|

市場調查報告書

商品編碼

1851796

數位雙胞胎(DT):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Digital Twin (DT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

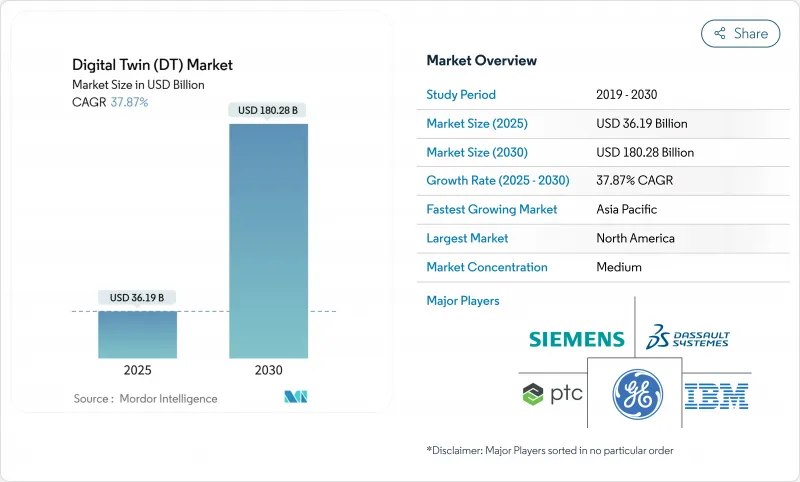

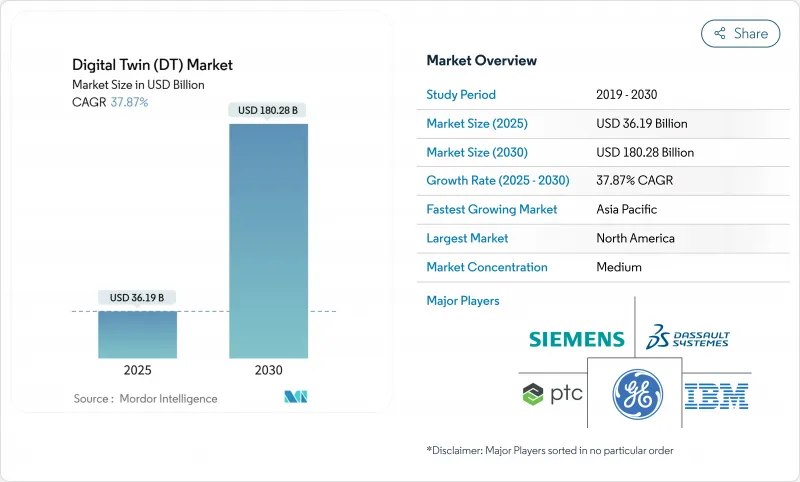

數位雙胞胎市場目前預計到 2025 年將達到 361.9 億美元,到 2030 年將達到 1,802.8 億美元,複合年成長率為 37.87%。

利好因素包括工業IoT平台的成熟、邊緣人工智慧的廣泛部署以及對安全關鍵基礎設施的監管要求。製造業憑藉已建立的智慧工廠投資,仍然是最大的應用領域;而石油和天然氣行業則呈現最強勁的成長,因為生產商在充滿挑戰的營運條件下尋求提高資產完整性。北美在區域市場中保持領先地位,但亞太地區正在縮小差距,中國、印度和日本的公共計畫正在資助大規模數位化。雖然解決方案目前佔據了大部分支出,但隨著企業尋求整合方面的專業知識,服務也迅速擴張。雲端採用率超過了本地部署,這表明人們對遠端資料管理保障和擴充性架構的信心日益增強。網路安全漏洞和基於實體建模的人才短缺正在抑製成長前景,即使它們並未改變主要的招募方向。

全球數位雙胞胎(DT)市場趨勢與洞察

工業IoT平台快速成長

工業物聯網 (IIoT) 的廣泛應用提供了即時數據,實現了數位模型與工廠車間的同步。憑藉其強大的 Xcelerator 生態系統,西門子預計到 2024 年,其數位化業務收入將成長 22%,達到 90 億歐元(97.2 億美元)。Honeywell的 Forge 平台每天處理超過 30 億資料點,將客戶工廠的非計劃停機時間減少了 35%。 OPC UA 和 MQTT 等標準化通訊協定降低了整合摩擦,使工廠能夠在數週內而非數月內部署孿生模型。最終成果包括:顯著降低成本、加速根本原因分析、更可預測的產能規劃。

在設備層面擴展邊緣/AI推理

將分析從雲端遷移到邊緣可以降低延遲並維護資料主權。微軟和西門子共同開發的工業基礎模型(IFM)可對資產進行推理,從而實現毫秒異常檢測響應。奧迪目前在邊緣運行帶有孿生體的虛擬PLC,最佳化了實際生產線的週期時間。由於向上游傳輸的資料量極少,本地模擬也限制了頻寬消耗。專用晶片和容器化運行時進一步降低了二級供應商的部署成本,並加速了整個價值鏈中人工智慧孿生體的應用。

IT/OT堆疊中的網路實體安全漏洞

西班牙國家網路安全研究所指出,連接IT和OT的孿生系統擴大了攻擊面,使流程控制器面臨資料完整性威脅。近期發生的勒索軟體事件迫使製造業停產數日,以便清理孿生資料湖。由於企業需要整合零信任架構並培訓員工,平均部署延遲長達18個月。多租戶孿生系統增加了複雜性,因為必須在不影響協作的情況下隔離合作夥伴的存取權限。

細分市場分析

在嵌入式工業嵌入式聯網感測器、預測性維護程序和持續改善文化的驅動下,製造業將在2024年佔據數位雙胞胎市場35.8%的佔有率。汽車和電子工廠正在部署生產線級孿生模型,以分析節拍時間變化以及品質和產量比率模式,從而實現兩位數的廢品率降低。能源效率的提高進一步提升了投資回報,尤其是在資源密集的冶金和水泥產業。預計即使其他行業迎頭趕上,製造業仍將保持規模優勢並穩定擴張。

預計到2030年,石油和天然氣產業將以29.3%的複合年成長率成長,這主要得益於目前規模較小的海上作業者對遠端偵測和故障隔離能力的需求。上游產業正在部署儲存系統,該系統整合了地震數據和生產測井數據,使工程師能夠在鑽井鑽機部署前模擬鑽井場景。中游企業正在應用儲層孿生系統進行管道洩漏檢測,而像殼牌這樣的下游煉油廠在使用檢驗DNV標準的儲層孿生系統後,計劃外停機時間減少了20%。政府的脫碳目標進一步推動了儲層孿生系統的應用,因為該系統能夠最佳化火炬燃燒最小化和熱能整合策略。在上游和中游領域,人工智慧驅動的情境測試正在將儲層孿生系統從監測系統提升為決策支援系統,從而擴大其在整體部署中的佔有率。

2024年,解決方案類別(軟體平台、實體引擎和連網硬體)將佔支出總額的63.6%,企業將致力於取得核心能力。供應商正在將建模庫和視覺化引擎捆綁銷售,使流程工程師無需從頭開始編寫程式碼即可建立模型。授權模式正轉向基於使用量的分級模式,從而擴大了二級供應商的覆蓋範圍。

然而,服務規模正以31.4%的複合年成長率快速擴張。實施顧問負責調整資料管道、建立語意模型並檢驗模擬精度。託管服務合約監控孿生健康指標、應用修補程式並調整演算法偏差。勞斯萊斯的TotalCare服務以孿生分析為支撐,確保引擎執行時間。隨著基於結果的合約日益普及,服務合作夥伴承擔了更多風險,將費用與效率提升而非計費工時掛鉤。這種模式增強了客戶忠誠度,並鼓勵平台持續改進。

數位數位雙胞胎市場報告按應用(製造業、能源電力、航太與國防、石油天然氣、汽車等)、組件(解決方案/平台、服務)、部署類型(本地部署、雲端部署)、公司規模(大型企業、中小企業)和地區進行細分。

區域分析

到2024年,北美將佔據數位雙胞胎市場38.4%的收入佔有率,這主要得益於工業4.0的早期部署、廣泛的航太項目以及工業SaaS領域強勁的創業融資。美國航空監管機構對基於模擬的認證的認可,正在推動飛機原始設備製造商(OEM)和一級供應商對數位孿生技術的投資。加拿大和美國的能源巨頭正在管線和LNG接收站部署數位孿生技術,以降低甲烷外洩率,從而回應日益嚴格的環境政策。由於網路保險框架成熟且資料保護義務標準化,雲端運算的應用尤為強勁。

亞太地區將以27.2%的複合年成長率領跑,主要得益於大型政府計劃的推動。中國的「數位中國」建設計畫要求為新建基礎設施建設都市區數位孿生模型,這將為國內外供應商創造大量的採購機會。印度的「桑格姆數位雙胞胎」計畫將網路孿生能力整合到全國電訊升級中,為6G做好準備。日本的NTT數位孿生計算舉措支援城市規模的數位孿生模型,為交通和災害應變演算法提供數據支援。韓國和新加坡則著重推進即時碳足跡追蹤,並積極推廣智慧工廠和港口試點計畫。由於該地區在供應鏈中扮演核心角色,其累積的經驗將迅速傳播到全球原始設備製造商(OEM)手中。

在監管要求的推動下,歐洲正穩步向前發展。數位產品護照迫使製造商在產品生命週期內實現可追溯性,實際上使大規模生產的產品必須具備輕量化的「孿生體」特性。德國的工業4.0平台提供標準化的管理框架指南,並降低了中小企業的整合成本。法國正在投資虛擬造船廠「孿生體」以維持海軍建設的競爭力,北歐國家則利用建築「孿生體」來滿足淨零排放標準。阿拉伯聯合大公國和沙烏地阿拉伯正在試點油田“孿生體”和巨型計劃城市“孿生體”,以期在大規模擴張之前獲得效率和永續性的效益。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 工業IoT平台快速成長

- 在設備層面擴展邊緣/AI推理

- 隨著安全關鍵型基礎設施數位化,資產密集型產業的監管將更加嚴格。

- 對虛擬試運行的需求增加,以降低棕地計劃的資本支出

- 基於結果的服務合約的興起需要即時資產副本數據

- 歐盟和美國數位產品護照的興起

- 市場限制

- IT/OT堆疊中的網路實體安全漏洞

- 缺乏專業的基於物理的建模專家

- 聯邦孿生體產生的資料的智慧財產權所有權不透明

- 仿真標準的碎片化限制了互通性。

- 關鍵法規結構評估

- 價值鏈分析

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 關鍵相關人員影響評估

- 主要用例和案例研究

- 宏觀經濟因素對市場的影響

- 投資分析

第5章 市場區隔

- 透過使用

- 製造業

- 能源與電力

- 航太/國防

- 石油和天然氣

- 車

- 其他

- 按組件

- 解決方案/平台

- 服務

- 透過部署模式

- 本地部署

- 雲

- 按公司規模

- 主要企業

- 中小企業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 澳洲

- 紐西蘭

- 亞太其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ANSYS, Inc.

- AVEVA Group plc

- Bentley Systems, Incorporated

- Cal-Tek SRL

- Cityzenith, Inc.

- Dassault Systemes SE

- General Electric Company

- Hexagon AB

- International Business Machines Corporation

- Lanner Group Limited(Royal HaskoningDHV)

- Mevea Ltd.

- Microsoft Corporation

- Oracle Corporation

- PTC Inc.

- Rescale, Inc.

- Robert Bosch GmbH(Bosch.IO)

- SAP SE

- Schneider Electric SE

- Siemens AG

- Amazon Web Services, Inc.

第7章 市場機會與未來展望

The digital twin market currently stands at USD 36.19 billion in 2025 and is projected to reach USD 180.28 billion in 2030, advancing at a 37.87% CAGR.

Tailwinds include the maturation of industrial IoT platforms, wider edge-AI deployment, and regulatory requirements for safety-critical infrastructure. Manufacturing remains the largest application thanks to established smart-factory investments, while Oil and Gas shows the strongest growth as producers seek asset-integrity gains in harsh operating conditions. Regionally, North America retains the lead, but Asia-Pacific is closing the gap as public programs in China, India, and Japan channel funding toward large-scale digitalization. Solutions account for most spending today, yet services are scaling quickly as firms seek integration expertise. Cloud deployment is growing faster than on-premises, signaling rising confidence in remote data-management safeguards and scalable architectures. Cyber-security gaps and scarce physics-based modeling talent temper the growth outlook, though they have not altered the primary trajectory of adoption.

Global Digital Twin (DT) Market Trends and Insights

Rapid growth of industrial IoT platforms

Widespread IIoT deployment supplies real-time data that keeps digital models synchronized with factory floors. Siemens reported EUR 9 billion (USD 9.72 billion) digital business revenue in 2024, up 22% on the strength of its Xcelerator ecosystem. Honeywell's Forge platform processes 3 billion+ datapoints daily, cutting unplanned downtime by 35% in client plants. Standardized protocols such as OPC UA and MQTT reduce integration friction, enabling plants to deploy twins in weeks rather than months. The result is steady cost avoidance, quicker root-cause analysis, and more predictable capacity planning.

Expansion of edge/AI inference at the device level

Moving analytics from cloud to edge trims latency and preserves data sovereignty. Microsoft and Siemens co-developed Industrial Foundation Models that run inference at the asset, allowing millisecond-level responses for anomaly detection. Audi now operates virtual PLCs through edge-deployed twins that optimize cycle times in real manufacturing lines. Local simulation also limits bandwidth consumption because only exception of data moves upstream. Specialized chips and containerized runtimes further cut deployment costs for tier-two suppliers, accelerating the spread of AI-ready twins throughout value chains.

Cyber-physical security vulnerabilities across IT/OT stacks

The Spanish National Cybersecurity Institute notes that twins bridging IT and OT widen attack surfaces, exposing process controllers to data-integrity threats. Recent ransomware events forced manufacturers to halt production for days while cleansing twin data lakes. Average deployment delays of 18 months arise as firms integrate zero-trust architectures and train staff. Multi-tenant twins add complexity because partner access must be segmented without slowing collaboration.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory push for asset-intensive industries to digitise safety-critical infrastructure

- Demand for virtual commissioning to cut CAPEX

- Shortage of domain-specific physics-based modelling expertise

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing contributed 35.8% of the digital twin market in 2024 thanks to embedded IIoT sensors, predictive maintenance programs, and continuous-improvement cultures. Automotive and electronics plants deploy line-level twins to analyze takt-time fluctuations and quality-yield patterns, trimming scrap rates by double digits. Energy-efficiency gains add another payback layer, particularly in resource-intensive metallurgy and cement operations. The segment is forecast to expand steadily, preserving its quantitative edge even as other verticals catch up.

Oil and Gas, though smaller today, is projected to grow at a 29.3% CAGR to 2030 as offshore operators require remote inspection and fault-isolation capabilities. The upstream segment deploys reservoir twins that integrate seismic data and production logs, allowing engineers to simulate well-workover scenarios before mobilizing rigs. Midstream companies apply pipeline twins for leak detection, while downstream refineries like Shell have documented 20% unplanned downtime reductions using twins verified by DNV standards. Government decarbonization targets further propel adoption as twins optimize flare minimization and heat-integration strategies. Across both segments, AI-assisted scenario testing elevates twins from monitoring to decision-support systems, reinforcing their share of total deployments.

The solutions category-software platforms, physics engines, and connected hardware-accounted for 63.6% of spending in 2024 as companies acquired core capabilities. Vendors bundle modeling libraries with visualization engines so process engineers can assemble replicas without coding from scratch. Licensing models are shifting to consumption-based tiers, broadening access among tier-two suppliers.

Services, however, are scaling faster at a 31.4% CAGR. Implementation consultancies align data pipelines, create semantic models, and validate simulation fidelity. Managed-service contracts monitor twin health metrics, apply patches, and tune algorithms for drift, yielding predictable OPEX for asset owners. As outcome-based agreements proliferate-Rolls-Royce TotalCare guarantees engine uptime backed by twin analytics-service partners assume more risk, tying fees to efficiency gains rather than billable hours. This model strengthens customer loyalty and encourages continuous platform enhancements.

The Digital Twin Market Report is Segmented by Application (Manufacturing, Energy and Power, Aerospace and Defense, Oil and Gas, Automotive, and Others), Component (Solutions/Platforms, and Services), Deployment Mode (On-Premises, and Cloud), Enterprise Size (Large Enterprises, and Small and Medium Enterprises (SMEs)), and Geography.

Geography Analysis

North America commanded 38.4% of digital twin market revenue in 2024 driven by early Industry 4.0 rollouts, extensive aerospace programs, and robust venture funding for industrial SaaS. U.S. aviation regulators' acceptance of simulation-based certification has spurred widespread twin investment among aircraft OEMs and Tier-1 suppliers. Energy majors in Canada and the United States deploy pipeline and LNG terminal twins to cut methane leak rates, aligning with tightening environmental policy. Cloud adoption is particularly strong due to mature cyber-insurance frameworks and standardized data-protection mandates.

Asia-Pacific posts the highest CAGR at 27.2%, supported by government megaprojects. China's Digital China Construction plan mandates urban digital twins for new infrastructure, creating large procurement pipelines for domestic and foreign vendors. India's Sangam Digital Twin scheme integrates network twin capability into nationwide telecom upgrades as the country moves toward 6G readiness. Japan's NTT Digital Twin Computing Initiative supports city-scale replicas that feed transportation and disaster-response algorithms. South Korea and Singapore push smart-factory and smart-port pilots, emphasizing real-time carbon-footprint tracking. The region's supply-chain centrality means lessons learned here propagate quickly to global OEMs.

Europe advances steadily as regulatory imperatives take center stage. The digital product passport forces manufacturers to embed traceability across product life cycles, effectively making a lightweight twin mandatory for high-volume goods. Germany's Plattform Industrie 4.0 provides standardized administration shell guidelines, reducing integration overhead for SMEs. France invests in virtual shipyard twins to maintain competitive edge in naval construction, while the Nordics use building twins to meet net-zero codes. The Middle East and Africa remain nascent but promising: the UAE and Saudi Arabia are piloting oil-field twins and giga-project city twins, seeking efficiency and sustainability benefits prior to large-scale expansion.

- ANSYS, Inc.

- AVEVA Group plc

- Bentley Systems, Incorporated

- Cal-Tek S.R.L.

- Cityzenith, Inc.

- Dassault Systemes SE

- General Electric Company

- Hexagon AB

- International Business Machines Corporation

- Lanner Group Limited (Royal HaskoningDHV)

- Mevea Ltd.

- Microsoft Corporation

- Oracle Corporation

- PTC Inc.

- Rescale, Inc.

- Robert Bosch GmbH (Bosch.IO)

- SAP SE

- Schneider Electric SE

- Siemens AG

- Amazon Web Services, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid growth of industrial IoT platforms

- 4.2.2 Expansion of edge/AI inference at the device level

- 4.2.3 Regulatory push for asset-intensive industries to digitise safety-critical infrastructure

- 4.2.4 Demand for virtual commissioning to cut CAPEX in brownfield projects

- 4.2.5 Rise of outcome-based service contracts needing real-time asset replica data

- 4.2.6 Proliferation of digital product passports in EU and U.S.

- 4.3 Market Restraints

- 4.3.1 Cyber-physical security vulnerabilities across IT/OT stacks

- 4.3.2 Shortage of domain-specific physics-based modelling expertise

- 4.3.3 Opaque IP ownership of data generated in federated twins

- 4.3.4 Fragmentation of simulation standards limiting interoperability

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Manufacturing

- 5.1.2 Energy and Power

- 5.1.3 Aerospace and Defense

- 5.1.4 Oil and Gas

- 5.1.5 Automotive

- 5.1.6 Others

- 5.2 By Component

- 5.2.1 Solutions/Platforms

- 5.2.2 Services

- 5.3 By Deployment Mode

- 5.3.1 On-premises

- 5.3.2 Cloud

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Nigeria

- 5.5.4.2.4 Rest of Africa

- 5.5.5 Asia-Pacific

- 5.5.5.1 China

- 5.5.5.2 India

- 5.5.5.3 Japan

- 5.5.5.4 South Korea

- 5.5.5.5 ASEAN

- 5.5.5.6 Australia

- 5.5.5.7 New Zealand

- 5.5.5.8 Rest of Asia-Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ANSYS, Inc.

- 6.4.2 AVEVA Group plc

- 6.4.3 Bentley Systems, Incorporated

- 6.4.4 Cal-Tek S.R.L.

- 6.4.5 Cityzenith, Inc.

- 6.4.6 Dassault Systemes SE

- 6.4.7 General Electric Company

- 6.4.8 Hexagon AB

- 6.4.9 International Business Machines Corporation

- 6.4.10 Lanner Group Limited (Royal HaskoningDHV)

- 6.4.11 Mevea Ltd.

- 6.4.12 Microsoft Corporation

- 6.4.13 Oracle Corporation

- 6.4.14 PTC Inc.

- 6.4.15 Rescale, Inc.

- 6.4.16 Robert Bosch GmbH (Bosch.IO)

- 6.4.17 SAP SE

- 6.4.18 Schneider Electric SE

- 6.4.19 Siemens AG

- 6.4.20 Amazon Web Services, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment