|

市場調查報告書

商品編碼

1537601

全球瀝青膜市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Bitumen Membranes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

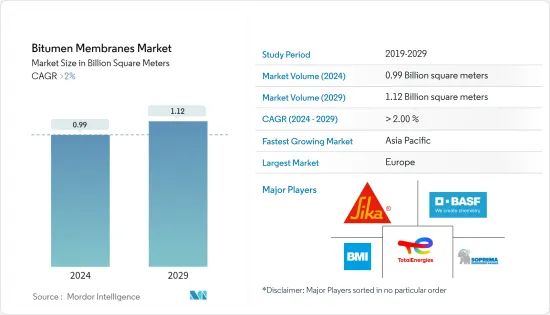

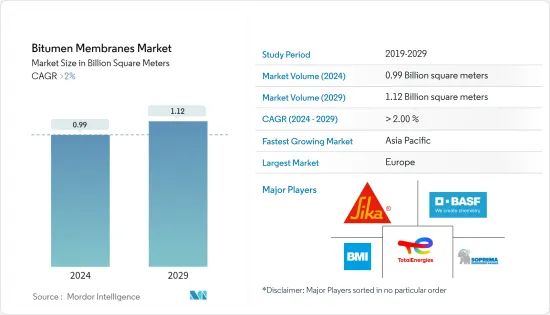

預計2024年全球瀝青防水卷材市場規模為9.9億平方公尺,2029年達到11.2億平方公尺,預測期間(2024-2029年)複合年成長率超過2%。

COVID-19 對瀝青防水卷材產業產生了重大影響。建設產業面臨各國停工、物流受限、供應鏈中斷、勞動力短缺、零件供應限制、需求減少、企業流動性減少以及因停工導致生產中斷等挑戰,並受到負面影響。為此,原料供應商和相關企業被迫重新考慮自己的策略,以滿足這段關鍵時期的產業需求。不過,這種情況在2021年初有所恢復,進而恢復了市場的成長軌跡。

主要亮點

- 亞太地區建設活動的活性化以及薄膜在防水、加濕、捆綁和其他應用等各個領域的多功能性預計將推動市場需求。

- 另一方面,由於存在各種溶劑和稀釋劑,與瀝青膜相關的潛在健康和環境問題正在阻礙市場成長。

- 然而,人們對綠色屋頂日益成長的興趣預計將增加對防水膜的需求,並為市場提供利潤豐厚的機會。

- 預計在預測期內,歐洲將佔據全球瀝青防水卷材市場的最大佔有率。

瀝青防水卷材市場趨勢

建設產業壟斷需求

- 瀝青防水卷材廣泛應用於建築防水工程中,形成防水屏障,防止結構損壞並確保較長的使用壽命。

- 瀝青膜也用於保護地基免受進水,特別是地下結構的腐蝕和結構的損壞。

- 瀝青防水卷材有多種應用,包括屋頂、露台、儲槽襯裡、地基、地下結構和地下室。

- 目前,全球建設產業正在穩步成長。亞太地區的建築業正在以驚人的速度成長,其中中國、印度和東南亞國家是熱點。

- 根據國家統計局的數據,2022年中國建築業產值將達到31.2兆元(4.39兆美元),而前一年為29.31兆元人民幣(4.12兆美元)。

- 印度財政部的數據顯示,2023會計年度印度建設業實際附加價值毛額成長超過9%,但21會計年度下降8.6%,2022會計年度下降10.7%。

- 同樣,根據美國人口普查局的數據,2022年美國建設業總產值成長超過1,660億美元,達到1,7,920億美元。隨著建築產量的擴大,建築、基礎設施開拓和維修等應用對瀝青防水卷材的需求增加,這可能對特種膠帶市場產生正面影響。

- 根據國家統計和普查局的數據,2022年阿根廷許可建築面積和建築許可數量達到1485萬平方公尺和57240棟建築,與上一年的資料相比出現成長。

- 同樣,根據OICA的數據,2022年法國汽車產量超過138萬輛,其中乘用車佔73.05%。與去年的汽車總產量相比,這一數字有所增加。

- 上述因素導致預測期內該地區瀝青防水卷材消費需求的增加。

歐洲主導市場

- 預計在預測期內,歐洲將佔據全球瀝青防水卷材市場的最大佔有率。

- 德國擁有歐洲最大的建築業。根據聯邦統計局(德國聯邦當局)的數據,2023 年德國住宅建設收入達到 579.5 億歐元(收益億美元),而 2022 年為 610 億歐元(657.9 億美元)。

- 此外,該國的非住宅和商業建築預計在未來幾年將顯著成長。低利率、實際可支配收入的增加以及歐盟和德國政府的大量投資正在支撐經濟成長。

- 英國的住宅正在穩步成長。然而,該國的非住宅產業正在苦苦掙扎,預計將在預測期內復甦。

- 此外,雖然瀝青防水卷材不直接應用於汽車製造過程,但瀝青基產品透過防銹、隔音和改善整體駕駛體驗,在增強車輛耐用性、舒適性和性能方面發揮作用。

- 根據國際工業協會(OICA)統計,2022年,義大利汽車產業汽車銷售量約151萬輛,其中乘用車佔87.45%。由於各車型銷量下降,該國新車註冊量與前一年同期比較%。然而,義大利到2022年仍保持歐洲第四大汽車市場的地位。

- 因此,預計在預測期內歐洲國家對瀝青防水卷材的需求將會成長。

瀝青防水卷材產業概況

全球瀝青防水卷材市場部分分散。研究市場的主要企業包括(排名不分先後)Sika AG、SOPREMA SAS、BMI Group、TotalEnergies、 BASF SE 等。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 亞太地區建設活動的成長

- 膜應用的多樣性

- 其他司機

- 抑制因素

- 潛在的健康和環境問題

- 其他

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(基於數量的市場規模)

- 年級

- 雜排聚丙烯

- 聚丁二烯

- 其他

- 產品類型

- 床單

- 液體

- 最終用戶產業

- 建造

- 車

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- ARDEX Group

- BASF SE

- BMI Group

- Bondall

- Firestone Building Products Company, LLC

- IKO PLC

- Isoltema Spa

- Sika AG

- SOPREMA SAS

- Tiki Tar Industries India Ltd

- TotalEnergies

第7章 市場機會及未來趨勢

- 對綠色屋頂日益成長的興趣推動了對防水膜的需求

The Bitumen Membranes Market size is estimated at 0.99 Billion square meters in 2024, and is expected to reach 1.12 Billion square meters by 2029, growing at a CAGR of greater than 2% during the forecast period (2024-2029).

COVID-19 has had a significant impact on the bitumen membrane industry. The construction industry has faced challenges such as lockdowns in different countries, logistical constraints, supply chain interruptions, workforce shortages, limited component availability, decreased demand, low company liquidity, and manufacturing shutdowns due to lockdowns, has experienced adverse impacts. In response, raw material suppliers and affiliated businesses are compelled to reassess their strategies to address the industry's needs during this crisis period. However, the condition recovered in early 2021, thereby restoring the market's growth trajectory.

Key Highlights

- The growing construction activities in the Asia-Pacific region and the versatility of membrane applications in various areas, such as waterproofing, humidifying, binding, and other applications, are likely to enhance market demand.

- On the flip side, the potential health and environmental issues affiliated with bitumen membranes due to the presence of various solvents and diluents are hindering the growth of the market.

- Nevertheless, the rising interest in green roofs to boost demand for waterproofing membranes is expected to offer lucrative opportunities to the market.

- The European region is expected to account for the largest share of the global bitumen membranes market over the forecast period.

Bitumen Membranes Market Trends

Construction Industry to Dominate the Demand

- Bitumen membranes are extensively used for waterproofing in construction and are used to create a protective barrier against water penetration, preventing damage to structures and ensuring longevity.

- They are also used to safeguard foundations against water infiltration, and bitumen membranes prevent corrosion and structural damage, particularly in below-ground structures.

- Bitumen membranes are used for various applications, which include roofing, terraces, tank lining, podiums, below-grade structures, and basements, among others.

- Currently, the global construction industry has been growing steadily. The construction industry in the Asia-Pacific region is growing at a significant pace, with China, India, and Southeast Asian countries being in the hotspot.

- According to the National Bureau of Statistics of China, the construction output value in China has reached CNY 31.2 trillion (USD 4.39 trillion) in 2022 and registered growth when compared to CNY 29.31 trillion (USD 4.12 trillion) in the previous year.

- As per the Ministry of Finance (India), in FY2023, the real gross value added in the construction industry across India increased by more than 9%, whereas during FY 2021 and FY2022, it was -8.6% and 10.7%, respectively.

- Simialry, according to the US Census Bureau, the total value of construction output in the United States increased by more than USD 166 billion in 2022, reaching a total of USD 1,792 billion. As construction output expands, the need for bitumen membranes in applications like building, infrastructure development, and renovation is likely to increase, positively influencing the specialty tape market.

- According to the National Institute of Statistics and Censuses, the surface area of buildings authorized for construction and number of building permits in Argentina has reached 14.85 million square meters and 57.24 thousands in 2022 and registred growth when compared to the previous years data.

- Similarly, according to OICA, France witnessed the production of more than 1.38 million motor vehicles in 2022, with passenger cars constituting 73.05 percent of this total. This marked an increase in growth compared to the overall vehicle production in the preceding year.

- The factors above contribute to the increasing demand for bitumen membranes consumption in the region during the forecast period.

Europe Region to Dominate the Market

- The European region is expected to account for the largest share in the global bitumen membranes market over the forecast period.

- Germany has the largest construction industry in Europe. According to the Federal Statistical Office (a federal authority of Germany), revenue in housing construction in Germany has reached EUR 57.95 billion (USD 62.50 billion) in 2023, however registred less revunes when comapred with EUR 61 billion ((USD 65.79 billion)) in 2022.

- Additionally, the non-residential and commercial buildings in the country are expected to witness significant growth prospects in the coming years. Lower interest rates, an increase in real disposable incomes, and numerous investments by the European Union and the German governments support the growth.

- Residential construction in the United Kingdom is witnessing steady growth. However, the non-residential sector in the country is struggling and is expected to recover during the forecast period.

- Furthur, while bitumen membranes are not directly applied in the automotive manufacturing process, bitumen-based products play a role in enhancing the durability, comfort, and performance of vehicles by providing protection against rust, dampening noise, and improving overall driving experience.

- According to The International Organization of Motor Vehicle Manufacturers (OICA), in 2022, Italy's automotive sector recorded the sale of approximately 1.51 million motor vehicles, with passenger cars constituting 87.45 percent of this total. The overall new vehicle registrations in the country witnessed a 9.8 percent year-over-year decline, attributed to reduced sales in various vehicle categories. Nevertheless, Italy retained its position as the fourth-largest vehicle market in Europe for the year 2022.

- Therefore, the demand for bitumen membranes is expected to grow in European countries during the forecast period.

Bitumen Membranes Industry Overview

The global bitumen membranes market is partially fragmented. The major companies of the market studied include (not in any particular order) Sika AG, SOPREMA S.A.S. , BMI Group, TotalEnergies, and BASF SE, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction Activities in Asia-Pacific Region

- 4.1.2 Versatility of Membrane Applications

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Potential Health and Environmental Issues

- 4.2.2 Others

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (market size in volume)

- 5.1 Grade

- 5.1.1 Atactic Polypropylene

- 5.1.2 Styrene-Butadiene-Styrene

- 5.1.3 Others

- 5.2 Product Type

- 5.2.1 Sheets

- 5.2.2 Liquids

- 5.3 End-user Industry

- 5.3.1 Construction

- 5.3.2 Automotive

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle-East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARDEX Group

- 6.4.2 BASF SE

- 6.4.3 BMI Group

- 6.4.4 Bondall

- 6.4.5 Firestone Building Products Company, LLC

- 6.4.6 IKO PLC

- 6.4.7 Isoltema Spa

- 6.4.8 Sika AG

- 6.4.9 SOPREMA S.A.S

- 6.4.10 Tiki Tar Industries India Ltd

- 6.4.11 TotalEnergies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Interest in Green Roofs to Boost Demand for Waterproofing Membranes