|

市場調查報告書

商品編碼

1548880

全球軟性混合電子 (FHE) 市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Flexible Hybrid Electronics (FHE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

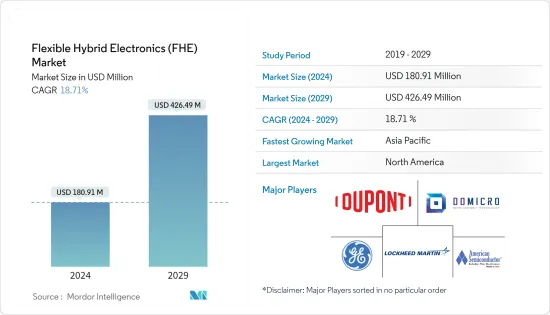

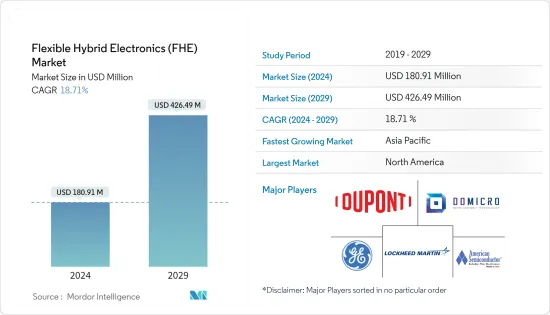

全球軟性混合電子(FHE)市場規模預計2024年為1.8091億美元,2029年達到4.2649億美元,在預測期內(2024-2029年)複合年成長率為18,預計將成長71。

這些電子元件的應用不斷增加,例如穿戴式電子產品、性能監測系統、建築結構安全監控、軟機器人和陣列天線,預計將在預測期內推動市場成長。

主要亮點

- 透過將大面積電子產品的靈活性、輕量、薄度和處理能力與半導體結合,混合電子產品可用於各種應用,包括物聯網 (IoT)、智慧建築、醫療保健、產品包裝、零售,以及消費性電子開拓。

- 靈活的混合電子產品還幫助產品設計人員以新的方式使用感測器來收集資料並提供可增強功能的可行見解。擴大市場開發和技術創新預計將徹底改變電子產業。隨著物聯網的出現,軟性混合電子有望為開發和整合可低成本日常使用的智慧系統和設備提供巨大的機會。汽車、軍事、航太、醫療保健和顯示器等行業正在其產品中使用靈活的混合感測器和穿戴式裝置。

- 印刷電子產品是使用網版印刷、噴墨印刷和凹版印刷等印刷製程在各種基板上創建電子電路和元件的過程。為了製造電子設備,將由銀、奈米碳管和導電聚合物製成的導電墨水塗布在基板上。 RFID 標籤、軟性顯示器、印刷感測器、智慧包裝和電子紡織品是印刷電子應用的一些例子。輕質、靈活的組件和可擴展、廉價的生產過程使其成為大規模應用的理想選擇。與標準矽基裝置相比,它們的電氣性能有限,耐用性、可靠性和材料品質較差,阻礙了它們在苛刻情況下的性能。

- 醫療、汽車和消費性電子等應用日益增加對輕質、機械靈活且經濟高效的設備的需求。軟性混合電子設備在滿足產業需求方面正在獲得巨大的動力。軟性電子產品具有透過使系統可以彎曲成任意形狀來改變計算的潛力。

- 政府資助支持研發活動,促進 FHE 的創新和技術進步。這種支援幫助克服了技術挑戰、降低了成本並提高了 FHE 產品的性能和可靠性。政府資助了多項舉措,包括 NextFlex Project Call 4.0、Semi-Flex Tech Project 和 HiFES(混合整合式軟性電子產品系統)計畫。

- 對研發 (R&D) 和基礎設施的高要求是限制軟性混合電子 (FHE) 需求成長的一些挑戰。由於研發和基礎設施的初始成本較高,包括企業和消費者在內的潛在採用者對投資 FHE 技術猶豫不決。這種不情願源自於對投資收益(ROI) 和初始部署負擔能力的擔憂。

- 在經濟擴張時期,對商業產品和服務的需求增加。公司經常投資軟性混合電子等技術,因為對輕質、軟性和共形設計不斷成長的需求可以擴展各個行業的規模。例如,根據MOSPI的數據,2023會計年度,印度國內電子產品生產對GDP的貢獻約為2.9%。預計 2026 會計年度這項貢獻將增至 4.7%。電子產品生產的擴張預計將增加所研究市場的需求。

軟性混合電子 (FHE) 市場趨勢

電子應用佔據主要市場佔有率

- 軟性混合電子 (FHE) 市場範圍中的感測器、顯示器和照明等電子領域包括薄型指紋感測器、用於測試水鹽度的印刷天線、印刷 LED 照明等。

- 軟性混合電子 (FHE) 是軟性電子產品和印刷電子的融合,包括用於原型製作的數位積層製造、靈活性和可拉伸性以及與R2R(卷對卷)生產的兼容性等優點,並且正在獲得發展勢頭。 FHE 將矽基積體電路和印刷電子元件結合在軟式電路板上。採用 Si CMOS 製程的著名主動元件包括微控制器、數位訊號處理器、高密度記憶體和射頻 (RF) 晶片。

- 軟性混合電子產品正在透過軟性顯示器、可捲曲螢幕、軟性電池和電子紡織品徹底改變消費性電子產品。這些進步創造了更耐用和多功能的設備。消費性電子產品正在轉向超高解析度,為高解析度顯示器、軟性螢幕和設計複雜的 LED 照明鋪平了道路。高解析度增強視覺吸引力和功能,豐富使用者體驗。

- 從地區來看,北美的電子產業可望快速成長。 2024 年 6 月,由美國國防部 (DoD) 和 FlexTech 聯盟共同成立的 NextFlex聯盟宣布獲得 530 萬美元的新資金籌措機會。該舉措旨在加速軟性混合電子(FHE)在美國的商業化。

- 2024 年 5 月,NextFlex 宣布了 Project Call 9.0 (PC 9.0),這是一項總額超過 1,100 萬美元的資金籌措舉措。這使得 NextFlex 自成立以來對混合電子技術進步的總投資達到 1.43 億美元。 PC 9.0 特別注重提高混合電子設備的效能和可靠性。

- 隨著 Micro-LED 等技術與 OLED 一起獲得關注,軟性和可折疊顯示器市場正在顯著成長。雖然 Micro-LED 顯示器具有卓越的品質,但其製造卻面臨挑戰。據 DSCC 稱,全球折疊式和旋轉性智慧型手機市場收益激增,從 2020 年的 45 億美元增至 55 億美元。預計2020年至2025年複合年成長率將超過80%,到2025年將達到1,050億美元以上。

亞太地區錄得強勁成長

- 亞太地區,包括中國大陸、台灣和日本等半導體中心,是許多由國內外供應商營運的純晶圓代工廠的所在地。例如,中國成都擁有完善的產業叢集、先進的新材料生產技術、廣大的消費市場以及強大的研發基礎,特別是在高性能材料方面。

- 該地區在全球連網型穿戴式裝置需求中也佔有很大佔有率,並且是成長最快的市場之一。中國、日本和新加坡等國家對靈活智慧型手機和家用電器的需求正在增加。日本電子市場正致力於透過靈活的混合電子產品實現產品小型化。

- 因此,三星、LG 和蘋果等公司專門在該地區推出靈活的智慧型手機。中國供應商正在與大學和研究機構合作進行創新。例如,清華大學的研究人員開發出厚度小於25微米的超薄軟性晶片,可以嵌入軟式電路板上的各種材料。

- 2023年12月,成都高新區與中國軟性電子產品電子產業發展大會共同舉辦第四屆「金熊貓」全球軟性軟性電子產品產業創新創業大賽。本次活動旨在強化產業生態,推動成都FHE產業發展。成都高新利用產業投資基金,整合資本與產業鏈。到2027年,成都高新區計畫部署3,000億元人民幣(4,137億美元)的產業基金,並吸引多元化的產業合作者。軟性混合電子產品對於中國的獨立性和技術力至關重要。 CDHT旨在建立FHE產業鏈技術與計劃整合的交流平台。

- 軟性電子產品產業發展聯盟指出,中國FHE產業已成為全球關注的焦點。要利用這一點,中國必須規劃產業佈局,建立「中國碳谷」基地,並專注於核心技術研究,加強頂層設計,發揮軟性混合電子人才的功能。

軟性混合電子 (FHE) 產業概覽

彈性混合電子市場高度分散,主要參與者包括杜邦帝人薄膜公司、Domicro BV、通用電氣公司、洛克希德馬丁公司和美國半導體公司。市場公司正在採取聯盟和收購等策略來增強其產品陣容並獲得永續的競爭優勢。

- 2024 年 4 月:Brewer Science Inc. 推出創新智慧倉庫監控系統,將徹底改變職場安全和生產力。這項先進的解決方案專為工業和倉儲應用而設計,可提供即時資料,以確保員工安全、提高生產力並最佳化業務效率。

- 2024 年 2 月:杜邦帝人薄膜在全球更名為Mylar 專門食品 Films。此次更名將影響美國、歐洲和亞洲的所有國際業務和辦事處。新公司名稱的選擇是向Mylar品牌的傳統致敬,該品牌於 20 世紀 50 年代作為開創性的雙向拉伸 PET 薄膜推出。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 靈活的混合電子生態系分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介和 FHE藍圖

第5章市場動態

- 市場促進因素

- 對輕質、機械靈活且具成本效益的產品的需求不斷成長

- 政府資助計劃

- 市場限制因素

- 研究與發展 (R&D) 和基礎設施所需的資金量

- COVID-19後遺症和其他宏觀經濟趨勢對市場的影響

- 專利分析

第6章 政府支持的研究中心

- NextFlex

- Holst Centre

- IMEC

- VTT Technical Research Centre of Finland Ltd (VTT)

- CPI

- CEA Liten

- Korea Institute of Machinery and Materials

第7章 市場區隔

- 按用途

- 電子產品

- 健康工具

- 應用概述和市場潛力

- 使用案例

- 安全標籤

- 工業/環境監測

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第8章 競爭格局

- 公司簡介

- DuPont Teijin Films

- Domicro BV

- General Electric Company

- Lockheed Martin Corporation

- American Semiconductor Inc

- Flex Ltd

- Brewer Science Inc.

- Integrity Industrial Inkjet Integration

- Antenna Research Associates Inc.(SI2 Technologies)

- Epicore Biosystems

第9章投資分析

第10章市場展望

The Flexible Hybrid Electronics Market size is estimated at USD 180.91 million in 2024, and is expected to reach USD 426.49 million by 2029, growing at a CAGR of 18.71% during the forecast period (2024-2029).

The increasing applications of these electronic components in wearable electronics, performance monitoring systems, structural health monitoring for constructions, soft robotics, and array antennas are expected to drive the market's growth during the forecast period.

Key Highlights

- Hybrid electronics combine the flexibility, lightweight nature, thinness, and large-area electronics with the processing power of semiconductors to open a broad range of new applications across different end-use applications, such as the Internet of Things (IoT), smart buildings, healthcare, product packaging, retail, and consumer electronics.

- Flexible hybrid electronics are also helping product designers use sensors in a new way to collect data and deliver actionable insights that enhance functioning. The growing development and innovations in the market are expected to revolutionize the electronics industry. With the advent of the IoT, flexible hybrid electronics are expected to provide massive opportunities to develop and integrate smart systems and devices for low-cost, everyday use. Industries like automotive, military, aerospace, healthcare, and displays are utilizing flexible and hybrid sensors and wearables in their products.

- Printed electronics is the process of creating electronic circuits and components on various substrates using printing processes such as screen printing, inkjet printing, and gravure printing. To create electrical devices, conductive inks consisting of silver, carbon nanotubes, or conductive polymers are applied to substrates. RFID tags, flexible displays, printed sensors, smart packaging, and e-textiles are a few examples of printed electronics applications. Lightweight, flexible components and scalable and affordable production procedures make them ideal for large-scale applications. Limited electrical performance compared to standard silicon-based devices, inferior durability, dependability, and material qualities hinder performance in demanding situations.

- There is an emerging need for lightweight, mechanically flexible, and cost-effective devices in medical, automotive, and consumer electronics applications. Flexible hybrid electronic devices have gained considerable momentum in catering to the industry's needs. Flexible electronics have the potential to transform computing by enabling bendable systems with arbitrary shapes.

- Government funding boosts R&D activities, leading to innovations and technological advancements in FHE. This support helps overcome technical challenges, reduces costs, and enhances the performance and reliability of FHE products. The government provided funding for various initiatives, including NextFlex Project Call 4.0, the Semi-Flex Tech Project, and the HiFES (hybrid integrated flexible electronic systems) program.

- The high requirement for research and development (R&D) and infrastructure poses several challenges restraining the demand growth for flexible hybrid electronics (FHE). The significant upfront costs of R&D and infrastructure development deter potential adopters, including businesses and consumers, from investing in FHE technologies. This reluctance stems from concerns over return on investment (ROI) and the affordability of initial deployment.

- There is a greater need for business goods and services during economic expansion. Businesses frequently invest in technology like flexible hybrid electronics that can increase various industries because of this increase in demand for lightweight, flexible, and conformal designs. For instance, according to MOSPI, in the financial year 2023, the contribution of domestic electronics production value to the Indian GDP was about 2.9%. This contribution share was estimated to increase to 4.7% by the financial year 2026. Such possible expansion in electronics production is projected to increase demand in the market studied.

Flexible Hybrid Electronics (FHE) Market Trends

Electronics Application Segment Holds Significant Market Share

- The electronics segment, including sensors, displays, and lighting, in the flexible hybrid electronics (FHE) market scope includes thin fingerprint sensors, printed antennas to test water salinity, and printed LED lighting.

- Flexible hybrid electronics (FHE), a blend of flexible and printed electronics, is gaining momentum for its advantages, including digital additive manufacturing for prototyping, flexibility and stretchability, and compatibility with Roll-to-Roll (R2R) production. FHE merges printed electronics with silicon-based integrated circuits on a flexible substrate. Notable active components from Si CMOS processes include microcontrollers, digital signal processors, high-density memories, and radiofrequency (RF) chips.

- Flexible hybrid electronics is revolutionizing consumer electronics with flexible displays, rollable screens, flexible batteries, and electronic textiles. These advancements lead to more durable and versatile devices. There's a shift in consumer electronics toward ultra-high resolution, paving the way for high-resolution displays, flexible screens, and intricately designed LED lighting. The heightened resolution enhances visual appeal and functionality, enriching the user experience.

- By geography, North America is set for a surge in its electronics sector. In June 2024, the NextFlex consortium, a collaboration between the US Department of Defense (DoD) and FlexTech Alliance, unveiled a new funding opportunity of USD 5.3 million. This initiative aims to accelerate the commercialization of flexible hybrid electronics (FHE) in the United States.

- In May 2024, NextFlex released Project Call 9.0 (PC 9.0), a funding initiative with a total value exceeding USD 11 million. This brings NextFlex's total investment in hybrid electronics advancements to a substantial USD 143 million since its inception. PC 9.0 specifically focuses on enhancing the performance and reliability of hybrid electronic devices.

- The market for flexible and foldable displays is growing significantly, with technologies like micro-LEDs gaining prominence alongside OLEDs. While micro-LED displays offer exceptional quality, their manufacturing is challenging. According to DSCC, the global market for foldable and rollable smartphones witnessed a revenue surge, increasing from USD 4.5 billion in 2020 to USD 5.5 billion. Projections indicate a substantial uptick, with the market poised to exceed USD 105 billion by 2025, reflecting an impressive compound annual growth rate (CAGR) of over 80% from 2020 to 2025.

Asia-Pacific to Register Major Growth

- The Asia-Pacific region, including semiconductor hubs like China, Taiwan, and Japan, hosts many pure-play foundries operated by domestic and international vendors. Chengdu, China, for instance, has a comprehensive industrial cluster, advanced technology for new material production, a vast consumer market, and a strong R&D foundation, especially for high-performance materials.

- The region also holds a significant share of global demand for connected wearables and is one of the fastest-growing markets. Countries like China, Japan, and Singapore are seeing increased demand for flexible smartphones and consumer electronics. The Japanese electronics market is focusing on miniaturizing products with flexible hybrid electronics.

- Consequently, companies like Samsung, LG, and Apple are launching flexible smartphones exclusively in the region. Chinese vendors are innovating by collaborating with universities and research institutes. For example, Tsinghua University researchers developed ultra-thin flexible chips, less than 25 micrometers thick, that can be embedded in various materials on flexible substrates.

- In December 2023, Chengdu Hi-tech Industrial Development Zone (CDHT) hosted the China Flexible Electronics Industry Development Conference and the 4th 'Golden Panda' Global Flexible Electronic Industry Innovation and Entrepreneurship Competition. The event aimed to bolster industrial ecosystems and propel Chengdu's FHE sector. CDHT leverages industrial investment funds to integrate capital and industry chains. By 2027, CDHT plans to roll out RMB 300 billion (USD 413.7 billion) in industrial funds, attracting diverse industry collaborators. Flexible hybrid electronics are crucial for China's self-reliance and technological strength. CDHT aims to establish an exchange platform to consolidate technologies and projects in the FHE industry chain.

- The Chinese FHE industry gained global prominence, as noted by the Flexible Electronic Industry Development Alliance. To capitalize on this, China must plan its industrial layout, establish the "China Carbon Valley" base, focus on core technology research, enhance top-level design, and leverage its flexible hybrid electronics talent.

Flexible Hybrid Electronics (FHE) Industry Overview

The flexible hybrid electronics market is highly fragmented with the presence of major players like DuPont Teijin Films, Domicro BV, General Electric Company, Lockheed Martin Corporation, and American Semiconductor Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- April 2024: Brewer Science Inc. launched its innovative smart warehouse monitor system, a game-changer in workplace safety and productivity. This advanced solution engineered for industrial and warehouse applications provides real-time data, ensuring employee safety, enhancing productivity, and optimizing operational efficiency.

- February 2024: DuPont Teijin Films globally rebranded to Mylar Specialty Films. This rebranding is expected to affect all international operations and offices in the United States, Europe, and Asia. The decision to adopt the new company name pays homage to the legacy of the Mylar brand, which was first introduced as the pioneering biaxially oriented PET film in the 1950s.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Flexible Hybrid Electronics Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot and FHE Roadmap

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Emerging Need for Lightweight, Mechanically-flexible, and Cost-effective Products

- 5.1.2 Government Funded Projects

- 5.2 Market Restraints

- 5.2.1 High Capital Requirement for Research and Development (R&D) and Infrastructure

- 5.3 Impact of COVID-19 Aftereffects and Other Macroeconomic Trends on the Market

- 5.4 Patent Analysis

6 GOVERNMENT SUPPORTED RESEARCH CENTRE

- 6.1 NextFlex

- 6.2 Holst Centre

- 6.3 IMEC

- 6.4 VTT Technical Research Centre of Finland Ltd (VTT)

- 6.5 CPI

- 6.6 CEA Liten

- 6.7 Korea Institute of Machinery and Materials

7 MARKET SEGMENTATION

- 7.1 By Application

- 7.1.1 Electronics

- 7.1.2 Health Performance Tool

- 7.1.2.1 Application Summary and Market Potential

- 7.1.2.2 Use-cases

- 7.1.3 Security Tag

- 7.1.4 Industrial and Environmental Monitoring

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia

- 7.2.4 Australia and New Zealand

- 7.2.5 Latin America

- 7.2.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 DuPont Teijin Films

- 8.1.2 Domicro BV

- 8.1.3 General Electric Company

- 8.1.4 Lockheed Martin Corporation

- 8.1.5 American Semiconductor Inc

- 8.1.6 Flex Ltd

- 8.1.7 Brewer Science Inc.

- 8.1.8 Integrity Industrial Inkjet Integration

- 8.1.9 Antenna Research Associates Inc. (SI2 Technologies)

- 8.1.10 Epicore Biosystems