|

市場調查報告書

商品編碼

1549858

全球液體紙板市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Liquid Paperboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

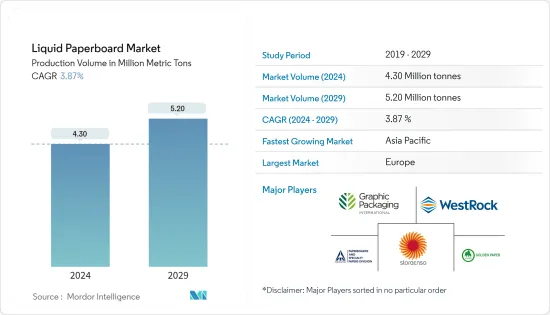

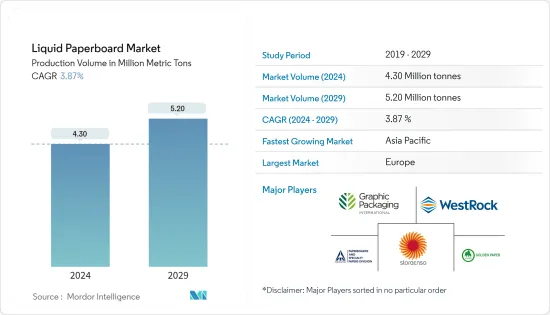

基於產量的全球液體紙板市場規模預計將從2024年的430萬噸擴大到2029年的520萬噸,預測期間(2024-2029年)複合年成長率為3.87%。

主要亮點

- 液體紙板 (LPB) 是一種多功能且永續的包裝材料,主要用於食品和飲料行業。紙板由塗有各種阻隔材料(例如聚乙烯和其他生物聚合物)的層組成,以提供額外的保護。這種多層結構提供了強大的物理保護和有效的防潮、防氧和防光屏障,使其成為包裝牛奶、果汁、湯和醬汁等液體產品的理想選擇。

- 液體紙板因其永續性和阻隔性而被廣泛用於包裝液體紙盒。製造商正在採用極簡、高設計的方法來生產更小的單份包裝,以減少材料的使用和浪費。這些緊湊的設計透過最大限度地減少與包裝相關的碳排放,提高了消費者的便利性並促進了環境責任。

- 阻隔塗層的技術進步是液體紙板發展和增強的主要驅動力。正在開發包括生物基和生物分解性材料在內的創新塗層技術,以提高 LPB 性能,同時最大限度地減少對環境的影響。這些塗料不僅可以防止污染和變質,從而提高包裝產品的保存期限和質量,還可以滿足消費者和監管機構對永續包裝不斷成長的需求。例如,奈米技術的進步使得創建超薄但高效的隔離層成為可能,可塗布LPB 以改善功能,而無需顯著增加重量或成本。

- 然而,由於液體紙板是紙板和聚乙烯的複合材料,回收帶來了挑戰。現有的回收基礎設施通常需要協助分離這些層,阻礙了有效的回收過程。這種複雜性需要回收技術和系統的進步,以有效地處理液體紙板並提高永續性。

液體紙板市場趨勢

飲料業需求增加將提振市場

- 飲料行業需求的成長正在顯著推動液體紙板市場的發展。包裝製造商和消費品牌擴大轉向液體,因為與選擇紙板等其他材料相比,它們使用的原料更少,產生的廢棄物更少,並且可以節省成本。液體紙板使公司能夠生產更輕、更永續的包裝,降低運輸成本並最大限度地減少對環境的影響。這種效率在飲料業尤其有利,因為包裝體積和重量對整體物流和碳足跡有重大影響。

- 優質液體包裝紙板具有成本效益,並提供卓越的產品保護,確保飲料的新鮮度和安全性。這些紙板具有卓越的印刷、加工和填充性能,使品牌能夠保持高品質標準和視覺上吸引人的設計。這種功能性和美觀性的結合使液體紙板成為果汁、湯、水和優格等飲料行業包裝應用的有吸引力的選擇。強大的防潮、氧氣和光阻隔性能進一步提高了這些產品的保存期限和質量,使液體紙板成為製造商的首選材料。

- 為了使液體紙板更加永續性和高效,斯道拉恩索等公司正在大力投資,使廢棄飲料紙盒更加循環利用。斯道拉恩索致力於提高材料效率並開發創新解決方案來提高液體紙板的性能。其中一項進步是微纖化纖維素 (MFC) 的使用,它可以增強紙板強度,同時減輕重量。這項改進減少了所需原料的數量,提高了包裝的耐用性和功能性,並提高了其相對於其他形式的競爭力。

- 用於長保存期限液體產品(例如乳製品、豆奶、果汁、水果檸檬水和純淨水)的飲料紙盒也採用箔片貼合加工。這種薄薄的鋁層可以保護您的飲料免受光和氧氣的影響。鋁層厚度僅6.5微米,不到人類頭髮厚度的四分之一。鋁是氧氣和光線的絕佳屏障,這些飲料無需防腐劑或冷藏即可保存長達 18 個月。

- 根據芬寶2023年紙板年度報告發布的報告,液體包裝紙板的年需求量為500萬噸,僅佔紙箱紙板總需求量5,900萬噸的8.5%。由於耐用性、防潮性和永續性等特殊性能,該行業在液體包裝領域很受歡迎,這對於飲料和乳製品等行業至關重要。

歐洲預計將實現顯著成長

- 歐洲液體紙板市場正在經歷變革,這主要是由於對永續性的日益關注。由於環保意識不斷增強,消費者的偏好越來越傾向環保包裝。這一趨勢極大地推動了對傳統塑膠包裝更永續的液體紙板替代品的需求。

- 歐盟一次性塑膠指令等歐洲法規也強化了這種轉變,該指令強制減少一次性塑膠的使用,並鼓勵使用液體紙板等可再生和可回收材料。

- 此外,電子商務的快速發展也對市場產生影響。網路購物的增加增加了對堅固可靠的包裝解決方案的需求,這些解決方案可以保護運輸途中的產品,同時又環保。液體紙板很好地滿足了這項要求,具有耐用性和永續性。這兩個優勢使得液體紙板對尋求將其營運與永續性目標保持一致並滿足消費者對環保包裝的期望的零售商和電子商務公司具有吸引力。

- 歐洲液體紙板產業的市場整合也值得注意。市場由少數大型企業主導,導致高度整合。這種整合將有助於對研發進行大量投資,促進創新和提高效率。這些領先的製造商不斷尋找透過技術進步來提高液體紙板性能和永續性的方法。

- 數位印刷技術等進步實現了高品質、可自訂的包裝解決方案,使品牌脫穎而出並吸引消費者。此外,生物分解性和可堆肥塗料的進步使液體紙板更具永續性。這些創新將改善液體紙板的環境足跡,擴大其在各個領域的應用,並進一步推動市場成長。

- 根據聯合國糧食及農業組織的資料,德國2024年產能為2,453萬噸。另一方面,紙箱紙板產能為174萬噸,僅佔紙及紙板總產能的7%。紙箱紙板包括折疊式牛奶紙盒和食品服務盒紙板。

液體紙板產業概況

液體紙板市場由斯道拉恩索、ITC、Graphic Packaging、WestRock 和 Golden Paper Group 等主要企業主導。 領先的公司正在透過策略併購來推動這種整合,增加市場佔有率並擴大其全球影響力,以滿足對永續包裝不斷成長的需求。

2023 年 6 月:斯道拉恩索和利樂在波蘭斯道拉恩索的 Ostroleka 紙板工廠啟用了一條新的消費後飲料紙盒回收生產線。兩家公司表示,新增產能將使該工廠成為歐洲主要的液體紙板包裝回收站。根據斯道拉恩索介紹,新生產線的吞吐能力為每年5萬噸。它僅處理飲料紙盒並將纖維與聚合物和鋁分離。然後,這些纖維被回收並重新用於紙板製造。 Czech Plastigram Industries 和利樂公司正在工業化一種解決方案,將非纖維「PolyAl」部分回收到新產品中。

2023 年 3 月:Asia Symbol 江蘇採用 Teat Every 的製造執行系統 (MES) 來業務並提高其如皋工廠紙箱紙板生產線的業務效率。現代資訊技術、關鍵業務流程的數位化和自動化提高了生產和營運管理。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 液體紙板和液體包裝的市場現狀

- 技術進步提高了阻隔性並延長了保存期限

- 分析導致更小的飲料紙盒包裝的極簡設計趨勢

- 紙板材料進出口的國際貿易政策

- 行業法規

第5章市場動態

- 市場促進因素

- 對方便易用的包裝形式的需求不斷成長

- 越來越重視永續和環保的包裝解決方案

- 市場挑戰

- 替代包裝形式的市場成長挑戰

第6章 市場細分

- 依材料類型

- 液體包裝紙板

- 食品/杯湯

- 按最終用途

- 飲料

- 食品

- 食品補充品

- 家庭和個人護理

- 其他最終用途

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東/非洲

第7章 供應商市場佔有率

第8章 競爭格局

- 公司簡介

- Stora Enso Oyj

- Graphic Packaging International

- WestRock Company

- ITC Limited

- Golden Paper Company

- Greatview Aseptic Packaging Co. Ltd

- Ningbo Sure Paper Co. Ltd

- Suneja Sons

- Billerud AB

- Asia Symbol Paper Co. Ltd

第9章投資分析

第10章 市場未來展望

The Liquid Paperboard Market size in terms of production volume is expected to grow from 4.30 Million metric tons in 2024 to 5.20 Million metric tons by 2029, at a CAGR of 3.87% during the forecast period (2024-2029).

Key Highlights

- Liquid paperboard (LPB) is a versatile and sustainable packaging material predominantly used in the food and beverage industry. Liquid paperboard consists of layers coated with various barrier materials, typically polyethylene or other biopolymers, to enhance its protective qualities. This multi-layered structure provides robust physical protection and effective barriers against moisture, oxygen, and light, making it ideal for packaging liquid products like milk, juices, soups, and sauces.

- Liquid paperboard is widely used in packaging for liquid cartons due to its sustainability and barrier properties. Manufacturers employ a minimalist, designable approach to create smaller packs that cater to single servings, reducing material usage and waste. These compact designs enhance convenience for consumers and promote environmental responsibility by minimizing the carbon footprint associated with packaging.

- Technological advancements in barrier coating have been a key driver in developing and enhancing liquid paperboard. Innovative coating technologies, such as those involving bio-based and biodegradable materials, are being developed to improve the performance of LPB while minimizing its environmental impact. These coatings not only enhance the shelf life and quality of the packaged products by preventing contamination and spoilage but also align with the growing consumer and regulatory push for sustainable packaging. For instance, advancements in nanotechnology have enabled the creation of ultra-thin yet highly effective barrier layers that can be applied to LPB, improving its functionality without significantly increasing its weight or cost.

- However, recycling liquid paperboard presents challenges because it is a composite material made from paperboard and polyethylene. Existing recycling infrastructure often needs help to separate these layers, hindering the recycling process efficiently. This complexity necessitates advancements in recycling technologies and systems to effectively handle liquid paperboard and improve its sustainability credentials.

Liquid Paperboard Market Trends

Rising Demand from the Beverage Segment Boosts The Market

- The rising demand from the beverage segment is significantly boosting the liquid paper board market. Packaging manufacturers and consumer brands increasingly opt for liquid paperboard because it can use fewer raw materials and create less waste, offering cost savings compared to other materials such as plastic or glass. By utilizing liquid paperboard, companies can produce lighter, more sustainable packaging that reduces transportation costs and minimizes environmental impact. This efficiency is particularly beneficial in the beverage industry, where the volume and weight of packaging can substantially influence overall logistics and carbon footprint.

- Premium liquid packaging boards are cost-effective and deliver exceptional product protection, ensuring the freshness and safety of beverages. These boards offer superior printing, converting, and filling performance, enabling brands to maintain high-quality standards and visually appealing designs. This combination of functionality and aesthetics makes liquid paperboard an attractive choice for packaging applications in the beverage industry, including juice, soups, water, and yogurt. The ability to provide a strong barrier against moisture, oxygen, and light further enhances these products' shelf life and quality, making liquid paperboard a preferred material for manufacturers.

- To further enhance the sustainability and efficiency of liquid paperboard, companies like Stora Enso are making significant investments in boosting the circularity of used beverage cartons. They are focusing on improving material efficiency and developing innovative solutions to enhance the performance of liquid paperboard. One such advancement is incorporating microfibrillated cellulose (MFC), which strengthens the paperboard while reducing its weight. This improvement decreases the amount of raw material needed and enhances the durability and functionality of the packaging, making it more competitive against other formats.

- Beverage cartons for long-life liquid products, like dairy products, soy milk, juices, fruit-based lemonades, and non-carbonated waters, additionally have a foil laminate. This thin aluminum layer protects beverages from light and oxygen. The aluminum layer is just 6.5 micrometers thick, less than a quarter of a hair. Aluminum is an excellent barrier for oxygen and light, and these drinks can last up to 18 months without preservatives or refrigeration.

- According to a report published in the annual report of the Metsa Board in 2023, a liquid packaging board with an annual demand of 5 million tons represents only 8.5% of the total carton board demand, which stands at 59 million tons. This segment is popular for packaging liquids due to specialized properties, such as durability, moisture resistance, and sustainability, making it crucial for sectors like beverages and dairy.

Europe is Set To Witness Significant Growth

- The European liquid paperboard market is experiencing a transformative shift, primarily driven by a heightened focus on sustainability. Consumer preferences increasingly lean toward eco-friendly packaging options due to growing environmental awareness. This trend significantly boosts the demand for liquid paperboard, a more sustainable alternative to traditional plastic packaging.

- The shift is also reinforced by European regulations, such as the EU's single-use plastics directive, which mandates the reduction of single-use plastics and encourages using renewable, recyclable materials like liquid paperboard.

- Additionally, the market is being influenced by the rapid growth of e-commerce. The rise in online shopping has increased the need for robust and reliable packaging solutions that protect goods during transit while being environmentally friendly. Liquid paperboard fits this requirement well, offering both durability and sustainability. This dual benefit makes liquid paperboard attractive for retailers and e-commerce companies looking to align their operations with sustainability goals and meet consumer expectations from green packaging.

- The market consolidation in the European liquid paperboard sector is also noteworthy. A few large players dominate the market, leading to high levels of consolidation. This consolidation enables significant investments in research and development, fostering innovation and efficiency improvements. These large manufacturers are continually exploring ways to enhance the performance and sustainability of liquid paperboard through technological advancements.

- Developments such as digital printing technologies allow for high-quality, customizable packaging solutions that cater to brand differentiation and consumer engagement. Additionally, biodegradable and compostable coating advancements make liquid paperboard even more sustainable. These technological innovations improve the environmental footprint of liquid paperboard and expand its applications across various sectors, further driving market growth.

- According to Food and Agriculture Organization data, Germany has a production capacity of 24.53 million tons in 2024. In contrast, the country has a production capacity of 1.74 million tons for carton boards, which is only 7% of total paper and paperboard production capacity. The carton boards include folding milk cartons and foodservice boxboards.

Liquid Paperboard Industry Overview

The market for liquid paperboard is dominated by key players such as Stora Enso, ITC, Graphic Packaging, WestRock, and Golden Paper Group. Major players are driving this consolidation through strategic mergers and acquisitions, enhancing their market share and expanding their global reach to meet the rising demand for sustainable packaging.

June 2023: Stora Enso and Tetra Pak started a new recycling line for post-consumer beverage cartons at Stora Enso's Ostroleka corrugated packaging plant in Poland. According to the companies, the newly added capacity intends to make the site one of Europe's main recycling hubs for liquid paperboard packaging. Stora Enso reported that the new line has a capacity of 50,000 tonnes a year. It handles only beverage cartons, separating the fibers from polymers and aluminum. The fibers are then recycled and reused for board production. Czech companies Plastigram Industries and Tetra Pak are industrializing a solution to recycle the non-fiber "PolyAl" fraction into new products.

March 2023: Asia Symbol Jiangsu Co. Ltd selected Tietoevry's Manufacturing Execution System (MES) to execute business transformation and increase operational efficiency in their Rugao mill's carton board line. The latest information technologies, digitalization, and automation of key business processes enable production and operations management improvements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Current Market Scenario For Liquid Paperboard and Liquid Cartons

- 4.4.1 Technological Advancements Leading to Better Barrier Properties and Extended Shelf Life

- 4.4.2 Trend Analysis for Minimalist Designs Resulting in Smaller Beverage Carton Packs

- 4.4.3 International Trade Policies on Import and Export of Paperboard Materials

- 4.4.4 Industry Regulations

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Convenient and Easy-to-Use Packaging Formats

- 5.1.2 Growing Focus on Sustainable and Eco-Friendly Packaging Solutions

- 5.2 Market Challenge

- 5.2.1 Alternative Forms of Packaging is Challenging the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Liquid Packaging Board

- 6.1.2 Food and Cupstock

- 6.2 By End-Use Application

- 6.2.1 Beverage

- 6.2.2 Food

- 6.2.3 Nutraceuticals

- 6.2.4 Homecare and Personal Care

- 6.2.5 Other End-use Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Stora Enso Oyj

- 8.1.2 Graphic Packaging International

- 8.1.3 WestRock Company

- 8.1.4 ITC Limited

- 8.1.5 Golden Paper Company

- 8.1.6 Greatview Aseptic Packaging Co. Ltd

- 8.1.7 Ningbo Sure Paper Co. Ltd

- 8.1.8 Suneja Sons

- 8.1.9 Billerud AB

- 8.1.10 Asia Symbol Paper Co. Ltd