,迫使營運商購買額外電力或接受更低的產量。在開發中國家,儘管減排需求龐大,但由於優惠融資管道有限,排放捕集技術的普及速度放緩。因此,資本密集技術延長了投資回收期,並將早期採用者限制在能夠承擔風險的大型企業和國有企業。

細分市場分析

燃燒前捕集技術預計在2024年將佔據碳捕集與儲存(CCS)市場82.19%的佔有率,該技術與煉油廠和化工廠中已廣泛應用的蒸汽甲烷重整器和生質能氣化爐相契合。該領域擁有數十年的運行數據積累,且在待開發區項目中安裝成本較低,具有一定的優勢。然而,此製程會帶來20-25%的能源損耗,溶劑再生仍需大量資金投入。富氧燃燒燃燒技術預計到2030年將以18.51%的複合年成長率成長,這主要得益於像布雷維克水泥廠這樣的計劃,這些項目無需進行複雜的廢氣分離即可捕集製程廢氣。在純氧中燃燒燃料可產生近乎純淨的二氧化碳廢氣流,從而簡化下游壓縮。技術供應商正在推出適用於維修的模組化富氧燃燒裝置,而空氣分離技術的改進使其在與燃燒後捕集方案的競爭中更具優勢。由於重工業在尋求大幅削減成本的同時盡可能減少效率損失,預計富氧燃燒的市場佔有率將迅速擴大,對長期以來一直是碳捕獲和儲存(CCS) 市場領導者的燃燒前技術構成挑戰。

區域分析

北美在碳捕獲與儲存(CCS)市場佔據領先地位,預計2024年將佔51.24%的市場佔有率。北美為直接空氣捕獲(DAC)提供每噸85美元的45Q稅額扣抵,為點源捕獲提供每噸60美元的稅收抵免。美國墨西哥灣沿岸集中了眾多排放、輸油管和鹹水層,這為埃克森美孚提案1000億美元的休士頓航道網路等樞紐項目提供了支持。加拿大為該地區提供補充,對DAC設施提供60%的投資稅額扣抵,對其他捕獲系統提供50%的投資稅收抵免,這促進了合資企業的建立,例如斯特拉斯科納資源公司與加拿大成長基金之間價值20億美元的夥伴關係。墨西哥正將自身定位為跨國運輸合作夥伴,並探索在枯竭的近海油田中採用共用儲存解決方案。

預計在2025年至2030年間,歐洲將以26.64%的複合年成長率成為全球成長最快的地區,這主要得益於創新基金、歐盟排放交易體系(EU ETS)以及挪威開創性的「長船」(Longship)計劃。該計畫於2025年在奧羅拉(Aurora)啟動了二氧化碳注入。德國的碳捕獲與封存(CCS)法案草案將解除陸上儲存禁令,並釋放北德盆地的潛力;荷蘭正在推進波爾托斯(Porthos)樞紐項目,英國則在推廣海內特(HyNet)和蒂賽德(Teeside)叢集。跨境運輸協議日趨成熟,基礎設施共用將降低小型工業排放的單位成本。碳定價、邊境關稅和專案公共津貼相結合,將刺激私人投資,確保歐洲縮小與北美先驅的差距。

從長遠來看,亞太地區有望成為碳捕獲與封存(CCS)技術的最大推動力,這主要得益於中國2060年實現碳中和的承諾,以及2025年首個富氧水泥示範試驗的開展,該試驗證明了這項技術適用於該地區的加工工業。日本正與澳洲合作開發一條液化二氧化碳運輸路線,將重工業區與波拿巴盆地的海上儲存連接起來。印尼計劃在2030年建成15個CCS計劃,充分利用其豐富的深海含水層資源。然而,該地區目前面臨監管分散和融資管道不暢等問題,這可能會將CCS技術的全面推廣推遲到2030年後。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對二氧化碳驅油計劃的新需求

- 擴大碳定價體系與排放交易體系

- 加強國家淨零排放立法

- 擴大低碳合成燃料計劃規模

- 直接空氣捕獲 (DAC) 系統建造需要儲存空間

- 市場限制

- 碳捕集與封存(CCS)工廠的資本支出和營運成本都很高。

- 更便宜的可再生能源日益受到歡迎

- 民眾反對陸上二氧化碳管道

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 透過技術

- 初步燃燒

- 燃燒後回收

- 富氧燃料捕集

- 按最終用戶行業分類

- 石油和天然氣

- 煤電和生質能發電廠

- 鋼

- 水泥

- 化學品

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 挪威

- 荷蘭

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Air Liquide

- Aker Solutions

- Baker Hughes

- Carbon Clean

- CF Industries Holdings, Inc.

- Climeworks

- Dakota Gasification Company

- ENEOS Xplora Inc.

- Equinor ASA

- Exxon Mobil Corporation

- Fluor Corporation

- General Electric Company

- Halliburton

- Honeywell International LLC

- Linde plc

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Occidental Petroleum Corporation

- Shell plc

- Siemens Energy

- SLB Capturi

- Svante Technologies Inc

- TotalEnergies

第7章 市場機會與未來展望

The Carbon Capture And Storage Market size is estimated at USD 2.76 billion in 2025, and is expected to reach USD 5.37 billion by 2030, at a CAGR of 14.21% during the forecast period (2025-2030).

Rising regulatory pressure, maturing capture technologies, and the recognition that heavy industries cannot meet net-zero obligations without dedicated abatement solutions underpin this expansion. Governments are tightening emissions caps, expanding carbon-pricing schemes, and raising tax incentives, creating a price signal that has shifted CCS from pilot-scale experiments to commercial deployment. The convergence of supportive policy and technology cost decline also attracts private capital from oil majors and industrial conglomerates that see CCS as a hedge against future carbon liability. Competition from renewable power does temper the outlook, yet sectors such as cement, steel, chemicals, and refineries have few practical alternatives, making CCS a structural requirement rather than a transitional option.

Global Carbon Capture And Storage Market Trends and Insights

Emerging Demand for CO2-EOR Projects

Enhanced oil recovery is regaining prominence because it creates dual revenue streams-monetizing captured carbon while extending production from mature reservoirs. Oil majors are pairing fertiliser, steel, and petrochemical emitters with depleted fields, turning capture hubs into profit-generating assets during the early adoption stage. The approach lowers payback periods, secures anchor customers, and accelerates infrastructure build-out in regions that already possess extensive pipeline networks. It also provides practical experience in handling large CO2 volumes, establishing a bridge to pure storage projects as EOR demand tails off over time. Revenue visibility from incremental barrels helps investors justify the high upfront capital required for capture plants and injection wells, smoothing the transition toward stand-alone sequestration services.

Expansion of Carbon-Pricing and ETS Schemes

Carbon markets now extend beyond cap-and-trade to include border adjustments and sector-specific levies, changing the economic calculus for manufacturers that export into regulated regions. The EU's Carbon Border Adjustment Mechanism applies a shadow price to imported emissions-intensive goods, forcing foreign producers to invest in CCS or risk losing market share. California extended its cap-and-trade through 2030 and tightened allowance allocations, making CCS a compliance cost-avoidance tool rather than a corporate social responsibility add-on. Voluntary carbon markets are maturing, and though questions around additionality persist, they still create secondary monetization routes for verified storage tonnes. Each of these policy levers lifts the floor price for abatement, narrowing the economic gap between capture costs and market incentives.

High CAPEX and OPEX of CCS Plants

Industrial-scale facilities routinely require USD 500 million-800 million in upfront investment, making equity financing challenging where policy certainty is weak. Even innovative solvent systems such as Carbon Clean's CycloneCC, which lowers capture cost to USD 30 per tonne, have yet to demonstrate economies of scale at commercial rates . Operating cost is further burdened by energy penalties that trim baseline plant efficiency 15-30%, forcing operators either to buy additional electricity or accept lower output. Access to concessional finance remains limited in developing economies, delaying uptake despite substantial emissions reduction needs. Capital intensity therefore prolongs payback periods and narrows the pool of early adopters to large corporations or state-owned enterprises capable of absorbing risk.

Other drivers and restraints analyzed in the detailed report include:

- Stricter National Net-Zero Legislation

- Scale-Up of Low-Carbon Synthetic-Fuel Projects

- Growing Attractiveness of Cheaper Renewables

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pre-combustion capture accounted for 82.19% of carbon capture and storage market share in 2024 because it dovetails with steam-methane reformers and biomass gasifiers already common in refineries and chemical complexes . The segment benefits from decades of operational data and lower incremental cost when installed during greenfield builds. However, the process imposes a 20-25% energy penalty, and solvent regeneration remains capital intensive. Oxy-fuel combustion is projected to grow 18.51% CAGR to 2030, propelled by projects such as the Brevik cement plant that capture process emissions without extensive flue-gas separation. By burning fuel in pure oxygen, the exhaust stream is nearly pure CO2, simplifying downstream compression. Technology providers are introducing modular oxy-fuel units suited for retrofit, and improved air-separation economics reinforce competitiveness against post-combustion alternatives. As heavy industries seek deep cuts with minimal efficiency loss, oxy-fuel's market share is expected to expand quickly, challenging pre-combustion's long-held lead in the carbon capture and storage market.

The Carbon Capture and Storage Market Report is Segmented by Technology (Pre-Combustion Capture, Post-Combustion Capture, and Oxy-Fuel Combustion Capture), End-User Industry (Oil and Gas, Coal and Biomass Power Plant, Iron and Steel, Cement, and Chemical), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 51.24% carbon capture and storage market share in 2024, supported by generous 45Q tax credits that provide USD 85 per tonne for direct air capture and USD 60 for point-source capture. The U.S. Gulf Coast concentrates emitters, pipeline corridors, and saline aquifers, enabling hub concepts like ExxonMobil's proposed USD 100 billion Houston Ship Channel network. Canada complements the region with an investment tax credit of 60% for DAC equipment and 50% for other capture systems, spurring joint ventures such as Strathcona Resources and Canada Growth Fund's USD 2 billion partnership. Mexico positions itself as a cross-border transport partner, exploring shared storage solutions in depleted offshore fields.

Europe is projected to post the fastest CAGR at 26.64% between 2025-2030, underpinned by the Innovation Fund, the EU ETS, and Norway's pioneering Longship project, which began CO2 injection at Northern Lights in 2025. Germany's draft CCS law removes the onshore storage ban and unlocks the North German Basin, while the Netherlands advances the Porthos hub and the UK pushes HyNet and Teesside clusters. Cross-border transport agreements are maturing, and shared infrastructure lowers unit costs for smaller industrial emitters. The combination of carbon pricing, border tariffs, and dedicated public grants accelerates private investment, ensuring that Europe closes the gap with early-moving North America.

Asia-Pacific represents the largest long-term upside, driven by China's 2060 neutrality pledge and the first oxy-fuel cement demonstration in 2025, which validated technology fit for regional process industries. Japan is co-developing shipping routes with Australia for liquefied CO2, linking heavy industrial zones with offshore storage in the Bonaparte Basin . Indonesia targets 15 CCS projects by 2030, leveraging abundant deep-saline aquifers, while South Korea's Green New Deal earmarks CCS expenditure across steel and petrochemicals. The region, however, grapples with fragmented regulations and access to affordable finance, factors that may delay full-scale take-off until post-2030.

- Air Liquide

- Aker Solutions

- Baker Hughes

- Carbon Clean

- CF Industries Holdings, Inc.

- Climeworks

- Dakota Gasification Company

- ENEOS Xplora Inc.

- Equinor ASA

- Exxon Mobil Corporation

- Fluor Corporation

- General Electric Company

- Halliburton

- Honeywell International LLC

- Linde plc

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Occidental Petroleum Corporation

- Shell plc

- Siemens Energy

- SLB Capturi

- Svante Technologies Inc

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Emerging Demand for CO2-EOR Projects

- 4.2.2 Expansion of Carbon-Pricing and ETS Schemes

- 4.2.3 Stricter National Net-Zero Legislation

- 4.2.4 Scale-Up of Low-Carbon Synthetic-Fuel Projects

- 4.2.5 Direct-Air-Capture (DAC) Build-Outs Needing Storage

- 4.3 Market Restraints

- 4.3.1 High CAPEX And OPEX Of CCS Plants

- 4.3.2 Growing Attractiveness of Cheaper Renewables

- 4.3.3 Public Opposition to On-Shore CO2 Pipelines

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Pre-combustion Capture

- 5.1.2 Post-combustion Capture

- 5.1.3 Oxy-fuel Combustion Capture

- 5.2 By End-user Industry

- 5.2.1 Oil and Gas

- 5.2.2 Coal and Biomass Power Plant

- 5.2.3 Iron and Steel

- 5.2.4 Cement

- 5.2.5 Chemical

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 Australia

- 5.3.1.5 South Korea

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Norway

- 5.3.3.5 Netherlands

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Air Liquide

- 6.4.2 Aker Solutions

- 6.4.3 Baker Hughes

- 6.4.4 Carbon Clean

- 6.4.5 CF Industries Holdings, Inc.

- 6.4.6 Climeworks

- 6.4.7 Dakota Gasification Company

- 6.4.8 ENEOS Xplora Inc.

- 6.4.9 Equinor ASA

- 6.4.10 Exxon Mobil Corporation

- 6.4.11 Fluor Corporation

- 6.4.12 General Electric Company

- 6.4.13 Halliburton

- 6.4.14 Honeywell International LLC

- 6.4.15 Linde plc

- 6.4.16 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 6.4.17 Occidental Petroleum Corporation

- 6.4.18 Shell plc

- 6.4.19 Siemens Energy

- 6.4.20 SLB Capturi

- 6.4.21 Svante Technologies Inc

- 6.4.22 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment