|

市場調查報告書

商品編碼

1537606

防冰塗料:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Anti-icing Coating - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

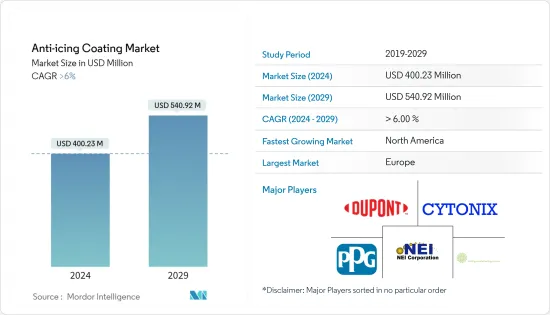

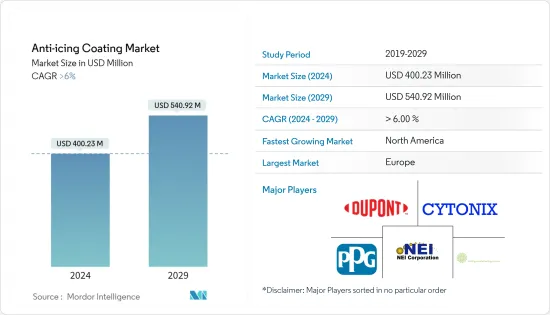

預計2024年全球防冰塗料市場規模將達到4.023億美元,並在2024-2029年預測期內以超過6%的複合年成長率成長,到2029年將達到5.4092億美元。

主要亮點

- 由於全球停工、嚴格的社會隔離措施和供應鏈中斷,COVID-19 大流行對市場產生了負面影響。全國隔離期間原物料價格上漲也對防冰被覆劑市場產生了負面影響。

- 不過,限購解除後,市場穩定復甦。在汽車、交通、建築、IT/通訊和可再生能源產業防冰被覆劑消費增加的推動下,市場顯著反彈。

- 汽車和航太領域不斷成長的需求、寒冷地區的高需求以及防冰塗料的優越性能預計將推動防冰塗料市場的發展。

- 具有成本效益的替代品的可用性預計將阻礙市場的成長。

- 在預測期內,自持潤滑防凍層的開拓預計將在市場上創造機會。

- 歐洲地區在市場上佔據主導地位,因為該地區寒冷的氣候條件下防冰塗料的應用不斷增加,這增加了防冰塗料的需求。

防冰塗料市場趨勢

汽車和交通運輸產業主導市場

- 防冰塗料有助於降低能源成本和消費量,提陞技術產品的性能,提高產品安全性,提振防冰塗料市場。

- 由於在寒冷氣候條件下廣泛使用防冰被覆劑,汽車和運輸業成為主導產業。清潔能源部長級 (CEM) 下的舉措,例如電動車舉措和電動車的日益普及,可能會在不久的將來推動防冰被覆劑的消費。

- 全球汽車產量的成長預計將推動防冰被覆劑市場的發展。根據國際汽車製造商組織(OICA)預測,2022年全球汽車產量將達8,501萬輛,較2021年的8,021萬輛成長6%。中國、美國和印度是世界上最重要的汽車市場。

- 中國汽車及零件生產和出口居世界領先地位。中國仍然是全球最大的汽車市場。根據OICA統計,2022年中國汽車產量總合2,702萬輛,與前一年同期比較同期成長3%。

- 美國是僅次於中國的全球第二大汽車市場,在全球汽車市場中佔有很大佔有率。根據OICA統計,2022年美國汽車產量達1,006萬輛,而2021年產量為915萬輛,成長率為9%。這促進了汽車工業的成長,刺激了防冰塗料的市場需求。

- 最近,飛機製造商一直在尋找加速生產的方法,以填補積壓訂單。例如,波音《2022-2041 年商業展望》預計,到 2041 年,全球新飛機交付總量將達到 41,170 架。因此,飛機產量的增加預計將推動當前的研究市場。

- 因此,由於上述因素,汽車和交通運輸終端用戶產業預計將帶動防冰塗料市場。

歐洲地區主導市場

- 歐洲地區預計將主導防冰被覆劑市場。航太、通訊、電力線路、建築和海上平台等許多行業的應用不斷擴大,預計將推動防冰被覆劑的需求。

- 德國汽車製造業是整個歐洲地區汽車生產的最大股東。該國是大眾、梅賽德斯-奔馳、奧迪、寶馬和保時捷等主要汽車製造品牌的所在地。 OICA預計,2022年汽車和輕型商用車總產量將達367萬輛,而2021年為330萬輛,成長率為11%。因此,汽車產業的成長也推動了防冰被覆劑的需求。

- 同樣,在法國,汽車工業也錄得強勁成長。根據OICA統計,2022年全國汽車產量138萬輛,與前一年同期比較同期成長2%。由於車輛成本上漲,2022 年乘用車、輕型商用車、大型商用車、巴士和客車的銷售量下降。

- 德國是歐洲建築業規模最大的國家。在新住宅建設活動增加的推動下,該國的建築業繼續溫和成長。例如,根據歐盟統計局的數據,2022年建築施工收入為1,140億美元,預計2024年將達到1,254億美元。因此,建築業的成長可能會推動當前的研究市場。

- 在歐洲,隨著空中交通量的增加,對飛機的需求也增加。根據波音《2022-2041年商業展望》,預計到2041年新飛機交付總量將達到8,550架,市場服務價值將達到8,500億美元,從而增加該地區對防冰被覆劑的需求。

- 防冰塗層廣泛應用於風力發電機葉輪,以防止結冰對機械強度的影響,降低維護成本並確保平穩運作。歐洲的風力發電能力正在增加。 2022年,歐洲新增風電裝置容量19吉瓦。此外,歐洲的目標是在 2023 年至 2027 年間安裝 129GW(吉瓦)的新風力發電廠。因此,風力發電產業的成長預計將推動該地區防冰塗料市場的發展。

- 因此,所有這些市場趨勢預計將在預測期內推動該地區防冰塗料市場的需求。

防冰塗料產業概況

防冰塗料市場得到部分完整。該市場的主要企業包括(排名不分先後)NEI Corporation、Cytonix、PPG Industries, Inc.、DuPont 和 NanoSonic, Inc.。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 汽車和航太領域的需求不斷成長

- 寒冷地區需求量大

- 防冰塗層的優異性能

- 抑制因素

- 具有成本效益的替代方案的可用性

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:以金額為準)

- 基板

- 金屬

- 玻璃

- 陶瓷

- 混凝土的

- 最終用戶產業

- 汽車/交通

- 建造

- 通訊

- 可再生能源

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 其他領域

- 南美洲

- 中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟和協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Aerospace & Advanced Composites GmbH

- Battelle Memorial Institute

- CG2 Nanocoatings

- Cytonix

- DuPont

- Fraunhofer

- Helicity Technologies, Inc.

- HygraTek

- NanoSonic, Inc.

- NEI Corporation

- Opus Materials Technologies

- PPG Industries, Inc.

第7章 市場機會及未來趨勢

- 永續自潤滑防冰層的開發

- 其他機會

簡介目錄

Product Code: 69435

The Anti-icing Coating Market size is estimated at USD 400.23 million in 2024, and is expected to reach USD 540.92 million by 2029, growing at a CAGR of greater than 6% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic negatively impacted the market due to worldwide lockdowns, strict social distancing measures, and disruptions in supply chains, which had adverse effects on the market for anti-icing coatings. The prices of raw materials increased during the lockdown, further contributing to the negative impact on the anti-icing coatings market.

- However, the market recovered well after the restrictions were lifted. It rebounded significantly, driven by increased consumption of anti-icing coatings in the automotive, transportation, construction, telecommunication, and renewable energy industries.

- The growing demand from the automotive and aerospace sectors, high demand in cold climatic conditions, and the superior properties of anti-icing coatings are expected to drive the market for anti-icing coatings.

- The availability of cost-effective alternate substitutes for anti-icing coatings is expected to hinder market growth.

- The development of a self-sustainable lubricating anti-icing layer is expected to create opportunities for the market during the forecast period.

- The European region dominates the market, owing to the growing application of anti-icing coatings in cold climatic conditions in the region, which augments the demand for anti-icing coatings.

Anti-Icing Coating Market Trends

Automotive and Transportation Industries to Dominate The Market

- Anti-icing coatings help reduce the cost and consumption of energy, enhance the performance of technical goods, and contribute to product safety, which will provide a boost to the anti-icing coating market.

- The automotive and transportation industry stands to be the dominant segment owing to the extensive consumption of anti-icing coatings in vehicles under cold climatic conditions. The initiatives under the Clean Energy Ministerial (CEM), like the electric vehicle initiative and the growing popularity of electric vehicles, are likely to drive the consumption of anti-icing coatings in the near future.

- The increase in the global production of automotive vehicles is expected to drive the market for anti-icing coatings. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), global automotive vehicle production reached 85.01 million in 2022, compared to 80.21 million manufactured in 2021, at a growth rate of 6%. China, the United States, and India are the most prominent automotive vehicle markets globally.

- China is the world's leading producer and exporter of automobiles and their parts. China continues to be the world's largest vehicle market. According to OICA, automotive vehicle production in China reached a total of 27.02 million units in 2022, an increase of 3% over the previous year for the same period.

- The United States is the second-largest automotive market in the world after China, which occupies a significant share of the global automotive vehicles market. According to OICA, in 2022, the United States automotive vehicle production reached 10.06 million compared to 9.15 million units manufactured in 2021, at a growth rate of 9%. This enhanced the growth of the automobile industry, which has stimulated the market demand for anti-icing coatings.

- Furthermore, recently, aircraft manufacturers have been looking for ways to accelerate production to fill order backlogs. For instance, according to the Boeing Commercial Outlook 2022-2041, the total global deliveries of new airplanes are estimated to be 41,170 by 2041. Thus, the increased aircraft production is expected to drive the current studied market.

- Hence, owing to the above-mentioned factors, the automotive and transportation end-user industry is expected to drive the market for anti-icing coatings.

Europe Region to Dominate the Market

- The European region is expected to dominate the market for anti-icing coatings. The increasing application in many industries, including aerospace, telecommunications, power lines, construction, and offshore platforms, is expected to propel the demand for anti-icing coatings.

- The automobile manufacturing industry in Germany is a prominent shareholder of the overall automotive production in the European region. The country hosts major car-making brands, including Volkswagen, Mercedes-Benz, Audi, BMW, Porsche, etc. According to OICA, the total production volume of cars and light commercial vehicles reached 3.67 million units in 2022, compared to 3.30 million units manufactured in 2021, at a growth rate of 11%. Therefore, such growth in the automotive industry has also been driving the demand for anti-icing coatings.

- Similarly, in France, the automotive industry registered a significant growth rate. According to OICA, the total production of vehicles in the country amounted to 1.38 million units in 2022, registering a growth of 2% from the previous year. Passenger cars, light commercial vehicles, heavy commercial vehicles, buses, and coaches witnessed a decline in 2022 sales in the country owing to the growing cost of vehicles.

- Germany has the most significant construction industry in Europe. The country's construction industry has been growing slowly, driven by increasing new residential construction activities. For instance, according to Eurostat, the building construction revenue is registered at USD 114 billion in 2022 and is expected to reach USD 125.4 billion by 2024. Thus, growth in the construction industry is likely to drive the current studied market.

- In Europe, with the increase in air traffic, the demand for aeroplanes is increasing in the country. According to the Boeing Commercial Outlook 2022-2041, the total deliveries of new airplanes are estimated to be 8,550 units by 2041, with a market service value of USD 850 billion, thereby increasing the demand for anti-icing coatings in the region.

- Anti-icing coatings are widely used on rotor blades of wind turbines to protect against the effect of icing on mechanical strength, reduce maintenance costs, and ensure smooth operations. Europe is increasing its wind energy generation capacity. In 2022, Europe installed 19 gigawatts of new wind energy capacity. Furthermore, Europe aims to install 129 GW (gigawatts) of new wind farms over the period 2023-2027. Thus, the growth in the wind energy sector is expected to drive the anti-icing coating market in the region.

- Hence, all such market trends are expected to drive the demand for the anti-icing coating market in the region during the forecast period.

Anti-Icing Coating Industry Overview

The anti-icing coating market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) NEI Corporation, Cytonix, PPG Industries, Inc., DuPont, and NanoSonic, Inc., amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing demand from Automotive and Aerospace Sector

- 4.1.2 High Demand in Cold Climatic Conditions

- 4.1.3 Superior Properties of Anti-icing Coatings

- 4.2 Restraints

- 4.2.1 Availability of Cost-Effective Alternate Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Substrate

- 5.1.1 Metal

- 5.1.2 Glass

- 5.1.3 Ceramics

- 5.1.4 Concrete

- 5.2 End User Industry

- 5.2.1 Automotive and Transportation

- 5.2.2 Construction

- 5.2.3 Telecommunication

- 5.2.4 Renewable Energy

- 5.2.5 Other End-User Industries (Marine, Industrial, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Aerospace & Advanced Composites GmbH

- 6.4.2 Battelle Memorial Institute

- 6.4.3 CG2 Nanocoatings

- 6.4.4 Cytonix

- 6.4.5 DuPont

- 6.4.6 Fraunhofer

- 6.4.7 Helicity Technologies, Inc.

- 6.4.8 HygraTek

- 6.4.9 NanoSonic, Inc.

- 6.4.10 NEI Corporation

- 6.4.11 Opus Materials Technologies

- 6.4.12 PPG Industries, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Self Sustainable Lubricating Anti-Icing Layer

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219