|

市場調查報告書

商品編碼

1549977

日本智慧家庭:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Japan Smart Home - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

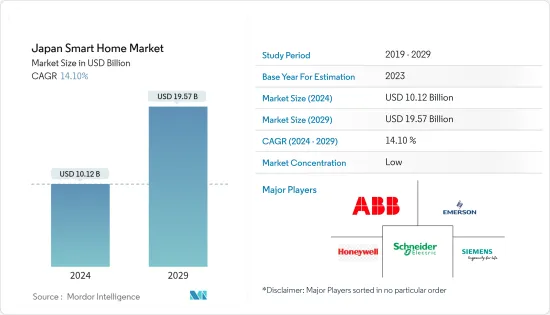

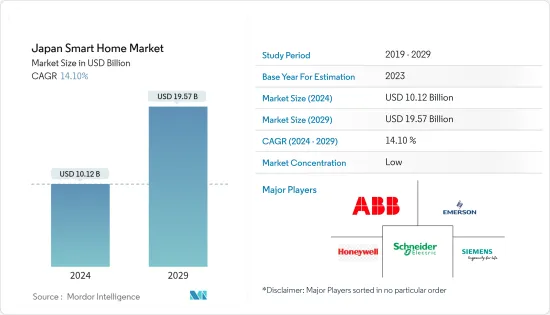

日本智慧家庭市場規模預計到 2024 年為 101.2 億美元,預計到 2029 年將達到 195.7 億美元,在預測期內(2024-2029 年)複合年成長率為 14.10%。

主要亮點

- 隨著世界走向數位化,利用日常生活中產生的資料來解決社會問題並激發創新的運動日益盛行。來自各行業的公司和政府機構在物聯網 (IoT) 計劃方面處於領先地位。這些工作從多個地點收集詳細資料,從辦公室和工廠到道路和電網。這些資料通常儲存在雲端,並使用人工智慧 (AI) 等最尖端科技進行處理。這項運動已經滲透到日本的許多行業,並且正在擴展到家庭並塑造智慧家庭的概念。

- 日本因其大量的智慧型手機用戶而在行動市場中脫穎而出。最近一份關於日本移動經濟的報告強調了一些值得注意的趨勢。平均每天使用行動裝置的時間激增,在過去 10 年中幾乎增加了兩倍,達到每人約 106 分鐘。這一激增主要是由於智慧型裝置(尤其是智慧型手機)的激增,它們席捲了市場並刺激了物聯網連接的成長。

- 此外,物聯網 (IoT) 在日本的興起也以許多獨特的方式受到歡迎。從自動化工廠生產線到智慧家電,物聯網正在改變日本生活的幾乎各個方面,並帶來大量投資。例如,Softbank Corporation公司最近宣佈在包括日本在內的亞太地區全面拓展其全球物聯網(IoT)業務,並宣布將推出專注於物聯網業務的物聯網服務。

- 2024 年 4 月,Google宣布將投資 10 億美元建造 Proa 和 Taiping 兩條新海底電纜,以加強日本和美國之間的聯繫,改善兩國之間的數位連接。這兩條海底電纜預計將改善美國、日本以及多個太平洋島國和地區之間的互聯互通。

- 增加對智慧城市發展的投資預計將極大地促進智慧住宅基礎設施的建設。例如,2023年3月,日本政府宣布啟動2023會計年度智慧城市投資計劃,並進一步宣布第二期戰略創新推進計劃(SIP)/網路空間基礎設施技術/架構建設、巨量資料和人工智慧等。將包括智慧城市相關項目作為「利用

日本智慧家庭市場趨勢

節能意識的增強正在推動市場

- 針對2011年福島第一核能發電廠事故以及隨後依賴石化燃料進口造成的高成本,日本實施了促進可再生能源利用的政策。這些政策也注重能源效率和節約,這對日本的能源安全至關重要。

- 日本在監管和政治承諾方面的 ETI 高分證明了這一承諾。就背景而言,日本在 2023 年 ETI 的 120 個國家中排名第 27 位,並且在過去十年中一直保持其系統性能和遷移準備分數。值得注意的是,日本在 2021 年 10 月宣布的第六次能源戰略計畫的目標是到 2030 年再生能源佔能源結構的 36-38%。

- 早在2024年3月,日本就承諾提供9,010萬日圓用於加強亞太地區的能源效率和低碳舉措。該資金將透過亞太地區能源工作小組提供,專門針對能源效率、低碳和能源彈性措施的子基金。其目標是促進永續成長、加強能源安全並擴大各部門的能源取得。

- 為了推動這一勢頭,日本國土交通省宣布計劃於 2023 年重新引入補貼制度。該舉措旨在幫助有幼兒和新婚夫婦的家庭建造節能住宅,特別是在房地產價格飆升的情況下。

- 根據該制度,有18歲以下子女的家庭或配偶一方未滿39歲的家庭可獲得100萬日圓的補助金。這是有條件的,即正在建造的新住宅必須符合淨零能耗住宅 (ZEH) 的嚴格標準。總的來說,這些舉措凸顯了日本對能源效率的日益關注,這對日本智慧家庭市場來說是個好兆頭。

智慧家電佔較大市場佔有率

- 日本智慧家庭的快速成長主要得益於在全球市場上站穩腳跟的國內主要電子製造商的主導地位。這些日本智慧家居公司處於技術創新的前沿,創造了複雜的自動化解決方案。他們的專長在於開發透過智慧設備和物聯網技術智慧管理照明、暖氣、安全和各種家用電器的系統。

- 日本擁有Panasonic、SONY、東芝、日立、三菱電機等頂級智慧家庭公司。另外值得注意的是,日本是所有主要相機品牌的故鄉,包括Canon、尼康、FUJIFILM、Pentax Corporation、西格瑪和Olympus。相機產業的這種主導地位可以追溯到戰爭期間德國相機產業的衰落、日本經濟的快速復甦以及戰後強大的智慧財產權標準。

- 此外,日本在電視製造方面的歷史實力,再加上產業巨頭總部的存在,奠定了堅實的基礎。這些公司不僅推出了各種智慧家庭產品,還根據當今住宅的需求量身定做,提高便利性、安全性和舒適性,在擴大日本智慧家庭市場方面一直處於領先地位。

- 2023 年 7 月,東芝發布了最新創新產品-東芝 4K Mini LED 智慧電視 M650。這款最先進的電視擁有大量連接功能,包括 HDMI、藍牙音訊、雙頻 Wi-Fi 和 USB 連接埠。它還具有多種語音助理選項,包括 Alexa、VIDAA 和 Google Assistant。

- 2023年6月,物聯網解決方案供應商移遠無線宣布推出最新的移遠FCM360W Wi-Fi和藍牙模組。此模組將高效能處理器與 Wi-Fi 6 和藍牙 5.1 功能結合。

日本智慧家庭產業概況

日本的智慧家庭市場較為分散。市場高度集中,各種規模的公司林立。所有主要公司都擁有較大的市場佔有率,並致力於擴大消費群。該市場的一些重要參與者包括施耐德電氣公司、艾默生電氣公司、ABB 有限公司、霍尼韋爾國際公司和西門子公司。公司正在透過建立多個聯盟、合作夥伴關係、收購和投資新產品推出來擴大市場佔有率,以獲得預測期內的競爭優勢。

- 2024 年 5 月,Qsee 宣布向充滿活力的日本市場進行全球擴張。日本蓬勃發展的經濟和精通技術的國家為該公司提供了一個理想的平台來展示其針對消費者和企業的多樣化需求量身定做的一系列智慧家居解決方案。

- 2024 年 2 月:Aqara 宣佈在日本開設亞馬遜品牌店,在亞馬遜商城上提供各種尖端智慧家居設備。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 後遺症和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 人們對家庭安全和安全的興趣日益濃厚

- 物聯網、人工智慧和語音控制助理等技術進步

- 市場限制因素

- 複雜的安裝和設置

- 互通性問題

第6章 市場細分

- 依產品類型

- 舒適度和照明

- 控制和連接

- 能源管理

- 家庭娛樂

- 安全

- 智慧家電

- 暖通空調控制

- 依技術

- Wi-Fi

- 藍牙

- 其他技術

第7章 競爭格局

- 公司簡介

- Schneider Electric SE

- Emerson Electric Co.

- ABB Ltd

- Honeywell International Inc.

- Seimens AG

- Signify Holding

- Microsoft Corporation

- Google Inc.

- Cisco Systems Inc.

- General Electric Company

- Dahua Technology

- D-Link Electronics Co. Ltd

第8章投資分析

第9章 市場的未來

The Japan Smart Home Market size is estimated at USD 10.12 billion in 2024, and is expected to reach USD 19.57 billion by 2029, growing at a CAGR of 14.10% during the forecast period (2024-2029).

Key Highlights

- As the world moves more toward digitization, there is a notable push to leverage the data generated in daily life to tackle social issues and innovate. Companies and government bodies across various sectors spearhead IoT (Internet of Things) initiatives. These initiatives involve gathering detailed data from multiple locations, from offices and plants to roads and power grids. This data, often stored in the cloud, is then processed using cutting-edge technologies like artificial intelligence (AI). This movement, which is already prevalent in many industries in Japan, is poised to extend its reach to everyday households, shaping the concept of the smart home.

- With its substantial smartphone user base, Japan stands out in the mobile market landscape. A recent report on Japan's mobile economy highlights a remarkable trend: the average daily mobile device usage has surged, nearly tripling over the past decade to reach around 106 minutes per person. This surge is predominantly driven by the popularity of smart devices, especially smartphones, which dominate the market and fuel the growth of IoT connections.

- Furthermore, the rise of the Internet of Things (IoT) in Japan has been embraced in many unique ways. From automated factory lines to smart home appliances, IoT is transforming almost every aspect of life in Japan, resulting in significant investments. For instance, recently, SoftBank Corp. announced the launch of a full-fledged expansion of its global Internet of Things (IoT) business in Asia-Pacific (APAC), including Japan, with a primary emphasis on marketing IoT services, with a key focus on promoting the '1NCE IoT Flat Rate.'

- In April 2024, Google announced that it would invest USD 1 billion to improve digital connectivity between the United States and Japan through two new subsea cables, Proa and Taihei, to boost ties between the two countries. The two subsea cables are expected to improve connectivity between the United States, Japan, and multiple Pacific island countries and territories.

- Rising investments toward smart city development are expected to significantly contribute to creating a smart residential infrastructure. For instance, in March 2023, the Japanese government announced the launch of a program of smart city investment for fiscal 2023 and further announced the inclusion of smart city-related business as a part of the "Strategic Innovation Promotion Programme (SIP) Phase 2/Cyberspace infrastructure technology/architecture construction as well as demonstration research using big data and AI."

Japan Smart Home Market Trends

Rising Focus Toward Energy Efficiency is Driving the Market

- Following the Fukushima disaster in 2011 and Japan's subsequent costly reliance on imported fossil fuels, the nation implemented policies to boost its use of renewable energy. These policies also emphasized energy efficiency and conservation, crucial for Japan's energy security.

- This commitment is evident in Japan's robust ETI scores for regulation and political dedication. For context, Japan ranked 27th out of 120 countries in the 2023 ETI, maintaining consistent scores for system performance and transition readiness over the past decade. Notably, Japan's Sixth Strategic Energy Plan, unveiled in October 2021, aims for renewables to make up 36-38% of its energy mix by 2030.

- Fast forward to March 2024, Japan pledged JPY 90.1 million to bolster the APEC region's energy efficiency and low-carbon initiatives. This funding, channeled through the APEC Energy Working Group, explicitly targets the sub-fund energy efficiency, low carbon, and energy resiliency measures. Its goal is to bolster sustainable growth, enhance energy security, and broaden energy access across various sectors.

- Adding to this momentum, Japan's land ministry unveiled plans in 2023 to reintroduce a subsidy program. This initiative aims to assist families with young children and newlyweds in constructing energy-efficient homes, especially in the face of escalating real estate prices.

- Under this program, households with a child under 18 or a married couple, where either partner is under 39, can receive a JPY 1 million subsidy. This is contingent on building a new house that meets the stringent criteria of a net zero energy house (ZEH). These initiatives collectively underscore Japan's growing emphasis on energy efficiency, boding well for the country's smart home market.

Smart Appliances to Hold Significant Market Share

- The surge in smart homes in Japan can be primarily attributed to the dominance of major domestic electronics manufacturers, who have a strong foothold in the global market. These Japanese smart home firms are at the forefront of innovation, crafting sophisticated automation solutions. Their expertise lies in developing systems that intelligently manage lighting, heating, security, and various appliances, all through smart devices and IoT technology.

- Japan boasts a lineup of top-tier smart home players, including Panasonic, Sony, Toshiba, Hitachi, and Mitsubishi Electric. It is worth highlighting that Japan stands out as the home to every major camera brand, such as Canon, Nikon, Fujifilm, Pentax, Sigma, and Olympus. This camera industry dominance can be traced back to the decline of Germany's camera sector during wartime, Japan's rapid economic recovery, and its robust post-war intellectual property standards.

- Furthermore, Japan's historical prowess in TV manufacturing, bolstered by the presence of industry giants' headquarters, has laid a strong foundation. These companies have not only introduced a diverse range of smart home offerings but have tailored them to meet the demands of today's homeowners, enhancing convenience, safety, and comfort, thereby propelling Japan's smart home market.

- In a significant move in July 2023, Toshiba unveiled its latest innovation, the 'Toshiba 4K Mini LED Smart TV M650,' setting new benchmarks in visual excellence. This cutting-edge TV boasts a host of connectivity features, including HDMI, Bluetooth audio, dual-band Wi-Fi, and USB ports. It is equipped with multiple voice assistant options, such as Alexa, VIDAA, and Google Assistant.

- In June 2023, Quectel Wireless Solutions, an IoT solutions provider, launched its latest Quectel FCM360W Wi-Fi and Bluetooth module. This module combines a high-performance processor with Wi-Fi 6 and Bluetooth 5.1 capabilities.

Japan Smart Home Industry Overview

The Japanese smart home market is fragmented. The market is highly concentrated due to the presence of various small and large players. All the major players account for a significant market share and focus on expanding the consumer base. Some of the critical players in the market are Schneider Electric SE, Emerson Electric Corporation, ABB Ltd, Honewell International Inc., and Siemens AG. Companies are increasing their market share by forming multiple collaborations, partnerships, and acquisitions and investing in introducing new products to earn a competitive edge during the forecast period.

- May 2024: Qsee announced its global expansion into the dynamic Japanese market. Owing to Japan's booming economy and tech-savvy populace, the company has an ideal platform to introduce a range of smart home solutions tailored to meet the diverse needs of consumers and businesses alike.

- February 2024: Aqara announced the debut of its Amazon brand store in Japan, which will provide a diverse range of cutting-edge smart home devices on the Amazon Marketplace.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Concern about Home Security and Safety

- 5.1.2 Advances in Technology, such as IoT, Artificial Intelligence, and Voice Controlled Assistants

- 5.2 Market Restraints

- 5.2.1 Complex Installation and Setup

- 5.2.2 Interoperability Issues

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Comfort and Lighting

- 6.1.2 Control and Connectivity

- 6.1.3 Energy Management

- 6.1.4 Home Entertainment

- 6.1.5 Security

- 6.1.6 Smart Appliances

- 6.1.7 HVAC Control

- 6.2 By Technology

- 6.2.1 Wi-Fi

- 6.2.2 Bluetooth

- 6.2.3 Other Technologies

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Emerson Electric Co.

- 7.1.3 ABB Ltd

- 7.1.4 Honeywell International Inc.

- 7.1.5 Seimens AG

- 7.1.6 Signify Holding

- 7.1.7 Microsoft Corporation

- 7.1.8 Google Inc.

- 7.1.9 Cisco Systems Inc.

- 7.1.10 General Electric Company

- 7.1.11 Dahua Technology

- 7.1.12 D-Link Electronics Co. Ltd