|

市場調查報告書

商品編碼

1537598

生態纖維:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Eco Fibers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

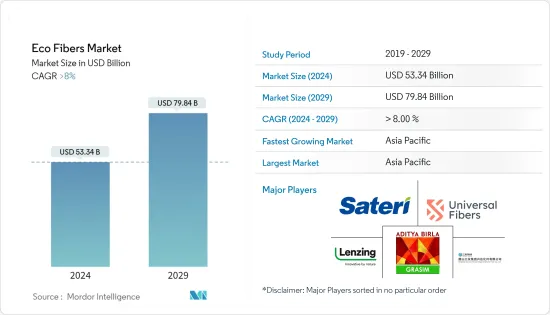

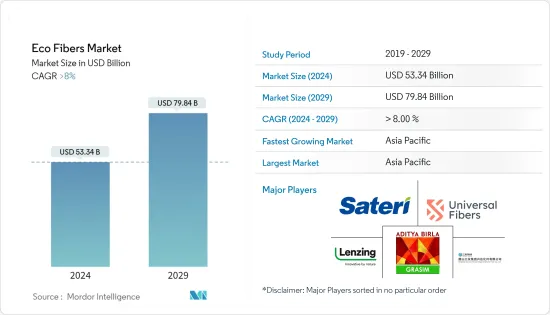

生態纖維市場規模預計到 2024 年為 533.4 億美元,預計到 2029 年將達到 798.4 億美元,在預測期內(2024-2029 年)複合年成長率超過 8%。

2020 年生態纖維市場受到了 COVID-19 的負面影響。紡織業是受疫情影響最嚴重的產業之一,全球市場服飾業務訂單出現兩位數下降。然而,大多數國家的政府啟動了各種計劃來振興該行業,隨後導致該行業的顯著成長和改善。例如,在歐洲,歐盟(EU)和改善服飾工作條件的「Better Work」計畫決定聯手改善孟加拉和越南等國家的工作條件。這些努力帶動了服飾的復興,從而增加了對生態纖維的需求。

從長遠來看,日常服裝和時尚服裝需求的增加以及生態纖維在家庭應用中的使用增加預計將推動研究的市場。

最終產品的高成本預計將阻礙未來幾年生態纖維市場的成長。

各種應用對天然纖維的需求不斷成長,預計將在未來幾年創造市場機會。

預計亞太地區也將主導全球生態纖維市場,並在整個預測期內實現最快的成長。

生態纖維市場趨勢

紡織業需求不斷成長

- 生態纖維對環境無害,並且由於世界對提高永續性的興趣日益濃厚,擴大用於紡織紡織品。

- 生態纖維通常由多種材料製成,包括大麻、亞麻、有機棉和竹子,用於生產纖維。有機棉等產品作為傳統棉花的永續替代品正在全球市場上佔有一席之地。

- 有機棉生產最早始於土耳其,目前有機棉產業在許多開發中國家的紡織業中佔有關鍵地位。該部門在促進幾個新興經濟體的經濟發展方面也發揮著重要作用。

- 根據《國際新型研究與發展期刊》通報,在消費者需求不斷成長的推動下,到 2030 年,印度的棉花產量預計將達到 720 萬噸(4,300 萬包,重 170 公斤)。此外,中國國家統計局預計,2022年中國棉花產量將達到近598萬噸,與前一年同期比較增加4.3%。

- 竹纖維作為天然抗菌材料,具有抑菌、除臭功效。此外,竹纖維透氣性好、觸感柔軟、易拉直,並且在織物上具有優異的染料和顏料著色性能。

- 日常穿著舒適性需求的發展、時尚布料的技術進步以及已開發地區政府對紡織化學品的監管正在推動紡織業對技術創新的需求,這將推動未來幾年生態纖維市場的發展。

- 根據印度工業聯合會(CII)統計,印度是世界第二大紡織品和服飾生產國,佔全球紡織品和服飾貿易的4%佔有率。此外,紡織服飾業對印度GDP的貢獻率為2.3%,對工業生產的貢獻率為13%,對出口的貢獻率為12%。

- 此外,2022年美國紡織品和服裝出貨收益達658億美元。該國是世界第三大紡織相關產品出口國。 2021年紡織品、紡織品和服裝出口額為340億美元。

- 因此,所有這些因素預計將在預測期內推動生態纖維市場。

亞太地區主導市場

- 亞太地區預計將主導全球市場,這主要歸功於中國和印度高度發展的紡織業。此外,由於棉花產量高且擁有廉價勞動力,製造商更願意在中國、印度、孟加拉和巴基斯坦等國家設立製造單位。

- 由於紡織產品中使用的各種化學物質以及大多數人口中各種疾病的流行,人們對環境的關注日益增加,這增加了對各種應用的生態纖維的需求。生態纖維對人類友好,在生產過程中不會對環境造成任何破壞。

- 生態纖維也用於家庭應用,如防水布、地工織物、袋子、地毯和家具材料。中國主要向印度、巴基斯坦、歐洲等國家和地區出口家居用品。

- 此外,根據印度投資局的分析,到2030年,印度紡織品產量將達2,500億美元,出口額將達1,000億美元。

- 由於對永續包裝的需求不斷成長,包裝也是最近對環保紡織品需求成長的領域。 Protega Global Ltd. 的數據顯示,2023 年 1 月,尋求永續包裝的消費者比例上升至 81%。

- 據印度包裝工業協會 (PIAI) 稱,包裝被認為是印度經濟的第五大部門,並且每年以 22-25% 左右的速度成長。

- 此外,根據世界貿易組織(WTO)的資料,中國在全球生態纖維紡織品市場上處於領先地位。

- 總體而言,這些因素預計將在預測期內推動市場成長。

生態纖維產業概況

全球生態纖維市場具有部分整合的性質,少數參與者在全球市場中佔有較大佔有率。全球市場主要企業(排名不分先後)包括SATERI、Aditya Birla Management Corporation Pvt. Ltd(Grasim Industries Limited)、Universal Fibers Inc.、LENZING AG(ECOVERO)、唐山三友集團興達化纖等。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 日常服裝和時尚服裝的需求不斷成長

- 家庭使用量增加

- 抑制因素

- 最終產品成本高

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 有機纖維

- 再生纖維

- 其他類型

- 按用途

- 紡織品

- 工業的

- 家居/家具

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國家

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- LENZING AG

- Grasim Industries Limited

- Pilipinas Ecofiber Corporation

- Polyfibre Industries Private Limited

- SATERI

- Shanghai Tenbro Bamboo Textile Co.,Ltd.

- Tangshan Sanyou Group Xingda Chemical Fiber Co.,Ltd.

- TEIJIN FRONTIER CO., LTD.

- Universal Fibers, Inc.

- Wellman Advanced Materials

第7章 市場機會及未來趨勢

- 各種應用對天然纖維的需求不斷成長

- 其他機會

The Eco Fibers Market size is estimated at USD 53.34 billion in 2024, and is expected to reach USD 79.84 billion by 2029, growing at a CAGR of greater than 8% during the forecast period (2024-2029).

The eco fibers market was negatively impacted by COVID-19 in 2020. The textile industry was one of the industries to be worst affected by the pandemic, with business orders of garments dropping by double-digit numbers in the global market. However, the governments of most countries initiated various schemes to revive the sector, which later led to substantial growth and improvement in the sector. For instance, in Europe, the European Union (EU) and Better Work, a program to improve working conditions in the garment industry, decided to join efforts to improve working conditions in countries such as Bangladesh and Vietnam. Such initiatives helped revive the sector and consequently boosted eco-fiber demand.

Over the long run, growing demand for daily and fashion wear and increasing use of eco-fiber in household applications are expected to drive the market studied.

The high cost of final products is expected to hinder the market growth of eco fibers through the coming years.

Growing demand for natural fibers in various applications is expected to create opportunities for the market in the coming years.

Asia-Pacific is expected to dominate the global eco fibers market, and it is also expected to register the fastest growth through the forecast period.

Eco Fibers Market Trends

Growing Demand from Textile Industry

- Eco-fibers are environmentally friendly and have been increasingly used in textile fabrics because of the growing global focus on improved sustainability.

- Eco-fibers are usually made of different substances, such as hemp, flax, organic cotton, and bamboo, which are used in the production of fabrics. Products, such as organic cotton, are gaining traction and serve as a sustainable alternative to conventional cotton in the global market.

- Organic cotton production initially started in Turkey, and the organic cotton industry currently occupies the place of the backbone of the textile industry of many developing countries. The sector has also played an important role in boosting the economies of a few developing countries.

- According to the International Journal of Novel Research and Development, cotton production in India is projected to reach 7.2 million tons (43 million bales of 170 kg each) by 2030, driven by increasing consumer demand. Additionally, the National Bureau of Statistics of China stated that China produced nearly 5.98 million tonnes of cotton in 2022, up 4.3% yearly.

- Bamboo fiber works naturally as an anti-bacterial material and has properties of bacteriostatic and deodorant. Additionally, bamboo fibers offer permeability, a soft feel, and easy straightening and have excellent dye and pigmentation color effect properties to fabrics.

- Increasing demand for comfort in daily wear, technological advancements in fashion fabrics, and government regulations on textile chemicals in developed regions are driving the demand for innovations in the textile industry, which, in turn, is expected to drive the market for eco fibers through the years to come.

- According to the Confederation of Indian Industry (CII), India is the world's second-largest producer of textiles and garments and has a 4% share of the global trade in textiles and apparel. Furthermore, the textiles and apparel industry contributes 2.3% to India's GDP, 13% to industrial production, and 12% to exports.

- Furthermore, the United States' textile and apparel shipments totaled USD 65.8 billion in 2022. The country is the third largest exporter of textile-related products in the world. Fiber, textile, and apparel exports were USD 34.0 billion in 2021.

- Thus, all such factors are expected to drive the eco fibers market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the global market, largely driven by the highly developed textile industry in China and India. Moreover, manufacturers prefer to set up manufacturing units in countries like China, India, Bangladesh, and Pakistan, owing to high cotton production and availability of cheap labor.

- Growing environmental issues because of various chemicals used in textiles and a large proportion of the population getting affected by various diseases are increasing the demand for eco fibers in different applications. Eco fibers are human-friendly and cause no damage to the environment, even during the production phase.

- Eco-fibers have also been used for household applications, such as tarpaulins, geotextiles, bags, carpets, and furniture materials. China majorly exports its household materials to other countries and regions, like India, Pakistan, Europe, etc.

- Furthermore, as per Invest India's analysis, India is set to achieve USD 250 billion in textiles production and USD 100 billion in exports by 2030.

- Packaging is another sector where the demand for eco-friendly fibers is recently gaining momentum due to the increasing demand for sustainable packaging. According to Protega Global Ltd., in January 2023, the percentage of consumers demanding sustainable packaging was risen to 81%.

- Packaging is considered the fifth largest sector in the Indian economy and is growing around 22-25% per annum, according to the Packing Industry Association of India (PIAI).

- Additionally, according to World Trade Organization (WTO) data, China leads the global eco-fiber textile market.

- Overall, such factors are expected to drive market growth during the forecast period.

Eco Fibers Industry Overview

The global eco fibers market is partially consolidated in nature, with few players having a significant share in the global market. Some of the major players in the global market (not in any particular order) include SATERI and Aditya Birla Management Corporation Pvt. Ltd (Grasim Industries Limited), Universal Fibers Inc., LENZING AG (ECOVERO), and Tangshan Sanyou Group Xingda Chemical Fibre Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Daily and Fashion Wear

- 4.1.2 Increasing Household Applications

- 4.2 Restraints

- 4.2.1 High Cost of Final Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Organic Fibers

- 5.1.2 Recycled Fibers

- 5.1.3 Other Types

- 5.2 Application

- 5.2.1 Textiles

- 5.2.2 Industrial

- 5.2.3 Household and Furnishing

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 LENZING AG

- 6.4.2 Grasim Industries Limited

- 6.4.3 Pilipinas Ecofiber Corporation

- 6.4.4 Polyfibre Industries Private Limited

- 6.4.5 SATERI

- 6.4.6 Shanghai Tenbro Bamboo Textile Co.,Ltd.

- 6.4.7 Tangshan Sanyou Group Xingda Chemical Fiber Co.,Ltd.

- 6.4.8 TEIJIN FRONTIER CO., LTD.

- 6.4.9 Universal Fibers, Inc.

- 6.4.10 Wellman Advanced Materials

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Natural Fibers in Various Applications

- 7.2 Other Opportunities