|

市場調查報告書

商品編碼

1549918

生成式人工智慧:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Generative AI - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

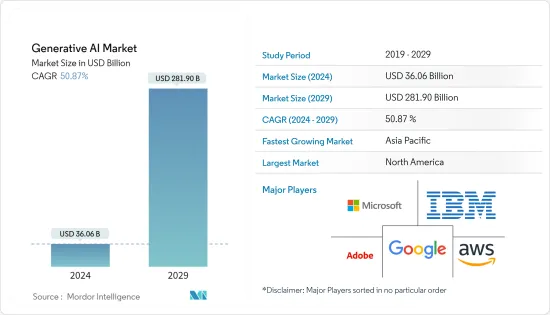

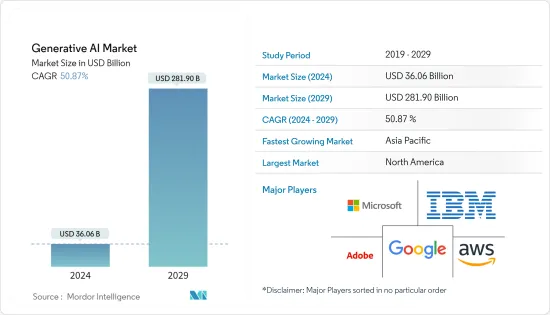

生成式人工智慧市場規模預計到 2024 年為 360.6 億美元,預計到 2029 年將達到 2,819 億美元,在預測期內(2024-2029 年)複合年成長率為 50.87%。

主要亮點

- 該市場主要由不斷擴大的資訊技術 (IT) 行業以及擴大使用人工智慧整合系統來提高生產力和敏捷性所推動。除此之外,輔助聊天機器人進行有效對話並提高消費者滿意度的生成式人工智慧的日益普及也推動了市場的成長。生成式人工智慧可以根據個人選擇和行動建立個人化推薦、客製化廣告和客製化產品。此外,該市場還受到生成式人工智慧的日益使用的推動,例如在元宇宙中構建虛擬世界、使用基於文字的說明創建數位藝術作品以及生成獨特和創新的內容。此外,這個市場吸引了老牌公司和創業投資的大量投資和資金。

- 生成式人工智慧能夠實現模型的多模態演化,可以同時處理圖像和文字等多種模態,從而擴大了應用領域並提高了多功能性。生成式人工智慧透過利用自然語言而不是程式語言來加強世界上人類和電腦之間的聯繫。生成式人工智慧可以改變您的業務,同時為自動化、創新和個人化開闢新的機會,從而降低成本並改善客戶體驗。例如,2023 年 3 月,提供基於 AI 的寫作助理的 Grammarly 公司宣布推出 GrammarlyGo,這是一種生成式 AI 功能,可讓用戶創建、編輯和個性化自己的寫作。

- GAN已經在許多領域和公司得到應用,適應性很強。它用於圖像合成、風格傳輸、圖像到圖像轉換、文字生成、影片生成、資料增強等。 GAN 開發新的、多樣化的、現實的模型的能力使其成為各種生成任務的理想選擇,並且是市場開拓的驅動力。此外,開放原始碼實作和預訓練 GAN 模型的可用性正在推動 GAN 的採用和使用。這些資源與 PyTorch 和 TensorFlow 等易於使用的庫和框架整合,降低了設計人員和研究人員的進入門檻,使他們能夠在應用程式中利用 GAN,而無需從頭開始。

- 醫學研究依賴於獲取有關各種健康狀況的大量資料。這項資料需要改進,特別是對於罕見疾病。此類資料也很昂貴,隱私法規範其使用和共用。醫療保健領域的生成式人工智慧可以產生合成資料樣本,以擴增實境世界的健康資料集。由於醫療保健資料不屬於特定個人,因此這些樣本不受隱私法規的約束。人工智慧可以開發 EHR資料、掃描等。例如,一個德國研究團隊建立了一個名為 GANerAid 的人工智慧模型,用於產生用於臨床試驗的合成患者資料。該模型基於 GAN 程序,即使訓練資料集集有限,也能夠創建具有所需特徵的醫療資料。

- 生成式人工智慧解決方案使組織能夠更好地了解合規性相關問題和資料管理。軟體工具使人工智慧解決方案能夠及時提取大量資料並創建準確完整的資料。大量公司擴大轉向基於人工智慧的解決方案。此外,多個行業的新興企業數量顯著增加。這些新參與企業非常願意採用人工智慧來實現業務自動化和規模化。基於人工智慧的解決方案主要因其成本和時間效率、改善的用戶體驗、易用性以及先進技術的新功能而被採用。

- 相反,人工智慧有潛力解決常見的業務挑戰。儘管如此,隨著公司將消費者和供應商資料輸入複雜的人工智慧演算法以創建新的敏感訊息,隱私問題正在出現。安全和隱私問題是數位轉型市場的主要挑戰之一。隨著公司越來越依賴數位技術,他們收集和儲存大量敏感資料,使他們更容易受到網路攻擊和資料外洩。此外,隨著連接設備數量的增加,駭客的攻擊面也在擴大,使保護這些設備及其收集和傳輸的資料變得更加困難。

生成式人工智慧市場趨勢

BFSI 預計將佔據較大市場佔有率

- 生成式人工智慧有潛力在未來幾年徹底改變銀行的風險管理。這是從以任務為導向的活動轉向與企業部門合作進行策略性風險預防和新消費者旅程早期的控制過程,通常被稱為「左移」方法。因此,風險專業人士可以為公司提供新產品開發和策略性企業決策的建議,探索新出現的風險趨勢和情景,增強抵禦能力,並主動加強風險和控制流程。

- 此外,生成式人工智慧模型使銀行能夠透過分析歷史資料模式和市場趨勢來識別風險領域並保持盈利。透過模擬各種經濟場景,GAN 使銀行能夠評估和降低信用風險、市場風險和操作風險等風險。例如,萬事達卡最近宣布了一種新的生成人工智慧模型,以幫助銀行更好地檢測其網路上的可疑交易。根據萬事達卡稱,這項技術可以讓銀行將詐欺偵測率提高 20%,在某些情況下高達 300%。

- 客戶服務永遠是成功的基石。然而,如何有效地滿足消費者的多樣化需求是一項挑戰。這就是配備生成式人工智慧的聊天機器人發揮作用的地方。人工智慧驅動的聊天機器人可以與消費者進行自然的、類似人類的對話,並提供 24/7 即時幫助。這些機器人不僅僅是基於規則的;它們理解上下文、情感和語言的細微差別,以創建無縫、個性化的互動。當消費者提出問題或需要幫助時,聊天機器人會使用生成式人工智慧來檢查詢問並提供適當的答案和解決方案。

- 同樣,資產管理在業務中非常重要,客戶依靠金融機構來開拓和保護他們的資產。生成式人工智慧對於改善資產管理和投資組合最佳化流程至關重要。生成式人工智慧模型可以解釋財務資料、經濟指標、市場趨勢和客戶檔案。人工智慧可以利用這些資料產生預測模型,提案最佳的資產配置和投資策略。根據不斷變化的市場狀況和新機會,這些模型可以即時調整投資組合。這種動態資產管理方法使銀行能夠在有效管理風險的同時實現最大回報。

- 根據 NVIDIA Research 2023 的數據,資料分析是 2023 年金融服務業中最常用的人工智慧應用。調查顯示,43%的受訪者使用AI進行生成,69%的受訪者使用AI進行資料分析,其次是資料處理和資料處理。其他常見的人工智慧使用案例包括自然語言處理和大規模語言模型。從2022年起,人工智慧在金融業務中的採用將大幅增加,並且預計未來將進一步擴大。人工智慧在金融領域的大規模採用預計將推動所研究市場的需求。

預計北美將佔據很大的市場佔有率

- 北美擁有功能齊全的人工智慧研究社區,傑出的機構和研究人員推動著生成式人工智慧的進步。該地區領先的研究中心和大學開展高級研究,發表重要論文,並為產生人工智慧方法的發展做出貢獻。該地區龐大的人口、高消費支出和先進的技術基礎設施也為生成式人工智慧解決方案的採用和商業化創造了有利的環境。此外,北美預計將在人工智慧研究和開發方面處於領先地位,Google、微軟和IBM等大公司在生成式人工智慧技術上投入大量資金。此外,該地區先進的基礎設施、有利的政府舉措以及人工智慧在醫療保健、金融和汽車等領域的早期採用也有助於該地區的市場主導地位。

- 美國國家人工智慧安全委員會的最終報告呼籲,到 2026 會計年度,美國人工智慧的聯邦研發資金每年增加一倍,達到 320 億美元。在2023年預算中,政府決定將聯邦研發預算在2021年授權水準基礎上增加28%,達到超過2,040億美元。國家人工智慧研究機構,無論是新的還是現有的,都準備好獲得部分資金。這些機構將商業部門、協會、學術機構以及聯邦、州和地方當局聚集在一起,共同應對人工智慧研究和勞動力發展的挑戰。這些政府措施預計將為生成人工智慧市場創造成長機會。

- 根據史丹佛人工智慧指數報告,到 2023 年,美國機構將出現 61 個著名的人工智慧模型,遠遠領先歐盟的 21 個和中國的 15 個。 2023年以及過去五年,美國人工智慧相關法規數量大幅增加。到 2023 年,人工智慧相關法規將達到 25 項,而 2016 年只有 1 項。 2023年,人工智慧相關法規數量將增加56.3%。此外,新的人工智慧指數研究表明,可靠的人工智慧報告嚴重缺乏標準化。主要開發商,包括 OpenAI、Google 和 Anthropic,主要根據各種負責任的 AI 基準測試他們的模型。

- IBM委託的一項新市場研究顯示,加拿大企業擴大採用和部署人工智慧 (AI),大約 37% 的企業規模組織(1,000 名或更多員工)表示這是其業務的一部分。使用人工智慧。儘管全球人工智慧採用率保持穩定(自 2023 年 4 月以來為 42%),但在加拿大,實施人工智慧的公司數量從 2023 年 4 月的 34% 增加到 2023 年 11 月的 37%。早期採用者處於領先地位,35% 的公司已經致力於人工智慧,並打算加速或擴大對該技術的投資。人工智慧在該國的大規模採用預計將為該地區的市場公司創造成長機會。

- 產生人工智慧市場的公司正在共同努力,以滿足加拿大企業的需求。例如,2024 年 4 月,IBM 宣佈在魁北克省蒙特婁創建新的雲多區域 (MZR)。它將旨在幫助客戶滿足不斷變化的監管要求,並在安全的企業雲端平台中利用生成式人工智慧等技術。在 2021 年啟用 IBM Cloud 多倫多 MZR 和蒙特婁現有資料中心的基礎上,新的蒙特婁 MZR 計劃於 2025 年上半年投入使用。 IBM 在加拿大擴大業務預計將有助於加拿大各地的客戶管理新興的監管要求和現有法規,例如主權的地理要求,同時推動創新。

生成式人工智慧產業概述

全球生成式人工智慧市場由少數知名公司半壟斷,包括Google公司、IBM公司、微軟公司、Adobe公司和亞馬遜網路服務公司。為了增加市場佔有率,公司持續投資於策略聯盟、收購以及解決方案和服務的開拓。例如

- 2024 年 5 月,Sainsbury’s 與微軟達成了為期五年的合作關係,將生成式人工智慧納入超級市場的業務中。這家英國零售巨頭將利用微軟的生成式人工智慧網路購物和人工智慧客戶支援中「改善客戶的搜尋體驗」。 Sainsbury’s 也表示,將利用微軟的人工智慧來提高店內員工的效率,人工智慧將引導員工到需要補貨的貨架。

- 2024 年 5 月,IBM 和 SAP SE 宣布了他們對下一個合作時代的願景,包括新的生成式 AI 功能和產業專用的雲端解決方案,以幫助客戶釋放業務價值。兩家公司正在與 SAP 一起為 RISE 建立新的生成式 AI 功能,並探索將 AI 跨垂直雲端解決方案和業務應用程式線引入 SAP 業務流程的機會。最初,IBM 計劃在 SAP 業務技術平台 (SAP BTP) 的支援下,在 SAP 的雲端解決方案和應用程式中擴展 AI 功能。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 市場生態系分析

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 宏觀經濟因素對市場的影響

- 案例研究分析

第5章市場動態

- 市場促進因素

- 跨多個行業更多地使用人工智慧整合系統

- 客製化和個人化需求日益成長

- 市場限制

- 隱私和道德問題

- 科技的影響

- 產生互惠網路 (GAN)

- 變壓器

- 變分自動編碼器 (VAE)

- 擴散網路

第6章 市場細分

- 按成分

- 軟體

- 服務

- 按最終用戶

- BFSI

- 衛生保健

- 資訊科技/通訊

- 政府機構

- 零售/消費品

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Adobe Inc

- Amazon Web Services

- Cohere

- Nvidia Corporation

- SAP SE

- Rephrase AI

- Konverge AI

第8章投資分析

第9章市場展望及未來性

The Generative AI Market size is estimated at USD 36.06 billion in 2024, and is expected to reach USD 281.90 billion by 2029, growing at a CAGR of 50.87% during the forecast period (2024-2029).

Key Highlights

- The market is primarily propelled by the expanding information technology (IT) sector and the growing use of AI-integrated systems for improving productivity and agility. Besides this, generative AI's ever-increasing popularity for aiding chatbots in conducting effective conversations and enhancing consumer satisfaction also propels the market's growth. Generative AI can construct personalized recommendations, tailored advertisements, and customized products based on individual choices and behavior. Moreover, the increasing utilization of generative AI for making virtual worlds in the metaverse, producing digital artworks using text-based descriptions, and generating unique and innovative content is also pushing the market forward. Furthermore, the market has drawn significant investments and funding from established businesses and venture capitalists.

- Generative AI allows models to evolve multimodal, which implies they can process multiple modalities simultaneously, such as images and text, widening their application areas and improving their versatility. Generative AI enhances the connection to the globe where humans communicate with computers, utilizing natural language rather than programming languages. Generative AI can transform businesses by opening new opportunities for automation, innovation, and personalization, all while lowering costs and improving customer experience. For instance, in March 2023, Grammarly, Inc., an AI-based writing assistant, announced the launch of GrammarlyGo, a feature of generative AI that allows users to compose writing, edit, and personalize text.

- GANs have found applications in numerous fields and enterprises, making them highly adaptable. They are utilized in image synthesis, style transfer, image-to-image translation, text generation, video generation, data augmentation, and more. The ability of GANs to develop new, diverse, and realistic models has made them a go-to choice for various generative tasks, driving the market studied. Moreover, the availability of open-source implementations and pre-trained GAN models have facilitated the adoption and usage of GANs. These resources, integrated with easy-to-use libraries and frameworks like PyTorch and TensorFlow, have lowered the obstacle to entry for designers and researchers, letting them leverage GANs for their applications without starting from scratch.

- Medical research depends on accessing vast amounts of data on different health conditions. This data needs to be improved, especially regarding rare diseases. Such data is also expensive, and privacy laws govern its usage and sharing. Generative AI in medicine can produce synthetic data samples that augment real-life health datasets. These samples are not subject to privacy regulations, as healthcare data does not belong to particular individuals. Artificial intelligence can develop EHR data, scans, etc. For example, a team of German researchers built an AI-powered model, GANerAid, to generate synthetic patient data for clinical trials. This model is based on the GAN procedure and can create medical data with the desired properties even if the training dataset is limited.

- Generative AI solutions allow organizations to understand their compliance-related issues and data management better. Software tools enable AI-enabled solutions to extract a large amount of data on time and produce accurate and complete data. There is a surge in the trend where a significant number of companies are increasingly demanding AI-based solutions. Moreover, multiple industries are witnessing a considerable increase in startups. These new players are highly attracted to adopting AI to automate and expand their businesses. AI-based solutions are mainly deployed due to their cost and time efficiency, improved user experience, ease of use, and new features with advanced technology.

- On the contrary, artificial intelligence can potentially solve common business challenges. Still, privacy concerns are popping up, and firms feed consumer and vendor data into advanced, AI-fueled algorithms to create new sensitive information. Security and privacy concerns are among the key challenges in the digital transformation market. As firms rely more on digital technology, they collect and store enormous volumes of sensitive data, making them vulnerable to cyberattacks and data breaches. Furthermore, as the number of connected devices rises, hackers' attack surface expands, making it more challenging to secure these devices and the data they collect and transmit.

Generative AI Market Trends

BFSI is Expected to Hold a Significant Share of the Market

- Generative AI can revolutionize banks' risk management over the next few years. It could permit processes to move away from task-oriented activities toward partnering with company lines on strategic risk prevention and having controls at the outset in new consumer journeys, often referred to as a "shift left" approach. That, in turn, would free up risk professionals to advise companies on new product development and strategic corporation decisions, explore emerging risk trends and scenarios, strengthen resilience, and enhance risk and control processes proactively.

- Furthermore, generative AI models can enable banks to identify risk areas and preserve profitability by analyzing historical data patterns and market trends. By simulating different economic scenarios, GANs can allow banks to assess and mitigate risks, such as credit, market, and operational risks. For instance, Mastercard recently launched a new generative AI model to enable banks to better detect suspicious transactions on its network. According to Mastercard, the technology is poised to allow banks to improve their fraud detection rate by 20%, with rates reaching as much as 300% in some cases.

- Customer service has always been a cornerstone of success. However, serving consumers' diverse requirements efficiently can be challenging. This is where generative AI-powered chatbots step in. AI-driven chatbots can engage consumers in natural, human-like conversations, providing instant assistance 24/7. These bots are not just rule-based; they understand context, sentiment, and nuances in language, making exchanges seamless and personalized. When a consumer has a query or needs assistance, the chatbot uses generative AI to examine the inquiry and provide relevant responses or solutions.

- Similarly, wealth management is critical in banking, where customers entrust financial institutions to develop and safeguard their assets. Generative AI is pivotal in improving wealth management and portfolio optimization processes. Generative AI models can interpret financial data, economic indicators, market trends, and customer profiles. AI can utilize this data to generate predictive models that suggest optimal asset allocations and investment strategies. Based on varying market conditions and emerging opportunities, these models can adjust portfolios in real time. This dynamic method of wealth management allows banks to maximize returns while managing risk effectively.

- According to Nvidia survey 2023, Data analytics was the most used AI-enabled application in the financial services industry in 2023. Based on the study, 43% of the respondents used AI for generative AI, and 69% of the respondents used AI for data analytics, followed by data processing and data processing. Other common AI use cases were natural language processing and large language models. The adoption of AI in financial businesses increased significantly since 2022, and it is anticipated to grow even further in the coming years. Such massive adoption of AI in the finance sector is expected to drive the demand for the market studied.

North America is Expected to Hold Significant Share of the Market

- North America has a functional AI research community, with eminent institutions and researchers propelling advancements in generative AI. The region's foremost research centers and universities conduct advanced research, publish significant papers, and contribute to developing generative AI methods. The region's large population, high consumer spending, and advanced technology infrastructure also create a favorable environment for the adoption and commercialization of generative AI solutions. In addition, North America is expected to lead in AI research and development, with major players like Google, Microsoft, and IBM investing heavily in generative AI technologies. Moreover, the region's advanced infrastructure, favorable government initiatives, and early adoption of AI in sectors such as healthcare, finance, and automotive contribute to its market dominance.

- The final report of the National Security Commission on Artificial Intelligence recommended increasing federal R&D funding for AI in the United States by a factor of two annually, up to USD 32 billion in fiscal 2026. The government decided to increase the federal R&D budget by 28% from FY 2021 authorized levels to more than USD 204 billion under the fiscal 2023 budget plan. The national AI research institutes, both new and established, were poised to get some of those funds. To address the difficulties of AI research and workforce development, these institutes bring together the commercial sector, organizations, academics, and federal, state, and municipal authorities. Such government initiatives are expected to create opportunities for the generative AI market to grow.

- According to the Stanford AI Index Report, in 2023, 61 notable AI models originated from US-based institutions, far outpacing the European Union's 21 and China's 15. The number of AI-related regulations in the United States has risen significantly in 2023 and over the last five years. In 2023, there were 25 AI-related regulations, up from just one in 2016. In 2023, the number of AI-related regulations increased by 56.3%. Moreover, new research from the AI Index indicates a substantial lack of standardization in reliable AI reporting. Leading developers, including OpenAI, Google, and Anthropic, primarily test their models against various responsible AI benchmarks.

- New market research commissioned by IBM reports that Canadian companies are increasingly adopting and deploying artificial intelligence (AI), with about 37% of enterprise-scale organizations (over 1,000 employees) saying their company uses it as part of their business operations. While AI adoption remained steady globally (42% since April 2023), Canada saw an uptick in enterprises deploying AI from 34% in April 2023 to 37% in November 2023. Early adopters are leading the way, with 35% of the enterprises already working with AI intending to accelerate and expand investment in the technology. Such a huge adoption of AI in the country is expected to create opportunities for growth for the market players in the region.

- The players in the generative AI market are collaborating with Canadian enterprises to cater to their needs. For instance, in April 2024, IBM announced its new Cloud Multizone Region (MZR) in Montreal, Quebec. It will be designed to help clients address their evolving regulatory requirements and leverage technology such as generative AI with a secured enterprise cloud platform. Building on the opening of IBM Cloud's Toronto MZR in 2021 and existing data centers in Montreal, the new Montreal MZR is planned for the first half of 2025. IBM's expanded presence in Canada is expected to help clients throughout the country manage their emerging and existing regulatory demands, including geographic requirements around sovereignty, while driving innovation.

Generative AI Industry Overview

The global generative AI market is semi-consolidated, with a few prominent players, such as Google LLC, IBM Corporation, Microsoft Corporation, Adobe Inc., Amazon Web Services, and others. To increase market share, corporations continually spend on strategic partnerships or acquisitions and solution and services development. For instance,

- In May 2024, Sainsbury's agreed a five-year partnership deal with Microsoft to incorporate generative AI into the supermarket chain's operations. The British retail giant will use Microsoft generative AI to "improve customers' search experience" for online shopping and AI customer support. Sainsbury's said it will also use Microsoft AI to improve the efficiency of in-store staff, with AI guiding workers to shelves that need restocking.

- In May 2024, IBM and SAP SE announced their vision for the next era of their collaboration, which includes new generative AI capabilities and industry-specific cloud solutions that can assist clients in unlocking business value. The companies are exploring opportunities to build new generative AI capabilities for RISE with SAP and infuse AI into SAP business processes across industry-specific cloud solutions and lines of business applications. Initially, IBM plans to extend AI capabilities across SAP's cloud solutions and applications, all underpinned by the SAP Business Technology Platform (SAP BTP).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macro Economic Factors on the Market

- 4.5 Case Study Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Use of AI-Integrated System across Multiple Industries

- 5.1.2 Increase in Demand for Customization and Personalization Needs

- 5.2 Market Restrains

- 5.2.1 Privacy and Ethical Concerns

- 5.3 Impact of Technologies

- 5.3.1 Generative Adversarial Network (GANs)

- 5.3.2 Transformer

- 5.3.3 Variational Autoencoder (VAE)

- 5.3.4 Diffusion Networks

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By End User

- 6.2.1 BFSI

- 6.2.2 Healthcare

- 6.2.3 IT and Telecommunication

- 6.2.4 Government

- 6.2.5 Retail and Consumer Goods

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Google LLC

- 7.1.2 IBM Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 Adobe Inc

- 7.1.5 Amazon Web Services

- 7.1.6 Cohere

- 7.1.7 Nvidia Corporation

- 7.1.8 SAP SE

- 7.1.9 Rephrase AI

- 7.1.10 Konverge AI