|

市場調查報告書

商品編碼

1537637

混凝土修補砂漿:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Concrete Repair Mortar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

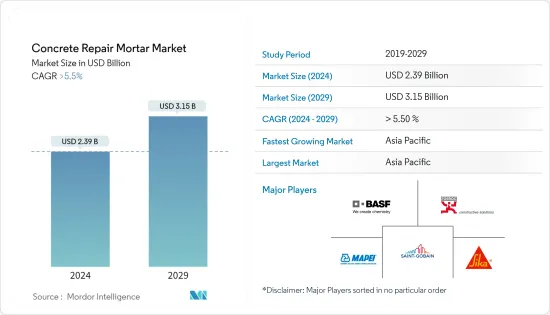

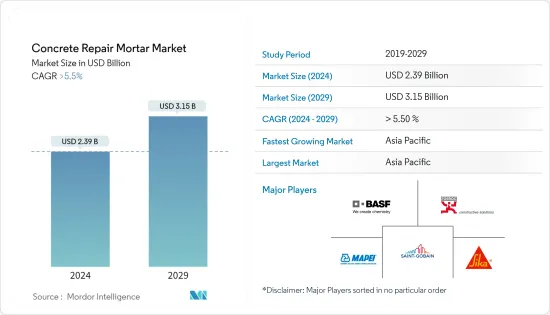

預計2024年全球混凝土修補砂漿市場規模將達23.9億美元,2024-2029年預測期間複合年成長率超過5.5%,2029年將達到31.5億美元。

COVID-19 大流行對整個行業的成長產生了負面影響。然而,大流行後的住宅和商業建築正在加速對混凝土修補砂漿的需求。

推動市場研究的主要因素是現有住宅基礎設施狀況的惡化以及人口成長對現有基礎設施造成的壓力。

另一方面,有關建築規範的嚴格規定可能會阻礙市場成長。

公路修補修補砂漿的開拓預計將為市場成長帶來新的機會。

亞太地區是最大的市場,由於中國、印度和日本等國家的消費,預計亞太地區將成為預測期內成長最快的市場。

混凝土修補砂漿的市場趨勢

基礎設施領域主導市場

- 由於混凝土修補砂漿用於建築業以恢復舊建築物的結構強度和建築形式,因此對混凝土修補砂漿的需求預計將激增。住宅領域預計將佔據很大的市場佔有率,因為這些建築的建造時間較長,而且砂漿卓越的結構強度提供了進一步的耐用性。

- 混凝土修補砂漿具有優異的性能,如抗滲性、拉伸強度、抗應力性和觸變性,這可能會增加其作為主要建築材料的需求。

- 該產品用於多個需要混凝土修復的區域,例如由於劇烈的溫度變化而導致的建築物結構缺陷。它也用於避免由於不必要的進水而導致內部結構支撐腐蝕。

- 水泥混凝土砂漿用於磚基應用,例如柵欄、牆壁和人行道。這種砂漿為結構提供了多種有利的特性,包括耐腐蝕、抑制內部柱狀生鏽和吸濕性。環氧混凝土砂漿主要用於高強度應用,例如修復破裂或破損的混凝土地板,賦予混凝土額外的強度,並使其使用壽命更長。

- 世界各地正在進行許多維修,其中包括阿根廷政府耗資 4,700 萬美元的 Belgrano Sur計劃,用於維修22 個火車站。該計劃是運輸部公佈的國家首都地區軌道交通網規劃(總投資140億美元)的一部分。

- A 航站樓重建 (EWR) 和 W 滑行道維修(EWR) 是美國將於 2019 年至 2023 年實施的一些主要機場計劃。

- 此外,由於空中交通量增加,英國航空業也期待機場擴建。

- 例如,2019 年 3 月,伯明罕國際機場計劃進行重大航站樓改造和機場重新配置,作為其 2018 年總體規劃的一部分。該機場將實施價值5億英鎊的自籌資金改善、現代化和擴建計劃,到2033年將年客運量增加到1,800萬人次。預計將於 2019 年第二季開始施工,並於 2033 年完工。

- 所有上述因素預計將在未來幾年推動混凝土修補砂漿市場的發展。

亞太地區主導市場

- 亞太地區預計將成為混凝土修補砂漿最大且成長最快的市場。該地區的高成長率是由於人口成長率高,這給各國現有基礎設施帶來了壓力。

- 此外,更快的施工速度和在施工中使用較低品質的建材會導致更快的修復。

- 開發中國家道路基礎設施和房地產業的快速發展預計將進一步增加對混凝土修補砂漿的需求。

- 中國、印度和澳洲建築業的快速發展導致對混凝土修補砂漿的需求增加,主要是住宅和非住宅建築應用。日本和澳洲等國在交通基礎設施維修和保養方面投入更多資金也支持了這種成長。

- 中國的建築業是世界上最大的建築業,從業人員超過5,300萬人。根據國家統計局的數據,2022 年中國建築業產值將達到 31.2 兆元(約 4.57 兆美元),而 2021 年為 29.31 兆元(約 4.29 兆美元),增幅為6 %。 2022年中國建築業對GDP的貢獻率約為6.9%。

- 預計到2030年,中國的建築支出將達到約13兆美元,使得乾混砂漿市場前景樂觀。中國是全球最大的建築市場,佔全球整體建築投資的20%。

- 由於 2023-2024 年預算的部分資本支出激增,印度建築業預計將在 2023 年獲得重大推動。在最新的預算中,印度政府將建築總支出增加了7.5%,從2022-2023 年的預計支出41.9 兆印度盧比(5,222 億美元)增加到2023-2024 年的45 兆印度盧比(5,616 億美元)。

- 在印度尼西亞,雅加達的大眾捷運(MRT)計劃正在擴建,並將很快擴大其地下鐵路網路。 JMT雅加達計劃二期將於9月開始,預計2027年完工。日本三井住友建設公司和印尼的 Hutama Karya 已訂單契約,在該線北端的 Mangga Besar 站和 Kota 站以及 Glodok 站和 Kota 站之間修建一條 1.4 公里長的隧道。

- 總體而言,所有這些因素都可能有助於確定該國對混凝土修補砂漿的需求。

混凝土修補砂漿產業概況

混凝土修補砂漿市場分散。主要參與者(排名不分先後)包括 Sika AG、Flexcrete Technologies Ltd、MAPEI SpA、Saint-Gobain Weber 和 Fosroc International Ltd。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 歐洲和北美建築維修活動的成長

- 基礎設施維修需求增加

- 其他司機

- 抑制因素

- 原料可用性和成本

- 嚴格的環境法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:金額)

- 類型

- 水泥混凝土

- 環氧混凝土

- 目的

- 噴

- 注射

- 手動的

- 最終用戶產業

- 住宅

- 商業的

- 產業

- 基礎設施

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 馬來西亞

- 泰國

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 土耳其

- 北歐國家

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 卡達

- 阿拉伯聯合大公國

- 埃及

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Adhesives Technology Corporation

- Flexcrete Technologies Ltd

- Fosroc International Ltd

- MAPEI SpA

- Pidilite Industries Ltd

- Remmers Gruppe AG

- Saint-Gobain Weber

- Sika AG

- The Euclid Chemical Co.

第7章 市場機會及未來趨勢

- 含天然纖維的混凝土修補砂漿介紹

The Concrete Repair Mortar Market size is estimated at USD 2.39 billion in 2024, and is expected to reach USD 3.15 billion by 2029, growing at a CAGR of greater than 5.5% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the overall industry growth. However, the post-pandemic residential and commercial construction has accelerated the demand for concrete repair mortar.

The major factors driving the market study are the deteriorating condition of existing residential infrastructure and pressure on existing infrastructure because of the rising population.

On the flip side, stringent regulations pertaining to building codes are likely to hinder the market's growth.

The development of patch repair mortar for highway repairs is expected to create new opportunities for the market to grow.

Asia-Pacific region represents the largest market and is expected to be the fastest-growing market over the forecast period owing to the consumption from countries such as China, India, and Japan.

Concrete Repair Mortar Market Trends

Infrastructure Sector to Dominate the Market

- The demand for the product is anticipated to surge owing to its applications in the construction industry for restoring structural strength and architectural shape of old buildings. The residential segment is expected to hold a major market share since these buildings are built for a more extended period, and the mortar's superior structural strength further offers their durability.

- Concrete repair mortar exhibits excellent properties such as impermeability, tensile strength, stress immunity, and thixotropy, which are likely to boost the demand as a key construction material.

- The product finds its application in several areas that need concrete repair, such as structural defects in buildings owing to intense variations in temperature. It is also employed to avoid corrosion of internal structural supports caused by unwanted water inflow.

- Cementitious concrete mortar is employed for brick-based applications such as fences, walls, and walkways. It offers several advantageous properties to the structures, like corrosion resistance, minimized rusting of internal supports, and moisture absorption. Epoxy concrete mortar is mainly employed for high-strength applications like repairing cracked or broken concrete flooring, providing extra strength to concrete, and making it useful for longer.

- Many renovation activities have been carried out across the world, including the launch of the Belgrano Sur project by the Government of Argentina, which involves the rehabilitation of 22 railway stations under a USD 47 million investment. This project is part of the Integral Plan of Works announced for the Metropolitan Railway Network program, launched by the Ministry of Transport, worth a total value of investment of USD 14 billion.

- Terminal A Redevelopment (EWR) and Rehabilitation of Taxiway W (EWR) are some of the leading airport projects embarked on by the United States during 2019-23.

- Additionally, the aviation industry in the United Kingdom is also looking forward to airport expansion due to an increase in air traffic.

- For instance, in March 2019, Birmingham International Airport, as part of its 2018 Master Plan, planned for a major terminal transformation and airfield re-configuration. The airport is expected to self-finance the improvement, modernization, and extension project worth GBP 500 million to increase its annual passenger handling capacity to 18 million by 2033. The construction commenced during the second quarter of 2019, and it is scheduled for completion by 2033.

- All the above factors are expected to drive the concrete repair mortar market in the coming years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to be the largest and fastest-growing market for concrete repair mortars. The high growth rate in the region is attributable to the high population growth, which is putting pressure on the existing infrastructure in the countries.

- In addition, the fast rate of construction and usage of lower-quality building materials in construction is leading to faster repairs.

- The speedy development of road infrastructure and the real estate industry in developing nations is further anticipated to drive the need for concrete repair mortars.

- The fast pace of the construction industry in China, India, and Australia has led to an increased demand for concrete repair mortars, mainly in residential and non-residential building applications. The growth is further supported by increased spending by countries like Japan and Australia on the repair and maintenance of transport infrastructure.

- China's construction sector is the largest construction industry in the world, employing more than 53 million people. According to the National Bureau of Statistics, China's construction sector output was CNY 31.20 trillion (~USD 4.57 trillion) in 2022, compared to CNY 29.31 trillion (~USD 4.29 trillion) in 2021, registering a 6% growth. China's construction industry contributed around 6.9% to its GDP in 2022.

- China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for the dry-mix mortars market. China has the largest construction market in the world, encompassing 20% of all construction investments globally.

- The Indian construction industry was expected to receive a significant boost in 2023 due to a sharp increase in capital expenditure as part of the FY 2023-2024 budget. In its latest budget, the Indian government increased its total expenditure on construction by 7.5%, from an estimated expenditure of INR 41.9 trillion (USD 522.2 billion) in the FY 2022-2023 to INR 45 trillion (USD 561.6 billion) in FY 2023-2024.

- Indonesia will soon be boasting a larger network of underground railway systems with the extension of Jakarta's Mass Rapid Transit (MRT) project. Phase 2 of the JMT Jakarta project started in September and is expected to complete in 2027. Sumitomo Mitsui Construction, Japan, and Hutama Karya, Indonesia, have been awarded the contract to build a 1.4 km tunnel between Mangga Besar and Kota and Glodok and Kota stations at the northern end of the line.

- Overall, all such factors will help in determining the demand for concrete repair mortar in the country.

Concrete Repair Mortar Industry Overview

The concrete repair mortar market is fragmented in nature. The major players (not in any particular order) include Sika AG, Flexcrete Technologies Ltd, MAPEI SpA, Saint-Gobain Weber, and Fosroc International Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Building Repair Activities in Europe and North America

- 4.1.2 Increasing Demand for Infrastructure Repair

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability and Cost of Raw Materials

- 4.2.2 Stringent Environmental Regulations

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Cementitious Concrete

- 5.1.2 Epoxy Concrete

- 5.2 Application

- 5.2.1 Spraying

- 5.2.2 Pouring

- 5.2.3 Manual

- 5.3 End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Infrastructure

- 5.3.5 Other End-user Industries (Marine, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Indonesia

- 5.4.1.6 Malaysia

- 5.4.1.7 Thailand

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Turkey

- 5.4.3.8 NORDIC Countries

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Qatar

- 5.4.5.4 UAE

- 5.4.5.5 Egypt

- 5.4.5.6 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Adhesives Technology Corporation

- 6.4.2 Flexcrete Technologies Ltd

- 6.4.3 Fosroc International Ltd

- 6.4.4 MAPEI SpA

- 6.4.5 Pidilite Industries Ltd

- 6.4.6 Remmers Gruppe AG

- 6.4.7 Saint-Gobain Weber

- 6.4.8 Sika AG

- 6.4.9 The Euclid Chemical Co.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Incorporation of Concrete Repair Mortar with Natural Fibers