|

市場調查報告書

商品編碼

1549768

包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

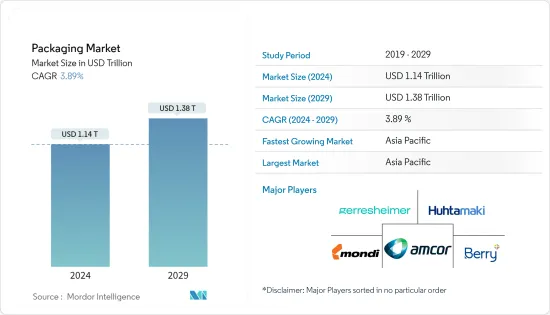

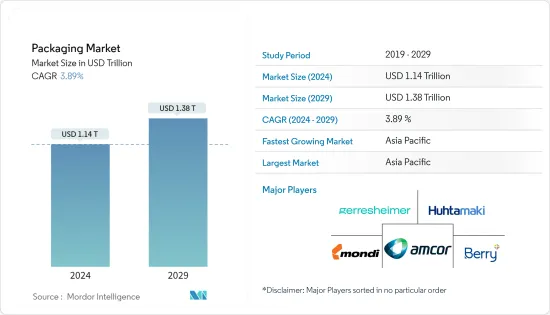

2024年包裝市場規模預計為1.14兆美元,預計到2029年將達到1.38兆美元,在預測期內(2024-2029年)複合年成長率為3.89%。

主要亮點

- 過去十年,在不斷變化的基材偏好、新市場和不斷變化的所有權結構的推動下,全球包裝市場經歷了穩定成長。特別是在食品領域,軟質包裝、高阻隔薄膜和自立式殺菌袋日益挑戰金屬罐和玻璃瓶等傳統形式。

- 在提供高品質、可自訂和具有成本效益的解決方案的能力的推動下,包裝行業的數位印刷有望實現顯著成長。智慧包裝技術的引入可能會徹底改變這個產業。

- RFID 標籤、QR 碼和感測器增強了可追溯性、品管和消費者互動。隨著物聯網(IoT)的發展,智慧包裝解決方案在包裝產業變得極為重要。

- 零售額的增加可能會鼓勵製造商創新包裝以吸引消費者。創新且具有視覺吸引力的包裝設計有助於產品在商店上脫穎而出並吸引消費者,從而提高先進包裝解決方案的採用率。根據美國人口普查局的數據,2023 年美國零售額為 72,420 億美元。與 2019 年相比,銷售額為 53,960 億美元。

- 相反,不可回收、非生物分解的塑膠包裝的使用增加導致碳排放急劇增加,可能成為成長的阻礙力。相比之下,亞馬遜、谷歌和利樂等大公司正努力實現淨零碳排放。

包裝市場趨勢

紙和紙板包裝產品將經歷最高成長

- 對環保材料的需求不斷成長正在推動包裝市場的發展。環保包裝以其可回收性、生物分解性、再生性和低毒性為特點,因其最大限度地減少對環境的影響而受到關注。特別是,包括袋子、小袋和紙箱在內的紙質解決方案正在導致永續包裝的採用激增。

- 線上零售的成長趨勢以及對非生物分解和不可回收包裝解決方案的環境法規正在創造對環保紙包裝解決方案的巨大需求。

- 公司擴大轉向永續包裝,以滿足消費者的需求和監管要求。消費者認為紙和紙板包裝比塑膠包裝更環保。

- 日益成長的環境問題和減少塑膠廢棄物的監管壓力推動了食品和飲料行業從塑膠包裝轉向紙質包裝。製造商擴大採用紙和紙板包裝解決方案。例如,2024 年 5 月,Mondi 推出了 Tray Wrap,這是一種紙質二次包裝解決方案,旨在取代我用來捆綁食品和飲料的傳統塑膠收縮膜。

- 根據 AFRY 和 Suzano PaperLine 的數據,全球紙張消費量預計將從 2022 年的 4.15 億噸增加到 2032 年的 4.76 億噸。隨著網路購物的不斷增加,對永續、高效包裝解決方案的需求將會增加。紙和紙板通常是首選,因為它們可回收且生物分解性。

亞太包裝市場將大幅擴張

- 塑膠包裝在亞洲已被廣泛使用,印度和中國等國家透過食品和飲料市場做出了巨大貢獻。中國的包裝產業深受人均收入成長、社會風氣變化、人口趨勢等變數的影響,並實施禁塑令以盡量減少塑膠足跡。因此,它對包裝業務產生重大影響。

- 印度包裝產業正在經歷強勁成長,每年以22-25%的速度擴張,在全球包裝產業中發揮重要作用。作為印度經濟第五大部門,包裝產業近年來呈現持續成長態勢,並具有進一步擴張的巨大潛力,尤其是出口產業。

- 值得注意的是,印度食品加工和包裝的相關成本比許多歐洲國家低 40%。再加上印度豐富的熟練勞動力,使其成為對尋求包裝行業的公司有吸引力的投資目的地。

- 日本是報紙、包裝、印刷、通訊甚至衛生應用等多個領域紙製品的重要消費者。值得注意的是,在消費者對永續實踐意識不斷增強、對森林砍伐和原料供應的擔憂的推動下,日本包裝產業擴大轉向紙質解決方案。

- 中國塑膠製品產量平均每月659萬噸。中國國家統計局的報告顯示,產量在2023年12月達到峰值,達698萬噸。

- 產量的增加將確保包裝製造商塑膠原料的穩定供應。這種穩定性意味著更一致的生產計劃、更短的前置作業時間以及更可靠的包裝產品交付。

包裝行業概況

全球包裝產業似乎分散,供應商眾多。主要企業包括 Amcor Group GmbH、Berry Global Group, Inc.、International Paper Company 和 Mondi Group。透過創新、市場滲透、退出障礙、廣告支出、競爭策略和企業集中度實現的永續競爭優勢是全球包裝市場的關鍵因素。該市場中的公司正在利用技術創新來提高競爭力。尤其是塑膠包裝材料規格上的產品差異化空間很大。

- 2024 年 6 月,Berry Global Group Inc. 推出了適用於美容、家居和個人護理領域的方形 Domino 瓶。該瓶子採用 100% 消費後再生塑膠 (PCR) 製造。 250 毫升多米諾瓶子具有獨特的 75 毫米寬前面板和可自訂的側面板。

- 2024 年 6 月,永續包裝解決方案供應商Smurfit Kappa 收購了位於保加利亞舒門的盒中袋包裝工廠 Artemis。 Artemis 專注於食品和飲料包裝,生產襯袋紙盒以及葡萄酒行業的薄膜和瓶蓋。

- 2024 年 4 月,全球永續包裝解決方案供應商 Amcor 推出了專專用碳酸軟性飲料 (CSD) 設計的 1 公升聚對苯二甲酸乙二醇酯 (PET) 瓶。該瓶子由 100% 消費後回收 (PCR) 材料製成。透過提供這項開創性的股票選擇權,Amcor 強調了對永續性的承諾,並幫助客戶實現其環保目標。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- 市場促進因素(紙張和玻璃)

- 市場挑戰(塑膠)

- 全球主要國家人均包裝消費量覆蓋率

- 市場機會

第5章市場區隔

- 按包裝類型

- 塑膠包裝

- 硬質塑膠包裝

- 依材料類型:PE-HDPE &LDPE、PP、PET、PVC、PS、EPS

- 依產品類型:瓶子/罐子(容器)、蓋子與封口裝置、散裝級產品 - IBC、板條箱/托盤等。

- 最終用戶產業:食品/飲料、工業/建築、汽車、化妝品/個人護理、其他

- 軟質塑膠包裝

- 依材料類型:PE、BOPP、CPP、其他

- 依產品類型:小袋、袋子、薄膜、包裝物

- 最終用戶產業:食品和飲料、藥品、化妝品、個人護理

- 按地區:北美、歐洲、亞太地區、中東/非洲、拉丁美洲

- 紙和紙板

- 依產品類型:折疊紙盒、瓦楞紙箱、免洗紙產品(袋子、杯子等)

- 按最終使用者:食品/飲料、工業/電子、化妝品/個人護理、醫療保健、其他(家居用品)、運輸(汽車零件運輸、機械等)

- 按地區:北美、歐洲、亞太地區、中東/非洲、拉丁美洲

- 金屬包裝

- 依產品類型:罐頭(食品、飲料、氣霧劑、其他)、瓶蓋及封蓋、其他

- 按地區:北美、歐洲、亞太地區、中東/非洲、拉丁美洲

- 玻璃容器

- 按最終使用者:食品、飲料(酒精和非酒精)、個人護理和化妝品、藥品

- 按地區:北美、歐洲、亞太地區、中東/非洲、拉丁美洲

- 塑膠包裝

第6章 競爭狀況

- 公司簡介

- International Paper Company

- Mondi Group

- Smurfit Kappa Group

- DS Smith PLC

- WestRock Company

- UFlex Limited

- Huhtamaki Oyj

- Amcor Group GmbH

- Coveris Holding SA

- Sealed Air Corporation

- Greif, Inc.

- Sonoco Products Company

- Aptar Group Inc.

- Berry Global Group, Inc.

- Alpla Group

- Owens-illinois, Inc.

- Vidrala, SA

- Verallia SA

- Gerresheimer AG

- Vitro, SAB De CV

- Ball Corporation

- Crown Holdings, Inc.

- Ardagh Group SA

- Can Pack SA

- Silgan Holdings Inc.

第7章 投資分析

第8章 市場未來展望

The Packaging Market size is estimated at USD 1.14 trillion in 2024, and is expected to reach USD 1.38 trillion by 2029, growing at a CAGR of 3.89% during the forecast period (2024-2029).

Key Highlights

- Over the past decade, the global packaging market has grown steadily, driven by substrate preference shifts, new markets, and evolving ownership structures. Flexible packaging, high-barrier films, and stand-up retort pouches are increasingly challenging traditional formats like metal tins and glass jars, especially in the food sector.

- Digital printing in the packaging sector is set for significant growth, propelled by its capacity to deliver high-quality, customizable, and cost-efficient solutions. The incorporation of smart packaging technologies is set to revolutionize the sector.

- RFID tags, QR codes, and sensors bolster traceability, quality control, and consumer interaction. With the evolution of the Internet of Things (IoT), smart packaging solutions are becoming pivotal in the packaging industry.

- Rising retail sales will encourage manufacturers to innovate packaging to attract consumers. Creative and visually appealing packaging designs can help products stand out on store shelves and capture consumer attention, leading to a higher adoption of advanced packaging solutions. According to the United States Census Bureau, retail sales in the United States were USD 7.242 trillion in 2023. When compared to 2019, the sales value was USD 5.396 trillion.

- Conversely, the rise in the use of non-recyclable, non-biodegradable plastic packaging is leading to a surge in carbon emissions, potentially acting as a growth deterrent. In response, major players such as Amazon, Google, and Tetrapak are pivoting toward achieving net-zero carbon emissions, a move that's set to define their future capital investments.

Packaging Market Trends

Paper and Paperboard Packaging Products to Witness the Highest Growth

- Increasing demand for environmentally friendly materials propels the packaging market. Eco-friendly packaging, characterized by recyclability, biodegradability, reusability, and low toxicity, is gaining prominence due to its minimal environmental footprint. Notably, paper-based solutions, including bags, pouches, and cartons, have led to a surge in sustainable packaging adoption.

- The increasing trend of online retail and environmental regulations on non-biodegradable and non-recyclable packaging solutions progressively creates a massive demand for eco-friendly paper packaging solutions.

- Companies increasingly shift towards sustainable packaging to meet consumer demands and regulatory requirements. Consumers perceive paper and paperboard packaging as more environmentally friendly than plastic packaging.

- The food and beverage industry's shift from plastic to paper packaging is driven by increasing environmental concerns and regulatory pressures to reduce plastic waste. Manufacturers are increasingly embracing paper and paperboard packaging solutions. For instance, in May 2024, Mondi introduced 'TrayWrap,' a secondary paper packaging solution designed to supplant the conventional plastic shrink film utilized in bundling food and beverage items.

- According to AFRY and Suzano PaperLine, the global consumption of paper is expected to increase from 415 million metric tons in 2022 to 476 million metric tons in 2032. As online shopping continues to rise, the demand for sustainable and efficient packaging solutions will grow. Paper and paperboard are often preferred for their recyclability and biodegradability.

Asia Pacific Packaging Market to Expand Significantly

- Plastic packaging has observed wide-scale utilization in Asia, with countries like India and China contributing significantly through their food and beverages market. The Chinese packaging sector is heavily influenced by variables such as rising per capita income, changing social atmosphere, and demographics, including ban enforcement on plastics to minimize its plastic footprint. This results in significant impacts on the packaging business.

- India's packaging industry is experiencing robust growth, expanding at a rate of 22-25% annually, solidifying its position as a key player in the global packaging landscape. As the 5th largest sector in India's economy, the packaging industry has demonstrated consistent growth in recent years, with significant potential for further expansion, especially in the industry of exports.

- Notably, the costs associated with processing and packaging food in India can be as much as 40% lower than in many European countries. This, coupled with India's abundant skilled labor force, renders the nation an enticing investment destination for businesses eyeing the packaging sector.

- Japan stands out as a significant consumer of paper-based products across diverse sectors, spanning newspapers, packaging, printing, communication, and even sanitary applications. Notably, driven by a growing consumer consciousness towards sustainable practices, concerns over deforestation, and the availability of raw materials, Japan's packaging industry is increasingly pivoting towards paper-based solutions.

- China's monthly plastic product output averages 6.59 million metric tons. Notably, December 2023 marked a peak, with production hitting 6.98 million metric tons, as reported by the National Bureau of Statistics of China.

- Higher production volumes ensure a more stable supply of plastic raw materials for packaging manufacturers. This stability can lead to more consistent production schedules, reducing lead times and improving delivery reliability for packaging products.

Packaging Industry Overview

The global packaging industry appears fragmented due to several vendors. Some leading players in the are Amcor Group GmbH, Berry Global Group, Inc., International Paper Company, Mondi Group, and others. In the global packaging market, key factors include sustainable competitive advantages driven by innovation, market penetration levels, exit barriers, advertising expenditure, competitive strategy, and firm concentration ratios. Players in this market leverage innovation for a competitive edge. The material specifications, especially in plastic packaging, offer ample room for product differentiation.

- June 2024 - Berry Global Group Inc. launched a new offering: a rectangular Domino bottle tailored for the beauty, home, and personal care sectors. This bottle is manufactured from up to 100% post-consumer recycled (PCR) plastic. The 250ml Domino bottle boasts a distinctive 75-millimeter-wide front panel, complemented by customizable side panels.

- June 2024 - Smurfit Kappa, a sustainable packaging solutions provider, has acquired Artemis Ltd, a Bag-in-Box packaging facility in Shumen, Bulgaria. Specializing in food and beverage packaging, Artemis manufactures bags for bag-in-box items and produces films and caps tailored to the wine industry.

- April 2024 - Amcor, a global provider of sustainable packaging solutions, launched a product: a one-liter polyethylene terephthalate (PET) bottle designed specifically for carbonated soft drinks (CSDs). It's manufactured entirely from 100% post-consumer recycled (PCR) materials. By offering this pioneering stock option, Amcor underscores its commitment to sustainability and empowers its customers to align with their eco-conscious goals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers (Paper and Glass)

- 4.5 Market Challenges (Plastic)

- 4.6 Coverage of Per Capita Packaging Consumption in Major Countries Across the World

- 4.7 Market Opportunities

5 MARKET SEGMENTATION

- 5.1 By Packaging Type

- 5.1.1 Plastic Packaging

- 5.1.1.1 Rigid Plastic Packaging

- 5.1.1.1.1 By Material Type - (PE - HDPE & LDPE, PP, PET, PVC, PS and EPS)

- 5.1.1.1.2 By Product Type - (Bottles and Jars (Containers), Caps and Closures, Bulk-Grade Products - IBC, Crates & Pallets, Others)

- 5.1.1.1.3 By End-User Industry - (Food, Beverage, Industrial and Construction, Automotive, Cosmetics and Personal Care, Other End-user Industries)

- 5.1.1.2 Flexible Plastic Packaging

- 5.1.1.2.1 By Material Type - (PE, BOPP, CPP, Others)

- 5.1.1.2.2 By Product Type - (Pouches, Bags, Films and Wraps)

- 5.1.1.2.3 By End User Industry - (Food, Beverage, Pharmaceutical, Cosmetics and Personal Care)

- 5.1.1.3 By Region - (North America, Europe, Asia Pacific, Middle East and Africa (GCC, United Arab Emirates, KSA, Rest of GCC, Rest of Middle East and Africa), Latin America)

- 5.1.2 Paper and Paperboard

- 5.1.2.1 By Product Type - (Folding Carton, Corrugated Boxes, Single-use Paper Products (Bags, Cups, Others))

- 5.1.2.2 By End-user (Food, Beverage, Industrial & Electronic, Cosmetics & Personal Care, Healthcare, Others (Household Care, Transit (Transportation of Automobile Components, Machinery, etc.))

- 5.1.2.3 By Region - (North America, Europe, Asia Pacific, Middle East and Africa (GCC, United Arab Emirates, KSA, Rest of GCC, Rest of Middle East and Africa), Latin America)

- 5.1.3 Metal Packaging

- 5.1.3.1 By Product Type - (Cans (Food, Beverage, Aerosols, Others), Caps and Closures, Other Product Types)

- 5.1.3.2 By Region - (North America, Europe, Asia Pacific, Middle East and Africa (GCC, United Arab Emirates, KSA, Rest of GCC, Rest of Middle East and Africa), Latin America)

- 5.1.4 Container Glass

- 5.1.4.1 By End-user - (Food, Beverage (Alcoholic, Non-Alcoholic), Personal Care and Cosmetics, Pharmaceuticals)

- 5.1.4.2 By Region - (North America, Europe, Asia Pacific, Middle East and Africa (GCC, United Arab Emirates, KSA, Rest of GCC, Rest of Middle East and Africa), Latin America)

- 5.1.1 Plastic Packaging

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 International Paper Company

- 6.1.2 Mondi Group

- 6.1.3 Smurfit Kappa Group

- 6.1.4 DS Smith PLC

- 6.1.5 WestRock Company

- 6.1.6 UFlex Limited

- 6.1.7 Huhtamaki Oyj

- 6.1.8 Amcor Group GmbH

- 6.1.9 Coveris Holding SA

- 6.1.10 Sealed Air Corporation

- 6.1.11 Greif, Inc.

- 6.1.12 Sonoco Products Company

- 6.1.13 Aptar Group Inc.

- 6.1.14 Berry Global Group, Inc.

- 6.1.15 Alpla Group

- 6.1.16 Owens-illinois, Inc.

- 6.1.17 Vidrala, S.A.

- 6.1.18 Verallia SA

- 6.1.19 Gerresheimer AG

- 6.1.20 Vitro, S.A.B. De C.V.

- 6.1.21 Ball Corporation

- 6.1.22 Crown Holdings, Inc.

- 6.1.23 Ardagh Group S.A.

- 6.1.24 Can Pack SA

- 6.1.25 Silgan Holdings Inc.