|

市場調查報告書

商品編碼

1690760

IT 外包 (ITO):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)IT Outsourcing (ITO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

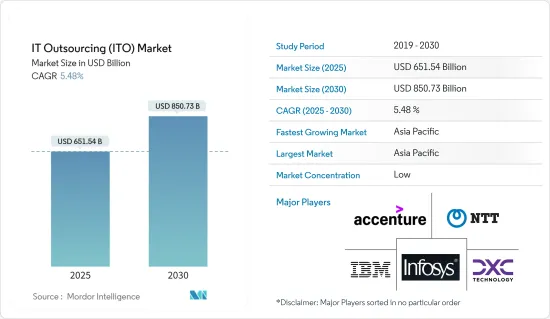

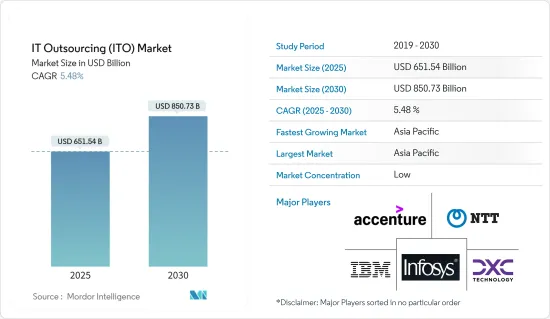

2025 年 IT 外包 (ITO) 市場規模預計為 6,515.4 億美元,預計到 2030 年將達到 8,507.3 億美元,預測期內(2025-2030 年)的複合年成長率為 5.48%。

主要亮點

- 資訊科技已成為大多數組織的競爭優勢。隨著雲端遷移和雲端服務選項的出現,IT 外包已不再只是一個削減成本的過程。因此,這種新形式主要由客戶體驗、業務成長和競爭顛覆等組織動機所驅動。

- 更重要的是,新興和小型組織日益成長的這種偏好使得市場上領先的供應商越來越注重尋找將其離岸團隊與現場團隊整合在一起的方法。小型供應商的另一個重要方面是其所提供服務的靈活性。

- 隨著企業對簡化業務營運和專注於推動收益的關鍵活動的需求不斷增加,他們正在外包 IT 服務以獲得能夠保護資料的安全IT基礎設施。企業正在利用 IT 服務市場參與者的專業知識來降低整個組織內與資料相關的風險。由於招募高技能專業人才需要時間,BFSI 產業正在推動市場發展。為了降低整體成本,企業正在投資外包解決方案。

- 然而,雲端和基於伺服器的服務缺乏資料安全性正在阻礙市場的成長。雲端基礎的服務存在許多獨特的安全問題和挑戰。資料通常儲存在第三方供應商處,並可透過網際網路在雲端存取。這限制了資料的可見性和控制力。然而,對高效、擴充性基礎設施的需求不斷成長,以及向雲端的遷移不斷增加,正在推動市場的發展。

IT外包(ITO)市場的趨勢

按行業分類,BFSI 是最大的

- 銀行、金融服務和保險 (BFSI) 是主要的終端用戶產業之一,其技術採用發生了重大轉變,這主要是由於疫情和不斷變化的競爭格局所帶來的情況。

- 金融機構擴大將流程和服務外包給第三方。銀行可以將從郵寄宣傳活動到付款處理的所有事務外包。銀行只有擁有強大而全面的內部 IT 部門或值得信賴的外部合作夥伴才能生存並吸引客戶。例如,2023 年 3 月,數位和產品開發公司 Orion Innovation 宣布收購金融機構銀行實施合作夥伴 Banktec Software Services Limited。 BankTech 將補充 Orion 的金融服務專業知識、開放銀行解決方案和實施能力。

- BFSI 產業也正向雲端轉移,帶來新的市場機會。根據 Google Cloud 最近進行的一項調查,全球約 41.4% 的技術人員和商業領袖計劃投資雲端基礎的服務來管理他們的工作負載。此外,根據 Flexera 軟體的資料,IT 支出將在 2022 年和 2023 年成長,其中軟體產業的支出將成長 18%,其次是雲端服務的支出,2023 年將成長 16%。

- 現今的客戶要求更加個人化、更加簡化的銀行服務。您的 IT 外包商可以幫助您過渡到全通路平台,以便在任何裝置上提供無縫存取。此外,這些平台還促進即時資料收集和分析,使金融機構能夠改善客戶體驗。因此,這些發展正在推動銀行的 IT 外包。

- 總體而言,BFSI 行業對 IT 外包服務的需求將受到先進的網路安全、數位轉型、日益成長的監管合規性以及對創新解決方案的需求的推動,以滿足不斷變化的客戶期望和行業趨勢。

亞太地區可望主導市場

- 中國是亞太地區主要外包目的地之一。外包產業正在尋找大多數美國公司認為有吸引力的好處。降低開發成本對於保留外包的真正好處起著關鍵作用。

- 中國做出了巨大努力,透過數位化和工業化,從(廉價)勞動力製造向高階工業生產轉型。商務部資料顯示,2023年中國服務外包產業成長,企業簽訂服務外包合約金額達4,040億美元,比去年成長17.6%。

- 印度是一個相當成熟的全球IT外包目的地,擁有廣泛的選擇。由於對熟練軟體開發人員的需求不斷成長,中國的 IT 外包公司正在全球迅速擴張。成本和強大的技術人才隊伍對該國的市場優勢發揮關鍵作用。

- 基於近年來IT技術的進步,日本正在擴大國內商業領域的IT外包範圍,其中包括雲端處理、資料保護和網路安全等。雲端處理服務的使用正在增加,因為它們不需要大量的基礎設施投資來提供業務能力。

- 總體而言,隨著市場的持續發展,該地區各國預計未來幾年將大幅成長。此外,該地區的資料中心建設正在推動強勁的需求。此外,隨著資料中心市場不斷成熟,基礎設施升級帶來的大量收益將推動該地區的 IT 外包發展。

IT外包(ITO)市場概況

IT外包市場的主要企業包括IBM Corporation、DXC Technologies、埃森哲PLC、NTT Corporation和Infosys Limited。這些市場參與企業正在採取各種策略,包括建立夥伴關係和收購,以加強產品系列建立永續的競爭優勢。

- 2023 年 11 月,全球技術和服務公司 DXC Technology 與數位工作流程公司 ServiceNow 宣佈建立策略合作夥伴關係,以在全球範圍內轉變客戶服務和工作流程管理。兩家公司將把 ServiceNow 的 ITSM Pro 和 Process Mining 解決方案的高級分析和 AI 整合到 DXC 平台 X 中,以推動共同客戶的創新。

- 2023年7月,全球領先的數位業務和IT服務公司NTT 資料宣布將推出安全管理外包服務,旨在預防網路攻擊事件並在發生時將損害降至最低。該服務於 2023 年 7 月在日本推出,並在本會計年度(2024 年 3 月)內擴展到全球。

- 2023 年 6 月,印孚瑟斯公司收購了丹麥銀行在印度的 IT 業務,這是一項為期五年、價值 4.54 億美元的 IT 外包協議的一部分,旨在專注於數位轉型。透過這筆交易,該公司將人工智慧引入其服務中。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場概況

- 市場促進因素

- 對高效、擴充性IT基礎設施的需求不斷增加

- 越來越多的組織開始強調 IT 是依靠外包供應商來脫穎而出的一種手段

- 日益成長的雲端遷移和虛擬基礎設施的採用

- 市場挑戰

- 市場分化與資料外洩增多

- IT架構的動態需求影響最終用戶的客製化成本

- COVID-19 對 IT 外包產業的影響

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場分析

- 在岸和境外外包趨勢

- 外包產業細分 - BPO 與 IT 外包的比較

- IT 解決方案商品化的影響

- IT 外包與管理服務產業分析

- 關鍵 IT 外包細分市場 - 應用程式和基礎設施

- 數位轉型的影響與「即服務」模式的出現

第6章 市場細分

- 按組織規模

- 中小型企業

- 大型企業

- 按最終用戶產業

- BFSI

- 衛生保健

- 媒體與通訊

- 零售與電子商務

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 波蘭

- 比利時

- 荷蘭

- 盧森堡

- 瑞典

- 丹麥

- 挪威

- 芬蘭

- 冰島

- 亞洲

- 中國

- 印度

- 日本

- 印尼

- 越南

- 馬來西亞

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 哥倫比亞

- 中東和非洲

- GCC

- 南非

- 土耳其

- 北美洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- DXC Technologies

- Accenture PLC

- NTT Corporation

- Infosys Limited

- Tata Consultancy Services

- Cognizant Technology Solutions Corporation

- Capgemini SE

- Wipro Limited

- Andela Inc.

- Wns Holding Ltd

- Pointwest Technologies

- ATOS SE

- Amadeus IT Group

- Specialist Computer Centres(SCC)

- HCL Technologies Ltd

第8章 全球主要IT外包公司企業發展排名分析

第9章 市場展望

The IT Outsourcing Market size is estimated at USD 651.54 billion in 2025, and is expected to reach USD 850.73 billion by 2030, at a CAGR of 5.48% during the forecast period (2025-2030).

Key Highlights

- Information technology has become a competitive edge for most organizations. IT outsourcing has become more than a simple cost-reduction process with cloud migrations and cloud service options. Therefore, this new form is mainly driven by organizational motivations in terms of customer experience, business growth, and competitive disruption.

- More importantly, such a rise in preference among the newer and smaller organizations has led the key vendors of the market to increasingly concentrate on finding a way to integrate the offshore team with the on-site. Another critical aspect driven by small-scale players is the agility in vendor offerings, which refers to the time-to-market.

- There is a rise in demand by businesses to streamline business operations and focus on crucial activities that are revenue drivers, and outsource IT services for secure IT infrastructure enabling data protection. The businesses deploy market players' expertise in IT services to reduce organization-wide data-related risks. The BFSI sector is driving the market since recruiting specialists with advanced skills is time-consuming. To reduce the overall cost involved, the companies invest in outsourcing solutions.

- However, the lack of data security in cloud and server-based services is hindering the market's growth. Cloud-based services pose many specific security issues and challenges. Data is usually stored with a third-party provider and can be accessed over the internet in the cloud. This indicates that visibility and control over that data are limited. Nevertheless, growing demand for efficiency and scalable infrastructure and increasing cloud migration are driving the market.

IT Outsourcing (ITO) Market Trends

BFSI to be the Largest End-user Vertical

- Banking, financial services, and insurance (BFSI) is one of the major end-user verticals experiencing significant change in technology adoption, mainly due to the conditions brought on by the pandemic and the evolving competitive landscape.

- Financial organizations are increasingly outsourcing their process and services to third parties. Banks are capable of outsourcing everything from mailing campaigns to payment processing. Banks can only survive and attract customers with a robust and comprehensive in-house IT department or trusted outside partners. For instance, in March 2023, Orion Innovation, a digital and product development firm, announced the acquisition of Banktech Software Services Ltd, a banking implementation partner for financial institutions that will complement Orion's financial services for expertise, open banking solutions, and implementation capabilities to Banktech.

- The BFSI industry is also shifting toward the cloud, which presents new market opportunities. According to a recent survey by Google Cloud, around 41.4% of global tech and business leaders planned to invest in cloud-based services to manage their workloads. Also, as per data by Flexera software, there was growth in IT spending in 2022 and 2023, and the software industry experienced 18% spending, followed by cloud services with 16% spending in 2023.

- Modern customers need more personalized and streamlined access to banks' services. The transition to omnichannel platforms, which provide seamless access for all devices, can be carried out by IT outsourcers. Moreover, such platforms facilitate real-time data collection and analysis so that financial institutions can improve customers' experience. Hence, such developments are driving IT outsourcing in the banks.

- Overall, the BFSI industry's demand for IT outsourcing services will be fueled by the need for advanced cybersecurity, digital transformation, growing regulatory compliance, and innovative solutions to meet evolving customer expectations and industry trends.

Asia-Pacific is Expected to Dominate the Market

- China is one of the significant outsourcing destinations in the Asia-Pacific. The outsourcing industry considers benefits that the majority of the companies in the United States find attractive. Reduction in development costs plays a critical role in retaining the actual benefits of outsourcing.

- China has made significant efforts to transition from (cheap) employment manufacturing to high-end industrial production through digitization and industrialization. According to data from the Ministry of Commerce, China's outsourcing industry grew in 2023. The firms signed outsourcing contracts of USD 404 billion, a 17.6% growth from last year.

- India is a considerably mature global IT outsourcing destination with a vast range of options. IT outsourcing companies in the country are rapidly expanding operations worldwide due to an increasing demand for skilled software developers. The cost aspect and talented skill pool have played a critical role in ensuring the nation's dominance in the market.

- In Japan, based on recent technological advancements in IT, the scope of IT outsourcing in the country's business sector has expanded to include cloud computing, data protection, and cybersecurity. Owing to the ability to provide business functionality without the need for substantial infrastructure investment, cloud-computing services are increasingly being utilized.

- Overall, the countries in the region are expected to gain significantly in the coming years as the market continues to develop. In addition, the data center buildings in the region have fueled a significant demand. Also, with the data center market on the verge of maturing, significant revenues in upgrading infrastructure have been poised to develop IT outsourcing in the region.

IT Outsourcing (ITO) Market Overview

The IT outsourcing market exhibits significant fragmentation, featuring key industry players such as IBM Corporation, DXC Technologies, Accenture PLC, NTT Corporation, and Infosys Limited. These market participants employ various strategies, such as forming partnerships and pursuing acquisitions, to bolster their product portfolios and establish sustainable competitive advantages.

- In November 2023, DXC Technology, a global technology service company, and ServiceNow, a digital workflow company, announced a strategic partnership to transform customer service and workflow management globally. They aim to integrate ServiceNow's advanced analytics and AI from its ITSM Pro and process mining solutions into DXC platform X to drive innovation for joint customers.

- In July 2023, NTT DATA (global digital business and IT service leader) announced the launch of an outsourcing service for security management to prevent cyber attack incidents and minimize damage when incidents occur. The service was launched in Japan in July 2023 and expanded worldwide within the fiscal year (March 2024).

- In June 2023, Infosys acquired Danske Bank's IT operation in India, part of an IT outsourcing contract worth USD 454 million over five years, to focus on its digital transformation. Through this contract, the company introduced generative artificial intelligence into the services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Efficiency and Scalable IT Infrastructure

- 4.2.2 Organizations are Increasingly Focusing on IT as a means to Gain Differentiation by Relying on Outsourced Vendors

- 4.2.3 Ongoing Migration Toward the Cloud and Adoption of Virtualized Infrastructure

- 4.3 Market Challenges

- 4.3.1 Fragmented Nature of the Market And Growing Incidence of Data Breaches

- 4.3.2 Dynamic Needs of IT Structure Impacts the Cost of Customization for End Users

- 4.4 Impact of COVID-19 on the IT Outsourcing Industry

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET ANALYSIS

- 5.1 Trends Related to Onshoring and Offshoring

- 5.2 Breakdown of Outsourcing Industry - BPO vs IT-based Outsourcing

- 5.3 Impact of the Ongoing Commodification of IT Solutions

- 5.4 Analysis of IT Outsourcing and Managed Service Industry

- 5.5 Breakdown of the Major IT Outsourcing Segments - Application and Infrastructure

- 5.6 Impact of Digital Transformation and Emergence of "As-a-Service" Model

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small and Medium Enterprises

- 6.1.2 Large Enterprises

- 6.2 By End-user Vertical

- 6.2.1 BFSI

- 6.2.2 Healthcare

- 6.2.3 Media and Telecommunications

- 6.2.4 Retail and E-commerce

- 6.2.5 Manufacturing

- 6.2.6 Other End-user verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.2.6 Poland

- 6.3.2.7 Belgium

- 6.3.2.8 Netherlands

- 6.3.2.9 Luxembourg

- 6.3.2.10 Sweden

- 6.3.2.11 Denmark

- 6.3.2.12 Norway

- 6.3.2.13 Finland

- 6.3.2.14 Iceland

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Indonesia

- 6.3.3.5 Vietnam

- 6.3.3.6 Malaysia

- 6.3.3.7 South Korea

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Colombia

- 6.3.5 Middle East and Africa

- 6.3.5.1 GCC

- 6.3.5.2 South Africa

- 6.3.5.3 Turkey

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 DXC Technologies

- 7.1.3 Accenture PLC

- 7.1.4 NTT Corporation

- 7.1.5 Infosys Limited

- 7.1.6 Tata Consultancy Services

- 7.1.7 Cognizant Technology Solutions Corporation

- 7.1.8 Capgemini SE

- 7.1.9 Wipro Limited

- 7.1.10 Andela Inc.

- 7.1.11 Wns Holding Ltd

- 7.1.12 Pointwest Technologies

- 7.1.13 ATOS SE

- 7.1.14 Amadeus IT Group

- 7.1.15 Specialist Computer Centres (SCC)

- 7.1.16 HCL Technologies Ltd