|

市場調查報告書

商品編碼

1548564

失敗分析:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Failure Analysis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

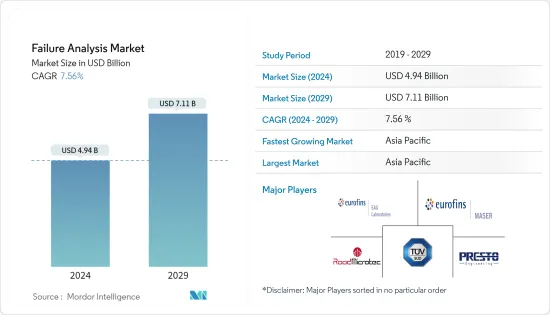

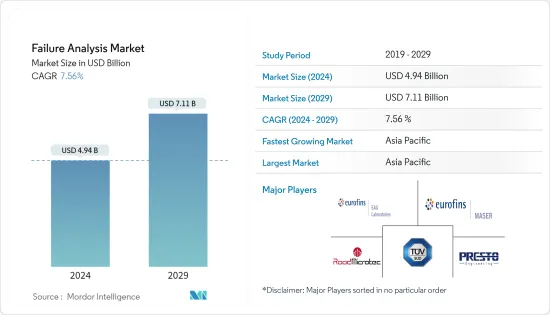

故障分析市場規模預計到 2024 年為 49.4 億美元,預計到 2029 年將達到 71.1 億美元,在預測期內(2024-2029 年)複合年成長率為 7.56%。

故障分析是收集和分析資料以識別故障原因並確定糾正措施和責任的過程。了解故障的根本原因對於防止未來發生類似事件至關重要。常見原因包括組裝錯誤、誤用或濫用、緊固件有缺陷、維護不足、製造缺陷、材料品質差、熱處理不當、不可預見的操作條件、設計錯誤以及品質保證不足、環境保護不足和鑄造不連續性。

根本原因分析 (RCA) 對於所有產業的持續品質改進至關重要。首先調查事件、缺陷和品質問題並確定其根本原因。此流程可協助組織解決影響產品或服務品質的因素並防止未來再次發生。 RCA 也揭示了流程效率低下的問題,並提高了品質和業務效率。隨著 RCA 擴大其故障分析範圍,其成長預計將為故障分析市場創造新的機會。

老化的基礎設施對系統構成威脅。不穩定的基礎設施在極端條件下尤其令人擔憂,因為它增加了在嚴重和長期壓力下發生故障的可能性。特別是,由於自然災害的數量和嚴重性不斷增加,造成了重大的經濟影響和人員傷亡,基礎設施的復原力最近受到了關注。

除此之外,汽車製造商對故障分析的需求不斷成長,以及採用基於視覺和人工智慧的分析工具進行性能分析、動態車輛研究和事故重建,也推動了市場的擴張。此外,對奈米技術領域進步的投資增加預計將在預測期內推動失效分析市場的發展。

穿透式電子顯微鏡(TEM)、掃描電子顯微鏡(SEM)和聚焦離子束系統等失效分析設備的成本相當高。另一方面,光學顯微鏡比電子顯微鏡便宜,儘管它們具有更先進的功能和更廣泛的應用範圍。

2023年,半導體產業在全球的重要性日益增強。半導體晶片不僅對當今的基本技術至關重要,而且還為明天的變革性創新鋪平了道路。

然而,儘管半導體產業的未來充滿希望,但它也面臨著許多挑戰。美國和中國之間持續的緊張局勢正在重塑全球供應鏈,並導致政府對向中國銷售晶片實施更嚴格的監管,而中國仍然是全球最大的半導體市場。為了應對這些挑戰,政策制定者正在實施策略,以加強美國在半導體設計領域的領導地位,透過全面的移民和 STEM 教育改革來增強國內勞動力,並維持該行業的成長軌跡以倡導自由貿易和市場進入。

故障分析市場趨勢

建築業成長帶動家具產品需求

- 由於電子和半導體行業故障分析服務的使用率很高,許多公司都提供故障分析,導致市場佔有率最高。

- 電子和半導體中的故障分析有助於識別半導體製造過程中的缺陷並對其進行分類,例如短路、開路、污染和材料不匹配。失效分析的主要目的是了解導致失效的根本問題,改善製造程序,提高產品可靠性,並確保符合品質標準。

- 隨著故障模式複雜性的增加,半導體技術的不斷進步,例如更小、更複雜的積體電路 (IC) 和系統晶片(SoC) 設計的發展,推動了對徹底故障分析的需求。

- 例如,2024 年 2 月,NVIDIA 的硬體產品是具有眾多組件無縫協作的重要工程範例。隨著這些產品的複雜性增加,組件發生故障的可能性也隨之增加。 NVIDIA 的故障分析實驗室專注於解決矽和基板層級的問題。該團隊致力於確保半導體是否因設計缺陷、製造錯誤、可靠性測試失敗或污染而損壞。

- 如果半導體銷量增加,產量也會增加。隨著生產規模的增加,出現缺陷和故障的可能性也隨之增加,需要嚴格的故障分析來維持品質。例如,根據SIA(半導體產業協會)的數據,2024年1月中國半導體銷售額將達到147.6億美元。與 2023 年 1 月相比,這一數字顯著成長,當時中國的銷售額為 116.6 億美元。

亞太地區預計將佔據主要市場佔有率

- 在中國和印度等新興經濟體的推動下,亞太地區預計將在預測期內成長最快。此外,日本、泰國、馬來西亞等國家的製造業和公私合營基礎設施產業也不斷成長。由於幾個關鍵因素,包括都市化和工業化的不斷發展、基礎設施的大量投資以及設備成本的下降,區域故障分析市場正在不斷成長。

- 亞太地區經濟和人口共同經歷了顯著成長,預計未來仍將持續,透過促進基礎設施發展進一步推動市場成長。故障分析是一種取證工程,旨在確定基礎設施故障的根本原因。找出這些原因可以為採取必要措施防止未來發生類似情況鋪路。結構失效的後果是嚴重的,包括人類、社會、環境和經濟影響。因此,對於嚴重依賴基礎設施的組織來說,故障分析的重要性怎麼強調都不為過。

- 在永續政策和向服務型經濟轉型的推動下,印度建設產業正在蓬勃發展。印度政府對大規模基礎設施投資的關注凸顯了其促進成長的承諾。 IBEF表示,2024-25年中期預算將基礎建設資本投資分配增加11.1%,達到111.1億印度盧比(相當於1,338.6億美元),相當於GDP的3.4%。

- 此外,隨著半導體製造設施在該地區的擴張,對故障分析的需求預計也會增加。例如,2024 年 3 月,印度政府根據該國的旗艦獎勵計畫核准建立三個新的半導體製造設施。

失效分析產業概述

故障分析市場分散且競爭激烈,有多家主要企業參與其中。這些主要企業以其強大的市場影響力而聞名,正在積極尋求擴大其在各個工業領域的業務。其中許多公司採用策略聯盟來提高市場佔有率和盈利。在這個市場上營運的公司也會進行收購以增強其產品能力。該領域的知名公司包括 Presto Engineering Inc.、TUV SUD、Rood Microtec GmbH、Eurofins EAG Laboratories 和 Eurofins Maser BV。

2024 年 5 月 - 日立高新科技公司發表其最新產品,高解析度蕭特基掃描電子顯微鏡 SU3900SE 和 SU3800SE。這些儀器旨在實現奈米級大而重樣品的精確觀察。最重要的是,它具有攝影機導航功能,可無縫整合影像,使操作員能夠更好地了解樣品。此增強功能不僅有助於精確定位感興趣的區域,還可以改善整體使用者體驗。

2024 年 1 月——售價 63,000 印度盧比的沃爾沃 C40 Recharge 電動 SUV 在最近的一次事故中起火後,印度的電動車重新成為人們關注的焦點。儘管具體原因尚未確定,但這起事故凸顯了產品故障分析的重要性。研究表明,高達 80% 的新產品在發布的第一年內就失敗了。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 基礎設施老化和維護需求增加

- 技術進步推動市場成長

- 材料、設計和生產方法的創新

- 市場限制因素

- 設備成本高是市場問題

第 6 章 技術概覽

- 失效模式與影響分析(FMEA)

- 故障模式影響嚴重性分析 (FMECA)

- 功能故障分析

- 斷裂物理分析

- 失效物理分析

- 故障樹分析(FTA)

- 其他失效模式影響分析

第7章 市場區隔

- 依技術

- 二次離子質譜 (SIMS)

- 能量色散 X光光譜 (EDX)

- 化學機械平坦化 (CMP)

- 掃描探針顯微鏡

- 聚焦離子束 (FIB)

- 相對離子蝕刻(RIE)

- 其他技術

- 按設備

- 掃描電子顯微鏡(SEM)

- 聚焦離子束 (FIB) 裝置

- 穿透式電子顯微鏡(TEM)

- 雙束系統

- 其他設備

- 按行業分類

- 車

- 石油和天然氣

- 防禦

- 建造

- 製造業

- 電子和半導體

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第8章 競爭格局

- 公司簡介

- Presto Engineering Inc.

- TUV SUD

- Rood Microtec GmbH

- Eurofins EAG Laboratories

- Eurofins Maser BV

- NanoScope Services Ltd

- CoreTest Technologies

- Materials Testing

- McDowell Owens Engineering Inc.

- Leonard C Quick & Associates Inc.

- Crane Engineering

- Exponent Inc.

第9章 投資展望

第10章市場的未來

The Failure Analysis Market size is estimated at USD 4.94 billion in 2024, and is expected to reach USD 7.11 billion by 2029, growing at a CAGR of 7.56% during the forecast period (2024-2029).

Failure analysis is the process of gathering and analyzing data to determine the cause of failure and determine corrective actions or liability. It is crucial to understand the root cause of failure to prevent similar incidents in the future. Some of the common causes include assembly error, misuse or abuse, fastener failure, inadequate maintenance, manufacturing defects, low-quality material, improper heat treatments, unforeseen operating conditions, design errors, insufficient quality assurance, inadequate environmental protection, and casting discontinuities.

Root Cause Analysis (RCA) is crucial for continuous quality improvement across industries. It begins by examining incidents, defects, and quality issues to identify their root causes. This process helps organizations address factors compromising product or service quality, preventing future recurrences. RCA also reveals process inefficiencies, enhancing both quality and operational efficiency. As RCA expands the scope of failure analysis, its growth is expected to create new opportunities in the failure analysis market.

Aged infrastructure poses a threat to the system, as unstable infrastructure raises the chances of breakdowns during severe and prolonged strain, which is particularly worrisome during extreme circumstances. Infrastructure resiliency has recently come into focus, especially as the number and severity of natural disasters are increasing, causing significant economic impacts and loss of life.

In addition to this, the increasing requirement for failure analysis among automobile manufacturers, who are also employing vision and AI-based analysis tools for performance analysis, dynamic vehicle studies, accident reconstruction, etc., is augmenting the market. Besides this, the inflating investments in the advancement of the nanotechnology sector are anticipated to fuel the failure analysis market over the forecasted period.

The cost of failure analysis equipment, including transmission electron microscopes (TEM), scanning electron microscopes (SEM), and focused ion beam systems, is considerably high. In contrast, optical microscopes are less expensive than electron microscopes despite the fact that the latter provides more advanced capabilities and a wider range of applications.

In 2023, the semiconductor industry's global significance continues to escalate. Semiconductor chips are not only integral to the essential technologies of today but are also paving the way for the transformative innovations of tomorrow.

However, alongside its promising future, the industry faces a myriad of challenges. Persistent US-China tensions are reshaping the global supply chain, leading to heightened government restrictions on chip sales to China, which remains the world's largest semiconductor market. Addressing these challenges, policymakers are urged to implement strategies that bolster US leadership in semiconductor design, enhance the domestic workforce through comprehensive immigration and STEM education reforms, and advocate for free trade and market access to sustain the industry's growth trajectory.

Failure Analysis Market Trends

Growth in the Construction Sector Boosting the Demand for Furniture Products

- A large number of companies provide failure analysis for the electronics and semiconductor industry, considering the high usage of these services in the sector, which in turn resulted in its highest market share.

- Failure analysis in electronics and semiconductors helps identify and categorize defects during the semiconductor fabrication, such as shorts, opens, contamination, or material inconsistencies. The primary aim of failure analysis is to understand the underlying issues that lead to failures, improve manufacturing processes, enhance product reliability, and ensure compliance with quality standards.

- The continuous advancements in semiconductor technology, such as the development of smaller, more complex integrated circuits (ICs) and system-on-chip (SoC) designs, increase the complexity of failure modes, thus driving the demand for thorough failure analysis.

- For instance, in February 2024, NVIDIA's hardware products are significant engineering examples, with numerous components that function together seamlessly. As the complexity of these products increases, so does the possibility of component failures. The Failure Analysis Lab at NVIDIA focuses on resolving challenges at the silicon and board levels. This team is known for tackling challenging problems in the semiconductor industry by determining the underlying cause of malfunctions, whether the semiconductors stem from a design flaw, a production error, a reliability test failure, or foreign contaminants.

- Higher semiconductor sales result in increased production volumes. As production scales up, the likelihood of defects and failures also rises, necessitating rigorous failure analysis to maintain quality. For instance, according to the SIA (Semiconductor Industry Association), semiconductor sales in China reached USD 14.76 billion in January 2024. This figure represents substantial growth compared to January 2023, when sales in China were USD 11.66 billion.

Asia-Pacific is Expected to Hold Significant Market Share

- Asia-Pacific is expected to grow fastest during the forecast period due to developing economies like China and India. Countries such as Japan, Thailand, and Malaysia are also home to increasing manufacturing and public-private infrastructure industries. The region's failure analysis market is experiencing growth due to several critical factors, such as the rise in urbanization and industrialization, significant investment in infrastructure development, and decreasing equipment costs.

- Asia-Pacific is united in experiencing substantial economic and population growth, which is anticipated to continue over the years and fuel infrastructure development, further supporting the market growth. Failure analysis is a forensic engineering component dedicated to identifying the underlying reasons behind infrastructure failures. Pinpointing these causes paves the way for implementing necessary measures to prevent future occurrences. The repercussions of structural failures can be severe, encompassing human, social, environmental, and financial consequences. Hence, the significance of failure analysis cannot be overstated for organizations heavily reliant on infrastructure.

- India's construction industry has surged, propelled by sustainable policies and a service-centric economic shift. The Indian government's emphasis on large-scale infrastructure investments underscores its commitment to driving growth. According to IBEF, in the 2024-25 Interim Budget, the allocation for capital investment in infrastructure increased by 11.1% to reach INR 11.11 lakh crore (equivalent to USD 133.86 billion), representing 3.4% of the GDP.

- In addition, the growing expansion of semiconductor manufacturing facilities in the region will drive the demand for failure analysis. For instance, in March 2024, The Indian government approved establishing three new semiconductor manufacturing facilities under the country's flagship incentive program.

Failure Analysis Industry Overview

The failure analysis market is fragmented and highly competitive, featuring several key players. These leading companies, known for their significant market presence, are actively seeking to expand their operations across various industry sectors. Many of these firms are employing strategic collaborations to bolster their market share and profitability. Companies operating within this market are also engaging in acquisitions to enhance their product capabilities. Notable players in this sector include Presto Engineering Inc., TUV SUD, Rood Microtec GmbH, Eurofins EAG Laboratories, and Eurofins Maser BV.

May 2024 - Hitachi High-Tech Corporation unveiled its latest offerings, the SU3900SE and SU3800SE High-Resolution Schottky Scanning Electron Microscopes. These devices are designed to deliver precise observations of large, weighty specimens at the nano level. Notably, they have a camera navigation feature that seamlessly merges images, facilitating operators to view the complete specimen. This enhancement not only aids in pinpointing areas of interest but also elevates the overall user experience.

January 2024 - India's spotlight once again turned to electric vehicles after a Volvo C40 Recharge electric SUV, priced at a hefty INR 63 lakh, caught fire in a recent accident. While the exact cause remains elusive, the incident underscores the criticality of product failure analysis. Studies underscore this, revealing that up to 80% of new products falter within their inaugural year on the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Ageing Infrastructure and Increasing Need for Maintenance

- 5.1.2 Technological Advancements Drive the Market Growth

- 5.1.3 Innovation in Materials, Design, and Production Methods

- 5.2 Market Restraints

- 5.2.1 High Equipment Cost Challenge the Market

6 TECHNOLOGY SNAPSHOT

- 6.1 Failure Modes Effect Analysis (FMEA)

- 6.1.1 Failure Modes, Effects, and Criticality Analysis (FMECA)

- 6.1.2 Functional Failure Analysis

- 6.1.3 Destructive Physical Analysis

- 6.1.4 Physics of Failure Analysis

- 6.1.5 Fault Tree Analysis(FTA)

- 6.1.6 Other Failure Mode Effect Analysis

7 MARKET SEGMENTATION

- 7.1 By Technology

- 7.1.1 Secondary ION Mass Spectrometry (SIMS)

- 7.1.2 Energy Dispersive X-ray Spectroscopy (EDX)

- 7.1.3 Chemical Mechanical Planarization (CMP)

- 7.1.4 Scanning Probe Microscopy

- 7.1.5 Focused Ion Beam (FIB)

- 7.1.6 Relative Ion Etching (RIE)

- 7.1.7 Other Technologies

- 7.2 By Equipment

- 7.2.1 Scanning Electron Microscope (SEM)

- 7.2.2 Focused Ion Beam (FIB) System

- 7.2.3 Transmission Electron Microscope (TEM)

- 7.2.4 Dual Beam System

- 7.2.5 Other Equipment

- 7.3 By End-user Vertical

- 7.3.1 Automotive

- 7.3.2 Oil and Gas

- 7.3.3 Defense

- 7.3.4 Construction

- 7.3.5 Manufacturing

- 7.3.6 Electronics and Semiconductors

- 7.3.7 Other End-user Verticals

- 7.4 By Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia

- 7.4.4 Australia and New Zealand

- 7.4.5 Latin America

- 7.4.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Presto Engineering Inc.

- 8.1.2 TUV SUD

- 8.1.3 Rood Microtec GmbH

- 8.1.4 Eurofins EAG Laboratories

- 8.1.5 Eurofins Maser BV

- 8.1.6 NanoScope Services Ltd

- 8.1.7 CoreTest Technologies

- 8.1.8 Materials Testing

- 8.1.9 McDowell Owens Engineering Inc.

- 8.1.10 Leonard C Quick & Associates Inc.

- 8.1.11 Crane Engineering

- 8.1.12 Exponent Inc.