|

市場調查報告書

商品編碼

1550228

休閒航海導航軟體:市場佔有率分析、產業趨勢、成長預測(2024-2029)Recreational Marine Navigation Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

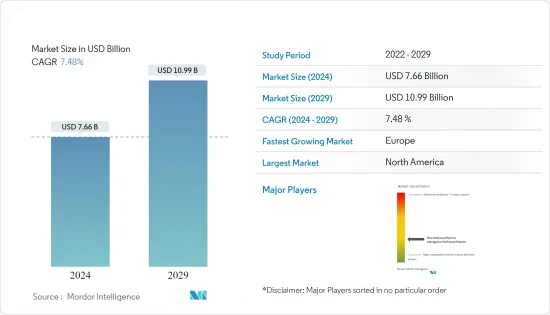

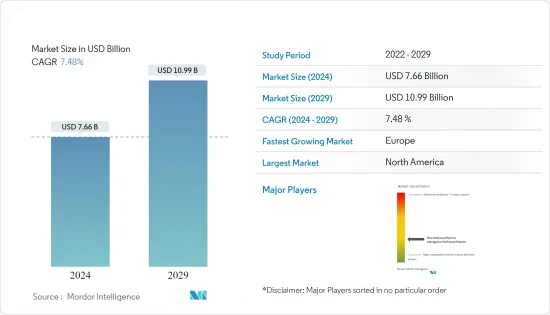

預計2024年市場規模為76.6億美元,預計2029年將達到109.9億美元,在預測期內(2024-2029年)複合年成長率為7.48%。

主要亮點

- 海上航行涉及船舶航行的規劃、管理和指導,依賴航海技術、專業知識和科學技術的結合。

- 在海上,船舶依靠有關其位置、速度和航向的準確資料來安全且有效率地到達目的地。在離開或進入港口時,這種對準確性的需求尤其重要。船長和高級船員等海事專業人士依靠航海導航軟體在海上引導船舶。該軟體整合了全球導航衛星系統(GNSS)、電子導航海圖(ENC)、即時資料和先進演算法。這些技術共同為有效的海上導航提供了基本功能,包括準確定位、路線規劃和避免碰撞。

- 海洋導航軟體對於當今的海員來說已經變得至關重要,它提高了海上的安全性、效率和環境責任。透過利用軟體,使用者可以規劃更準確的到達時間、導航更安全的路線、降低事故風險、提高效率、減少排放氣體,並實現持續的燃油節省。

- 巡航、帆船和賽車等海洋休閒正迅速普及。每項活動都有自己的要求,安全性和易用性至關重要。路線規劃、AIS 功能、雷達覆蓋和探魚器等功能很重要,但其重要性各不相同。因此,對休閒航海導航軟體(包括路線規劃、安全錐和里程表導航)的需求正在上升。

- 如今,很少有水手的行動電話上沒有導航應用程式,而且遊艇上也越來越青睞平板電腦,而不是固定的多功能顯示器 (MFD)。手邊有導航資訊很有幫助,但水手的資訊優先順序與摩托艇駕駛者不同。雖然天氣更新很受歡迎,但了解潮汐預報才是最重要的。水手們會注意風向、與航線的相關性以及附近地標等細節。休閒航海導航軟體將所有這些服務整合到一個平台中。

休閒航行導航軟體市場趨勢

休閒航海導航中物聯網技術和位置鄰近性的整合推動市場成長

- 聯合國國際海事組織(IMO)引入了海事物聯網的概念,最初稱為「電子導航」。該舉措的核心目標是海上導航資料的合理化數位化,以增強廣泛的海事服務。與其他物聯網應用一樣,強大的通訊,尤其是機器類型通訊 (MTC),將在實現這一願景中發揮至關重要的作用。

- 隨著雷達和自動駕駛儀不斷發展,iOS 划船應用程式也變得更加多樣化。如今,很少會遇到智慧型手機上沒有導航應用程式的水手。事實上,許多人在遊艇上選擇平板電腦而不是固定多功能顯示器 (MFD),因為他們欣賞在旅途中觸手可及的導航訊息的好處。雖然有很多選擇,但一些導航應用程式已經在水手中流行起來。

- 對於水手和遊艇所有者來說,優先事項與摩托艇所有者不同。雖然了解天氣仍然很重要,但水手們非常重視了解潮汐模式、風力及其如何影響導航,尤其是與航向相關的因素。此外,深入了解附近的興趣點,以增強休閒航海體驗。

北美佔最大市場佔有率

- 根據美國海岸警衛隊海岸防衛隊和划船安全研究所的報告,2023 年,美國擁有約 1,150 萬艘註冊休閒船,位居世界第一。加拿大成為休閒划船領域的重要參與者。

- 傳統上,一個國家的休閒遊艇數量與GDP和人口有關。較大的經濟體和人口往往擁有較多的船隻,但也有例外。例如,加拿大。儘管加拿大的人口比美國少,但加拿大卻擁有世界上休閒遊艇數量最多的國家之一。這種異常現像很大程度上是由於其廣闊的海岸線和複雜的運河網路孕育了強大的划船文化。

- 有幾個因素推動北美休閒航海導航軟體市場的成長。這些包括可支配收入的增加、都市化、高技術採用率以及對戶外活動的興趣增加。隨著人口的增加和採用先進的海洋導航技術,對休閒海洋導航軟體的需求將進一步成長。

休閒航行導航軟體產業概況

休閒航海導航軟體市場競爭激烈,主要企業包括 Timezero、i-Boating、Rose Point 和 Expedition Marine。他們利用收購、發布和合作等策略來部署尖端軟體。這些公司也優先考慮研發,不斷突破技術界限並鞏固其市場主導地位。

- 2024 年 4 月,主要企業Seadronix 宣布了其最新創新產品 Rec-SEA 插件。這種先進的人工智慧軟體利用雷射雷達和雷達等船上感測器將傳統船舶轉變為「智慧」船舶。 Rec-SEA 外掛不僅提高了安全性,還提高了海上環境中的業務效率。

- 2024 年 3 月,Kongsberg Discovery 發布了 Seapath(R) 385,慶祝其慣性導航產品線誕生 30 週年。這個最先進的系統結合了最先進的硬體和先進的導航演算法,保證了水文測量無與倫比的準確性。 Seapath 385 將慣性技術和處理演算法與各種衛星訊號整合在一起,包括多頻 GPS、GLONASS、伽利略、北斗、QZSS 和地球靜止衛星。無縫處理來自 Kongsberg Discovery 的優質 MGC(R)(運動陀螺指南針)或 MRU(運動參考單元)慣性感測器的資料以及 GNSS資料,以提供 RTK、PPP 或 DGNSS 校正。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 物聯網技術與位置鄰近性的整合

- GIS、繪圖和建模工具的進步

- 基於雲端基礎的部署的增加

- 市場限制因素

- 初始基礎設施成本很高

- 開放原始碼軟體可用性

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 關鍵使用案例和案例研究

- 生態系分析

第5章市場區隔

- 依產品

- 軟體

- 服務

- 依部署類型

- 雲

- 本地

- 按平台

- 筆記型電腦

- 移動的

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭狀況

- 公司簡介

- Timezero

- i-Boating

- Rose Point

- EuroNav

- Expedition Marine

- NaAVIC

- Chetu

- BME-Barrenjoey Marine Electrics

- Danelec Marine A/S

- Periskal Group

第7章 投資分析

第8章 市場機會及未來趨勢

The Market size is estimated at USD 7.66 billion in 2024, and is expected to reach USD 10.99 billion by 2029, growing at a CAGR of 7.48% during the forecast period (2024-2029).

Key Highlights

- Marine navigation involves planning, managing, and directing a vessel's voyage, relying on seamanship, professional expertise, and the integration of science and technology.

- At sea, vessels depend on precise data regarding their position, speed, and heading to reach their destinations safely and efficiently. This need for accuracy is especially crucial during port departures and arrivals. Maritime professionals, such as ship captains and navigators, utilize marine navigation software to guide vessels at sea. This software integrates Global Navigation Satellite Systems (GNSS), electronic navigation charts (ENCs), real-time data, and advanced algorithms. Together, these technologies provide precise positioning, route planning, collision avoidance, and other essential features for effective maritime navigation.

- Marine navigation software has become indispensable for today's sailors, enhancing maritime safety, efficiency, and environmental responsibility. By leveraging this software, users can plan more precise arrival times, sail safer routes, reduce the risk of incidents, improve efficiency, and cut emissions, leading to continual fuel savings.

- Marine recreational activities, such as cruising, sailing, and racing, are experiencing a surge in popularity. Each of these activities has its own unique requirements, with safety and user-friendliness being top priorities. Features like route planning, AIS capabilities, radar overlays, and fish finders, while important, hold varying degrees of significance. Consequently, the demand for recreational marine navigation software, including route planning, security cones, and odometer navigation, is on the rise.

- Today, it's uncommon to find a sailor without a navigation app on their phone, with tablets increasingly preferred over fixed multifunction displays (MFDs) on yachts. While having navigation information at hand and on the go is convenient, sailors prioritize different information compared to motorboaters. While weather updates are appreciated, understanding the tide forecast is paramount. Sailors focus on details like wind direction, its relevance to their course, and nearby landmarks. Recreational marine navigation software consolidates all these services in one platform.

Recreational Marine Navigation Software Market Trends

Integration of IoT Technology and Location Proximity in Recreational Marine Navigation is Fueling the Market's Growth

- The International Maritime Organization (IMO) of the United Nations introduced the concept of maritime IoT, initially termed "e-navigation." This initiative's core objective was to streamline and digitize marine navigation data, enhancing a spectrum of maritime services. As with any IoT application, robust communication, particularly MTC (Machine Type Communication), plays a pivotal role in realizing this vision.

- While radar and autopilots have seen advancements, a diverse array of iOS boating applications is increasingly aiding boaters. Today, it's a rarity to encounter a sailor without a navigation app on their smartphone. In fact, many are opting for tablets over fixed multifunction displays (MFDs) on yachts, appreciating the advantage of having navigation information readily available on the go. Amidst the plethora of options, several navigation apps have emerged as favorites among sailors.

- For sailors and yacht owners, their priorities differ from those of motorboaters. While weather awareness remains crucial, sailors place a premium on comprehending tide patterns, wind dynamics, and their implications on navigation, especially in relation to their course. Additionally, they seek insights on nearby points of interest, enhancing their recreational sailing experiences.

North America to Hold Largest Market Share

- In 2023, the US, with around 11.5 million registered recreational boats, dominated the global count, as reported by the US Coastguard and Boating Safety Association. Canada emerges as a significant player in the recreational boating sector.

- Traditionally, a nation's recreational boat count correlates with its GDP and population. While larger economies and populations tend to have more boats, there are exceptions. Take Canada, for example. Despite a smaller population compared to the US, it boasts a notable recreational boat count on the world stage. This anomaly is largely due to its extensive coastline and intricate canal network, nurturing a robust boating culture.

- Several factors are driving the growth of North America's recreational marine navigation software market. These include rising disposable incomes, urbanization, a strong tech adoption rate, and a growing interest in outdoor activities. As the population swells and embraces advanced marine navigation technology, the demand for recreational marine navigation software is set for further growth.

Recreational Marine Navigation Software Industry Overview

In the Recreational Marine Navigation Software market, key players like Timezero, i-Boating, Rose Point, and Expedition Marine engage in fierce competition. They leverage strategies like acquisitions, launches, and collaborations to roll out cutting-edge software. These firms also prioritize R&D, constantly pushing the boundaries of technology to cement their market dominance.

- April 2024: Seadronix, a key player in AI maritime solutions, introduced its latest innovation: the Rec-SEA Plugin. This advanced AI software transforms traditional vessels into 'smart' ships by leveraging onboard sensors such as LiDAR and RADAR. The Rec-SEA Plugin not only enhances safety but also elevates operational efficiency in maritime environments.

- March 2024: Celebrating the 30th anniversary of its inertial navigation product line, Kongsberg Discovery unveiled the Seapath(R) 385. This state-of-the-art system combines cutting-edge hardware with advanced navigation algorithms, ensuring unmatched precision for hydrographic surveying. Seapath 385 integrates inertial technology and processing algorithms with a wide array of satellite signals, including multi-frequency GPS, GLONASS, Galileo, Beidou, QZSS, and geostationary. It seamlessly processes data from Kongsberg Discovery's premium MGC(R) (motion gyro compass) or MRU (motion reference unit) inertial sensors, alongside GNSS data, offering RTK, PPP, or DGNSS corrections.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration of IoT Technology and Location Proximity

- 4.2.2 Advancement in GIS, Mapping, and Modelling Tools

- 4.2.3 Rise in Cloud-based Deployment

- 4.3 Market Restraints

- 4.3.1 High Initial Expenses in Infrastructure

- 4.3.2 Availability of Open-source Software

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Key Use Cases and Case Studies

- 4.6 Ecosystem Analysis

5 MARKET SEGMENTATION

- 5.1 By Offering

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment Type

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Platform

- 5.3.1 Laptop/PCs

- 5.3.2 Mobile

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Rest of World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Timezero

- 6.1.2 i-Boating

- 6.1.3 Rose Point

- 6.1.4 EuroNav

- 6.1.5 Expedition Marine

- 6.1.6 NaAVIC

- 6.1.7 Chetu

- 6.1.8 BME - Barrenjoey Marine Electrics

- 6.1.9 Danelec Marine A/S

- 6.1.10 Periskal Group