|

市場調查報告書

商品編碼

1685752

智慧高速公路:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Smart Highway - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

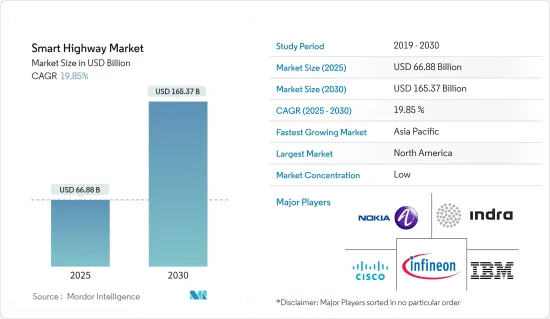

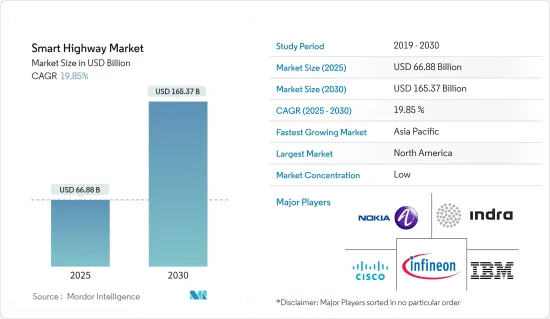

2025年智慧高速公路市場規模預估為668.8億美元,預估至2030年將達1,653.7億美元,預測期間(2025-2030年)複合年成長率為19.85%。

智慧技術的好處,例如由於資料驅動的交通控制而提高道路安全性和減少基礎設施損壞,以及對智慧城市的投資不斷增加,正在推動智慧高速公路市場的成長。

主要亮點

- 隨著都市化的快速發展,溫室氣體(GHG)排放的增加導致了碳足跡的擴大,迫使智慧交通採用清潔和永續的技術。例如,根據美國環保署的數據,交通運輸產生的溫室氣體 (GHG)排放約占美國溫室氣體排放總量的 28%。

- 智慧交通管理系統使用數位感測器,可以在發生山崩、惡劣天氣或交通堵塞時捕獲並記錄資料。它還可以在州和國家高速公路的 LED 螢幕上顯示預報和警告。

- 許多因素正在推動市場的發展,例如減少高速公路上發生的事故、提供安全和高效的運輸系統、減少連接全國主要城市的高速公路上的運輸時間。所有這一切都可以透過實施智慧技術來實現,智慧技術可以有效監控交通狀況並保持高速公路正常運轉,同時向當局提供即時資訊。

- 新興國家缺乏基礎設施發展可能會嚴重抑制智慧高速公路市場的發展。智慧高速公路的實施需要在技術、感測器、通訊網路和熟練勞動力方面進行大量投資。新興國家通常面臨預算限制,政府可能會優先考慮其他重要領域,而不是先進的交通基礎設施。

智慧高速公路市場趨勢

智慧交通管理系統產品技術可望佔領較大市場佔有率

- 智慧交通管理系統 (STMS) 在智慧高速公路市場中發揮關鍵作用,因為它是實現先進交通解決方案整合的關鍵技術,可提高效率、安全性和永續性。 SMTS 包括一系列產品和技術,有助於對運輸系統內的各個元素進行即時監控、控制和管理。

- ITMS 包括感測器、攝影機和交通控制系統網路,可監控即時交通狀況。這些系統收集交通流量、交通密度和擁塞資料,使交通操作員能夠最佳化交通號誌時序、管理車道控制並有效應對事故。

- ETC系統是智慧高速公路的重要組成部分。使用 RFID、ANPR、DSRC 和 GNSS 等各種技術,收費將實現自動化,從而減少收費站的擁塞並改善交通流量。例如,2024 年 4 月,德里運輸部計劃在首都各個路口安裝 5,000 台CCTV攝影機,作為 ITSMS 整合計劃的一部分。在新的競標文件中,選定的機構將被要求在三年內為 16 項道路交通違規安裝帶有 ANPR 系統的CCTV攝影機以及 ICCC 基礎設施。選定的機構還必須安排儲存容量,以保存所有CCTV影像和資料五年。

- 交通資訊和導航系統 (TINS) 透過可變訊息標誌、行動應用程式和導航設備為駕駛員提供即時交通資訊。這使得駕駛員能夠做出更明智的決定,避開擁擠的路線並改善交通分配。

- 環境監測系統將監測高速公路沿線的空氣品質和其他環境參數,以評估污染水平並採取資料主導的決策,以減少排放並改善空氣品質。

預計北美將佔據較大的市場佔有率

- 北美智慧高速公路市場經歷了智慧交通系統(ITS)和智慧基礎設施的穩定成長和進步。北美政府機構正積極推動採用智慧交通解決方案,以解決交通堵塞、減少事故並提高整體交通效率。

- 該地區強大的技術基礎設施和較高的智慧型手機普及率正在促進電子收費系統、交通管理系統和即時交通資訊等 ITS 技術的採用。

- 人們一直強調引入智慧高速公路技術,透過事故偵測、管理系統和車輛間通訊來提高道路安全。

- 該地區對自動駕駛和車聯網技術的興趣日益濃厚。這些技術有可能改變交通運輸,並需要智慧高速公路基礎設施來支援其部署。

- 北美是全球技術領導者。預計建築和道路基礎設施支出的增加將為該地區的擴張創造更多的機會。此外,美國在高速公路和道路計劃上的公共建設支出非常高。例如,2024年3月,領先的AI行動平台公司NoTraffic宣布,此前其系統在科利爾縣、帕斯科縣和奧蘭多等地部署取得巨大成功,該公司已獲得佛羅裡達州運輸部(FDOT)的批准,可以在該州營運。這一重要里程碑彰顯了 NoTraffic 對最高安全和未來標準的堅定承諾。

智慧高速公路產業概況

智慧高速公路市場高度分散,主要參與者包括阿爾卡特朗訊企業公司(諾基亞)、思科Cisco公司、IBM 公司、Indra Systemas SA 和英飛凌科技股份公司。市場參與者正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 5 月,Applied Information Inc. 和 Curruix Vision LLC 宣佈建立策略合作夥伴關係,為日益複雜的交通管理環境提供新的先進交通洞察和主動安全解決方案。此次策略合作將把Curruix Vision的智慧城市ITS路口AI技術與Applied Information的智慧城市監控平台Applied Information Glance結合,結合兩家公司的技術優勢。

- 2024 年 2 月 Actelis Networks 是一家為物聯網 (IoT) 應用提供網路安全、快速部署網路解決方案的供應商,該公司已在納帕一些最繁忙的路口部署了混合光纖到戶 (H2P) 連接解決方案。 Acteris 的當地合作夥伴 Econolite 訂購並安裝了此解決方案。 Econolite 和 Actelis 已在該市最繁忙的十字路口之一完成了 ATMS 升級計劃。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 產業相關人員分析

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 更多高速公路和基礎設施計劃

- 安全高效交通的需求日益增加

- 市場挑戰

- 資本密集型計劃

- 新興國家缺乏基礎設施

- 市場機會

- 近期重要案例

- 智慧高速公路技術的演變

第6章 市場細分

- 依產品技術

- 智慧交通管理系統

- 智慧交通管理系統

- 監控系統

- 服務

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Alcatel-Lucent Enterprise(Nokia Corporation)

- Cisco Systems Inc.

- IBM Corporation

- Indra Sistemas SA

- Infineon Technologies AG

- Huawei Technlogies Co. Ltd

- Kapsch AG

- LG CNS Co. Ltd(LG Electronics Inc.)

- Schneider Electric SE

- Siemens AG

- Xerox Corporation

第8章投資分析

第9章 市場機會與未來趨勢

The Smart Highway Market size is estimated at USD 66.88 billion in 2025, and is expected to reach USD 165.37 billion by 2030, at a CAGR of 19.85% during the forecast period (2025-2030).

The growing investment in smart cities, along with the benefits associated with smart technologies, such as improved traffic safety and data-driven traffic control to reduce infrastructure damage, drives the growth of the smart highway market.

Key Highlights

- With rapid urbanization, an increase in greenhouse gas (GHG) emissions contributes to an expanding carbon footprint and forcing the adoption of clean and sustainable technology for intelligent transportation. For instance, according to the United States Environmental Protection Agency, greenhouse gas (GHG) emissions from transportation account for about 28% of the total greenhouse gas emissions in the United States.

- Smart transport management systems use digital sensors that can acquire and record data during landslides, poor weather conditions, and traffic congestion. They can also display forecasts and alerts on LED screens on state and national highways.

- The market is driven by many factors, such as reducing the number of accidents occurring on highways, providing safe and efficient transportation systems, and reducing the transportation time on highways connecting the major cities of a country. All of these can be done by implementing smart technologies, which efficiently monitor traffic and help properly functioning highways while providing real-time information to the authorities.

- The lack of infrastructural support in developing countries can significantly restrain the smart highway market. Implementing smart highways necessitates substantial investment in technology, sensors, communication networks, and a skilled workforce. Developing countries often face budget constraints, and governments may prioritize other essential sectors over advanced transportation infrastructure.

Smart Highway Market Trends

Smart Transport Management Systems Product Technology is Expected to Hold Significant Market Share

- Smart transport management systems (STMS) play a vital role in the smart highway market, as they are a key technology that enables the integration of advanced transportation solutions to improve efficiency, safety, and sustainability. SMTS encompasses a range of products and technologies that facilitate real-time monitoring, control, and management of various elements within the transportation system.

- ITMS includes a network of sensors, cameras, and a traffic control system that monitors real-time traffic conditions. These systems collect traffic flow, density, and congestion data, enabling traffic operators to optimize traffic signal timing, manage lane control, and respond to incidents efficiently.

- ETC systems are an essential part of smart highways. They use various technologies like RFID, ANPR, DSRC, or GNSS to automate toll collection, reducing congestion and improving traffic flow at toll plazas. For instance, in April 2024, the Delhi transport department planned to set up 5,000 CCTV cameras at various junctions in the national capital as part of the ITSMS integration project. Under the new tender document, the chosen agency will be required to set up CCTV cameras with an ANPR system for 16 road traffic violations, along with the ICCC infrastructure, within three years. The selected agency will also be required to arrange for a storage capacity to store all the CCTV footage and data for five years.

- Traffic information and navigation systems (TINS) provide real-time traffic information to drive through variable message signs, mobile apps, or navigation devices. This helps drivers make informed decisions, avoid congested routes, and improve traffic distribution.

- Environmental monitoring systems monitor air quality and other environmental parameters along highways to assess pollution levels and make data-driven decisions to reduce emissions and improve air quality.

North America is Expected to Hold Significant Market Share

- The North American smart highway market experienced steady growth and advancements in intelligent transportation systems (ITS) and smart infrastructure. Government agencies in North America have been actively promoting the adoption of smart transportation solutions to address traffic congestion, reduce accidents, and enhance overall transportation efficiency.

- The region's strong technological infrastructure and high smartphone penetration have facilitated the implementation of ITS technologies, such as electronic toll collection systems, traffic management systems, and real-time traffic information.

- There has been a significant emphasis on deploying smart highway technologies to enhance road safety through incident detection, management systems, and vehicle-to-infrastructure communication.

- The region has seen increasing interest in autonomous and connected vehicle technologies. These technologies have the potential to revolutionize the transportation landscape and require smart highway infrastructure to support their deployment.

- North America is a global technological leader. The increased spending on construction and road infrastructure is expected to offer more opportunities for the region to expand. Moreover, the public construction spending on highway and street projects in the United States is very high. For instance, in March 2024, NoTraffic, the developer of the leading AI Mobility Platform, announced that it received approval from the Florida Department of Transportation (FDOT) to operate in the state, accompanied by substantial successful implementations of NoTraffic's systems in various locations including Collier County, Pasco County, Orlando, and more. This significant milestone underscores NoTraffic's unwavering commitment to the highest safety and future-ready standards.

Smart Highway Industry Overview

The smart highway market is highly fragmented, with the presence of major players like Alcatel-Lucent Enterprise (Nokia Corporation), Cisco Systems Inc., IBM Corporation, Indra Sistemas SA, and Infineon Technologies AG. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- May 2024: Applied Information Inc. and Curruix Vision LLC announced a strategic partnership to provide new, enhanced traffic insights and proactive safety solutions to increasingly complex traffic management environments. The strategic partnership will combine their technical strengths by integrating Curruix Vision's smart city ITS intersection AI technology into Applied Information's intelligent city supervisory platform, Applied Information Glance.

- February 2024: Actelis Networks Inc., a cyber-secure, fast-deployment networking solution for Internet of Things (IoT) applications, deployed a hybrid fiber-to-the-premises (H2P) connectivity solution at several of Napa's busiest traffic junctions. Actelis' local partner, Econolite, ordered and installed the solution. Econolite and Actelis completed an ATMS upgrade project at the city's busiest intersections.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Highway and Infrastructure Projects

- 5.1.2 Rising Need for Safe and Efficient Transportation

- 5.2 Market Challenges

- 5.2.1 Capital-intensive Projects

- 5.2.2 Lack of Infrastructural Support in Developing Countries

- 5.3 Market Opportunities

- 5.4 Key Recent Case Studies

- 5.5 Evolution of Smart Highway Technology

6 MARKET SEGMENTATION

- 6.1 By Product Technology

- 6.1.1 Smart Traffic Management Systems

- 6.1.2 Smart Transport Management Systems

- 6.1.3 Monitoring Systems

- 6.1.4 Services

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alcatel-Lucent Enterprise (Nokia Corporation)

- 7.1.2 Cisco Systems Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Indra Sistemas SA

- 7.1.5 Infineon Technologies AG

- 7.1.6 Huawei Technlogies Co. Ltd

- 7.1.7 Kapsch AG

- 7.1.8 LG CNS Co. Ltd (LG Electronics Inc.)

- 7.1.9 Schneider Electric SE

- 7.1.10 Siemens AG

- 7.1.11 Xerox Corporation