|

市場調查報告書

商品編碼

1687747

測試、檢驗和認證 (TIC):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Testing, Inspection, And Certification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

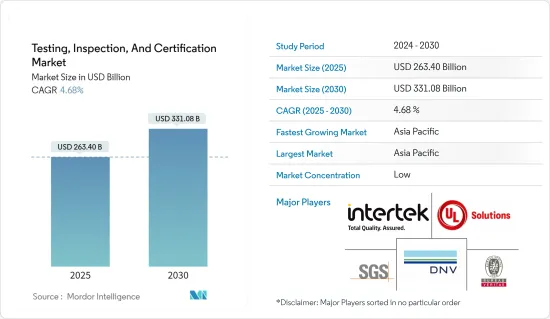

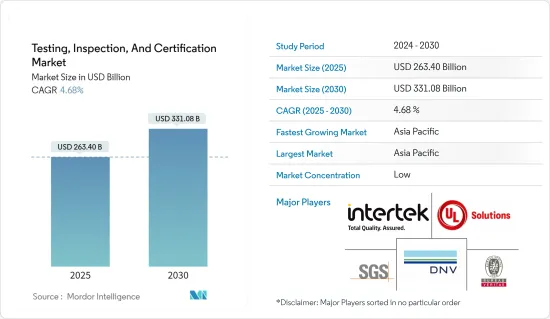

測試、檢驗和認證 (TIC) 市場規模預計在 2025 年為 2,634 億美元,預計到 2030 年將達到 3,310.8 億美元,預測期內(2025-2030 年)的複合年成長率為 4.68%。

測試涉及按照特定程序確定物件或系統的一個或多個特性。它是評估產品或系統的性能、功能、可靠性和其他相關方面的過程。測試可以在實驗室或現場進行,有助於識別缺陷、弱點和不符合標準和要求的情況。

檢查檢查產品的設計、工藝、安裝等,以確保其符合既定標準。該過程涉及對產品的物理特性、操作能力和法規遵從性的詳細評估。檢查至關重要,並在生產、安裝和定期維護的各個階段進行,以確保符合所需的標準和準則。

目前,全球能源和電力產業正在經歷重大轉型。這種轉變的主要動機是應對氣候變遷、提高能源效率和確保永續的未來。近年來,對節能工藝的投資激增。這項變化背後有許多因素,包括需要減少溫室氣體排放、降低能源消費量和降低營運成本。節能過程涵蓋廣泛的技術,包括先進的隔熱材料、節能照明系統和高效能暖通空調系統。

近年來,環境污染問題受到全世界的廣泛關注。造成這一問題的主要因素之一是汽車產業,其中車輛排放氣體起著關鍵作用。

更重視車輛排放測試和認證的主要原因是車輛排放對環境造成的有害影響。一氧化碳、氮氧化物和粒狀物等有害污染物會造成空氣污染和氣候變遷。這些污染物不僅惡化空氣質量,也導致臭氧層的破壞。政府旨在透過實施嚴格的排放標準和測試方法來減輕這些環境危害。

近年來,TIC 市場已看到各行各業的法規、標準和認證不斷增加。因此,供應鏈變得更加複雜和相互關聯,涉及多個相關人員、供應商、製造商和經銷商。全球化也增加了這種複雜性,因為產品來自不同的地區,每個地區都受到監管。

在當前情況下,宏觀經濟狀況仍然不穩定,參與者認為,高利率、通貨膨脹、景氣衰退恐慌和地緣政治緊張局勢加劇等宏觀趨勢將繼續在世界部分地區出現,這可能會影響未來的工業活動和TIC市場的產品需求。 2024年4月,聯合國貿易和發展會議(UNCTAD)預測全球經濟成長將放緩至2.6%,略高於通常被認為是景氣衰退的2.5%。

測試、檢驗和認證 (TIC) 市場趨勢

能源和化學品是最大的終端用戶市場

- 鑑於潛在的危險,安全是能源和化學領域的首要任務。 TIC 服務有助於檢驗是否符合安全法規和業界標準。例如,在化學工業中,TIC 可確保管道、儲存槽和鑽井設備的完整性,從而最大限度地降低事故風險。 TIC 有助於評估製造流程和危險物質處理的安全性。

- TIC 的服務對於維護能源和化學領域的產品品質至關重要。透過嚴格的測試、檢驗和認證,TIC 確保其產品符合要求的標準。在可再生能源領域,TIC檢驗太陽能板、風力發電機和能源儲存系統系統的性能和耐用性。在化學產品中,TIC 有助於評估純度、成分和品質規格的符合情況。

- 永續性和環境責任現在對於能源和化學品領域至關重要。 TIC 的服務可協助您評估並盡量減少您的營運對環境的影響。環境測試有助於識別污染物並監測空氣、水和土壤品質。 TIC 也協助遵守環境法規,例如排放控制和廢棄物管理。

- TIC 服務對於維護整個供應鏈中的產品完整性和可追溯性至關重要。這包括驗證原料的來源和品質、在生產的各個階段進行檢查以及對出口和分銷的最終產品進行認證。

- 在能源和電力領域,安全檢查對於防止事故、保護工人和維護安全的工作環境至關重要。這些檢查評估設備、機械和基礎設施是否有潛在危險。消防安全檢查、電氣安全審核和氣體洩漏檢測是為了識別風險和實施糾正措施而進行的一些安全檢查。

- 2023年11月,ScottishPower Renewables與DNV簽署了為期三年的合約。 DNV將為酵母英吉利三號計劃提供全面檢驗服務。服務範圍包括到 2026 年對全球計劃和供應商現場進行現場檢查、供應商評估和品管服務。酵母英吉利中心執行董事表示,酵母英吉利三號風電場將於 2026 年開始營運,屆時將成為世界第二大風電場。酵母英吉利三號風電場預計將在加強英國能源安全和供應清潔可再生能源方面發揮關鍵作用。

- 根據世界能源監測報告,到2024年6月,中國將有129個風電場運作,其中大部分是離岸風電場,位居世界首位。繼中國之後,其他擁有大量離岸風電場的國家包括英國、德國和越南。離岸風力發電受益於比陸上風力發電更強的風速,從而帶來發電量的增加。 SSR 在風力發電機控制系統中發揮重要作用,有助於調整葉片螺距和偏航方向。其精確、可靠的運作對於最大限度地提高渦輪機的性能和有效獲取風力發電至關重要。

亞太地區實現強勁成長

- 中國是市場成長的主要貢獻者。透過發展國內產業並由此加速出口、實施嚴格標準以及快速都市化,該國已成為一個具有吸引力的國家,為該國的 TIC 創造了各種機會。

- 中國的「中國製造2025」計畫將5G定位為新興產業。這為中國企業在國際市場上提高競爭力和創新能力提供了機會,並防止低品質或競爭產品進入市場,並可透過特定行業的認證來實現。

- 為了推動逐步自由化,中國政府實施了優惠政策,允許外國公司進入。中國各省的TIC市場大部分都是由本地公司佔據。政府透過消除國際 TIC 供應商進入中國當地市場和開展業務的障礙,鼓勵外商對 TIC 領域進行投資。

- 例如,2024年4月,MPR China Certification GmbH及其子公司MPR International GmbH和中國認證公司揭露與CERTANIA建立策略夥伴關係。這個快速發展的集團專門提供測試、檢驗和認證 (TIC) 服務。此次合作標誌著 MPR 取得了重大成就,並將加速公司的成長舉措。

- 日本政府宣布了一系列能源政策,目標是到2050年實現碳中和。這些政策旨在電力、工業和交通等關鍵領域大幅減少溫室氣體排放。特別是,政府為電力產業設定了雄心勃勃的2030年目標。這些目標包括增加對可再生能源發電的投資,發展核能發電,減少石化燃料發電。

- 預計電力和能源領域的各種發展將創造市場機會。例如,2024年4月,GE Vernova燃氣發電業務宣布,已獲得韓國電力公司(KEPCO)子公司韓國西部電力公司(KOWEPO)的訂單,將為KOWEPO位於韓國忠清南道公州的發電廠訂單GE Vernova 7HA.02燃氣渦輪機和H65發電機。

- 都市化加快、人口結構變化和零售貿易的穩定成長正在推動印度食品加工產業的成長。需求的增加導致食品和飲料公司的產量激增。這些公司透過推出新產品和擴大現有產品線來利用不斷成長的中階人口,從而支持市場成長。

測試、檢驗和認證 (TIC) 行業概覽

全球測試、檢驗和認證 (TIC) 市場分散,有各種參與者,包括 Intertek Group PLC、SGS SA、Bureau Veritas、UL Solutions Inc、DNV AS、Eurofins Scientific SE、Dekra SE、ALS Limited 等。所研究的測試、檢驗和認證 (TIC) 市場中競爭公司之間的競爭態勢非常激烈,預計在預測期內將保持不變。

現有市場和新市場的現有企業正在採用數位轉型策略。公司正在進行重大的併購活動,預計將加劇市場競爭。鑑於預期的市場成長、日益全球化數位化趨勢的上升,現有的 TIC 公司預計將在預測期內將擴張和產品創新活動納入其核心策略。

整體來看,預計市場競爭將會加劇。我們預期未來幾年產業整合程度將大幅提升,競爭對手之間的競爭也將更加激烈。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素和 COVID-19 對 TIC 產業的影響

第5章 市場動態

- 市場促進因素

- 增加對能源效率流程的投資以及能源和電力領域智慧電網的廣泛使用

- 增加車輛排放測試和認證

- 市場限制

- 由於供應鏈複雜,評估專案的前置作業時間增加

第 6 章 無損檢測服務業分析

- 當前市場需求

- 市場區隔

第7章 市場區隔

- 按服務類型

- 測試和檢驗服務

- 身份驗證服務

- 依採購類型

- 外包

- 內部

- 按行業

- 消費品和零售

- 食品和農業

- 石油和天然氣

- 建築與工程

- 能源與化工

- 工業製造

- 交通運輸(航太、鐵路)

- 工業和汽車

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 挪威

- 亞洲

- 中國

- 日本

- 韓國

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 土耳其

- 奈及利亞

- 北美洲

第8章 競爭格局

- 公司簡介

- Intertek Group PLC

- SGS SA

- Bureau Veritas SA

- UL Solutions Inc.

- DNV GL

- Eurofins Scientific SE

- Dekra SE

- ALS Limited

- BSI Group

- CIS Commodity Inspection Services BV

- MISTRAS Group Inc.

- Element Materials Technology(Temasek Holdings)

- TUV SUD

- Applus Services SA

- Kiwa NV

第9章 投資分析及市場展望

The Testing, Inspection, And Certification Market size is estimated at USD 263.40 billion in 2025, and is expected to reach USD 331.08 billion by 2030, at a CAGR of 4.68% during the forecast period (2025-2030).

Testing involves the determination of one or more characteristics of an object or system according to a specific procedure. It is the process of evaluating the performance, functionality, reliability, and other relevant aspects of a product or system. Testing can be conducted in laboratories or on-site, and it helps identify any defects, weaknesses, or non-compliance with standards or requirements.

Inspection entails scrutinizing a product's design, process, or installation to verify its adherence to defined standards. This process involves a detailed assessment of a product's physical characteristics, operational capabilities, and regulatory compliance. Inspections are pivotal and can occur at different junctures, such as during production, installation, or routine upkeep, guaranteeing alignment with requisite standards and guidelines.

The global energy and power sector is currently experiencing a substantial transformation. This shift is primarily motivated by the imperatives of combating climate change, enhancing energy efficiency, and securing a sustainable future. In recent years, there has been a surge in investments in energy-efficient processes. This change can be attributed to various factors, including the need to reduce greenhouse gas emissions, decrease energy consumption, and lower operational costs. Energy-efficient processes encompass a wide range of technologies, such as advanced insulation, energy-efficient lighting systems, and high-efficiency HVAC systems.

In recent years, the issue of environmental pollution has gained significant attention worldwide. One of the major contributors to this problem is the automotive sector, with vehicle emissions playing a crucial role.

The primary reason for the growing emphasis on automotive emission testing and certification is the detrimental impact of vehicle emissions on the environment. Harmful pollutants like carbon monoxide, nitrogen oxides, and particulate matter contribute to air pollution and climate change. These pollutants not only degrade air quality but also contribute to the depletion of the ozone layer. By implementing stringent emission standards and testing procedures, governments aim to mitigate these environmental hazards.

In recent years, the TIC market has witnessed a proliferation of regulations, standards, and certifications across various industries. This has resulted in a more complex and interconnected supply chain involving multiple stakeholders, suppliers, manufacturers, and distributors. Globalization has also amplified this complexity, with products being sourced from different regions, each subject to its regulations.

In the current scenario, the macroeconomic situation remains volatile, and players continue to see macro trends such as high interest rates, inflation, fear of recession, and geopolitical tensions increasing in some parts of the world, which can impact industrial activities in the future and the demand for products in the TIC market. In April 2024, UN Trade and Development (UNCTAD) forecast global economic growth to slow down to 2.6%, marginally above the 2.5% threshold commonly associated with a recession, which would lower the market growth.

Testing, Inspection, and Certification Market Trends

Energy and Chemicals to be the Largest End-user Vertical

- Given the potential hazards, safety stands as a top priority in the energy and chemicals sector. TIC services help verify compliance with safety regulations and industry standards. For instance, in the chemical industry, TIC ensures the integrity of pipelines, storage tanks, and drilling equipment, minimizing the risk of accidents. TIC helps evaluate the safety of manufacturing processes and handling hazardous substances.

- TIC services are essential in maintaining product quality across the energy and chemicals segment. Through rigorous testing, inspection, and certification, TIC ensures that products meet the required standards. In the renewable energy sector, TIC verifies the performance and durability of solar panels, wind turbines, and energy storage systems. For chemical products, TIC helps assess purity, composition, and adherence to quality specifications.

- In the energy and chemicals sector, sustainability and environmental responsibility are now pivotal. TIC services aid in assessing and minimizing the environmental impact of operations. Environmental testing helps identify pollutants and monitor air, water, and soil quality. TIC also supports compliance with environmental regulations, such as emissions control and waste management.

- TIC services are crucial for maintaining product integrity and traceability across supply chains. This includes verifying the origin and quality of raw materials, conducting inspections at various stages of production, and certifying the final products for export or distribution.

- Safety inspections are crucial in the energy and power sector to prevent accidents, protect workers, and maintain a safe working environment. These inspections involve assessing equipment, machinery, and infrastructure for potential hazards. Fire safety inspections, electrical safety audits, and gas leak detection are some of the safety inspections carried out to identify risks and implement corrective measures.

- In November 2023, ScottishPower Renewables awarded DNV a three-year contract. DNV will provide integrated inspection services for the East Anglia Three project. The scope includes site inspections, vendor evaluations, and quality management services, spanning both project and vendor sites worldwide until 2026. As per the Managing Director for the East Anglia Hub, East Anglia Three is set to be the world's second-largest wind farm when it comes into operation in 2026. It is anticipated to play a key role in enhancing the United Kingdom's energy security and providing clean, renewable energy that would facilitate it to reach net zero.

- As per the Global Energy Monitor report, in June 2024, China led the world with 129 operational wind farms, predominantly offshore. Following China, the countries with significant offshore wind farm presence include the United Kingdom, Germany, and Vietnam. The offshore setting benefits from stronger wind speeds, translating to increased electricity generation compared to onshore installations. SSRs are crucial in wind turbine control systems, facilitating blade pitch and yaw orientation adjustments. Their precise and reliable operation is vital for maximizing turbine performance and capturing wind energy efficiently.

Asia Pacific to Register Major Growth

- China is significantly investing in the market's growth. The country has become an attractive spot through developing indigenous industries and subsequent acceleration in exports, the introduction of stringent standards, and rapid urbanization, which creates various opportunities for TIC in the country.

- China's "Made in China 2025" initiative has identified 5G as an emerging industry. It offers opportunities for Chinese enterprises to become more competitive and innovative in the international market and prevent low-quality and counterfeit goods from entering the market, which can be achieved through domain-specific certifications.

- The Chinese government has implemented beneficial policies to allow foreign entities to establish a presence in the country to promote gradual liberalization. Local companies dominate the majority of the TIC market in various Chinese provinces. The government has promoted foreign investments in the TIC sector by removing obstacles for international TIC providers to enter and function in the mainland market.

- For instance, in April 2024, MPR China Certification GmbH and its subsidiaries MPR International GmbH and China Certification Corporation revealed their strategic alliance with CERTANIA. This rapidly expanding group specializes in testing, inspection, and certification (TIC) services. This partnership signifies a significant achievement for MPR, enabling the company to expedite its growth initiatives.

- In pursuit of carbon neutrality by 2050, the Japanese government has unveiled a series of energy policies. These policies target significant reductions in greenhouse gas emissions across key sectors, including electric power, industry, and transportation. Specifically, the government has set ambitious 2030 targets for the electric power sector. These targets involve ramping up investments in renewable energy, bolstering nuclear generation, and scaling back reliance on fossil fuels for electricity production.

- Various developments in the power and energy sector are expected to create opportunities for the market studied. For instance, in April 2024, GE Vernova's Gas Power business announced it had secured an order from Korea Western Power Co. Ltd (KOWEPO), a subsidiary of Korea Electric Power Corporation (KEPCO), to provide a GE Vernova7HA.02 gas turbine and a H65 generator for KOWEPO's power station in Gongju-si, Chungcheongnam-do Republic of Korea.

- The growing urbanization, changing demographics, and steady growth in retail have propelled the growth of the food processing industry in India. This increased demand has led to a surge in production from food and beverage companies. These companies are capitalizing on the growing middle-class population by introducing new products and expanding their existing product lines, thus supporting the market growth.

Testing, Inspection, and Certification Industry Overview

The global testing, inspection, and certification market is fragmented with the presence of various companies like Intertek Group PLC, SGS SA, Bureau Veritas, UL Solutions Inc., DNV AS, Eurofins Scientific SE, Dekra SE, ALS Limited, etc. The intensity of competitive rivalry in the testing, inspection, and certification market studied is high and expected to remain the same over the forecast period.

Both existing and new market incumbents are adopting a digital innovation strategy. Companies are engaging in significant merger and acquisition activities that are expected to intensify market competition. Existing TIC companies are expected to continue incorporating expansion and product innovation activities into their core strategies over the forecast period, considering the anticipated market growth, increasing globalization, and rising digitalization trends.

Overall, the market studied is expected to be highly competitive. With high consolidation expected over the next few years, the competitive rivalry will increase further.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macro Economic Factors and COVID-19 on the TIC Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Investments in Energy Efficiency Process and Increasing Usage of Smart Grids in the Energy and Power Sector

- 5.1.2 Rising Automotive Emission Testing and Certification

- 5.2 Market Restraint

- 5.2.1 Increase in Lead Times for Assessment Programs Due to the Growing Complexity of the Supply Chain

6 ANALYSIS OF THE NDT SERVICE INDUSTRY

- 6.1 Current Market Demand

- 6.2 Market Breakdown

7 MARKET SEGMENTATION

- 7.1 By Service Type

- 7.1.1 Testing and Inspection Service

- 7.1.2 Certification Service

- 7.2 By Sourcing Type

- 7.2.1 Outsourced

- 7.2.2 In-house

- 7.3 By End-user Vertical

- 7.3.1 Consumer Goods and Retail

- 7.3.2 Food and Agriculture

- 7.3.3 Oil and Gas

- 7.3.4 Construction and Engineering

- 7.3.5 Energy and Chemicals

- 7.3.6 Manufacturing of Industrial Goods

- 7.3.7 Transportation (Aerospace and Rail)

- 7.3.8 Industrial and Automotive

- 7.3.9 Other End-user Verticals

- 7.4 By Geography

- 7.4.1 North America

- 7.4.1.1 United States

- 7.4.1.2 Canada

- 7.4.2 Europe

- 7.4.2.1 United Kingdom

- 7.4.2.2 Germany

- 7.4.2.3 France

- 7.4.2.4 Spain

- 7.4.2.5 Norway

- 7.4.3 Asia

- 7.4.3.1 China

- 7.4.3.2 Japan

- 7.4.3.3 South Korea

- 7.4.3.4 India

- 7.4.4 Australia and New Zealand

- 7.4.5 Latin America

- 7.4.5.1 Brazil

- 7.4.5.2 Mexico

- 7.4.6 Middle East and Africa

- 7.4.6.1 Saudi Arabia

- 7.4.6.2 United Arab Emirates

- 7.4.6.3 Qatar

- 7.4.6.4 Turkey

- 7.4.6.5 Nigeria

- 7.4.1 North America

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Intertek Group PLC

- 8.1.2 SGS SA

- 8.1.3 Bureau Veritas SA

- 8.1.4 UL Solutions Inc.

- 8.1.5 DNV GL

- 8.1.6 Eurofins Scientific SE

- 8.1.7 Dekra SE

- 8.1.8 ALS Limited

- 8.1.9 BSI Group

- 8.1.10 CIS Commodity Inspection Services BV

- 8.1.11 MISTRAS Group Inc.

- 8.1.12 Element Materials Technology (Temasek Holdings)

- 8.1.13 TUV SUD

- 8.1.14 Applus Services SA

- 8.1.15 Kiwa NV