|

市場調查報告書

商品編碼

1548904

噴墨印刷:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Inkjet Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

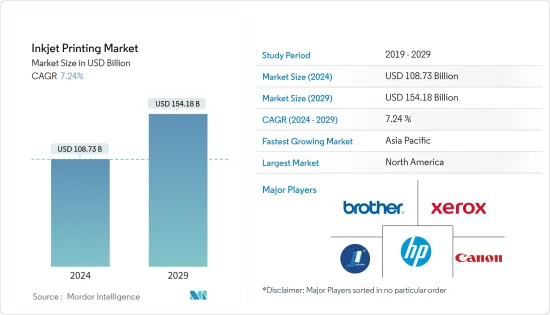

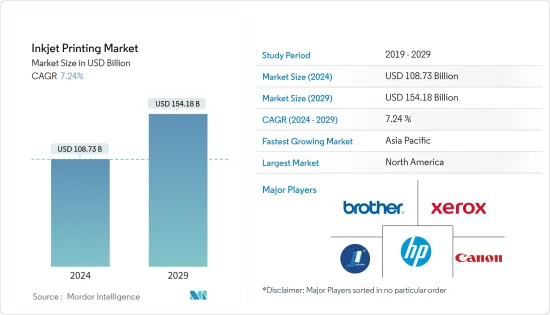

噴墨印刷市場規模預計到2024年為1087.3億美元,預計到2029年將達到1541.8億美元,在預測期內(2024-2029年)複合年成長率為7.24%。

噴墨印刷是一種將微小的液體墨水液滴噴射到類似紙張的表面上的技術,在數位印刷的興起中發揮了關鍵作用。您將獲得可與照片媲美的高品質圖像。值得關注的是它的高成本績效。憑藉壓倒性的多功能性和最低的設置成本,它是小批量印刷的理想選擇。

主要亮點

- 噴墨印表機在高效率生產小批量、獨特產品方面具有巨大優勢。線上訂單的激增和網路印刷技術的使用正在推動商業印刷行業的發展。噴墨印表機可以適應小批量和客製化產品,在這個不斷發展的環境中發揮著至關重要的作用。

- 巨量資料、物聯網以及印刷加工和包裝數位化的快速發展是噴墨印刷市場的關鍵促進因素。巨量資料分析的整合使生產流程更加準確和高效,物聯網連接有助於列印業務的即時監控和最佳化。

- 科技的普及以及辦公室和個人空間使用的增加預計將增加全球對噴墨頭的需求。噴墨印表機被商業印刷企業用來製作高品質的小冊子、傳單等,也常用於家庭和小型辦公室。

- 製造商面臨著應對不斷變化的趨勢和升級技術以保持競爭力的挑戰。雖然提供升級的影響相對較小,但更換整台機器可能會對您的業務產生重大影響。

- 噴墨印刷領域的公司嚴重依賴造紙工業。造紙業已經感受到了預計 2023 年全球景氣衰退的影響,並在 2024 年繼續面臨挑戰。全球經濟放緩和全球需求收縮加劇了能源集中和週期性造紙產業的脆弱性。

噴墨列印市場趨勢

包裝領域預計將顯著成長

- 噴墨印刷因其多功能性和按需客製化能力而成為包裝行業的主力。這種列印方法擅長可變資料列印,能夠以最短的設定時間實現個人化包裝、有針對性的宣傳活動、季節性設計等。噴墨列印支援高效的小批量生產,降低庫存成本,並允許公司按需列印包裝。由於它響應了動態的市場需求並且適合推出新產品,因此它在包裝中的採用正在不斷成長。

- 儘管塑膠廣泛用於包裝,但印刷卻面臨挑戰。對於需要印製可追溯代碼或重要產品資料(例如保存期限)以遵守法規或供應商標準的企業來說,這個問題尤其重要。與任何材料一樣,選擇正確的印表機和墨水對於有效的塑膠打標至關重要。由於其速度、可靠性和廣泛的墨水相容性,噴墨列印擴大用於工業塑膠噴碼。

- 此外,隨著網路購物和電子商務的快速成長,隨著紙板包裝使用量的增加,各國正在定義新常態。上述組織透過創造獨特的品牌包裝體驗創造了對噴墨印刷的更多需求,透過創新的噴墨印刷吸引客戶並超越競爭對手。

- 根據中國商務部預測,2023年中國網路商務規模將達21,230億美元,與前一年同期比較約12%。近年來,中國電子商務產業持續成長。不斷成長的電子商務領域是關鍵的市場驅動力。

- 食品和飲料製造商面臨著列印挑戰,例如高速生產線、對可變內容的需求增加以及使線上產品編碼工作複雜化的短期生產。此外,包裝上的冷凝通常是由填充、運輸和產品生命週期期間的溫度變化引起的,可能會導致紙箱、袋子、瓶子、罐頭、小桶和其他食品上的有效期、條碼和其他資訊無法顯示。

亞太地區預計將錄得最快成長

- 以中國、印度和東南亞國家為中心的亞太地區正經歷消費支出的激增。這種成長正在推動對印刷產品的需求。隨著包裝、標籤、教科書和其他文件需求的成長,噴墨印刷在該地區發揮越來越大的作用。

- 技術進步,尤其是數位印刷,正在改變印刷業。數位印刷可以實現更快的印刷時間、更快的周轉時間和個人化內容。這些特點不僅吸引了大公司,也吸引了中小企業。因此,市場公司正在推出新產品、建立策略合作夥伴關係並擴大業務範圍,從而實現產品供應多元化並增加亞太地區噴墨列印市場的價值。

- 澳洲印刷業正日益走向自動化和高效化。雖然一些澳洲印刷商正在接受這一轉變並投資於自動化和軟體,但其他印刷商尚未意識到其中的好處。一些膠印印刷商對數位化猶豫不決,尤其是在處理需要膠印的客製化最少的長印刷時。隨著列印量的增加,這種偏好變得更加明顯。

- 在噴墨列印領域,日本製造商正迅速採用全彩3D列印,將傳統的2D噴墨系統拋在後面。較新的 3D 列印機使用 CMYK 著色,可提供多種色調。這些印表機使用水溶性支撐物,簡化了列印後過程。這些印表機使用 UV 墨水提供出色的性能,特別是對於工業原型製作和生產。

噴墨印刷業概況

由於存在大量公司,噴墨列印市場高度分散。市場滲透率不斷提高,主要參與者在成熟市場中佔有一席之地。考慮到市場產品的同質化,許多公司面臨價格競爭,主要公司有HP Development Company LP (HP Inc.)、Jet Inks Private Limited、Brother Industries Ltd、Xerox Corporation、Canon Inc.等。

- 2024 年 5 月 - 噴墨和單張紙膠印技術領域的領導者Canon和海德堡宣佈建立噴墨印刷領域的全球銷售和服務合作夥伴關係。兩家公司之間的合作旨在幫助商業印刷公司過渡到混合膠印數位生產,以適應不斷變化的印刷買家需求,並提高他們在短時間內管理多樣化工作的能力。

- 2024 年 3 月 -FUJIFILM公司推出了 Jet Press FP790,這是一項專為軟包裝印刷市場設計的創新產品。這款水性數位噴墨印刷機是成熟的噴墨印刷機系列的延伸,可為使用者提供高生產力和適應性。借助 Jet Press FP790,軟質包裝領域營運的公司可以無縫創建從食品到家居產品的各種包裝解決方案。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈分析

- 評估主要宏觀經濟趨勢的市場影響

第5章市場動態

- 市場促進因素

- 巨量資料、物聯網、印刷加工和包裝數位化

- 市場限制因素

- 數位廣告媒體的擴展

- 價格高、投資和技術限制

- 柔印和絲網印刷等成熟技術之間的激烈競爭

- 市場機會

- 轉向永續性可以促進市場成長

第6章 市場細分

- 按用途

- 書籍/出版

- 商業印刷

- 廣告

- 交易

- 標籤

- 包裹

- 其他用途

- 按地區

- 北美洲

- 歐洲

- 東歐

- 西歐

- 亞太地區

- 亞洲

- 澳洲/紐西蘭

- 日本

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- HP Development Company LP(HP Inc.)

- Jet Inks Private Limited

- Brother Industries Ltd

- Xerox Corporation

- Canon Inc.

- Hitachi Industrial Equipment Systems Co. Ltd

- Seiko Epson Corporation

- Videojet Technologies Inc.

- Inkjet Inc.

- Fujifilm Holdings Corporation

- Mojoprint Ltd

- Takara Printing Co. Ltd

- King Printing Co. Ltd

- CTC Japan Co. Ltd

- Iseto Co. Ltd

- Yamagata Corporation

- Niki Electronics Co. Ltd

- Shashinkosha Japan Co.

第8章投資分析

第9章 市場機會及未來趨勢

The Inkjet Printing Market size is estimated at USD 108.73 billion in 2024, and is expected to reach USD 154.18 billion by 2029, growing at a CAGR of 7.24% during the forecast period (2024-2029).

Inkjet printing, a technique that sprays minuscule liquid ink droplets onto surfaces like paper, played a pivotal role in the rise of digital printing. This approach yields high-quality images comparable to photographs. Notably, inkjet printing stands out for its cost-effectiveness. It boasts unparalleled versatility and minimal setup expenses, making it ideal for cost-efficient, low-volume, single-copy printing.

Key Highlights

- Inkjet printers offer a significant advantage in efficiently producing short runs and unique products. The surge in online ordering and the use of web-to-print technology is pushing the commercial printing sector forward. With their ability to handle small runs and customized products, Inkjet printers have cemented their pivotal role in this evolving landscape.

- The rapid advancements in Big Data, IoT, and the digitalization of print processing and packaging are key drivers for the inkjet printing market. Integrating Big Data analytics enables more precise and efficient production processes, while IoT connectivity facilitates real-time monitoring and optimization of printing operations.

- Technological proliferation and rising applications in offices and personal spaces are anticipated to increase the demand for inkjet printheads globally. In addition to being used in commercial printing businesses to create high-quality brochures, flyers, and other materials, inkjet printers are typically used in homes and small offices.

- Manufacturers face the challenge of adapting to changing trends and upgrading technologies to remain competitive. While providing upgrades can have a relatively lower impact, replacing entire machines can significantly affect businesses.

- Companies in the inkjet printing sector heavily rely on the paper industry. The paper sector, already feeling the effects of the global economic downturn predicted for 2023, is continuing to face challenges in 2024. Being energy-intensive and cyclical, the paper sector's vulnerabilities are exacerbated by the broader global economic slowdown and a shrinking global demand.

Inkjet Printing Market Trends

Packaging Segment is Expected to Witness Major Growth

- Inkjet printing has become a significant force in the packaging industry due to its versatility and capability for on-demand customization. This printing method excels in variable data printing, enabling personalized packaging, targeted campaigns, and seasonal designs with minimal setup time. Inkjet printing supports efficient short-run production, reducing inventory costs and allowing businesses to print packaging as needed. As it is suitable for responding to dynamic market demands and launching new products, its adoption is growing in packaging.

- Despite its extensive use in packaging, plastic presents challenges for printing. This issue is particularly significant for companies required to imprint traceable codes and essential product data (such as expiration dates) to comply with regulatory and distributor standards. As with any material, choosing the appropriate printer and ink is crucial for effective plastic marking. In industrial plastic coding, the usage of inkjet printing has increased for its speed, reliability, and versatile ink compatibility.

- Moreover, with the increasing use of cardboard packaging with the rapid growth in online shopping and e-commerce across, the countries are being defined as the new normal; the above organizations are creating unique brand packaging experiences that engage customers through innovative inkjet printing to stay ahead of the competition, further creating demand for inkjet printing.

- According to MOFCOM China, online commerce transactions reached 2.123 trillion USD in China in 2023, showing an almost 12% increase compared to the previous year. The e-commerce sector in China has experienced consistent growth in the past few years. The growing e-commerce sector is a significant market driver.

- Food and beverage manufacturers are facing challenges in printing, including high-speed production lines, increasing demand for variable content, and small-batch productions that complicate online product coding operations. Additionally, condensation on the packaging, often caused by temperature changes during filling, shipping, and the product lifecycle, poses challenges for manufacturers when applying best-by dates, barcodes, and other information directly onto cartons, pouches, bottles, cans, kegs, and other food and beverage packaging.

Asia-Pacific is Expected to Register the Fastest Growth

- The Asia-Pacific region, led by China, India, and several Southeast Asian nations, is experiencing a surge in consumer spending. This increase is driving demand for printed products. The region is witnessing a growing demand for packaging and labels, textbooks, and additional documentation, which highlights the growing role of inkjet printing in the region.

- Technological advancements, especially in digital printing, are transforming the printing industry. Digital printing allows shorter print runs, faster turnarounds, and personalized content. Such features attract SMEs as well as large businesses. Therefore, market players are launching new products, forming strategic partnerships, and expanding their business presence, thereby diversifying their offerings and increasing the inkjet printing market's value in Asia-Pacific.

- The Australian printing industry is increasingly leaning toward automation and efficiency. While some Australian printers have embraced this shift and are investing in automation and software, others have yet to realize the advantages. Certain offset printers are hesitant to adopt digital methods, especially when handling long runs with minimal customization, where offset printing is required. This preference is evident with larger print quantities.

- Japanese manufacturers in the inkjet printing sector are swiftly adopting full-color 3D printing, leaving behind traditional 2D inkjet systems. The new 3D printers employ CMYK coloring, enabling a broad spectrum of shades. These printers use water-soluble support materials, simplifying post-printing processes. These printers exhibit exceptional performance on UV ink, especially in industrial prototyping and production.

Inkjet Printing Industry Overview

The Inkjet Printing Market is highly fragmented due to the presence of a large number of players. Market penetration is growing, with a strong presence of major players in established markets. Considering the homogenous nature of market products, many firms operating are further driven to compete on price, and some of the key players include HP Development Company LP (HP Inc.), Jet Inks Private Limited, Brother Industries Ltd, Xerox Corporation, and Canon Inc.

- May 2024 - Canon and Heidelberger Druckmaschinen AG (HEIDELBERG), leaders in inkjet and sheetfed offset printing technology, revealed their worldwide sales and service collaboration in inkjet printing. The company's combined efforts are aimed at assisting commercial print businesses in transitioning to hybrid offset/digital production in order to adapt to evolving print buyer demands and enhance its capacity to manage shorter print runs and a wider variety of jobs.

- March 2024 - FUJIFILM Corporation unveiled its new innovation, the Jet Press FP790, explicitly designed for the flexible packaging printing market. This water-based digital inkjet press, an extension of the renowned Jet Press series, promises heightened productivity and adaptability for its users. By leveraging the Jet Press FP790, businesses operating in the flexible packaging sector can seamlessly craft diverse packaging solutions, catering to everything from food items to household products, and that too, efficiently, even with smaller order volumes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of the Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Big Data, IoT, and Digitalization of Print Processing and Packaging

- 5.2 Market Restraints

- 5.2.1 Growing Popularity of Digital Advertising Media

- 5.2.2 High Price and Investment and Technological Limitations

- 5.2.3 Cut-throat Competition Among Established Technologies, Such As Flexographic Printing and Screen Printing

- 5.3 Market Opportunities

- 5.3.1 Shift Toward Sustainability Can Increase the Market's Growth

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Books/Publishing

- 6.1.2 Commercial Print

- 6.1.3 Advertising

- 6.1.4 Transaction

- 6.1.5 Labels

- 6.1.6 Packaging

- 6.1.7 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.2.1 Eastern Europe

- 6.2.2.2 Western Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 Asia

- 6.2.3.2 Australia and New Zealand

- 6.2.3.3 Japan

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 HP Development Company LP (HP Inc.)

- 7.1.2 Jet Inks Private Limited

- 7.1.3 Brother Industries Ltd

- 7.1.4 Xerox Corporation

- 7.1.5 Canon Inc.

- 7.1.6 Hitachi Industrial Equipment Systems Co. Ltd

- 7.1.7 Seiko Epson Corporation

- 7.1.8 Videojet Technologies Inc.

- 7.1.9 Inkjet Inc.

- 7.1.10 Fujifilm Holdings Corporation

- 7.1.11 Mojoprint Ltd

- 7.1.12 Takara Printing Co. Ltd

- 7.1.13 King Printing Co. Ltd

- 7.1.14 CTC Japan Co. Ltd

- 7.1.15 Iseto Co. Ltd

- 7.1.16 Yamagata Corporation

- 7.1.17 Niki Electronics Co. Ltd

- 7.1.18 Shashinkosha Japan Co.