|

市場調查報告書

商品編碼

1549997

智慧家庭門禁控制:市場佔有率分析、產業趨勢、成長預測(2024-2029)Smart Home Access Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

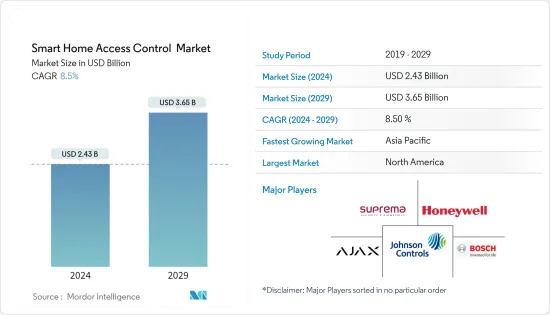

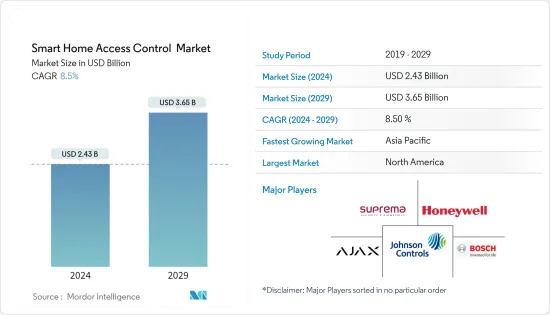

智慧家庭門禁市場規模預計到2024年為24.3億美元,預計到2029年將達到36.5億美元,在預測期內(2024-2029年)複合年成長率為8.5%,預計會成長。

雖然有關家庭安全的討論往往集中在重型鋼門和刺耳的警報上,但智慧門禁控制提供了更微妙、更強大的安全解決方案。智慧門禁控制使用門禁碼、鑰匙圈和門禁卡來管理進入。其主要優勢在於其確保空間安全並影響從保險範圍到減輕事故損失等各種因素的能力。

推動智慧家庭門禁市場成長的因素有很多。其中包括由於入室盜竊率上升而日益引起的安全擔憂,以及核心家庭的普遍存在,特別是涉及工作父母和分居的年長親戚的情況。

對於住宅來說,智慧存取控制對於確保隱私和安全至關重要。無論是在公共區域、停車場還是私人公寓,設置屏障以防止未授權存取可以提高您的財產的吸引力,並提供有關建築物入侵的寶貴見解。

此外,精通技術的人口的快速成長和家庭自動化計劃的興起正在推動市場需求。

現代門禁系統利用生物識別、射頻、藍牙和 NFC 等最尖端科技,但最終用戶可能會因相關的測試、培訓和實施成本而望而卻步。此外,公眾意識的缺乏和操作上的猶豫,特別是對於雲端整合無線鎖的好處,正在阻礙市場的擴張。

全球大流行極大地改變了智慧家庭門禁系統的格局,強調對佔用資料的監控以確保安全。憑藉現有技術和疫情後復甦計劃引入的新技術,市場預計將在未來發現新的機會。

智慧家庭門禁市場趨勢

生物辨識讀卡機佔據主要市場佔有率

- 生物識別家庭安全代表了身份驗證方法的現代轉變,它使用個人的獨特特徵而不是傳統證書進行身份驗證。這項技術在家庭安全領域迅速普及。住宅擴大利用指紋、視網膜和臉部辨識技術來增強存取控制。

- 生物識別鎖改進了安全措施並減少了對傳統密鑰系統的依賴。它在多因素認證中也極為重要,尤其是在高安全場景下。例如,在安全設施中出示實體徽章後,指紋可以充當附加的身份驗證層。

- 根據統計,搶劫往往是一種機會主義犯罪。傳統鑰匙鎖很容易受到這些機會主義者的攻擊,但主要依賴藍牙或 Wi-Fi 的智慧鎖卻引入了新的漏洞。此外,依賴 PIN 碼的數位鎖容易受到駭客攻擊且容易被遺忘。

- 鑑於這些漏洞,生物辨識讀取器在世界各地越來越受歡迎,以增強家庭安全。生物辨識感測器將資料儲存在您的裝置上,因此即使斷電或 Wi-Fi 連線不可靠也不會危及您鎖的安全。因此,您可以透過智慧鎖安全地存取您的家、汽車、保險箱或手提箱,確保只有授權使用者才能進入。

- 這種安全性增強引起了消費者的共鳴。根據最近的一項調查,近三分之一的消費者有興趣在未來使用生物識別閱讀器進出他們的家。除了安全方面之外,生物識別讀取器提供的便利性也進一步推動了該市場的成長。

亞太地區實現顯著成長

- 亞洲正迅速成為智慧家居門禁市場。未來五年,該地區的成長軌跡將取決於需求的激增和技術進步的採用,特別是在家用電器和家電領域。

- 智慧型手機的普及、線上業務的成長以及政府針對數位轉型的強大舉措等因素正在推動這一勢頭。根據GSMA的2023年報告《亞太地區移動經濟》,多個國家已使5G成為主流技術,包括澳洲、日本、新加坡和韓國。

- 值得注意的是,印度已成為成長最快的 5G 市場之一,預計僅 2023 年將增加數千萬個 5G 連線。預計到2030年,該地區5G連線數將達到約14億,佔所有行動連線的41%。

- 此外,該地區強勁的經濟成長使中產階級不斷壯大,購買力不斷增強,消費群不斷擴大。隨著亞洲地區收入的增加,更多消費者將進入高所得階層。消費趨勢的這些變化預計將推動特別先進的技術和服務的消費,進一步推動智慧家庭門禁市場的發展。

- 此外,該地區政府對智慧城市計畫的投資正在增加,可能會創造新的商機。例如,豐田公司雄心勃勃的「編織城市」計劃即將完工,該計畫將成為以無人駕駛汽車為特色的創新城市生活的試驗場。 「編織城市」點綴著裝有感測器的“智慧房屋”,可實現居住者、建築物和車輛之間的無縫通訊。該市以氫能發電為重點,旨在引領排放氣體和氫基技術。

智慧家庭門禁產業概況

智慧家庭門禁市場較為分散,全球和地區廠商都在激烈的競爭中力爭獲得更大的佔有率。儘管進入障礙很高,但一些新參與企業還是在市場上取得了成功。其他主要企業包括 Suprema Inc.、Johnson Controls、Ajax Systems、Bosch Security System Inc. 和 Honeywell International Inc.。公司正在做出重要的策略決策,以提高其市場佔有率。

2024年4月,Resideo Technologies宣布美國智慧家庭科技公司。作為收購的一部分,Resideo 將把 Snap One 整合到其 ADI 全球分銷部門。這項策略性舉措旨在透過將更廣泛的第三方產品與我們自己的解決方案相結合來加強我們為整合商提供的產品。增強的產品系列將透過廣泛的實體網路和強大的數位工具進行補充。

2023 年 9 月,Guardian Access Solutions 被 CenterOak Partners 收購,進入 CenterOak 旗下 Guardian 的下一階段成長。隨著 Guardian 擴大其在整個東南部和全國門禁行業的領先地位,CenterOak 將透過持續投資於有機和無機成長計劃來支持該公司。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 宏觀經濟走勢對市場的影響

第5章市場動態

- 市場促進因素

- 由於犯罪率和威脅不斷上升,門禁系統的採用率增加

- 技術進步

- 市場限制因素

- 對營運和投資回報率的擔憂

- 技術簡介

- 存取控制解決方案的演變

- RFID與NFC技術比較分析

- 主要技術趨勢

第6章 市場細分

- 按類型

- 讀卡機及門禁設備

- 卡座

- 接近型

- 智慧卡(接觸式/非接觸式)

- 生物辨識閱讀器

- 電子鎖

- 軟體

- 其他類型

- 讀卡機及門禁設備

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Suprema Inc.

- Tyco International PLC(Johnson Controls)

- Bosch Security Systems

- Ajax Systems

- Honeywell International Inc.

- Nedap NV

- Thales Group(Gemalto NV)

- Allegion PLC

- ASSA ABLOY AB Group

- Schneider Electric SE

- Panasonic Corporation

- Brivo Systems LLC

- Identiv Inc.

- Dormakaba Holding AG

- NEC Corporation

- Idemia Group

- Axis Communication AB

第8章投資分析

第9章 市場的未來

The Smart Home Access Control Market size is estimated at USD 2.43 billion in 2024, and is expected to reach USD 3.65 billion by 2029, growing at a CAGR of 8.5% during the forecast period (2024-2029).

While heavy steel doors and blaring alarms are often the focus of home security discussions, smart access control presents a more nuanced yet potent security solution. Utilizing entry codes, key fobs, and access cards, smart access control governs entries. Its key strength lies in its capacity to secure spaces and impact factors ranging from insurance coverage to mitigating accident losses.

Several factors are fueling the growth of the smart home access control market. These include heightened safety concerns due to rising burglary rates and the prevalence of nuclear families, especially in scenarios involving working parents and separated elderly relatives.

For homeowners, smart access control is pivotal in ensuring the privacy and security they deserve. Whether for communal areas, car parks, or personal flats, implementing barriers against unauthorized access enhances a property's appeal and provides valuable insights into building entries.

Moreover, the surge in tech-savvy populations and the rise of home automation projects bolstered the demand in the market.

While modern access control systems leverage cutting-edge technologies like biometrics, RF, Bluetooth, and NFC, end users are sometimes deterred by the associated testing, training, and implementation costs. Additionally, a lack of public awareness and operational hesitations, especially concerning the benefits of cloud-integrated wireless locks, pose hurdles to market expansion.

The global pandemic has significantly altered the landscape of smart home access control systems, emphasizing the monitoring of occupancy data to ensure safety. With both existing technologies and new additions introduced under the post-pandemic recovery agenda, the market is poised to unveil fresh opportunities in the future.

Smart Home Access Control Market Trends

The Biometric Readers Segment to Hold Major Market Share

- Biometric home security represents a modern shift in authentication methods, utilizing unique individual features for verification rather than traditional credentials. This technology is rapidly gaining traction in the home security sector. Homeowners increasingly use fingerprint, retina, or facial recognition technologies to bolster access control.

- Biometric locks elevate security measures, reducing reliance on conventional key-based systems. They are also crucial in multifactor verification, especially in high-security scenarios. For instance, after presenting a physical badge at a secure facility, a fingerprint can serve as an additional layer of verification.

- Statistically, burglary is often an opportunistic crime. While traditional key locks have long been vulnerable to such opportunists, smart locks, predominantly reliant on Bluetooth or Wi-Fi, introduce new vulnerabilities. Additionally, digital locks, hinging on PIN codes, are susceptible to hacking and prone to being forgotten.

- Considering these vulnerabilities, biometric readers are becoming popular for enhancing home security worldwide. Biometric sensors store data on the device, ensuring that power outages or unreliable Wi-Fi connections do not compromise the lock's security. This results in secure access to homes, cars, safes, and suitcases through smart locks, allowing only authorized users to gain entry.

- This heightened security is resonating with consumers. Recent research indicates that nearly one in three consumers express interest in adopting biometric readers for home access in the future. Beyond the security aspect, the convenience offered by biometric readers is further propelling the growth of this market.

Asia-Pacific to Witness Significant Growth

- Asia is swiftly establishing itself as a dominant smart home access control market. Over the next five years, the region's growth trajectory hinges on the surging demand and adoption of technological advancements, particularly in home appliances and consumer electronics.

- Factors like the widespread adoption of smartphones, an expanding online business landscape, and robust government initiatives focused on digital transformation drive this momentum. According to the GSMA's 2023 report, "The Mobile Economy for Asia Pacific," several countries, including Australia, Japan, Singapore, and South Korea, have made 5G a mainstream technology.

- Notably, India is emerging as one of the fastest-growing 5G markets, with projections indicating the addition of tens of millions of 5G connections in 2023 alone. The region is poised to reach around 1.4 billion 5G connections by 2030, accounting for 41% of all mobile connections.

- Additionally, the region's robust economic growth has swelled the middle class, expanding the consumer base with increased purchasing power. As incomes rise across Asia, a larger consumer segment will move into higher income brackets. This shift within the consumer landscape is set to drive consumption, particularly in advanced technologies and services, further propelling the smart home access control market.

- Moreover, the region's escalating government investments in smart city initiatives are poised to unlock fresh opportunities. For instance, iToyota's ambitious 'Woven City' project, nearing completion, will serve as a testing ground for innovative urban living featuring driverless cars. 'Woven City' will be dotted with 'smart homes' embedded with sensors, enabling seamless communication among residents, buildings, and vehicles. With a primary focus on hydrogen power, the city aims to lead in emissions reduction and hydrogen-based technology.

Smart Home Access Control Industry Overview

The smart home access control market is fragmented and comprises global and regional players striving for a larger share in a fiercely contested space. Despite the high barriers to entry, several new entrants have successfully made a mark in the market. Some of the notable players in the industry include Suprema Inc., Johnson Controls, Ajax Systems, Bosch Security System Inc., Honeywell International Inc., and others. Companies are making significant strategic decisions to increase their market presence.

April 2024: Resideo Technologies announced a USD 1.4 billion acquisition of a US smart home technology company. Resideo will merge Snap One into its ADI Global Distribution arm as part of the deal. This strategic move aims to bolster offerings for integrators, combining a wider array of third-party products with in-house solutions. The enhanced product lineup will be accessible through an expansive physical branch network complemented by robust digital tools.

September 2023: Guardian Access Solutions was acquired by CenterOak Partners, marking a transition into Guardian's next phase of growth under CenterOak, which will support the company through continued investments in organic and inorganic growth initiatives as Guardian expands its leading presence in the access control industry throughout the Southeast and nationally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats

- 5.1.2 Technological Advancements

- 5.2 Market Restraints

- 5.2.1 Operational and ROI Concerns

- 5.3 Technology Snapshot

- 5.3.1 Evolution of Access Control Solutions

- 5.3.2 Comparitive Analysis of RFID and NFC Technology

- 5.3.3 Key Technological Trends

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Card Reader and Access Control Devices

- 6.1.1.1 Card-based

- 6.1.1.2 Proximity

- 6.1.1.3 Smart Card (Contact and Contactless)

- 6.1.2 Biometric Readers

- 6.1.3 Electronic Locks

- 6.1.4 Software

- 6.1.5 Other Types

- 6.1.1 Card Reader and Access Control Devices

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 South Korea

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Suprema Inc.

- 7.1.2 Tyco International PLC (Johnson Controls

- 7.1.3 Bosch Security Systems

- 7.1.4 Ajax Systems

- 7.1.5 Honeywell International Inc.

- 7.1.6 Nedap NV

- 7.1.7 Thales Group (Gemalto NV)

- 7.1.8 Allegion PLC

- 7.1.9 ASSA ABLOY AB Group

- 7.1.10 Schneider Electric SE

- 7.1.11 Panasonic Corporation

- 7.1.12 Brivo Systems LLC

- 7.1.13 Identiv Inc.

- 7.1.14 Dormakaba Holding AG

- 7.1.15 NEC Corporation

- 7.1.16 Idemia Group

- 7.1.17 Axis Communication AB