|

市場調查報告書

商品編碼

1536979

汽車工程服務外包:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Automotive Engineering Services Outsourcing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

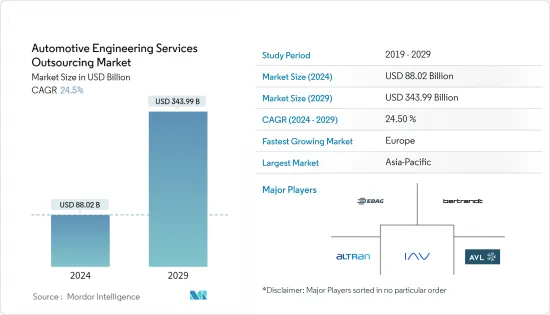

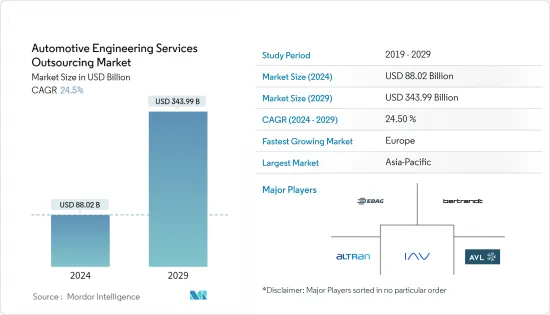

汽車工程服務外包市場規模預計到2024年為880.2億美元,預計到2029年將達到3,439.9億美元,在預測期內(2024-2029年)複合年成長率為24.5%。

從長遠來看,工程公司正在迅速轉向外包,以降低成本、提高效率和增加產能。公司出於多種原因外包工程服務,包括需要快速週轉時間、靈活性、缺乏內部專業知識以及預算限制。此外,對電動車的需求不斷成長、電動車的日益普及、自動駕駛汽車的創新技術(例如提高車輛和乘客安全的 ADAS)、輕型汽車等將對未來幾年的市場成長產生積極影響。引起

鑑於電動車銷量的成長,供應鏈中的多家公司正在合作加強汽車零件的設計。世界各地政府推出了各種計劃和舉措,鼓勵買家傾向於購買電動車而不是傳統汽車。

主要亮點

- 加州ZEV計劃就是其中一項鼓勵購買電動車的計劃,該計劃的目標是到2025年讓150萬輛電動車上路。

- 2023年11月,Capgemini SA將利用其在軟體開發和產品工程方面的關鍵專業知識,在自動駕駛、聯網汽車、電動和共享汽車領域開發永續、永續的連網型解決方案。Capgemini SA在 Everest Group ACES 汽車工程服務 PEAK Matrix 評估 2023 中獲得了最高的「願景和能力」評級,並被評為頂級領導者。

由於OEM的存在以及消費者對電動車偏好的變化,預計歐洲目標市場將顯著成長。德國和英國等國家的存在也對市場成長產生了積極影響,因為其政府實施了排放氣體政策和鼓勵使用綠色技術的政策。預計北美市場在預測期內也將出現可觀的成長。

汽車工程服務外包市場趨勢

乘用車佔有率第一

近年來,乘用車以其時尚的設計、緊湊的尺寸和經濟的價值等特點受到了駕駛者的廣泛歡迎。乘用車已成為許多已開發國家最常見的交通途徑。在全球範圍內,由於生活方式的改善、購買力的提高、可支配收入的增加、品牌知名度的提高和經濟的改善,客戶偏好正在發生變化,乘用車銷量也在增加。

印度汽車工業協會的數據顯示,2022-2023年乘用車銷量從14,67,039輛增加到17,47,376輛。

亞太地區對電動車的需求不斷成長也帶動了市場的成長。 2023年第一季,印度電動車銷量與2022年同期相比加倍。

運動型多用途車(SUV)的需求不斷成長,為市場參與者創造了利潤豐厚的機會,也是全球乘用車市場成長的主要動力。 SUV 在乘用車 (PV) 總銷量中的佔有率從 2016 年的 18% 上升到 2023 年的 41%。

兩家公司致力於開發汽車工程領域令人興奮的能力,並共用對未來移動出行的願景。我們也專注於在全球範圍內擴展這些能力和創新的協議。業務領域包括電氣和電子、軟體、諮詢服務、測試和車輛開發。

例如,2022 年 10 月,數位轉型、諮詢和業務再造服務及解決方案的領先供應商 Tech Mahindra 宣布將加入富士康主導的Mobility in Harmony)聯盟。

因此,預計上述因素將對市場產生正面影響。

亞太地區預計將佔據汽車工程服務外包市場的主要佔有率

預計亞太地區將佔據目標市場的很大佔有率。這是由於主要汽車製造商由於勞動力成本低廉而將生產和相關業務外包給印度、韓國和中國等國家。因此,汽車 ESO 提供者正在將其業務遷往該地區。

印度約佔低成本國家可用勞動力的30%。與歐洲、拉丁美洲和北美國家相比,我們具有15-26%的成本優勢。印度為全球OEM提供了一個競爭激烈的市場,以滿足世界各個領域的需求。起亞和名爵是印度市場的兩家新OEM。

印度低成本、受過良好教育的半技術純熟勞工使其成為尋求外包的國際OEM的有吸引力的選擇。多家公司專注於合作開發永續行動解決方案,並建立下一代電動車、自動駕駛解決方案和行動服務應用,為行動產業的消費者帶來價值。例如

- 2022年8月,總部位於印度的L&T Technology Services獲得了寶馬集團一份為期五年的資訊娛樂契約,為其資訊娛樂套件提供高階工程服務。由於靠近寶馬集團園區,LTTS 工程師能夠開發各種解決方案並即時提供服務。

因此,上述因素預計將對市場成長產生正面影響。

汽車工程服務外包產業概況

汽車工程服務外包市場由全球和地區知名公司整合和主導。這些公司採用新產品發布、聯盟和合併等策略來維持其市場地位。例如

- 2023年9月,HCLTech以2.76億美元收購德國汽車工程服務供應商ASAP集團100%股權。該交易預計將於 2023 年 9 月完成。 ASAP 專注於自動駕駛、電動車和連網領域的面向未來的汽車技術。

主導市場的一些主要企業包括 AVL List GmbH、Bertrandt AG、EDAG Engineering GmbH、IAV GmbH 和 Altran。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 汽車工業快速成長

- 市場限制因素

- 汽車領域研發業務數位化

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按服務類型

- 設計

- 原型製作

- 系統整合

- 測試

- 按位置類型

- 陸上

- 離岸

- 車輛類型

- 客車

- 商用車

- 推進類型

- 內燃機

- 電動引擎

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 公司簡介

- AVL List GmbH

- Bertrandt AG

- EDAG Engineering GmbH

- IAV GmbH

- HORIBA Ltd

- Altran(Capgemini Engineering)

- FEV Group GmbH

- MBtech Group GmbH(A subsidiary of AKKA Technologies)

- Alten GmbH

- P3 Automotive GmbH

- Altair Engineering Inc.

- ITK Engineering GmbH(Robert Bosch GmbH)

- ESG Elektroniksystem-und Logistik-GmbH

- RLE International Group

- ASAP Holding GmbH

- Kistler Holding AG

第7章 市場機會及未來趨勢

The Automotive Engineering Services Outsourcing Market size is estimated at USD 88.02 billion in 2024, and is expected to reach USD 343.99 billion by 2029, growing at a CAGR of 24.5% during the forecast period (2024-2029).

Over the long term, engineering firms are rapidly shifting to outsourcing to save costs, boost efficiency, or increase competence. Companies outsource engineering services for various reasons, including the need for fast delivery, flexibility, a lack of in-house specialists, and a constrained budget. Additionally, increasing demand for electric vehicles, as well as increasing adoption of electric vehicles, autonomous vehicle innovative technologies such as ADAS for vehicle and passenger safety, and lightweight vehicles, are key factors that may positively impact market growth in the coming years.

Considering the growth in electric vehicle sales, several companies from the supply chain are entering into partnerships to enhance the design of vehicle components. Governments have launched various plans and efforts worldwide to encourage buyers to lean toward electric vehicles over conventional automobiles.

Key Highlights

- One such plan that encourages the purchase of electric vehicles is the California ZEV program, which intends to have 1.5 million electric vehicles on the road by 2025.

- In November 2023, Capgemini offered sustainable, safe, secure, and connected solutions with key expertise such as software development and product engineering in the Autonomous, Connected, Electric, and Shared vehicles domains. It received the highest "Vision and Capability" rating and was designated the top Leader by the Everest Group ACES Automotive Engineering Services PEAK Matrix Assessment 2023.

Europe is expected to grow significantly in the target market, owing to the presence of OEMs and changing consumer preference toward electric vehicles. The presence of countries such as Germany and the United Kingdom also positively impacts the market's growth due to the policies and regulations implemented by their governments related to emissions and encouraging the usage of green technology. North America is also expected to witness considerable market growth during the forecast period.

Automotive Engineering Services Outsourcing Market Trends

Passenger Cars Hold the Highest Share

Passenger cars have gained immense popularity among drivers over the past few years due to features such as stylish design, compact size, and economic value. Passenger cars are the most common mode of transportation in numerous advanced countries. The improving lifestyles, increasing purchasing power, rising disposable incomes, growing brand awareness, and improving economy are leading to a shift in customer preferences worldwide globe, resulting in high sales of passenger cars.

According to the Society of Indian Automobile Manufacturers, sales of passenger cars increased from 14,67,039 to 17,47,376 units during 2022-2023.

The increased demand for electric vehicles in Asia-Pacific also resulted in market growth. In the first quarter of 2023, electric car sales in India doubled compared to the same period in 2022.

The rising demand for sport utility vehicles (SUVs) creates profitable opportunities for market players and acts as a major driving factor for the global passenger car market's growth. The share of SUVs in overall passenger vehicle (PV) sales rose from 18% in 2016 to 41% in 2023.

Companies are focusing on developing some exciting capabilities in automotive engineering and sharing their vision for the future of mobility. They are also focusing on agreements to scale these capabilities and innovations globally. The segments include electric/electronics, software, consulting and service, testing, and vehicle development.

For instance, in October 2022, Tech Mahindra, a leading provider of digital transformation, consulting, and business re-engineering services and solutions, announced a partnership with Foxconn-initiated MIH (Mobility in Harmony) Consortium, an open EV alliance that promotes collaboration in the mobility industry.

Thus, the abovementioned factors are expected to have a positive impact on the market.

Asia-Pacific is Expected to Hold a Major Share in the Automotive Engineering Service Outsourcing Market

Asia-Pacific is likely to have a large share of the target market, attributed to the presence of significant automobile OEMs and the outsourcing of production and associated operations to countries such as India, South Korea, and China due to the availability of low-cost labor. As a result, automotive ESO providers are transferring their operations to this region.

India accounts for roughly 30% of all available manpower among low-cost countries. The country has a 15-26% cost advantage over European, Latin American, and North American countries. India has provided a highly competitive market for global OEMs catering to the needs of various segments worldwide. Kia and MG are two new OEMs in the Indian market.

The availability of low-cost, educated, and semi-skilled labor in India makes it an attractive option for international OEMs seeking to outsource their operations. Several firms focus on partnerships to develop sustainable mobility solutions and build the next generation of electric vehicles, autonomous driving solutions, and mobility service applications that can deliver value for consumers in the mobility industry. For instance,

- In August 2022, L&T Technology Services, headquartered in India, bagged a 5-year infotainment deal from BMW Group to provide high-end engineering services for the company's suite of infotainment. The proximity to BMW Group's campus will enable LTTS' engineers to work on a variety of solutions and offer services in real-time.

Thus, the abovementioned factors are expected to positively impact the market's growth.

Automotive Engineering Services Outsourcing Industry Overview

The automotive engineering services outsourcing market is consolidated and led by globally and regionally established players. These companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions. For instance,

- In September 2023, HCLTech acquired a 100% stake in the German automotive engineering services provider ASAP Group for USD 276 million. The transaction was expected to close by September 2023. ASAP is focused on future-oriented automotive technologies in areas such as autonomous driving, e-mobility, and connectivity.

Some major players dominating the market include AVL List GmbH, Bertrandt AG, EDAG Engineering GmbH, IAV GmbH, and Altran.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Exponential Increase in Automotive Sector

- 4.2 Market Restraints

- 4.2.1 Digitization of R&D Operations in Automotive Sector

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Designing

- 5.1.2 Prototyping

- 5.1.3 System Integration

- 5.1.4 Testing

- 5.2 By Location Type

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Vehicle Type

- 5.3.1 Passenger Vehicles

- 5.3.2 Commercial Vehicles

- 5.4 Propulsion Type

- 5.4.1 IC Engine

- 5.4.2 Electric Engine

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE*

- 6.1 Company Profiles

- 6.1.1 AVL List GmbH

- 6.1.2 Bertrandt AG

- 6.1.3 EDAG Engineering GmbH

- 6.1.4 IAV GmbH

- 6.1.5 HORIBA Ltd

- 6.1.6 Altran (Capgemini Engineering)

- 6.1.7 FEV Group GmbH

- 6.1.8 MBtech Group GmbH (A subsidiary of AKKA Technologies)

- 6.1.9 Alten GmbH

- 6.1.10 P3 Automotive GmbH

- 6.1.11 Altair Engineering Inc.

- 6.1.12 ITK Engineering GmbH (Robert Bosch GmbH)

- 6.1.13 ESG Elektroniksystem- und Logistik-GmbH

- 6.1.14 RLE International Group

- 6.1.15 ASAP Holding GmbH

- 6.1.16 Kistler Holding AG