|

市場調查報告書

商品編碼

1549738

黏附包裝:市場佔有率分析、行業趨勢和成長預測(2024-2029)Adherence Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

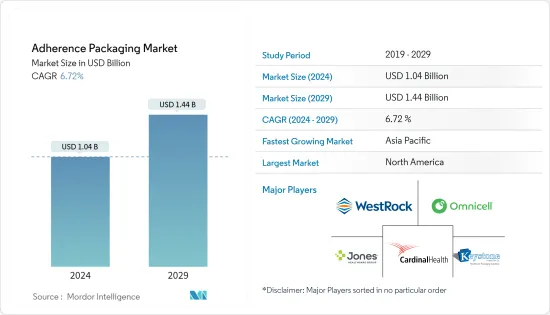

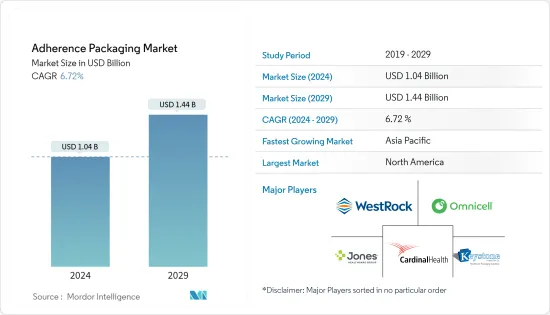

黏附包裝市場規模預計到2024年為10.4億美元,預計到2029年將達到14.4億美元,在預測期內(2024-2029年)複合年成長率為6.72%。

主要亮點

- 依從性包裝主要用於醫療保健領域,它取代了傳統的藥盒,以簡化藥物管理。這種包裝適合患者的日常生活,使其更容易按照醫療保健提供者的指示及時、準確地服用處方箋。

- 在慢性阻塞性肺病(COPD)患者中,藥物治療和疾病管理依從性差是導致緊急住院的已知因素。因此,對黏附包裝的需求正在上升,預計在不久的將來會有顯著成長。

- 此外,人們對盡量減少藥物浪費的興趣日益濃厚,這也正在加強依從性包裝產業的發展。廢棄物不僅給醫療保健財政帶來壓力,也帶來環境風險。然而,該行業面臨挑戰,特別是高昂的實施、安裝和維護成本,這可能會阻礙全球擴張。

- 包裝技術的最新進展正在使用近距離場通訊(NFC) 和無線射頻識別 (RFID) 整合數位擷取功能。這些創新旨在加強檢驗過程。具有被動、主動和互動元素的單位劑量泡殼處於應對鴉片類藥物危機和提高藥物安全性的最前線。被動元素包括基於圖形和文字的警報,而主動功能則利用電子設備進行及時提醒和警報。互動功能讓患者參與該套餐,並協助藥物追蹤和成癮管理。

- 一些公司正在積極尋求新產品發布和策略合作夥伴關係等策略,以在不斷變化的環境中保持競爭力。特別是,Acute Technology,一家技術主導的藥物依從性公司,正在推廣 Hydra Communications Gateway。該技術可以讓智慧型手機使用者以電子方式監控他們的藥物劑量,解決管理每週托盤中分配的藥物的問題。

- 吉利德(Gilead)和禮來(Eli Lilly)等製藥巨頭處於對抗 COVID-19 的前線。他們的股價飆升,反映出人們重新關注創新,特別是在感染疾病領域。由於迫切尋找 COVID-19 治療方法,活動激增,可能會對黏附包裝市場產生重大影響。總之,先進包裝和主要製藥公司對 COVID-19 治療的投資增加預計將推動黏附包裝市場的顯著成長。

遵守包裝市場趨勢

大批量包裝預計將顯著成長

- 藥物依從性的日益重要和藥物同步的好處正在刺激多藥物包裝解決方案的出現。多劑量泡殼卡有幾個好處,包括簡化給藥時間表以減少混亂、鼓勵自我治療以及減少每月去藥房的次數。大量研究支持多劑量泡殼包裝可改善藥物依從性和健康結果,尤其是與藥物治療管理 (MTM) 結合時。

- 印度品牌股權基金會(IBEF)的報告顯示,2024會計年度(截至2024年2月)印度藥品出口額達250億美元,高於2023會計年度的254億美元。在全球供應鏈中斷、停工和製造業低迷的背景下,這種彈性是顯著的。值得注意的是,美國、比利時、南非、英國和巴西已成為印度 2023 會計年度的主要出口目的地。印度在全球製藥業中發揮著舉足輕重的作用,其表現顯示出其在危機面前堅定不移的信譽,尤其是在疫情不斷升級的情況下。

- 據 IBEF 稱,印度在美國境外營運的符合 USFDA 要求的公司數量最多。值得注意的是,全球排名前 20 名的學名藥公司中有 8 家是印度公司,超過一半(55%)的出口針對高度監管的市場。作為主要疫苗出口國,印度滿足世界衛生組織(WHO)65-70%的疫苗需求。

- Omnicel 的研究結果強調了多藥包裝對病人依從性的影響。最初,該組患者的依從率為 80%,但在試驗結束時躍升至 90%。另一方面,僅依賴錠劑的患者的服藥順從率為 56%。 Omnicell 的解決方案 SureMed+ 是一種 7 天、4 劑量、冷封、雙折卡,在 Omnicell 提供多藥泡殼卡後,霍利奧克健康中心採用了該解決方案。

- 電子商務公司越來越關注便利性、合規性和增強老年人的醫療保健套餐。亞馬遜去年收購了 Pillpack,證實了線上藥物輸送的需求不斷成長,並表明人們對多功能醫療包的興趣日益濃厚。隨著 COVID-19 的爆發,多劑量包裝至關重要,因為它旨在簡化處方箋處理、最大限度地減少「接觸點」並減少自我用藥錯誤。

北美市場佔據主導地位

- 北美地區是一個發展中地區,擁有豐富的經濟、人口老化和先進的醫療保健服務系統。然而,各國的人口規模、醫療保健支出、國內生產總值(GDP) 水準和醫療保險體系差異很大。美國擁有先進的初級保健社區、廣泛的醫療和生命科學研究活動、高健康支出強度以及龐大的製藥、醫療用品和醫療設備產業,是世界上最大的黏附包裝產品市場之一。

- 此外,美國懲教機構的用藥依從性正在改善。大多數懲教設施中的人們依靠外部藥房來處方箋。該機構也可能有一名藥劑師在場。然而,這類人員往往有限,依賴集中地點提供藥品,並依靠現場護理人員管理人員和其他人員進行配藥。因此,為了確保病人用藥依從性,越來越需要一種減輕工作人員負擔、管理良好的配藥管理系統。

- 據 Parata Systems 稱,藥物依從性差每年給美國造成 3,000 億美元的損失。小袋包裝降低了醫療成本並改善了患者的治療效果。隨著市場上帶狀包裝的增加,患者意識預計會對藥房帶來壓力,而沒有適當的包裝會被拋在後面。該公司針對藥局推出了 Parata PASSTM 36。 Parata Systems 是一家藥局自動化系統供應商,產品包括管瓶灌裝、依從性包裝工作流程和病患體驗解決方案,推出了一款名為 PASSTM 36 的袋包裝機。

- 該地區的公司致力於幫助人們保持用藥依從性並改善治療結果。為了實現這一目標,我們擴大與創新市場公司合作,特別是那些與藥局有密切聯繫的公司。透過這樣做,這些公司的目標是將其服務範圍擴大到他們所服務的患者。透過利用其初級包裝專業知識以及與製藥領導者的關係,這些公司準備開發增強依從性的解決方案並擴大其影響。

- 堅持用藥對於改善治療結果至關重要,並且可以顯著減少昂貴的住院費用。在這種情況下,數位化治療支持備受關注。這種支援超越了傳統的穿戴式感測器和應用程式,擴展到連網型包裝、輸送系統和先進的藥物依從性監測。因此,合作夥伴關係和協作不斷湧現,為藥房提供雲端基礎的軟體和設備。這些工具使藥局能夠快速實施依從性解決方案,透過最少的工作流程調整來增強患者的健康之旅,並打開新收益來源的大門。

黏合包裝產業概述

黏附包裝市場是半靜態的,由一些重要的參與者組成。 Cardinal Health Inc.、WestRock Company、Omnicell Inc.、Parata Systems LLC 和 Keystone Folding Box Co. 等公司佔有很大佔有率。市場也見證了多種產品的發布和合作夥伴關係。

2024年4月,製藥、生物技術和化妝品行業的全球合作夥伴Gerresheimer最近與美國數位健康公司RxCap合作並收購了其少數股權。透過此次合作,Geresheimer 的子公司 Centor 擁有在美國藥房分銷 RxCap 依從性解決方案的獨家權利。這些解決方案包括連網型和雲端基礎的軟體,可增強 Centor 的現有產品。此舉凸顯了 Gerresheimer 向客戶提供整合包裝和數位監控解決方案的承諾。

2024 年 4 月,RICHARDS Packaging Inc. 旗下的加拿大醫療供應商 Healthmark Services Ltd. 與 JFCRx 合作。透過此次合作,Healthmark Services Ltd 將成為 JFCRx 貼標袋包裝、測試和半自動管瓶灌裝製藥自動化設備的唯一供應商。 JFCRx 以「分析主導的自動化」而聞名,為藥房提供即時資料洞察,以提高業務效率和盈利。該公司的旗艦產品 TruPak 整合了先進的硬體和軟體,透過提供 RFID 智慧罐、可自訂的袋子尺寸和即時補充等功能來節省勞動力並提高安全性。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 減少藥物浪費的需求日益增加

- 服藥不依從率高

- 市場挑戰

- 自動化系統的安裝和維護成本高昂

- 缺乏對藥物依從性包裝的認知

第6章 政府法規

第7章 市場區隔

- 材料

- 塑膠(PE、PET、PVC、PP)

- 紙和紙板

- 鋁

- 類型

- 單位劑量包裝

- 多藥包裝

- 包裝類型

- 泡殼

- 小袋

- 其他包裝類型

- 最終用戶產業

- 藥局

- 醫院

- 其他最終用戶產業

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第8章 競爭格局

- 公司簡介

- Westrock Company

- Keystone Folding Box Co.

- Cardinal Health Inc.

- Omnicell Inc.

- Jones Healthcare Group

- Drug Package LLC

- Parata Systems LLC

- Manrex Limited

- Medicine-On-Time LLC

- Rx Systems Inc.

第9章投資分析

第10章市場的未來

The Adherence Packaging Market size is estimated at USD 1.04 billion in 2024, and is expected to reach USD 1.44 billion by 2029, growing at a CAGR of 6.72% during the forecast period (2024-2029).

Key Highlights

- Adherence packaging, predominantly utilized in healthcare, serves to streamline medication management, replacing traditional pill organizers. This packaging aligns with patients' daily routines, facilitating timely and accurate prescription intake as directed by healthcare providers.

- Inadequate adherence to pharmacological therapy and illness management is a known factor leading to emergency hospitalizations among those with chronic obstructive pulmonary disease (COPD). Consequently, the demand for adherence packaging is on the rise, with projections indicating substantial growth in the near future.

- Furthermore, a heightened focus on minimizing drug waste is bolstering the adherence packaging sector. Waste not only strains healthcare finances but also poses environmental risks. Yet, the industry faces challenges, notably in the form of high implementation, installation, and maintenance costs, which could potentially impede its global expansion.

- Recent advancements in packaging technology are integrating digital capture features utilizing near-field communication (NFC) or radio frequency identification (RFID). These innovations aim to enhance verification processes. Unit-dose blisters, equipped with passive, active, and interactive elements, are at the forefront of combating the opioid crisis and bolstering pharmaceutical safety. Passive components include graphic or text-based alerts, while active features leverage electronics for timely reminders or alarms. Interactive functionalities empower patients to engage with the packaging, aiding in dose recording and addiction management.

- Several companies are actively pursuing strategies, like new product launches and strategic partnerships, to stay competitive in this evolving landscape. Notably, Acute Technology, a company in tech-driven medication adherence, is championing the Hydra Communications Gateway. This technology could potentially allow smartphone users to monitor their dosages electronically, addressing concerns around the control of medications dispensed via weekly trays.

- Pharmaceutical giants like Gilead and Eli Lilly are at the forefront of the battle against COVID-19. Their stocks are surging, reflecting a renewed focus on innovation, especially in infectious diseases. This heightened activity, driven by the urgent quest for COVID-19 treatments, is poised to have a substantial impact on the adherence packaging market. In conclusion, the advancements and increased investments in COVID-19 therapies by leading pharmaceutical companies are expected to drive significant growth in the adherence packaging market.

Adherence Packaging Market Trends

Multi-dose Packaging is Expected to Witness Significant Growth

- The rising significance of medication adherence and the advantages of synchronizing medications have spurred the emergence of multi-dose packaging solutions. Multi-dose blister cards offer several benefits, such as streamlining dosage schedules to reduce confusion, facilitating self-medication, and reducing monthly pharmacy visits. Numerous studies underscore the enhanced adherence and health outcomes associated with multi-med blister packs, especially when coupled with medication therapy management (MTM).

- As reported by the India Brand Equity Foundation (IBEF), India's drug and pharmaceutical exports in FY 2024 (until February 2024) reached USD 25.0 billion, from USD 25.4 billion recorded in FY 2023. This resilience is notable, given the backdrop of global supply chain disruptions, lockdowns, and subdued manufacturing. Notably, the United States, Belgium, South Africa, the United Kingdom, and Brazil emerged as India's primary export destinations in FY 2023. India's performance underscored its pivotal role in the global pharma landscape, showcasing unwavering reliability even in the face of crises, notably exemplified during the COVID-19 pandemic.

- According to IBEF, India boasts the highest number of USFDA-compliant companies operating outside the United States. Notably, 8 out of the top 20 global generic companies hail from India, and more than half (55%) of the country's exports target highly regulated markets. Given its status as a major vaccine exporter, India fulfills a substantial 65-70% of the World Health Organization's (WHO) vaccine demand.

- Findings from an Omnicell survey underscore the impact of multimed packaging on patient adherence. Initially, patients in this group achieved an 80% adherence rate, which surged to an impressive 90% by the trial's end. In contrast, patients relying solely on pill bottles managed a modest 56% adherence rate. Omnicell's solution, the SureMed+, a seven-day, four-time pass, cold-seal, bi-fold card, was adopted by Holyoke Health Center following Omnicell's provision of multimed blister cards.

- E-commerce players are increasingly focusing on enhancing convenience, compliance, and tailored healthcare packaging for the elderly. Amazon's acquisition of PillPack last year underscores the rising demand for online medication delivery, hinting at a growing interest in multi-med packs. With the onset of COVID-19, multi-dose packaging is crucial, aiming to streamline prescription processing, minimize 'touchpoints,' and mitigate self-medication errors.

North America Dominates the Market

- The North American region is developed with prosperous economies, aging population segments, and advanced medical delivery systems. Still, the countries vary measurably in population size, healthcare spending intensities, aggregate gross domestic product (GDP) levels, and the structure of health insurance plans. With an advanced primary medical community, extensive medical and life science research activities, high healthcare spending intensity, and large pharmaceutical and medical supply and device industries, the United States accounts for one of the world's largest geographical markets for adherence packaging products.

- Furthermore, the United States is witnessing improved medication adherence in the correctional setting. The incarcerated population in most correctional facilities relies on an outside pharmacy to fill their prescriptions. An onsite pharmacist may be provided in some situations. However, such staff is often restricted, relying on a centralized location to supply drugs and an onsite nurse manager or similar to dispense. This strengthens the case for dispensing administration systems that are low-effort for personnel while yet being well-managed to ensure patient adherence.

- As per Parata Systems, non-adherence to medication, on average, costs USD 300 billion/year in the United States. Pouch packaging has reduced the cost of care and improved patient outcomes. With the growing presence of strip packaging in the market, patient awareness is expected to pressure pharmacies without proper packaging to be left behind. The company launched Parata PASSTM 36, targeting pharmacies. Parata Systems, being a provider of pharmacy automation systems, including vial-filling, adherence packaging, and workflow and patient experience solutions, launched a pouch packager named PASSTM 36.

- Businesses in the region are focused on a mission: helping people stay adherent to their medications and improving their care outcomes. To achieve this, they are increasingly forging partnerships with innovative market players, particularly those with strong ties to pharmacies. By doing so, these businesses aim to expand the reach of the patients they serve. Leveraging their expertise in primary packaging and their relationships with pharmacy leaders, these companies are poised to develop enhanced adherence solutions, thereby magnifying their impact.

- Adherence to medication is pivotal to successful therapy outcomes and can significantly reduce the need for costly hospitalizations. In this landscape, digital therapy support is gaining prominence. This support extends beyond traditional body-worn sensors and apps, encompassing connected primary packaging, delivery systems, and advanced medication adherence monitoring. Consequently, collaborations and alliances are emerging, offering cloud-based software and devices to pharmacies. These tools empower pharmacies to swiftly introduce adherence solutions, bolstering patients' health journeys with minimal workflow adjustments and paving the way for new revenue streams.

Adherence Packaging Industry Overview

The adherence packaging market is semi-consolidated and consists of a few significant players. Companies like Cardinal Health Inc., WestRock Company, Omnicell Inc., Parata Systems LLC, and Keystone Folding Box Co. hold substantial market shares. The market is also witnessing multiple product launches and partnerships.

In April 2024, Gerresheimer, a global partner for the pharma, biotech, and cosmetics industries, recently partnered with US digital health company RxCap, acquiring a minority stake. In this collaboration, Gerresheimer's subsidiary, Centor, gains exclusive US pharmacy distribution rights for RxCap's adherence solutions. These solutions include connected prescription vial closures and cloud-based software, enhancing Centor's existing offerings. This move underscores Gerresheimer's commitment to providing customers with integrated packaging and digital monitoring solutions.

In April 2024, Canadian medical supplier Healthmark Services Ltd, a division of RICHARDS Packaging Inc., teamed up with JFCRx. This partnership designates Healthmark Services Ltd as the sole provider of JFCRx's adherence pouch packaging, inspection, and semi-automated vial filling pharmacy automation equipment. JFCRx, known for its "analytics-driven automation," empowers pharmacies with real-time data insights, enhancing operational efficiency and profitability. Their flagship product, TruPak, integrates advanced hardware and software, offering features like RFID smart canisters, customizable pouch sizes, and on-the-fly replenishment, ensuring both labor savings and enhanced safety.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Need to Minimize Medication Wastage

- 5.1.2 High Rate of Medication Non-adherence

- 5.2 Market Challenges

- 5.2.1 High Installation and Maintenance Costs of Automated Systems

- 5.2.2 Lack of Awareness Regarding Medication Adherence Packaging

6 GOVERNMENT REGULATIONS

7 MARKET SEGMENTATION

- 7.1 Material

- 7.1.1 Plastic (PE, PET, PVC, and PP)

- 7.1.2 Paper and Paperboard

- 7.1.3 Aluminum

- 7.2 Type

- 7.2.1 Unit-dose Packaging

- 7.2.2 Multi-dose Packaging

- 7.3 Packaging Type

- 7.3.1 Blisters

- 7.3.2 Pouches

- 7.3.3 Other Packaging Types

- 7.4 End-user Industry

- 7.4.1 Pharmacies

- 7.4.2 Hospitals

- 7.4.3 Other End-user Industries

- 7.5 Geography

- 7.5.1 North America

- 7.5.2 Europe

- 7.5.3 Asia-Pacific

- 7.5.4 Latin America

- 7.5.5 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Westrock Company

- 8.1.2 Keystone Folding Box Co.

- 8.1.3 Cardinal Health Inc.

- 8.1.4 Omnicell Inc.

- 8.1.5 Jones Healthcare Group

- 8.1.6 Drug Package LLC

- 8.1.7 Parata Systems LLC

- 8.1.8 Manrex Limited

- 8.1.9 Medicine-On-Time LLC

- 8.1.10 Rx Systems Inc.