|

市場調查報告書

商品編碼

1549891

全球工業自動化市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Industrial Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

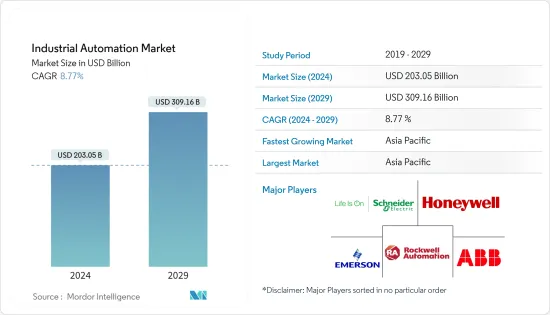

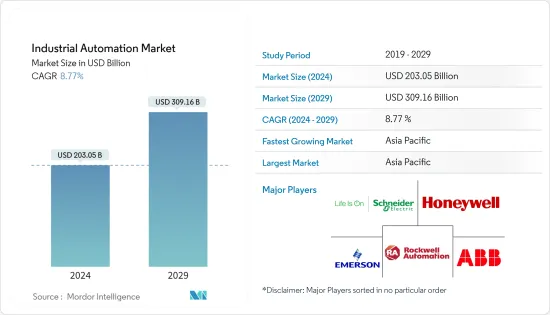

根據預測,2024年全球工業自動化市場規模預估為2,030.5億美元,2029年達3,091.6億美元,預測期間(2024-2029年)複合年成長率為8.77%。

主要亮點

- 工業自動化有潛力提高開發中國家的出口競爭力。透過自動化製造流程,這些國家可以更快、更有效、更便宜地生產商品,在全球市場上更具競爭力。因此,新興經濟體的工業自動化市場將受到刺激,出口水準提高,外匯收入改善,新興經濟體或將改善。

- 工業自動化對開發中國家的中小企業有重大影響。自動化有潛力使這些公司更具競爭力並實現永續成長。它使中小型企業能夠提高生產力、簡化業務並滿足大客戶和供應鏈的需求。例如,工業自動化可以最佳化資源並減少生產時間,從而騰出人員來執行策略業務。根據國際機器人聯合會 (IFR) 的數據,製造公司可以透過自動化多個流程將生產力提高高達 30%。

- 根據國際貨幣基金組織 (IMF) 的數據,新興市場和經濟體 2024 年和 2025 年的成長預計為 4.2%,而 2023 年為 4.3%。在印度等許多新興國家,印度政府的多項舉措,如印度市場的報廢政策、2026年汽車使命計劃以及與生產連結獎勵計畫計劃,使印度成為兩輪和四輪車市場的重要參與者。 。這些政策包括採用自動化技術和創造有利於市場研究的環境。

- 自動化設備需要智慧製造的高資本投資(自動化系統的安裝、設計和製造可能花費數百萬美元)。購買機器人系統、輸送機、感測器和控制系統等設備的成本可能很高。工廠自動化設備還需要客製化並整合到現有生產系統中。該過程涉及設備的設計、工程和編程,以滿足特定的製造要求。這是所研究市場成長的主要障礙。

- 除了對工業自動化解決方案的供應鏈和生產的直接影響外,疫情的後遺症也影響了所研究市場的成長。例如,包括北美在內的各個地區迫在眉睫的景氣衰退威脅正在對所研究市場的成長產生負面影響,因為經濟不確定性阻礙了消費者和企業增加汽車等大件產品的支出,而擴建計劃可能會受到影響。

工業自動化市場趨勢

石油和天然氣產業預計將顯著成長

- 石油和天然氣產業是迄今為止實施工業自動化解決方案的領域。然而,與其他發展中產業相比,該產業的工業自動化成長前景有限,因此預計該產業的成長速度將放緩。

- 石油和天然氣自動化(也稱為油田自動化)是一組由數位技術驅動的流程,旨在提高能源生產商在全球市場的競爭力。雖然產業內的某些部門將實現更大程度的自動化,但關鍵領域包括鑽井、生產業務、物流、安全和零售業務。石油和天然氣自動化主要依靠基於物聯網的感測器、預測系統和人工智慧專家系統來提高生產力並縮小勞動力短缺造成的技能差距。

- 石油和天然氣產業的危險環境日益透過自動化得到改善。機器人和自動化系統處理挖掘、檢查和維護等任務,大大減少了人類面臨的風險。

- 該行業正在透過緊急關閉系統等自動化功能來增強安全性,並確保對困難情況做出快速反應。透過部署感測器和自動化工具,公司可以確保合規性並減少對環境的影響。

- 石油和天然氣工業是全球經濟的重要組成部分。 IEA 預計,2024 年全球液體燃料產量將放緩至80 萬桶/日,較2023 年180 萬桶/日的增幅有所放緩,因為OPEC+ 自願減產被非OPEC+ 供應增量超過100 萬桶/日所抵銷。儘管2024年OPEC+原油產量預計將年減90萬桶/與前一年同期比較,但非OPEC+產量預計將增加180萬桶/日,其中以美國、圭亞那、巴西和加拿大為首。隨著石油產量的大幅增加數位化的提高,石油和燃氣公司越來越依賴數位技術和自動化。

亞太地區預計將錄得最快成長

- 亞太地區是世界上最大的製造業經濟體的所在地,包括中國、日本、韓國和台灣。汽車、電子、航太、醫療設備等製造業的持續擴張正在創造對工業自動化的巨大需求。

- 印度等新興國家擴大製造業和實現自力更生的努力進一步推動了市場成長。製造業已成為印度高成長產業之一。 「印度製造」計畫使印度成為世界地圖上的製造中心,並讓印度經濟獲得全球認可。 IBEF 預計,到 2030 年,印度將出口價值 1 兆美元的商品,預計將成為世界主要製造中心。

- 印度政府的目標是到2025年經濟規模達到5兆美元,其中製造業價值1兆美元。為了實現這一目標,印度製造、印度技能和數位印度等旗艦計畫的整合至關重要,這將推動該地區的市場成長。

- 為加速電動車的採用而建造電池製造廠的持續舉措進一步支持了市場成長。例如,Recharge Industries於2023年8月宣布,計劃興建一座年產能30吉瓦時的工廠,為約30萬輛電動車供應電池。建設計劃於 2024 年 5 月左右開始,生產計劃於 2025 年開始。

- 由於台積電等公司的存在,該地區是最大的半導體和電子產品製造商。台灣生產全球60%以上的半導體,以及90%以上最先進的半導體。大部分半導體由台積電生產。

工業自動化產業概況

由於中小企業和跨國公司的存在,工業自動化市場高度分散。該市場的主要企業包括Schneider Electric、羅克韋爾自動化、Honeywell國際、艾默生電氣和 ABB 有限公司。市場上的主要企業正在採取收購和合作等策略來加強其產品範圍並獲得永續的競爭優勢。

- 2024 年 6 月 - 羅克韋爾自動化宣布與 NVIDIA 合作,加速開發更安全、更智慧的工業 AI 移動機器人。此次合作預計將加速人工智慧在自主移動機器人(AMR)的應用,並提高其效能和效率。

- 2024 年 2 月 -Schneider Electric與科技巨頭英特爾和紅帽公司合作,宣布推出新的軟體框架:分散式控制節點 (DCN)。此創新框架基於Schneider Electric的 EcoStruxure Automation Expert 構建,可幫助工業公司轉向軟體定義的即插即用模型。這種轉變提高了業務效率和質量,並簡化了流程,最終節省了成本。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 技術趨勢/進展

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- 市場宏觀趨勢分析

第5章市場動態

- 市場促進因素

- 新興經濟體工業活動的成長

- 人們對能源效率和降低成本的興趣日益濃厚

- 市場限制

- 安裝/改造成本高

第6章 市場細分

- 按解決方案

- 工業控制系統

- 集散控制系統(DCS)

- 監控/資料採集 (SCADA)

- 可程式邏輯控制器(PLC)

- 人機介面 (HMI)

- 其他控制系統

- 現場設備

- 感測器和發射器

- 閥門和致動器

- 馬達和驅動器

- 機器人

- 其他現場設備

- 軟體

- 產品生命週期管理 (PLM)

- 企業資源規劃(ERP)

- 製造執行系統(MES)

- 其他軟體

- 工業控制系統

- 按最終用戶產業

- 石油和天然氣

- 製藥

- 汽車/交通

- 飲食

- 電力/公共產業

- 化工/石化

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Rockwell Automation Inc.

- Honeywell International Inc.

- Emerson Electric Co.

- ABB Limited

- Mitsubishi Electric Corporation

- Siemens AG

- Omron Corporation

- Yokogawa Electric Corporation

- Yaskawa Electric Corporation

- Kuka Aktiengesellschaft

- Fanuc Corporation

- Regal Rexnord Corporation

- Nidec Corporation

- Basler AG

第8章投資分析

第9章市場的未來

The Industrial Automation Market size is estimated at USD 203.05 billion in 2024, and is expected to reach USD 309.16 billion by 2029, growing at a CAGR of 8.77% during the forecast period (2024-2029).

Key Highlights

- Industrial automation may potentially and considerably increase export competitiveness in developing nations. By automating their manufacturing processes, these nations can create items more quickly, effectively, and affordably, which boosts their ability to compete in the global market. This may result in higher levels of exports, better foreign currency revenues, and an improvement in the emerging economy, hence driving the market for industrial automation in developing countries.

- Industrial automation significantly impacts small and medium-sized firms (SMEs) in developing nations. Automation may boost these companies' competitiveness and achieve sustained growth. It enables SMEs to improve productivity, streamline operations, and satisfy the needs of larger customers and supply chains. For instance, Industrial automation optimizes resources and reduces production times, freeing personnel for strategic tasks. According to the International Federation of Robotics (IFR), productivity increases by up to 30% in manufacturing with automation in multiple processes.

- According to the International Monetary Fund (IMF), growth rates for emerging markets and developing economies are projected to be 4.2% in 2024 and 2025 compared to 4.3% in 2023. In many developing countries such as India, several initiatives by the Government of India, like the scrappage policy, Automotive Mission Plan 2026, and production-linked incentive scheme in the Indian market, are expected to make India a significant player in the two-wheeler and four-wheeler market. Such policies include adopting automation technologies and fostering a favorable environment for the market studied.

- Automation equipment mandates high capital investment to fund smart manufacturing (an automated system may cost millions of dollars to install, design, and fabricate). The cost of purchasing the equipment, including robotic systems, conveyor belts, sensors, and control systems, can be substantial. The factory automation equipment also necessitates the customization and integration into existing production systems. This process involves designing, engineering, and programming the equipment to meet specific manufacturing requirements. This poses a significant hindrance to the growth of the market studied.

- Apart from the direct impact evident in the supply chains and production of industrial automation solutions, the aftereffects of the pandemic are also impacting the growth of the studied market. For instance, the ongoing threat of recession looming over various regions, including North America, may negatively influence the studied market's growth as the economic uncertainty will prevent consumers and businesses from spending more on high-value products such as automobiles and expansion projects, which may impact the growth of the market studied.

Industrial Automation Market Trends

Oil and Gas Industry to Witness Significant Growth

- The oil and gas industry has been a dominating segment in adopting industrial automation solutions. However, the growth prospects for industrial automation in this industry are limited compared to other developing industries, and therefore, the growth rate is expected to slow in this industry.

- Oil and gas automation, also known as oilfield automation, is a set of processes, many leveraging digital technologies, aimed at enhancing the competitiveness of energy producers in global markets. While certain sectors within the industry are more primed for automation, key areas include drilling, production operations, logistics, safety, and retail operations. Oil and gas automation predominantly relies on IoT-based sensors, predictive systems, and AI-driven expert systems to boost productivity and bridge skill gaps arising from labor shortages.

- The oil and gas industry's hazardous environments are increasingly being navigated through automation. Robots and automated systems handle tasks like drilling, inspection, and maintenance, significantly reducing human exposure to risks.

- The industry is bolstering safety with automated features like emergency shutdown systems, guaranteeing swift responses to difficult situations. By deploying sensors and automated tools, companies are ensuring compliance with regulations and curbing their environmental footprint.

- The oil and gas industry is a vital component of the global economy. As per IEA, global production of liquid fuels will increase by more than 0.8 million b/d in 2024, slowing from the 1.8 million b/d increase in 2023, as OPEC+ voluntary production cuts are offset by supply growth outside of OPEC+. Although OPEC+ crude oil production in 2024 decreases by 0.9 million b/d compared with last year, forecast production outside of OPEC+ increased by 1.8 million b/d, led by the United States, Guyana, Brazil, and Canada. With significant surge in oil production and surging digitization, oil and gas companies have increasingly relied on digital technology and automation.

Asia-Pacific is Expected to Register the Fastest Growth

- Asia-Pacific is home to some of the world's largest manufacturing economies, including China, Japan, South Korea, and Taiwan. The ongoing expansion of manufacturing industries in automotive, electronics, aerospace, and medical devices creates a significant demand for industrial automation.

- Initiatives by emerging countries like India to expand their manufacturing footprint and become self-reliant further propel the market growth. Manufacturing emerged as one of the high-growth sectors in India. The 'Make in India' program places India on the global map as a manufacturing hub and globally recognizes the Indian economy. According to IBEF, India can export goods worth USD 1 trillion by 2030 and is on the road to becoming a significant global manufacturing hub.

- The government of India aims for a USD 5 trillion economy by 2025, of which manufacturing would be worth USD 1 trillion. The convergence of flagship programs, such as Make in India with Skill India and Digital India, would be vital to achieving this goal, thereby driving the region's market growth.

- The ongoing initiatives to build a battery manufacturing plant for faster adoption of electric vehicles are further driving the market growth. For instance, in August 2023, Recharge Industries announced its plans to build a factory with an annual capacity of 30 gigawatt-hours to supply batteries for roughly 300,000 EVs. Construction is expected to begin around May 2024, with production slated to start in 2025.

- The region is the biggest semiconductor and electronics product manufacturer due to the presence of companies like Taiwan Semiconductor Manufacturing Company. Taiwan produces over 60% of the world's semiconductors and over 90% of the most advanced ones. Most of the semiconductors are manufactured by TSMC.

Industrial Automation Industry Overview

The industrial automation market is highly fragmented due to the presence of small and medium-sized enterprises and global players. Some of the major players in the market are Schneider Electric SE, Rockwell Automation Inc., Honeywell International Inc., Emerson Electric Co., and ABB Limited. Key players in the market are adopting strategies such as acquisitions and partnerships to enhance their product offerings and gain sustainable competitive advantage.

- June 2024 - Rockwell Automation announced a partnership with NVIDIA to expedite the development of safer and smarter industrial AI mobile robots. The collaboration is anticipated to drive the use of AI in autonomous mobile robots (AMRs), improving their performance and efficiency.

- February 2024 - Schneider Electric, in partnership with tech giants Intel and Red Hat, unveiled a new software framework, the Distributed Control Node (DCN). Building upon Schneider Electric's EcoStruxure Automation Expert, this innovative framework empowers industrial firms to transition to a software-defined, plug-and-play model. This shift boosts operational efficiency and quality and streamlines processes, ultimately leading to cost savings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends/Advancements

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Industry Value Chain Analysis

- 4.5 Analysis of the Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of Industrial Activities in Developing Economies

- 5.1.2 Growing Emphasis on Energy Efficiency and Cost Reduction

- 5.2 Market Restrains

- 5.2.1 High Cost of Installation and Re-building

6 MARKET SEGMENTATION

- 6.1 By Solution

- 6.1.1 Industrial Control Systems

- 6.1.1.1 Distributed Control System (DCS)

- 6.1.1.2 Supervisory Control and Data Acquisition (SCADA)

- 6.1.1.3 Programmable Logic Controller (PLC)

- 6.1.1.4 Human-machine Interface (HMI)

- 6.1.1.5 Other Control Systems

- 6.1.2 Field Devices

- 6.1.2.1 Sensors and Transmitters

- 6.1.2.2 Valves and Actuators

- 6.1.2.3 Motors and Drives

- 6.1.2.4 Robotics

- 6.1.2.5 Other Field Devices

- 6.1.3 Software

- 6.1.3.1 Product Lifecycle Management (PLM)

- 6.1.3.2 Enterprise Resource and Planning (ERP)

- 6.1.3.3 Manufacturing Execution System (MES)

- 6.1.3.4 Other Software

- 6.1.1 Industrial Control Systems

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Pharmaceuticals

- 6.2.3 Automotive and Transportation

- 6.2.4 Food and Beverage

- 6.2.5 Power and Utilities

- 6.2.6 Chemical and Petrochemical

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Rockwell Automation Inc.

- 7.1.3 Honeywell International Inc.

- 7.1.4 Emerson Electric Co.

- 7.1.5 ABB Limited

- 7.1.6 Mitsubishi Electric Corporation

- 7.1.7 Siemens AG

- 7.1.8 Omron Corporation

- 7.1.9 Yokogawa Electric Corporation

- 7.1.10 Yaskawa Electric Corporation

- 7.1.11 Kuka Aktiengesellschaft

- 7.1.12 Fanuc Corporation

- 7.1.13 Regal Rexnord Corporation

- 7.1.14 Nidec Corporation

- 7.1.15 Basler AG