|

市場調查報告書

商品編碼

1643079

電子製造服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Electronics Manufacturing Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

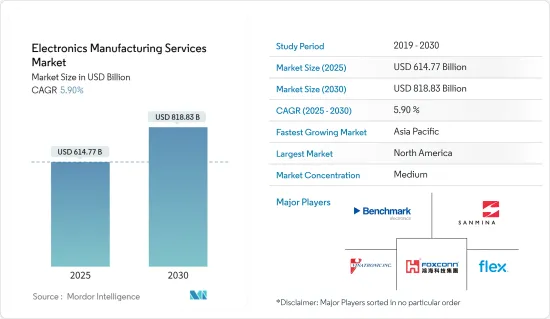

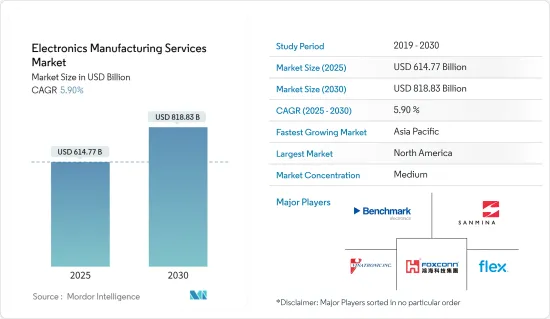

預計 2025 年電子製造服務市場規模為 6,147.7 億美元,到 2030 年將達到 8,188.3 億美元,預測期內(2025-2030 年)的複合年成長率為 5.9%。

主要亮點

- 工業物聯網 (IIoT) 中日益小型化和新技術的採用以及 5G通訊的增強正在徹底改變電子元件的設計和組裝。例如,5G通訊基地台已經開發出MIMO等更好的天線技術,增加了輻射元件的數量和性能。

- 此外,對智慧型手機和智慧型手錶等電子設備的需求正在推動市場成長。根據IBEF預測,到2025年,印度家用電器和家用電子電器產業規模預計將成長一倍以上,達到211.8億美元。此外,許多公司正在尋求減少製造活動中的庫存、設施和設備,並將資本支出的重點轉移到銷售、行銷和研發上。這導致對第三方製造服務提供者外包的需求增加。

- 例如,一家航空電子公司決定將 PCBA 製造轉移給 EMS 合作夥伴,以擴大其產品和服務範圍並避免額外的製造投資。主要要求是符合 AS9100 標準和 PCBA 上的多個 BGA(某些 PCB 上最多 16 層)。

- 各地區政府的措施正在推動市場成長。例如,根據IBEF報道,印度政府已批准14家公司參與IT硬體生產連結獎勵(PLI)計畫。此外,印度政府正考慮允許電子產品設計和製造領域進行 100% 的外商直接投資,並將多品牌零售領域的外商直接投資限額從目前的 49% 提高至 51%。這些發展將大大促進市場成長。

- 從全球來看,中小型企業使用第三方製造服務的趨勢日益成長。這種轉變使您能夠避免在生產線上進行大量的資本投資,並利用服務提供者的設計和製造專業知識。根據國際金融公司(IFC)估計,開發中國家約有 6,500 萬家正規微型、小型和中型企業(MSME)面臨未滿足的資金需求,約佔所有企業的 40%。考慮到全球大多數公司,尤其是新興國家的公司,都屬於中小型企業類別,它們對製造服務提供者的依賴可能會支持 EMS 市場的成長。

- COVID-19 疫情對許多終端用戶產業產生了重大影響,電子製造業也不例外。 IPC調查強調,家用電器因高度依賴中國的製造產能和供應鏈而受到影響。儘管如此,許多電子製造商和相關服務仍被認為是必不可少,因為它們發揮著至關重要的作用,從組裝產品到設計關鍵醫療設備的電路基板。即使在後疫情時代,電子製造業仍將繼續成為經濟和醫療保健領域的驅動力。

電子製造服務市場的趨勢

工業應用可望推動 EMS 需求

- 隨著環境革命的興起,馬達控制對工業馬達的效率要求更高。此外,需要最低成本整合來支援新技術的市場滲透並提高安全性和可靠性。這進一步推動了用於智慧型馬達電壓調節器的數位訊號控制器的電子產品的需求。

- 據 IBEF 稱,到 2025 年,印度電動車 (EV) 市場規模預計將達到 70.9 億美元。此外,CEEW能源金融中心的一項研究表明,到2030年,印度電動車的商機可能達到2,060億美元。

- 工業4.0可望大幅提高工廠資料自動化效率和生產力。工業IoT和人工智慧(AI)的同步發展將推動成長。雖然電子產業距離實現相同的智慧化和自動化水平還有很長的路要走,但電子製造服務市場的最新趨勢表明,向工業 4.0 的演變正在鋪平道路。

- 根據 IBM AI 全球採用指數,到 2023 年,降低成本和流程自動化將成為企業採用 AI 的主要驅動力,佔驅動力的 42%。工業自動化推動電子製造服務市場的成長。人工智慧工具的可訪問性不斷提高、流程自動化程度不斷提高以及人工智慧與主流商業應用的整合將進一步推動人工智慧的擴張。

- 羅克韋爾自動化最近簽署了一項最終協議,收購 CUBIC 公司,後者是一家專門從事電氣面板構造模組化系統的公司。此次合作可望使企業受益,縮短產品上市時間,實現智慧馬達控制在工廠範圍內的更廣泛應用,產生智慧資料,從而提高廣大客戶的馬達永續性和生產力。

- 工業自動化電子產品製造正在推動該領域的成長。工業自動化領域的參與者需要持續存取其系統產生的所有資料。然而,許多商務用公共事業的廣度使獲取這一級別的資料變得複雜。歐洲和北美等地區擴大採用監控和資料採集 (SCADA) 來收集準確的資料。

- 大多數 SCADA 系統由單板遠端終端裝置(RTU) 組成,這是一種緊湊、堅固的產品,在單一印刷電路基板包含所有輸入/輸出 (I/O) 模組。因此,公共事業領域 SCADA 的部署不斷增加將進一步推動對 EMS 的需求。

亞太地區可望大幅成長

- 預計預測期內亞太市場將大幅成長。印度和中國是全球 EMS 的強大市場,因為它們在消費性電子、半導體和其他通訊設備及裝置製造業中佔有重要地位。例如,塔塔集團宣布進軍半導體製造業務的計劃,旨在進入價值1兆美元的高科技電子製造業。

- 此外,5G網路和物聯網等技術變革正在加速電子產品的普及。 「數位印度」和「智慧城市」計劃等措施正在推動電子設備對物聯網的需求。

- 據印度電子工業協會稱,到 2025 年,該國專業電子代工預計將成長 6 倍以上,達到 1,520 億美元左右。此外,該國還設定了2025年僅行動電話出口額就達到約1000億美元的目標,並希望在政府的生產掛鉤激勵(PLI)系統的支持下實現這一目標。

- 據 IBEF 稱,該國旨在鼓勵製造業的 PLI 計劃約有 80%,涵蓋 14 家公司,總投資額為 389.9 億美元,集中在三個行業——電子、汽車和太陽能電池板製造。此次擴張支持了網路、5G、資料中心、汽車/雷射雷達以及航太和國防市場的新技術產品的快速成長。

- 亞太地區的供應鏈正逐步向亞太地區成本較低的國家轉移,包括印度和印度尼西亞,以降低製造成本,從產品設計、半導體製造和封裝、零件和子系統、最終組裝和測試開始。例如,成本上升和先前的貿易緊張局勢迫使台灣和碩將生產多元化到越南和印尼等國家。貿易緊張局勢造成的不確定性已導致亞洲許多公司重新調整投資並轉移製造地,以避免關稅。

電子製造服務業概況

由於各行業對服務的應用日益廣泛,且全球有多個市場參與者,電子製造服務市場呈現半固體。市場參與者將產品開發和創新視為擴大市場的一條有利可圖的途徑。

- 2024 年 1 月全球電子製造服務專業供應商 Creation Technologies 宣佈在安大略省馬克姆擴建廠。新用地面積佔地 118,500 平方英尺,比之前的工廠增加了 54%。此次擴張旨在增強公司提供高品質電子製造服務的能力,滿足不斷成長的客戶需求並支持其長期成長策略。

- 2024年5月,科技巨頭西門子股份公司與鴻海科技集團(簡稱富士康)簽署了合作備忘錄。兩家公司的目標是引領智慧製造領域的數位轉型和永續性,特別關注電子、ICT 和電動車領域。此次合作將建立一個高效率的工程和製造生態系統。透過結合各自的專業知識,西門子和富士康旨在創造創新解決方案,推動全球製造流程的進步,並實現更永續、更先進的未來。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 小型化趨勢日益明顯

- 採用工業物聯網 (IIoT)、區塊鏈和增強通訊等新技術

- 市場挑戰

- 競爭日益激烈,政府和環境法規日益嚴格

- 侵害智慧財產權

- 評估新冠肺炎疫情對市場的影響

第5章 市場區隔

- 按服務類型

- 電子設計與工程

- 電子組裝

- 電子製造業

- 其他服務類型

- 按應用

- 消費性電子產品

- 車

- 工業的

- 航太和國防

- 衛生保健

- 資訊科技和電訊

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 義大利

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 台灣

- 日本

- 韓國

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- Vinatronic Inc.

- Benchmark Electronics Inc.

- Hon Hai Precision Industry Co. Ltd(Foxconn)

- Flex Ltd

- Sanmina Corporation

- Jabil Inc.

- SIIX Corporation

- Nortech Systems Incorporated

- Celestica Inc.

- Integrated Micro-electronics Inc.

- Creation Technologies LP

- Wistron Corporation

- Plexus Corporation

- TRICOR Systems Inc.

- Sumitronics Corporation

第7章投資分析

第 8 章:市場的未來

簡介目錄

Product Code: 69610

The Electronics Manufacturing Services Market size is estimated at USD 614.77 billion in 2025, and is expected to reach USD 818.83 billion by 2030, at a CAGR of 5.9% during the forecast period (2025-2030).

Key Highlights

- With increasing miniaturization and adoption of emerging technologies in the Industrial Internet of Things (IIoT) and enhanced communication posed by 5G, electronic component design and assembly have been revolutionized. For instance, the communication base stations for 5G developed a superior antenna technology, such as MIMO, leading to a rise in the number and performance of radiating elements.

- Additionally, the demand for electronic devices, such as smartphones, smartwatches, and other devices, has boosted the market's growth. According to IBEF, the Indian appliances and consumer electronics industry is anticipated to more than double, reaching USD 21.18 billion by 2025. Further, many companies seek to lower their inventory, facilities, and equipment in their manufacturing activities, shifting the focus of their capital investments toward sales, marketing, and R&D. This has increased the demand for outsourcing to third-party manufacturing service providers.

- For instance, an avionics company decided to transfer its PCBA production to an EMS partner to broaden its product and service offerings and not make an additional investment in manufacturing. The primary requirements were compliance with AS9100 standards and multiple BGAs on the PCBAs, with up to 16 layers on some PCBs.

- Government initiatives across various regions are propelling market growth. For example, as reported by IBEF, the Indian government greenlit 14 companies for the IT hardware production-linked incentive (PLI) scheme. Additionally, the Indian government sanctioned 100% FDI in electronics design and manufacturing, and it is considering raising the FDI cap for multi-brand retail to 51%, up from the current 49%. These moves are poised to significantly boost market growth.

- Globally, SMEs and MSMEs are increasingly turning to third-party manufacturing services. This shift allows them to sidestep hefty capital investments in production lines and tap into the design and manufacturing expertise of service providers. According to the International Finance Corporation (IFC), an estimated 65 million firms, roughly 40% of formal micro, small, and medium enterprises in developing nations, face unmet financial needs. Given that the majority of businesses worldwide, especially in developing nations, fall under the SME category, their reliance on manufacturing service providers is set to underpin the EMS market's growth.

- The COVID-19 pandemic significantly affected numerous end-user industries, and electronics manufacturing was no exception. A survey by IPC highlighted that consumer electronics were impacted, given their heavy dependence on China's manufacturing capacity and supply chains. Despite this, many electronics manufacturers and associated services were deemed essential, given their pivotal role in tasks ranging from product assembly to designing circuit boards for vital medical equipment. In the post-COVID era, electronics manufacturing is poised to remain a cornerstone of both the economy and the healthcare sector.

Electronics Manufacturing Services Market Trends

Industrial Applications Are Expected to Drive the Demand for EMS

- With the rising trend of the environmental revolution, electric motor controls are demanding higher efficiency for industrial motors. Furthermore, increased integration at the lowest cost is required to support market penetration of new technologies and improve safety and reliability. This further drives the demand for electronic products used in smart motors' digital signal controllers for voltage control operations.

- According to IBEF, India's electric vehicle (EV) market is estimated to reach USD 7.09 billion by 2025. Further, a study by the CEEW Centre for Energy Finance recognized a USD 206 billion opportunity for electric vehicles in India by 2030.

- Industry 4.0 assures huge gains in factory data automation efficiency and productivity. The parallel advancements in industrial IoT and artificial intelligence (AI) drive growth. Even though the electronics industry is far from achieving the same level of intelligence and automation, the evolution toward Industry 4.0 is paving the way, as evident by recent trends in the electronics manufacturing services market.

- As per the IBM AI Global Adoption Index, in 2023, one of the primary drivers for AI adoption in organizations was cost reduction and process automation, accounting for 42% of the factors. Industrial automation propels growth in the electronic manufacturing services market. AI expansion is further fueled by the rising accessibility of AI tools, a push for process automation, and the integration of AI into mainstream business applications.

- Rockwell Automation Inc. recently signed a definitive contract to acquire CUBIC, which specializes in modular systems for constructing electrical panels. The collaboration is expected to benefit a company by offering faster time to market, enabling broader plant-wide applications for intelligent motor control, and generating smart data to increase sustainability and productivity for a wide range of customers.

- The manufacturing of electronics for industrial automation is fueling the growth of this segment. Players in the industrial automation segment need consistent access to all the data generated by the system. However, because of the scope of many operational utility applications, this level of data acquisition is complicated. Regions like Europe and North America are increasingly deploying Supervisory Control and Data Acquisition (SCADA) for accurate data collection.

- Most SCADA systems consist of single-board remote terminal units (RTUs), compact, ruggedized products that locate all input/output (I/O) modules on a single printed circuit board. Hence, the increasing deployment of SCADA in the utility sector further drives the demand for EMS.

Asia-Pacific is Expected to Witness Major Growth

- The Asia-Pacific market is expected to grow significantly during the forecast period. India and China have strong markets for EMS worldwide, owing to their solid position in the consumer electronics, semiconductor, and other telecommunications devices and equipment manufacturing industries. For instance, Tata Group announced plans to enter the semiconductor manufacturing business, seeking a proportion of the USD 1 trillion high-tech electronics manufacturing sector.

- Moreover, technology changes, such as the rollout of 5G networks and IoT, are driving the accelerated adoption of electronic products. Initiatives such as 'Digital India' and 'Smart City' projects have increased the demand for IoT in electronic devices.

- According to the Electronic Industries Association Of India, the country's electronic contract manufacturing sector is expected to grow more than sixfold to reach around USD 152 billion by 2025. The country has also set a target of approximately USD 100 billion in exports of mobiles alone by 2025, which is expected to be made possible with the support of the government's production-linked incentive (PLI) scheme.

- According to IBEF, about 80% of the PLI scheme to encourage manufacturing in the country, which covers 14 enterprises and has a total investment of USD 38.99 billion, is concentrated in only three sectors: electronics, automobiles, and solar panel production. This expansion supports rapid growth for new technology products across networking, 5G, data center, automotive/LIDAR, and aerospace and defense markets.

- APAC's supply chain starts with product design, semiconductor fabrication and packaging, components and subsystems, final assembly, and testing, which is also slowly moving toward low-cost countries in APAC, including India and Indonesia, to reduce manufacturing costs. For instance, rising costs and previous trade tensions compelled Taiwan's Pegatron to diversify production to countries such as Vietnam and Indonesia. Such uncertainty due to trade tension led many companies in Asia to readjust investments and shift their manufacturing bases to avoid tariffs.

Electronics Manufacturing Services Industry Overview

The electronics manufacturing services market is semi-consolidated, owing to the improved adoption of these services across industries and the presence of several market players globally. Market players view product developments and innovations as a lucrative path for market expansion.

- January 2024: Creation Technologies, a Specialty Global Electronic Manufacturing Services provider, unveiled its expanded facility in Markham, Ontario. The new site, covering 118,500 square feet, is a 54% increase in size compared to its previous location. This expansion aims to enhance the company's capacity to deliver high-quality electronic manufacturing services, meeting the growing demands of its clients and supporting its long-term growth strategy.

- May 2024: Siemens AG, a technology giant, and Hon Hai Technology Group, known as Foxconn, inked a memorandum of understanding (MoU). Their goal is to spearhead digital transformation and sustainability in smart manufacturing, with a particular emphasis on electronics, ICT, and electric vehicles. The collaboration is set to establish an efficient engineering and manufacturing ecosystem. By combining their expertise, Siemens and Foxconn aim to create innovative solutions to drive advancements in global manufacturing processes, ensuring a more sustainable and technologically advanced future.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Growing Trends of Miniaturization

- 4.3.2 Adoption of Emerging Technologies in IIoT (Industrial Internet of Things), Blockchain, and Enhanced Communication

- 4.4 Market Challenges

- 4.4.1 Intensifying Competition and Rigorous Government and Environmental Regulations

- 4.4.2 Intellectual Property Rights Infringements

- 4.5 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Electronics Design and Engineering

- 5.1.2 Electronics Assembly

- 5.1.3 Electronics Manufacturing

- 5.1.4 Other Service Types

- 5.2 By Application

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive

- 5.2.3 Industrial

- 5.2.4 Aerospace and Defense

- 5.2.5 Healthcare

- 5.2.6 IT and Telecom

- 5.2.7 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Italy

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Taiwan

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 India

- 5.3.3.6 Rest of the Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Vinatronic Inc.

- 6.1.2 Benchmark Electronics Inc.

- 6.1.3 Hon Hai Precision Industry Co. Ltd (Foxconn)

- 6.1.4 Flex Ltd

- 6.1.5 Sanmina Corporation

- 6.1.6 Jabil Inc.

- 6.1.7 SIIX Corporation

- 6.1.8 Nortech Systems Incorporated

- 6.1.9 Celestica Inc.

- 6.1.10 Integrated Micro-electronics Inc.

- 6.1.11 Creation Technologies LP

- 6.1.12 Wistron Corporation

- 6.1.13 Plexus Corporation

- 6.1.14 TRICOR Systems Inc.

- 6.1.15 Sumitronics Corporation

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219