|

市場調查報告書

商品編碼

1548938

加密軟體:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Encryption Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

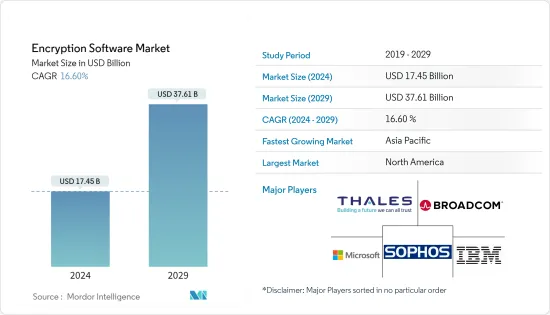

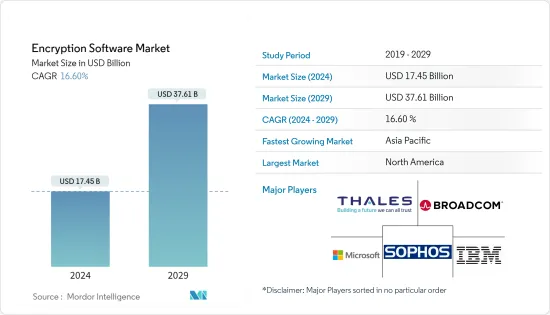

預計到 2024 年,加密軟體市場規模將達到 174.5 億美元,預計到 2029 年將達到 376.1 億美元,在預測期內(2024-2029 年)複合年成長率為 16.60%。

加密軟體市場在網路安全領域至關重要,由於對資料保護和隱私的需求不斷成長,網路安全領域正在不斷擴大。該市場涵蓋一系列解決方案,這些解決方案透過先進的加密演算法保護敏感資訊,並確保各行業的資料完整性和機密性。加密軟體在金融、醫療保健和政府等領域尤其重要,保護敏感資料是這些領域的首要任務。

加密演算法保護重要資料

主要亮點

- 加密演算法在確保資料安全方面發揮著重要作用,無論資料是儲存在磁碟上、資料網路發送還是透過資料共用。磁碟加密軟體、檔案加密軟體和行動加密軟體等解決方案對於保護資料免於未授權存取非常重要。雲端處理的激增將雲端加密和 EaaS(加密即服務)推到了最前沿,為企業提供了可擴展且靈活的選項來保護雲端環境中的資料。

市場區隔與採用狀況

主要亮點

- 組件:市場分為軟體和服務,由於軟體的廣泛採用,軟體佔據主導地位。加密軟體為各行業的組織提供了重要的工具,以保護資料免於外洩和未授權存取。

- 部署模型:本地和雲端基礎的解決方案是主要的部署模型。具有嚴格安全要求的組織喜歡本地解決方案,而雲端基礎的解決方案則提供靈活性和擴充性,以滿足不斷變化的業務需求。

- 公司規模:市場為大型和小型企業提供服務,但大公司處於領先地位,因為它們大力投資強大的網路安全措施。同時,小型企業也意識到資料保護的重要性,並且擴大採用加密解決方案。

- 按行業分類:主要行業包括 IT/通訊、BFSI、醫療保健和政府機構。由於需要在網路威脅日益增加的背景下保護敏感訊息,這些行業已成為加密軟體最重要的用戶。

區域分析:主要市場

主要亮點

- 北美:該地區在嚴格的監管要求和領先加密軟體供應商的支持下引領加密軟體市場。歐洲的 GDPR 和美國的 HIPAA 等法規都強調需要加密來維護資料安全。

- 歐洲:該地區對資料保護的關注(以 GDPR 為代表)正在推動對加密軟體的巨大需求。在歐洲營運的公司因違規面臨嚴厲處罰,這使得加密成為一項重要的投資。

- 亞太地區:在數位轉型和網路安全意識不斷提高的推動下,該地區有望快速成長。政府對加密技術的措施和投資進一步支持中國、印度和日本等國家的市場擴張。

塑造市場的監理標準

主要亮點

- 合規性的重要性:GDPR、HIPAA、PCI DSS 和 CCPA 等監管標準對於塑造加密軟體市場至關重要。遵守這些標準對於企業避免懲罰和維持客戶信任至關重要。這些法規要求採取嚴格的資料保護措施,並推動加密解決方案在各行業的採用。

- 行業特定要求:醫療保健和金融等行業有特定行業的法規,強調加密的重要性。例如,HIPAA 強制要求保護患者資料,而 PCI DSS 則專注於保護付款訊息,進一步增加了對加密軟體的需求。

網路攻擊和手機竊盜對加密採用的影響

主要亮點

- 網路威脅增加:包括勒索軟體和網路釣魚在內的網路攻擊的增加和複雜性是加密軟體採用的關鍵促進因素。加密提供了重要的防禦機制,確保即使攻擊者獲得了對資料的存取權限,如果沒有適當的解密金鑰,也無法讀取資料。

- 行動裝置安全:行動裝置的激增(尤其是在職場)增加了因被盜或遺失而導致資料遺失的風險。行動加密軟體對於保護智慧型手機和平板電腦上儲存的資料並降低未授權存取的風險至關重要。

- 遠距工作趨勢:疫情後遠距工作的擴展增加了對安全通訊管道的需求。擴大實施端對端加密和網路加密,以保護透過潛在不安全的網路共用的敏感資訊。

加密軟體市場趨勢

IT/通訊佔很大佔有率

- IT/通訊的優勢:由於資料安全需求的增加,IT/通訊領域預計將在加密軟體市場中佔據很大佔有率。隨著每天傳輸大量敏感資料,該行業的組織擴大採用加密演算法來防止未授權存取和資料外洩。

- 雲端和行動加密的成長:雲端處理的興起顯著增加了對雲端加密和EaaS的需求。 IT 部門專注於加密金鑰管理以保護雲端環境中的資料對於遵守 AES、PCI DSS 和 GDPR 等全球加密標準至關重要。

- 創新:加密技術的持續進步對於滿足 IT 和通訊產業不斷變化的需求至關重要。量子安全加密等創新正在為資料安全樹立新的基準,並確保敏感資訊免受新威脅。

- 資料外洩問題:資料外洩事件的快速增加凸顯了加強加密實踐的迫切需求。包括 IT 在內的專業服務業特別容易受到網路威脅,凸顯了全面加密解決方案的重要性。

亞太地區的成長和政府舉措

- 數位轉型:由於各行業的快速數字化轉型,預計亞太地區加密軟體市場將顯著成長。隨著金融、醫療保健和政府等行業採用數位技術,對保護敏感資料的加密軟體的需求不斷增加。

- 政府投資:亞太地區各國政府為建立強大的網路安全框架而進行的大量投資正在推動先進加密解決方案的發展。新加坡投資量子運算等舉措凸顯了該地區對加密技術應對網路安全威脅的關注。

- 對雲端加密的需求:亞太地區雲端基礎平台的採用不斷增加,推動了對雲端加密的需求。 EaaS 擴大用於保護雲端環境中的資料,尤其是在資料保護非常重要的金融領域。

- 技能差距與諮詢服務:亞太地區缺乏合格的網路安全專業人員,推動了對有效實施加密軟體的諮詢服務的需求。行業參與者透過提供專業諮詢服務並為市場成長做出貢獻來回應。

加密軟體產業概況

市場適度整合:加密軟體市場適度整合,IBM、微軟、Broadcom Inc.、Sophos Ltd.和 Thales 等全球主要公司領先市場。這些公司因其全面的產品系列和成熟的基本客群而具有優勢。

策略重點關注創新:領導企業越來越關注技術創新,特別是抗量子密碼學和零信任架構的開發。將加密與其他網路安全措施結合的整合安全解決方案的需求也在增加,並將塑造未來的市場趨勢。

小型供應商的作用:儘管大公司佔據主導地位,但小型專業供應商繼續在利基市場和特定地區發揮重要作用,為特定行業的需求提供客製化解決方案。

在IT和通訊領域的資料安全措施以及亞太地區快速數位轉型的推動下,加密軟體市場預計將出現強勁成長。加密技術的創新、不斷提高的監管要求以及網路威脅的日益普遍是塑造市場趨勢的關鍵因素。隨著企業優先考慮加密來保護敏感訊息,市場不斷擴大,為行業領導者和新進入者提供了利潤豐厚的機會。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 資料傳輸及其安全的監管標準

- 網路攻擊和手機竊盜增加

- 市場限制因素

- 昂貴的加密軟體的實施和維護成本

- 使用開放原始碼或盜版加密產品

第6章 市場細分

- 按成分

- 軟體

- 服務

- 按部署模型

- 本地

- 雲

- 按公司規模

- 主要企業

- 小型企業

- 按功能分類

- 磁碟加密

- 通訊加密

- 文件/資料夾加密

- 雲端加密

- 資料庫加密

- 按行業分類

- 資訊科技/通訊

- BFSI

- 衛生保健

- 政府機構

- 零售

- 教育

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 中東/非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- IBM

- Microsoft

- Broadcom Inc.

- Sophos Ltd.

- Thales

- McAfee, LLC

- Trend Micro Incorporated

- Dell Inc.

- Check Point Software Technologies Ltd.

- Micro Focus International plc

第8章投資分析

第9章 市場未來展望

The Encryption Software Market size is estimated at USD 17.45 billion in 2024, and is expected to reach USD 37.61 billion by 2029, growing at a CAGR of 16.60% during the forecast period (2024-2029).

The encryption software market is pivotal in the expanding domain of cybersecurity, driven by the escalating need for data protection and privacy. This market covers an array of solutions that secure sensitive information through advanced encryption algorithms, ensuring data integrity and confidentiality across various industries. Encryption software is particularly crucial in sectors such as finance, healthcare, and government, where the protection of sensitive data is a top priority.

Encryption Algorithms: Safeguarding Critical Data

Encryption algorithms are fundamental in securing data, whether stored on disks, transmitted over networks, or shared via email. Solutions like disk encryption software, file encryption software, and mobile encryption software are critical in protecting data from unauthorized access. The growing adoption of cloud computing has brought cloud encryption and Encryption as a Service (EaaS) to the forefront, offering businesses scalable and flexible options to secure their data in cloud environments.

Market Segmentation and Adoption

- Components: The market is divided into software and services, with software taking a dominant position due to its widespread adoption. Encryption software provides essential tools for organizations across various sectors to protect their data from breaches and unauthorized access.

- Deployment Models: On-premise and cloud-based solutions are the primary deployment models. On-premise solutions are favored by organizations with stringent security requirements, while cloud-based solutions offer flexibility and scalability, catering to the evolving needs of businesses.

- Enterprise Size: The market serves both large enterprises and SMEs, with large enterprises leading due to their significant investments in robust cybersecurity measures. SMEs, however, are increasingly adopting encryption solutions as they recognize the importance of data protection.

- Industry Verticals: Key industries include IT & telecommunications, BFSI, healthcare, and government. These sectors are the most critical users of encryption software, driven by the need to secure sensitive information against a backdrop of rising cyber threats.

Regional Analysis: Leading Markets

- North America: The region is a leader in the encryption software market, supported by stringent regulatory requirements and the presence of major encryption software providers. The enforcement of regulations like the GDPR in Europe and HIPAA in the U.S. underscores the necessity of encryption in maintaining data security.

- Europe: The region's focus on data protection, highlighted by the GDPR, drives significant demand for encryption software. Companies operating in Europe face severe penalties for non-compliance, making encryption a crucial investment.

- Asia-Pacific: This region is poised for rapid growth, driven by digital transformation and increasing awareness of cybersecurity. Government initiatives and investments in encryption technologies are further propelling market expansion in countries like China, India, and Japan.

Regulatory Standards Shaping the Market

- Compliance Imperatives: Regulatory standards such as GDPR, HIPAA, PCI DSS, and CCPA are crucial in shaping the encryption software market. Compliance with these standards is essential for businesses to avoid penalties and maintain customer trust. These regulations mandate stringent data protection measures, driving the adoption of encryption solutions across various industries.

- Industry-Specific Requirements: Sectors like healthcare and finance have industry-specific regulations that emphasize the importance of encryption. For example, HIPAA mandates the protection of patient data, while PCI DSS focuses on securing payment information, further fueling the demand for encryption software.

Impact of Cyber Attacks and Mobile Theft on Encryption Adoption

- Rising Cyber Threats: The increasing volume and sophistication of cyber attacks, including ransomware and phishing, are major drivers of encryption software adoption. Encryption provides a critical defense mechanism, ensuring that even if attackers access data, it remains unreadable without the appropriate decryption keys.

- Mobile Device Security: The proliferation of mobile devices, particularly in the workplace, has amplified the risk of data loss due to theft or loss. Mobile encryption software is essential in protecting data stored on smartphones and tablets, mitigating the risk of unauthorized access.

- Remote Work Trends: The expansion of remote work post-pandemic has heightened the need for secure communication channels. End-to-end encryption and network encryption are increasingly deployed to protect sensitive information shared over potentially unsecured networks.

Encryption Software Market Trends

IT & Telecommunication to Hold a Significant Share

- IT & Telecommunications Dominance: The IT & telecommunications sector is expected to hold a significant share of the encryption software market due to escalating data security needs. With vast amounts of sensitive data transmitted daily, organizations in this sector are increasingly adopting encryption algorithms to prevent unauthorized access and data breaches.

- Cloud and Mobile Encryption Growth: The rise of cloud computing has significantly increased the demand for cloud encryption and EaaS. The IT sector's focus on encryption key management to secure data across cloud environments is crucial for compliance with global encryption standards like AES, PCI DSS, and GDPR.

- Technological Innovations: Continuous advancements in encryption technology are vital for meeting the evolving needs of the IT & telecommunications sector. Innovations, such as quantum-safe encryption, are setting new benchmarks in data security, ensuring that sensitive information remains protected against emerging threats.

- Data Breach Concerns: The sharp increase in data breaches emphasizes the urgent need for enhanced encryption measures. The professional services sector, including IT, is particularly vulnerable to cyber threats, underscoring the importance of comprehensive encryption solutions.

Asia-Pacific Growth and Government Initiatives

- Digital Transformation: Asia-Pacific is expected to witness substantial growth in the encryption software market, driven by rapid digital transformation across various industries. As sectors like finance, healthcare, and government embrace digital technologies, the demand for encryption software to secure sensitive data is rising.

- Government Investments: Significant investments by governments in Asia-Pacific to build robust cybersecurity frameworks are driving the development of advanced encryption solutions. Initiatives like Singapore's investment in quantum computing highlight the region's focus on encryption technology to counter cybersecurity threats.

- Cloud Encryption Demand: The increasing adoption of cloud-based platforms in Asia-Pacific is fueling demand for cloud encryption. EaaS is becoming a popular choice for securing data in cloud environments, particularly in the financial sector, where data protection is critical.

- Skill Gap and Consulting Services: The shortage of qualified cybersecurity professionals in Asia-Pacific is creating demand for consulting services to implement encryption software effectively. Industry players are responding by offering specialized consultancy services, contributing to market growth.

Encryption Software Industry Overview

Moderately Consolidated Market: The encryption software market is moderately consolidated, with major global players like IBM, Microsoft, Broadcom Inc., Sophos Ltd., and Thales leading the landscape. These companies dominate due to their comprehensive product portfolios and established customer bases.

Strategic Focus on Innovation: Leading players are increasingly focusing on innovation, particularly in developing quantum-resistant encryption and zero-trust architecture. The demand for integrated security solutions that combine encryption with other cybersecurity measures is also rising, shaping future market trends.

Role of Smaller Vendors: Despite the dominance of large firms, smaller, specialized vendors continue to play a crucial role in niche markets or specific regions, offering tailored encryption solutions that address specific industry needs.

The encryption software market is set for robust growth, driven by the IT & telecommunications sector's commitment to data security and the rapid digital transformation in the Asia-Pacific region. Innovations in encryption technology, increasing regulatory demands, and the rising prevalence of cyber threats are key factors shaping market trends. As organizations prioritize encryption to safeguard sensitive information, the market will continue to expand, offering lucrative opportunities for industry leaders and new entrants alike.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Regulatory Standards Related to Data Transfer and its Security

- 5.1.2 Growing Volume of Strength of Cyber Attacks and Mobile Theft

- 5.2 Market Restraints

- 5.2.1 Expensive Encryption Software Deployment and Maintenance costs

- 5.2.2 Utilization of Open-Source and Pirated Encryption Products

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Service

- 6.2 By Deployment Model

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Enterprise Size

- 6.3.1 Large Enterprises

- 6.3.2 Small & Medium Enterprises

- 6.4 By Function

- 6.4.1 Disk Encryption

- 6.4.2 Communication Encryption

- 6.4.3 File/Folder Encryption

- 6.4.4 Cloud Encryption

- 6.4.5 Database Encryption

- 6.5 By Industry Vertical

- 6.5.1 IT & Telecommunication

- 6.5.2 BFSI

- 6.5.3 Healthcare

- 6.5.4 Government

- 6.5.5 Retail

- 6.5.6 Education

- 6.5.7 Others

- 6.6 By Geography

- 6.6.1 North America

- 6.6.2 Europe

- 6.6.3 Asia

- 6.6.4 Australia and New Zealand

- 6.6.5 Middle East and Africa

- 6.6.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM

- 7.1.2 Microsoft

- 7.1.3 Broadcom Inc.

- 7.1.4 Sophos Ltd.

- 7.1.5 Thales

- 7.1.6 McAfee, LLC

- 7.1.7 Trend Micro Incorporated

- 7.1.8 Dell Inc.

- 7.1.9 Check Point Software Technologies Ltd.

- 7.1.10 Micro Focus International plc