|

市場調查報告書

商品編碼

1537584

全球氣動設備市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Pneumatic Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

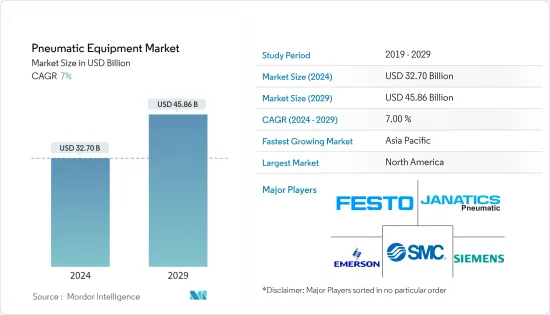

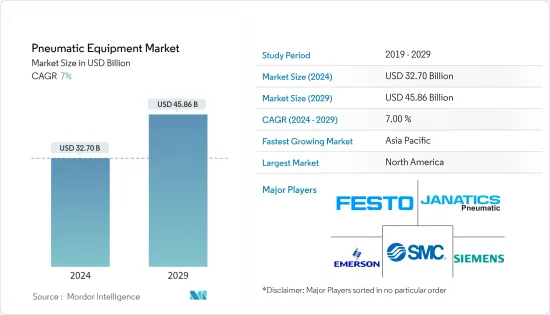

2024年全球氣動設備市場規模預估為327億美元,預估至2029年將達458.6億美元,預測期(2024-2029年)複合年成長率為7%。

氣動設備的主要優點之一是安全。壓縮空氣無毒、不易燃且易於獲取,比電力和液壓等其他動力來源更安全。這使得氣動設備適合在有火災或爆炸風險的危險環境中使用。此外,氣動系統可以在潮濕和灰塵較多的區域運行,這些區域的電氣設備會造成嚴重的安全隱患。

主要亮點

- 氣動設備的另一個優點是其可靠性和耐用性。氣動設備以其堅固性和承受惡劣工作條件的能力而聞名。它不易因過載、衝擊和振動而損壞,因此適用於製造、建設業和採礦等惡劣應用。氣動設備還需要最少的維護,從而減少停機時間和營業成本。

- 促進物聯網廣泛採用的因素包括快速數位化、技術進步、旨在加速數位轉型和工業 4.0 的政府舉措、政策和投資。如今,提高石油公司對自動化的依賴以保持流程順利運作是一個主要目標。

- 人們正在努力實現油田數位化,並對儀器進行投資,以提高生產力並在既定預算內完成計劃。這些舉措非常有益,特別是對於按時收集海上鑽機的生產資料,進一步推動市場研究。

- 近年來,世界各國政府都在大力發展科技業。例如,阿根廷政府透過支持新興企業和科技公司的法律來吸引投資者。這就是為什麼越來越多的公司正在利用人工智慧、機器學習和機器人技術。

- 阻礙氣動設備市場成長的主要挑戰是設備使用壽命內維護成本的波動。不銹鋼、鐵礦石、鋁、青銅等金屬合金等原料價格的波動正在造成氣動設備的佈置成本的波動。這就造成了供需缺口。

- COVID-19 大流行迫使製造業重新評估傳統生產流程,主要推動跨生產線的數位轉型和智慧製造實踐。 COVID-19 大流行和全球封鎖法規嚴重影響了工業活動。封鎖的影響包括勞動力短缺、供應鏈中斷、製造過程中使用的原料缺乏、可能增加最終產品產量並超出預算的價格波動以及運輸問題。

氣動設備的市場趨勢

工業最終用戶細分市場佔據大部分市場佔有率

- 氣動系統為機械臂、夾具和致動器提供動力,在自動化製造中至關重要。這些系統沿著組裝準確、快速地移動零件。特別是,氣動致動器透過為機器人應用提供力和控制來提高製造業務的生產率。

- 由於技術進步、基礎設施開拓和技術純熟勞工等因素,全球製造業的成長預計將推動氣動設備市場的發展。例如,中國製造業正在蓬勃發展,國家統計局報告稱,2023年工業產出將成長4.6%。

- 隨著各行業自動化的進步,工廠中氣動設備的採用預計將迅速增加。國際機器人聯合會(IFR)預測,到2024年,全球將有超過518,000台工業機器人運作。

- 工業機器人市場的強勁成長是氣動設備領域的重要驅動力。光是 2020 年,全球工業機器人出貨量就超過 384,000 台,其中澳洲/亞洲領先,估計出貨量為 266,000 台。到 2024 年,該地區預計安裝數量將進一步增加,達到 37 萬個。

- 氣動設備,例如氣動輸送機和真空系統,對於在製造設施內運輸材料至關重要。氣動輸送機可處理散裝物料,而真空系統則非常適合提升精緻或不規則形狀的物品而不會造成損壞。

- 空氣壓縮機是氣動系統的支柱,產生為氣動設備和機械提供動力所需的壓縮空氣。此外,氣動乾燥機透過去除壓縮空氣中的水分和污染物,在維持這些系統的可靠性和性能方面發揮關鍵作用。氣動設備也應用於製造設施內的安全系統,例如氣動安全閥和緊急關閉系統。

亞太地區錄得強勁成長

- 中國在全球製造業的主導地位正在推動對氣動設備的需求。中國製造企業擴大採用工業 4.0 解決方案來加強營運,推動市場成長。

- 近年來,中國的醫療保健和生命科學(HLS)產業取得了顯著的成長,其特點是投資強勁、技術創新迅速、業務擴張。在政府支持政策和充足的資本資源的支持下,中國正努力成為全球醫藥創新的領導者。

- 由於城市人口不斷成長和食品消費模式不斷變化等因素,日本食品飲料加工和包裝行業預計將實現成長。值得注意的是,《全球有機貿易指南》強調,日本包裝有機食品的消費將從 2018 年的 4.014 億美元增加到 2025 年的估計 4.271 億美元。

- 此外,到 2025 年,保健食品、飲料和包裝食品的零售預計將達到 573 億美元。這些趨勢將鼓勵對日本食品加工和包裝廠的投資,進而推動該領域氣動設備的需求。

- 在都市化、人口變化和蓬勃發展的零售業等因素的推動下,印度的食品和飲料加工及包裝行業正在經歷顯著成長。需求激增刺激食品和飲料公司增加產量。公司正在利用不斷成長的中產階級消費者基礎,推出新產品並使其產品多樣化。

氣動設備產業概況

氣動設備市場高度分散,主要企業包括 Festo SE、艾默生電氣公司、SMC 公司、Janatics 和西門子公司。市場上的公司正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 3 月 - 芝加哥氣動宣布計畫推出適用於大型商用車的新型 eBlueTork 系列電池扭力扳手。 eBlueTork 提供先進的功能,可提高衝擊扳手應用中工人和船員的安全、可追溯性和生產力。

- 2023 年 11 月 - 日本氣壓控制系統製造商SMC 將在2026 年之前投資400 億日元(2.7 億美元),目標是將產品開發所需的時間減少一半,並宣布將在每個地點建立24 小時營運中心。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 各行業自動化的進步

- 嚴格的政府法規

- 市場挑戰

- 設備使用壽命期間維護成本高

第6章 市場細分

- 依設備類型

- 致動器

- 閥門

- 配件

- 其他設備

- 按最終用戶產業

- 車

- 食品和飲料加工和包裝

- 航太/國防

- 生命科學

- 化工/石化

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭狀況

- 公司簡介

- Festo SE

- Emerson Electric Co.

- SMC Corporation

- Janatics

- Siemens AG

- Parker Hannifin Corp.

- Ingersoll Rand

- Koki Holdings Co. Ltd

- Chicago Pneumatic

- Eaton Corporation

- ROSS Controls

- Bimba Manufacturing Company(IMI PLC)

第8章投資分析

第9章市場的未來

The Pneumatic Equipment Market size is estimated at USD 32.70 billion in 2024, and is expected to reach USD 45.86 billion by 2029, growing at a CAGR of 7% during the forecast period (2024-2029).

One of the primary advantages of pneumatic equipment is safety. Compressed air is non-toxic, non-flammable, and readily available, making it a safer alternative to other power sources like electricity or hydraulics. This makes pneumatic equipment suitable for use in hazardous environments where the risk of fire or explosion is a concern. Additionally, pneumatic systems may operate in areas with high levels of moisture or dust, where electrical equipment would pose a significant safety hazard.

Key Highlights

- Another advantage of pneumatic equipment is its reliability and durability. Pneumatic components are known for their robustness and ability to withstand harsh operating conditions. They are less susceptible to damage from overloading, shock, or vibration, making them suitable for heavy-duty applications in industries like manufacturing, construction, and mining. Pneumatic equipment also requires minimal maintenance, resulting in reduced downtime and lower operating costs.

- The increasing adoption of IoT may be attributed to factors like rapid digitalization, technological advancements, government initiatives, policies, and investments aimed at promoting digital transformation and Industry 4.0. Increasing oil companies' reliance on automation to conduct processes without delay is the main aim nowadays.

- Initiatives to digitize oil fields are implemented, leading to investment in instrumentation to increase productivity and complete projects within defined budgets. Such initiatives are incredibly beneficial to gathering production data on time, especially for offshore rigs, which further drive the market studied.

- Various governments globally have been boosting the technological sector over the past few years. For instance, the Argentine government attracts investors with legislation supporting startups and technology firms. Therefore, there has been a rise in firms utilizing AI, machine learning, and robotics.

- The major challenge impeding the pneumatic equipment market growth is the volatility in maintenance costs over the equipment's lifespan. Fluctuations in prices of raw materials such as stainless steel, iron ore, aluminum, bronze, and other metal alloys have caused volatility in the arrangement cost of pneumatic equipment. This has led to a demand-supply gap.

- The COVID-19 pandemic forced manufacturing industries to re-evaluate their traditional production processes, primarily driving digital transformation and smart manufacturing practices across production lines. The COVID-19 pandemic and lockdown restrictions worldwide severely affected industrial activities. The effects of the lockdown include labor shortages, disruptions in the supply chain, lack of availability of raw materials utilized in the manufacturing process, fluctuating prices that could force the production of the final product to increase and go beyond budget, shipping problems, etc.

Pneumatic Equipment Market Trends

Industrial End-user Segment to Hold Major Market Share

- Pneumatic systems are pivotal in automated manufacturing, powering robotic arms, grippers, and actuators. These systems ensure precise and swift movement of components along assembly lines. Pneumatic actuators, in particular, enhance productivity in manufacturing operations by providing force and control for robotic applications.

- The global rise in the manufacturing sector, driven by factors like technological advancements, infrastructure development, and skilled labor, is expected to fuel the pneumatic equipment market. China, for instance, witnessed a notable boost in its manufacturing sector, with a 4.6% increase in industrial production in 2023, as reported by the National Bureau of Statistics.

- As automation gains traction across industries, the adoption of pneumatic equipment in factory settings is poised to surge. Projections from the International Federation of Robotics (IFR) indicate that the global number of operational industrial robots will surpass 518,000 by 2024.

- The robust growth of the industrial robot market is a significant driver for the pneumatic equipment sector. In 2020 alone, over 384,000 units of industrial robots were shipped worldwide, with Australia/Asia leading the pack at an estimated 266,000 installations. By 2024, this region is expected to rise further to 370,000 installations.

- Pneumatic equipment, such as air-powered conveyors and vacuum systems, is vital in material transfer within manufacturing facilities. Pneumatic conveyors handle bulk materials, while vacuum systems are ideal for lifting delicate or irregularly shaped objects without causing damage.

- Air compressors are the backbone of pneumatic systems, generating the compressed air needed to power pneumatic equipment and machinery. Additionally, pneumatic dryers play a crucial role in maintaining the reliability and performance of these systems by removing moisture and contaminants from the compressed air. Pneumatic equipment finds applications in safety systems within manufacturing facilities, including pneumatic safety valves and emergency stop systems.

Asia-Pacific to Register Major Growth

- China's dominance in the global manufacturing landscape is propelling the demand for pneumatic equipment. As Chinese manufacturing firms increasingly adopt Industry 4.0 solutions, they are bolstering their operations, driving the market's upward trajectory.

- China's healthcare and life sciences (HLS) sector has witnessed remarkable growth in recent years, which has been marked by robust investments, rapid innovation, and expanding businesses. Backed by supportive government policies and ample capital resources, China is striving to emerge as a leading force in global pharmaceutical innovation.

- The Japanese food and beverage processing and packaging industry is poised for growth, driven by factors like a rising urban population and evolving food consumption patterns. Notably, the Global Organic Trade Guide highlights that the consumption of packaged organic food in Japan is set to rise from USD 401.4 million in 2018 to an estimated USD 427.1 million by 2025.

- Additionally, the retail sales value of health and wellness beverages and packaged food is projected to hit USD 57.3 billion by 2025. These trends are fueling investments in food processing and packaging plants in Japan, which, in turn, will drive the demand for pneumatic equipment in this sector.

- The Indian food and beverage processing and packaging sector has witnessed significant growth, driven by factors like urbanization, shifting demographics, and a thriving retail landscape. This surge in demand has spurred food and beverage companies to ramp up production. They are leveraging the expanding middle-class consumer base, introducing new products, and diversifying their offerings.

Pneumatic Equipment Industry Overview

The pneumatic equipment market is highly fragmented, with major players like Festo SE, Emerson Electric Co., SMC Corporation, Janatics, and Siemens AG. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- March 2024 - Chicago Pneumatic announced plans to launch a new eBlueTork Series of battery torque wrenches for heavy commercial vehicles. eBlueTork offers advanced features to improve operator and passenger safety, traceability, and productivity in impact-wrench applications.

- November 2023 - SMC, a Japanese manufacturer of pneumatic control systems, announced to invest JPY 40 billion (USD 0.27 billion) by 2026 to establish a round-the-clock model at its sites, seeking to halve the time needed for product development.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Automation Across Industries

- 5.1.2 Stringent Government Regulations

- 5.2 Market Challenges

- 5.2.1 High Maintenance Cost Over the Equipment's Lifespan

6 MARKET SEGMENTATION

- 6.1 By Type of Equipment

- 6.1.1 Actuators

- 6.1.2 Valves

- 6.1.3 Fittings

- 6.1.4 Other Types of Equipment

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Food and Beverage Processing and Packaging

- 6.2.3 Aerospace and Defense

- 6.2.4 Life Sciences

- 6.2.5 Chemical and Petrochemical

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Festo SE

- 7.1.2 Emerson Electric Co.

- 7.1.3 SMC Corporation

- 7.1.4 Janatics

- 7.1.5 Siemens AG

- 7.1.6 Parker Hannifin Corp.

- 7.1.7 Ingersoll Rand

- 7.1.8 Koki Holdings Co. Ltd

- 7.1.9 Chicago Pneumatic

- 7.1.10 Eaton Corporation

- 7.1.11 ROSS Controls

- 7.1.12 Bimba Manufacturing Company (IMI PLC)