|

市場調查報告書

商品編碼

1687400

醫療保健領域的半導體應用:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)Semiconductor Applications in Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

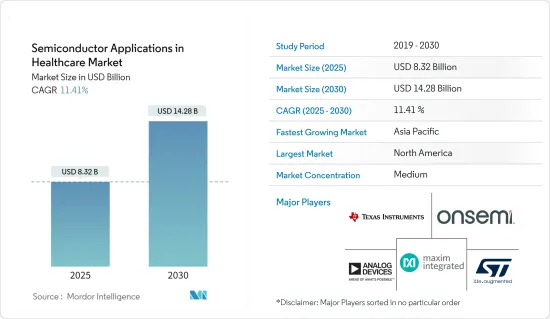

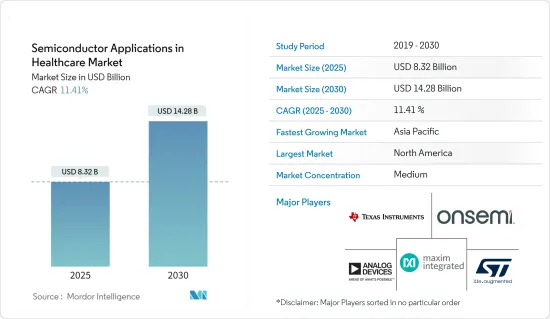

醫療保健市場中的半導體應用規模預計在 2025 年為 83.2 億美元,預計到 2030 年將達到 142.8 億美元,預測期內(2025-2030 年)的複合年成長率為 11.41%。

醫療保健行業使用的大部分設備都依賴半導體製造技術。感測器、積體電路 (IC)、分離式元件、記憶體和電源管理元件等半導體元件正在推動醫學成像、臨床診斷和治療以及攜帶式和家庭醫療保健等領域的各種應用。

主要亮點

- 市場正在見證醫療設備的多種發展,對先進半導體的需求預計將上升。可攜式透析設備一直是市場驅動力,疫情過後,百特等供應商生產的機器已獲得美國食品藥物管理局(FDA)批准,可直接連接患者的處方箋和治療資料電子健康記錄。這些發展正在推動對先進半導體的需求。

- 遠距病人監護設備的使用不斷增加、先進的診斷和治療方法以及非傳染性疾病的高發性等因素預計也將推動醫療保健市場半導體的成長。例如,美國癌症協會預測,2024年美國將診斷出234,580例新發生肺癌和支氣管癌病例。據報道,其中佛羅裡達州的數量最多。有多種治療方案可供選擇,但現代冷凍手術技術可以實現完全康復。

- 此外,儘管癌症預防和治療不斷取得進展,但癌症負擔仍在增加,根據國際癌症研究機構的《世界癌症報告》,預計2018年至2040年間全球癌症病例數將增加50%。 IARC 在 2000 年發現 1,010 萬例新發癌症病例,2018 年發現 1,810 萬例,並預測到 2040 年這一數字將上升到每年 2,700 萬例。

- 大量醫療保健專業人員和醫院仍在使用各種需要達到當前技術標準的傳統硬體,並且無法升級到更新的技術。此外,全球二手醫療技術市場龐大,對此類設備的更大可用性和資金籌措需求阻礙了新技術的發展和採用。

- 俄烏戰爭正在影響半導體供應鏈。俄羅斯和烏克蘭是生產半導體和電子元件及一系列設備的重要原料供應國。衝突可能擾亂供應鏈,造成原料短缺和價格上漲,影響製造商並導致最終用戶成本上升。

- 此外,根據烏克蘭投資局的數據,銅價在 2022 年 3 月初上漲至 10,845 美元/噸,但 2023 年有所回落。俄羅斯與烏克蘭之間的戰爭、能源成本的上升以及歐洲更嚴格的排放標準被認為是銅短缺持續的主要原因。

醫療保健領域半導體應用的市場趨勢

醫療圖像成為成長最快的應用

- 醫療圖像領域包括電腦斷層掃描、磁振造影、X光成像和正電子發射斷層掃描,醫療圖像用於診斷各種疾病,包括癌症和慢性病。

- 隨著技術進步和醫療保健領域的日益普及,醫療輻射設備和技術取得了許多進步。

- 介入性X光成像在過去幾年中取得的關鍵進展之一是專注於核心和支援技術,以便在不增加輻射劑量的情況下提供高品質、高解析度的影像。這是西門子的 Artis Q、飛利浦的 ClarityIQ 和 Q.zen 技術、通用電氣醫療的影像引導系統 (IGS) 和東芝的 Infinix Elite 產品線等技術進步的關鍵驅動力。這些正在推動對先進半導體的需求。

- 由於對診斷放射學的關注度不斷提高以及慢性病負擔的不斷加重,醫療設備業每年進行的影像和診斷測試數量不斷增加。

- 根據聯合國世界人口展望報告,65歲及以上人口數量正穩定增加。預計到2050年,全世界老年人口(60歲以上)數量將增加至20億,其中80%將生活在中低收入國家。因此,老年人口的增加以及整形外科和心血管手術數量的增加預計將進一步推動醫學影像在醫療保健應用中的應用。

- 在醫療領域,牙科應用需要更小、更短的掃描。據李施德林專業口腔護理公司稱,口腔疾病是全球最嚴重的健康問題,影響39億人。因此,牙科領域對X光成像的主要需求預計將增加,從而推動所調查市場對各種半導體的需求。

- 此外,一些公司已經推出了與X光影像分析軟體相關的產品,從而對該領域的成長產生了積極影響。例如,2024 年 1 月,Carestream Health 推出了 DXR-Excel Plus。 DXR-Excel Plus 是一種二合一系統,適用於透視和一般 X 光檢查,可輕鬆為各種檢查提供即時影像,同時提供有助於改善使用者、病患和管理員體驗的功能。

亞太地區可望成為成長最快的市場

- 預計預測期內亞太地區將經歷健康擴張。關鍵成長要素包括增加對研究和研發中心的投資、政府計劃以及促進 IT 和醫療設備及器械市場的政策。此外,該地區也是全球最大的半導體市場。這是由於中國、日本、印度、台灣、韓國和新加坡等國所致。這些國家正在為醫療保健產業的發展做出貢獻。

- 在日本,企業正在投資醫療保健領域,以打造具有前瞻性的業務並實現永續成長。例如,FUJIFILM Holdings推出了新的中期經營計劃“VISION2023”,涵蓋從2022年3月結束的會計年度(2021會計年度)到2023會計年度的三年時間。根據“VISION2023”,該公司將在三年內共投資8.491兆日元,以加速業務成長,主要在醫療保健和高性能材料業務方面。醫療保健業務將擴大為銷售額和營業利潤最大的業務領域,並建立實現永續成長的穩健業務基礎。

- 此外,中國國務院於2014年發布的《國家積體電路產業發展指南》提出了2030年在半導體產業各個領域成為世界領導者的目標。此外,「中國製造2025」舉措也強調了半導體製造對中國未來經濟和社會的重要性。此外,該國在醫療保健領域的支出為 5,740 億美元。

- 此外,韓國是受調查市場中領先的消費者、投資者和創新者之一。韓國在半導體產業和醫療設備製造業的強大地位有助於增強該國在全球半導體醫療保健市場的地位。政府在發展國內市場方面也發揮關鍵作用,主要是為了推動經濟發展。

- 此外,該國正在利用製藥業的人工智慧進一步擴大其市場。據政府稱,韓國人工智慧主導的藥物開發市場預計每年成長 40%,到 2024 年達到 39 億美元。

醫療保健市場中的半導體應用概述

預計預測期內醫療保健半導體市場將以中等速度成長。德州儀器公司、安森美半導體公司、美國模擬裝置公司、美信整合產品公司和意法半導體等市場競爭對手正在採取聯盟和收購等策略來加強其產品組合併獲得永續的競爭優勢。

- 2023 年 11 月,Miller 宣布了收購 Sentron 的策略計劃,Sentron 是一家壓力和 pH 感測器的全整合製造商,旨在透過壓力感測器技術增強醫學理解並實現科學發現。

- 2023 年 11 月杜邦 Livo Healthcare 宣布與意法半導體合作,將意法半導體的多功能微型感測器和控制電子設備融入杜邦的軟性貼片設計中,開發用於遠端生物訊號監測的新型智慧穿戴裝置概念。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

- 評估主要宏觀趨勢的市場影響

第5章 市場動態

- 市場促進因素

- 連網醫療連網型設備的成長

- 醫療保健需要先進的半導體技術

- 市場限制

- 現有硬體的更新和最終產品設備成本的上升

第6章 市場細分

- 按應用

- 醫學影像

- 消費醫療電子產品

- 診斷性病患監測和治療

- 醫療設備

- 按組件

- 積體電路

- 模擬

- 邏輯

- 記憶

- 微型組件

- 光電子

- 感應器

- 分立元件

- 積體電路

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 公司簡介

- Texas Instruments Incorporated

- ON Semiconductor Corporation

- Analog Devices Inc.

- Maxim Integrated Products Inc.

- STMicroelectronics

- NXP Semiconductors NV

- Broadcom Inc.

- ams Osram

- Vishay Intertechnology Inc.

- Renesas Electronics Corporation

第8章投資分析

第9章:市場的未來

The Semiconductor Applications in Healthcare Market size is estimated at USD 8.32 billion in 2025, and is expected to reach USD 14.28 billion by 2030, at a CAGR of 11.41% during the forecast period (2025-2030).

Many devices used in the healthcare industry rely on semiconductor manufacturing technology. Semiconductor components, such as sensors, integrated circuits (ICs), discrete devices, and memory power management devices, are driving various applications in fields, including medical imaging, clinical diagnostics and therapy, and portable and home healthcare.

Key Highlights

- The market is witnessing various developments in medical devices that are expected to increase the need for advanced semiconductors. Portable dialysis machines are gaining market traction, and vendors like Baxter have received FDA clearance post-pandemic that is designed to directly connect electronic medical records for patients' prescriptions and treatment data. Such developments are driving the need for advanced semiconductors.

- Factors like increasing use of remote patient monitoring devices, development in diagnostic and treatment modalities, and high incidence of non-communicable diseases are also expected to drive the growth of the semiconductor in the healthcare market. For instance, the American Cancer Society predicts that there will be 234,580 new cases of lung and bronchus cancer diagnosed in the United States overall in 2024. The state of Florida is reported to have the most significant number of these instances. Even though there are multiple treatment options, modern cryosurgery technology gives a complete cure.

- Furthermore, according to the IARC's World Cancer Report, despite constant progress in cancer prevention and treatment, the global cancer burden is still growing as the number of new cases is anticipated to increase by 50% between 2018 and 2040. IARC detected 10.1 million new cancer cases in 2000 and 18.1 million in 2018, and the number is projected to increase to 27 million new cancer cases per year by 2040.

- A significant number of healthcare professionals and hospitals still use various legacy hardware that need to be in line with current technological standards and are incapable of upgrading to new tech. In addition to this, there is a huge market for pre-owned medical technology worldwide, owing to the need for more availability and funding for such devices, which is hampering the growth and adoption of new technology.

- The Russia-Ukraine War is impacting the supply chain of semiconductors. Being a significant supplier of raw materials for producing semiconductors and electronic components, including various equipment. The dispute has disrupted the supply chain, causing shortages and price increases for these materials, impacting manufacturers and potentially leading to higher costs for end users.

- Further, according to UkraineInvest, copper prices escalated to USD 10,845/mt in early March 2022; however, it eased somewhat in 2023. The war between Russia and Ukraine, high energy costs, and stricter emissions standards in Europe have been noted as the primary reasons for the continued shortage of copper.

Semiconductor Applications in Healthcare Market Trends

Medical Imaging to be the Fastest-growing Application

- The medical imaging segment consists of computed tomography, magnetic resonance imaging, X-ray, and positron emission tomography that find applications in diagnosing various diseases, such as cancer and chronic diseases, via medical imaging.

- With the advancements in technology and the increasing adoption of technology in the healthcare sector, many advances were seen in medical radiation regarding equipment and techniques.

- Over the past few years, one of the significant advancements in interventional X-ray has been an increased focus on core and supporting technologies to provide high-quality, high-resolution images without a corresponding increase in radiation dose. This has been a critical driver behind technological advancements, such as Siemens' Artis Q, Philips' ClarityIQ and Q.zen technology, GE Healthcare's image-guided systems (IGS), and Toshiba's Infinix Elite product line. These have been driving the demand for advanced semiconductors.

- Owing to the increasing focus on radiological diagnostic tests and the rising burden of chronic diseases, the medical devices industry is witnessing growth in yearly imaging and diagnostic tests performed.

- According to the United Nations World Population Prospects, the number of people aged 65 years and over is steadily increasing. The number of older people (60 years and older) around the world is estimated to increase to 2 billion by 2050, of which 80% will live in low-income and middle-income countries. Therefore, the growing elderly population and increasing number of orthopedic and cardiovascular procedures are likely to further promote the adoption of medical imaging in healthcare applications.

- In the medical sector, dental applications require smaller and shorter scans. According to the Listerine Professional, oral conditions are the most faced health issues affecting 3.9 billion people globally. Therefore, in the dental sector, the primary demand for X-ray imaging is expected to increase and drive the demand for various semiconductors in the market studied.

- Furthermore, several companies are launching products associated with X-ray image analysis software to positively impact the segment's growth. For example, in January 2024, Carestream Health launched the DXR-Excel Plus, which is a two-in-one system for both fluoroscopy and general radiology that facilitates real-time images for a wide range of exams while providing features that help create an enhanced experience for users, patients, and administrators.

Asia-Pacific is Expected to be the Fastest-growing Market

- Asia-Pacific is expected to expand healthy during the forecast period. Key growth factors include increased investment in research and innovation centers, government programs, and policies to promote the IT and healthcare equipment and devices market. Additionally, the region is also the world's largest semiconductor market. This is due to countries like China, Japan, India, Taiwan, South Korea, and Singapore. These countries contribute to the growth of the healthcare segment.

- In Japan, companies invest in healthcare to build advanced businesses and achieve sustainable growth. For instance, FUJIFILM Holdings Corporation launched a new medium-term management plan, VISION2023, covering three years from the fiscal year ending March 2022 (FY2021) to FY2023. Over three years, VISION2023 foresees investments totaling USD 8.491 trillion to accelerate business growth, focusing on healthcare and highly functional materials businesses. The healthcare business will be expanded to the most considerable revenue and operating income segment to build a robust business foundation that enables sustainable growth.

- Moreover, China's State Council's 2014 National Integrated Circuit Industry Development Guidelines set the goal of becoming a world leader in all areas of the semiconductor industry by 2030. Furthermore, the Made in China 2025 initiative emphasizes semiconductor manufacturing as crucial to China's future economy and society. In addition, the country spent USD 574 billion on the healthcare sector.

- Additionally, South Korea is one of the major consumers, investors, and innovators in the market studied. South Korea's strong presence in the semiconductor industry and medical device manufacturing is helping the country strengthen its presence in the global semiconductor healthcare market. The government also plays a significant role in developing the domestic market, mainly to drive its economy.

- Moreover, the country utilizes AI in its pharmaceutical industry, further expanding the market. According to the government, South Korea's AI-driven drug development market is expected to grow by 40% annually and reach USD 3.9 billion in 2024.

Semiconductor Applications in Healthcare Market Overview

The semiconductor in the healthcare market is expected to grow moderately during the forecast period. The major players in the market, like Texas Instruments Incorporated, On Semiconductor Corporation, Analog Devices Inc., Maxim Integrated Products Inc., and STMicroelectronics, are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023: Miller announced its strategic plan to acquire Sentron, which is a fully integrated pressure and pH sensor manufacturing company for advancing medical understanding and enabling scientific discoveries through pressure sensor technology.

- November 2023: DuPont Liveo Healthcare announced its collaboration with STMicroelectronics to develop a new smart wearable device concept for remote biosignal monitoring, which employs multifunctional microsensors and control electronics from ST embedded in a flexible patch design from DuPont.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Key Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Connected Devices in Medicines

- 5.1.2 Need for Advanced Semiconductor Technology for Better Medical Care

- 5.2 Market Restraints

- 5.2.1 Revamp of the Existing Hardware and High Equipment Cost of the End-use Product

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Medical Imaging

- 6.1.2 Consumer Medical Electronics

- 6.1.3 Diagnostic Patient Monitoring and Therapy

- 6.1.4 Medical Instruments

- 6.2 By Component

- 6.2.1 Integrated Circuits

- 6.2.1.1 Analog

- 6.2.1.2 Logic

- 6.2.1.3 Memory

- 6.2.1.4 Micro Components

- 6.2.2 Optoelectronics

- 6.2.3 Sensors

- 6.2.4 Discrete Components

- 6.2.1 Integrated Circuits

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 ON Semiconductor Corporation

- 7.1.3 Analog Devices Inc.

- 7.1.4 Maxim Integrated Products Inc.

- 7.1.5 STMicroelectronics

- 7.1.6 NXP Semiconductors NV

- 7.1.7 Broadcom Inc.

- 7.1.8 ams Osram

- 7.1.9 Vishay Intertechnology Inc.

- 7.1.10 Renesas Electronics Corporation