|

市場調查報告書

商品編碼

1548614

顏色檢測感測器:市場佔有率分析、產業趨勢、成長預測(2024-2029)Colour Detection Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

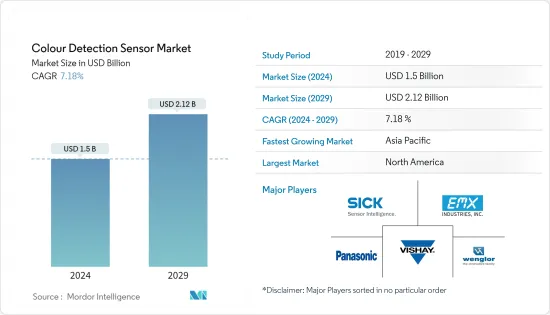

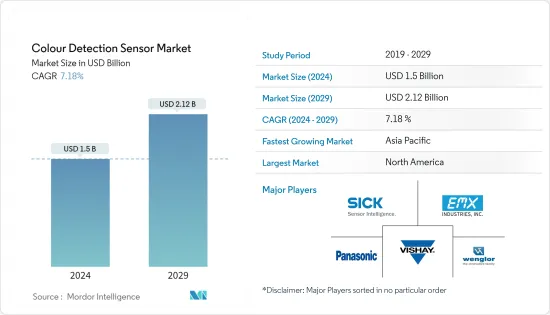

顏色偵測感測器市場規模預計到 2024 年為 15 億美元,預計到 2029 年將達到 21.2 億美元,在預測期內(2024-2029 年)複合年成長率為 7.18%。

顏色偵測感測器將光線照射到物體上並測量直接反射或輸出。許多此類感測器都具有整合光源,以確保實現所需的效果。這些感測器對於對彩色產品進行分級、識別編碼標記以及確認包裝上是否存在黏合劑或資料代碼至關重要。主要應用是真彩色辨識和色標檢測。專為真彩色識別而設計的感測器必須區分顏色或色調,並且通常在分類或匹配模式下運行。

主要亮點

- 使用擴散技術的顏色感測器已被開發用於檢測各種顏色。這些感測器採用顏色敏感濾光片和感測器陣列的組合來執行顏色感測。此資料用於分析影像和指定物件的顏色。顏色測量過程通常涉及照亮目標表面的光源和捕獲並測量反射波長的接收器。

- 顏色感測器整合到智慧型手機中將極大地影響顏色檢測感測器的成長。智慧型手機中的顏色感測器可以區分自然光和人造光,從而增強這些設備中光學鏡頭的功能。將顏色感測器與物聯網和人工智慧技術結合,可實現即時資料分析和決策,進一步改善應用。

- 顏色檢測感測器在紡織等行業中發揮至關重要的作用,可確保生產中的顏色一致性,並且是工業自動化設定的主要組成部分。食品和飲料、商業印刷、消費印刷、消費電子、汽車、製藥、醫療保健和化學品等行業擴大使用這些感測器來識別甚至細微的色差。

- 高初始成本是限制顏色檢測市場成長的因素。雖然顏色檢測感測器具有許多優點,包括確保製造過程中的品管和一致性以及提高顏色檢測的準確性和可靠性,但其成本可能會成為採用的障礙。

- 儘管疫情的影響已經消退,但自動化和機器人技術的吸引力仍然強勁,各行業活性化了對這些技術的投資。據IFR稱,未來幾年全球引進的工業機器人數量將迅速增加。 2026 年安裝設備數量將從 2022 年的 553,000 台增加到 718,000 台。這樣的成長軌跡為所研究的市場描繪了一幅充滿希望的圖景,因為顏色感測器作為自動化設定的關鍵要素而受到關注,特別是在包裝、汽車、紡織和醫療保健等領域。

顏色檢測感測器市場趨勢

食品和飲料行業作為最終用戶正在快速成長。

- 在食品和飲料行業,顏色和外觀對於產品的成功至關重要。因此,從原料到最終產品,對顏色檢測感測器的需求正在迅速增加。該技術以其高精度而聞名,可以評估從固態和液體到粉末和顆粒的各種樣品的顏色屬性。

- 透過快速識別任何差異,公司可以滿足色彩品質標準、簡化流程、減少浪費並增加利潤。部署這些感測器可確保最終產品始終滿足所需的視覺標準,這對於維持品牌聲譽和客戶滿意度至關重要。

- 成分不僅對於味道和質地很重要,而且對於為食品添加視覺上吸引人的顏色也很重要。穀物、粉末、砂糖和可可等原料的化學性質各不相同,每種材料都需要量身定做的測試方法。食品加工部門認知到原料顏色的重要性,並選擇高度標準化的方法來確保最終產品的顏色品質。這些方法使用先進的顏色測量設備,可以準確地檢測最小的顏色變化,確保最終產品的視覺一致性和消費者吸引力。對色彩品質的密切關注對於滿足監管標準和消費者期望至關重要。

- 在食品和飲料行業,這些感測器有助於監控肉類生產的安全和品管。由於食品和飲料包裝的嚴格法規和不斷成長的需求,顏色檢測感測器,特別是顏色標記和註冊應用,已變得至關重要。

- 不同國家的包裝食品消費也是支撐市場成長的主要因素。例如,根據有機貿易協會的數據,全球包裝有機食品的消費量正在增加。在美國,2025年年消費金額預計將達到250.6億美元,高於2018年的174.6億美元。

亞太地區預計將經歷顯著成長

- 美國憑藉其在技術主導領域的專長,在市場上佔據主導地位。根據國際貿易管理局的數據,美國是世界領先的工業自動化設備生產國,包括用於工業和製造環境中自動化系統的硬體和組件。

- 汽車、石油天然氣和電力等行業的持續支出增加了對工業自動化的需求,並推動了與自動化相關的市場,包括顏色檢測感測器市場。

- 近年來,智慧彩色相機和智慧彩色感光元件的銷量在美國大幅成長。智慧顏色感測器在這項技術方面向前邁出了一大步。提供更好的色彩解析度。此外,許多製造商提供這些感測器的版本,使您能夠獲得校準的 RGB 顏色結果。

- 美國市場主要企業的強大影響力以及這些主要企業對顏色感測器的持續開拓在市場中發揮重要作用。例如,羅克韋爾透過創新其提供的智慧感測器,不斷改進其感測器產品組合。該公司的光電感測器被認為是工業自動化領域最強大的感測器。

顏色檢測感測器產業概述

由於進入障礙較低,顏色偵測感測器市場較為分散。市場的主要企業包括 SICK AG、EMX Industries Inc.、Wenglor Sensoric GmbH、Vishay Intertechnology Inc. 和 Panasonic Corporation。

- 2023 年 11 月,SICK Ag 顯著增強了其顏色感測器陣容,推出了以高解析度和高速度而聞名的 CSS 和 CSX 型號。 SICK 的最新旗艦型號 CSS 具有壓倒性的色彩解析度,讓您能夠區分細微的色調差異。它識別細微表面紋理的能力擴展了其應用可能性。

- 2023 年 10 月,巴魯夫有限公司將在墨西哥阿瓜斯卡連特斯開設新的生產設施,使感測器和自動化專家能夠實現計畫成長,同時建立彈性供應鏈。這個新地點將有助於向美洲客戶提供高可用性和短交貨時間的本地生產產品。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 技術簡介

- 工業自動化

- 家用電子產品

- 流體/氣體分析

- 照明數位電子看板

第5章市場動態

- 市場促進因素

- 各行業的流程自動化

- 智慧型手機中顏色感測器的使用增加

- 市場限制因素

- 初始成本增加

第6章 市場細分

- 按類型

- 亮度感測器

- 分子發光感測器

- RGB感測器

- 列印標記感應器

- 按最終用戶產業

- 飲食

- 衛生保健

- 化學

- 纖維

- 車

- 家電

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- SICK AG

- EMX Industries Inc.

- Wenglor Sensoric GmbH

- Vishay Intertechnology, Inc.

- Panasonic Corporation

- Astech Applied Sensor Technology Gmbh

- Banner Engineering Corp.

- Keyence Corporation

- Baumer NV

- Rockwell Automation Inc.

- Ams-Osram AG

- Datalogic SpA

- Omron Corporation

- SensoPart Industriesensorik GmbH

- Jenoptik AG

- Hamamatsu Photonics KK

- Balluff GmbH

- Pepperl+Fuchs

第8章投資分析

第9章 市場機會及未來趨勢

The Colour Detection Sensor Market size is estimated at USD 1.5 billion in 2024, and is expected to reach USD 2.12 billion by 2029, growing at a CAGR of 7.18% during the forecast period (2024-2029).

Color detection sensors emit light onto objects and measure the direct reflection or the output. Many of these sensors come equipped with integral light sources, ensuring they achieve the desired effect. These sensors are pivotal in grading-colored products, distinguishing coded markings, and verifying the presence of adhesive or data codes on packages. Their primary applications include true color recognition and color mark detection. Sensors designed for true color recognition must differentiate between colors or shades, often operating in sorting or matching modes.

Key Highlights

- Color sensors, utilizing diffuse technology, have been developed to detect a broad spectrum of colors. These sensors employ a combination of color-sensitive filters and an array of sensors to conduct color sensing. This data then analyzes the colors in an image or a specified object. The color measurement process typically involves a light source that illuminates the target surface and a receiver that captures and measures the reflected wavelengths.

- The integration of color sensors in smartphones significantly influences the growth of color detection sensors. Smartphone color sensors distinguish between natural and artificial light, enhancing the functionality of optical lenses in these devices. Integrating color sensors with IoT and AI technologies allows for real-time data analysis and decision-making, further improving their applications.

- Color detection sensors play a crucial role in industries like textiles, ensuring color consistency in production, and are a staple in industrial automation setups. Industries spanning food and beverages, commercial and consumer printing, consumer electronics, automotive, pharmaceuticals, healthcare, and chemicals use these sensors increasingly to identify even the subtlest color variations.

- The high initial costs are one factor restricting the growth of the color detection market. While color detection sensors offer numerous benefits, including ensuring quality control and consistency during manufacturing processes and enhancing accuracy and reliability in color detection, their cost can be a barrier to adoption.

- While the pandemic's impact has waned, the allure of automation and robotics remains strong, prompting diverse industries to ramp up investments in these technologies. According to IFR, the global installation of industrial robots is set to surge in the coming years. 2026 installations will reach 718 thousand units, up from 553 thousand units in 2022. This growth trajectory paints a promising picture for the market studied, particularly as color sensors gain prominence as vital elements in automation setups, notably in sectors like packaging, automotive, textiles, and healthcare.

Color Detection Sensor Market Trends

Food and Beverage Industry to be the Fastest Growing End User

- In the food and beverage industry, color and appearance are pivotal for a product's success. Consequently, the demand for color detection sensors has surged, from raw materials to the final product. This technology, known for its high precision, enables users to assess color attributes across various samples, from solids and liquids to powders and granules.

- By swiftly pinpointing any inconsistencies, companies meet color quality standards and streamline processes, reducing waste and boosting profits. Implementing these sensors ensures that the final product consistently meets the desired visual standards, crucial for maintaining brand reputation and customer satisfaction.

- Ingredients are crucial, not just for taste and texture, but also for adding visually appealing colors to food products. Given the diverse chemical properties of ingredients like grains, powders, sugar, and cocoa, each necessitates a tailored testing approach. Food processing units, recognizing the significance of ingredient color, opt for highly standardized methods to ensure the final product's color quality. These methods involve using advanced color measurement devices that may accurately detect even the slightest variations in color, ensuring that the end product is visually consistent and appealing to consumers. This meticulous attention to color quality is essential for meeting regulatory standards and consumer expectations.

- In the food and beverage industry, these sensors are instrumental in monitoring safety and quality control in meat production. With stringent regulations and heightened food and beverage packaging demands, color detection sensors, especially in color mark and registration applications, have become indispensable.

- Packaged food consumption across different countries is also a major factor supporting the market's growth. For instance, according to the Organic Trade Association, the consumption of packaged organic foods has been growing globally. In the United States, the annual consumption value is anticipated to reach USD 25.06 billion in 2025 from USD 17.46 billion in 2018.

Asia-Pacific Expected to Witness Major Growth

- Owning its expertise in the technology-driven sectors, the United States dominates the market. According to the International Trade Administration, the United States is the primary producer of equipment for industrial automation globally, including hardware and the components used for the industrial and manufacturing settings to automate systems.

- The ongoing expenditure for industries like automotive, oil and gas, and power is increasing the demand for industrial automation and boosting the market associated with automation, including the market of color detection sensors.

- The significant rise in sales of smart color cameras and smart color sensors has progressed significantly in the United States over the past several years. With the smart color sensor, this technology has made massive gains. It provides a more excellent color resolution. Many manufacturers also offer versions of these sensors that may give calibrated RGB color results.

- The solid presence of the market's leading players in the United States and the continuous development of color sensors by these top players play a significant role in the market. For instance, Rockwell continuously improves its sensors portfolio by innovating smart sensors offered by the company. Its photoelectric sensors are recognized as the most robust in industrial automation.

Color Detection Sensor Industry Overview

The color detection sensor market is fragmented due to low entry barriers. Some key players in the market are SICK AG, EMX Industries Inc., Wenglor Sensoric GmbH, Vishay Intertechnology Inc., and Panasonic Corporation.

- In November 2023, SICK Ag unveiled a significant enhancement to its color sensor lineup, debuting the CSS and CSX models known for their high resolution and speed. The CSS, SICK's latest flagship, stands out for its unparalleled color resolution, excelling in discerning even the most subtle shade variations. Its prowess in recognizing nuanced surface textures broadens its potential applications.

- In October 2023, Balluff GmbH opened its new production facility in Aguascalientes, Mexico, enabling the sensor and automation specialist to achieve its planned growth while creating resilient supply chains. The new site would help the company supply its customers in the Americas region with locally produced products with high availability and short delivery times.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products and Services

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.4.1 Industrial Automation

- 4.4.2 Consumer Electronics

- 4.4.3 Fluid and Gas Analysis

- 4.4.4 Lighting and Digital Signage

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Process Automation across Various Industries

- 5.1.2 Increased Use of Color Sensors in Smartphones

- 5.2 Market Restraints

- 5.2.1 Higher Initial Costs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Brightness Sensor

- 6.1.2 Molecular Luminescence Sensor

- 6.1.3 RGB Sensor

- 6.1.4 Printed Mark Sensor

- 6.2 By End-user Industry

- 6.2.1 Food and Beverage

- 6.2.2 Healthcare

- 6.2.3 Chemical

- 6.2.4 Textile

- 6.2.5 Automotive

- 6.2.6 Consumer Electronics

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SICK AG

- 7.1.2 EMX Industries Inc.

- 7.1.3 Wenglor Sensoric GmbH

- 7.1.4 Vishay Intertechnology, Inc.

- 7.1.5 Panasonic Corporation

- 7.1.6 Astech Applied Sensor Technology Gmbh

- 7.1.7 Banner Engineering Corp.

- 7.1.8 Keyence Corporation

- 7.1.9 Baumer NV

- 7.1.10 Rockwell Automation Inc.

- 7.1.11 Ams-Osram AG

- 7.1.12 Datalogic SpA

- 7.1.13 Omron Corporation

- 7.1.14 SensoPart Industriesensorik GmbH

- 7.1.15 Jenoptik AG

- 7.1.16 Hamamatsu Photonics KK

- 7.1.17 Balluff GmbH

- 7.1.18 Pepperl+Fuchs