|

市場調查報告書

商品編碼

1549972

日本地理空間分析:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Japan Geospatial Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

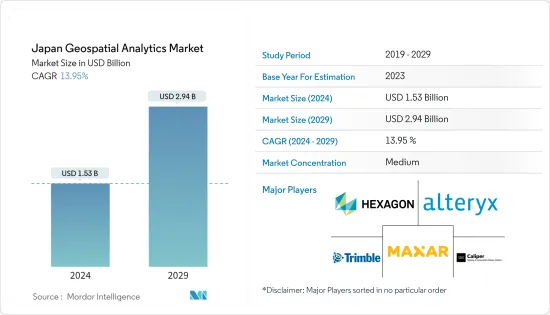

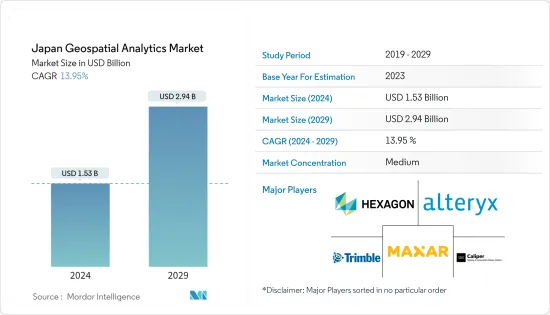

日本地理空間分析市場規模預計到 2024 年為 15.3 億美元,預計到 2029 年將達到 29.4 億美元,預測期內(2024-2029 年)複合年成長率為 13.95%。

主要亮點

- 地理空間分析是收集、操作和顯示地理資訊系統 (GIS)資料和影像(例如 GPS 和衛星影像)的過程。日本地理空間分析市場上年度的市場規模為14億美元,預計未來五年將達到28.1億美元,複合年成長率為12.69%。

- 由於智慧城市開發計劃的採用不斷增加,日本的地理空間分析市場正在顯著成長。這些措施利用先進技術來加強城市基礎設施、改善公共服務並最佳化資源管理。透過將地理空間分析納入規劃和營運,日本城市可以更好地分析空間資料、監測環境變化並做出明智的決策。預計這一趨勢將繼續推動市場發展,並為創新和投資提供大量機會。

- 例如,東京智慧城市工作室是喬治亞理工學院和東京大學合作的研究項目,旨在東京發展智慧和生態社區。該程式使用地理空間分析和其他技術來分析和視覺化有關城市規劃、交通、能源消耗等的資料。

- 此外,5G 技術的部署也顯著增強了日本地理空間分析市場的需求和成長。隨著 5G 的出現,地理空間分析功能不斷擴展,提供更快的資料處理、更高的準確性和即時分析。這項技術進步使地理空間資料能夠在交通、城市規劃和災害管理等各個領域得到更有效的使用。因此,在 5G 技術日益普及的推動下,日本地理空間分析市場正經歷強勁成長。

- 在日本,儘管有多個因素正在推動地理空間分析市場的發展,但高成本和營運挑戰是阻礙其需求和成長的主要限制因素。實施地理空間分析解決方案所需的高成本(包括軟體、硬體和技術人員)是許多組織面臨的主要障礙。此外,資料隱私問題、整合複雜性以及持續更新和維護的需求等營運問題進一步阻礙了市場擴張。

日本地理空間分析市場的趨勢

減少災害風險和管理

- 日本自然災害的頻率和強度不斷增加,需要引進先進的地理空間分析。這些工具有助於預測、準備和減輕此類事件的影響,從而提高日本的抗災能力。例如,地理空間分析對潛在的災難場景進行建模,使當局能夠制定更有效的疏散計劃和資源分配策略。

- 旨在減少災害風險的政府措施和政策也對地理空間分析市場的成長做出了重大貢獻。日本政府正在投資先進技術以改善災害管理策略,這推動了對地理空間分析的需求。國家抗災計畫和減少災害風險基本計畫等計畫強調地理空間資料的整合,以加強備災和救災。

- 此外,地理空間分析與人工智慧和巨量資料等其他技術的整合正在為災害管理創新創造新的機會。這種整合可以實現更準確、更及時的資料分析,這對於有效的災難應變和復原至關重要。例如,人工智慧演算法正在分析地理空間資料來預測颱風的路徑,從而實現更快、更準確的緊急應變。

- 2023年9月,位於日本廣島縣的東廣島市推出了先進的網路GIS應用程式,用於洪水災害和防災。該平台由 ASP.NET 的 TatukGIS 開發內核 (DK) 提供支持,旨在評估與大量農業水庫相關的洪水風險。

對定位服務(LBS) 的需求不斷成長

- 定位服務(LBS) 在日本越來越受歡迎,為地理空間分析市場的擴張做出了重大貢獻。這些服務利用即時地理資料提供資訊、娛樂和安全,以改善用戶體驗和業務效率。 LBS 與導航、社交網路和行動行銷等各種應用的整合正在迅速增加對地理空間分析解決方案的需求。

- 此外,技術進步在定位服務的廣泛使用中發揮著重要作用。智慧型手機的普及和高速網路基礎設施的發展使消費者和企業更容易存取和使用LBS。 2023年,日本智慧型手機擁有率將迅速增至約79%,自2010年代中期以來大幅成長。這些技術進步使得能夠收集更準確、更可靠的地理空間資料,進一步激發日本地理空間分析市場的活力。

- 此外,日本政府正積極推動將地理空間資訊用於各種公共服務和城市規劃措施。改善地理空間資料基礎設施的政府政策和投資正在為地理空間分析市場的成長創造有利的環境。這些努力預計將進一步推動各領域的創新和地理空間技術的採用。

- 地理空間分析在運輸、物流和零售業中越來越多的使用也促進了市場的成長。這些行業的公司正在利用地理空間資料來最佳化路線、管理資產並改善客戶體驗。空間資料分析和視覺化提供了寶貴的見解,可以幫助企業做出明智的決策並提高業務效率。

日本地理空間分析產業概況

由 Hexagon AB 等大型企業主導的日本地理空間分析市場正在見證整合趨勢。這些主要企業正在建立策略聯盟和收購,以擴大其市場佔有率。同時,我們專注於創新、新應用部署和研發,以開發先進的地理空間工具。這些工具涉及城市規劃、災害管理和環境監測等不同領域。此類舉措將支持未來幾年的市場成長。

2024年1月,AWS宣布計畫在2027年在日本投資2.26兆日圓(152.4億美元),以擴大其在日本的雲端運算基礎設施。除了擴大在東京和大阪的設施外,AWS 還計劃透過 AWS 教育計畫、培訓和認證解決數位技能差距,幫助日本釋放其雲端潛力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第 2 章執行摘要

第3章調查方法

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 智慧城市發展的採用率不斷提高

- 引入5G推動市場成長

- 市場限制因素

- 高成本和營運問題

- 法律障礙

第6章 市場細分

- 按類型

- 表面分析

- 網路分析

- 地理空間視覺化

- 按最終用戶產業

- 農業

- 公共事業和通訊

- 國防/情報

- 政府機構

- 採礦/自然資源

- 汽車/交通

- 衛生保健

- 房地產/建築業

- 其他最終用戶產業

第7章 競爭格局

- 公司簡介

- Alteryx

- Hexagon AB

- TomTom

- Maxar Technologies

- Trimble

- ESRI

- Caliper Corporation

- General Electric

- Bentley Systems Co.

- Fugro

第8章投資分析

第9章 市場機會及未來趨勢

The Japan Geospatial Analytics Market size is estimated at USD 1.53 billion in 2024, and is expected to reach USD 2.94 billion by 2029, growing at a CAGR of 13.95% during the forecast period (2024-2029).

Key Highlights

- Geospatial analytics is the process of gathering, manipulating, and displaying geographic information system (GIS) data and imagery, including GPS and satellite photographs. The Japanese geospatial analytics market was valued at USD 1.40 billion in the previous year, and it is expected to register a CAGR of 12.69%, reaching USD 2.81 billion by the next five years.

- The Japanese geospatial analytics market is experiencing significant growth due to the increasing adoption of smart city development projects. These initiatives leverage advanced technologies to enhance urban infrastructure, improve public services, and optimize resource management. As cities in Japan integrate geospatial analytics into their planning and operations, they better analyze spatial data, monitor environmental changes, and make informed decisions. This trend is expected to continue driving the market forward, offering numerous opportunities for innovation and investment in the coming years.

- For instance, the Tokyo Smart City Studio, a collaboration between the Georgia Institute of Technology and the University of Tokyo, is a research program that aims to develop a smart and ecologically sound community in Tokyo. The program uses geospatial analytics and other technologies to analyze and visualize urban planning, transportation, energy consumption, and more data.

- Also, the deployment of 5G technology is significantly enhancing the demand and growth of the geospatial analytics market in Japan. With the advent of 5G, the capabilities of geospatial analytics are expanding, offering faster data processing, improved accuracy, and real-time analytics. This technological advancement enables various sectors, including transportation, urban planning, and disaster management, to leverage geospatial data more effectively. As a result, the geospatial analytics market in Japan is experiencing robust growth, driven by the increased adoption of 5G technology.

- In Japan, while several factors propel the geospatial analytics market, high costs and operational challenges are significant constraints that impede its demand and growth. The high costs associated with implementing geospatial analytics solutions, including software, hardware, and skilled personnel, pose a substantial barrier for many organizations. Additionally, operational concerns such as data privacy issues, integration complexities, and the need for continuous updates and maintenance further hinder the market's expansion.

Japan Geospatial Analytics Market Trends

Disaster Risk Reduction and Management

- The increasing frequency and intensity of natural disasters in Japan have necessitated the adoption of advanced geospatial analytics. These tools help predict, prepare for, and mitigate the impacts of such events, thereby enhancing the country's disaster resilience. For instance, geospatial analytics can model potential disaster scenarios, allowing authorities to develop more effective evacuation plans and resource allocation strategies.

- Also, government initiatives and policies aimed at disaster risk reduction significantly contribute to the growth of the geospatial analytics market. The Japanese government has been investing in advanced technologies to improve disaster management strategies, which drives the demand for geospatial analytics. Programs such as the National Resilience Program and the Basic Plan for Disaster Risk Reduction emphasize the integration of geospatial data to enhance disaster preparedness and response.

- Also, the integration of geospatial analytics with other technologies, such as artificial intelligence and big data, is creating new opportunities for innovation in disaster management. This integration allows for more accurate and timely data analysis, crucial for effective disaster response and recovery. For example, AI algorithms are used to analyze geospatial data to predict the path of a typhoon, enabling quicker and more precise emergency responses.

- In September 2023, Higashihiroshima City, located in the Hiroshima Prefecture of Japan, launched an advanced web GIS application for flood hazard and disaster prevention. This platform, powered by the TatukGIS developer kernel (DK) for ASP.NET, is engineered to assess flood risks associated with numerous agricultural irrigation reservoirs.

Growing Demand for Location-based Services

- Location-based services (LBS) have become increasingly popular in Japan, contributing significantly to the expansion of the geospatial analytics market. These services utilize real-time geographical data to provide information, entertainment, and security, enhancing user experience and operational efficiency. The integration of LBS in various applications, such as navigation, social networking, and mobile marketing, has led to a surge in demand for geospatial analytics solutions.

- Moreover, technological advancements have played a crucial role in the proliferation of location-based services. The widespread adoption of smartphones and the development of high-speed internet infrastructure have made it easier for consumers and businesses to access and utilize LBS. In 2023, smartphone ownership in Japan surged to nearly 79%, marking a substantial rise from the mid-2010s. This technological progress has enabled more precise and reliable geospatial data collection, further boosting the geospatial analytics market in Japan.

- Additionally, the Japanese government has been actively promoting the use of geospatial information for various public services and urban planning initiatives. Government policies and investments to improve geospatial data infrastructure have created a favorable environment for the growth of the geospatial analytics market. These initiatives are expected to drive further innovation and adoption of geospatial technologies across different sectors.

- Also, the increasing use of geospatial analytics in transportation, logistics, and retail industries contributes to market growth. Companies in these sectors are leveraging geospatial data to optimize routes, manage assets, and enhance customer experiences. Analyzing and visualizing spatial data provides valuable insights that help businesses make informed decisions and improve operational efficiency.

Japan Geospatial Analytics Industry Overview

The Japanese geospatial analytics market, dominated by major players like Hexagon AB, is witnessing a trend toward consolidation. These key players are strategically partnering and acquiring to fortify their market presence. Simultaneously, they innovate, roll out new applications, and focus on R&D to craft advanced geospatial tools. These tools are tailored for diverse sectors, spanning urban planning, disaster management, and environmental monitoring. Such initiatives are poised to propel market growth in the coming years.

In January 2024, AWS announced plans to invest JPY 2.26 trillion (USD 15.24 billion) in Japan by 2027 to expand cloud computing infrastructure in the country. In addition to expanding its facilities in Tokyo and Osaka, AWS planned to help Japan unlock its cloud potential by addressing the digital skills gap through AWS education programs, training, and certification.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Factors on Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase In Adoption of Smart City Development

- 5.1.2 Introduction of 5G to Boost Market Growth

- 5.2 Market Restraints

- 5.2.1 High Costs and Operational Concerns

- 5.2.2 Legal Hurdles

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Surface Analysis

- 6.1.2 Network Analysis

- 6.1.3 Geovisualization

- 6.2 By End-user Vertical

- 6.2.1 Agricultural

- 6.2.2 Utility and Communication

- 6.2.3 Defense and Intelligence

- 6.2.4 Government

- 6.2.5 Mining and Natural Resources

- 6.2.6 Automotive and Transportation

- 6.2.7 Healthcare

- 6.2.8 Real Estate and Construction

- 6.2.9 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Alteryx

- 7.1.2 Hexagon AB

- 7.1.3 TomTom

- 7.1.4 Maxar Technologies

- 7.1.5 Trimble

- 7.1.6 ESRI

- 7.1.7 Caliper Corporation

- 7.1.8 General Electric

- 7.1.9 Bentley Systems Co.

- 7.1.10 Fugro