|

市場調查報告書

商品編碼

1537625

室內位置資訊:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Indoor Location - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

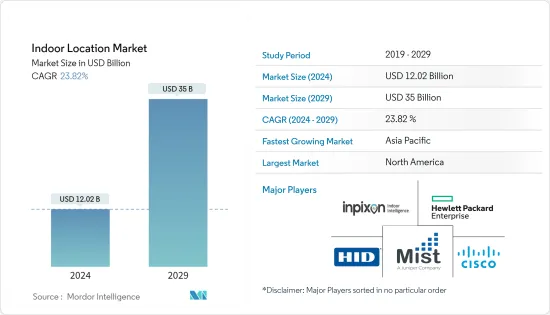

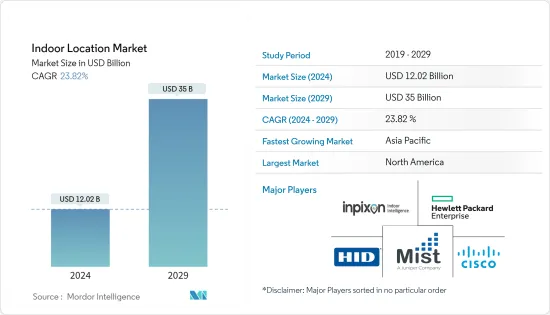

室內位置資訊市場規模預計到2024年為120.2億美元,預計到2029年將達到350億美元,在預測期內(2024-2029年)複合年成長率為23.82%。

主要亮點

- 室內定位系統 (IPS) 可以滿足傳統 GPS 的不足,尤其是在高層建築、機場和地下停車場等複雜環境中。這些系統由設備網路組成,事實證明對於精確定位人和物體至關重要。

- 無論規模大小,越來越多的公司正在轉向室內定位系統以提高準確性。這些系統不僅支援準確的追蹤,還有助於最佳化生產設施的占地面積。利用信標和藍牙 BLE 標籤的應用程式的激增,以及它們與攝影機設備、POS 系統和數位電子看板的整合,正在推動室內定位市場的成長。

- 企業正在迅速採用雲端處理和物聯網來簡化業務,醫療保健產業處於領先地位。隨著醫療保健物聯網應用與醫療需求更加緊密地結合,該行業有望顯著成長。

- 此外,由於對配備先進應用的智慧型手機的需求不斷成長、數位化的提高以及技術的持續改進,室內位置資訊市場預計將擴大。

- 然而,也存在許多挑戰。基礎設施之間的不相容性、互通性問題和資料安全問題都會影響最終用戶。此外,維護挑戰也可能阻礙市場成長。

室內位置資訊市場趨勢

交通物流領域佔據壓倒性市場佔有率

- 這一成長可能是由於機場和火車站對移動援助的需求,以幫助乘客找到餐廳和商店,而火車需要在正確的地方找到它們。

- 在交通領域使用室內定位解決方案有助於了解消費行為。它提供了有價值的資料,可用於制定更詳細的廣告宣傳、選擇正確的地點並最佳化我們的服務。透過選擇室內定位解決方案,運輸業還可以確保有效的庫存管理,以追蹤遺失的設備並降低審核成本。

- 為了節省資產管理中損失的時間,監控和識別實體位置的需求是物流領域室內定位解決方案發展的主要驅動力。企業可以使用位置分析工具來組織和解讀複雜的計畫、獲得見解並快速參與。

- 成功的運輸和物流行業需要複雜、持續的營運和資本集中流程。識別儲存設施對於物流部門來說非常重要。物流業也正在推廣室內定位解決方案,採用監控和定位資產的要求,以消除管理資產位置時浪費的時間。

- 透過使用位置分析工具來組織和分析詳細計劃,公司可以獲得洞察以改善客戶互動。

在預測期內,北美將佔據最高的市場佔有率

- 由於該地區智慧型手機數量的增加以及物聯網技術的發展,預計北美將在室內定位市場中佔據較大佔有率。北美也是平板電腦、智慧型手機和商用車輛導航系統的第二重要市場,而北美則是世界領先的飛機製造商以及航太和航海導航設備的領先製造商。

- 美國在北美幾乎所有最終用戶類別(消費性電子產品除外)中都佔有很大佔有率。在這個國家,智慧型手機的普及率和銷售量都非常可觀。

- 根據GSMA預測,2025年北美行動產業規模將達到3,330億美元,成為全球最大的行動市場,領先中國50%。鑑於該國計劃向 5G 服務過渡,預計銷售額將進一步成長。預計年終,非洲24%的地區將擁有5G網路,到2025年,46%的地區將達到2億連結。

- 由於智慧型手機普及率的提高和消費行為購買行動電話行為的改變,企業家和老牌公司正在努力開發定位服務,以吸引全部區域的室內用戶。透過利用室內定位技術,零售商正在改善客戶體驗並提供相關產品和位置的導航。

- 支持北美室內定位市場成長的另外兩個關鍵因素是新技術開發和室內定位解決方案利用的投資增加。此外,每個地區室內位置資訊相關企業數量的增加預計將成為市場成長的驅動力。

室內定位行業概況

由於不斷的研究,室內位置資訊市場變得分散,技術進步預計將成為市場的主要趨勢。企業採用多樣化的策略來增加客戶群並在市場上展現自己的存在。

- 2024 年 3 月,即時定位服務 (RTLS) 領域的全球領導者之一 Arista 宣布,Gartner Inc. 已將其評為 2024 年室內定位服務」。 AiRISTA 致力於透過位置洞察為客戶的工作流程提供支持,從而提高 RTLS 投資的價值。它結合了 Wi-Fi、低功耗藍牙 (BLE)、蜂窩網路、紅外線 (IR)、被動 RFID 和狀態感測,可提高流程效率、改善團隊協作並確保員工安全。

- 2024 年 1 月 Tack One 在 2024 年消費性電子展 (CES) 上宣布推出 Tack GPS Plus。這款下一代世界追蹤器的設計目的不僅是利用定位技術來滿足日常消費者的需求,還可以用於商業和商業應用,例如室內和室外定位服務、增強的護理、阿茲海默症患者的安全以及災難管理和準備。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19對室內位置資訊市場的影響分析

第5章市場動態

- 市場促進因素

- 配備信標和 BLE 標籤的應用程式增加

- 室內 GPS 技術效率低下

- 連網型設備、智慧型手機和基於位置的應用程式的成長

- 市場限制因素

- 資料和安全問題

- 部署和維護挑戰

- 政府嚴格的規章制度

第6章 市場細分

- 按成分

- 解決方案

- 服務

- 按用途

- 室內導航地圖

- 追蹤/追蹤應用

- 遠端監控/緊急管理

- 其他用途

- 按最終用戶產業

- 零售

- 運輸/物流

- 衛生保健

- 電訊

- 石油、天然氣和採礦

- 政府/公共部門

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Inpixon

- Hewlett Packard Enterprise Development LP

- Mist Systems Inc.

- HID Global Corporation

- Cisco Systems Inc.

- Google LLC

- Microsoft Corporation

- Acuity Brands Inc.

- Zebra Technologies Corporation

- CenTrak

- Ubisense Limited

- Sonitor Technologies AS

- Broadcom Corporation

- HERE Global BV

- AiRISTA

- Tack One

第8章投資分析

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 70200

The Indoor Location Market size is estimated at USD 12.02 billion in 2024, and is expected to reach USD 35 billion by 2029, growing at a CAGR of 23.82% during the forecast period (2024-2029).

Key Highlights

- Indoor positioning systems (IPS) are stepping in where traditional GPS falls short, especially in complex environments like multistory buildings, airports, and underground parking lots. These systems, comprising a network of devices, are proving crucial in pinpointing people or objects.

- Businesses, irrespective of their size, are increasingly turning to indoor location systems for enhanced precision. These systems not only aid in precise tracking but also assist production facilities in optimizing their floor space. The surge in applications leveraging beacons, Bluetooth BLE tags, and even integrating with camera equipment, point-of-sale (POS) systems, and digital signage is propelling the indoor location market's growth.

- Businesses are swiftly adopting cloud computing and IoT for streamlined operations, with the healthcare sector leading the charge. The sector is poised for substantial growth as healthcare IoT applications align more closely with medical needs.

- Furthermore, the market for indoor spaces is expected to expand, driven by the rising demand for smartphones with advanced applications, the push for digitalization, and ongoing technology enhancements.

- However, challenges loom. Incompatibilities among infrastructures, interoperability issues, and concerns over data security are casting shadows on end users. Additionally, maintenance challenges could impede market growth.

Indoor Location Market Trends

Transportation and Logistics Vertical to Hold a Dominant Market Share

- The growth can be attributed to the demand for mobile assistance for passengers at airports and railway stations to find restaurants and shops in airports, and trains have been attributed to the need to find them in the right place.

- The use of indoor location solutions in the transport sector will help to understand consumer behavior. It provides valuable data that may be used to develop more detailed advertising campaigns, select suitable locations, and optimize services. By choosing an indoor location solution, the transport industry can also trace missing equipment and ensure effective inventory control to reduce audit costs.

- The need to monitor and recognize the physical location to save time lost in asset management is a key driver for developing an indoor positioning solution within the logistics sector. A company can organize and decipher complex plans with location analytics tools, enabling it to gain insight and engage with them quickly.

- Complicated, continuously running operations and capital-intensive processes are needed to make the transport and logistics sector a success. It is important for the logistics sector to identify storage facilities. The logistics industry has also adopted the requirement to monitor and locate assets in order to reduce waste of time during asset location management, as well as promote solutions for indoor locations.

- The company can use location analysis tools to organize and analyze detailed plans, which will enable them to gain insight in order to improve their interactions with customers.

North America to Hold the Highest Market Share During the Forecast Period

- It is expected that North America will account for a significant share of the indoor location market due to the increasing number of smartphones in this region and the development of Internet of Things technologies. North America is also the second most important market for tablets, smartphones, and navigation systems on commercial vehicles compared to being the world's leading producer of airplanes and a major manufacturer of aerospace and maritime navigational equipment.

- The United States has a large market share in nearly all sectors of end users in North America, with the exception of consumer electronics. In this country, the penetration rate of smartphones and their sales is remarkable.

- According to the GSMA, the North American mobile industry will be worth USD 333 billion in 2025, which would make it the world's largest mobile market by a margin of 50% over China. Sales are expected to increase even further in view of the country's planned transition toward 5G services. By the end of this year, 24% will be on 5G networks in Africa, and by 2025, it is expected to reach 46 % or 200 million connections.

- As a result of the growing adoption of smartphones and changes in consumer behavior when purchasing mobiles, entrepreneurs and existing companies are taking steps to develop locational services that will engage indoor users throughout the region. By using indoor location technology, retailers are enhancing their customers' experience and providing appropriate product or place navigation.

- Two other important factors supporting the growth of the market for indoor locations in North America are increasing investments in developing new technologies and using indoor location solutions. Market growth is also expected to be driven by the growing number of indoor location companies in different regions.

Indoor Location Industry Overview

The indoor location market is fragmented due to continuous research, and technological advancements are anticipated to be the principal trends in the market. The firms are adopting diverse strategies to increase their customer base and mark their presence in the market.

- March 2024: Arista, one of the global leaders in real-time location services (RTLS), announced that Gartner Inc. had recognized it as a "Leader" in the 2024 Magic Quadrant for Indoor Location Services. AiRISTA is committed to increasing the value of RTLS investments by empowering customer workflows with location insights. It combines Wi-Fi, Bluetooth low energy (BLE), cellular, infrared (IR), passive RFID, and condition-sensing to increase process efficiency, improve team coordination, and provide staff safety.

- January 2024: Tack One announced the Tack GPS Plus at the Consumer Electronics Show (CES) 2024. This next-generation global tracker redefines the way location technology can be applied to consumers' daily needs as well as commercial and at-scale applications, including indoor and outdoor location services, enhanced care, safety for patients with Alzheimer's disease, and disaster management and preparedness.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Analysis on the impact of COVID-19 on the Indoor Location Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Number of Applications Powered by Beacons and BLE Tags

- 5.1.2 Inefficiency of the GPS Technology in Indoor Premises

- 5.1.3 Growth of Connected Devices, Smartphones, and Location-based Applications

- 5.2 Market Restraints

- 5.2.1 Data and security related Issues

- 5.2.2 Deployment and Maintenance Challenges

- 5.2.3 Strict Rules and Regulations by Government

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Indoor Navigation & Maps

- 6.2.2 Tracking and Tracing Application

- 6.2.3 Remote Monitoring and Emergency Management

- 6.2.4 Other Applications

- 6.3 By End-user Industry

- 6.3.1 Retail

- 6.3.2 Transportation and Logistics

- 6.3.3 Healthcare

- 6.3.4 Telecom

- 6.3.5 Oil and Gas and Mining

- 6.3.6 Government and Public Sector

- 6.3.7 Manufacturing

- 6.3.8 Other End-user Industries

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Inpixon

- 7.1.2 Hewlett Packard Enterprise Development LP

- 7.1.3 Mist Systems Inc.

- 7.1.4 HID Global Corporation

- 7.1.5 Cisco Systems Inc.

- 7.1.6 Google LLC

- 7.1.7 Microsoft Corporation

- 7.1.8 Acuity Brands Inc.

- 7.1.9 Zebra Technologies Corporation

- 7.1.10 CenTrak

- 7.1.11 Ubisense Limited

- 7.1.12 Sonitor Technologies AS

- 7.1.13 Broadcom Corporation

- 7.1.14 HERE Global BV

- 7.1.15 AiRISTA

- 7.1.16 Tack One

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219