|

市場調查報告書

商品編碼

1537616

汽車語音辨識系統:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automotive Voice Recognition System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

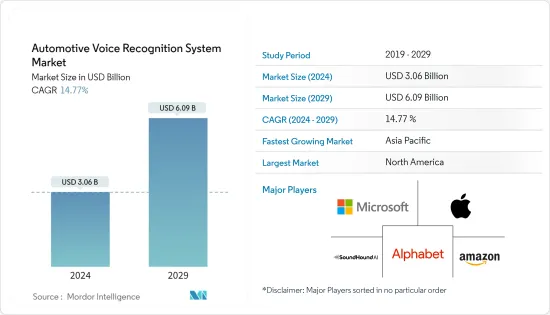

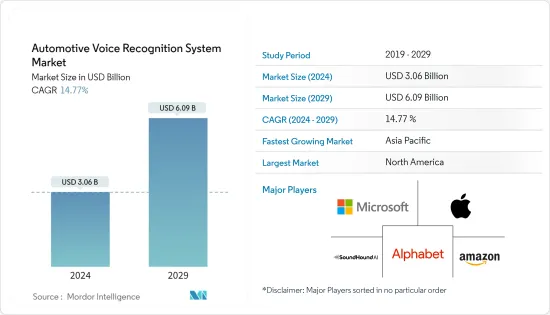

預計2024年全球汽車語音辨識系統市場規模將達30.6億美元,2024-2029年預測期間複合年成長率為14.77%,2029年將達到60.9億美元。

市場促進因素包括汽車產量和銷售的增加、世界大部分地區消費者收入水準的提高(他們現在能夠在舒適和豪華的服務上花費更多)以及對駕駛員安全的需求增加,其中包括資訊娛樂和偏好服務的開拓。

*根據國際汽車工業協會(OICA)的數據,2022年輕型商用車新車銷量將達到1,980萬輛,而2021年為1,860萬輛,較去年同期與前一年同期比較成長7%。

此外,自動駕駛汽車和連網汽車技術的快速增強正在刺激對 ADAS(高級駕駛員輔助系統)的需求,因為它們有助於為駕駛者提供免持體驗,我認為這需要一段時間。此外,電動車在全球範圍內的日益普及也大大促進了汽車語音辨識系統需求的成長。

*根據國際能源總署(IEA)的數據,2022年全球電池式電動車銷量將達到730萬輛,而2021年為460萬輛,與前一年同期比較58.6%。

該市場的主要企業正在透過與主要汽車製造商 (OEM) 合作,將語音辨識技術整合到OEM車輛中來擴展其服務。

*2023 年 8 月,SoundHound AI Inc. 宣布推出先進的人工智慧技術,包括創新的邊緣+雲端連接、多語言功能和自訂品牌語音助手,以幫助土耳其行動提供商 Togg 的智慧汽車整合到新產品線中。此外,該公司表示,Togg 的車載人工智慧語音助理可以即時追蹤和理解語音上下文,有時甚至在用戶說完之前。使用 SoundHound 專有的 Speech-to-Meaning (R) 和 Deep Meaning Understanding (R) 技術,您可以回答多個問題,甚至過濾結果。

*2022年9月,寶馬集團宣布已選擇微軟公司子公司Cerence Inc.開發新的語音和人工智慧驅動的語音助手,以整合到最新版本的寶馬智慧個人助理(IPA)中。這些功能將配備在新款 BMW 7 系列和 BMW i7 上。

由於聯網汽車銷量高、年輕汽車購買者願意選擇語音辨識技術等最新連網型功能以及汽車製造商的強大影響力,亞太地區成為成長最快的地區,預計這將成為一個區域市場。由於汽車購買者對語音辨識等新時代技術的親和性以及聯網汽車的高銷量,歐洲和北美是第二大市場。

汽車語音辨識系統的市場趨勢

乘用車領域將成為預測期內的驅動力

客戶尋求的是駕駛舒適性和便利性,而不是功率和扭力數據,並且越來越傾向於購買具有先進連接功能而不是機械規格的汽車。這種趨勢在全球主要汽車市場中越來越明顯,增加了對車載語音辨識系統等功能的需求。

- 根據國際汽車工業協會(OICA)預測,2022年全球新乘用車銷量將達到5,740萬輛,而2021年為5,640萬輛,年成長與前一年同期比較1.9%。

此外,聯網汽車和自動駕駛汽車銷售的增加也推動了對語音辨識系統的需求。除了聯網汽車之外,自動駕駛汽車也標配語音辨識技術。語音辨識系統有望將駕駛者從基本的日常任務中解放出來,讓他們完全專注於駕駛,從而減少車禍的數量。梅賽德斯、寶馬和奧迪等多家汽車製造商的豪華車和高級乘用車正在迅速將先進的語音辨識系統融入其車輛中,以獲得行業競爭優勢,這對市場產生了積極影響。細分市場的需求激增。

- 2022年,BMW、賓士、奧迪將成為全球豪華車銷量最高的主要汽車製造商。 2022年豪華車銷售BMW為240萬輛,賓士為207萬輛,奧迪為161萬輛。

因此,聯網汽車和自動駕駛汽車的銷售趨勢不斷成長,車輛安全性提高的趨勢,以及家庭轎車和緊湊型 SUV 等中等價格分佈車輛中包含語音辨識系統,這些都是推動這一趨勢的一些因素。在預測期內推動市場。

預計亞太地區在預測期內成長最快

亞太地區預計將成為繼北美和歐洲之後成長最快的區域市場。亞太地區是一個龐大的乘用車市場。印度和中國是全球最大的兩個乘用車市場,佔全球乘用車銷售量的近30%,使亞太地區成為汽車語音辨識系統最有利的區域市場。

- 根據電動車工業協會統計,2023年電動四輪車銷量達48,105輛,而2022年為19,782輛,比與前一年同期比較成長143.1%。

- 日本汽車經銷商協會的數據顯示,日本新車市場在2023年10月呈現強勁復甦,銷量從2022年10月的359,159輛成長10.7%至397,672輛。

亞太國家的領先汽車製造商越來越願意將先進的解決方案融入其車輛中,以提高客戶的便利性。將人工智慧和支援虛擬助理的語音辨識系統融入車輛中是這些玩家所依賴的創新技術功能之一。領先的汽車製造商與語音辨識系統供應商建立了長期合作夥伴關係,並大力投資開發先進的語音辨識系統,以滿足不斷成長的需求。

- 雷諾韓國汽車公司於2023年11月宣布,已與Tmap Mobility Co.簽署了關於未來資訊娛樂合作的合作備忘錄。作為新車開發計劃“Aurora Project”的一部分,雷諾韓國宣布將能夠提供帶有車載語音辨識功能的中型混合運動休旅車(SUV)“NUGU Auto”,Tmap Store,in-車輛便捷付款,以及專門針對電動車的服務我們計劃安裝「Tmap Infotainment」。

- Cerence Inc.於2023年4月宣布,中國智慧汽車供應商斑馬將為上海大眾汽車有限公司(SVW)和一汽大眾(FAW-VW)等斑馬汽車製造商客戶提供先進的車載對話服務。和語音辨識技術。 Cerence 的旗艦產品對話式人工智慧 (Conversational AI) 讓車載助理能夠充當主動且值得信賴的副駕駛,指導駕駛員日常出行,同時確保他們安全、知情和舒適。

因此,由於該領域的快速進步和創新,預計亞太國家商用車和乘用車領域的汽車語音辨識系統市場在預測期內都將成長。

汽車語音辨識系統產業概況

汽車語音辨識系統市場分散且競爭激烈,因為各種現有和新進業者都在生態系統中運作。該市場的特點是存在與主要汽車製造商結盟的相當大的參與者。這些參與者還進行合資、併購、新產品發布和產品開拓,以擴大其品牌組合併鞏固其市場地位。例如,

- 2024 年 1 月,大眾汽車宣布,從 2024 年春季開始,作為大眾 1D3、ID4、ID5、ID7、Tiguan、Passat 和 Golf 資訊娛樂系統一部分的 Cerence Chat Pro 系統將整合 ChatGPT 來分析已宣布的語音請求。它將支援並啟用各種功能。這包括資訊娛樂、導航和氣候控制功能的控制。

- 2023 年 6 月,英國汽車製造商 Morris Garages 的印度分公司 MG Motor India 宣布與 Jio Platforms 合作,為其在印度新推出的智慧電動車帶來獨特的音訊作為聯網汽車功能的一部分。解決方案。根據協議,Jio 的印度英語語音助理系統「HelloJio」將為駕駛 Comet EV 的印度客戶提供多功能車載語音助理。

- 2022 年 7 月,LG Electronics Inc. 與 SoundHound AI Inc. 合作,將 SoundHound 基於人工智慧的先進語音辨識平台整合到 LG 的汽車 IVI 資訊娛樂系統中。此次合作將使LG電子公司能夠提供SoundHound公司先進的基於語音的AI,提供對話式語音控制,以顯著提高車輛駕駛人和乘客的便利性。

未來幾年,市場預計將看到人工智慧和 Alexa 等虛擬助理等先進技術整合到車輛語音辨識系統中。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 對豪華和高檔乘用車的需求不斷成長推動市場成長

- 市場限制因素

- 高昂的購買和安裝成本阻礙因素了市場成長

- 工業吸引力 - 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模:美元)

- 按車型

- 客車

- 商用車

- 依技術

- 嵌入式

- 雲端基礎

- 混合

- 按車輛類別

- 經濟

- 中間價格分佈

- 奢華

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 其他領域

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Microsoft Corporation

- Apple Inc.

- Alphabet Inc.

- Harman International Industries

- Nuance Communications Inc.

- Sensory Inc.

- IBM Corporation

- SoundHound AI Inc.

- Kardome Technology Ltd

- Amazon.com Inc.

- Robert Bosch GmbH

- iNago Corporation

第7章 市場機會及未來趨勢

- 將人工智慧(AI)和虛擬助理等先進技術融入語音辨識系統將推動市場需求

The Automotive Voice Recognition System Market size is estimated at USD 3.06 billion in 2024, and is expected to reach USD 6.09 billion by 2029, growing at a CAGR of 14.77% during the forecast period (2024-2029).

Over the forecast period, the market is expected to be driven by several factors, including increasing automobile production and sales, higher income levels of consumers in most parts of the world, enabling them to spend more on comfort and luxury services, development of infotainment and technology services to provide safety and comfort to the driver as well as the growing preference of young customers for automobiles equipped with the latest connectivity and AI features.

* According to the International Organization of Motor Vehicle Manufacturers (OICA), new light commercial vehicle sales touched 19.8 million units in 2022 compared to 18.6 million units in 2021 worldwide, recording a substantial Y-o-Y growth of 7%.

Moreover, rapid enhancement in autonomous vehicles and connected vehicle technology will fuel the demand for advanced automotive voice recognition systems as they assist in providing a hands-free experience to drivers. Coupled with that, the increasing penetration of electric vehicles worldwide is also a major contributor to the rising demand for automotive voice recognition systems.

* According to the International Energy Agency (IEA), battery electric vehicle sales worldwide touched 7.3 million units in 2022 compared to 4.6 million units in 2021, representing a Y-o-Y growth of 58.6%.

Key players in the market are expanding their services by tying up with major automobile original equipment manufacturers (OEMs) to integrate their voice recognition technologies into OEMs' vehicles. For instance,

* In August 2023, SoundHound AI Inc. launched its advanced AI technology, including innovative Edge+Cloud connectivity, multiple language capabilities, and a custom-branded voice assistant to be integrated into a new line of smart vehicles from Turkish mobility provider Togg. Further, the company stated that Togg's in-vehicle AI-powered voice assistant can track and understand speech context in real-time (in instances even before the user has finished speaking). Using SoundHound's proprietary Speech-to-Meaning(R) and Deep Meaning Understanding(R) technologies, it can also address multiple questions and filter results.

* In September 2022, BMW Group announced that it had selected Cerence Inc., a Microsoft Corp. subsidiary, for developing a new voice and AI-powered voice assistant for integration into the latest version of BMW Intelligent Personal Assistant (IPA). These features would be available in the new BMW 7 Series and BMW i7.

Asia-Pacific is expected to become the fastest-growing regional market due to large sales of connected vehicles, young automobile buyers' willingness to opt for the latest connectivity features like voice recognition technology, and a large presence of automakers. Europe and North America are the next largest markets because of the close affinity of car buyers to new-age technologies like voice recognition and high sales of connected vehicles.

Automotive Voice Recognition System Market Trends

Passenger Cars Segment to Gain Traction During the Forecast Period

Customers increasingly prefer to purchase a car with advanced connectivity features rather than the mechanical specifications of the vehicle because they demand driving comfort and convenience more than the outright power or torque figures. This trend is increasingly observed in major automotive markets worldwide, which has led to an increase in the demand for features like in-vehicle voice recognition systems.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), new passenger vehicle sales worldwide touched 57.4 million units in 2022 compared to 56.4 million units in 2021, representing a Y-o-Y growth of 1.9%.

Further, the demand for voice recognition systems is being accelerated by the rising sales of connected cars and autonomous vehicles. Both connected as well as autonomous vehicles have voice recognition technology as a standard feature. Voice recognition systems have been seen to reduce the number of vehicle accidents since they free drivers from basic, routine tasks so they can fully concentrate on driving. Luxury and premium passenger cars offered by various automakers, such as Mercedes, BMW, and Audi, are rapidly integrating advanced voice recognition systems in their vehicles to gain a competitive edge in the industry, which, in turn, is positively impacting the surging demand for this segment of the market.

- In 2022, BMW, Mercedes-Benz, and Audi were the leading automakers with the highest luxury vehicle sales worldwide. BMW registered sales of 2.4 million units of luxury vehicles, followed by 2.07 million units by Mercedes-Benz and a sales volume of 1.61 million units by Audi in 2022.

Thus, increasing sales of connected and autonomous vehicles, the trend toward greater vehicle safety, and the availability of voice recognition systems in mid-priced vehicles like family sedans and compact SUVs are some of the factors anticipated to drive the market in the forecast period.

Asia-Pacific Expected to be the Fastest-growing Regional Market During the Forecast Period

The Asia-Pacific is expected to be the fastest-growing regional market, followed by North America and Europe. Asia-Pacific is a huge market for passenger vehicles. India and China are some of the largest markets for passenger vehicles in the world, contributing to almost 30% of the global passenger vehicle sales, thus making Asia-Pacific the most lucrative regional market for automotive voice recognition systems.

- According to the Society of Manufacturers of Electric Vehicles, electric four-wheeler sales touched 48,105 units in FY 2023 compared to 19,782 units in FY 2022, representing a Y-o-Y growth of 143.1%.

- According to the Japan Automobile Dealers Association, in October 2023, the new vehicle market in Japan made a strong recovery, with sales rising by 10.7% to 397,672 units from 359,159 units in October 2022.

Major auto manufacturers in Asia-Pacific countries are increasingly preferring to integrate advanced solutions in their vehicles to enhance customers' convenience. The incorporation of artificial intelligence and virtual assistant-enabled voice recognition systems in their vehicle fleets is among the innovative technological features that these players are relying on. Major automakers are forming long-term partnerships with voice recognition system suppliers and are investing hefty sums in the development of advanced voice recognition systems that can cater to the increasing demand. For instance,

- In November 2023, Renault Korea Motors announced that it had signed a memorandum of understanding (MOU) with Tmap Mobility Co. for future infotainment collaboration. As part of the new car development project "Aurora Project," Renault Korea plans to equip the mid-size hybrid sports utility vehicle (SUV) with "Tmap Infotainment," which is capable of providing in-car voice recognition "NUGU Auto," Tmap Store, in-car easy payment, and electric vehicle-specialized services.

- In April 2023, Cerence Inc. announced that Chinese smart car supplier Banma had tapped Cerence to bring advanced in-car conversational AI and voice recognition technology to Banma's automaker customers, including Shanghai Volkswagen Automotive Co. (SVW) and FAW-Volkswagen (FAW-VW). Cerence's flagship conversational AI enables in-car assistants to function as proactive, trusted co-pilots, leading drivers through their daily journeys while staying safe, informed, and comfortable.

Thus, with rapid advancements and innovations in this segment, the market for automotive voice recognition systems is expected to grow over the forecast period for both the commercial and passenger vehicles segment across Asia-Pacific countries.

Automotive Voice Recognition System Industry Overview

The automotive voice recognition system market is fragmented and highly competitive due to various incumbent players and new entrants operating in the ecosystem. The market is characterized by the presence of considerably large players who have entered into collaborations with major auto manufacturers. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions. For instance,

- In January 2024, Volkswagen announced that starting in spring 2024, the Cerence Chat Pro systems that are part of the infotainment in the VW 1D3, ID4, ID5, ID7, Tiguan, Passat, and Golf would integrate ChatGPT to assist with parsing voice requests and enabling a variety of functions. This includes controlling the infotainment, navigation, and climate functions.

- In June 2023, MG Motor India, the Indian unit of British car maker Morris Garages, announced its partnership with Jio Platforms to offer unique voice solutions as part of its connected car features in its newly launched smart electric vehicle in India. As per the agreement, Jio's Hinglish voice assistant system, HelloJio, will offer versatile in-car voice assistants to Indian users driving the Comet EV.

- In July 2022, LG Electronics Inc. collaborated with SoundHound AI Inc. to incorporate SoundHound's advanced AI-based voice recognition platform into LG's IVI infotainment systems for automobiles. The partnership will enable LG Electronics Inc. to offer SoundHound Inc.'s advanced voice-based AI that offers conversational voice controls to ensure a very high degree of convenience for drivers and passengers of the vehicle.

The market is anticipated to witness the integration of advanced technologies such as artificial intelligence and virtual assistants like Alexa in automotive voice recognition systems over the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Luxury and Premium Passenger Cars to Foster Market Growth

- 4.2 Market Restraints

- 4.2.1 High Purchase and Installation Costs Deter Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Technology

- 5.2.1 Embedded

- 5.2.2 Cloud-based

- 5.2.3 Hybrid

- 5.3 By Vehicle Class

- 5.3.1 Economy

- 5.3.2 Mid-priced

- 5.3.3 Luxury

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Microsoft Corporation

- 6.2.2 Apple Inc.

- 6.2.3 Alphabet Inc.

- 6.2.4 Harman International Industries

- 6.2.5 Nuance Communications Inc.

- 6.2.6 Sensory Inc.

- 6.2.7 IBM Corporation

- 6.2.8 SoundHound AI Inc.

- 6.2.9 Kardome Technology Ltd

- 6.2.10 Amazon.com Inc.

- 6.2.11 Robert Bosch GmbH

- 6.2.12 iNago Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Advanced Technologies such as Artificial Intelligence (AI) and Virtual Assistants into Voice Recognition Systems Propel Market Demand