|

市場調查報告書

商品編碼

1537622

零信任安全:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Zero Trust Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

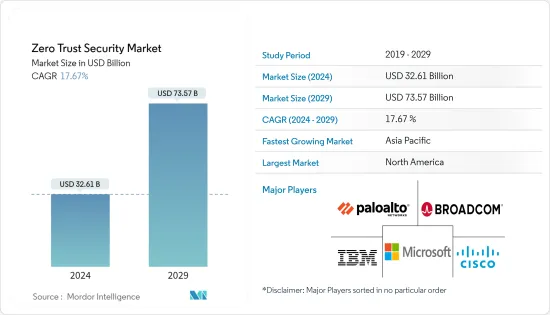

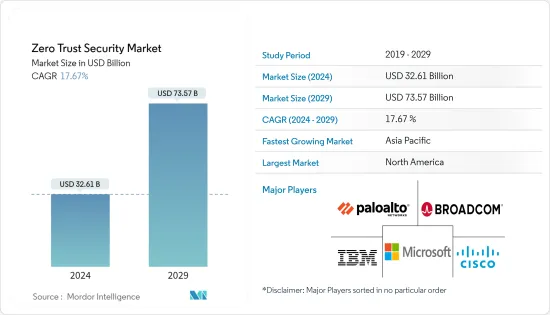

零信任安全市場規模預計到 2024 年為 326.1 億美元,預計到 2029 年將達到 735.7 億美元,在預測期內(2024-2029 年)複合年成長率為 17.67%。

向雲端運算的轉變迫使企業重新考慮其安全狀況。零信任支援安全存取雲端基礎的應用程式和資料,非常適合雲端優先計劃。組織需要開發強大的資料保護機制,以遵守 GDPR 和 CCPA 等嚴格的資料隱私法,而零信任可以實現合規性。企業正在各領域更廣泛地利用零信任框架作為基本安全策略。傳統的基於邊界的範式正在被放棄。各大科技公司正在收購零信任安全業務,以改善保全服務。

主要亮點

- 為了成功實施零信任安全,企業擴大與網路安全供應商和託管安全服務提供者 (MSSP) 合作。這些夥伴關係提供知識和資源來應對確保更廣泛安全邊界的挑戰。雲端運算的使用日益廣泛,提供了靈活性、擴充性和成本效率,正在徹底改變企業的運作方式。敏感資訊和關鍵應用程式不再局限於本地資料中心,安全範圍已經擴大。

- 企業經常使用許多雲端供應商,導致其資料和應用程式分散。這種多重雲端策略使得保護擴展的安全邊界變得更加困難。在共用責任方法中,雲端服務提供者 (CSP) 保護基礎設施,客戶負責保護資料和應用程式。這種責任分工強調了全面安全計畫的必要性。員工和第三方合作夥伴從各種位置和裝置存取雲端服務。這需要持續監控和安全存取控制。

- 適應不斷變化的安全邊界(資料和使用者分佈在許多位置和設備上)對於網路安全的未來至關重要。零信任安全提供了一個可擴展的架構,可以領先於新威脅並解決當前問題。隨著企業不斷重新評估其安全策略以應對這些變化,以及創新解決方案不斷重塑網路安全格局,全球零信任安全市場可望持續成長。

- 對於擁有舊有系統的公司來說,實施零信任安全需要很長的過渡期。因此,徹底的安全措施的部署可能會被推遲。升級或更換遺留系統以符合零信任方法需要時間、金錢和精力。因此,有些公司可能不願採取零信任措施。隨著組織逐漸在現代系統和應用程式中使用零信任安全,遺留元件可能會出現安全缺陷,從而抵消了網路其他部分的零信任優勢。

- 在後 COVID-19 環境中,零信任安全變得更加重要。遠距工作、雲端、新威脅和合規性要求凸顯了對靈活、主動的安全方法的需求。採用零信任的組織能夠更好地應對疫情後的挑戰,並在不斷發展的數位環境中保護其最重要的資產。

零信任安全市場趨勢

中小企業實現顯著成長

- 中小企業在經濟格局中發揮核心作用,有助於增強金融包容性,並向貧困階級和服務不足的市場提供商品和服務。這些公司是創新的重要推動者,具有很高的成長潛力。例如,根據歐盟委員會預計,2023年歐盟將有約2,440萬家中小企業(SME),中小企業構成歐洲經濟的支柱。

- 即使採用混合模式,大多數中小企業仍然沒有為未來職場環境和員工政策的靈活性做好準備。在家工作、混合工作安排和以家庭為中心的勞動力結構的增加正在幫助快速過渡到更安全的策略。為了確保永續性,小型企業需要識別市場機會和消費者需求。

- 雲端基礎的環境可確保長期永續性和彈性,推動中小型企業對各種網路安全策略的需求。零信任安全性可確保強大且安全的工作環境,並且只有在信任得到檢驗的情況下,任何存取組織網路架構的嘗試才會成功。當使用者存取應用程式時,系統會驗證使用者和裝置並持續監控信任。這使您能夠保護組織的應用程式和環境免受任何使用者、裝置或位置的影響,這對於中小型企業的未來發展至關重要。

- 許多老牌和新興網路安全公司正在向中小型企業提供零信任網路存取(ZTNA) 服務,以滿足不斷成長的需求。雲端發送服務將零信任解決方案擴展到雲端原生企業和企業,擁抱雲端採用,並使中小型企業能夠提高生產力、增強安全性、提高可見度並顯著減少所帶來的攻擊面。

亞太地區預計將出現顯著成長

- 過去十年,亞洲的技術力得到了提高,許多公司將數位轉型作為其主要目標之一。數位轉型革命開始得更早,但疫情加速了其速度。特別是,它影響了組織處理 IT 生態系統和安全的方式。

- 亞太地區預計將主導全球製造業,年增率最高,尤其是中國。與大流行前相比,該國的生產力取得了顯著成長。

- 中國繼續優先考慮數位化並改善網路安全態勢。 ZAT 的解決方案可保護他們的數位業務並幫助他們遵守監管標準。中國企業越來越認知到 ZAT 解決方案的價值,而中國市場是亞太地區採用 ZAT 解決方案的關鍵驅動力。

- 2023 年 8 月,亞洲領先的通訊技術集團新加坡電信宣佈建立策略合作夥伴關係,首次在亞洲提供 Zscaler 安全解決方案。透過此次合作,新加坡電信的 MSSE 將為內部資源和技能不足的企業提供一體化數位安全解決方案,以保護其數位資產免受網路威脅。

- 新加坡電信的託管安全服務邊緣 (MSSE) 由專門的網路安全專家提供售前和售後支援、部署、平台諮詢、維護和 24/7 威脅緩解等資源。隨著企業繼續以前所未有的速度數位化,網路威脅的風險也在增加。

零信任安全產業概述

零信任安全市場是分散的,有以下全球和區域公司。思科系統公司、帕洛阿爾托網路公司、IBM 公司、博通公司(賽門鐵克公司)和微軟公司的產品差異化程度較高,產品滲透率不斷提高,競爭水平較高。一攬子解決方案提供,使整合的產品看起來像是產品服務的一部分。

- 2023 年 9 月,博通收購了 VMware。透過收購 VMware,博通能夠將賽門鐵克的安全產品組合與 VMware 的 SD-WAN 功能結合。透過整合賽門鐵克、VMware SD-WAN 和 Carbon Black 的一些安全功能,Broadcom 進入了單一供應商安全存取服務邊際(SASE) 行業,如果成功,將佔領整個 SASE 行業的佔有率和收益。 Broadcom 目前的 Symantec SASE 和保全服務邊緣 (SSE) 產品組合包括安全 Web 閘道 (SWG)、預防資料外泄(DLP)、雲端存取安全仲介(CASB)、零信任網路存取(ZTNA)、SSL 檢查,包含下列組件網路隔離。

- 2023 年 7 月,Accenture與 Palo Alto Networks 合作加強零信任安全。為了協助企業改善網路安全狀況並加速實施業務轉型舉措,兩家公司將聯手使用 SASE 解決方案共同提供安全存取服務邊緣解決方案。 Palo Alto Networks 和Accenture提供全面的託管 SASE 解決方案來應對企業挑戰。透過將全球最大的系統整合商的優勢與 SASE 解決方案相結合,世界各地的企業可以加速業務轉型,並從改進的網路效能、一致的安全策略和實施中受益。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 的影響

- 產業價值鏈分析

- 技術簡介

- 零信任網路

- 零信任設備

- 零信任資料

- 零信任身份

- 零信任應用程式(可見性和分析)

第5章市場動態

- 市場促進因素

- 資料外洩增加

- 您組織的安全範圍不僅限於職場

- 市場限制因素

- 遺留應用程式、基礎架構和作業系統使得採用零信任模型變得困難

第6章 市場細分

- 按發展

- 本地

- 雲

- 按組織規模

- 小型企業

- 主要企業

- 按最終用戶產業

- 資訊科技/通訊

- BFSI

- 製造業

- 衛生保健

- 能源/電力

- 零售業

- 政府機構

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- Palo Alto Networks Inc.

- Broadcom Inc.(Symantec Corporation)

- Microsoft Corporation

- IBM Corporation

- Google Inc.

- Check Point Software Technologies Ltd

- Blackberry Limited

- Akamai Technologies Inc.

- Delinea(Centrify Corporation)

- Okta Inc.

- Fortinet Inc.

- Sophos Group PLC

- Cyxtera Technologies Inc.

第8章投資分析

第9章市場的未來

The Zero Trust Security Market size is estimated at USD 32.61 billion in 2024, and is expected to reach USD 73.57 billion by 2029, growing at a CAGR of 17.67% during the forecast period (2024-2029).

Organizations have had to review their security postures due to the move toward cloud computing. Zero Trust facilities secure access to cloud-based apps and data, which fits well with cloud-first plans. Organizations must develop robust data protection mechanisms to comply with strict data privacy laws like GDPR and CCPA, making Zero Trust a compliance enabler. Businesses use the Zero Trust framework in various sectors more widely as a fundamental security strategy. The conventional perimeter-based paradigm is being abandoned. Big technology corporations are buying Zero Trust security businesses to improve security services.

Key Highlights

- To successfully adopt zero-trust security, businesses are increasingly developing alliances with cybersecurity vendors and managed security service providers (MSSPs). These collaborations contribute knowledge and resources to handle the challenges of protecting the wider security perimeter. The growing use of cloud computing, which provides flexibility, scalability, and cost-efficiency, has completely changed how businesses function. Sensitive information and essential applications are no longer restricted to on-premises data centers, which also expanded the security perimeter.

- Businesses frequently use numerous cloud providers, which results in scattered data and applications. The enlarged security perimeter is more difficult to secure with this multi-cloud strategy. Under a shared responsibility approach, cloud service providers (CSPs) secure the infrastructure while customers are in charge of protecting their data and applications. This shared duty emphasizes the necessity of an all-encompassing security plan. Employees and third-party partners use a variety of locations and devices to access cloud services. So, there is a need for continuous monitoring and safe access controls.

- Adapting to the changing security perimeter, where data and users are dispersed across numerous locations and devices, is essential for the future of cybersecurity. Zero-trust security offers a scalable architecture to keep ahead of new threats and address current issues. The global zero-trust security market has been anticipated to experience sustained growth as enterprises continue to reevaluate their security policies in response to these shifts, with innovative solutions continuously reshaping the cybersecurity landscape.

- Adopting zero-trust security requires a longer transition period for organizations with legacy systems. The deployment of thorough security measures may be delayed as a result. It takes time, money, and labor to upgrade or replace historical systems so they align with the zero-trust approach. As a result, some businesses may be discouraged from adopting zero-trust efforts. Legacy components may develop security flaws as organizations progressively use zero-trust security for their contemporary systems and applications, thereby offsetting the advantages of zero trust elsewhere in the network.

- Zero Trust Security has become much more crucial in the post-COVID-19 environment. Remote work, the cloud, emerging threats, and compliance obligations highlight the necessity for a flexible, proactive security approach. Organizations that adopt zero trust are better equipped to deal with the challenges of the post-pandemic scenario and protect their most essential assets in a constantly evolving digital environment.

Zero Trust Security Market Trends

Small and Medium Enterprises to Witness Major Growth

- SMEs play a central role in the economic landscape, helping to strengthen financial inclusion and supplying goods and services to poor and underserved markets. These enterprises are critical drivers of innovation and offer high growth potential. For instance, according to the European Commission, approximately 24.4 million small and medium-sized enterprises (SMEs) were estimated to be in the European Union in 2023, as SMEs form the backbone of the European economy.

- Even following a hybrid model, most small businesses have yet to prepare for flexibility within future work environments and employee policies. Growth in working from home, hybrid modalities, and family-focused employee structures aid quick transition to more secure strategies. To ensure sustainability, MSMEs should identify market opportunities and consumer demands.

- The cloud-based environment ensures long-term sustainability and resilience, driving the demand for various cybersecurity strategies for SMEs. A robust and secure work environment is guaranteed with zero-trust security, and an attempt to access an organization's network architecture can only succeed once trust is validated. When a user accesses an application, the user and device are confirmed, and trust is continuously monitored. This helps secure the organization's applications and environments from any user, device, and location, which is vital for SME's future growth.

- Many established and emerging cybersecurity players offer zero-trust network access (ZTNA) services for small and medium enterprises to cater to the rising demands. The cloud-delivered service extends the company's zero-trust solutions to cloud-native businesses and enterprises, embracing cloud adoption and giving SMEs improved productivity, better security, greater visibility, and a significantly reduced attack surface.

Asia Pacific Expected to Register Significant Growth

- Asia's technological abilities have increased over the past decade, with many businesses concentrating on the digital shift as one of their key goals throughout the pandemic. While the revolutions of digital transformation were set in motion much earlier, the pandemic accelerated their speed. It particularly impacted how organizations approach their IT ecosystem and security.

- Asia-Pacific is anticipated to dominate the global manufacturing industry, recording the highest inter-annual growth rate, especially in China. This country has achieved significant growth in its production rates compared to its pre-pandemic pace.

- China keeps prioritizing digitalization and improving its cybersecurity posture. ZAT solutions safeguard its digital operations and help comply with regulatory standards. Chinese businesses are increasingly realizing the value of ZAT solutions, making the Chinese market a key driver of adoption in the Asia-Pacific region.

- In August 2023, Singtel, Asia's leading telecommunications technology group, announced a strategic partnership to offer Zscaler's security solutions in Asia, a first for the region. Through this partnership, Singtel's MSSE offers businesses impacted by insufficient in-house resources or skill sets an all-in-one digital security solution that helps to protect their digital assets against cyber threats.

- Enterprises in the APAC region will now have seamless access to Zscaler's Zero Trust Exchange, a cloud-based platform, through Singtel's Managed Security Service Edge (MSSE) suite of services, which includes pre-sales to post-sales support from dedicated cybersecurity experts as well as resources such as build implementation, platform consultation, maintenance, and round-the-clock threat mitigation. As the rate of enterprise digitalization continues to accelerate at an unprecedented pace, so does the risk of cyber threats.

Zero Trust Security Industry Overview

The zero trust security market is fragmented with the presence of global and regional players such as Cisco Systems Inc., Palo Alto Networks Inc., IBM Corporation Inc., Broadcom Inc. (Symantec Corporation), and Microsoft Corporation. Moderate to high product differentiation, growing levels of product penetration, and high levels of competition characterize the market. Generally, the solutions are offered as a package solution, making the consolidated offering look like a part of the product's service.

- In September 2023, Broadcom acquired Vmware. With its potential VMware acquisition, Broadcom can meld Symantec's security portfolio with VMware's SD-WAN capabilities. By integrating Symantec, VMware SD-WAN, and some of Carbon Black's security capabilities, Broadcom could enter the single-vendor secure access service edge (SASE) industry and boost its overall SASE industry share and revenue if executed well. Broadcom's current Symantec SASE and security service edge (SSE) portfolio includes components such as secure web gateway (SWG), data loss prevention (DLP), cloud access security brokers (CASB), zero-trust network access (ZTNA), SSL inspection, and web isolation.

- In July 2023, Accenture teamed with Palo Alto Networks to bolster Zero Trust Security. In order to enable enterprises to improve their cybersecurity posture and speed up the implementation of business transformation initiatives, they have joined forces to deliver jointly secure access service edge solutions using a SASE solution. Palo Alto Networks and Accenture provide a comprehensive managed SASE solution that tackles organizations' challenges. Enterprises worldwide can accelerate their business transformation by combining the strength of the largest global systems integrator with the SASE solution, benefiting from improved network performance and a consistent security policy and implementation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19

- 4.4 Industry Value Chain Analysis

- 4.5 Technology Snapshot

- 4.5.1 Zero Trust Networks

- 4.5.2 Zero Trust Devices

- 4.5.3 Zero Trust Data

- 4.5.4 Zero Trust Identities

- 4.5.5 Zero Trust Applications (Visibility and Analytics)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Data Breaches

- 5.1.2 Security Perimeter of an Organization not Being Limited to Workplace

- 5.2 Market Restraints

- 5.2.1 Legacy Applications, Infrastructure, and Operating Systems Not Likely to Adopt Zero Trust Model

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 IT and Telecom

- 6.3.2 BFSI

- 6.3.3 Manufacturing

- 6.3.4 Healthcare

- 6.3.5 Energy and Power

- 6.3.6 Retail

- 6.3.7 Government

- 6.3.8 Other End-user Industries

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Palo Alto Networks Inc.

- 7.1.3 Broadcom Inc. (Symantec Corporation)

- 7.1.4 Microsoft Corporation

- 7.1.5 IBM Corporation

- 7.1.6 Google Inc.

- 7.1.7 Check Point Software Technologies Ltd

- 7.1.8 Blackberry Limited

- 7.1.9 Akamai Technologies Inc.

- 7.1.10 Delinea (Centrify Corporation)

- 7.1.11 Okta Inc.

- 7.1.12 Fortinet Inc.

- 7.1.13 Sophos Group PLC

- 7.1.14 Cyxtera Technologies Inc.