|

市場調查報告書

商品編碼

1550203

Cap Liner:市場佔有率分析、產業趨勢、成長預測(2024-2029)Cap Liners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

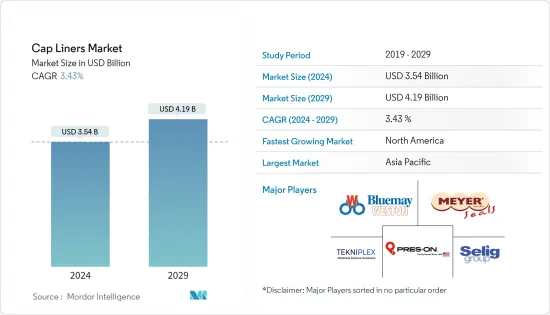

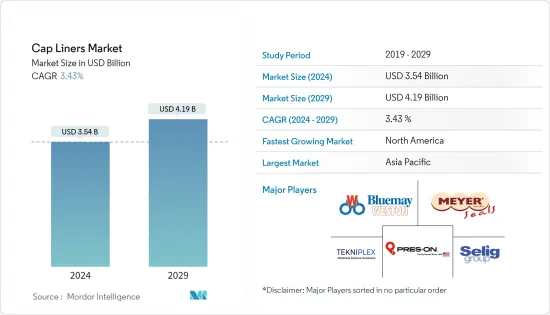

Cap Liner市場規模預計到2024年為35.4億美元,預計到2029年將達到41.9億美元,預計在預測期內(2024-2029年)複合年成長率為3.43%。

隨著包裝行業不斷突破界限,包裝行業對瓶蓋襯墊的需求預計將激增。在食品、飲料和製藥等多個最終用戶行業中,瓶蓋內襯變得比以往任何時候都更加重要。

瓶蓋內襯的防篡改功能正在將其需求推向新的高度。各種瓶蓋襯墊正在徹底改變包裝行業,包括必需品、壓感和熱感應型。

公司擴大轉向使用永續材料來減少碳排放。對於產品製造商來說,採用透氣感應瓶蓋襯墊來解決高海拔地區的瓶子塌陷問題尤其有希望。人們越來越依賴這些襯墊來改善包裝產品的密封、品牌和貨架可見度。

根據整合式 Liner Technologies 的說法,常見的瓶蓋襯墊類型包括矽膠、丁基橡膠、PTFE、聚乙烯和鋁箔。每種產品都具有針對最終用戶行業的不同需求而客製化的獨特優勢,選擇過程取決於內容化學、溫度敏感性和外部脆性等因素。這些考慮因素旨在確保耐化學性、靈活性、緩衝性和法規遵循性,所有這些對於維持品質和安全標準都至關重要。

此外,消費者對食品安全和永續性意識的提高正在推動創新瓶蓋內襯材料和設計的採用。此外,製藥公司根據其與內容物的兼容性以及保持密封完整性的能力來選擇瓶蓋襯墊,這對於在儲存期間保護樣品至關重要。

您還可能面臨由於蓋子和內襯之間接觸不良而導致的密封不良、洩漏和溢出等挑戰。 IH 蓋內襯的過度加熱會損害包裝質量,並且是市場上的一個挑戰。然而,塑膠或聚酯內襯的使用令有環保意識的公司感到失望,並阻礙了瓶蓋內襯的廣泛採用。

瓶蓋內襯市場趨勢

製藥業擴大使用瓶蓋內襯

- 藥品生產和包裝受到嚴格監管,包裝合作夥伴必須熟悉產業要求。製藥公司負責人依靠感應封蓋機來確保非處方 (OTC)錠劑、錠劑和液體的安全。

- 根據設計,感應密封提供了核准的防篡改解決方案。容器的邊緣會留下襯裡殘留物,以通知消費者容器已打開。感應密封不僅具有防篡改功能,而且還可透過防止洩漏和保持產品新鮮度在製藥業務中發揮作用。感應蓋的氣密密封可防止氧氣和濕氣損壞容器中的內容物。

- 根據整合式 Technologies 的說法,製藥公司在選擇實驗室儲存容器的瓶蓋襯墊時非常謹慎。這些襯墊包括矽膠、丁基橡膠、PTFE、聚乙烯和鋁箔,其選擇基於其與內容物的兼容性以及保持密封完整性的能力,這對於防止樣品污染非常重要。每種襯管類型都具有根據您的製藥需求量身定做的獨特優勢。

- 此外,瓶蓋內襯的選擇過程取決於內容物的化學性質、溫度敏感性以及對外部元素的脆弱性。透過優先考慮耐化學性、靈活性、緩衝和氣密密封,公司確保其產品符合嚴格的監管標準,並維持業界最高的品質和安全基準。

- 由於疾病的增加,製藥業也在成長。根據Astra Zeneca,2023年至2027年拉丁美洲醫藥市場的成長預測為22%,其中拉丁美洲預計佔據全球首位,其次是歐洲,成長10.6%。然而,由於各種藥品的包裝要求不斷增加,製藥業的崛起可能會進一步提振瓶蓋內襯市場。

北美預計將成為最大的成長地區

- 塑膠蓋和密封件在許多行業中都至關重要,可提供經濟高效的密封解決方案。熱感應蓋和襯裡與多種塑膠(如 PP、HDPE 和 LDPE)相容,不僅可以防止洩漏,還可以提供增強的詐欺性能。這種雙重功能將在預測期內推動市場成長。

- 包裝飲料和藥品的需求正在急劇增加。因此,預計接受調查的市場在預測期內的需求也會增加。消費者的健康意識日益增強,對健康飲品的需求也不斷增加。這使得個人更容易獲得瓶裝水,從而推動了區域瓶蓋內襯市場的成長。

- 該地區大量消費非酒精飲料,包括瓶裝水。美國擁有廣泛的消費群,主導全球瓶裝水市場。 FDA 規定,密封在容器中的瓶裝水僅供人類飲用,不得含有任何其他成分。根據飲料行銷公司和國際瓶裝水協會 2023 年 3 月發布的報告,瓶裝水將在 2022 年成為美國最受歡迎的飲料,約佔所有飲料消費的 25%。

- 此外,根據Monster Beverage Corporation的數據,就2023年美國非酒精飲料銷售成長率而言,能量飲料類別將以8.3%領先,其次是碳酸飲料,成長3.6%。因此,飲料成長率的上升預計將加強全部區域的瓶蓋內襯市場。

瓶蓋內襯產業概況

瓶蓋內襯市場由多家從事該行業的公司組成,例如 Tekni-Plex Inc.、Meyer Seals GmbH、Bluemay Weston Limited、Press-On Corporation、Selig UK Limited 和 B&B Cap Liners LLC。公司專注於透過收購、合作、合併和其他策略來擴展業務。

- 2024 年 1 月,TekniPlex 推出了一系列新的可回收紙基底感應熱封襯墊。 ProTecSeals 可回收 IHS 襯墊由樹漿製成的可回收紙製成。與傳統 IHS 內襯相同的標準,提供防潮和阻隔性、防洩漏、防止污染並延長保存期限。

- 2023 年 6 月 Selig UK Limited 宣布推出推出容器密封和通風技術的新網站,擴大業務。新網站整合了多個舊網站的內容,以展示 Selig 的多樣化解決方案和產品。為了反映公司的全球影響力和基本客群,該網站提供五種語言版本:英語、普通話、法語、德語和西班牙語。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 安全可靠地處理、儲存和運輸產品

- 製藥業需求增加

- 市場限制因素

- 不合適的內襯會縮短保存期限或導致產品洩漏。

第6章 市場細分

- 依材料類型

- 橡皮

- 金屬

- 塑膠

- 紙

- 按用途

- 瓶子

- 瓶子/容器

- 依產品類型

- 導熱帽內襯

- 一件

- 兩件套

- 半月班輪

- 其他導熱帽襯

- 壓感襯裡

- 其他產品類型

- 導熱帽內襯

- 按最終用戶產業

- 食品

- 飲料

- 個人護理和化妝品

- 化學品/肥料

- 油、潤滑劑、潤滑脂

- 居家護理

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 法國

- 德國

- 西班牙

- 英國

- 土耳其

- 亞太地區

- 中國

- 印度

- 日本

- 泰國

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Meyer Seals GmbH

- Tekni-Plex Inc.

- Bluemay Weston Limited

- Press-On Corporation

- B&B Cap Liners LLC

- Low's Cap Seal Sdn Bhd

- Tien Lik Cap Seal Sdn Bhd

- Captel International Pvt. Ltd

- The Cary Company

- Selig UK Limited

- MFI Capliners

第8章主要企業概況熱圖分析

第9章公司分類分析-新興企業和現有公司

第10章投資分析

第11章 市場未來展望

The Cap Liners Market size is estimated at USD 3.54 billion in 2024, and is expected to reach USD 4.19 billion by 2029, growing at a CAGR of 3.43% during the forecast period (2024-2029).

The demand for cap liners in the packaging industry is poised to surge as the industry pushes its boundaries. Cap liners are gaining unprecedented importance in multiple end-user industries, such as food, beverage, and pharmaceuticals, driven by the growing reliance of the affluent population.

Cap liners' ability to establish tamper evidence propels their demand to new heights. A wide array of cap liners, including essential, pressure-sensitive, and heat induction, is revolutionizing the packaging industry.

Businesses are increasingly turning to sustainable materials to shrink their carbon footprints. Adopting vented induction cap liners to tackle the high-altitude bottle collapsing issue is particularly promising for product manufacturers. Industries increasingly rely on these liners to enhance the sealing, branding, and shelf appeal of their packaged product.

According to Integrated Liner Technologies, the prevalent cap liner types include silicone, butyl rubber, PTFE, polyethylene, and foil. Each offers distinct advantages tailored to different end-user industry needs, with the selection process hinging on factors like content chemistry, temperature sensitivity, and external vulnerability. These considerations aim to ensure chemical resistance, flexibility, cushioning, and regulatory compliance, all pivotal for upholding quality and safety standards.

Moreover, heightened consumer awareness of food safety and sustainability is driving the adoption of innovative cap liner materials and designs. Also, pharmaceutical companies select cap liners based on their compatibility with the contents and ability to maintain seal integrity, which is crucial for safeguarding samples in storage.

The market might also face challenges, such as poor cap-liner contact, leading to inadequate sealing, leaks, and spills. Excessive heating of induction cap liners compromises packaging quality and challenges the market. However, using plastic or polyester liners is a letdown for eco-conscious businesses, hindering the wider adoption of cap liners.

Cap Liners Market Trends

Increased Use of Cap Liners in the Pharmaceutical Industry

- Pharmaceutical production and packaging are subject to stringent regulations, necessitating packaging partners to be well-versed in the industry's demands. Pharmaceutical packagers rely on induction cap sealers to secure over-the-counter (OTC) prescription pills, tablets, and liquids.

- By design, induction seals offer an approved tamper-evident solution. They leave a liner residue on the container lip, signaling to consumers of any prior opening. Beyond tamper-evidence, induction seals also aid pharmaceutical operations by ensuring leak prevention and preserving product freshness. The airtight seal on the induction cap prevents oxygen and moisture from compromising the container's contents.

- According to Integrated Liner Technologies, pharmaceutical companies meticulously select cap liners for their lab storage containers. These liners, including silicone, butyl rubber, PTFE, polyethylene, and foil, are chosen based on their compatibility with the contents and ability to maintain seal integrity, which is crucial for preventing sample contamination. Each liner type offers distinct advantages tailored to the pharmaceutical product's needs.

- Additionally, the selection process of cap liners depends on content chemistry, temperature sensitivity, and vulnerability to external elements. By prioritizing chemical resistance, flexibility, cushioning, and hermetic sealing, companies ensure their products meet stringent regulatory standards, upholding the industry's highest quality and safety benchmarks.

- The pharmaceutical industry is also growing owing to the rise in diseases. According to AstraZeneca, the projected pharmaceutical market growth between 2023 and 2027 in Latin America is expected to be 22%, with Latin America taking the top position globally, followed by Europe recording a 10.6% growth. However, a rise in the pharmaceutical industry would further boost the cap liners market, with growing packaging requirements for various medicines and drugs.

North America is Expected to be the Largest-growing Regional Market

- Plastic caps and closures are pivotal in many industries, offering a cost-effective sealing solution. Heat induction cap liners, compatible with a range of plastics like PP, HDPE, and LDPE, not only prevent leaks but also enhance tamper-proof features. This dual functionality is set to drive market growth over the forecast period.

- The demand for packaged beverages and pharmaceutical drugs has been increasing enormously. As a result, the market studied is also expected to register increased demand during the forecast period. Consumers are becoming increasingly health-conscious, and the demand for healthy beverages is rising. This has made bottled water more accessible to individuals, aiding the regional cap liner market's growth.

- The region witnesses vast consumption of non-alcoholic beverages, including bottled water. The United States dominates the global market for bottled water, boasting an extensive consumer base. The FDA specifies that bottled water, sealed in its container, is solely intended for human consumption and must not contain any additional ingredients. According to a report published by the Beverage Marketing Corporation and the International Bottled Water Association in March 2023, bottled water was the most popular drink in the United States in 2022, accounting for about 25% of all beverage consumption.

- Further, according to Monster Beverage Corporation, in terms of sales value growth of non-alcoholic beverages in the United States in 2023, the energy drinks segment took the top position with 8.3%, followed by carbonated soft drinks with 3.6% in the same year. Therefore, rising beverage growth is expected to bolster the cap liners market across the region.

Cap Liners Industry Overview

The cap liners market is fragmented, with various players, such as Tekni-Plex Inc., Meyer Seals GmbH, Bluemay Weston Limited, Press-On Corporation, Selig UK Limited, and B&B Cap Liners LLC, operating in the industry. The players are focused on expanding their business through acquisitions, collaborations, mergers, and other strategies.

- January 2024: TekniPlex launched a new series of recyclable, paper-based induction heat seal liners designed to seal dry pharma, nutrition, and food products in bottles and jars with protective properties identical to conventional solutions. The ProTecSeals Recyclable IHS Liners are made of recyclable paper from tree pulp. They offer moisture and oxygen barrier properties, resist leaks, prevent contamination, and prolong shelf life to the same standard as traditional IHS liners.

- June 2023: Selig UK Limited announced that it was expanding its business by launching a new website that consolidates its container sealing and venting technologies. The new site integrates content from several legacy websites and exhibits Selig's diverse solutions and products. To reflect the company's global presence and customer base, the website was made available in five languages: English, Mandarin, French, German, and Spanish.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Safe and Secure Handling, Storage, and Transport of Products

- 5.1.2 Increased Demand from the Pharmaceutical Industry

- 5.2 Market Restraints

- 5.2.1 Improper Liners May Shorten Shelf Life or Cause Leakage of Products

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Rubber

- 6.1.2 Metal

- 6.1.3 Plastic

- 6.1.4 Paper

- 6.2 By Application

- 6.2.1 Bottles

- 6.2.2 Jars & Containers

- 6.3 By Product Type

- 6.3.1 Heat-induction Cap Liners

- 6.3.1.1 One-piece

- 6.3.1.2 Two-piece

- 6.3.1.3 Halfmoon Liner

- 6.3.1.4 Other Heat-induction Cap Liners

- 6.3.2 Pressure Sensitive Liners

- 6.3.3 Other Product Types

- 6.3.1 Heat-induction Cap Liners

- 6.4 By End-user Industry

- 6.4.1 Food

- 6.4.2 Beverage

- 6.4.3 Personal Care & Cosmetics

- 6.4.4 Chemicals & Fertilizers

- 6.4.5 Oil, Lubricants, and Grease

- 6.4.6 Home Care

- 6.4.7 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 France

- 6.5.2.2 Germany

- 6.5.2.3 Spain

- 6.5.2.4 United Kingdom

- 6.5.2.5 Turkey

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Thailand

- 6.5.3.5 Australia and New Zealand

- 6.5.4 Latin America

- 6.5.4.1 Brazil

- 6.5.4.2 Mexico

- 6.5.5 Middle East and Africa

- 6.5.5.1 United Arab Emirates

- 6.5.5.2 Saudi Arabia

- 6.5.5.3 Egypt

- 6.5.5.4 South Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Meyer Seals GmbH

- 7.1.2 Tekni-Plex Inc.

- 7.1.3 Bluemay Weston Limited

- 7.1.4 Press-On Corporation

- 7.1.5 B&B Cap Liners LLC

- 7.1.6 Low's Cap Seal Sdn Bhd

- 7.1.7 Tien Lik Cap Seal Sdn Bhd

- 7.1.8 Captel International Pvt. Ltd

- 7.1.9 The Cary Company

- 7.1.10 Selig UK Limited

- 7.1.11 M.F.I. Capliners