|

市場調查報告書

商品編碼

1537605

磁性材料:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Magnetic Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

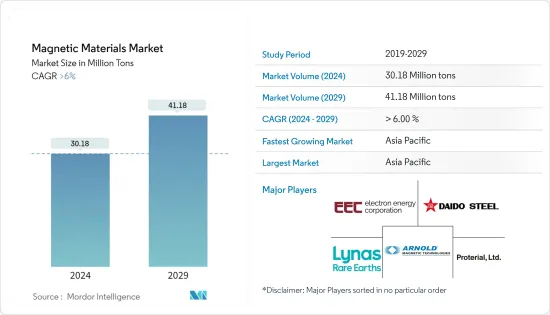

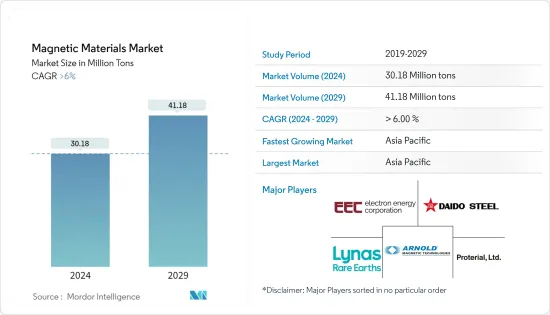

預計2024年全球磁性材料市場規模將達3,018萬噸,2024年至2029年複合年成長率將超過6%,2029年將達4,118萬噸。

磁性材料市場受到COVID-19大流行的影響,多個國家採取全國性的封鎖措施和嚴格的社交距離措施,導致汽車和電子元件的生產停止,這對磁性材料市場產生了負面影響。然而,在COVID-19大流行之後,大多數工業生產設施和汽車製造商恢復營運,導致磁性材料市場復甦。近年來,由於汽車、電子和發電行業需求的增加,市場出現了顯著的成長。

發電行業中磁性材料採用率的上升以及電子終端用戶行業中磁性材料使用率的增加預計將推動當前的研究市場。

另一方面,稀土元素材料的高開採成本預計將阻礙市場成長。

混合電動車對磁性材料的需求不斷成長預計將在預測期內創造市場機會。

預計亞太地區將主導市場。由於汽車、電子和發電行業對磁性材料的需求不斷成長,預計在預測期內複合年成長率將達到最高。

磁性材料市場趨勢

發電業需求增加

- 磁性材料擴大用於發電。這些材料用於發電和傳輸的馬達。磁性材料應用於馬達、發電機、變壓器、致動器等設備。

- 電子機械由硬磁性材料製成,用於一個主要功能:提供磁通量。硬磁材料具有高矯頑力,可以承受電路退磁和高溫下的熱退磁。

- 根據能源與資源研究所的數據,2022年全球發電量為29,165四瓦時,而2021年為28,520四瓦時,成長率為2.26%。因此,發電能力的增加預計將推動磁性材料市場的發展。

- 美國的發電能力僅次於中國,位居第二。 2022 年,美國公共產業規模發電設施發電量約為 42,430 億度 (kWh)。大約 60% 的發電量來自煤炭、天然氣、石油和其他氣體等石化燃料。

- 此外,風力發電廠對磁性材料的需求不斷增加。過去兩年,中國增加了風電裝置容量。 2022年,中國建設的風電場數量將比歐洲多出46%。根據IEA預測,2022年中國陸上風電發電量預計將達到30.9GW,到年終將達到59GW。

- 因此,發電應用領域預計將在預測期內主導磁性材料市場。

亞太地區主導市場

- 由於中國和印度發電行業高度發達,以及多年來持續投資發展電子和汽車行業,亞太地區預計將主導全球市場。

- 此外,亞太地區日益成長的環境問題正在增加政府對內燃機汽車的監管。這導致該地區對電動車的需求不斷成長,支持了各種應用中磁性材料的消耗。

- 在中國,隨著消費者越來越喜歡電動車,汽車產業正在呈現轉型趨勢。此外,中國政府預計2025年電動車產量的滲透率將達到20%。這反映在該國電動車銷售趨勢上,2022年電動車銷量創下歷史新高。

- 根據中國乘用車協會的數據,2022年中國電動車和插電式混合動力車銷量為567萬輛,幾乎是2021年銷量的兩倍。由於該國對潤滑油添加劑的需求預計將下降,市場預計將維持目前的銷售速度。

- 同樣,在印度,重點正在轉向電動車,以減少溫室氣體排放。政府承諾,到 2023 年,印度新車銷量的 30% 將是電動車。此外,多家公司正在該國建立電動車製造設施,以增加電動車的生產數量。

- 例如,日產和雷諾在2023年2月宣布,計畫未來三到五年在印度投資6億美元,擴大乘用車和電動車市場佔有率。這將提振電動車市場並推動對磁性材料的需求。

- 由於上述因素,預測期內該地區對磁性材料的需求可能會增加。

磁性材料行業概況

磁性材料市場部分整合。市場主要企業包括(排名不分先後)Arnold Magnetic Technologies、Daido Steel、Electron Energy Corporation、PROTERIAL, Ltd.、Lynas Rare Earths Ltd.。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 發電業擴大採用磁性材料

- 擴大電子領域的應用

- 其他司機

- 抑制因素

- 稀土開採成本高

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:基於數量)

- 類型

- 硬磁性材料

- 軟磁性材料

- 半硬磁性材料

- 最終用戶產業

- 車

- 電子產品

- 發電

- 工業的

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟和協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- Adams Magnetic Products

- Arnold Magnetic Technologies

- Daido Steel Co., Ltd.

- Dexter Magnetic Technologies

- Electron Energy Corporation

- GKN Powder Metallurgy

- Lynas Rare Earths Ltd.

- Molycorp Inc

- PROTERIAL, Ltd.

- Quadrant.

- Shin-Etsu Chemical Co., Ltd.

- Steward Advanced Materials LLC.

- TDK Corporation

- Tengam

- Toshiba Materials Co., Ltd.

第7章 市場機會及未來趨勢

- 混合動力汽車對磁性材料的需求不斷增加

- 其他機會

The Magnetic Materials Market size is estimated at 30.18 Million tons in 2024, and is expected to reach 41.18 Million tons by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

The magnetic materials market was negatively affected by the COVID-19 pandemic due to nationwide lockdowns in several countries and strict social distancing measures, which resulted in production halts of automotive vehicles and electronic components, thereby affecting the market for magnetic materials. However, post-COVID-19 pandemic, most of the industrial manufacturing facilities and automotive manufacturers resumed their operations, which helped to revive the market for magnetic materials. In recent years, the market registered a significant growth rate due to increasing demand from the automotive, electronics, and power generation industries.

The rising adoption of magnetic materials in the power generation industry and the increasing usage in the electronics end-user industry are expected to drive the current studied market.

On the flip side, the high cost of extracting rare earth materials is expected to hinder the growth of the market.

The rising demand for magnetic materials in hybrid electric vehicles is expected to create opportunities for the market during the forecast period.

The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to the rising demand for magnetic materials in the automotive, electronics, and power generation industries.

Magnetic Materials Market Trends

Growing Demand from Power Generation Sector

- Magnetic Materials have been increasingly used in the power generation sector. These materials are used in motors to generate power and transmission of electricity. Magnetic materials are applied in equipment such as motors, generators, transformers, and actuators, amongst others.

- Electric machines are made of hard magnetic materials and are used for one primary function, which is to provide magnetic flux. Ard magnetic materials have high coercivity to resist demagnetization from the electric circuit and thermal demagnetization under high operating temperatures.

- According to the Energy and Resource Institute, the global electricity generation capacity is registered at 29,165 tetra watt-hours in the year 2022 at a growth rate of 2.26% as compared to 28,520 tetra watt-hours of electricity generated in the year 2021. Thus, the increasing electricity generation capacity is anticipated to drive the market for magnetic materials.

- The United States occupies second place after China regarding power generation capacity. In 2022, about 4,243 billion kilowatt hours (kWh) of electricity were generated at utility-scale electricity generation facilities in the United States.1 About 60% of this electricity generation was from fossil fuels-coal, natural gas, petroleum, and other gases.

- Furthermore, the demand for magnetic materials is increasing in wind power stations. China added more wind generation capacity in the past two years. In 2022, China generated 46% more wind power than Europe by installing more wind power stations. According to the IEA, the onshore wind electricity generation in China registered at 30.9 GW in 2022, and it is expected to reach 59 GW by the end of 2023.

- Thus, the power generation applications segment is anticipated to dominate the market for magnetic materials during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the global market owing to the highly developed power generation sector in China and India, coupled with continuous investments in the region to advance the electronics and automotive industry through the years.

- Moreover, the growing environmental issues in the Asia-Pacific region have increased government regulations on combustion engine vehicles. This has increased the need for electric cars in the area, supporting the consumption of magnetic materials in various applications.

- In China, the automotive industry is witnessing switching trends as the consumer inclination toward battery-operated vehicles is higher. Moreover, the government of China estimates a 20% penetration rate of electric vehicle production by 2025. This is reflected in the electric vehicle sales trend in the country, which went to a record-breaking high in 2022.

- As per the China Passenger Car Association, the country sold 5.67 million EVs and plug-ins in 2022, almost double the sales figures achieved in 2021. Anticipating a decline in the nation's need for lubricant additives, the market is poised to sustain sales at the current pace.

- Similarly, in India, the focus is shifting to electric vehicles to reduce greenhouse gas emissions. The government has committed that 30% of the new vehicle sales in India will be electric by 2023. Furthermore, various companies are establishing electric vehicle manufacturing facilities in the country to increase the production volume of electric vehicles.

- For instance, in February 2023, Nissan and Renault announced their plan to invest USD 600 million in India over the next 3-5 years to expand their market share in passenger cars and electric vehicles. It will boost the market for electric vehicles, thereby driving the demand for magnetic materials.

- Due to the factors above, the demand for magnetic materials will likely increase in the region during the forecast period.

Magnetic Materials Industry Overview

The magnetic materials market is partially consolidated in nature. Some of the major players in the market (not in any particular order) include Arnold Magnetic Technologies, Daido Steel Co., Ltd, Electron Energy Corporation, PROTERIAL, Ltd., and Lynas Rare Earths Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 The Rising Adaption of Magnetic Materials in Power Generation Industry

- 4.1.2 Increasing Applications in Electronics

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost in Extracting Rare Earth Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Hard Magnetic Materials

- 5.1.2 Soft Magnetic Materials

- 5.1.3 Semi-Hard Magnetic Materials

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Electronics

- 5.2.3 Power Generation

- 5.2.4 Industrial

- 5.2.5 Other End-user Industries (Consumer Goods, Communication and Technology, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Adams Magnetic Products

- 6.4.2 Arnold Magnetic Technologies

- 6.4.3 Daido Steel Co., Ltd.

- 6.4.4 Dexter Magnetic Technologies

- 6.4.5 Electron Energy Corporation

- 6.4.6 GKN Powder Metallurgy

- 6.4.7 Lynas Rare Earths Ltd.

- 6.4.8 Molycorp Inc

- 6.4.9 PROTERIAL, Ltd.

- 6.4.10 Quadrant.

- 6.4.11 Shin-Etsu Chemical Co., Ltd.

- 6.4.12 Steward Advanced Materials LLC.

- 6.4.13 TDK Corporation

- 6.4.14 Tengam

- 6.4.15 Toshiba Materials Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for Magnetic Materials in Hybrid Electric Vehicles

- 7.2 Other Opportunities