|

市場調查報告書

商品編碼

1640415

資料中心冷卻:市場佔有率分析、產業趨勢與統計、成長預測(2025-2031)Data Center Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

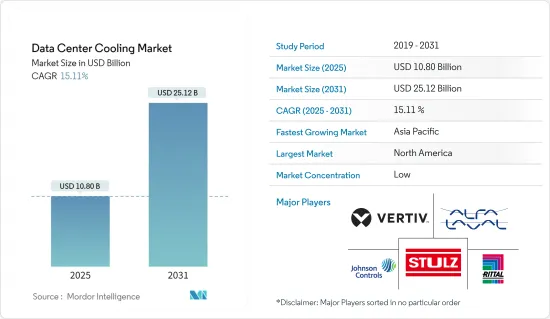

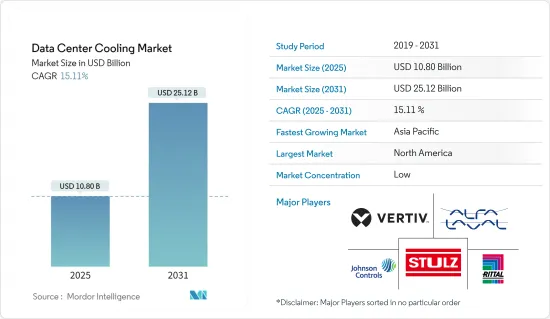

資料中心冷卻市場規模預計在 2025 年為 108 億美元,預計到 2031 年將達到 251.2 億美元,預測期內(2025-2031 年)的複合年成長率為 15.11%。

主要亮點

- 人工智慧和媒體應用的高運算需求正在推動全球資料中心的部署。這些資料中心消耗大量電力並產生大量熱量,進一步增加了對各種高效冷卻系統的需求。

- 隨著數位化的提高導致電腦效能的提高以及對更多整合式小型晶片的需求,資料中心冷卻市場預計將大幅成長。資料中心的設計和冷卻需求主要由用於 AI 工作負載的強大電腦硬體驅動。製造商正在推出更大的矽晶片,以最佳化人工智慧和高效能運算工作負載的效能。人工智慧和高效能運算環境中強大的GPU的使用凸顯了資料中心對冷卻技術的需求。

- OTT 和串流媒體服務的使用日益成長導致資料增加,從而刺激了市場發展。此外,Disney+Hotstar、Hulu和Netflix等線上串流服務的資料消耗增加預計將推動資料中心冷卻系統的需求。

- 市場參與者正致力於擴大其全球企業發展和服務範圍,以增加消費群。例如,2024 年 3 月,智慧電源管理公司伊頓宣布了一項北美擴展計劃,為希望快速滿足機器學習、邊緣運算和人工智慧日益成長的需求的組織提供創新的模組化資料中心解決方案。宣布將於2024 年3 月發佈在伊頓的 SmartRack 模組化資料中心主要將 IT 機架與冷卻和服務機櫃結合,為設備負載高達 150kW 的關鍵 IT 設備創建效能最佳化的資料中心解決方案。

- 預計該市場的成長將受到對多功能適應性需求的不斷成長和全球電力短缺的阻礙。此外,使用效率低下的冷卻系統設計(例如過時的基礎設施和不理想的佈局)會導致能源效率降低和營運成本增加,而能源價格上漲會使冷卻成本過高。因素之一時期。

資料中心冷卻市場趨勢

資訊科技和通訊領域有望實現最高成長

- 資訊科技產生的資料的急劇成長需要高效的資料中心,這反過來又推動了對先進冷卻解決方案的需求。隨著資料中心不斷擴展以適應日益成長的工作負載和儲存需求,產生的熱量成為一個重大問題,從而產生了對有效冷卻解決方案的需求。

- 雲端儲存的採用率每年都在增加。為了提供更有效率的工作流程,微軟、AWS 和Google等雲端儲存供應商正在擴大雲端中可用的儲存量。這些公司正在投資超大規模交易。因此,由於雲端儲存供應商能夠增加容量,軟體即服務 (SaaS) 的擴展預計將增加對資料中心冷卻系統的需求。

- 浸入式冷卻可採用單相或雙相解決方案。單相浸入式冷卻將伺服器置於封閉的底盤中,並允許機架安裝或獨立設計。另一方面,雙相浸入式冷卻將伺服器浸入液體中,但液體在冷卻過程中會發生變化。當液體升溫和凝結時,水迴路和熱交換器會帶走熱量。透過 2P 浸入式冷卻,容納伺服器的金屬儲存罐內的介電冷卻液在安全的冷卻系統中沸騰和冷凝,大大提高了傳熱效率。

- 2023 年 5 月,KT Cloud 與瑞士液體冷卻解決方案供應商 Immersion 4 簽署協議,在 KT Cloud 的資料中心引進下一代浸入式冷卻技術。浸入式冷卻是將資訊和通訊技術設備浸入不導電的介電溶液中來去除熱量。這消除了資料中心伺服器機房中風冷系統可能出現的溫度不平衡和風扇噪音。

亞太地區將迎來顯著成長

- 預計亞太地區將在預測期內實現最快的成長率,這主要歸功於網路基礎設施的快速發展。該地區面臨日益成長的資料生成需求,尤其是印度和中國等國家,這些國家的政府政策正在推動節能基礎設施的發展。此外,人工智慧冷卻管理和液體冷卻系統等技術進步正在改變遊戲規則並推動該地區的進一步應用。

- 中國和日本是最重要的國家之一,預計將憑藉物聯網、機器學習和人工智慧等領域的持續技術創新和發展,大幅推動市場成長機會。此外,這些國家的資料中心數量正在迅速成長,政府在全部區域推行的綠色基礎設施政策也推動了這些資料中心更好、更有效率的冷卻。

- 例如,2024 年 4 月,在亞洲營運和開發高效能資料中心的公司 GDS 和專注於亞太房地產市場和其他高門檻全球市場的私募股權基金管理人 Gaw 宣布他們已經收購了GDS 100%的股份。 Capital Capital Partners已與GDS達成策略夥伴關係關係,將在日本東京建置一個40兆瓦(MW)的資料中心園區。

- 亞太地區的資料中心冷卻市場主要受到資料消費和雲端服務的快速成長的推動。隨著企業擴展其數位基礎設施,對高效冷卻系統以維持最佳動作溫度的需求也日益增加。此外,有關能源效率和環境永續性的嚴格法規正在推動創新冷卻技術的採用。新興經濟體正在大力投資IT基礎設施,對可靠、擴充性的冷卻解決方案的需求進一步推動了市場的成長。

- 2023 年 12 月,澳洲雲端服務供應商ResetData 開設了一個用於開拓性液冷資料中心和伺服器技術的測試和模擬實驗室。這是亞太地區首批能夠在液冷環境中試驗工作負載的設施之一。此舉使本地企業能夠享受更生態和高效能的基礎設施即服務(IaaS),這對於人工智慧和機器學習等要求苛刻的應用程式至關重要。

資料中心冷卻產業概況

資料中心冷卻市場在主要產業參與者之間的整合程度較低。著名的市場領導包括 Stulz GmbH、Alfa Laval AB、Schneider Electric SE、Johnson Controls Inc.、Vertiv Group Corp. 和 Asetek A/S。憑藉顯著的市場佔有率,這些行業巨頭正在積極致力於擴大其在該全部區域的基本客群。他們的成長策略主要依靠旨在增加市場佔有率和整體盈利的策略合作。此外,施耐德電機、江森自控和三菱電機歐洲公司等公司也提供液體和空氣冷卻產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 冷卻的主要成本考量

- 從直流冷卻角度分析與直流營運相關的主要成本開銷

- 根據設計複雜性、PUE、優點、缺點和自然天氣條件下的使用範圍等關鍵因素,對每種冷卻技術的成本和營運考慮進行比較研究

- 資料中心冷卻的關鍵創新和發展

- 資料中心採用的主要節能技術

第5章 市場動態

- 市場促進因素

- 全球範圍內人工智慧和 HPC 工作負載的快速數位化和普及

- 綠色資料中心的出現

- 市場挑戰

- 成本、調適要求和停電

- 全球供應鏈中斷

- 市場機會

- 數位經濟的成長與重點地區政府支持力道的加大

- 產業生態系統分析

第6章:全球資料中心現狀

- 資料中心 IT 負載能力與麵積足跡分析(2017-2030)

- 目前全球資料中心熱點及未來擴展前景分析

- 重點區域領先資料中心建置商及營運商分析

7. 印尼資料中心市場細分

- 按冷卻技術

- 空氣冷卻

- 冷卻器和節熱器

- CRAH

- 冷卻塔(涵蓋直接冷卻、間接冷卻、兩級冷卻)

- 其他空氣冷卻技術

- 液體冷卻

- 浸入式冷卻

- 晶片間直接冷卻

- 後門式熱交換器

- 空氣冷卻

- 按類型

- 超大規模資料中心業者(自有和租賃)

- 企業(本地)

- 搭配

- 按行業

- 資訊科技和電訊

- 零售和消費品

- 衛生保健

- 媒體與娛樂

- 聯邦政府

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第8章 競爭格局

- 公司簡介

- Vertiv Co.

- Stulz GmbH

- Schneider Electric SE

- Rittal GmbH & Co. KG

- Alfa Laval Corporate AB

- Fujitsu General Limited

- Johnson Controls Inc.

- Hitachi Ltd

- CoolIT Systems Inc.

- Liquid Stack Inc.

- Asetek Inc. A/S

- Asperitas

- Chilldyne Inc.

- Fujitsu Ltd

- Mikros Technologies

- KAORI HEAT TREATMENT Co. Ltd

- Lenovo Group Limited

第9章投資分析

第10章 市場機會與未來趨勢

第 11 章:出版商

The Data Center Cooling Market size is estimated at USD 10.80 billion in 2025, and is expected to reach USD 25.12 billion by 2031, at a CAGR of 15.11% during the forecast period (2025-2031).

Key Highlights

- Due to the high computational needs of AI and media applications, data centers are being increasingly deployed worldwide. These data centers consume a massive amount of power, generating a significant amount of heat, further creating the need for various efficient cooling systems.

- The data center cooling market is expected to show substantial growth due to increased digitization, leading to greater computer performance and requiring a larger number of integrated small chips. The design of data centers and the need to cool them are mainly influenced by powerful computer hardware for AI workloads. Manufacturers are introducing large silicon chips to optimize the performance of artificial intelligence and high-performance computing workloads. The use of powerful GPUs in artificial intelligence and high-performance computing environments supports the need for data center cooling technologies.

- The increasing use of OTT and streaming services has led to a growth in data, fostering market development. Also, the increasing data from online streaming services such as Disney+ Hotstar, Hulu, and Netflix is expected to drive the demand for data center cooling systems.

- Market players are taking action to augment their consumer base by focusing on expanding their global footprint and service offerings. For instance, in March 2024, the intelligent power management company Eaton declared the North American launch of an innovative modular data center solution for organizations that are seeking to rapidly fulfill the increasing requirements for machine learning, edge computing, and AI. Eaton's SmartRack modular data centers primarily combine IT racks and cooling and service enclosures to build a performance-optimized data center solution for critical IT equipment with up to 150 kW of equipment load.

- The market's growth is expected to be hampered by the rising need for various adaptability requirements and power shortages worldwide. Also, the use of inefficient cooling system designs, such as outdated infrastructure or poorly optimized layouts, leading to energy inefficiencies and increased operational costs, and rising energy prices, which might make the cooling expenses prohibitive, are some of the factors that can restrain the market's growth during the forecast period.

Data Center Cooling Market Trends

The IT and Telecom Segment is Expected to Witness the Highest Growth

- The exponential growth of data generated by information technology significantly necessitates efficient data centers, driving demand for advanced cooling solutions. As data centers expand to accommodate increasing workloads and storage demands, the heat generated becomes a significant matter of concern, creating demand for effective cooling solutions.

- The adoption of cloud storage has been increasing over the years. To provide more efficient work processes, cloud storage providers such as Microsoft, AWS, and Google are expanding their capacity to store in the cloud. These companies make their investments in hyperscale transactions. As a result, the demand for data center cooling systems is expected to grow due to the expansion of Software-as-a-Service, enabling cloud storage providers to augment their capacity.

- Immersion cooling can be executed in a single-phase or two-phase solution. Single-phase immersion cooling encapsulates the server in a sealed chassis, and the design can be configured in a rackmount or standalone format. However, two-phase immersion cooling locations the server in the liquid, but the liquid transitions during the cooling process. As the fluid warms up and turns to condensation, the water circuit and heat exchanger withdraw the heat. In 2P immersion cooling, dielectric cooling fluid inside a metal holding tank contained with servers is boiled and condensed in a secured cooling system, exponentially growing heat transfer efficiency.

- In May 2023, KT Cloud signed a deal with Immersion 4, a Swiss provider of liquid cooling solutions, to install next-generation immersion cooling technology at KT Cloud data centers. Immersion cooling removes heat by immersing information and communications technology equipment in a dielectric solution where electricity does not flow. This eliminates the imbalance in server room temperatures and fan noise at data centers that can occur with an air-cooling system.

Asia-Pacific is Expected to Register Significant Growth

- Asia-Pacific is estimated to witness the fastest growth rate during the forecast period, mainly due to the rapid development of the network infrastructure. The demand for data generation is increasing in the region, and government policies are promoting more energy-efficient infrastructure, especially in countries like India and China. Also, advancements in technologies such as AI-driven cooling management and liquid cooling systems are reshaping the landscape, driving further adoption in the region.

- China and Japan are among the most important countries that are expected to fuel the market's growth opportunities, significantly based on their ongoing innovations and developments in domains like IoT, ML, and AI. Moreover, the rapidly growing number of data centers in these countries and the government policies to promote more environmentally sound infrastructure across the region are driving the need for better and more effective cooling solutions within these data centers.

- For instance, in April 2024, GDS, an operator and developer of high-performance data centers in Asia, and Gaw Capital Partners, a private equity fund management firm especially focusing on the real estate markets in Asia-Pacific and other high barrier-to-entry markets worldwide, signed a strategic partnership to build a 40 megawatts (MW) data center campus in Tokyo, Japan.

- The Asia-Pacific data center cooling market is primarily fueled by the exponential growth of data consumption and cloud services. As businesses expand their digital infrastructure, the demand for efficient cooling systems to maintain optimal operating temperatures increases. Additionally, stringent regulations regarding energy efficiency and environmental sustainability encourage the adoption of innovative cooling technologies. With emerging economies investing heavily in IT infrastructure, the need for reliable and scalable cooling solutions further fuels market growth.

- In December 2023, the Australian cloud service provider ResetData launched a test and simulation lab for its pioneering liquid-cooled data center server technology. This was one of the first facilities in Asia-Pacific capable of trialing workloads in a liquid-cooled environment. This step empowered local businesses to utilize a more ecological and high-performance Infrastructure-as-a-Service (IaaS) that is essential for strenuous applications like AI and machine learning.

Data Center Cooling Industry Overview

The data center cooling market exhibits a low level of consolidation among key industry players. Notable market leaders include Stulz GmbH, Alfa Laval AB, Schneider Electric SE, Johnson Controls Inc., Vertiv Group Corp., and Asetek A/S. These industry giants, boasting significant market shares, are actively engaged in expanding their customer base throughout the region. Their growth strategies primarily hinge on strategic collaborative efforts aimed at enhancing market share and overall profitability. Moreover, companies such as Schneider Electric SE, Johnson Controls Inc., and Mitsubishi Electric Europe BV offer both liquid and air-based cooling products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Key Cost Considerations for Cooling

- 4.2.1 Analysis of the Key Cost Overheads Related to DC Operations with an Eye on DC Cooling

- 4.2.2 Comparative Study of the Cost and Operational Considerations Related to Each Cooling Technology Based on Key Factors Such as Design Complexity, PUE, Advantages, Drawbacks, and Extent of Utilization of Natural Weather Conditions

- 4.2.3 Key Innovations and Developments in Data Center Cooling

- 4.2.4 Key Energy Efficiency Practices Adopted in Data Centers

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Digitization and Adoption of AI and HPC Workload Around the Globe

- 5.1.2 Emergence of Green Data Centers

- 5.2 Market Challenges

- 5.2.1 Costs, Adaptability Requirements, and Power Outages

- 5.2.2 Supply Chain Disruption Globally

- 5.3 Market Opportunities

- 5.3.1 The Growth of the Digital Economy and Increasing Government's Support across Major Regions

- 5.4 Industry Ecosystem Analysis

6 ANALYSIS OF THE CURRENT DATA CENTER FOOTPRINT IN GLOBAL

- 6.1 Analysis of IT Load Capacity and Area Footprint of Data Centers (For the Period of 2017-2030)

- 6.2 Analysis of the Current DC Hotspots and Scope for Future Expansion Globally

- 6.3 Analysis of Major Data Center Contractors and Operators Across Major Regions

7 INDONESIA DATA CENTER MARKET SEGMENTATION

- 7.1 By Cooling Technology

- 7.1.1 Air-based Cooling

- 7.1.1.1 Chiller and Economizer

- 7.1.1.2 CRAH

- 7.1.1.3 Cooling Tower (Covers Direct, Indirect, and Two-stage Cooling)

- 7.1.1.4 Other Air-based Cooling Technologies

- 7.1.2 Liquid-based Cooling

- 7.1.2.1 Immersion Cooling

- 7.1.2.2 Direct-to-chip Cooling

- 7.1.2.3 Rear-door Heat Exchanger

- 7.1.1 Air-based Cooling

- 7.2 By Type

- 7.2.1 Hyperscalers (Owned and Leased)

- 7.2.2 Enterprise (On-premise)

- 7.2.3 Colocation

- 7.3 By End-user Vertical

- 7.3.1 IT and Telecom

- 7.3.2 Retail and Consumer Goods

- 7.3.3 Healthcare

- 7.3.4 Media and Entertainment

- 7.3.5 Federal and Institutional Agencies

- 7.3.6 Other End-user Verticals

- 7.4 By Region

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia-Pacific

- 7.4.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Vertiv Co.

- 8.1.2 Stulz GmbH

- 8.1.3 Schneider Electric SE

- 8.1.4 Rittal GmbH & Co. KG

- 8.1.5 Alfa Laval Corporate AB

- 8.1.6 Fujitsu General Limited

- 8.1.7 Johnson Controls Inc.

- 8.1.8 Hitachi Ltd

- 8.1.9 CoolIT Systems Inc.

- 8.1.10 Liquid Stack Inc.

- 8.1.11 Asetek Inc. A/S

- 8.1.12 Asperitas

- 8.1.13 Chilldyne Inc.

- 8.1.14 Fujitsu Ltd

- 8.1.15 Mikros Technologies

- 8.1.16 KAORI HEAT TREATMENT Co. Ltd

- 8.1.17 Lenovo Group Limited