|

市場調查報告書

商品編碼

1549842

補充裝和可重複使用包裝:市場佔有率分析、行業趨勢和成長預測(2024-2029)Refillable And Reusable Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

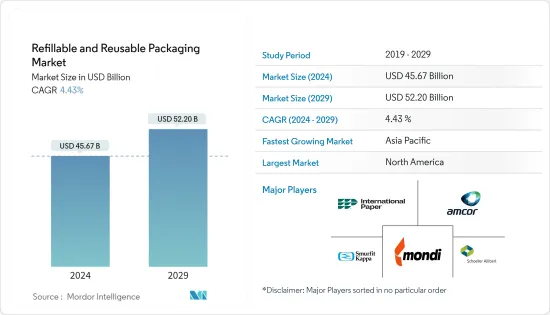

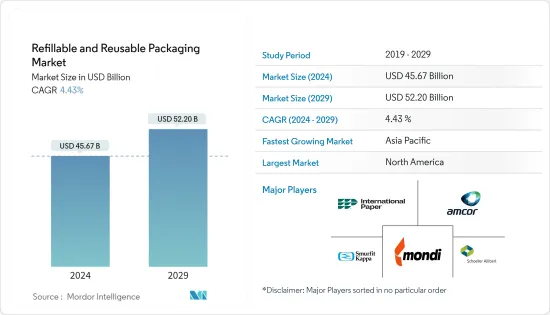

可再填充和可重複使用包裝市場規模預計到 2024 年將達到 456.7 億美元,到 2029 年將達到 522 億美元,在市場預測期間(2024-2029 年)複合年成長率為 4.43%。

在全球轉向永續性和環保意識不斷增強的推動下,再填充和可重複使用包裝市場正在經歷顯著的快速成長。世界各國政府正在推出更嚴格的法規,國際貿易不斷成長,進一步增加了可再填充和可重複使用包裝的需求。減少一次性包裝廢棄物、提高經濟效益和確保包裝安全等因素正在促進市場成長。

主要亮點

- 可再填充包裝是一種永續的解決方案,允許產品多次再填充,與一次性替代品相比,可顯著減少廢棄物。這種趨勢在食品和飲料、家庭清潔、個人衛生和其他消耗品領域尤其明顯。

- 補充包裝的主要目的是為客戶提供延長容器使用壽命的選擇,從而解決普遍存在的塑膠污染問題。補充包裝提供的不僅是初始成本,更強調這項初始成本的長期回報,使經營模式更具永續性。透過強調補充包裝的環境效益,公司可以提高品牌忠誠度並吸引特定的細分市場。

- 全球對永續性的關注正在增加對可重複使用包裝解決方案的需求。這些選擇不僅限制廢棄物,而且支持循環經濟。汽車和製藥等不同行業正在轉向可重複使用的包裝選項。物流和運輸業也透過使用可重複使用的托盤和板條箱來運輸貨物來減少包裝廢棄物。

- 可重複使用的產品可大幅減少生態廢棄物並提供永續的解決方案。在食品和飲料行業,它可確保更安全的運輸,有助於減少固態廢棄物並增強產品保護。可重複使用的包裝系統在保護自然資源方面發揮著至關重要的作用。透過選擇重複利用而不是不斷生產新材料,公司不僅可以延長包裝的使用壽命,還可以減少對木材、油和水等新鮮原料的需求。

- 塑膠面臨著日益嚴峻的環境挑戰,但其彈性和多功能性鞏固了其在嚴重依賴塑膠容器和托盤的零售、物流和汽車行業中作為可重複使用包裝材料的作用。

補充裝和可重複使用包裝市場趨勢

托盤和木箱的預期成長

- 托盤具有剛性形狀,可在處理散裝貨物時提供機械穩定性並保持品質。搬運是指與起重、堆放、儲存產品以及透過陸地或海上運輸產品相關的所有活動。塑膠托盤被開發用於透過堆高機、托盤搬運車和前置裝載機等設備移動,以方便貨物的移動。塑膠托盤具有許多優點,包括重量輕、衛生且經濟高效。企業可以根據自己的需求從多種塑膠托盤設計中進行選擇。塑膠托盤常見於倉庫、工廠、商店、運輸公司等。

- 電子商務的日益普及導致物流活動的擴大,導致全球托盤的需求急劇增加。此外,有組織的零售業的日益滲透預計也將推動托盤需求,因為托盤被廣泛用於零售空間中的重型貨物裝卸。

- 該行業的各種公司都致力於透過收購和合作來擴大業務。例如,Hine Group 於 2024 年 4 月宣布,將透過收購位於布里斯班附近納蘭巴的 Express Pallets and Crate (Express) 來拓展新的業務部門。 Hein此次收購涉及Express Pallets & Crates的資產和貿易業務。 Express 擁有龐大的基本客群,在各個細分市場中建立了重要的長期合作關係。

- 塑膠托盤和板條箱具有許多優點,包括比木材優越的強度和耐用性。它在高重複、封閉式場景中表現出色,並具有木棧板無法比擬的堅固性。與木材不同,塑膠托盤和塑膠盒沒有釘子或鋒利的邊緣,並且在手動搬運過程中不存在碎裂或鬆動的風險。

- 根據Modern 物料輸送統計,2023年托盤市場收入為906.1億美元,預計2024年將達到952.3億美元。電子商務的爆炸式成長推動了對托盤和板條箱的需求增加,這對於運輸從消費品到工業零件的各種產品至關重要。這種成長迫使零售商和製造商擴大倉庫並加強庫存。產品製造商通常購買或租賃托盤並將其計入運輸包裝成本。相反,當零售商面臨托盤短缺時,回收商就會介入,維修並轉售這些關鍵的運輸資產。

亞太地區預計將推動市場

- 亞太地區由於重視環境因素和對永續實踐的承諾,成為包裝產業的成熟地區之一。人們對生態保育的認知和興趣的提高正在增加補充裝和可重複使用包裝在該地區的主導地位。

- 政府的措施和立法主要透過頒布環境法規和鼓勵公司使用永續包裝技術,使該地區的再填充和可重複使用包裝產業得以擴大。根據環境、森林和氣候變遷部 2023 年 7 月發布的塑膠包裝生產者延伸責任 (EPR) 指南,要求重複使用硬質塑膠包裝,並遵守印度食品安全和標準局針對食品接觸制定的法規這是強制性的。 EPR 指南還鼓勵永續塑膠包裝並減少塑膠足跡。

- 與印度和中國等國家的全球貿易增加也可能推動可重複使用包裝市場的發展。根據國際貿易管理局(ITA)預測,到2024年3月,印度將成為世界上成長最快的重要經濟體之一。美國和印度之間的關係依然牢固,商品和服務貿易總額到 2022 年迅速增至 1,910 億美元,約為 2014 年的兩倍。 2022年4月1日至2023年3月31日的財政年度,印度經濟成長7.2%。特別是特倫甘納邦、安得拉邦、泰米爾納德邦、卡納塔克邦和喀拉拉邦的成長率明顯高於全國平均水平,達到8%至9%。

- 據印度品牌股權基金會(IBEF)稱,印度的化學工業高度多元化,大致分為散裝、特殊、農業化學品、石化產品、聚合物和化肥。印度是世界第六大化學品生產國、亞洲第三大化學品生產國,佔GDP的7%。

- 此外,根據印度經濟顧問辦公室(OEA)的數據,印度化學品和化學產品批發價格指數為133.5。 2023年將達145.4。在全球範圍內,印度是繼美國、日本和中國之後的第四大農藥生產國。 2023年4月至2023年12月印度農藥出口額估計為31.2億美元。印度在化學品出口和進口方面均處於強勢地位,出口排名第 14 位,進口排名第 8 位(不包括藥品)。

補充和可重複使用包裝行業概述

補充裝和可重複使用包裝市場較為分散,公司眾多,包括: Schoeller Allibert Services BV、International Paper、Mondi PLC、Amcor PLC、Berry Global Inc. 和 Smurfit Kappa Group。

- 2024 年 2 月 歐洲領先的玻璃包裝製造商之一 Brau Union Osterreich 和 Vetropack Group 推出了一款新型可重複使用的 0.33 公升可回收瓶。它作為啤酒行業的標準解決方案投放市場。

- 2023 年 9 月 Mondi PLC 和 Veete 在英國推出首款紙質乾冰包裝。 Veetee 的新型米包裝採用 Mondi 的功能屏障紙製成,為標準塑膠包裝提供安全、可靠且堅固的包裝替代品。 Veetee 和 Mondi 在英國推出了首款紙質乾冰替代品,專門針對消費者對更永續包裝的需求而量身定做。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 對永續和可回收再填充包裝的需求不斷成長

- 對智慧、可追溯和可重複使用的包裝解決方案的需求不斷成長

- 市場限制因素

- 供應鏈中斷和監管變化可能會限制市場成長

第6章 市場細分

- 按材質

- 塑膠

- 紙板

- 金屬

- 玻璃

- 依產品

- 瓶子/容器

- 托盤/木框架

- IBC

- 鼓桶

- 盒子/紙箱

- 罐/桶

- 其他產品(管、袋、袋子、麻袋等)

- 按最終用戶產業

- 飲食

- 化妝品/個人護理

- 家居用品

- 化學/石化

- 建築/施工

- 運輸/運輸

- 其他最終用戶產業(汽車、製藥等)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Schoeller Allibert Services BV

- International Paper

- Nefab Group

- IPL Inc.

- Vetropack Holding Ltd

- Mondi PLC

- Greif Inc.

- Berry Global Inc.

- IFCO Systems

- Smurfit Kappa Group

- GWP Group

- Orbis Corporation

- Petainer Ltd

- Refillism

- Amcor PLC

- Bormioli Luigi Corporation

- Jiangmen UA Packaging Co. Ltd

第8章投資分析

第9章 市場未來展望

The Refillable And Reusable Packaging Market size is estimated at USD 45.67 billion in 2024, and is expected to reach USD 52.20 billion by 2029, growing at a CAGR of 4.43% during the forecast period (2024-2029).

The refillable and reusable packaging market is witnessing a notable surge, propelled by a global shift towards sustainability and heightened environmental consciousness. Governments worldwide are rolling out stringent regulations, and with international trade on the rise, the demand for refillable and reusable packaging is being further catalyzed. Factors such as curbing single-use packaging waste, enhancing economic efficiency, and ensuring packaging safety contribute to the market's growth.

Key Highlights

- The refillable packaging is a sustainable solution that allows multiple product refills, significantly reducing waste compared to single-use items. This trend is particularly prominent in food and beverage, household cleaning, personal hygiene, and other consumables.

- The main goal of refillable packaging is to provide customers with the choice to prolong the life of their containers, therefore tackling the widespread problem of plastic pollution. Refillable packaging offers more than an initial cost, and emphasizing the long-term returns on this upfront cost enhances the business model's sustainability. By highlighting the environmental benefits of refillable packaging, businesses can boost brand loyalty and draw a specific market segment.

- The global emphasis on sustainability has propelled the demand for reusable packaging solutions. These alternatives not only curb waste but also support a circular economy. Various industries, such as automotive and pharmaceutical, have started opting for reusable packing options. The logistics and transportation industry also reduced their packing waste by using pallets and crates to transport goods, which can be reused.

- Reusable products have significantly curbed ecosystem waste, offering a sustainable solution. In the food and beverage sector, they ensure safer transportation, aid in solid waste reduction, and enhance product protection. Reusable packaging systems play a pivotal role in conserving the natural resources. By opting for reuse over the constant production of new materials, businesses not only extend the life of their packaging but also curb the need for fresh raw materials like timber, petroleum, or water.

- While plastic faces mounting environmental concerns, its resiliency and versatility have cemented its role in reusable packaging in retail, logistics, and automotive industries, which lean heavily on plastic containers and pallets.

Refillable And Reusable Packaging Market Trends

Pallets and Crates are Expected to Witness Growth

- Pallets are rigid forms that provide mechanical stability to bulk goods during handling to preserve quality. Handling comprises all activities related to lifting, stacking, product storage, and transportation by land or sea. Plastic pallets are developed to be moveable by equipment such as forklifts, pallet jacks, and front loaders to facilitate the mobility of goods. Plastic pallets have many advantages, such as being lightweight, hygienic, and cost-effective. A business may choose from several plastic pallet designs depending on their needs. Plastic pallets can be noticed in warehouses, factories, stores, and shipping companies.

- The increasing popularity of e-commerce resulted in the expansion of logistics activities, which, in turn, surged the demand for pallets worldwide. Furthermore, the rising penetration of organized retail is anticipated to drive the demand for pallets, as these are widely used in retail spaces for the loading and unloading of heavy merchandise.

- Various companies operating in the industry are focused on expanding their business through acquisitions, collaborations, and more. For instance, in April 2024, Hyne Group announced the expansion of its new operating division with the acquisition of Express Pallets and Crates (Express), based at Narangba near Brisbane. Hyne's acquisition involves the assets and trading business of Express Pallets & Crates. Express has a vast client base with significant long-term relationships across various market segments.

- Plastic pallets and crates have many benefits, such as outshining wood in strength and durability. They excel in high-repeat, closed-loop scenarios, offering robustness that wooden counterparts struggle to match. Unlike their wooden counterparts, plastic pallets and boxes are crafted without nails or sharp edges, eliminating the risk of splinters or loose parts during manual handling.

- According to Modern Materials Handling, the revenue of the pallet market in 2023 was USD 90.61 billion, and it is expected to reach USD 95.23 billion in 2024. The surge in e-commerce is fueling a rising demand for pallets and crates, essential for transporting diverse products, from consumer goods to industrial components. This uptick is prompting retailers and manufacturers to enlarge their warehouses and bolster their inventory. Generally, product manufacturers purchase or lease pallets, factoring them into transportation packaging costs. Conversely, when retailers face a shortage of pallets, recycling firms step in, refurbishing and reselling these essential transport assets.

Asia-Pacific is Expected to Drive the Market

- Asia-Pacific is one of the established regions in the packaging industry due to reasons highlighting environmental care and commitment to sustainable practices. Growing awareness and concern for ecological conservation drive the region's refillable and reusable packaging dominance.

- Government initiatives and legislation have primarily enabled the expansion of the region's refillable and reusable packaging industry by enacting environmental regulations and encouraging companies to use sustainable packaging techniques. According to the Ministry of Environment, Forest and Climate Change in July 2023, the Extended Producer's Responsibility (EPR) guidelines on plastic packaging mandate the reuse of rigid plastic packaging, subject to the regulations specified by the Food Safety and Standards Authority of India for food contact applications. The EPR guidelines also encourage sustainable plastic packaging, thus reducing the plastic footprint.

- Increasing trade with countries such as India and China globally will also push the market for reusable packaging. According to the International Trade Administration (ITA), in March 2024, India stood out as one of the swiftest expanding significant economies worldwide. The US-India ties, robust as ever, saw their combined trade in goods and services soar to a noteworthy USD 191 billion in 2022, nearly doubling the figures from 2014. For the fiscal year spanning April 1, 2022, to March 31, 2023, the Indian economy surged by 7.2%. Notably, Telangana, Andhra Pradesh, Tamil Nadu, Karnataka, and Kerala outshone the national average, boasting a remarkable growth rate of 8% to 9%.

- According to the India Brand Equity Foundation (IBEF), covering more than 80,000 commercial products, India's chemical industry is highly diversified and can be broadly categorized into bulk, specialty, agrochemicals, petrochemicals, polymers, and fertilizers. India is the sixth largest producer of chemicals globally and third in Asia, contributing 7% to its GDP.

- Further, according to the Office of Economic Advisor (OEA) India, the wholesale price index of chemicals and chemical products in India was 133.5. It reached 145.4 in 2023. Globally, India is the fourth-largest producer of agrochemicals after the United States, Japan, and China. From April 2023 to December 2023, India's agrochemicals exports were estimated at USD 3.12 billion. India holds a strong position in chemical exports and imports and ranks 14th in exports and 8th in imports (excluding pharmaceuticals).

Refillable And Reusable Packaging Industry Overview

The refillable and reusable packaging market is fragmented, with various players such as Schoeller Allibert Services BV, International Paper, Mondi PLC, Amcor PLC, Berry Global Inc., and Smurfit Kappa Group. The players are focused on expanding their business in the region through acquisitions, collaborations, mergers, and more.

- February 2024: Brau Union Osterreich and Vetropack Group, one of Europe's manufacturers of glass packaging, launched a new 0.33-liter returnable bottle that can be reused. It was launched on the market as a standard solution for the brewing industry.

- September 2023: Mondi PLC and Veete launched the first paper-based packaging for dry ice in the United Kingdom. Veetee's new rice packaging has been created using Mondi's FunctionalBarrier Paper, providing a safe, secure, and robust alternative to standard plastic packs. Veetee and Mondi were the first in the United Kingdom to launch a paper-based alternative for dry rice, customized in direct response to consumer demands for more sustainable packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Sustainable and Recyclable Refillable Packaging

- 5.1.2 Increasing Need for Smart and Trackable Reusable Packaging Solutions

- 5.2 Market Restraints

- 5.2.1 Supply Chain Disruptions and Regulatory Changes Might Limit the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper and Paperboard

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 By Product

- 6.2.1 Bottles and Containers

- 6.2.2 Pallets and Crates

- 6.2.3 IBCs

- 6.2.4 Drums and Barrels

- 6.2.5 Boxes and Cartons

- 6.2.6 Cans and Pails

- 6.2.7 Others Products (Tubes, Pouches, Bags and Sacks, Etc.)

- 6.3 By End-user Industry

- 6.3.1 Food and Beverage

- 6.3.2 Cosmetics and Personal Care

- 6.3.3 Household Care

- 6.3.4 Chemicals and Petrochemicals

- 6.3.5 Building and Construction

- 6.3.6 Shipping and Transportation

- 6.3.7 Other End-user Industries (Automotive, Pharmaceuticals, Etc.)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schoeller Allibert Services BV

- 7.1.2 International Paper

- 7.1.3 Nefab Group

- 7.1.4 IPL Inc.

- 7.1.5 Vetropack Holding Ltd

- 7.1.6 Mondi PLC

- 7.1.7 Greif Inc.

- 7.1.8 Berry Global Inc.

- 7.1.9 IFCO Systems

- 7.1.10 Smurfit Kappa Group

- 7.1.11 GWP Group

- 7.1.12 Orbis Corporation

- 7.1.13 Petainer Ltd

- 7.1.14 Refillism

- 7.1.15 Amcor PLC

- 7.1.16 Bormioli Luigi Corporation

- 7.1.17 Jiangmen UA Packaging Co. Ltd