|

市場調查報告書

商品編碼

1549941

全球金屬探測器市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Metal Detectors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

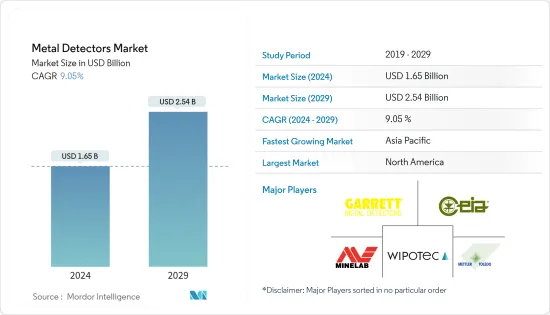

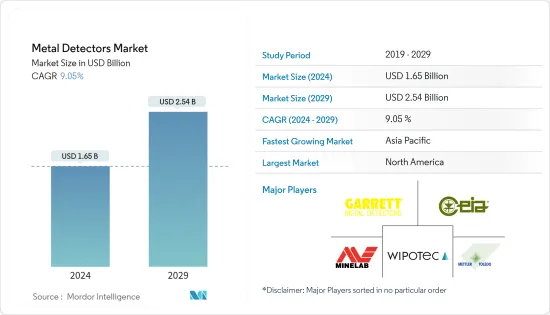

全球金屬探測器市場規模預計到 2024 年為 16.5 億美元,到 2029 年達到 25.4 億美元,在預測期內(2024-2029 年)複合年成長率為 9.05%。

金屬探測器市場是指製造和銷售用於安全篩檢、工業應用、考古探勘、尋寶等各種用途的金屬探測器的行業。金屬探測器是一種利用電磁場檢測金屬物體是否存在的電子設備。

安全威脅和公共需求已成為全球關注的重要議題。金屬探測器對於加強各種環境(包括機場、港口、政府設施、學校、公共活動和娛樂場所)的安全措施至關重要。人們對安全風險的認知不斷增強,以及對有效篩檢措施的需求正在推動對金屬探測器的需求。

金屬探測器產業經歷了重大的技術進步。製造商不斷提高檢測精度、靈敏度和可靠性,同時引入先進目標識別、無線連接和方便用戶使用介面等功能。技術創新吸引了希望升級現有金屬探測器或投資先進系統的客戶,從而促進市場成長。

2023 年 9 月,印度馬德拉斯理工學院 (IIT Madras) 的研究人員將開發一種攜帶式使用點可攜式,可以檢測土壤和水中的重金屬,其功能即使對於未受過科學訓練的人也易於使用。他表示,透過開發該工具,我們在減少環境污染方面取得了創新進展。目前的高階技術,例如感應耦合電漿發射光譜法(ICP-OES),需要複雜的實驗室和漫長的流程,這超出了農民的需求。

此外,武器和非法物質被帶入校園的案例正在增加,特別是在美國。因此,政府和學校董事會正在實施預防措施,其中金屬探測器發揮重要作用。例如,2023 年 3 月,迪卡爾布縣教育委員會核准了與 Evolv WeaponsDetection 簽訂的價值 800 萬美元的契約,在該縣的每所中小學安裝金屬探測器。四年內,將投入 800 萬美元在校園安裝金屬探測器。據 Agenda 稱,Evolve 使用感測器和人工智慧來篩檢學生是否攜帶武器。

然而,價格敏感度是金屬探測器市場的主要挑戰。在教育機構、活動和小型企業等對價格敏感的行業中,客戶會選擇更便宜的金屬探測器,而不是更先進和更昂貴的選擇。這可能會給生產商帶來價格壓力,限制其盈利,並影響研發投資。

金屬探測器市場趨勢

手持式金屬探測器預計將佔據主要市場佔有率

- 手持式金屬探測器是一種可以偵測物體或人體內金屬碎片或顆粒的設備。手持式金屬探測器由兩部分組成:產生電磁場的發射線圈和觀察電磁場的接收線圈。發射線圈在距離手持式金屬探測器約20cm處產生磁場,有助於辨識金屬物體。

- 這些設備不僅可用於金屬檢測。它還可以幫助識別試圖攜帶違禁物品參加活動的人員,提高整體安全性,讓與會者感到更安全。此外,手持式探測器便於攜帶,可以在從入口到會議廳的任何地方快速有效地使用。

- 此外,機場旅客數量的增加是由個人收入增加和遊客數量增加等多種因素推動的,為了應對這種成長,正在開發手持探測器等高效設備,包括安全措施。無可否認,需要採取日益強力的安全措施來確保乘客、航空公司和機場基礎設施的安全。根據國際航空運輸協會的數據,2023年亞太地區航空公司約佔航空客運量的31.7%。

- 由於世界各地的安全威脅日益增多,手持式金屬探測器廣泛應用於機場、地鐵站、政府機關等各種安全目的。此類設備旨在檢測隱藏在人身上的金屬物體,例如武器或其他危險物體。透過手持式金屬探測器,安全負責人可以在進入安全區域之前快速有效地檢測並消除潛在威脅。

- 監控、飯店和監獄服務中手持檢測器的部署證明了該技術在安全方面的強大功能和重要性。手持式金屬探測器可快速且準確地檢測金屬物體,使其成為各行業安全通訊協定的重要組成部分。因此,組織增加對可靠手持式檢測器的投資至關重要。

預計北美將佔據較大市場佔有率

- 近年來,由於恐怖主義威脅和對公共安全的擔憂等多種因素,安全措施在北美越來越受到關注。金屬探測器可提高公共場所、機場、學校、體育場和其他人流量大的場所的安全性。對安全措施的日益重視正在推動該地區對金屬探測器的需求。

- 北美各國政府推出了嚴格的法規和標準來確保公共。這些法規通常要求在交通、國防和執法等特定行業使用金屬探測器。遵守這些法規正在推動該地區金屬探測器的需求。

- 北美正在進行基礎設施開發計劃,包括機場、港口和大眾交通工具系統的建設。據CAPA稱,建設計劃價值1107億美元,新機場建設預算為16億美元。這些計劃通常整合先進的安全系統,包括金屬探測器,以確保基礎設施和用戶的安全。

- 此外,金屬探測器在各個行業都有廣泛的應用,包括製造、採礦、食品加工和製藥。北美國家在這些行業中佔有重要地位,擴大採用金屬探測器來確保產品品管、防止設備損壞並遵守行業法規。

金屬探測器產業概述

金屬探測器市場由 Garrett Metal Detectors、CEIA SpA、Minelab、WIPOTEC GmbH 和 Mettler Toledo 等幾家大公司展開激烈競爭。這些公司透過研究和開發不斷創新產品,獲得了競爭優勢。透過策略夥伴關係、併購,這些公司在市場上佔有一席之地,探測器技術可望進一步升級。

2023 年 7 月:Garrett 金屬探測器宣布將開始訂單。 Paragon 是 Garrett 步入式篩檢產品線的新旗艦產品,擁有一流的 66 個檢測區域和易於使用的創新新功能,包括零接觸 NFC 和 Ambiscan 方向靈敏度,配備:該公司表示,Paragon 是步行式金屬檢測領域 40 年安全經驗的結晶,他們為未來制定了令人興奮的發展計畫。

2023 年 5 月:梅特勒-托利多宣布發布 M30 R 系列金屬檢測系統的升級版。 M30 R 系列是梅特勒-托利多產品系列中首款採用最先進的 SENSE 軟體技術的產品,將金屬偵測智慧和創造力提升到新的高度。除了以合理的價格提供更高水準的金屬檢測安全性和性能外,高度創新的 SENSE 軟體還滿足世界各地製造商使用的廣泛食品安全要求和標準。改進的軟體使 M30R 系列金屬檢測機能夠與 ProdX資料管理軟體無縫互動。結果是最佳化的檢查程序和自動檢查報告,只需按一下按鈕即可輕鬆、即時地收集資料。它還簡化了資料儲存、實現無紙化並加快資訊搜尋速度。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 價值鏈分析

- 宏觀趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 全球恐怖活動增加預計將推動市場成長

- 金屬探測器技術的進步

- 市場限制因素

- 成本限制

第6章 市場細分

- 按類型

- 手持式

- 靜態/演練

- 按最終用途

- 飲食

- 保全和安全

- 藥品

- 採礦和建築

- 其他最終用途

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東

- 非洲

第7章 競爭格局

- 公司簡介

- Thermo Fischer Scientific Inc.

- CEIA SpA

- Garrett Metal Detectors

- Minelab

- WIPOTEC GmbH

- Fortress Technology Inc.

- Mettler Toledo

- Safeway Inspection System Limited

- Westminster Group PLC

- Nuctech Company Limited

- OSI Systems Inc.

- Hikvision Digital Technology Co. Ltd

第8章投資分析

第9章 市場未來展望

The Metal Detectors Market size is estimated at USD 1.65 billion in 2024, and is expected to reach USD 2.54 billion by 2029, growing at a CAGR of 9.05% during the forecast period (2024-2029).

The metal detectors market refers to the industry that manufactures and sells metal detection devices for various purposes, such as security screening, industrial applications, archaeological exploration, and treasure hunting. Metal detectors are electronic devices that detect the presence of metallic objects with the use of electromagnetic fields.

Security threats and the need for public safety have become significant concerns globally. Metal detectors are crucial in enhancing security measures across various settings, including airports, seaports, government buildings, schools, public events, and entertainment venues. The rising awareness of security risks and the need for effective screening measures drive the demand for metal detectors.

The metal detectors industry has witnessed significant technological advancements. Manufacturers are continually improving detection accuracy, sensitivity, and reliability while introducing features like advanced target identification, wireless connectivity, and user-friendly interfaces. Technological innovations attract customers looking to upgrade their existing metal detectors or invest in advanced systems, contributing to market growth.

In September 2023, researchers from the Indian Institute of Technology Madras (IIT Madras) mentioned taking innovative strides toward mitigating environmental contamination by developing a portable, point-of-use tool that can detect heavy metals in soil and water with user-friendly features even for those without scientific training. Current high-end techniques like Inductively Combined Plasma and Optical Emission Spectroscopy (ICP-OES) require complex laboratory and lengthy procedures, which are outside the needs of farmers.

Further, there have been increasing instances in school premises, majorly in the United States, where weapons and illegal substances are being brought. Hence, the government and school boards are implementing preventative measures where metal detectors play a significant role. For instance, in March 2023, the DeKalb County Board of Education approved a USD 8 million contract with Evolv Weapons Detection for installing metal detectors in all elementary and secondary schools within the district. Over four years, USD 8 million will be used to install the metal detectors on school premises. According to the agenda, Evolv uses sensors and artificial intelligence to screen students for weapons.

However, price sensitivity is a significant challenge in the metal detectors market. Customers choose cheaper metal detectors over advanced, higher-cost ones in price-sensitive industries such as educational institutions, events, and SMEs. This can lead to price pressures on producers, which may limit their profitability and affect R&D investments.

Metal Detectors Market Trends

Handheld Metal Detectors Expected to Hold Significant Market Share

- A handheld metal detector is a device that can detect metallic fragments and particles in objects or people's bodies. Handheld metal detectors have two parts, including a transmitter coil to create the electromagnetic field and a receiver coil to observe electromagnetism. The transmitter coil will produce a magnetic field about 20 cm away from the handheld metal detector, which helps identify the metal objects.

- These devices are more than helpful in detecting metal objects. They also help identify individuals who intend to bring banned items to an event, thereby increasing overall safety and making visitors feel more secure. In addition, handheld detecting devices are portable and can be swiftly and effectively used anywhere from the entry point to the conference hall itself.

- Further, increased passenger traffic at airports is driven by several factors, such as increased personal income and tourism, which lead to the increasing need for security measures, including efficient and accurate metal detectors, such as handheld detectors, to cope with this growth. There is an undeniable need for increasingly robust security measures to ensure the safety of passengers, air carriers, and airport infrastructure. According to the IATA, the airlines of the Asia-Pacific region accounted for about 31.7% of air passenger traffic during 2023.

- Owing to the increasing security threats worldwide, handheld metal detectors are widely utilized at airports, metro stations, and government offices for various security purposes. Such devices are intended to detect metal objects, such as weapons or other hazardous substances, hidden on a person. Security personnel can rapidly and efficiently detect possible threats before they enter a secure area through a handheld metal detector, neutralizing them.

- The ability and importance of the technology for security purposes have been demonstrated by the deployment of handheld detectors in surveillance, hospitality, and prison services. They are an essential element of security protocols in different industries due to their rapid and accurate detection of metallic objects. Therefore, increasing investments in reliable handheld detectors is paramount to organizations.

North America Expected to Hold Significant Market Share

- North America has been increasingly focused on security measures in recent years due to various factors, such as terrorism threats and concerns about public safety. Metal detectors enhance security in public spaces, airports, schools, stadiums, and other high-traffic areas. The growing emphasis on security measures drives the demand for metal detectors in the region.

- Governments across North American countries have implemented stringent regulations and standards to ensure public safety. These regulations often mandate using metal detectors in specific industries, such as transportation, defense, and law enforcement. Compliance with these regulations drives the demand for metal detectors in the region.

- North America is witnessing ongoing infrastructure development projects, including the construction of airports, seaports, and public transportation systems. According to the CAPA, construction projects are worth USD 110.7 billion, while the new airport construction budget is USD 1.6 billion. These projects often involve integrating advanced security systems, including metal detectors, to ensure infrastructural and user safety.

- Moreover, metal detectors have diverse applications across various industries, including manufacturing, mining, food processing, and pharmaceuticals. North American countries have a strong presence in these industries, which increasingly adopt metal detectors to ensure product quality control, prevent equipment damage, and comply with industry regulations.

Metal Detectors Industry Overview

The metal detectors market is significantly competitive due to several major players, such as Garrett Metal Detectors, CEIA SpA, Minelab, WIPOTEC GmbH, and Mettler Toledo. These companies have gained a competitive advantage by continually innovating their offerings through research and development. Through strategic partnerships, mergers, and acquisitions, these players have gained a strong footprint in the market and are expected to upgrade the detector technologies further.

July 2023: Garrett Metal Detectors announced that it would begin accepting orders for its newly released Paragon detector. Paragon is the new capstone for Garrett's line of walkthrough security screening products, with best-in-class 66 detection zones and revolutionary new features for ease of use, such as Zero Touch NFC and Ambiscan directional sensitivity. The company mentioned that Paragon is a culmination of 40 years of security achievements in the world of walkthrough metal detection, with plans for exciting future developments.

May 2023: Mettler Toledo announced the release of the upgraded version of its M30 R-Series metal detection systems. The M30 R-Series is the first of Mettler-Toledo's product family that has been created with cutting-edge SENSE software technology, empowering metal detection to achieve new heights of intelligence and creativity. In addition to providing a higher level of metal detection security and performance at a reasonable price, the highly innovative SENSE software meets a wide range of food safety requirements and standards that manufacturers worldwide use. Due to the improved software, the M30R series metal detectors can now interact seamlessly with ProdX data management software. This results in optimized procedures and automatic reporting of inspections, enabling easy and real-time data collection at the push of a button. This also simplifies data storage and makes it paperless while making information retrievals quick.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Impact of Macro Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Terrorism Activities Worldwide Expected to Drive Market Growth

- 5.1.2 Advancing Metal Detector Technologies

- 5.2 Market Restraints

- 5.2.1 Cost-related Constraints

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Handheld

- 6.1.2 Static/Walk-through

- 6.2 By End-use Application

- 6.2.1 Food and Beverage

- 6.2.2 Security and Safety

- 6.2.3 Pharmaceuticals

- 6.2.4 Mining and Construction

- 6.2.5 Other End-use Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East

- 6.3.7 Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Thermo Fischer Scientific Inc.

- 7.1.2 CEIA SpA

- 7.1.3 Garrett Metal Detectors

- 7.1.4 Minelab

- 7.1.5 WIPOTEC GmbH

- 7.1.6 Fortress Technology Inc.

- 7.1.7 Mettler Toledo

- 7.1.8 Safeway Inspection System Limited

- 7.1.9 Westminster Group PLC

- 7.1.10 Nuctech Company Limited

- 7.1.11 OSI Systems Inc.

- 7.1.12 Hikvision Digital Technology Co. Ltd