|

市場調查報告書

商品編碼

1689700

永續食品服務包裝:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Sustainable Foodservice Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

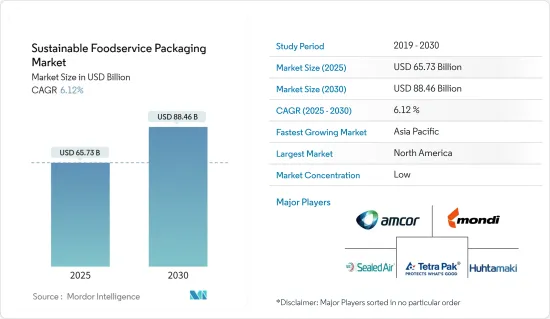

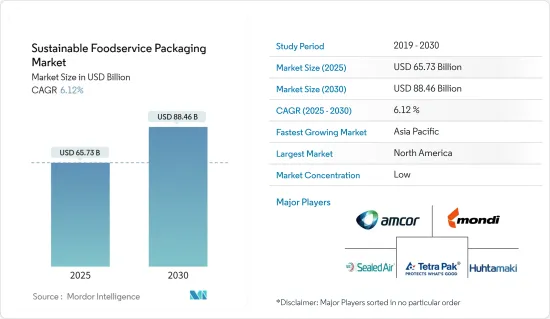

永續食品服務包裝市場規模預計在 2025 年為 657.3 億美元,預計到 2030 年將達到 884.6 億美元,預測期內(2025-2030 年)的複合年成長率為 6.12%。

主要亮點

- 隨著客戶對環境問題和包裝洩漏影響的關注度不斷提高,包裝的永續性正成為影響產業的關鍵趨勢。因此,各個領域都出現了嚴格的永續性要求。餐飲業擔心塑膠包裝對環境的影響,正轉向再生材料,推動市場研究。越來越多的公司採用可回收和生物分解性的材料,這不僅有助於減少碳排放,而且還能滿足有環保意識的消費者群體的需求。

- 城市人口的快速成長推動了對已調理食品和已調理食品食品的需求,從而增加了餐飲業對永續包裝解決方案的需求。因此,餐飲業對永續包裝解決方案的需求日益增加。都市化推動人口向都市區集中,增加了對簡便食品的需求。這一趨勢在大都會圈尤其明顯,因為繁忙的生活方式需要快速簡便的膳食解決方案,從而增加了對食品包裝的依賴。

- 在全部區域,都市化、不斷變化的生活方式、現代忙碌的工作生活以及對線上食品平台日益成長的依賴正在重塑餐飲服務和格局。這項變化推動了該行業對永續包裝解決方案的需求。網路食品宅配服務的便利性導致一次性包裝的激增,推動了對更多永續替代品的需求。為了應對這一問題,各公司正在開發創新包裝,這種包裝不僅環保,而且還能在運輸過程中保持食品的品質和安全。

- 隨著產業向廢棄物未來轉變,包裝創新問題(包括新材料、補充系統和回收解決方案)正成為焦點。雀巢透過雀巢包裝科學研究所內部進行了廣泛的研究,並設立了 2.5 億瑞士法郎的永續包裝風險基金,以支持專注於這些關鍵領域的新興企業。該基金旨在加速尖端永續包裝技術的開發和應用,並確保新的解決方案有效且可擴展。

- 雖然永續包裝的好處顯而易見,但必須注意的是,其成本明顯高於傳統的外食方式。這種成本差異是由於材料採購(原始材料和再生材料)、供應鏈和製造流程(該行業仍在發展中)目前都缺乏規模經濟,阻礙了市場成長。高成本還在於開發符合行業標準和消費者期望的永續包裝解決方案所需的先進技術和研究。

永續食品服務包裝市場的趨勢

快餐店預計在終端用戶中引領市場

- 快餐店 (QSR) 注重快速服務和價格實惠,與注重最低限度餐桌服務和自助服務的傳統餐飲場所有所區別。然而,該行業對永續性的立場並不一致。

- 從歷史上看,QSR 一直與不太環保的做法聯繫在一起,例如使用發泡聚苯乙烯杯、塑膠蓋、紙板容器、基因改造蔬菜和無機肉,但這種趨勢正在轉變。隨著顧客越來越重視環保服務,許多速食店紛紛轉向更綠色、更環保的選擇。

- 一些快餐店,尤其是那些以提供有機食品而聞名的快餐店,正在積極採用環保做法來減少其碳排放。這些努力包括採購有機和當地種植的農產品、使用生物分解性的包裝和實施節能業務。

- 此外,該行業的夥伴關係正在不斷增多,這在很大程度上是由於對永續包裝解決方案的需求不斷成長。這些合作通常包括與專門從事環保材料和技術的供應商合作,進一步促進產業的永續性。例如,2024 年 6 月,包裝解決方案公司 Saika Group 與主要企業的快速消費品製造商億滋國際聯手推出了一款創新的紙製品。該產品專為糖果零食、餅乾和巧克力市場的多件包裝而設計。新的包裝可以在紙質廢物流中回收,並且可以熱封。此外,它還具有靈活性,可以根據所需的最終外觀製造塗層或無塗層的產品。

亞太地區佔最大市場佔有率

- 亞太地區是中國和印度等人口稠密的新興經濟體的所在地,該地區對餐飲服務的需求正在激增。同時,人們開始明顯轉向永續包裝,該地區預計將在未來幾年引領這一趨勢。這種轉變是由消費者對環境問題意識的不斷提高和政府減少塑膠廢棄物的嚴格監管所推動的。

- 塑膠長期以來一直是包裝中為消費者提供便利的基石,但其主導地位正在喪失。儘管具有成本效益,塑膠在食品工業中的應用正在超越紙板、玻璃和金屬等傳統材料。然而,塑膠的耐用性使得它如此吸引人,但同時也意味著它不可分解,並造成了印度 43% 的污染。塑膠廢棄物對環境的影響促使公共和私營部門探索永續的替代方案。

- 印度鐵路公司和印度航空等公司認知到形勢的緊迫性,已承諾用環保紙和木質刀叉餐具取代塑膠,標誌著整個行業的轉變。這些努力是永續性運動的一部分,包括減少碳足跡和促進循環經濟。從大公司到本土品牌,人們越來越傾向於放棄使用一次性塑膠,轉而選擇可回收、可重複使用和可堆肥的替代品。預計這項轉變不僅可以減少環境破壞,還能實現全球永續性目標。

永續食品服務包裝產業概況

在永續食品服務包裝市場,Amcor Limited、Sealed Air Corporation 和 Mondi PLC 等知名公司正在透過策略夥伴關係、聯盟和創新舉措推動成長。這些努力包括開發環保包裝解決方案、投資研發和擴大產品系列。這些活動正在推動市場發展勢頭並滿足對永續包裝選擇日益成長的需求。

- 2024 年 3 月,SEE 推出了創新的紙基網,幫助食品加工商和零售商減少塑膠使用量,同時滿足消費者對紙包裝日益成長的需求。該產品以 CRYOVAC 阻隔成型紙品牌銷售,由 90% 的 FSC 認證纖維製成。據 SEE 稱,用這種阻隔紙取代傳統的 PET/PE 網可顯著減少底網包裝中 77% 的塑膠使用量。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 競爭程度

- 替代品的威脅

- 生態系分析

- 評估微觀經濟因素對產業的影響

第5章 市場動態

- 市場促進因素

- 線上食品訂購服務將推動市場

- 消費者偏好轉向可回收和環保材料

- 市場限制

- 永續食品服務包裝所用材料的高回收成本可能會阻礙市場成長

第6章 市場細分

- 依產品類型

- 瓦楞紙箱和紙箱

- 托盤、盤子、食品容器、碗

- 泡殼

- 其他產品類型

- 按最終用戶

- 速食店

- 全方位服務餐廳

- 機構

- 飯店業

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Amcor PLC

- Mondi PLC

- Sealed Air Corporation

- Tetra Pak International SA

- Huhtamaki Oyj

- Winpak Limited

- Amhil North America

- Sonoco Products Company

- WestRock Company

- Dart Container Corporation

第8章投資分析

第9章:市場的未來

The Sustainable Foodservice Packaging Market size is estimated at USD 65.73 billion in 2025, and is expected to reach USD 88.46 billion by 2030, at a CAGR of 6.12% during the forecast period (2025-2030).

Key Highlights

- With a rising customer focus on environmental concerns and the repercussions of package leaks, sustainability in packaging emerges as a pivotal trend shaping the industry. Consequently, stringent sustainability mandates are emerging across various sectors. The foodservice industry, alarmed by the environmental impact of plastic containers, is pivoting toward recycled materials, propelling the market studied. Companies are increasingly adopting recycled and biodegradable materials to meet these new standards, which not only help in reducing the carbon footprint but also cater to the eco-conscious consumer base.

- The surge in urban population growth is fueling the demand for prepared and ready-to-eat foods, consequently bolstering the need for sustainable packaging solutions in the foodservice sector. This, in turn, is set to drive the market in the coming years. Urbanization leads to a higher concentration of people in cities, which increases the demand for convenient food options. This trend is particularly evident in metropolitan areas where busy lifestyles necessitate quick and easy meal solutions, thereby increasing the reliance on foodservice packaging.

- Across major regions, urbanization, evolving lifestyles, the rush of modern work life, and a growing reliance on online food platforms are reshaping the food service and landscape. This shift is amplifying the call for sustainable packaging solutions in the sector. The convenience of online food delivery services has led to a surge in single-use packaging, prompting a need for more sustainable alternatives. Companies are responding by developing innovative packaging that is not only eco-friendly but also maintains the quality and safety of food during transit.

- As the industry steers toward a waste-free future, challenges like packaging innovation, encompassing novel materials, refill systems, and recycling solutions, come to the forefront. Nestle, bolstering commitment, conducts extensive in-house research via the Nestle Institute of Packaging Sciences, earmarking a CHF 250 million sustainable packaging venture fund to back startups focusing on these pivotal areas. This fund aims to accelerate the development and adoption of cutting-edge sustainable packaging technologies, ensuring that new solutions are both effective and scalable.

- While the benefits of sustainable packaging are evident, it is crucial to note that its costs are notably higher than traditional foodservice alternatives. This cost disparity is attributed to the sourcing of materials, both virgin and recycled, and the industry's nascent supply chains and manufacturing processes, all of which currently lack economies of scale, thus impeding market growth. The higher costs are also due to the advanced technology and research required to develop sustainable packaging solutions that meet industry standards and consumer expectations.

Sustainable Foodservice Packaging Market Trends

Quick-service Restaurants are Expected to Drive the Market Among End Users

- Quick-service restaurants (QSRs) prioritize fast service and affordability, distinguishing them from traditional dining establishments with their minimal table service and self-service focus. However, the industry's stance on sustainability has been inconsistent.

- While QSRs have historically been associated with less eco-friendly practices, such as styrofoam cups, plastic lids, cardboard holders, genetically modified vegetables, and inorganic meat, the tide is turning. With customers increasingly valuing eco-conscious services, many QSRs are pivoting toward greener, more eco-friendly options.

- Some QSRs, particularly those known for their organic offerings, are actively adopting eco-friendly practices to shrink their carbon footprint. These practices include sourcing organic and locally grown produce, using biodegradable packaging, and implementing energy-efficient operations.

- Moreover, the sector is witnessing a surge in partnerships, largely driven by the growing demand for sustainable packaging solutions. These collaborations often involve working with suppliers who specialize in eco-friendly materials and technologies, further promoting sustainability within the industry. For instance, in June 2024, Saica Group, a packaging solutions company, and Mondelez, a leading fast-moving consumer goods manufacturer, collaborated to introduce an innovative paper-based product. This product is specifically designed for multipack offerings in the confectionery, biscuits, and chocolate markets. The new packaging is recyclable within the paper waste stream and compatible with heat-seal processes. Additionally, it offers the flexibility of being produced either coated or uncoated, depending on the desired final appearance.

Asia-Pacific Accounts for the Largest Market Share

- The Asia-Pacific region, home to densely populated and emerging economies like China and India, is witnessing a surge in the demand for food services. Concurrently, there is a notable shift toward sustainable packaging, with the region poised to lead this trend in the coming years. This shift is driven by increasing consumer awareness about environmental issues and stringent government regulations to reduce plastic waste.

- While plastic has long been the cornerstone of consumer convenience in packaging, its dominance is being challenged. Despite its cost-effectiveness, plastics have edged traditional materials like corrugated paper boards, glass, and metals in the food industry. Yet, the very durability that makes plastic appealing also renders it non-degradable, leading to a concerning 43% pollution contribution in India. The environmental impact of plastic waste has prompted both public and private sectors to seek sustainable alternatives.

- Recognizing the urgency, entities like the Indian Railways and Air India have pledged to swap plastic for eco-friendly paper and wooden cutlery, signaling a broader industry shift. These initiatives are part of a larger movement toward sustainability, which includes efforts to reduce carbon footprints and promote circular economies. From major corporations to local brands, there is a palpable momentum toward ditching single-use plastics in favor of recyclable, reusable, and compostable alternatives. This transition is expected to not only mitigate environmental damage but also align with global sustainability goals.

Sustainable Foodservice Packaging Industry Overview

In the sustainable foodservice packaging market, prominent companies like Amcor Limited, Sealed Air Corporation, and Mondi PLC are driving growth through strategic partnerships, collaborations, and innovative initiatives. These efforts encompass the development of eco-friendly packaging solutions, investment in research and development, and the expansion of product portfolios. Such activities are enhancing the market's momentum and meeting the rising demand for sustainable packaging options.

- March 2024: SEE introduced an innovative paper-based bottom web designed to assist food processors and retailers in reducing plastic usage while meeting the growing consumer demand for paper packaging. Marketed under the CRYOVAC Barrier Formable Paper brand, this product is composed of 90% FSC-certified fibers. According to SEE, replacing traditional PET/PE webs with this Barrier Formable Paper can achieve a significant 77% reduction in plastic usage in bottom web packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Degree of Competition

- 4.3.5 Threat of Substitutes

- 4.4 Industry Ecosystem Analysis

- 4.5 Assessment of the Impact of Microeconomic Factors on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Online Food Ordering Services Will Drive the Market

- 5.1.2 Shift in Consumer Preferences Toward Recyclable and Eco-friendly Materials

- 5.2 Market Restraints

- 5.2.1 The High Recycling Cost for the Materials Used for the Sustainable Foodservice Packaging Might Hinder the Growth of the Market

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Corrugated Boxes and Cartons

- 6.1.2 Trays, Plates, Food Containers, and Bowls

- 6.1.3 Clamshells

- 6.1.4 Other Product Types

- 6.2 By End Users

- 6.2.1 Quick Service Restaurants

- 6.2.2 Full Service Restaurants

- 6.2.3 Institutional

- 6.2.4 Hospitality

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Mondi PLC

- 7.1.3 Sealed Air Corporation

- 7.1.4 Tetra Pak International SA

- 7.1.5 Huhtamaki Oyj

- 7.1.6 Winpak Limited

- 7.1.7 Amhil North America

- 7.1.8 Sonoco Products Company

- 7.1.9 WestRock Company

- 7.1.10 Dart Container Corporation