|

市場調查報告書

商品編碼

1537621

工業離心機:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Industrial Centrifuges - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

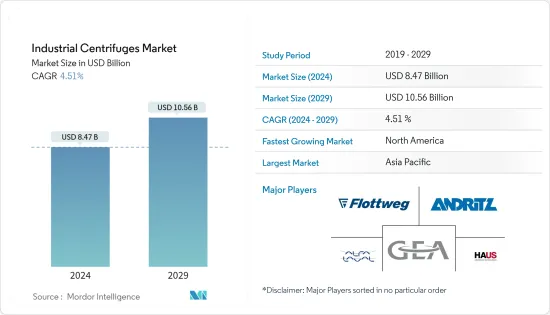

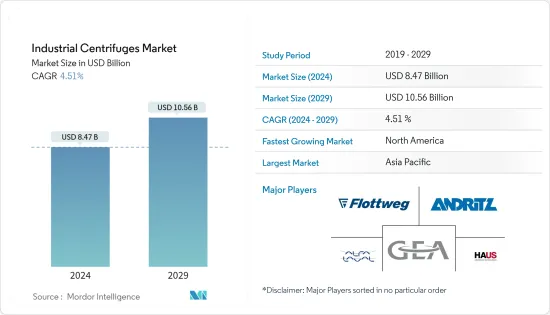

預計2024年全球工業離心機市場規模將達84.7億美元,2024-2029年預測期間複合年成長率為4.51%,2029年將達到105.6億美元。

從長遠來看,化學工業需求的增加預計將刺激工業離心機的成長。化學和製造業投資的增加預計將推動市場成長。

另一方面,離心機的高資本成本和技術缺陷預計將阻礙預測期內的市場成長。

然而,隨著能源使用既成為成本問題又成為長期環境問題的趨勢日益明顯,工業過程的各個階段對節能離心機的需求不斷成長。因此,根據客戶對能源來源需求的增加和能源消耗的減少,離心機的技術進步預計將在預測期內為市場參與者創造充足的機會。

亞太地區可能會主導市場,並預計在預測期內保持最高的複合年成長率。這一成長是由加工食品、製藥和污水處理行業的投資和需求增加所推動的。

工業離心機市場趨勢

化學工業主導市場

- 在化學工業中,工業離心機是重要的工具,具有多種用途,有助於提高各種製程的效率和品質。主要應用之一是從混合物中分離化學品,這是化學品製造的基本過程。

- 工業離心機在化學工業中的另一個重要角色是澄清和精製。離心機通過去除雜質、污染物或不需要的顆粒來澄清和精製化學溶液。工業離心機根據分子量和粒度等物理特性分離不同的成分,有助於化學產品的精製。

- 化工離心分離技術也隨著化學工業的快速發展而不斷增加。例如,2023 年 3 月,GEA訂單化學集團 Albemarle 的安裝離心機的訂單。兩台離心機套裝的訂單價值約為2555萬美元。具體來說,我們將為每個煉油廠的生產線提供四種類型的離心機:臥螺離心機、篩螺旋離心機、推料離心機和削皮離心機。

- 化學工業在全球經濟和供應鏈網路中發揮重要作用。根據美國工業理事會統計,2022年全球工業工業總收入達5.72兆美元。 2022年,化學工業收益達到近15年來的最高水準。

- 全球各行業(包括製藥、農業和製造業)對化學品的需求不斷成長,正在推動基礎設施投資,以滿足不斷成長的生產需求。例如,2023年9月,四川禾方生物科技有限公司宣布巨額投資8億美元,在爪哇綜合工業港園區(JIIPE)內建造化學生產設施。工程完成後,預計形成年產60萬噸碳酸鈉、氯化銨、20萬噸Glyphosate的生產能力。

- 隨著化學品處理能力的增加,對離心機等分離和精製技術的需求不斷成長,以處理更大量的化學品並確保產品品質和純度。因此,離心機製造商將從全球工業產業不斷擴大的商機中受益。

- 由於這些因素,在預測期內,化學工業對工業離心機的需求將增加,以滿足化學品的製造和生產量。

亞太地區將在預測期內主導市場

- 由於中國的化學與製造、製藥和污水處理行業的需求量最大,亞太地區是成長最快的離心機市場之一。此外,由於人口快速成長和工業擴張,印度、印尼和馬來西亞等南亞國家的電力需求迅速增加。

- 中國是世界第二大經濟體,也是電力、醫藥、化學、製造、食品飲料等多個產業的領先國家之一。由於這些因素,中國在全球工業離心機市場中佔有很大佔有率。

- 以GDP計算,中國是世界第二大經濟體。 2023年,國內生產毛額達到17.66兆美元。隨著人口老化和經濟從製造業轉向服務業、從外需轉向內需、從投資轉向消費的再平衡,國家成長逐漸下滑。

- 中國國家能源局(NEA)正在考慮是否有可能在本十年內加大國家清潔能源計畫的雄心壯志。國家能源局提案,2030年,中國40%的電力來自核能和可再生能源,目標是2030年核能發電達到120至150吉瓦。這些政府政策和目標預計將支持該國未來幾年的核能發電廠開拓,並為工業離心機市場創造重大機會。

- 同樣,由於各行業的開發活動不斷增加,印度成為亞太地區最大的工業離心機市場之一。

- 印度石化業務投資取得進展,工業離心機需求預計將增加。例如,2024 年 4 月,Chatterjee Group (TCG) 宣布計劃與控股石化公司 Haldia Petrochemicals Ltd (HPL) 以及本地和全球公司合作,在印度南部建造一個價值超過 100 億美元的計劃。這家私募股權公司正計劃在泰米爾納德邦古達洛爾建設一個石油化工計劃,從 2028 年到 2029 年,每年可生產 350 萬噸乙烯和丙烯。

- 亞太地區的精製產業在過去十年中顯著成長,工業離心機在精製過程中發揮至關重要的作用。根據《世界能源數據統計回顧》,2022年亞太地區煉油產能為36,189,000桶/日,較2013年成長8.9%。由於未來幾年將推出許多計劃,因此在預測期內,這一數字將大幅上升。

- 因此,亞太地區各個最終用戶產業的需求正在增加,亞太地區可能在預測期內引領市場。

工業離心機的產業概況

全球工業離心機市場適度分散。市場上的主要企業(排名不分先後)包括 Andritz AG、HAUS Centrifuge Technologies、Alfa Laval AB、GEA Group 和 Flottweg SE。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 市場規模/需求預測,美元,~2029

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 各個最終用戶產業的需求不斷成長

- 抑制因素

- 資本和營運成本上升

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 類型

- 沉澱

- 澄清/濃縮離心機

- 臥螺離心機

- 碟片離心機

- 水力旋流器

- 其他沉降離心機

- 過濾

- 籃式離心機

- 渦旋篩離心機

- 剝離式離心機

- 推料離心機

- 其他過濾離心機

- 沉澱

- 設計

- 水平離心機

- 直立式離心機

- 操作方式

- 批次

- 連續的

- 產業

- 食品/飲料

- 製藥

- 用水和污水處理

- 化學

- 金屬/礦業

- 電力

- 紙漿/造紙製造

- 其他行業

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 俄羅斯

- 北歐的

- 土耳其

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 南非

- 奈及利亞

- 埃及

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟和協議

- 主要企業策略

- 公司簡介

- MSE Hiller

- Andritz AG

- Alfa Laval AB

- GEA Group AG

- Multotec Pty Ltd

- Thomas Broadbent & Sons Ltd

- Flottweg SE

- Ferrum Ltd

- HAUS Centrifuge Technologies

- 市場佔有率分析

第7章市場機會與未來趨勢

- 節能工業離心機的需求不斷成長

The Industrial Centrifuges Market size is estimated at USD 8.47 billion in 2024, and is expected to reach USD 10.56 billion by 2029, growing at a CAGR of 4.51% during the forecast period (2024-2029).

Over the long term, the growing demand from the chemical industry is expected to stimulate the growth of industrial centrifuges. Increasing investments in the chemical and manufacturing industry are expected to drive the growth of the market.

On the other hand, centrifuges' high capital costs and technical drawbacks are expected to hamper the growth of the market during the forecast period.

However, there is increased demand for energy-efficiency centrifuges in every step of the industrial process, with the growing trend that energy used is both a cost and a long-term environmental issue. Hence, depending on the energy sources and increased customer need for lower energy consumption, technical advancements in centrifuges are expected to create ample opportunities for the market players during the forecast period.

Asia-Pacific will likely dominate the market and is expected to register the highest CAGR during the forecast period. This growth is attributed to the increasing investments and demands from the processed food, pharmaceutical, and wastewater treatment industries.

Industrial Centrifuges Market Trends

The Chemical Industry to Dominate the Market

- In the chemical industry, industrial centrifuges are indispensable tools with many applications that contribute to the efficiency and quality of various processes. One primary application lies in separating chemicals from mixtures, a fundamental process in chemical manufacturing.

- Another critical role of industrial centrifuges in the chemical industry is clarification and purification. They clarify and purify chemical solutions by removing impurities, contaminants, or unwanted particles. Industrial centrifuges aid in refining chemical products by separating different components based on their physical properties, such as molecular weight or particle size.

- Chemical centrifuges' separation technology has also increased with the chemical industry's rapid development. For instance, in March 2023, GEA received an order from the chemical group Albemarle to install centrifuges. The order value for the two centrifuge packages is approximately USD 25.55 million. Specifically, GEA is going to supply four different types of centrifuges: decanter centrifuges, screen screw centrifuges, pusher centrifuges, and peeler centrifuges, and for the processing lines of each refinery.

- The chemical industry plays a significant role in the global economy and supply chain network. According to the American Chemistry Council, in 2022, the chemical industry's total worldwide revenue stood at USD 5.72 trillion. In 2022, the chemical industry revenue reached the highest value in the last 15 years.

- Rising global demand for chemicals across various industries, including pharmaceuticals, agriculture, and manufacturing, is prompting investments in infrastructure to meet increasing production needs. For instance, in September 2023, Sichuan Hebang Biotechnology Co. announced a significant investment of USD 800 million to establish a chemical production facility within the Java Integrated Industrial and Port Estate (JIIPE). Upon completion, the facility is expected to achieve an annual production capacity of 600,000 tons of sodium carbonate and ammonium chloride, with a glyphosate production capacity estimated at 200,000 tons.

- As chemical processing capacities grow, there is a greater need for separation and purification technologies like centrifuges to handle larger volumes of chemicals and ensure product quality and purity. As a result, centrifuge manufacturers stand to benefit from the growing opportunities in the global chemical industry.

- Owing to this factor, the demand for industrial centrifuges in the chemical sector will increase during the forecast period to meet the manufacturing and production quantities of chemicals.

Asia-Pacific to Dominate the Market During the Forecast Period

- Asia-Pacific is one of the fastest growing centrifuges markets, owing to the presence of China, which has one of the highest demands from the chemical and manufacturing, pharmaceutical, and wastewater treatment industries. Additionally, the electricity demand is growing rapidly in South Asian countries like India, Indonesia, and Malaysia due to a surge in population and industrial expansion.

- China is the second largest economy globally and one of the leaders in numerous power, pharmaceutical, chemical, manufacturing, food, and beverage industries. Due to these factors, China accounts for a significant share of the global industrial centrifuges market.

- In terms of GDP, China is the second-largest economy in the world. In 2023, the country's GDP reached USD 17.66 trillion. The growth in the country is gradually diminishing as the aging population, manufacturing to services, and external to internal demand, and the economy is rebalancing from investment to consumption.

- China's National Energy Administration (NEA) is examining the possibility of increasing the ambition of the country's clean energy programs this decade. The NEA proposes that China obtain 40% of its electricity from nuclear and renewable sources by 2030 and set its nuclear capacity target to 120-150 gigawatts by 2030. Such government policies and targets aid the country's development of nuclear power plants in the coming years and are anticipated to provide significant opportunities for the industrial centrifuges market.

- Similarly, India is one of the largest markets for industrial centrifuges in Asia-Pacific, owing to the increasing development activities in various industries.

- India is also investing in its petrochemical business, which is anticipated to create a rising demand for industrial centrifuges. For instance, in April 2024, the Chatterjee Group (TCG) announced plans to partner with local and global companies with its majority-owned petrochemical firm Haldia Petrochemicals Ltd (HPL) to build a more than USD 10 billion project in southern India. The private equity firm plans to make the oil-to-chemical project, capable of producing 3.5 million metric tons per year of ethylene and propylene, at Cuddalore in Tamil Nadu from 2028 to 2029.

- The refinery sector of Asia-Pacific has risen significantly over the last 10 years, and industrial centrifuge is vitally used during the refinery process. According to Statistical Review of World Energy Data, in 2022, the refinery capacity of Asia-Pacific was 36,189 thousand barrels daily, increased by 8.9 % compared to 2013. The number rises significantly during the forecast period, as many projects will start in the coming years.

- Therefore, with increasing demand from various end-user industries in the region, Asia-Pacific will likely be a market leader during the forecast period.

Industrial Centrifuges Industry Overview

The global industrial centrifuges market is moderately fragmented. Some of the major players in the market (in no particular order) include Andritz AG, HAUS Centrifuge Technologies, Alfa Laval AB, GEA Group, and Flottweg SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand from Various End-user Industries

- 4.5.2 Restraints

- 4.5.2.1 Higher Capital and Operational Cost

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Sedimentation

- 5.1.1.1 Clarifier/Thickener Centrifuges

- 5.1.1.2 Decanter Centrifuges

- 5.1.1.3 Disc Stack Centrifuges

- 5.1.1.4 Hydrocyclones

- 5.1.1.5 Other Sedimentation Centrifuges

- 5.1.2 Filtering

- 5.1.2.1 Basket Centrifuges

- 5.1.2.2 Scroll Screen Centrifuges

- 5.1.2.3 Peeler Centrifuges

- 5.1.2.4 Pusher Centrifuges

- 5.1.2.5 Other Filtering Centrifuges

- 5.1.1 Sedimentation

- 5.2 Design

- 5.2.1 Horizontal Centrifuges

- 5.2.2 Vertical Centrifuges

- 5.3 Operation Mode

- 5.3.1 Batch

- 5.3.2 Continuous

- 5.4 Industry

- 5.4.1 Food and Beverages

- 5.4.2 Pharmaceutical

- 5.4.3 Water and Wastewater Treatment

- 5.4.4 Chemical

- 5.4.5 Metal and Mining

- 5.4.6 Power

- 5.4.7 Pulp and Paper

- 5.4.8 Other Industries

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 NORDIC

- 5.5.2.8 Turkey

- 5.5.2.9 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Malaysia

- 5.5.3.7 Thailand

- 5.5.3.8 Indonesia

- 5.5.3.9 Vietnam

- 5.5.3.10 Rest of the Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Colombia

- 5.5.4.5 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Qatar

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of the Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 MSE Hiller

- 6.3.2 Andritz AG

- 6.3.3 Alfa Laval AB

- 6.3.4 GEA Group AG

- 6.3.5 Multotec Pty Ltd

- 6.3.6 Thomas Broadbent & Sons Ltd

- 6.3.7 Flottweg SE

- 6.3.8 Ferrum Ltd

- 6.3.9 HAUS Centrifuge Technologies

- 6.4 Market Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Demand for the Energy-efficient Industry Centrifuges