|

市場調查報告書

商品編碼

1631579

電氣測試設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Electrical Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

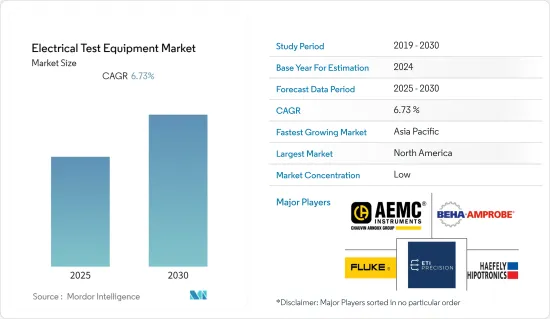

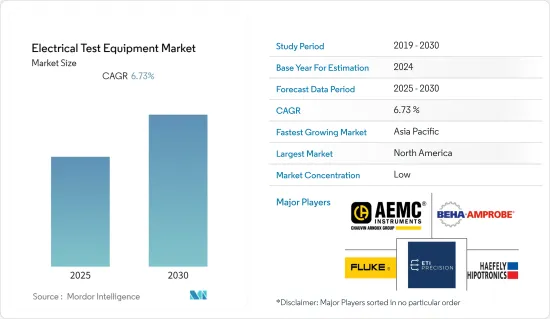

電氣測試設備市場預計在預測期內複合年成長率為6.73%

主要亮點

- 由於這些行業對電氣測試設備的需求不斷增加,市場參與企業正在推出新產品以贏得競爭。例如,2021年4月,Klein Tools推出了五款工業用電氣測試套件,包括鉤錶電氣測試套件數位萬用表電氣測試套件。本儀器保證絕緣電阻測試與 4 線低電阻測量相結合,並列出電感、電容和溫度測量。

- 此外,2021 年 4 月,是德科技為其專有的動態功率元件分析儀/雙脈衝測試儀 (PD1500A) 推出了客製化氮化鎵測試板。這使得層級和OEM電源轉換器設計人員能夠縮短原型設計週期並加速新產品的採用。

- NETA(國際電氣測試協會)認證的公司是獨立的第三方電氣測試和工程服務公司,提供電力系統的全方位測試、分析和維護服務。此外,2021 年 6 月,電力系統電氣測試、變壓器服務和配電設備壽命延長解決方案的市場參與企業RESA Power, LLC 宣布了此次收購,該公司近20 年來一直在佛羅裡達州和東南部地區提供電氣測試服務。透過此次收購,該公司將CET視為高品質的NETA服務供應商。

- 此外,許多政府法規要求對工業電子設備進行測試。例如,俄羅斯聯邦法律宣布了有關醫療設備分銷的新規定,以消除現有立法中的空白和不確定性,並降低參與企業市場的風險。到 2022 年 1 月,醫療設備製造許可證將逐步取消,取而代之的是遵守維護、實施和評估醫療設備品管系統的要求。這些措施和監管變化預計將為供應商增加市場機會。

- 此外,由於 COVID-19 相關限制,世界各地的工廠未滿載運作,一些公司開發了虛擬電氣測試設備。例如,伊頓公司開發了一個程序,為客戶提供電能品質和其他設備的虛擬測試。該程式允許您使用相機的變焦來更接近設備。另一方面,例如,當直接測試低壓開關設備時,設備的電壓為 480 伏特,所有觀察者必須距離 7 至 8 英尺。

電氣測試設備市場趨勢

能源和電力預計將佔據很大佔有率

- 可再生能源發電產業的快速成長對變壓器、電池、電能品質和絕緣測試應用的測試設備產生了巨大的需求。英國石油公司預計,到 2040 年,全球可再生能源發電預計將成長 400%,其中大部分可再生能源產生的直流電數量將超過傳統交流電,最終將產生對用於測量的電氣測試設備的高需求。全球人口和經濟、人口成長加上快速都市化預計將導致未來幾年能源需求大幅增加。

- 能源需求的增加導致了核能發電廠的建設。據估計,30 個國家有超過 450 座核子反應爐正在運作。目前還有 50 座核子反應爐正在 15 個國家建設(主要集中在中國、印度、俄羅斯和阿拉伯聯合大公國等國家)。然而,在高能量條件下展示電氣測試設備在經歷嚴重故障時的能力可能很複雜。

- 此外,在 2022 年 4 月於格拉斯哥舉行的 COP26 上,印度總理宣布了到 2030 年非石化燃料產能達到 500 吉噸 (GW)、50% 能源來自可再生能源、到 2070 年淨零排放的目標。結果,傳統上以煤炭為主的能源領域的競爭加劇。因此,可再生能源產能的增加正在推動該縣能源供應的成長。

- 由於 COVID-19 爆發,封鎖措施大大減少了商業和工業部門的電力需求。統計和規劃實施部(MOSPI)估計,21會計年度印度電力生產將下降-0.5%,預計到年終將收縮5%。此外,根據 MOSPI 的數據,到 2022 會計年度,印度電力產量預計將成長 10.2%,這將進一步推動市場成長。

- 此外,2020 年 3 月和 4 月,國際金融公司 (IFC) 觀察到其開展業務的許多國家的需求平均下降了 15%。 COVID-19 大流行對電力產業造成了很大的干擾,對市場產生了負面影響。

亞太地區預計將經歷最快的成長

- 高壓線路安裝和發電廠建設等多個基礎設施計劃預計將推動該地區對電氣試驗機的需求。例如,2022年8月,中國國家消費電子網路計畫在2022年下半年投資超過1,500億元(220億美元)用於特高壓(UHV)輸電線路。計劃新建八個特高壓計劃,將主要城市與中國偏遠西部地區連接起來,那裡主要位置太陽能、風能和水力發電廠,進一步推動市場成長。

- 2022年5月,伊頓宣布達成協議,收購江蘇匯能電氣(匯能)50%的股權,該公司在中國生產和銷售低壓電路斷流器,2021年銷售額為3500萬美元。這將使公司能夠進一步擴大業務,以滿足高成長市場的需求。

- 據 IEA 稱,印度可再生能源發電的成長速度比任何其他主要經濟體都要快,預計到 2026 年,新增發電量將翻倍。此外,據IBEF稱,到2025-26年,風力發電預計將佔能源消耗總量的33.01%。基於此趨勢,印度預計新增風電裝置容量約19.4吉瓦,其中中央競標佔總量的76%,其次是國有公共產業市場。

- 此外,2021 年 5 月,美國和印度宣佈為對提高電力傳輸系統的可靠性、靈活性和效率至關重要的兩個領域提供新的研究資金:智慧型能源電網和能源儲存,並同意擴大印美聯合清潔能源專案。該計劃在印度由印美雙邊科學技術論壇 (IUSSTF) 管理,在美國由能源部管理。此類公告預計將增加該地區對電氣測試設備的需求。

電氣測試設備產業概況

電氣測試設備市場高度分散,區域和全球參與企業眾多。然而,市場參與企業正在採取收購、聯盟、新產品開發和市場開發等競爭策略,以鞏固主導地位。

- 2022 年 3 月 - Anritsu 公司宣布推出新興技術測試解決方案,該解決方案結合了業界領先的 220GHz VectorSta 寬頻向量網路分析儀 (VNA)、最先進的實驗室和測量專家團隊。該舉措為設計放大器、濾波器、電晶體和晶片等高頻組件的製造商提供了使用新技術的無縫且高效的產品檢驗流程。

- 2022 年 3 月 - 福祿克推出了新的鉗形表系列,使服務和維護技術人員的電氣測量更加安全。 Fluke 377 FC 和 378 是非接觸式電壓 True-RMS AC/DC 鉗形表,使技術人員能夠執行快速電氣測試,而無需擔心接觸潛在危險的運作部件。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 有關電力安全措施的政府法規

- 新興地區產業發展

- 市場問題

- 電氣器材與設備配置複雜

第6章 市場細分

- 依設備類型

- 固定式

- 可攜式的

- 按測試目的

- 電壓測試

- 功能測試

- 其他

- 按行業分類

- 能源/電力

- 航太/國防

- 製造業

- 消費性電子產品

- 石油和天然氣

- 其他工業應用

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- AEMC Instruments(Chauvin Arnoux, Inc.)

- Beha-Amprobe GmbH

- Electrical Test Instruments, LLC(ETI)

- Fluke Corporation

- Haefely Hipotronics(Hubbell Incorporated)

- Kyoritsu Electrical Instruments Works Ltd.

- Megger Group Limited

- PCE Holding GmbH

- Scientific Mes-Technik Pvt. Ltd.

- Testo SE & Co. KGaA

- Keysight Technologies Inc.

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 71670

The Electrical Test Equipment Market is expected to register a CAGR of 6.73% during the forecast period.

Key Highlights

- Due to the increasing demand for electrical test equipment in these industries, players in the market have been launching new products to gain a competitive edge. For instance, in April 2021, Klein Tools launched five electrical test kits, such as the clamp meter electrical test kit and digital multimeter electrical test kit, among others, for industrial usage. The equipment ensures insulation resistance tests combined with four-wire low-resistance measurements and offers inductance, capacitance, and temperature measurements.

- Moreover, in April 2021, Keysight Technologies Inc. announced a customized gallium nitride test board for the company's own dynamic power device analyzer/double-pulse tester (PD1500A). This enables Tier 1 and OEM power converter designers to reduce prototype cycles and speed up the introduction of new products.

- NETA (InterNational Electrical Testing Association) Accredited Companies are third-party, independent electrical testing and engineering service businesses providing full-service testing, analysis, and electrical power systems maintenance. Further, in June 2021, RESA Power, LLC, a market player in power system electrical testing, transformer services, and life extension solutions for power distribution equipment, announced the acquisition of Crews Electrical Testing, Inc., a company that has provided electrical testing services in Florida and the southeast region for nearly two decades. Because of this acquisition, the company has long regarded CET as a high-quality provider of NETA services.

- Many government regulations also mandate the testing of industrial electronic devices. For example, the Russian Federal Law announced new rules for the circulation of medical devices to close gaps and uncertainties in existing legislation and reduce the risk to market participants. By January 2022, medical device manufacturing licensing will be phased out and replaced with compliance with requirements for the maintenance, implementation, and evaluation of a quality management system for medical devices. Such initiatives and changing regulations are expected to increase market opportunities for vendors.

- Furthermore, as factories across the world were not running at full capacity due to COVID-19-related restrictions, some companies developed virtual electrical testing equipment. For instance, Eaton Corporation developed a program to provide customers with virtual testing for power quality and other equipment. This program enables one to get closer to the equipment with camera zoom. Whereas, testing low-voltage switchgear in person, for example, the equipment is energized with 480 volts, and all observers are required to be seven to eight feet away.

Electrical Test Equipment Market Trends

Energy & Power is Expected to Hold Significant Share

- Surging the renewable energy sector generates significant demand for testing equipment for transformer, battery, power quality, and insulating testing applications. According to British Petroleum estimates, the world will see a 400% growth in renewable energy by 2040, which will eventually create high demand for electric test equipment to measure DC current as most renewable energy generates DC current more than traditional AC current. Growth in the global population and economy and population, coupled with rapid urbanization, is anticipated to contribute to a substantial increase in energy demand over the coming years.

- The increase in demand for energy is resulting in the construction of nuclear power plants. It is estimated that over 450 nuclear power reactors are operating in 30 countries. An additional 50 power reactors are currently being constructed in 15 countries (majorly concentrated in countries like China, India, Russia, and the United Arab Emirates). However, the electrical testing equipment's ability to perform under high energy conditions while encountering a significant fault is anticipated to be complicated.

- Further, at COP26 in Glasgow in April 2022, India's Prime Minister announced 500 gigatonnes (GW) of non-fossil fuel capacity and 50% of energy from renewable sources by 2030, with a net zero target by 2070. The response has been encouraging, resulting in increased competition in the traditionally coal-dominated energy sector. As a result, renewable energy capacity additions are now driving the county's energy supply growth.

- With the outbreak of COVID-19, lockdown measures have significantly reduced electricity demand in the commercial and industrial sectors. Ministry of Statistics and Programme Implementation (MOSPI) estimates that India's electricity production decreased by -0.5% in FY 2021 and forecasts a 5% contraction by the end of the year. In addition, according to MOSPI, electricity production in India is anticipated to be 10.2% by FY 2022, which will further drive market growth.

- Additionally, in March and April 2020, International Finance Corporation (IFC) observed a 15% drop in demand, on average, in many countries where it does business. The COVID-19 pandemic has caused many dislocations to the power sector, which negatively impacted the market.

Asia Pacific is Expected to Witness Fastest Growth

- Multiple infrastructure projects, such as implementing high voltage lines and power generation plants, are expected to drive the demand for electrical testing equipment in the region. For instance, in August 2022, China's State Grid plans to fund more than 150 billion yuan (USD 22 billion) in ultra-high voltage (UHV) power transmission lines in the second half of 2022. The construction of eight new UHV projects is planned to connect China's far western regions, where solar, wind, and hydropower plants are primarily located, to its major cities will further drive the market growth.

- In May 2022, Eaton announced that it had signed an agreement to acquire a 50% stake in Jiangsu Huineng Electric Co., Ltd. (Huineng), which manufactures and markets low-voltage circuit breakers in China and had revenues of USD 35 million in 2021. This will allow the company to expand further to meet the needs of the high-growth market.

- According to the IEA, renewable electricity is growing faster in India than in any other major economy, with new capacity additions on track to double by 2026. Furthermore, according to IBEF, wind power is expected to account for 33.01% of total energy consumption by 2025-26. According to this trend, India is expected to add approximately 19.4 Gw of wind capacity, with central tenders accounting for 76% of the total, followed by state utility markets; commercial and industrial segments will further drive the market growth.

- Further, in May 2021, The United States of America and India reached an agreement to expand the Indo-US Joint Clean Energy Research and Development Centre (JCERDC) by funding new research in two areas critical to improving the reliability, flexibility, and efficiency of the electricity delivery system, namely Smart Energy Grids and Energy Storage. The program is managed in India by the bilateral Indo-US Science and Technology Forum (IUSSTF) and in the United States by the Department of Energy. Such announcements are expected to increase the need for electrical testing equipment in the region.

Electrical Test Equipment Industry Overview

With significant regional and global players, the market for electrical test equipment is quite fragmented. However, the market's prominent players are involved in competitive strategic developments such as acquisitions and partnerships, new product development, and market expansion to augment their leadership position in the electrical test equipment market.

- March 2022 - Anritsu Company has launched its Emerging Technology Testing Solution, which combines its industry-leading 220 GHz VectorSta broadband vector network analyzers (VNAs), cutting-edge laboratory, and a team of measurement experts. The initiative provides a seamless and efficient product verification process for manufacturers designing high-frequency components such as amplifiers, filters, transistors, and chips using emerging technologies.

- March 2022 - Fluke has introduced a new clamp meter family that makes electrical measurements much safer for servicing and maintenance technicians. The Fluke 377 FC and 378 are non-contact voltage True-RMS AC/DC clamp meters that enable technicians to conduct rapid electrical tests without the risk of coming into contact with potentially hazardous live parts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Government Regulations for Electric Safety Measures

- 5.1.2 Industrial Development in Emerging Regions

- 5.2 Market Challenges

- 5.2.1 Complex Electric Equipment and Configuration of Devices

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Stationary

- 6.1.2 Portable

- 6.2 By Testing Application

- 6.2.1 Voltage Testing

- 6.2.2 Functionality Testing

- 6.2.3 Other Testing Applications

- 6.3 By Industry Application

- 6.3.1 Energy and Power

- 6.3.2 Aerospace and Defense

- 6.3.3 Manufacturing

- 6.3.4 Consumer Electronics

- 6.3.5 Oil and Gas

- 6.3.6 Other Industrial Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AEMC Instruments (Chauvin Arnoux, Inc.)

- 7.1.2 Beha-Amprobe GmbH

- 7.1.3 Electrical Test Instruments, LLC (ETI)

- 7.1.4 Fluke Corporation

- 7.1.5 Haefely Hipotronics (Hubbell Incorporated)

- 7.1.6 Kyoritsu Electrical Instruments Works Ltd.

- 7.1.7 Megger Group Limited

- 7.1.8 PCE Holding GmbH

- 7.1.9 Scientific Mes-Technik Pvt. Ltd.

- 7.1.10 Testo SE & Co. KGaA

- 7.1.11 Keysight Technologies Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219