|

市場調查報告書

商品編碼

1629801

真空幫浦:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Vacuum Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

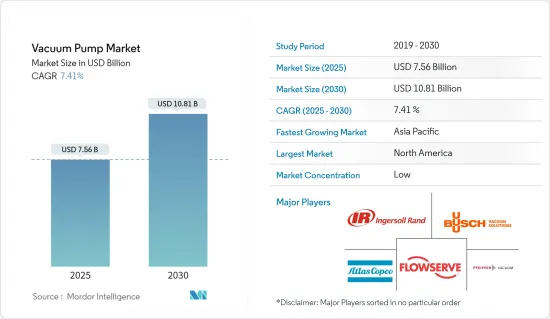

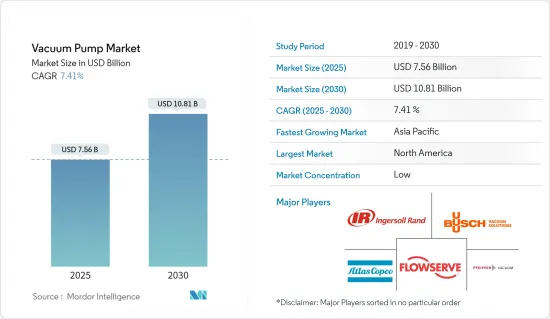

真空幫浦市場規模預估至2025年為75.6億美元,預估至2030年將達108.1億美元,預測期間(2025-2030年)複合年成長率為7.41%。

真空幫浦是一種從密封體積中吸入氣體顆粒、產生部分真空的幫浦。真空幫浦在眾多產業中都有廣泛的應用。真空幫浦對各種應用的適應性是全球真空幫浦市場的關鍵成長引擎。此外,真空幫浦還可用於多種應用,包括清洗、密封等。

主要亮點

- 真空幫浦廣泛用於各種工業和科學應用。它用於生產 CRT、真空管、電燈、飛機設備、印刷機、玻璃和石材切割廠、真空醫療應用、電子顯微鏡、光刻、鈾濃縮、複合材料成型等。

- 真空幫浦由於其多功能性而被用於多種應用。石油和天然氣行業採用這種機械進行天然氣開採和壓縮,對市場產生了重大影響。全球真空幫浦市場的主要成長動力是原油產量的增加和新油田的發現。

- 此外,真空幫浦對於半導體裝置的製造至關重要。智慧型手機和其他家用電子電器產品、汽車和其他應用程式正在推動對半導體 IC 的需求。這些將由 5G 無線和人工智慧等技術創新驅動。而且,隨著目前基於物聯網的設備的普及,半導體產業有望對這台機器進行投資。

- 真空泵也對製藥業產生重大影響。這些泵浦用於所有製造過程,包括乾燥、蒸餾、脫氣、結晶、昇華和填充。每個真空幫浦都是用於製造中間產品、原料藥和原料藥的真空灌注系統的組成部分。真空幫浦是在價值鏈中執行重要任務的重要組件,因為它們用於各種最終用戶產業的這些應用。

- 此外,為了保持市場競爭力,許多供應商繼續透過各種聯盟、產品發布、收購和其他活動進行投資。例如,阿特拉斯科普柯於 2022 年 1 月完成了對 HHV Pumps Pvt. Ltd 的收購。該業務開發和製造用於多種行業的真空泵和真空系統。 THHV Pumps 是旋片泵的領先供應商,其產品用於製造冷凍和空調、化學和製藥行業、電力設備和一般行業的真空泵。

- 此外,由於醫療產業真空幫浦使用的研究和開發不斷擴大,市場可能擁有利潤豐厚的成長機會。此外,由於真空幫浦在海水淡化中的使用不斷增加以及在太陽能價值鏈中的重要性日益增加,預計真空幫浦將為市場參與企業提供成長機會。

- 由於真空幫浦的廣泛應用和優點,預計市場將收到來自多個行業的巨大需求。然而,真空幫浦安裝不當、能耗高以及產品運作和維護成本增加可能會限制市場擴張。

- 真空技術市場最初受到 COVID-19 大流行造成的供應鏈和物流中斷的影響。但隨後其他解決方案的採用有所增加。阿爾特斯·科普柯表示,設備訂單也有所增加,主要是因為半導體產業多個地區對真空設備的需求增加。各行業開始恢復至或高於疫情前水平,市場預計將繼續擴大。

真空幫浦市場趨勢

旋轉真空幫浦預計將佔據主要市場佔有率

- 旋轉真空幫浦是在各種場合使用的幫浦之一,並被各個領域的專業人士使用。該泵浦採用正排量系統,最常用於商業、工業、汽車和商業行業。它也可用於實驗室和工業環境。在這些情況下最常被泵送的流體是天然氣、石油和水。

- 旋片幫浦最常用於汽車產業。此類型幫浦用於汽車煞車系統、動力方向盤系統、自動變速箱、增壓系統等。旋轉真空幫浦也用於各種車輛系統,例如飛機。空調、濃縮咖啡和軟性飲料分配器也是此類幫浦的應用。

- 此外,轉葉真空幫浦最常用於汽車產業,是各種車輛零件的重要組成部分。例如,動力方向盤系統中的液壓流體使用旋片泵加壓。它也用作自動變速器的固定和可變輸出單元。隨著汽車工業的成長,旋片幫浦的需求預計將大幅增加。例如,根據SIAM的數據,印度境內派遣的車輛數量從上一會計年度的1,414,277輛增加到2022-23年的1,706,831輛,增加了21%。

- 除了真空之外,旋轉真空幫浦還可以使用清潔空氣乾運轉或泵送液體(例如石油和天然氣)。石油和天然氣產業是一個顯著推動旋轉真空幫浦需求的產業。此外,由於有關真空泵整合到石油和天然氣行業的持續研究和開發,市場可能會享受利潤豐厚的擴張機會。

- 旋轉真空幫浦也可用於從封閉或受限空間中抽吸空氣或氣體。真空泵廣泛應用於食品和飲料、加工、化學和製藥、汽車、石油和天然氣等行業。此外,隨著有關真空泵整合到這些行業的研究和開發的不斷增加,市場可能會受益於利潤豐厚的擴張機會。

北美佔據主要市場佔有率

- 由於需求未滿足、水資源短缺加劇以及對清潔飲用水的需求不斷增加,在美國的推動下,預計北美在預測期內將佔據真空幫浦市場最大的市場佔有率。此外,製藥、醫療、工業製造和許多其他行業的大量研究和開發將有助於滿足預測期內不斷成長的需求。

- 對石油和天然氣、化學品和發電等最終用戶產業的投資不斷增加,對北美地區的真空幫浦市場產生了重大影響。油砂是包括美國和加拿大在內的該地區國家豐富的石油來源。例如,根據加拿大自然資源部的數據,加拿大已探明蘊藏量的 97% 是在油砂中發現的。

- 飲料加工是另一個受益於真空幫浦使用的行業。由於最近的技術趨勢和不斷上升的投資水平,預計該地區的飲料加工行業將為市場提供許多機會。例如,2023 年 1 月,雀巢宣布斥資 4,300 萬美元擴建威斯康辛州工廠,以增加 Boost 和 Carnation Breakfast Essentials 即飲 (RTD) 產品的產量。此類投資預計將增加工業對真空幫浦的需求。

- 此外,美國是開發新的可再生能源技術的領導者之一,並開創了多個太陽能計劃。在美國,能源生產持續快速成長。例如,美國主要石油生產商之一埃克森美孚最近宣布,計劃在2024年在德克薩斯州州二疊紀盆地生產約100萬桶/日石油當量,以擴大其生產業務。這些因素預計將為製造商提供更多機會來滿足需求並加速市場擴張。

- 真空幫浦廣泛應用於採礦廠,因此隨著北美地區煤炭銷量的增加,採礦公司的投資可能會增加。

真空幫浦產業概況

真空幫浦市場按知名全球參與企業和參與企業的存在進行細分。此外,全球對發電基礎設施研發的投資以及石油和天然氣設備升級是競爭對手之間激烈競爭的重要驅動力。主要參與企業包括 Gardner Denver Inc.、阿特拉斯·科普柯集團和福斯公司。

- 2023 年 10 月,阿特拉斯科普柯推出了下一代乾爪式真空幫浦 DZS A 系列。這個新系列樹立了效能、效率和可靠性的基準。 DZS A 系列在設計時考慮了製造業不斷變化的需求,具有顯著的優勢。

- 2023 年 3 月,Fowserve Corporation 宣布推出 SIHI Boost UltraPLUS 乾運轉真空幫浦。該新裝置旨在將批次的週期時間縮短 50% 或更多。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 工業措施

- COVID-19 對真空幫浦市場的影響

第5章市場動態

- 市場促進因素

- 增加石油產量和新油田

- 對乾式真空幫浦的需求增加

- 市場問題

- 高成本和相容性問題

第6章 市場細分

- 按類型

- 旋轉真空幫浦

- 旋片泵

- 螺旋泵和爪泵

- 羅茨幫浦

- 往復式真空幫浦

- 隔膜泵

- 活塞泵

- 動力真空幫浦

- 噴射幫浦

- 渦輪分子泵浦

- 擴散泵浦

- 動力泵

- 液環幫浦

- 側吸泵

- 特殊真空幫浦

- 吸氣幫浦

- 低溫泵

- 旋轉真空幫浦

- 按最終用戶使用情況

- 石油和天然氣

- 電子產品

- 醫療保健

- 化學處理

- 飲食

- 發電

- 其他最終用戶應用(木材、紙張/紙漿等)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Ingersoll Rand Inc.

- Atlas Copco AB(Edwards)

- Flowserve Corporation

- Busch Vacuum Solutions(Busch group)

- Pfeiffer Vacuum GmbH(Pfeiffer Vacuum Technology AG)

- ULVAC Inc.

- Graham Corporation

- Global Vac

- Becker Pumps Corporation

- Ebara Corporation

- Wintek Corporation

- Tsurumi Manufacturing Co. Ltd

第8章投資分析

第9章市場的未來

The Vacuum Pump Market size is estimated at USD 7.56 billion in 2025, and is expected to reach USD 10.81 billion by 2030, at a CAGR of 7.41% during the forecast period (2025-2030).

A vacuum pump is a type of pump that draws gas particles from a sealed volume and leaves a partial vacuum behind. There are numerous applications for vacuum pumps across numerous industries. Vacuum pumps' adaptability in various applications is a crucial growth engine for the global vacuum pump market. Additionally, it is utilized in multiple applications, including cleaning, sealing, and others.

Key Highlights

- Vacuum pumps are used in a wide variety of industrial and scientific applications. They manufacture CRTs, vacuum tubes, electric lamps, flight instruments, print presses, glass and stone cutting factories, suction-based medical applications, electron microscopy, photolithography, uranium enrichment, and composite molding.

- Due to their versatility, vacuum pumps are used in various applications. The oil and gas industry has adopted this machine to extract and compress the gas, which significantly impacts the market. The main growth drivers for the global vacuum pump market are rising crude oil production and the discovery of newer oilfields.

- Additionally, vacuum pumps are crucial to the manufacturing of semiconductor devices. Smartphones and other consumer electronics, automotive, and other applications drive the demand for semiconductor ICs. These are brought on by technological changes, including 5G wireless and artificial intelligence. Additionally, the semiconductor industry is anticipated to invest in this machinery due to the current popularity of Internet of Things-based devices.

- Vacuum pumps also have a significant impact on the pharmaceutical sector. All manufacturing processes use these pumps, including drying, distillation, degassing, crystallization, sublimation, and filling. Each vacuum pump is a component of a vacuum prime system used to create intermediate goods, active pharmaceutical ingredients, and large-scale pharmaceuticals. Vacuum pumps are essential components that perform essential tasks in the value chain because of these applications in various end-user industries.

- Moreover, to maintain a competitive edge in the market, many vendors continuously invest through a range of partnerships, product launches, acquisitions, and other activities. For instance, Atlas Copco completed the acquisition of HHV Pumps Pvt. Ltd in January 2022. The business develops and produces vacuum pumps and systems for use in a variety of industries. THHV Pumps is a top supplier of rotary vane pumps used in the production of refrigeration and air conditioning, vacuum pumps for the chemical and pharmaceutical industries, electrical power equipment, and general industry.

- Additionally, the market may have a profitable opportunity for growth due to growing research and development into the use of vacuum pumps in the medical industry. Additionally, vacuum pumps are expected to present growth opportunities for the market's players due to their increasing use in seawater desalination and their increasing significance in the photovoltaics value chain.

- Due to their wide-ranging applications and advantages, the market is anticipated to experience significant demand from several industries. However, improper vacuum pump installation, high power consumption, and increased product operation and maintenance costs could restrain market expansion.

- Due to supply chain and logistics disruptions brought on by the COVID-19 pandemic, the market for vacuum technologies was initially impacted. Later on, however, it saw a rise in adopting several other solutions. According to Altas Copco, order volumes for equipment also increased, primarily due to an increase in vacuum equipment demand across several regions in the semiconductor industry. The industries have begun to resume operations at levels equal to or higher than before the pandemic, so the market is anticipated to continue to expand.

Vacuum Pump Market Trends

Rotary Vacuum Pump Expected to Hold Significant Market Share

- The rotary vacuum pump is one of these types of pumps that is useful in various situations and used by professionals in multiple fields. These pumps, which use a positive displacement system, are most frequently used in the commercial, industrial, automotive, and Commercial industries. It can be used in laboratory and industrial settings as well. The fluids that are pumped most frequently in these situations are gas, oil, and water.

- The automotive sector is the one that employs rotary vane pumps the most. This kind of pump is used in the car's braking system, power steering system, automatic transmission, and supercharging system, among other places. Rotary vacuum pumps are used in the systems of different vehicle types, such as airplanes. Some air conditioners, espresso, and soft drink dispensers are other applications for this kind of pump.

- Moreover, the automotive industry is where rotary vane vacuum pumps are most frequently used, where they are essential parts of many different vehicle parts. For example, hydraulic fluid in power steering systems is pressurized using rotary vane pumps. Additionally, they are employed as fixed and variable output units in automatic transmissions. The demand for Rotary vane pumps is anticipated to increase significantly with the growth of the automotive industry. For instance, according to SIAM, domestic dispatches in India increased by 21% to 17,06,831 units in 2022-23 from 14,14,277 units in the preceding fiscal year.

- Rotating vacuum pumps can run dry with clean air or pump oil, gas, and other liquids in addition to the vacuum. The oil and gas industry is a sector that significantly boosts demand for Rotary vacuum pumps. Additionally, the market may benefit from a lucrative expansion opportunity due to growing research and development into the integration of vacuum pumps into the oil and gas industry.

- Air and gases can also be pumped out of a sealed or constrained space using rotary vacuum pumps. Food and beverage, processing, chemical and pharmaceutical, automotive, oil and gas, and a wide range of other industries all use them. Additionally, the market may benefit from a lucrative expansion opportunity due to growing research and development into the integration of vacuum pumps into these industries.

North America to Hold Significant Market Share

- North America is expected to hold the largest market share of the Vacuum Pump Market over the forecast period, led by the United States, owing to high unmet needs, growing water scarcity, and increased demand for clean drinking water. Additionally, over the forecasted period, significant research and developments in pharmaceutical, healthcare, industrial manufacturing, and many other industries will help to meet the rising demand.

- The rising investments in end-user industries like oil and gas, chemical, and power generation significantly impact the vacuum pump market in the North American region. Oil sands are a plentiful source of oil for the region's nations, including the US and Canada. For instance, 97% of Canada's proven oil reserves are found in the oil sands, according to Natural Resource Canada.

- The processing of beverages is yet another industry that gains from using vacuum pumps. The beverage processing industry in the region is expected to offer the market plenty of opportunities due to recent technological developments and rising investment levels. For instance, Nestle announced in January 2023 that it would expand a Wisconsin factory by USD 43 million in an effort to increase production of its Boost and Carnation Breakfast Essentials ready-to-drink (RTD) products. Such investments will increase the demand for vacuum pumps in the industry.

- Additionally, the US has been one of the leaders in developing new renewable energy technologies and has pioneered several solar energy projects. In the United States, energy production is still rising quickly. For instance, ExxonMobil, one of the major oil producers in the nation, recently announced plans to increase production activity in the West Texas Permian Basin by producing roughly 1 million BPD of oil equivalent by 2024. Such factors will accelerate market expansion by giving manufacturers more opportunities to meet demand.

- Due to their widespread use in mining plants, vacuum pumps may see an increase in investment by mining companies as coal sales in the North American region increase.

Vacuum Pump Industry Overview

The vacuum pump market is fragmented due to the presence of prominent global and local players. Also, global investment in R&D in power generation infrastructure and facility upgrades in the oil and gas are the essential drivers that are giving intense rivalry among competitors. Key players are Gardner Denver Inc., Atlas Copco Group, Flowserve Corporation, etc.

- October 2023: Atlas Copco, has announced its next generation of dry claw vacuum pumps - the DZS A series. This new series sets a benchmark for performance, efficiency, and reliability. Designed with the evolving needs of manufacturing industries in mind, the DZS A series offers significant advantages.

- March 2023: Fowserve Corporation has announced the release of the SIHI Boost UltraPLUS dry-running vacuum pump. The new unit is designed to reduce cycle times for batch processes by up to 50 percent or more.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Policies

- 4.5 Impact of COVID-19 on the Vacuum Pumps Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Crude Oil Production and the Newer Oilfields

- 5.1.2 Increasing Demand for Dry Vacuum Pump

- 5.2 Market Challenges

- 5.2.1 High Cost and Compatibility Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Rotary Vacuum Pumps

- 6.1.1.1 Rotary Vane Pumps

- 6.1.1.2 Screw and Claw Pumps

- 6.1.1.3 Roots Pumps

- 6.1.2 Reciprocating Vacuum Pumps

- 6.1.2.1 Diaphragm Pumps

- 6.1.2.2 Piston Pumps

- 6.1.3 Kinetic Vacuum Pumps

- 6.1.3.1 Ejector Pumps

- 6.1.3.2 Turbomolecular Pumps

- 6.1.3.3 Diffusion Pumps

- 6.1.4 Dynamic Pumps

- 6.1.4.1 Liquid Ring Pumps

- 6.1.4.2 Side Channel Pumps

- 6.1.5 Specialized Vacuum Pumps

- 6.1.5.1 Getter Pumps

- 6.1.5.2 Cryogenic Pumps

- 6.1.1 Rotary Vacuum Pumps

- 6.2 By End-user Application

- 6.2.1 Oil and Gas

- 6.2.2 Electronics

- 6.2.3 Medicine

- 6.2.4 Chemical Processing

- 6.2.5 Food and Beverage

- 6.2.6 Power Generation

- 6.2.7 Other End-user Applications (Wood, Paper and Pulp, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ingersoll Rand Inc.

- 7.1.2 Atlas Copco AB (Edwards)

- 7.1.3 Flowserve Corporation

- 7.1.4 Busch Vacuum Solutions (Busch group)

- 7.1.5 Pfeiffer Vacuum GmbH (Pfeiffer Vacuum Technology AG)

- 7.1.6 ULVAC Inc.

- 7.1.7 Graham Corporation

- 7.1.8 Global Vac

- 7.1.9 Becker Pumps Corporation

- 7.1.10 Ebara Corporation

- 7.1.11 Wintek Corporation

- 7.1.12 Tsurumi Manufacturing Co. Ltd