|

市場調查報告書

商品編碼

1548883

行動中間件:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Mobile Middleware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

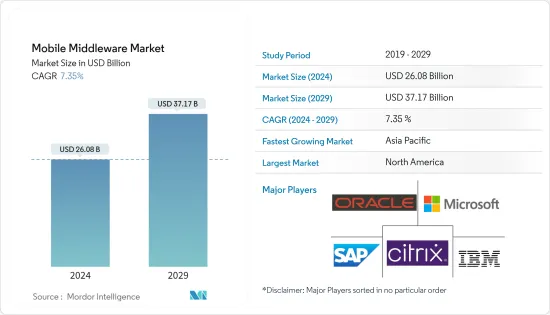

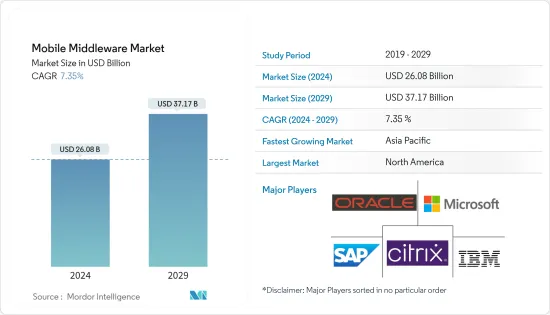

2024年移動中間件市場規模預計為260.8億美元,預計2029年將達到371.7億美元,在市場估計和預測期間(2024-2029年)複合年成長率預計為7.35%。

行動中間件解決了無線運行的行動應用程式所面臨的特定挑戰,執行通訊協定最佳化、資料同步和資料壓縮等功能。預計全球很大一部分勞動力將採用自己的設備進行業務,這增加了對行動中間件解決方案的需求。應用程式和設備之間不斷成長的連接需求正在推動行動中間件市場的成長。

主要亮點

- 行動中間件市場的主要促進因素是BYOD概念的擴展。隨著公司採取增加員工互動的政策,BYOD 擴展到工業應用程式使得提供對各種應用程式的資料的存取變得至關重要,預計將推動行動中介軟體市場的需求。

- BOYD(自備設備)是補充不斷變化的工作模式的完美模式。這一趨勢預計將提高生產力,因為員工將能夠隨時隨地在他們喜歡的設備上存取高效的解決方案,尤其是智慧型手機,這將間接增加組織中 BYOD 趨勢的採用。

- 行動中間件在各個最終用戶行業中迅速普及,並被許多應用程式開發人員用來設計他們的應用程式。 Java ME、Symbian、.NET、Android 和 iPhone 等中間件平台能夠滿足行動環境中的可存取性、可及性、適應性、可靠性和通用性等重要要求。

- 相容性和安全性問題限制了行動中介軟體市場的成長。行動中間件在確保行動裝置和後端系統之間的安全通訊和資料傳輸方面發揮著重要作用。隨著我們越來越依賴行動裝置來存取敏感資訊和執行關鍵任務,對強大的中間件解決方案的需求正在迅速增加。

- 在 COVID-19 大流行期間,行動醫療平台的出現是為了應對 COVID-19 的挑戰。行動運算使得建立基於醫療保健的解決方案或將現有應用程式適應到這些平台上成為可能。它還提供儲存、處理、通訊支援以及醫療保健行業通訊設備之間的中間件。後疫情時代,行動醫療平台為醫療保健專業人員提供最新、及時的訊息,推動市場成長。

行動中介軟體市場趨勢

雲端配置部分預計將佔據重要市場佔有率

- 近年來,隨著雲端服務和解決方案呈指數級成長,各種類型的雲端服務不斷湧現,市場對雲端上移動中間件的需求不斷增加。了解應用程式的效能以及基礎設施隨著流量增加和減少的可擴展性是實施 API 後的一些關鍵問題。

- 隨著公共雲端平台的成熟,它們擴大用於提供可靠的本地連接並作為核心IT基礎設施的擴展。雲端上託管的行動中間件的採用正在迅速增加,預計在預測期內還將擴大。

- Flexera Software 的數據顯示,截至 2023 年,72% 的企業受訪者表示他們已經採用了混合雲端。遷移到混合雲端通常會以運作單一私有雲端和公共雲端為代價。

- 行動中間件市場的新興企業正在採用雲端原生平台,使 DevOps 團隊能夠快速調試問題。當今的解決方案供應商透過策略性地建立高效的資料儲存管道以及內部壓縮和索引資料來降低成本。中間件提供對資料的完全控制,並確保資料安全性和合規性,支援在安全的雲端環境中存儲,從而為企業節省大量成本。

- 雲端上行動中間件平台提供基礎設施監控、日誌監控、資料庫監控、模擬請求效能綜合監控、無伺服器雲端功能可視化的無伺服器監控、容器監控以及Web和行動應用程式效能的精確監控,並提供可觀察的功能。

預計北美將佔據較大市場佔有率

- 由於美國越來越多採用巨量資料分析公司,預計北美將主導全球中介軟體市場。北美在採用雲端技術尤其是行動雲端方面處於主導。北美是採用行動中間件的領先地區之一,因為許多全球最大的科技公司都位於該地區。

- 智慧型手機銷量的成長和行動裝置的激增正在推動 BYOD 的採用,並迫使公司實施行動中間件。隨著許多行業採用物聯網來實現更好的營運,北美的雲端使用量正在上升。隨著公司努力提供安全服務,嚴格的政府法規也推動了該地區對行動中間件的需求。

- 中間件市場的北美公司正在為現有企業及其客戶帶來大量價值,使他們能夠利用行動性並從後端系統提取資料。物聯網、雲端運算和自帶設備 (BYOD) 等技術的日益普及對該地區的市場成長做出了重大貢獻。

- 隨著組織尋求提高其移動中間件解決方案的效率和準確性,人工智慧和機器學習擴大在區域移動中間件市場中被採用。這些技術自動化了資料分析和決策等各種流程,提高了行動中間件解決方案的整體效能。

- 整個企業的行動裝置提高了可訪問性和即時通訊,從而提高了企業生產力。這些設備連接到各種行動應用程式,推動了該地區對行動中間件的需求。

行動中介軟體產業概況

由於跨國公司和中小企業的存在,移動中間件市場高度分散。該市場的主要企業包括 SAP SE、微軟、 Citrix系統、IBM Corporation 和Oracle。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 4 月 Microsoft 計畫重用中間件解決方案進行一次性遷移和近即時整合,同時被動地解決包括切換策略和中間件遷移在內的轉型計劃。遷移到雲端需要一個遷移計劃,將應用程式、資料庫、中間件、使用者、管理員和其他相關人員遷移到要遷移到雲端的應用程式。

- 2023 年 11 月 去中心化金融 (DeFi) 聚合商 ParaSwap 整合了領先的加密貨幣進出解決方案 Transak,使 Transak 成為 ParaSwap iOS 行動錢包的首選入站解決方案。 ParaSwap 是一個 DeFi 中介軟體和聚合器,為用戶提供 DeFi 領域最優惠的價格。該平台透過安全且方便用戶使用的介面提供最佳化的資產交換路線。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素與市場約束因素介紹

- 市場促進因素

- 擴大雲端服務的採用和物聯網應用的廣泛採用

- 行動企業整合需求增加

- 市場限制因素

- 對全球資料安全和資料外洩的擔憂

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 軟體

- 服務

- 按配置

- 本地

- 在雲端

- 按最終用戶產業

- 通訊/ITES

- 零售業

- 製造業

- 衛生保健

- 運輸/物流

- BFSI

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- SAP SE

- Microsoft

- Citrix Systems Inc.

- IBM Corporation

- Oracle

- BlackBerry Limited

- Verivo Software Inc.

- TIBCO Software Incorporation

- VMware(Broadcom)

- Kony Inc.

- Axway Inc.

- Adobe Systems Incorporated

第7章 投資分析

第8章 市場機會及未來趨勢

The Mobile Middleware Market size is estimated at USD 26.08 billion in 2024, and is expected to reach USD 37.17 billion by 2029, growing at a CAGR of 7.35% during the forecast period (2024-2029).

Mobile middleware addresses specific challenges faced by mobile applications running on wireless and performs functions such as protocol optimization, data synchronization, and data compression. Many members of the global workforce are expected to adopt their own devices for work, emphasizing the need for mobile middleware solutions. The increasing need for connectivity between apps and devices has increased the demand for mobile middleware market growth.

Key Highlights

- The primary driver for the mobile middleware market is the expansion of the BYOD concept. With businesses adopting policies to increase employee interaction, it has become essential to provide access to data from various applications due to the expansion of BYOD into industrial applications, which is expected to increase the demand in the mobile middleware market.

- Bring your device (BOYD) is the perfect model to complement the shifting work paradigm. This trend is expected to yield higher productivity, as employees will have access to efficient solutions on their preferred devices, especially smartphones, at any point in time, from any location, indirectly increasing the adoption of the BYOD trend in organizations.

- Mobile middleware is gaining rapid traction among various end-user industries and has caught the attention of many app developers for use in their app design. Middleware platforms, such as Java ME, Symbian, .NET, Android, and the iPhone, enable the industry to comply with critical requirements such as accessibility, reachability, adaptability, trustworthiness, and universality in the mobile environment.

- Concerns related to compatibility and security restrain the growth of the mobile middleware market. Mobile middleware plays a crucial role in ensuring secure communication and data transfer between mobile devices and back-end systems. The demand for robust middleware solutions has surged with the increasing reliance on mobile devices for accessing sensitive information and performing critical tasks.

- During the COVID-19 pandemic, mobile health platforms emerged to address COVID-19 challenges. Mobile computing enabled platforms to build healthcare-based solutions or to adapt the existing applications on top of these platforms. They also provide storage, processing, communication support, and middleware between the communication devices operating in the healthcare industry. In the post-pandemic era, mobile health platforms provide up-to-date and timely information to healthcare professionals, thereby propelling market growth.

Mobile Middleware Market Trends

On-cloud Deployment Segment is Expected to Hold Significant Market Share

- Cloud services and solutions have grown exponentially in recent years, leading to the installation of various kinds of cloud services and the boosting of the demand for on-cloud mobile middleware in the market. Insight into the application's working and scalability of infrastructure depending on increase or decrease in traffic are a few significant concerns of post-API deployments.

- As public cloud platforms are maturing, the provision of reliable on-premises connectivity and their use as extensions of core IT infrastructure have increased. There is a high increase in the adoption of mobile middleware hosted on the cloud, which is estimated to grow during the forecast period.

- According to Flexera Software, as of 2023, 72% of the enterprise respondents exhibited that they had deployed a hybrid cloud in their organization. The migration to hybrid cloud solutions generally occurs at the expense of operating single private and public clouds.

- Emerging players in the mobile middleware market are embracing a cloud-native platform that allows DevOps teams to debug issues faster. Present-day solution providers are strategically creating an efficient data storage pipeline, compressing and indexing data in-house to lower costs. Middleware grants complete control over data, ensuring data security and compliance, leading to substantial cost savings for enterprises by enabling storage in its secure cloud environment.

- The on-cloud mobile middleware platform offers observability capabilities such as infrastructure monitoring, log monitoring, database monitoring, synthetic monitoring for performance with simulated requests, serverless monitoring to gain visibility into serverless cloud functions, container monitoring, and accurate user monitoring for performance of web and mobile applications, which is further propelling the market's growth.

North America is Expected to Hold Significant Market Share

- North America is anticipated to dominate the global middleware market, owing to the rising adoption of big data analytics companies in the United States. North America has led the adoption of cloud technologies, especially the mobile cloud. Many of the world's largest technology companies are located in the region, making North America one of the primary regions that have adopted mobile middleware.

- The increased sale of smartphones and mobile device penetration has resulted in high adoption of BYOD, forcing companies to adopt mobile middleware. With many industries implementing IoT to enable better operations, cloud usage in North America is also increasing. Also, strict government regulations are resulting in companies working to provide secure services, which is fuelling the thriving demand for mobile middleware in the region.

- North American companies in the middleware market bring much value by allowing existing companies and their customers to tap into mobility and pull data from back-end systems. Increasing adoption of technologies like IoT, cloud computing, and bring-your-own devices (BYOD) significantly contributes to the regional market's growth.

- Artificial intelligence and machine learning are increasingly being adopted in the regional mobile middleware market as organizations look to improve the efficiency and accuracy of their mobile middleware solutions. These technologies automate various processes, such as data analysis and decision-making, and enhance the overall performance of mobile middleware solutions.

- Mobile devices across enterprises offer greater accessibility and real-time communication, leading to greater business productivity. These devices are connected to different mobile applications, fueling the demand for mobile middleware in the region.

Mobile Middleware Industry Overview

The mobile middleware market is highly fragmented due to the presence of global players and small and medium-sized enterprises. Some of the major players in the market are SAP SE, Microsoft, Citrix Systems Inc., IBM Corporation, and Oracle. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- April 2024: Microsoft planned to address transformation projects reactively, including cutover strategy and middleware migration, while reusing the middleware solutions for one-time migrations and near-real-time integrations. Cloud transformations require transition planning to cutover applications, databases, middleware, users, administrators, and other stakeholders to the applications being migrated to the cloud.

- November 2023: ParaSwap, a decentralized finance (DeFi) aggregator, integrated Transak, the leading crypto on/off ramp solution that made Transak the preferred on-ramp solution in ParaSwap's iOS mobile wallet. ParaSwap is a DeFi middleware and aggregator that offers users access to the most favorable prices in the DeFi space. The platform provides an optimized route for exchanging assets in a secure and user-friendly interface.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rising Adoption of Cloud Services and Increasing Penetration of IOT Applications

- 4.3.2 Increasing Demand for Mobile Enterprise Integration

- 4.4 Market Restraints

- 4.4.1 Concerns Regarding Data Security and Data Breaching Globally

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Software

- 5.1.2 Service

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 On-cloud

- 5.3 By End-user Industry

- 5.3.1 Telecommunication and ITES

- 5.3.2 Retail

- 5.3.3 Manufacturing

- 5.3.4 Healthcare

- 5.3.5 Transportation and Logistic

- 5.3.6 BFSI

- 5.3.7 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE

- 6.1.2 Microsoft

- 6.1.3 Citrix Systems Inc.

- 6.1.4 IBM Corporation

- 6.1.5 Oracle

- 6.1.6 BlackBerry Limited

- 6.1.7 Verivo Software Inc.

- 6.1.8 TIBCO Software Incorporation

- 6.1.9 VMware (Broadcom)

- 6.1.10 Kony Inc.

- 6.1.11 Axway Inc.

- 6.1.12 Adobe Systems Incorporated