|

市場調查報告書

商品編碼

1641958

軟體定義儲存:市場佔有率分析、產業趨勢和成長預測(2025-2030 年)Software-Defined Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

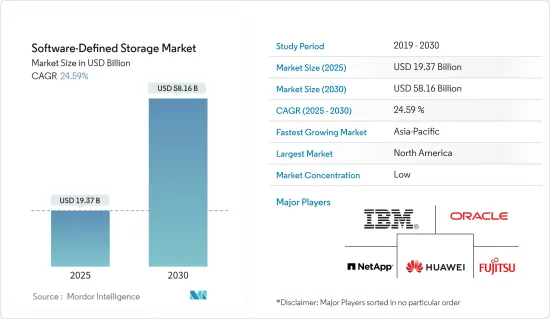

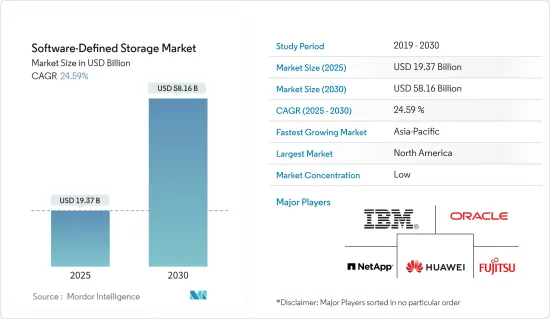

軟體定義儲存市場規模在2025年預估為193.7億美元,預計到2030年將達到581.6億美元,預測期間(2025-2030年)複合年成長率為24.59%。

軟體定義儲存(SDS)可讓企業從硬體平台中抽像出儲存資源,提供靈活性、效率和快速的可擴充性。在軟體設計資料中心 (SDDC) 架構中,資源不是孤立的,而是可以輕鬆實現自動化和編配。透過資料提高效率和業務流程的需求正在推動中小企業對 SDS 解決方案的需求。

由於競爭環境,公司正在將重點轉向新技術以獲得競爭優勢。使用 SDS 有助於透過自動化製程控制和以軟體取代傳統硬體來降低成本。

企業中非結構化資料的快速成長推動了對可靠、安全和可擴展的儲存架構的需求。此外,隨著物聯網在全球的普及,邊緣產生的資料量正在迅速增加。 SDS 模型透過提供更大的部署靈活性並允許透過單一介面在任何儲存平台上使用該軟體來滿足這些需求。

由於這項技術相對於傳統儲存方法具有優勢,正在經歷數位轉型的企業和 IT 組織可能會採用 SDS 來滿足其資料儲存需求。然而,需要熟練的操作員來管理向 SDS 的過渡以及安全問題可能會阻礙市場成長。

市場領先的供應商正在部署增強資料保護和可靠性的 SDS 軟體解決方案。

新冠疫情促使私營和公共部門從傳統管道轉向數位管道,使公民、企業和公共部門工作人員能夠從遠端位置安全地存取公共服務並共用資料。事實證明,軟體定義儲存在疫情期間對企業至關重要,預計疫情過後資料儲存將繼續成長。

軟體定義儲存市場趨勢

BFSI 領域預計將大幅成長

- 銀行是受到嚴格監管的業務,資料呈指數級成長,需要高度安全和可用的儲存功能,以便透過跨地點工作的設備進行擴展和擴展。軟體定義儲存解決方案可以透過處理龐大的資料集、透過加密限制檔案訪問,甚至備份和復原資料來幫助改善 BFSI業務。

- BFSI 領域競爭激烈,利用科技確保IT基礎設施靈活並能回應市場的動態需求。軟體定義的資料中心將使銀行能夠推出聚合應用程式,整合零售客戶經常使用的應用程式。只需使用應用程式即可輕鬆滿足雜貨、旅行、電子商務和整合付款選項等各種使用案例,這些優勢有助於客戶開展日常銀行業務。

- 對 BFSI 中海量資料進行更好管理的需求日益成長,推動了軟體定義儲存市場的大部分佔有率。預計在預測期內,BFSI 部門將實現最快的成長。這是因為客戶對資料分析的需求不斷增加,以獲得競爭優勢並推動該領域持續的數位轉型。

- 隨著數位經濟的擴張,資料已成為銀行業的重要組成部分。軟體定義的基礎架構和儲存解決方案使全球銀行能夠快速存取、分析和共用雲端本地資料,涵蓋從前台到後勤部門的業務。

亞太地區預計將經歷最快成長

- 在亞太地區,整個地區的企業都經歷著本地設備和雲端環境中儲存的非結構化資料量激增。此外,全部區域物聯網 (IoT) 的普及正在推動邊緣產生的資料呈指數級成長。

- 線上付款的採用呈指數級成長,每天都會產生企業需要處理的大量資料,從而推動對軟體定義儲存解決方案的需求。

- 此外,透過華為在中國提供SDS的FalconStor等領先供應商認為,包括中國在內的亞太地區的客戶/企業是IT服務最大的潛在市場之一,並且正在向現代儲存解決方案轉型。對此持正面態度。遷移趨勢主要受到資料安全、復原以及虛擬和非虛擬資源整合等挑戰的驅動。

- 隨著該國網路用戶數量的不斷成長,雲端儲存的使用量預計將大幅成長。

- 中國和印度等新興經濟體仍依賴傳統硬體進行存儲,迫切需要數位轉型以跟上技術進步。預計這些國家將在預測期內為軟體定義儲存 (SDS) 供應商提供潛在機會。

軟體定義儲存行業概覽

軟體定義儲存市場較為分散,主要參與者包括 IBM 公司、Oracle 公司和 NetApp 公司。市場主要企業不斷創新產品、增加活性化、產能擴張等舉措,進一步加劇競爭。

2023 年 11 月多重雲端資料管理解決方案供應商 DDN 宣布推出其下一代軟體定義儲存平台 DDN Infinia。該平台利用資料編配和基於人工智慧的最佳化來加速運算和生成人工智慧。 DDN Infinia 結合了多租戶、容器化和最高水準的速度和效率,以及易於管理和強大的安全屬性。此解決方案簡化了資料管理所需的工作流程。

2023年9月 加拿大投資銀行TD Securities專注於外匯兌換和大額交易等批發銀行業務,但其區塊儲存由多個儲存口袋組成,維護困難。在道明證券,儲存由通用基礎設施專家管理。因此,道明證券決定部署軟體定義儲存系統 Dell PowerMax。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 評估宏觀經濟對市場的影響

第5章 市場動態

- 市場促進因素

- 整個企業的資料量快速成長

- 遠端系統管理流程工業對工業移動性的需求不斷增加

- 市場挑戰

- 高成本、安裝複雜

第6章 市場細分

- 按類型

- 堵塞

- 文件

- 目的

- 融合式基礎架構

- 按公司規模

- 中小企業

- 大型企業

- 按最終用戶產業

- BFSI

- 通訊和 IT

- 政府

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Oracle Corporation

- Netapp Inc.

- Huawei Technologies Co. Ltd

- Fujitsu Limited

- Genetec Inc.

- VMWare Inc.(Dell Inc.)

- Hitachi Vantara Corp.

- Pure Storage Inc.

- Promise Technology Inc.

- FalconStor Software Inc.

- StarWind Software Inc.

第8章投資分析

第9章:市場的未來

The Software-Defined Storage Market size is estimated at USD 19.37 billion in 2025, and is expected to reach USD 58.16 billion by 2030, at a CAGR of 24.59% during the forecast period (2025-2030).

The software-defined storage (SDS) enables organizations to abstract storage resources from the hardware platform, offering flexibility, efficiency, and faster scalability. In the software-designed data center (SDDC) architecture, resources can be easily automated and orchestrated rather than residing in siloes. The need to improve efficiency and business processing with data drives the demand for SDS solutions in small and medium-sized enterprises.

Due to the competitive environment, companies have shifted their focus toward new technology to have a competitive edge. SDS usage helps minimize the cost by automating process controls and replacing traditional hardware with software.

The booming volume of unstructured data across various enterprises augments the demand for a scalable storage architecture that is reliable and secure. In addition, with the proliferation of IoT globally, the data generated at the edge is rapidly increasing. The SDS model addresses these needs by increasing deployment flexibility and enabling organizations to use the software with any storage platform through a single interface.

Due to this technology's advantages over traditional storage methods, enterprises or IT organizations undergoing digital transformation will likely adopt SDS for their data storage needs. However, the need for more skilled operators to manage the transition toward SDS and security concerns will hinder the market's growth.

The key vendors in the market have been rolling out SDS software solutions with enhanced data protection and reliability, owing to the growing requirements of large companies in the banking and telecom sectors.

The COVID-19 pandemic resulted in private and public sectors shifting from traditional channels to digital channels to enable citizens, businesses, and public sector staff to access public services and securely share data from remote locations. Software-defined storage has proven its importance for businesses during the pandemic and is anticipated to see continued growth in data storage post-pandemic.

Software-Defined Storage Market Trends

The BFSI Segment is Expected to Witness Significant Growth

- The banks are a highly regulated operational environment with exponential data growth and require highly secure and highly available storage capabilities to integrate, scale up, and out with appliances that link together across sites. The software-defined storage solutions help improve BFSI operations, including handling massive data sets, limited access to files with encryption, and even data backup and recovery.

- The BFSI segment is highly competitive, leveraging technology to ensure its IT infrastructure is highly flexible to meet dynamic market demands. Software-defined data centers enable banks to launch an aggregator app, consolidating the frequently used apps by retail customers. Benefits such as ease of operation from a single app for different use cases like food, travel, and e-commerce and integration of payment options are helping customers in everyday banking activities.

- The rising need for better managing vast data from BFSI contributes a substantial share of the software-defined storage market. The BFSI segment is anticipated to record the fastest growth during the forecast period, attributed to the increasing demand for customer data analysis to achieve a competitive advantage and boost the ongoing digital transformation in the segment.

- With the increase in the digital economy, data is an essential part of the banking industry. Software-defined infrastructure and storage solutions enable global banks to rapidly access, analyze, and share on-premises data in the cloud from front-to-back office operations.

Asia-Pacific is Expected to Witness Fastest Growth

- Asia-Pacific is experiencing rapid growth in the volume of unstructured data across various enterprises, which is being stored in on-premises devices and cloud environments. Also, with the proliferation of the internet of things (IoT) across the region, the data generated at the edge is drastically increasing.

- The adoption of online payments is rising exponentially, generating a huge amount of data daily, which the companies need to process, propelling the demand for software-defined storage solutions.

- Moreover, the key vendors, such as FalconStor, which provides SDS in China through Huawei, indicated that customers/enterprises in Asia-Pacific, including China, are one of the greatest potential markets for IT services and are positive about switching to modern storage solutions. The propensity to shift is mainly to overcome challenges such as data security, recovery, and the integration of virtual and non-virtualized resources.

- The use of cloud storage is poised to increase aggressively, driven by the country's rising number of internet users.

- Emerging economies like China and India are still dependent on traditional hardware for storage and the need for digital transformation to stay up with technological advancements; these countries are expected to provide a potential commercial opportunity for software-defined storage (SDS) suppliers during the forecast period.

Software-Defined Storage Industry Overview

The software-defined storage market is fragmented, with major players like IBM Corporation, Oracle Corporation, and NetApp Inc. The key players in the market are continuously innovating new products and rising activities such as mergers and acquisitions and capacity expansion, further increasing the competition.

November 2023: DDN, a provider of multi-cloud data management solutions, has announced DDN Infinia, a next-generation software-defined storage platform. This platform leverages data orchestration and AI-based optimization to accelerate computing and generative AI. DDN Infinia combines multi-tenancy, containerization, and the highest levels of speed and efficiency with ease of management and powerful security attributes. The solution simplifies workflows for the data management demands.

September 2023: TD Securities, a Canadian investment bank that focuses on wholesale banking such as currency conversion and large trades, introduced its TD Securities' block storage setup made up of several storage pockets, making it hard to maintain. General infrastructure specialists managed storage at TD Securities. TD Securities has thus selected to move forward with a software-defined storage system, Dell PowerMax.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Macroeconomic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapidly Growing Volume of Data Across Enterprises

- 5.1.2 Increased Demand for Industrial Mobility for Remotely Managing the Process Industry

- 5.2 Market Challenges

- 5.2.1 High Cost and Compliacted in Installation

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Block

- 6.1.2 File

- 6.1.3 Object

- 6.1.4 Hyper-converged Infrastructure

- 6.2 By Size of Enterprise

- 6.2.1 Small and Medium Enterprise

- 6.2.2 Large Enterprise

- 6.3 By End-user Industries

- 6.3.1 BFSI

- 6.3.2 Telecom and IT

- 6.3.3 Government

- 6.3.4 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Oracle Corporation

- 7.1.3 Netapp Inc.

- 7.1.4 Huawei Technologies Co. Ltd

- 7.1.5 Fujitsu Limited

- 7.1.6 Genetec Inc.

- 7.1.7 VMWare Inc. (Dell Inc.)

- 7.1.8 Hitachi Vantara Corp.

- 7.1.9 Pure Storage Inc.

- 7.1.10 Promise Technology Inc.

- 7.1.11 FalconStor Software Inc.

- 7.1.12 StarWind Software Inc.