|

市場調查報告書

商品編碼

1549740

成形充填密封(FFS) 包裝機:市場佔有率分析、產業趨勢、成長預測(2024-2029 年)Form-Fill-Seal (FFS) Packaging Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

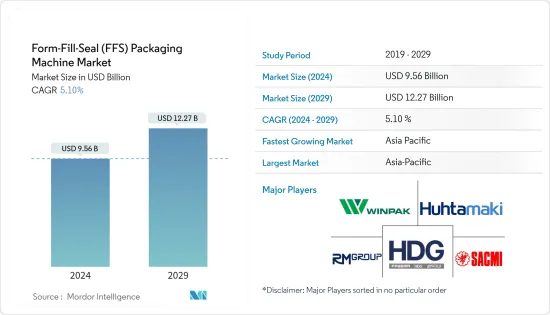

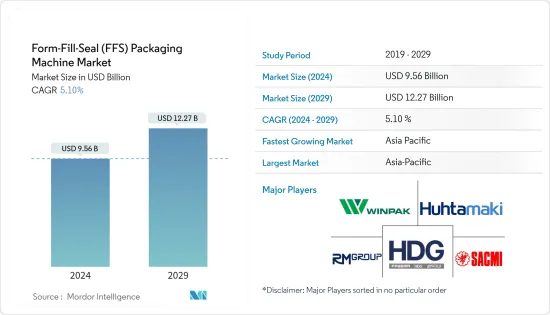

成形充填密封(FFS)包裝機市場規模預計2024年為95.6億美元,預計2029年將達到122.7億美元,複合年成長率預計將以5.10%的速度成長。

主要亮點

- 成形充填密封(FFS) 包裝機利用電腦控制的自動化技術來生產各種彈性到剛性的包裝,同時降低污染風險。在包裝機中,連續自動成形充填密封(FFS) 包裝機因其速度和效率而成為受歡迎的選擇,超越了傳統的獨立成型、填充和密封機器。

- 成形充填密封薄膜是一種多功能、經濟高效且環保的包裝選擇。非常適合消費品和食品的自動化包裝,提供最高水準的防潮、氧氣和紫外線保護。這些薄膜用於小袋、小袋和袋子,易於使用、耐用,並促進清潔、高效的分配。與水平式和垂直成形充填密封機相容,非常適合大規模生產。透過採用 FSS 薄膜,公司可以提高生產率,同時降低包裝成本。

- 由於消費品製造商努力留住員工,因此對能夠幫助進行轉換和故障排除的機器的需求不斷成長。 FFS 包裝機現在配備了運動控制和人機介面 (HMI),以促進流程的執行。

- FFS 袋包裝機已被證明是一種多功能解決方案,快速、準確、經濟高效,並自動提高效率和盈利。然而,以中速包裝麵粉、爽身粉、乳清粉等低密度產品是不經濟的。 FFS 包裝有這樣的包裝格式障礙。

- 隨著世界繼續遭受 COVID-19 大流行的影響,包裝衛生和安全成為消費者和企業關注的問題。大流行的蔓延表明,人們很容易透過人際接觸和交叉污染而被感染。許多政府制定了嚴格的法規,以確保食品的生產、包裝和分銷安全。

成形充填密封(FFS) 包裝機市場趨勢

水平成形充填密封(HFFS)設備預計市場將出現高速成長

- 水平成形充填密封(HFFS) 設備(通常稱為 FFS 機器)對於大批量生產設施中的包裝系統至關重要。這些機器簡化了食品的包裝、密封和運輸過程。

- 選擇HFFS機器不僅可以提高工作效率,還可以提高成本效率。這些機器專為速度和精度而設計,其性能優於體力勞動和手動包裝等傳統方法。 HFFS 擅長產品的快速包裝和真空密封,確保耐用性。特別值得注意的是這款包的容量高達 2.2 磅。

- 有些 HFFS 機器配備兩個成型站和兩個密封站,無需停機即可自動更改包裝尺寸。此功能對於頻繁更換的工廠非常有用。 HFFS 機器有通用的設定程序來生產高品質、形狀良好的包裝。

- 對包裝食品的需求不斷成長,加上軟包裝的成本效率,預計將推動對包裝袋的需求。軟包裝委託進行的哈里斯民意調查顯示,83% 的品牌所有者已經使用某種形式的軟包裝。這種穩定的採用支持了袋包裝市場的擴張,並刺激了對水平式 FFS 機器的需求。

- 整合技術的進步增強了這些 HFFS 機器的功能,允許快速調整外部變數。例如,Loesch Verpackungstechnik 提供適用於巧克力、格蘭諾拉麥片和蛋白棒初級包裝的臥式成形充填密封機。由於人們對包裝食品的日益偏好以及軟包裝的成本效益,對袋子的需求正在上升。

亞太地區市場預計將出現高速成長

- 中國人口的成長、可支配收入的增加以及食品和飲料行業的擴張正在推動市場的成長。該地區生活方式的改變和跨國食品的發展也促進了包裝市場的成長,導致成形充填密封機的使用增加。

- 對優質水的需求不斷成長以及注重健康的飲用習慣預計將增加瓶裝水的消費量,這可能會影響該地區的包裝行業。

- 日本是亞洲主要的製造地,擁有高品質的產品和最佳製造實踐。日本的製造業處於世界領先地位。除了無可挑剔的電子產品和龐大的汽車工業之外,日本還是世界化妝品生產國之一和包裝機最大的消費國之一。

- 根據國際貨幣基金組織的數據,2021年印度人口約13.9億人。據預測,到2026年這數字將增加至14.6億。由於人口眾多,印度預計將成為一個重要的消費市場,並推動對 FFS包裝器材的巨大需求。

- 韓國、澳洲、台灣、泰國、印尼和馬來西亞等其他國家也顯示出巨大的潛力,可以奪取顯著的市場佔有率。由於經濟成長、投資增加以及支持市場擴張的有利政府政策,這些國家正在成為主要企業。這些市場的多樣性和動態性為公司建立穩固的地位並實現顯著成長提供了眾多機會。

成形充填密封(FFS) 包裝機產業概述

成形充填密封(FFS) 包裝機市場較為分散,大型製造商面臨來自小型公司的激烈競爭。市場上的公司在價格、分銷網路、技術創新和品牌聲譽方面競爭。併購、合作和創新是這些公司為確保長期成長所採取的主要策略。主要公司包括 Winpak Ltd 和 HDG Verpackungsmaschinen GmbH。

- 2024 年 4 月 Rovema 是一家以永續包裝解決方案而聞名的公司,專注於高生產率和靈活性,在 Warsaw Pack 2024 上展示了一款創新產品:帶有按鈕閥的完全可回收咖啡袋。這項創新與現有的 BVC 機器無縫相容,突顯了 Robema 對創新和永續性的承諾。此次發表的核心產品是 Robema BVC260 垂直成形充填密封機。這台機器可確保快速穩定的咖啡包裝,即使在使用替代包裝材料時也能讓您保持高生產水準。

- 2024 年 5 月,ProMach 品牌 Matrix 將在墨西哥城舉行的 2024 年 Expo Pack Mexico 展會上展示直立式成形充填密封機 MVI-280E 和預製袋填充/密封機 Pacraft TT-8D-N,展位 1702 宣布計劃MVI-280E 是 Matrix 的經濟型多功能直立式成形充填密封設備。相容於 2 至 11 英吋寬、2 至 15 英吋長的袋子。可容納直徑達 14 英吋、寬度達 23 英吋的捲筒。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 木槌概述

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 消費者議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 微觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 無菌包裝產業需求不斷成長

- 寵物食品包裝需求增加

- 市場限制因素

- 對於低密度產品來說不經濟

第6章 市場細分

- 依設備類型

- 直立式成形充填密封裝置

- 飲食

- 藥品

- 個人護理

- 其他最終用戶

- 成形充填密封裝置

- 飲食

- 藥品

- 個人護理

- 其他最終用戶

- 直立式成形充填密封裝置

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Winpak Ltd

- HDG Verpackungsmaschinen GmbH

- Huhtamaki Oyj

- REES MACHINERY GROUP LIMITED

- SACMI Imola SC

- HAVER Continental Ltd

- Mega Plast GmbH

- Duravant LLC

- MDC Engineering Inc.

- Busch Machinery

- Rovema GmbH

- Fres-co System USA Inc.

- ProMach Inc.(Matrix Packaging Machinery LLC)

- PFM Group

- Viking Masek Global Packaging Technologies

- Nichrome Packaging Solutions

- Triangle Package Machinery Company

- Scholle IPN

- Bosch Rexroth AG

第8章投資分析

第9章市場的未來

The Form-Fill-Seal Packaging Machine Market size is estimated at USD 9.56 billion in 2024, and is expected to reach USD 12.27 billion by 2029, growing at a CAGR of 5.10% during the forecast period (2024-2029).

Key Highlights

- Form-fill-seal (FFS) machines leverage automated computer-controlled technology to craft packages, spanning from flexible to rigid, while mitigating contamination risks. Among packaging machines, the continuous automatic form-fill-seal (FFS) machine stands out as a prevalent choice, prized for its swiftness and efficiency, outpacing traditional standalone machines for forming, filling, and sealing.

- Form-fill-seal films stand out as a versatile, cost-effective, and eco-friendly packaging choice. They excel in automatically packaging consumer goods and food, providing top-tier protection against moisture, oxygen, and UV rays. These films, used in creating pouches, sachets, and bags, are user-friendly and durable and facilitate clean and efficient distribution. Their compatibility with horizontal and vertical form-fill-seal machines makes them ideal for large-scale production. By adopting FSS films, businesses can boost productivity and simultaneously cut packaging expenses.

- Since consumer-packaged goods companies struggle with employee retention, the need for machinery that helps with changeovers and troubleshooting problems is on the rise. FFS packaging machines now come with motion control and human-machine interfaces (HMIs), making executing the process easier.

- FFS pouch packing machines have been demonstrated to be quick, accurate, cost-effective, and versatile solutions that enhance efficiency and profitability automatically. However, packing low-density items such as wheat flour, talcum powder, and whey powder at medium speeds is uneconomical. FFS packaging has a hurdle with this form of packaging.

- Packaging hygiene and safety are a concern for consumers and businesses as the world continues to suffer due to the COVID-19 pandemic. The pandemic's spread has demonstrated how easily it may be disseminated through human contact and cross-contamination. Many governments have enacted strict regulations to ensure that food is produced, packed, and distributed safely.

Form-Fill-Seal (FFS) Packaging Machine Market Trends

Horizontal Form-fill-seal Equipment Expected to Register High Market Growth

- Horizontal form-fill-seal (HFFS) machines, commonly referred to as FFS machines, are pivotal in packaging systems within high-production manufacturing facilities. These machines streamline the process of packing, sealing, and shipping food products.

- Opting for HFFS machines not only enhances operational efficiency but also proves cost-effective. These machines, tailored for speed and precision, outpace traditional methods like manual or hand packaging. They excel in swiftly packaging and vacuum-sealing products, ensuring durability. Notably, the bags they create boast a capacity of up to 2.2 pounds.

- Some HFFS machines are equipped with two molding stations and two sealing stations, allowing for automatic changes from one pack size to another with no downtime. This feature is useful in factories where switching is frequent. There are general setup steps to ensure that the HFFS machine produces high-quality and well-shaped packs.

- The growing demand for packaged foods, coupled with the cost efficiency of flexible packaging, is expected to boost the demand for pouches. A Harris Poll, commissioned by Flexible Packaging, reveals that a significant 83% of brand owners are already leveraging some form of flexible packaging. This robust adoption underpins the expansion of the pouch packaging market, subsequently fueling the need for horizontal FFS machines.

- Advancements in integrated technology are enhancing the capabilities of these HFFS machines, allowing for swift adjustments to external variables. For example, Loesch Verpackungstechnik offers a horizontal form-fill-seal machine tailored for the primary packaging of chocolate, granola, and protein bars. The demand for pouches is on the rise, driven by a growing preference for packaged foods and the cost-efficiency of flexible packaging.

Asia-Pacific is Expected to Witness High Market Growth

- The growing population, rising disposable income, and expanding the food and beverage industry in China contribute to market growth. Changing lifestyles and the development of multi-national food shops in the region also contribute to the growth of the packaging market, leading to the increased use of form-fill-seal machines.

- The increasing need for quality water and health-conscious drinking habits are expected to increase the consumption of bottled water, which is likely to influence the region's packaging industry.

- Japan is Asia's major manufacturing hub, with high-quality products and best manufacturing practices. The country is a world leader in terms of manufacturing. Apart from its impeccable electronics and huge automobile industry, Japan is also a global producer of cosmetics and one of the biggest consumers of packaging machinery.

- India boasted a population of around 1.39 billion in 2021, as per the IMF. Projections indicate that this figure will climb to 1.46 billion by 2026. With such vast demographics, India is expected to emerge as a significant consumer market, driving substantial demand for FFS packaging machinery.

- Other countries such as South Korea, Australia, Taiwan, Thailand, Indonesia, and Malaysia also exhibit significant potential to capture a notable market share. These countries are emerging as key players due to their growing economies, increasing investments, and favorable government policies that support market expansion. The diverse and dynamic nature of these markets presents numerous opportunities for businesses to establish a strong presence and achieve substantial growth.

Form-Fill-Seal (FFS) Packaging Machine Industry Overview

The form-fill-seal (FFS) packaging machine market is fragmented as major manufacturers face stiff competition from smaller players. Companies in the market compete in price, distribution network, innovation, and brand reputation. Mergers and acquisitions, partnerships, and technological innovations are some of the primary strategies adopted by these companies to ensure long-term growth. Key players are Winpak Ltd and HDG Verpackungsmaschinen GmbH, among others.

- April 2024: Rovema, renowned for its sustainable packaging solutions emphasizing high output and flexibility, announced its plans to unveil a groundbreaking product at Warsaw Pack 2024, which is a fully recyclable coffee bag featuring a button valve. The innovation is seamlessly compatible with existing BVC machines, underlining Rovema's commitment to innovation and sustainability. At the heart of this launch is the Rovema BVC 260 vertical form-fill-seal machine. This equipment ensures swift and consistent coffee packaging and can maintain high output levels even when utilizing alternative packaging materials.

- May 2024: Matrix, a ProMach brand, announced its plans to showcase its MVI-280E vertical form-fill-seal machine and the Pacraft TT-8D-N pre-made pouch filler/sealer at booth 1702 during Expo Pack Mexico 2024 in Mexico City. The MVI-280E, an economical offering from Matrix, is a versatile vertical form, fill, and seal machine. It is designed to handle bags ranging from 2 to 11 inches in width and 2 to 15 inches in length. It can accommodate rolls up to 14 inches in diameter and 23 inches in width.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Maret Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Microeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from Aseptic Packaging Industry

- 5.1.2 Rising Demand for Pet Food Packaging

- 5.2 Market Restraints

- 5.2.1 Uneconomical for Low-density Products

6 MARKET SEGMENTATION

- 6.1 By Equipment Type

- 6.1.1 Vertical Form-fill-seal Equipment

- 6.1.1.1 Food and Beverage

- 6.1.1.2 Pharmaceuticals

- 6.1.1.3 Personal and Household Care

- 6.1.1.4 Other End Users

- 6.1.2 Horizontal Form-fill-seal Equipment

- 6.1.2.1 Food and Beverage

- 6.1.2.2 Pharmaceuticals

- 6.1.2.3 Personal and Household Care

- 6.1.2.4 Other End Users

- 6.1.1 Vertical Form-fill-seal Equipment

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Rest of Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Winpak Ltd

- 7.1.2 HDG Verpackungsmaschinen GmbH

- 7.1.3 Huhtamaki Oyj

- 7.1.4 REES MACHINERY GROUP LIMITED

- 7.1.5 SACMI Imola SC

- 7.1.6 HAVER Continental Ltd

- 7.1.7 Mega Plast GmbH

- 7.1.8 Duravant LLC

- 7.1.9 MDC Engineering Inc.

- 7.1.10 Busch Machinery

- 7.1.11 Rovema GmbH

- 7.1.12 Fres-co System USA Inc.

- 7.1.13 ProMach Inc. (Matrix Packaging Machinery LLC)

- 7.1.14 PFM Group

- 7.1.15 Viking Masek Global Packaging Technologies

- 7.1.16 Nichrome Packaging Solutions

- 7.1.17 Triangle Package Machinery Company

- 7.1.18 Scholle IPN

- 7.1.19 Bosch Rexroth AG