|

市場調查報告書

商品編碼

1536995

汽車電池管理系統:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automotive Battery Management Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

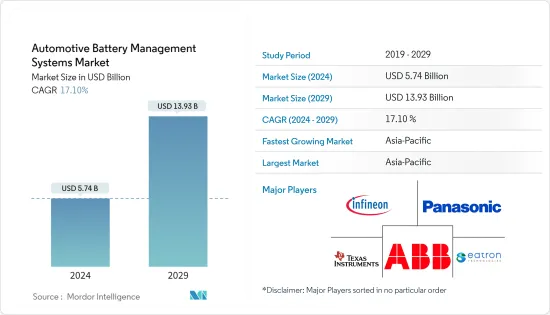

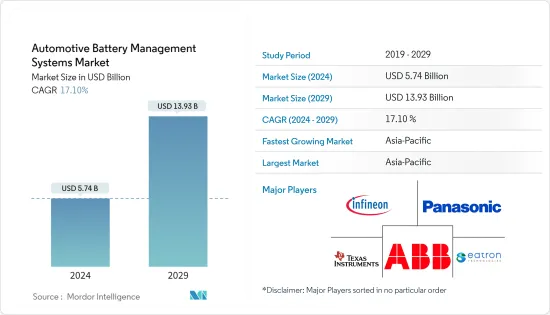

預計2024年汽車電池管理系統市場規模為57.4億美元,在預測期內(2024-2029年)複合年成長率為17.10%,到2029年將達到139.3億美元。

汽車電池管理系統的需求大幅成長,預計在預測報告期間內將繼續成長。地方政府有關電動車採用的政策主要推動了商業動態。公司專注於進入國際貿易,並大力投資研發計劃。

由於世界上大多數電動車都使用鋰離子電池,因此電動車的需求預計將增加,並可能在預測期內主要推動市場發展。電池管理系統對於鋰離子電池的安全和最佳性能至關重要。

電動汽車電池管理系統定期記錄煞車、加速、減速和充電過程中的資料。

汽車製造商已經推出了多項推出更多電動車的計畫。我們也參與合作夥伴關係和投資,以提高我們在市場上的競爭力。

主要亮點

- 例如,2023 年 1 月,德克薩斯) 宣布推出新的電池和電池組管理工具,聲稱將使電動車的續航里程增加 20%。

預計這些因素將對市場產生正面影響。

汽車電池管理系統市場趨勢

乘用車佔比最高

近年來,乘用車因其時尚的設計、緊湊的尺寸和經濟價值而受到駕駛者的廣泛歡迎。乘用車已成為許多已開發國家最常見的交通途徑。在全球範圍內,由於生活方式的改善、購買力平價可支配收入的增加、品牌知名度的提高和經濟成長,客戶偏好正在發生變化,乘用車銷售量也在增加。

印度汽車工業協會稱,2022-23 年乘用車銷量將從 14,67,039 輛增加到 17,47,376 輛。

亞太地區對電動車的需求不斷成長也帶動了市場的成長。 2023 年第一季印度電動車銷量較 2022 年同期成長一倍。

對運動型多用途車 (SUV) 的需求不斷成長,為市場公司創造了商機,並成為市場成長的關鍵驅動力。根據我們的分析,SUV 在乘用車 (PV) 總銷量中的佔有率將從 2016 年的 18% 增加到 2023 年的 41%。

啟動/停止、電動方向盤和電子煞車系統等功能增加了電池的功率負載。因此,從舒適度到安全等級對所有這些電氣負載進行優先排序是汽車電氣系統的關鍵挑戰。智慧電池管理系統(IBMS)正在受到汽車製造商的青睞,並在所有地區廣泛採用。 IBMS 由先進的電子設備組成,例如測量電池充電狀態 (SOC)、健康狀態 (SOH) 和溫度的電池感測器,並以串聯和並聯陣列連接到車輛電池組。

IBMS 的所有三項測量同時進行,即使在快速變化的車輛條件下也能確保準確的測量。 IBMS 的使用有助於以邏輯順序關閉這些電動車系統,並提醒駕駛員即將發生的電池問題,以保護駕駛員安全免受電池爆炸的影響。智慧電池感測器的知名供應商包括大陸集團、海拉和博世,它們在開發先進技術方面投入了大量資金,並致力於產品的進步。

亞太地區佔比最高

預計在預測期內,亞太地區將在全球乘用車市場中佔據重要佔有率。該地區的成長主要由印度、中國和日本等頂級汽車生產國推動。這些市場對乘用車的需求增加是由於人口可支配收入的增加、汽車工業的崛起以及購買新車的貸款和資金籌措的增加等因素。

除傳統內燃機汽車外,電動車的需求預計將推動電池管理系統市場的成長。由於各地區排放法規收緊,預測期內電動車的需求可能會增加。根據國際能源總署(IEA)預計,2022年,電動車佔中國國內汽車總銷量的佔有率將達29%,高於2021年的16%,2018年至2020年則不足6%。

電池是電動車的主要動力來源,推動了對高效能、先進電池管理系統的需求。

- 2023 年 5 月,森薩塔科技宣布推出一款新型緊湊型電池管理系統,具有適用於工業應用和低壓電動車的先進軟體功能。

汽車電池管理系統產業概況

汽車電池管理系統市場由全球和地區知名公司整合和主導。公司採用新產品發布、聯盟和合併等策略來維持其市場地位。

- 例如,2022 年 7 月,Neutron Controls 和英飛凌科技合作開發了先進的汽車電池管理平台。 Neutron Controls 推出 ECU8 系統平台,加速以英飛凌晶片組為基礎的 BMS 的開發。

該市場的主要參與者包括英飛凌科技公司、伊頓科技公司、德州儀器公司、ABB 有限公司和松下公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 電動車的擴張

- 市場限制因素

- 電池維護高成本

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 部分

- 電池IC

- 電池感應器

- 其他部件(IBMS 中使用的電子裝置和材料)

- 推進類型

- 內燃機車

- 電動車(HEV、PHEV、BEV)

- 車輛類型

- 客車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Robert Bosch GmbH

- Panasonic Corporation(Ficosa)

- LG Chem

- ABB Ltd

- Hitachi Ltd

- Mitsubishi Electric Corporation

- Continental AG

- Texas Instruments

- Preh GmbH

- Eatron Technologies

- Infineon Technologies AG

第7章 市場機會及未來趨勢

The Automotive Battery Management Systems Market size is estimated at USD 5.74 billion in 2024, and is expected to reach USD 13.93 billion by 2029, growing at a CAGR of 17.10% during the forecast period (2024-2029).

The demand for battery management systems from the automotive industry has been growing significantly, and it is expected to continue to grow during the forecast report. Regional government policies regarding EV adoption have primarily driven the business dynamics. Companies are focusing on entering international deals and are heavily investing in R&D projects.

The anticipated increase in demand for electric vehicles may primarily drive the market during the forecast period, as most electric vehicles worldwide utilize lithium-ion batteries. The battery management system is essential for the safe and optimal performance of lithium-ion batteries.

Battery management systems in electric cars regularly record data during braking, acceleration, deceleration, and charging.

Automakers are initiating several plans to launch a greater number of electric vehicles. They are also entering partnerships and making investments to have a competitive edge in the markets.

Key Highlights

- For instance, in January 2023, Texas Instruments introduced new battery cell and battery pack management tools, which claim to increase the range of an electric vehicle by 20%.

These factors are expected to have a positive impact on the market.

Automotive Battery Management Systems Market Trends

Passenger Cars Holds Highest Share

Passenger cars have gained immense popularity among drivers over the past few years due to features such as stylish design, compact size, and economic value. Passenger cars are the most common mode of transportation in numerous advanced countries. The improving lifestyles, increasing power purchase parity disposable income, raising brand awareness, and growing economy are leading to changes in customer preferences globally, resulting in high sales of passenger cars.

According to the Society of Indian Automobile Manufacturers, sales of passenger cars increased from 14,67,039 to 17,47,376 units in 2022-23.

The increase in demand for electric vehicles in Asia-Pacific also resulted in the market's growth. Electric car sales in India in the first quarter of 2023 doubled compared to the same period in 2022.

The rise in the demand for sports utility vehicles (SUVs) creates profitable opportunities for the market players and acts as a major driving factor for the market's growth. According to our analysis, the share of SUVs in the overall passenger vehicle (PV) sales increased from 18% in 2016 to 41% in 2023,

Features like start/stop, electric power steering, and electronic braking systems have increased the battery's power load. Therefore, prioritizing all these electrical loads on a scale from comfort to safety level has been a significant issue in a vehicle's electrical system. Intelligent battery management systems (IBMSs) have been gaining attention among automakers and are being widely adopted across all regions. IBMS consists of advanced electronics, such as battery sensors that measure the state of charge (SOC), state of health (SOH), and temperature across a cell, connected in series and parallel arrays in a vehicle battery pack.

All three measurements by IBMS have been taken simultaneously to ensure accurate measurements, even during rapidly changing vehicle conditions. The usage of IBMS aids in shutting down these electric vehicle systems in a logical order and warns the drivers about the impending battery problem to keep them safe from battery explosions. The prominent suppliers of intelligent battery sensors include Continental AG, Hella, and Bosch, which are heavily investing in developing advanced technologies and focusing on advancing their products.

Asia-Pacific Holds the Highest Share

During the forecast period, Asia-Pacific is expected to hold a major share of the global passenger vehicle market. The growth in the region is mainly driven by the top-producing automotive countries like India, China, and Japan. The growing demand for passenger vehicles in these markets is owing to the increasing disposable income of the population, the rising automotive industry, the growing availability of loans and funding to purchase new vehicles, etc.

Apart from conventional IC engine vehicles, the demand for electric vehicles is anticipated to boost the growth of the battery management system market. With stringent emission regulations across every region, the demand for electric vehicles is likely to increase during the forecast period. According to the International Energy Agency, in 2022, the share of electric cars in total domestic car sales reached 29% in China, up from 16% in 2021 and under 6% between 2018 and 2020.

The battery is the primary source of power for electric vehicles, driving the demand for efficient and advanced battery management systems.

- In May 2023, Sensata Technologies launched a new compact battery management system with advanced software features for industrial applications and low-voltage electric vehicles.

Automotive Battery Management Systems Industry Overview

The automotive battery management system market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

- For instance, in July 2022, Neutron Controls and Infineon Technologies partnered for an advanced automotive battery management platform. Neutron Controls announced its ECU8 system platform, which enables accelerated development of BMS based on Infineon chipsets.

Some of the major players in the market include Infineon Technologies AG, Eatron Technologies, Texas Instruments, ABB Ltd, and Panasonic Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Adoption of Electric Vehicles

- 4.2 Market Restraints

- 4.2.1 High Cost related to Maintenance of Batteries

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Components

- 5.1.1 Battery IC

- 5.1.2 Battery Sensors

- 5.1.3 Other Components (Electronics and Materials Used in IBMS)

- 5.2 Propulsion Type

- 5.2.1 IC Engine Vehicle

- 5.2.2 Electric Vehicle (HEV, PHEV, and BEV)

- 5.3 Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Italy

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Panasonic Corporation (Ficosa)

- 6.2.3 LG Chem

- 6.2.4 ABB Ltd

- 6.2.5 Hitachi Ltd

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.7 Continental AG

- 6.2.8 Texas Instruments

- 6.2.9 Preh GmbH

- 6.2.10 Eatron Technologies

- 6.2.11 Infineon Technologies AG