|

市場調查報告書

商品編碼

1550284

ANZ 袋包裝:市場佔有率分析、產業趨勢、成長預測(2024-2029 年)ANZ Pouch Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

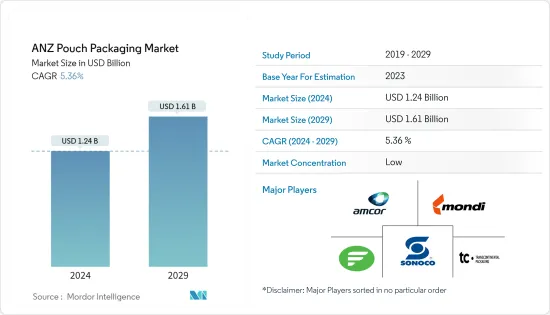

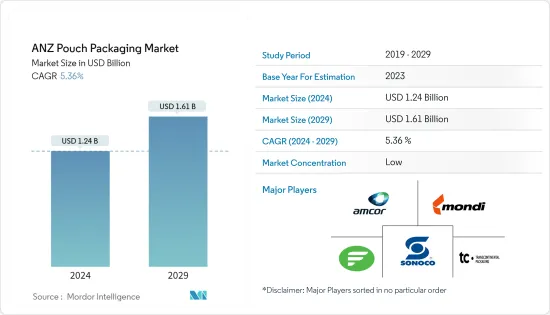

預計到 2024 年,ANZ 袋包裝市場規模將達到 12.4 億美元,預計在預測期內(2024-2029 年)複合年成長率為 5.36%,到 2029 年將達到 16.1 億美元。

出貨量方面,預計將從2024年的118.9億台擴大到2029年的157.7億台,預測期間(2024-2029年)複合年成長率為5.81%。

在食品產業需求不斷成長的推動下,澳洲和紐西蘭的袋包裝市場正經歷顯著成長。與傳統包裝相比,袋包裝的成本效率正在推動市場成長。

主要亮點

- 小袋包裝透過在運輸和儲存過程中調節溫度、排除氧氣、吸收水分來保持產品的新鮮度。聚乙烯和聚丙烯等常用材料可確保包裝的快速拆卸。由於其多功能性,軟包裝可用於多種行業,包括食品、飲料、個人護理和藥品。

- 過去十年,澳洲人口迅速增加,導致對消耗品,特別是塑膠包裝的需求增加。這種偏好主要是由於塑膠的輕質特性,使其更便於攜帶。消耗品包括飲料、預包裝餐點和便利套餐,其中包括可用於微波爐和烤箱的選項。這些消費者偏好可能會推動對袋包裝的需求。

- 為了因應這些發展,澳洲宣布了雄心勃勃的 2025 年國家包裝目標。這些目標代表著朝著更永續的包裝方法邁出的重要一步,需要市場相關人員和政府的廣泛支持。 2025 年目標非常全面,涵蓋了該國的所有包裝活動,澳洲包裝規範組織 (APCO) 在其實施方面處於主導。

- 紐西蘭的雜貨和食品零售業持續擴張。從美國進口的產品包括包裝食品、寵物食品和肉類。這增加了該地區袋包裝市場的需求。

- 此外,在紐西蘭通膨主導地位的推動下,紐西蘭零售市場的銷售持續強勁,其中超級市場和雜貨業處於主導。該地區的包裝市場也面臨挑戰。紐西蘭在 2023 年面臨持續的物流障礙、利率上升和家庭支出增加,消費者支出出現放緩跡象。 2023 年雜貨業收益下降。

ANZ袋包裝市場趨勢

電子商務對方便包裝產品的需求不斷成長

- 生活方式的改變正在推動該地區的袋包裝市場。市場對單份和方便攜帶式包裝的需求不斷增加。澳洲食品出口的崛起得益於電子商務的激增和物流的加強。包裝市場的品牌正在將重點轉向增強品牌體驗,並強調便利性。

- 根據澳洲郵政的研究,包括食品和酒類在內的電子商務領域佔線上購買量的 20.6%,與前一年同期比較增 11.4%。此外,包括大型賣場和網上市場在內的商店佔網上購物的18.1%,與前一年同期比較增8.6%。

- 澳洲製造商擴大採用方便、靈活的包裝解決方案。電子商務的爆發正在重塑包裝市場,並改變遊戲規則。製造商正在轉向軟包裝,以確保更快、更安全的產品交付。

- 據紐西蘭零售業協會稱,到 2030 年,線上購物預計將佔紐西蘭零售總額的 20%。消費者期望無縫的購物旅程,對全通路零售的要求也越來越高。傳統零售商必須優先考慮線上平台並進行行銷,以保持競爭力。結合多種溝通管道與客戶互動正在成為標準做法。

- 根據澳洲國民銀行的數據,截至2024 年4 月,就國內零售商線上零售支出的年成長率而言,百貨公司以38.7% 的成長率領先,其次是個人和娛樂產業,成長率為12.6%,食品和酒精飲料行業的成長率為12.6%。家庭更喜歡軟包裝而不是硬包裝,以適應他們不斷變化的生活方式。隨著小家庭數量的增加,對單劑量包裝的需求不斷增加。

已調理食品和食品產業預計將經歷強勁成長

- 在勞動力不斷成長和工作生活動態不斷變化的推動下,即食包裝食品在澳洲很受歡迎。根據 CSIRO 的報告,到 2030 年,國內已烹調和冷凍包裝食品的消費額預計將達到 37 億美元,反映了消費模式和人口結構的變化。

- 隨著澳洲擴大方便餐的生產,對軟包裝的需求將激增,推動市場成長。帶有噴嘴和封口的軟包裝袋可保持新鮮度和風味,並可容納各種固態和流質食品。

- 澳洲包裝市場主要受到生活方式變化的推動,攜帶式食品包裝的需求顯著激增。此外,電子商務的興起也有助於鞏固澳洲作為食品貿易主要參與者的地位。根據澳洲統計局的數據,2020年食品零售業的年營業額為1,515.5億澳元,2023年將上升至1,684.5億澳元。自2004年以來,澳洲食品零售業銷售額與前一年同期比較穩定成長。

- 根據國際貨幣基金組織(IMF)的數據,該國就業人數預計將從 2021 年的 279 萬人增加至 297 萬人。紐西蘭的雜貨業由三家主要企業主導:Foodstuffs New Zealand、Progressive Enterprises(以 Countdown 名義經營)和 Warehouse Group。這三家公司佔據了全國雜貨零售市場高達 90% 的佔有率。特別值得注意的是獨立商店、蔬菜水果店和小型便利商店的混合。

- 美國農業部表示,隨著通貨膨脹率飆升至 7%,紐西蘭消費者正在將很大一部分食品支出從非必需品轉向主食。這項調整引發了人們對奢侈品的挑剔眼光。消費者越來越被具有獨特賣點或具有顯著健康益處(例如實際營養或感知健康)的產品所吸引。紐西蘭零售市場的銷售持續強勁。紐西蘭當前的通膨環境導致超級市場和雜貨銷售快速成長,這也推動了市場成長。

澳洲和紐西蘭袋包裝市場

澳洲和紐西蘭的小袋包裝市場較為分散,國內有多家大型企業,如 Amcor PLC、Mondi PLC、Sonoco Products Company、TransContinental Packaging New Zealand 和 Filton Packaging。在該地區營運的公司致力於透過創新、合作、收購和合併來擴大業務。

- 2023年9月,澳洲軟包裝公司Filton Packaging收購了澳洲Contour Packaging (ACP),一家國內輪廓套袋解決方案供應商。透過此次收購,Filton Packaging 預計將增強其在袋子、輪廓套和印刷方面的製造能力。 ACP 預計將利用 Filton 廣泛的產品和服務來滿足客戶的需求。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 電子商務和方便的包裝產品導致需求不斷成長

- 市場限制因素

- 對包裝材料的動態和嚴格的規定

第6章 行業法規、政策與標準

第7章 市場區隔

- 依材料類型

- 塑膠

- 紙

- 鋁箔

- 按樹脂類型 - 塑膠

- 聚乙烯

- 聚丙烯

- 寵物

- PVC

- EVOH

- 其他樹脂

- 按類型

- 標準

- 無菌的

- 蒸餾

- 熱填充

- 依產品

- 平面(枕頭形狀和側封)

- 起來

- 按最終用戶產業

- 食品

- 糖果零食

- 冷凍食品

- 生鮮食品

- 乳製品

- 乾糧

- 肉類、家禽、魚貝類

- 寵物食品

- 其他食品(調味料、香辛料、抹醬、醬料、調味料等)

- 醫療/製藥

- 個人護理和家居產品

- 其他最終用戶產業(汽車、化工、農業)

- 食品

- 按國家/地區

- 澳洲

- 紐西蘭

第8章 競爭格局

- 公司簡介

- Amcor PLC

- Sonoco Products Company

- Favourite Packaging

- ePac Holdings LLC

- Mondi Plc

- Caspack New Zealand

- Transcontinental Packaging New Zealand

- TotalPak Ltd

- Filton Packaging

- Allflex Packaging

第 9 章回收與永續性觀點

第10章 未來展望

The ANZ Pouch Packaging Market size is estimated at USD 1.24 billion in 2024, and is expected to reach USD 1.61 billion by 2029, growing at a CAGR of 5.36% during the forecast period (2024-2029). In terms of shipment volume, the market is expected to grow from 11.89 billion units in 2024 to 15.77 billion units by 2029, at a CAGR of 5.81% during the forecast period (2024-2029).

The pouch packaging market in Australia and New Zealand is witnessing significant growth, driven by increasing demand from the food industry. The cost efficiency of pouch packaging compared to traditional packaging is driving the market growth.

Key Highlights

- Pouch packaging maintains product freshness by regulating temperature, eliminating oxygen, and absorbing moisture during transit or storage. Commonly used materials like polyethylene and polypropylene ensure the packaging breaks down quickly. Its versatility makes flexible packaging accessible across various industries, including food, beverage, personal care, pharmaceutical, and others.

- Over the last decade, Australia's population surged, leading to increased demand for consumables, particularly favoring plastic packaging. This preference is primarily attributed to the lightweight nature of plastic, which bolsters their portability. The consumables include beverages, packaged meals, and convenience packages, including microwave and oven-safe options. Such consumer preferences in the country might push the need for pouch packaging.

- Australia unveiled its ambitious 2025 National Packaging Targets in response to these trends. These targets represent a significant stride toward a more sustainable packaging approach, requiring widespread backing from market players and the government. The 2025 Targets are comprehensive, covering all packaging activities in the nation, with the Australian Packaging Covenant Organisation (APCO) leading the charge in their execution.

- The grocery and food retail sector continues to expand in New Zealand. Imports from the United States include packaged food, pet food, and meat, among others. This would leverage the need for the pouch packaging market in the region.

- Additionally, the retail market in New Zealand sustained robust sales, with supermarkets and grocery segments leading the charge, buoyed by the nation's prevailing inflation. The region also witnessed challenges in the packaging market. New Zealand grappled with persistent logistical hurdles, elevated interest rates, and increased household expenses in 2023, and consumer spending showed signs of moderation. The grocery sector's revenue declined in 2023.

ANZ Pouch Packaging Market Trends

Rising Demand From E-commerce for Convenient Packaging Products

- Lifestyle changes are propelling the pouch packaging market in the region. The market witnessed an increase in demand for single-serve and convenient portable packs. Australia's rising prominence in food exports can be attributed to the surge in e-commerce and enhanced logistics. Brands in the packaging market are pivoting toward enhancing brand experiences, with a notable emphasis on convenience.

- According to a survey by Australia Post, the e-commerce sector witnessed rapid growth, including food and liquor, which accounted for a 20.6% share of online purchases and an 11.4% Y-o-Y increase. Additionally, stores encompassing large retailers and online marketplaces accounted for an 18.1% share of online purchases, marking an 8.6% Y-o-Y increase.

- Manufacturers in Australia are increasingly adopting convenient and flexible packaging solutions. The surge in e-commerce has been a game-changer, reshaping the packaging market. Manufacturers are gravitating toward flexible packaging primarily for its promise of swifter and more secure product deliveries.

- According to Retail NZ, by 2030, online purchases are projected to account for 20% of all retail sales in New Zealand. Consumers increasingly demand omnichannel retailing, expecting a seamless shopping journey. Traditional retailers must pivot, prioritizing and marketing their online platforms to stay competitive. Embracing diverse communication channels for customer engagement is set to become standard practice.

- According to the National Australia Bank, in the annual growth in online retail spending by domestic merchants as of April 2024, the departmental stores took the top position with 38.7%, followed by the personal and recreational industry with 12.6% and grocery and liquor with 10.7%. Households prefer more flexible packaging over rigid options to align with their evolving lifestyles. With the rise of smaller households, the demand for single-serve packaging is increasing.

Ready-to-eat Meals and the Food Industry are Expected to Witness Significant Growth

- Ready-to-eat packaged meals are popular in Australia, driven by the growing working population and evolving work-life dynamics. As per a CSIRO report, the domestic consumption of prepared and frozen packaged meals is projected to be valued at USD 3.7 billion by 2030, reflecting spending patterns and demographic shifts.

- As Australia ramps up its production of convenient meals, the demand for flexible packaging is set to soar, fueling market growth. Flexible packaging pouches equipped with spouts and closures preserve freshness and flavor and accommodate a wide array of solid and liquid food products.

- Australia's packaging market is primarily propelled by shifting lifestyles, with a notable surge in demand for portable food packs. Additionally, bolstered by a rise in e-commerce, Australia is solidifying its position as a critical player in the food trade. According to the Australian Bureau of Statistics, the annual revenue of the food retail industry in 2020 was AUD 151.55 billion, which increased to AUD 168.45 billion in 2023. Since 2004, Australia's food retail revenue has witnessed steady year-on-year growth.

- According to the International Monetary Fund (IMF), the country's employment is expected to reach 2.97 million from 2.79 million in 2021. New Zealand's grocery sector is dominated by three key players: Foodstuffs New Zealand, Progressive Enterprises (operating as Countdown), and the Warehouse Group, the latter resembling a Walmart, with a significant focus on groceries. These three entities command a staggering 90% share of the nation's grocery retail landscape. Notably, the sector is further diversified by a mix of independents, greengrocers, and small convenience stores.

- According to the US Department of Agriculture, with price inflation soaring 7%, consumers in New Zealand are shifting a significant portion of their food spending from discretionary items to staples. This adjustment has led to a more discerning approach to luxury goods. Consumers are gravitating toward products that offer a unique selling point or boast notable health benefits, whether in actual nutrition or perceived well-being. The retail market in New Zealand has continued to show strong sales. Due to New Zealand's current inflationary environment, supermarkets and grocery sales are witnessing rapid growth, driving the market growth as well.

ANZ Pouch Packaging Industry Overview

The pouch packaging market in Australia and New Zealand is fragmented, with the presence of many domestic and major players, such as Amcor PLC, Mondi PLC, Sonoco Products Company, Transcontinental Packaging New Zealand, and Filton Packaging. Companies operating in the region are focused on expanding their business through innovations, collaborations, acquisitions, mergers, etc.

- September 2023: Australia-based flexible packaging company Filton Packaging acquired Australian Contour Packaging (ACP), a domestic provider of contoured sleeves and bag solutions. The deal was expected to help Filton Packaging bolster its manufacturing capacity to produce bags, contour sleeves, and printing work. ACP was expected to leverage Filton's extensive range of products and services to fulfill its customers' requirements.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand from E-commerce and Convenient Packaging Products

- 5.2 Market Restraints

- 5.2.1 Dynamic and Stringent Regulations Against Packaging Materials

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGMENTATION

- 7.1 By Material Type

- 7.1.1 Plastic

- 7.1.2 Paper

- 7.1.3 Aluminum Foil

- 7.2 By Resin Type - Plastic

- 7.2.1 Polyethylene

- 7.2.2 Polypropylene

- 7.2.3 PET

- 7.2.4 PVC

- 7.2.5 EVOH

- 7.2.6 Other Resins

- 7.3 By Type

- 7.3.1 Standard

- 7.3.2 Aseptic

- 7.3.3 Retort

- 7.3.4 Hot Fill

- 7.4 By Product

- 7.4.1 Flat (Pillow & Side-Seal)

- 7.4.2 Stand-up

- 7.5 By End-User Industry

- 7.5.1 Food

- 7.5.1.1 Candy & Confectionery

- 7.5.1.2 Frozen Foods

- 7.5.1.3 Fresh Produce

- 7.5.1.4 Dairy Products

- 7.5.1.5 Dry Foods

- 7.5.1.6 Meat, Poultry, And Seafood

- 7.5.1.7 Pet Food

- 7.5.1.8 Other Food Products (Seasonings & Spices, Spreadables, Sauces, Condiments, etc.)

- 7.5.2 Medical and Pharmaceutical

- 7.5.3 Personal Care and Household Care

- 7.5.4 Other End user Industries ( Automotive, Chemical, and Agriculture)

- 7.5.1 Food

- 7.6 By Country

- 7.6.1 Australia

- 7.6.2 New Zealand

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor PLC

- 8.1.2 Sonoco Products Company

- 8.1.3 Favourite Packaging

- 8.1.4 ePac Holdings LLC

- 8.1.5 Mondi Plc

- 8.1.6 Caspack New Zealand

- 8.1.7 Transcontinental Packaging New Zealand

- 8.1.8 TotalPak Ltd

- 8.1.9 Filton Packaging

- 8.1.10 Allflex Packaging