|

市場調查報告書

商品編碼

1690747

醫藥塑膠包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Pharmaceutical Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

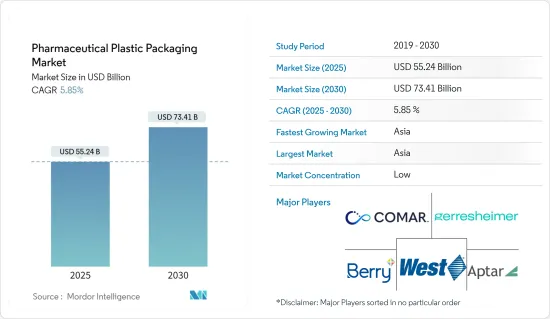

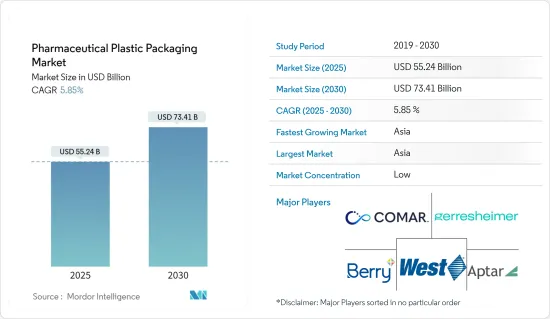

預計 2025 年醫藥塑膠包裝市場規模為 552.4 億美元,到 2030 年將達到 734.1 億美元,預測期內(2025-2030 年)的複合年成長率為 5.85%。

主要亮點

- 由於傳染性和非傳染性疾病的包裝需求,全球醫藥塑膠包裝產業正在蓬勃發展。這種成長主要是由於保護藥品免受損害、污染和其他外部因素的影響的需求。隨著技術的進步,對瓶子、管瓶和其他包裝解決方案以及醫藥產品的需求不斷增加。

- 此外,注射藥物的需求不斷成長是推動塑膠包裝產業發展的關鍵因素。主要成長要素是抗癌藥物、高效藥物(如抗體偶聯物和速效類固醇)的需求量大以及藥品支出不斷增加。同時,該行業正在轉向更永續的包裝解決方案,以減少對環境的影響並確保藥品安全。

- 日益嚴格的法規正在推動業界採用符合這些新標準的更好的包裝解決方案。人口老化和慢性病的增加也推動了藥品塑膠包裝的需求。

- 保護藥品免受光照、潮濕、污染和物理損壞非常重要。這項需求凸顯了確保產品安全並滿足嚴格規定的創新包裝解決方案的重要性。未來包裝技術的進步可望提高醫藥領域硬質塑膠包裝的保護功能和永續性。

- 此外,隨著世界對醫療保健的興趣日益濃厚,製藥公司正在擴張和投資以增加利潤。例如,2023 年 3 月,Oliver Healthcare Packaging 宣布將在馬來西亞開設新的製造工廠,擴大在亞太地區的影響力。

- 政府機構擴大禁止或限制在藥品包裝中使用某些類型的塑膠。此類限制通常針對一次性或不可回收的塑膠,是出於對環境問題的考慮。因此,藥品包裝選擇變得越來越有限,可能會減少對塑膠包裝的需求。這些監管變化將影響市場,鼓勵使用更環保的替代品,如生物基、生物分解性和可回收材料。

醫藥塑膠包裝市場趨勢

藥品擴大採用聚對苯二甲酸乙二醇酯 (PET) 包裝

- 聚對苯二甲酸乙二醇酯 (PET) 是一種透明、堅固且安全的聚酯塑膠。它無毒、無致癌性,是理想的藥品包裝。 PET 可防止二氧化碳和光線的進入,並抑制微生物的滋長。它也獲得了歐盟、NSF 和 FDA 的核准。

- PET 重量輕,具有類似玻璃的外觀,具有視覺吸引力。它們也堅固、無反應、抗碎,確保了較高的藥品安全標準。 PET 也可回收,支持環境的永續性。 PET 重量輕、耐用、可回收,是藥品包裝的最佳選擇,可確保藥品的安全性和完整性。

- 多年來,PET 已成為以安全性和品質著稱的領先塑膠。它廣泛用於包裝液體口服藥物,特別是針對兒童和老年人。 PET 的獨特特性凸顯了其在製藥領域日益成長的重要性。

- 包裝製造商正在加緊提供創新的 PET 包裝解決方案,以滿足製藥領域對永續塑膠包裝日益成長的需求。例如,2024 年 1 月,Bormioli Pharma SpA 宣布與 Loop Industries Inc. 合作推出由 100% 回收原生 PET 樹脂製成的創新藥品包裝瓶。這將使該公司能夠響應日益廣泛採用的永續實踐和材料,以減少製藥業對環境的影響。

- 此外,PET比玻璃輕90%,降低了運輸成本。 PET 塑膠瓶取代了製藥業中較重的玻璃瓶,為各種液體產品提供了可重複使用的解決方案。例如,中國的塑膠產量從2023年10月的656萬噸大幅增加到2024年1月/2月的1,189萬噸。這一成長主要是由於製藥業對塑膠包裝的需求不斷成長。

中國和印度的醫療改革推動醫藥塑膠包裝的成長

- 中國蓬勃發展的醫藥產業為醫藥塑膠包裝企業提供了許多機會。中國政府正在進行的醫療改革可能會加速該行業的擴張。對藥品安全性和合規性的日益關注推動了對複雜包裝解決方案的需求。此外,隨著中國人口老化和慢性病日益普遍,藥品消費量預計將大幅成長,直接增加對藥品塑膠包裝的需求。

- 中國醫藥包裝公司正在加大對內部研發團隊的投資。此舉旨在探索先進、環保、安全和永續的包裝材料和產品。這種策略轉變加上創新、合作、收購和藥品生產的激增正在推動市場價值的提升。

- 例如,Sanar Group 是醫療保健包裝和醫療組件領域的領導者。 2023 年 11 月,該公司在中國崑山推出了最先進的製造工廠,擴大了在亞太地區的業務。該工廠用地面積,其中生產面積為 4,000 平方米,符合 D 級無塵室標準,確保符合 GMP 要求的藥物輸送設備和醫療包裝生產。

- 此外,印度的醫療改革,特別是生產掛鉤激勵(PLI)計劃,對於推動市場成長至關重要。該計劃是印度自力更生計劃(Atmanirbhar Bharat)的基石,強調促進國內製造業。透過這些舉措,印度醫藥塑膠包裝市場專注於法規遵循和回收。

- 印度致力於加強醫療保健基礎設施並增加對製藥業的投資,這進一步加強了市場的成長軌跡。據印度藥品生產商組織稱,2022 年印度製藥業的價值為 490 億美元。據預測,到 2030 年,這一數字可能飆升至 1,300 億美元,到 2047 年則可能飆升至 4,500 億美元,這為藥品塑膠包裝市場帶來了光明的前景。

醫藥塑膠包裝產業概況

醫藥塑膠包裝市場的競爭格局較為分散,參與者包括 Gerresheimer AG、Amcor Group GmbH、Berry Global Inc.、Aptar Group Inc.、Comar LLC 和 West Pharmaceutical Services, Inc. 等。市場參與者正專注於擴大生產能力,以滿足醫藥產業對塑膠包裝日益成長的需求。

2024 年 4 月以患者為中心的醫療保健解決方案製造商 Berry Global Group Inc. 透過投資增強資產和製造能力,增強了其醫療保健生產能力。這項戰略舉措將使歐洲三家工廠的產量提高30%。

2023 年 11 月,領先的包裝開發和製造公司 Amcor Group GmbH 推出了在醫療層壓板領域的最新創新。這種先進的包裝透過引入一種可以無縫融入聚乙烯回收流程的全薄膜包裝,標誌著向前邁出了重要的一步。這種新的包裝解決方案是一種單一材料聚乙烯(PE)層壓板,旨在滿足各種包裝需求。具體來說,常用於手術巾、導管和注射系統的 3D 熱成型包裝可以用可回收的替代品無縫替換不可回收的蓋子。這些層壓板也可應用於2D袋,非常適合創傷護理材料和手套等產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 評估地緣政治情勢對產業的影響

第5章 市場動態

- 市場促進因素

- 剛性和軟性醫用塑膠產品需求不斷成長

- 建造更好、更先進的醫療保健基礎設施

- 市場限制

- 限制藥用塑膠製品銷售和供應的規定

- 原料成本波動

第6章 市場細分

- 按原料

- 聚丙烯(PP)

- 聚對苯二甲酸乙二醇酯(PET)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他成分

- 依產品類型

- 固態容器

- 滴管瓶

- 滴鼻劑瓶

- 液體瓶

- 口腔護理

- 小袋

- 管瓶/安瓿瓶

- 墨水匣

- 注射器

- 瓶蓋和封口

- 其他產品類型

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 亞洲

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Gerresheimer AG

- Amcor Group GmbH

- Berry Global Inc.

- Aptar Group Inc.

- O.Berk Company LLC

- Pretium Packaging LLC

- Klockner Pentaplast Group

- Comar LLC

- Gil Pack Group

- Drug Plastics & Glass Company Inc.

- West Pharmaceutical Services Inc.

第8章投資分析

第9章:市場的未來

The Pharmaceutical Plastic Packaging Market size is estimated at USD 55.24 billion in 2025, and is expected to reach USD 73.41 billion by 2030, at a CAGR of 5.85% during the forecast period (2025-2030).

Key Highlights

- The global pharmaceutical plastic packaging sector is growing fast because of the need for packaging for both communicable and non-communicable diseases. This growth is mainly due to the need to protect medicines from damage, contamination, and other external factors. As technology advances, the demand for bottles, vials, and other packaging solutions and medicines increases.

- Additionally, the rising demand for injectables is a crucial factor driving the plastic packaging sector. The main growth drivers are the high demand for cancer drugs, strong medications (like antibody conjugates and fast-acting steroids), and increased drug spending. At the same time, the industry is seeing more sustainable packaging solutions to reduce environmental impact while keeping medicines safe.

- Stricter regulations push the industry to adopt better packaging solutions that meet these new standards. The aging population and the rise in chronic diseases also increase the demand for pharmaceutical plastic packaging.

- Protecting medicines from light, moisture, contamination, and physical damage is crucial. This need highlights the importance of innovative packaging solutions that ensure product safety and meet strict regulations. Future advancements in packaging technology are expected to improve the protective and sustainable features of rigid plastic packaging in the pharmaceutical sector.

- Also, as global healthcare concerns grow, pharmaceutical companies expand and invest to increase profits. For example, in March 2023, Oliver Healthcare Packaging announced the opening of a new manufacturing facility in Malaysia, expanding its presence in Asia-Pacific.

- Government bodies are increasing bans and restrictions on certain types of plastics used in pharmaceutical packaging. These restrictions, often on single-use and non-recycled plastics, are due to environmental concerns. As a result, the options for pharmaceutical packaging are becoming more limited, which may reduce the demand for plastic packaging. These regulatory changes encourage using more eco-friendly alternatives, like bio-based, biodegradable, or recycled materials, which impact the market.

Pharmaceutical Plastic Packaging Market Trends

Increasing Adoption of Polyethylene Terephthalate (PET) Packaging for Pharmaceutical Products

- Polyethylene terephthalate (PET), a member of the polyester family, is a clear, strong, and safe plastic. It is non-toxic and non-carcinogenic, making it ideal for pharmaceutical packaging. PET protects against CO2 and light and repels microorganisms. The EU, NSF, and FDA also approve it.

- PET's lightweight nature and glass-like appearance make it visually appealing. It is also strong, non-reactive, and shatterproof, ensuring high pharmaceutical safety standards. PET is also recyclable, supporting environmental sustainability. Its lightweight, durable, and recyclable combination makes PET a top choice for pharmaceutical packaging, ensuring the safety and integrity of medicines.

- Over the years, PET has become a leading plastic known for its safety and quality. It is widely used in packaging liquid oral medications, especially for children and the elderly. PET's unique features highlight its growing importance in the pharmaceutical sector.

- Packaging manufacturers are focusing on offering innovative PET packaging solutions to cater to the growing demand for sustainable plastic packaging in the pharmaceutical sector. For instance, in January 2024, Bormioli Pharma SpA announced the launch of an innovative pharmaceutical packaging bottle made from 100% recycled virgin PET resin along with the partnership of Loop Industries Inc. This will help the company cater to the growing adopting of sustainable practices and materials to reduce its environmental impact in the pharmaceutical sector.

- Additionally, PET can reduce weight by up to 90% compared to glass, lowering transportation costs. PET plastic bottles replace heavier glass bottles in the pharmaceutical industry, offering a reusable solution for various liquid products. For example, China's plastic product production increased significantly, from 6.56 million metric tons in October 2023 to 11.89 million in January/February 2024. This increase is mainly due to the rising demand for plastic packaging in the pharmaceutical sector.

China and India's Healthcare Reforms Drive Growth in Pharmaceutical Plastic Packaging

- China's thriving pharmaceutical sector offers numerous opportunities for pharmaceutical plastic packaging companies. The Chinese government's ongoing healthcare reforms are set to amplify this sector's expansion. The demand for sophisticated packaging solutions is rising with a growing emphasis on drug safety and compliance. Moreover, as China's population ages and chronic diseases become more prevalent, the consumption of pharmaceuticals is expected to surge, directly boosting the need for pharmaceutical plastic packaging.

- Chinese pharmaceutical packaging firms are increasingly investing in in-house R&D teams. This move aims to explore advanced, eco-friendly, secure, and sustainable packaging materials and products. This strategic shift and a surge in innovation, partnerships, acquisitions, and drug production elevate the market's value.

- For instance, the Sanner Group is a leader in healthcare packaging and medical components. In November 2023, the company expanded its footprint in the Asia-Pacific by launching a state-of-the-art manufacturing plant in Kunshan, China. Covering 18,000 m2, with 4,000 m2 dedicated to production, the facility meets Class D clean room standards, ensuring GMP-compliant manufacturing for drug delivery devices and medical packaging.

- Also, India's healthcare reforms, notably the Production Linked Incentive (PLI) scheme, are pivotal in driving market growth. This scheme, a cornerstone of India's self-reliance initiative (Atmanirbhar Bharat), underscores the nation's push for local manufacturing. These initiatives drive India's pharmaceutical plastic packaging market with a heightened focus on regulatory compliance and recycling.

- India's commitment to bolstering healthcare infrastructure and its increased investments in the pharmaceutical sector further solidify the market's growth trajectory. According to the Organisation of Pharmaceutical Producers of India, the pharmaceutical industry was valued at USD 49 billion in 2022. Projections suggest this figure could soar to USD 130 billion by 2030 and an impressive USD 450 billion by 2047, offering a promising outlook for the pharmaceutical plastic packaging market.

Pharmaceutical Plastic Packaging Industry Overview

The competitive landscape of the pharmaceutical plastic packaging market is fragmented, consisting of several players like Gerresheimer AG, Amcor Group GmbH, Berry Global Inc., Aptar Group Inc., Comar LLC, West Pharmaceutical Services, Inc., and more. The players in the market are focusing on expanding their capacities to cater to the growing need for plastic packaging in the pharmaceutical sector.

April 2024: Berry Global Group Inc., a player in manufacturing patient-centric healthcare solutions, bolstered its healthcare production capacity by investing in enhanced assets and manufacturing capabilities. This strategic move is set to amplify production by as much as 30% at three of its European facilities.

November 2023: Amcor Group GmbH, a leading packaging developer and producer, unveiled its latest innovation in Medical Laminates. This advancement marks a significant step forward, introducing all-film packaging that seamlessly fits into the polyethylene recycling stream. The new packaging solution is a mono-material polyethylene (PE) laminate designed to cater to diverse packaging needs. Notably, a recyclable alternative can seamlessly substitute non-recyclable lids in 3D thermoformed packages commonly utilized for drapes, catheters, and injection systems. Also, these laminates find application in 2D pouches, which is ideal for products like wound care materials and gloves.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Geopolitical Scenario on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Rigid and Flexible Pharmaceutical Plastic Products

- 5.1.2 Development of Better and More Advanced Healthcare Infrastructure

- 5.2 Market Restraints

- 5.2.1 Regulations Restricting the Sales and Availability of Pharmaceutical Plastic Products

- 5.2.2 Fluctuations in Raw Material Cost

6 MARKET SEGMENTATION

- 6.1 By Raw Material

- 6.1.1 Polypropylene (PP)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Low Density Polyethylene (LDPE)

- 6.1.4 High Density Polyethylene (HDPE)

- 6.1.5 Other Raw Materials

- 6.2 By Product Type

- 6.2.1 Solid Containers

- 6.2.2 Dropper Bottles

- 6.2.3 Nasal Spray Bottles

- 6.2.4 Liquid Bottles

- 6.2.5 Oral Care

- 6.2.6 Pouches

- 6.2.7 Vials and Ampoules

- 6.2.8 Cartridges

- 6.2.9 Syringes

- 6.2.10 Caps and Closures

- 6.2.11 Other Product Types

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Spain

- 6.3.2.5 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Gerresheimer AG

- 7.1.2 Amcor Group GmbH

- 7.1.3 Berry Global Inc.

- 7.1.4 Aptar Group Inc.

- 7.1.5 O.Berk Company LLC

- 7.1.6 Pretium Packaging LLC

- 7.1.7 Klockner Pentaplast Group

- 7.1.8 Comar LLC

- 7.1.9 Gil Pack Group

- 7.1.10 Drug Plastics & Glass Company Inc.

- 7.1.11 West Pharmaceutical Services Inc.