|

市場調查報告書

商品編碼

1548931

全球介面IC市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Global Interface IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

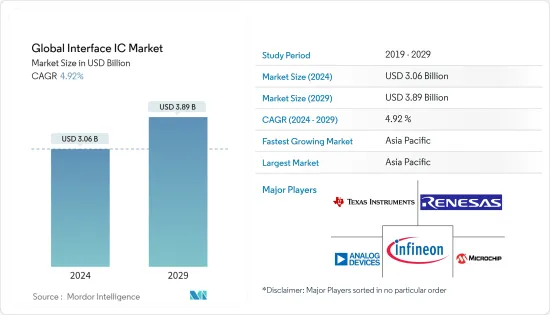

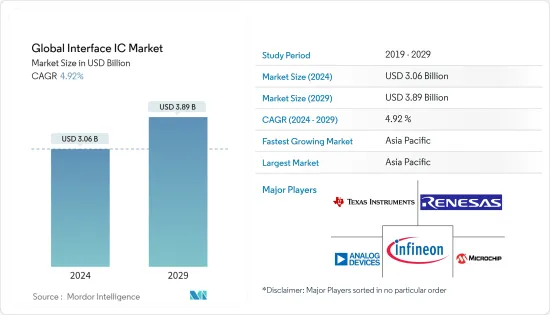

根據預測,2024年全球介面IC市場規模預估為30.6億美元,2029年達38.9億美元,在預測期間(2024-2029年)複合年成長率為4.92%。

介面 IC 將整個電子介面電路的功能集中到單一晶片上,從而實現設備之間經濟高效且可靠的資訊共用。管理和控制不同電子系統之間通訊的介面 IC 對於生物識別、電動車和通訊至關重要,從而推動了電子電路基板中介面 IC 的需求。

主要亮點

- 積體電路 (IC) 介面是控制和促進設備之間訊息傳輸的半導體晶片。電源電壓、資料速率、工作電流、功率損耗和結溫等效能參數都是 I2C 介面的重要考量。這些介面積體電路 (IC) 在管理不同電子系統之間的訊號通訊發揮關鍵作用。

- 介面 IC 促進不同電子元件和系統之間的無縫通訊和高效協作。透過在電子設備內實現資料、控制訊號和電源的順利交換,這些 IC 可確保最佳效能。專門設計用於支援各種通訊協定和標準,包括 USB、HDMI、乙太網路、SPI、I2C 和 CAN。

- 介面 IC 需求的成長主要是由連網型設備的激增所推動的。隨著物聯網生態系統的快速擴展,更多的設備需要無縫通訊和資料傳輸,而介面IC對於促進不同組件和系統之間的資料交換變得至關重要。結果是,從消費性電子產品到工業自動化等各個領域的連網型設備不斷增加,對這些關鍵晶片的需求不斷增加。愛立信預計,到 2029 年,全球連網型設備總數預計將達到 457.2 億台。

- 消費性電子市場正憑藉創新的產品和功能不斷發展。智慧型手機、平板電腦、穿戴式裝置和智慧家居設備擴大配備多個感測器、相機和連接選項,從而實現這些組件的無縫整合,以提供先進的功能並改善用戶體驗,因此需要一種能夠改良的介面IC。

- 隨著電子設備變得越來越複雜,導致先進的晶片系統(SoC) 設計的出現,整合介面 IC 提出了重大挑戰。平衡 SoC 內的效能、功耗和空間限制需要仔細考慮介面 IC 的選擇和佈局,使設計週期變得複雜並增加開發成本。

介面IC市場趨勢

汽車產業作為最終用戶正在快速成長

- 汽車領域的電動和混合動力汽車市場正在經歷顯著成長。汽車技術和製造的進步也增加了對更小、更節能設備的需求。

- ADAS(高級駕駛輔助系統)的使用不斷增加,以及全球強制實施 ADAS 的政府法規的實施,也正在擴大該領域的可能性。車載資訊娛樂系統的日益普及也將提供成長機會。汽車數位應用的持續進步需要介面 IC 和技術的持續開發。

- 汽車產業是介面IC的重要終端使用者之一。汽車技術和製造的進步增加了對緊湊、節能電子設備的需求。 5G網路的快速擴展以及智慧交通的駕駛輔助和車對車通訊等物聯網(IoT)應用的日益普及預計將增加對介面IC的需求。

- 2023 年 1 月, Synaptics Incorporated 推出了 SmartBridge SB7900 局部調光 IC,可實現更大、更高對比度、更高解析度的汽車 LCD,同時降低成本和功耗。 SB7900 SmartBridge 可改善影像品質、提高系統靈活性、減少裝置佔用空間、降低功耗並降低高達 30 吋和解析度高達 6K 的顯示器的複雜性。這是透過在背光陣列中整合局部調光技術以及驅動多個觸控和顯示輔助器整合 (TDDI) 控制器的能力來實現的。

- 隨著全部區域乘用車產量的增加,ADAS(高級駕駛員輔助系統)的採用顯著增加。這一趨勢預計將推動對介面積體電路(IC)的需求。這是因為這些組件可確保各種感測器、處理器和致動器之間的無縫通訊和資料傳輸。

- 這些 IC 處理來自攝影機、雷達和 LiDAR 感測器的高速資料,確保資訊處理準確、及時。根據國際汽車工業協會(OICA)的數據,中國乘用車產量最多,為26,123.76輛,其次是日本,為7,765.43輛。

亞太地區錄得強勁成長

- 亞太地區擁有全球大量半導體製造廠,其中以台積電和三星電子等產業領導者為首。該地區的主要國家,包括台灣、韓國、日本和中國,佔據了重要的市場佔有率。

- 由於半導體製造活動量大,預計該地區將佔據市場的很大一部分。根據WSTS預測,在積體電路需求不斷成長的背景下,預計2024年半導體銷售額將與前一年同期比較%, 2025年將較去年同期大幅成長12.3%。

- 印度、中國和日本等國家對消費性電子產業的投資不斷增加,是介面積體電路需求不斷成長的主要動力。例如,印度的家電產業預計會有巨大的需求。 「印度製造」和「數位印度」等舉措促進了消費性電子產業的擴張。這些策略旨在透過加強國內製造和數位基礎設施來減少對進口的依賴,並改善印度人獲得電子設備的機會和負擔能力。這些措施預計將增加市場機會。

- 根據 IBEF 的報告,印度已成為重要的製造地,其國內電子產品產量從 2014-15 年的 290 億美元增至 2022-23 年的 1,010 億美元。最近,電子和資訊技術部發布了印度電子製造業願景文件第二卷,預計電子製造業將從2020-21年的750億美元擴大到2025-26年的3000億美元。這些重大因素預計將推動市場成長。

- IBEF表示,預計將推動印度電子製造業成長的關鍵產品包括行動電話、筆記型電腦和平板電腦等IT硬體,電視和音訊設備等消費性電子產品,工業電子產品、穿戴式裝置等。

- Quess Corp.的研究報告顯示,2024年3月印度電子產業整體就業人數顯著成長,較去年同期成長154%。 Limited的研究報告顯示,2024年3月員工人數較去年同期成長154%。該地區的這些重大進步預計將推動整個電子產業對介面 IC 的需求。

- 該地區智慧型手機產業的重大開拓預計也將帶來市場機會。據IBEF稱,印度已成為僅次於中國的第二大行動電話製造國。過去十年,印度行動電話產量增加了20倍,達到493億美元(4.1兆印度盧比)。這一令人印象深刻的成長主要歸功於 PLI(生產連結獎勵)計劃等政府舉措。如此一來,印度將能夠滿足國內97%的行動電話需求,創造了巨大的市場機會。

介面IC產業概況

由於跨國公司和中小型公司的存在,介面IC市場高度分散。市場的主要企業包括英飛凌科技公司、瑞薩電子公司、德州儀器公司、類比元件公司和微芯科技公司。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 7 月 - 全球半導體公司 Analog Devices 與生物平台創新先驅 Flagship Pioneering 合作,加速全數位化生物領域的發展。透過將ADI 在類比和數位半導體工程領域的卓越技術與Flagship Pioneering 的應用生物學專業知識相結合,此次合作將加深生物學見解、完善測量、增強診斷並轉變我們的目標,引入有效的干涉措施。

- 2024 年 4 月 - Microchip Technology 收購了 Neuronix AI Labs,為其現場可程式閘陣列(FPGA) 中的高能效 AI主導邊緣解決方案提供支援。 Neuronix AI Labs 專注於神經網路的稀疏最佳化,能夠降低功耗、尺寸和運算複雜性,同時確保影像分類、物件偵測和語義分割等任務的高精度。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 和宏觀經濟趨勢的市場影響分析

第5章市場動態

- 市場促進因素

- 連網型設備和通訊技術的使用增加

- 智慧型手機、平板電腦和穿戴式裝置等消費性電子產品的需求不斷成長,推動了市場需求

- 市場限制因素

- 製造過程中的設計複雜性與整合挑戰

第6章 市場細分

- 依產品類型

- CAN介面IC

- USB介面IC

- 顯示介面IC

- 其他產品類型

- 按最終用戶產業

- 家電

- 電訊

- 產業

- 車

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Infineon Technologies AG

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Analog Devices, Inc.

- Microchip Technology Inc

- NXP Semiconductors Nv

- Broadcom Inc.

- SEIKO Epson Corporation

- Toshiba Corporation

- ON Semiconductor Corporation

第8章投資分析

第9章 未來展望

The Global Interface IC Market size is estimated at USD 3.06 billion in 2024, and is expected to reach USD 3.89 billion by 2029, growing at a CAGR of 4.92% during the forecast period (2024-2029).

Interface ICs consolidate entire electronic interface circuit functions onto a single chip, ensuring cost-effective and reliable information sharing between devices. Their capability to manage and control communications across diverse electronic systems makes them integral to biometrics, electric vehicles, and telecommunications, fueling the demand for interface ICs in electronic circuit boards.

Key Highlights

- Integrated circuit (IC) interfaces are semiconductor chips that regulate and facilitate the transfer of information between devices. Performance parameters such as supply voltage, data rate, operational current, power dissipation, and temperature junction are all important considerations for IC interfaces. These interface-integrated circuits (ICs) play a crucial role in managing signal communications between different electronic systems.

- Interface ICs facilitate seamless communication and efficient collaboration among diverse electronic components and systems. By enabling the smooth exchange of data, control signals, and power within electronic devices, these ICs ensure optimal performance. They are specially designed to support a wide range of communication protocols and standards, including USB, HDMI, Ethernet, SPI, I2C, and CAN.

- The increasing demand for interface ICs is primarily driven by the proliferation of connected devices. As the IoT ecosystem rapidly expands, more devices require seamless communication and data transfer, where interface ICs are essential for facilitating this data exchange among various components and systems. Consequently, as sectors ranging from consumer electronics to industrial automation experience a rise in connected devices, the demand for these critical chips intensifies. According to Ericsson, the total number of connected devices across the globe is expected to reach 45.72 billion by 2029.

- The consumer electronics market is advancing with innovative products and features. Smartphones, tablets, wearables, and smart home devices are now being incorporated with multiple sensors, cameras, and connectivity options, requiring interface ICs as they enable the seamless integration of these components, providing advanced functionalities and enhancing user experiences.

- The increasing complexities of electronic devices have led to sophisticated system-on-chip (SoC) designs, presenting significant challenges for interface IC integration. Balancing performance, power consumption, and space constraints within the SoC requires careful consideration of interface IC selection and placement, complicating design cycles and raising development costs.

Interface IC Market Trends

Automotive Industry to be the Fastest Growing End User

- The market for electric and hybrid vehicles in the automotive sector is experiencing significant growth. The advancements in automotive technology and manufacturing are also increasing the demand for compact, power-efficient devices.

- The increasing usage of advanced driver-assistance systems (ADAS) and the implementation of government regulations worldwide that require ADAS are also broadening the potential of this sector. The rising adoption of vehicle infotainment will offer growth opportunities. The ongoing advancements in automotive digital applications necessitate the continual development of interface IC and technologies.

- The automotive sector is one of the significant end users of interface IC. The advancements in automotive technology and manufacturing are increasing the need for compact, energy-efficient electronics. The swift expansion of 5G networks and the rising popularity of Internet of Things (IoT) applications like assisted driving and vehicle-to-everything communication for intelligent transportation are expected to increase demand for interface ICs.

- Synaptics Incorporated introduced the SmartBridge SB7900 local dimming IC in January 2023, enabling larger, higher-contrast, higher-resolution car LCDs at a reduced cost and power consumption. The SB7900 SmartBridge offers improved image quality, increased system flexibility, decreased device footprint, power usage, and complexity for displays up to 30 inches and resolutions up to 6K. This is achieved by integrating the capability to drive multiple touch and display driver-integrated (TDDI) controllers with local dimming technology for the backlight array.

- With the increasing production of passenger cars across the region, the adoption of Advanced Driver Assistance Systems (ADAS) has risen significantly. This trend is expected to drive the demand for interface integrated circuits (ICs), as these components ensure seamless communication and data transfer among various sensors, processors, and actuators.

- These ICs handle high-speed data from cameras, radars, and LiDAR sensors, ensuring accurate and timely information processing. According to the International Organization of Motor Vehicle Manufacturers (OICA), China was the largest producer of passenger cars with 26,123.76 units, followed by Japan with 7,765.43 units.

Asia-Pacific to Register Major Growth

- The Asia-Pacific region is home to a considerable number of global semiconductor manufacturing facilities, prominently featuring industry leaders such as TSMC and Samsung Electronics. Key nations within this region, including Taiwan, South Korea, Japan, and China, possess substantial market shares.

- The region is anticipated to capture a significant portion of the market due to a high volume of semiconductor manufacturing activities. According to WSTS, a remarkable increase in semiconductor sales is projected, with a year-on-year growth of 17.5% in 2024 and 12.3% in 2025, driven by the rising demand for integrated circuits.

- The growing investments in the consumer electronics industry across various countries like India, China, Japan, and others are significantly driving the growth of the demand for interface integrated circuits. For instance, the market is expected to witness a significant demand across India's consumer electronics industry. Initiatives such as "Make in India" and "Digital India" have catalyzed expansion within the consumer electronics industry. These strategies are designed to enhance domestic manufacturing and digital infrastructure, thereby decreasing reliance on imports and increasing the accessibility and affordability of electronics for the Indian population. Such initiatives are expected to boost the market opportunities.

- As reported by IBEF, India has established itself as a prominent manufacturing center, with its domestic electronics production increasing from USD 29 billion in 2014-15 to USD 101 billion in 2022-23. Recently, the Ministry of Electronics & Information Technology published the second volume of the Vision document on Electronics Manufacturing in India, which projects that the electronics manufacturing sector will expand from USD 75 billion in 2020-21 to USD 300 billion by 2025-26. These substantial factors are anticipated to enhance the growth of the market.

- According to IBEF, the primary products anticipated to propel growth in India's electronics manufacturing sector include mobile phones, IT hardware such as laptops and tablets, consumer electronics like televisions and audio devices, industrial electronics, as well as wearables and wearables, among others.

- The electronics industry in India has experienced a remarkable 154% increase in overall hiring in March 2024 compared to the same period last year, as reported by research from Quess Corp. Limited. These notable advancements in the region are projected to enhance the demand for interface ICs throughout the electronics industry.

- The region's significant developments in the smartphone segment are also expected to drive market opportunities. IBEF stated that India has emerged as the second-largest mobile phone manufacturing nation, following China. Over the past decade, mobile phone production in India has increased twenty-onefold, achieving a value of USD 49.3 billion (INR 4.1 lakh crore). This remarkable growth can be attributed primarily to government initiatives, including the Production Linked Incentive (PLI) scheme. As a result, India is now capable of fulfilling 97% of its domestic mobile phone demand, which will create enormous market opportunities.

Interface IC Industry Overview

The interface IC market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Infineon Technologies AG, Renesas Electronics Corporation, Texas Instruments Incorporated, Analog Devices Inc., and Microchip Technology Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- July 2024 - Analog Devices Inc., a global player in semiconductors, teamed up with Flagship Pioneering, a pioneer in bio-platform innovations, to fast-track the evolution of a fully digitized biological realm. By merging ADI's prowess in analog and digital semiconductor engineering with Flagship Pioneering's applied biology expertise, the collaboration aims to unveil deeper biological insights, refine measurements, enhance diagnostics, and introduce innovative interventions.

- April 2024 - Microchip Technology acquired Neuronix AI Labs, enhancing its power-efficient, AI-driven edge solutions on field programmable gate arrays (FPGAs). Neuronix AI Labs specializes in neural network sparsity optimization, allowing for reduced power consumption, size, and computational needs in tasks like image classification, object detection, and semantic segmentation, all while ensuring high accuracy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact Analysis of COVID-19 and Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Usage of Connected Devices and Communication Technologies

- 5.1.2 Increasing Demand for Consumer Electronics Such as Smartphones, Tablets, and Wearables, Driving Demand in the Market

- 5.2 Market Restraints

- 5.2.1 Complexity in Design and Integration Challenges in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 CAN Interface IC

- 6.1.2 USB Interface IC

- 6.1.3 Display Interface IC

- 6.1.4 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Telecom

- 6.2.3 Industrial

- 6.2.4 Automotive

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 Texas Instruments Incorporated

- 7.1.4 Analog Devices, Inc.

- 7.1.5 Microchip Technology Inc

- 7.1.6 NXP Semiconductors Nv

- 7.1.7 Broadcom Inc.

- 7.1.8 SEIKO Epson Corporation

- 7.1.9 Toshiba Corporation

- 7.1.10 ON Semiconductor Corporation