|

市場調查報告書

商品編碼

1550323

日本塑膠包裝薄膜:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Japan Plastic Packaging Film - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

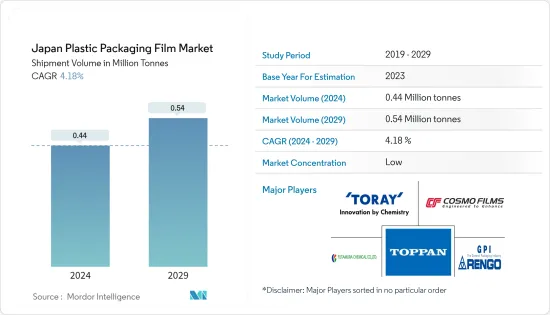

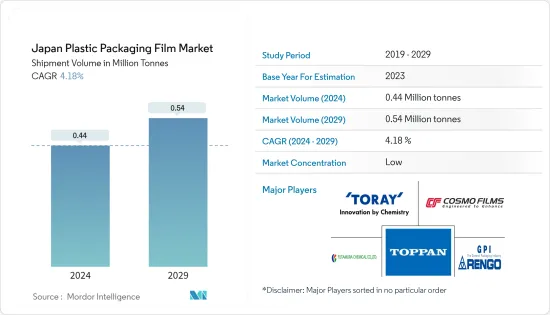

日本塑膠包裝薄膜市場規模(以出貨量為準)預計將從2024年的44萬噸成長到2029年的54萬噸,預測期間(2024-2029年)複合年成長率為4.18%。

主要亮點

- 在日本,食品工業的成長有望促進塑膠薄膜的銷售。這種快速成長主要歸功於薄膜優異的防潮和隔氧性能。聚丙烯包裝薄膜的化學和物理性能很有吸引力,食品和飲料行業越來越受到聚丙烯包裝薄膜的吸引。

- 日本工業經常需要客製化包裝解決方案。專為電子、個人護理和製藥行業設計的客製化拉伸膜有助於滿足這些多樣化的需求。

主要亮點

- 根據 Nipro Corporation 統計,過去幾年日本藥品包裝銷售額從 2019 年的 355.3 億日圓(2.2 億美元)增至 2023 年的 517.5 億日圓(3.2 億美元)。預計未來藥品包裝的持續成長將持續下去,從而推動對包裝薄膜和拉伸薄膜的需求。

- 此外,主要商業中心電子商務和零售活動的激增增加了對安全包裝解決方案(尤其是拉伸膜)的需求,以在運輸過程中保護貨物。拉伸薄膜的持續技術進步帶來了高性能變化,以滿足廣泛的行業需求。

- 日本包裝產業長期以來依賴大量塑膠,導致對永續和可回收包裝薄膜的需求增加。由於塑膠包裝的成本效益,領先製造商繼續支持塑膠包裝。環保且可回收的包裝材料(例如拉伸膜)的日益普及是消費者選擇和監管要求的結果。

- 日本政府推出了新的塑膠回收策略,目標是到2030年將塑膠包裝的回收率降低60%,一次性塑膠的回收率降低25%。這項舉措將影響一次性購物袋、袋子、小袋和小袋的需求,特別是那些由聚丙烯薄膜製成的產品,並抑制市場成長。

日本塑膠包裝薄膜市場趨勢

對聚丙烯 (PP) 薄膜的強勁需求支撐了營收

- 聚丙烯薄膜越來越受歡迎作為包裝材料。由於其密度低,因此具有成本效益,被定位為多種包裝應用的替代材料,包括聚乙烯、聚氯乙烯、聚酯和賽珞玢。該薄膜可應用於多種行業,從食品和飲料、製藥、個人護理到工業產品、文具、菸草和紡織品。

- 日本快速成長的食品工業預計將提振聚丙烯薄膜的銷售。聚丙烯薄膜因其卓越的防潮和氧氣阻隔能力而脫穎而出,使其成為食品和飲料公司的首選。公司之所以被該產品所吸引,是因為它能夠延長保存期限並防止水分和空氣等外部因素的影響。

- 隨著衛生意識的增強,日本消費者對抗病毒和抗菌產品越來越感興趣,特別是在住宅、醫療和商業環境中。採用聚合物除生物劑配製的聚丙烯包裝薄膜走在了這一趨勢的前沿,可有效抑制多種微生物的生長,包括真菌和細菌。這些薄膜採用活性抗菌劑配製,以增強其抗真菌功能。

- 該市場的成長主要是由於軟包裝薄膜在各行業的日益普及。此外,隨著人們對 PP 包裝薄膜優勢的認知不斷增強,尤其是與其他塑膠食品包裝薄膜相比,銷售量預計將大幅成長。特別是日本食品飲料、電子產品、化妝品和個人護理市場的擴張在推動聚丙烯包裝薄膜的需求方面發揮著至關重要的作用。

- 根據2024年4月日本財務省報告,過去幾年日本電子設備出口額持續成長,從2019年的585.9億美元增加至768.7億美元。隨著出口貿易的增加,預計整個市場對高阻隔PP薄膜的需求也將增加。

對糖果和糖果零食的需求促進了銷售

- 日本擁有亞洲最大的糖果零食市場之一。日本消費者喜歡外國糖果零食,經常吃糖果零食。特別是,日本糖果零食市場充滿活力,巧克力和糖果零食趨勢在季節期間多次變化,為新參與企業創造了巨大的機會。

- 隨著消費者的健康意識和養生意識日益增強,他們更喜歡口味和營養均衡的偏好食品,並傾向於選擇無罪惡感的選擇。這一趨勢不僅刺激了糖果零食的創新,消費者現在也要求糖果零食採用永續、環保和可回收的包裝薄膜。

- 在國內糖果零食業,對輕質、高防護、美觀和阻隔性包裝的需求不斷成長,預計將促進糖果零食包裝行業的銷售。這種包裝的感性吸引力不僅吸引了購買者,而且大大提升了市場前景。

- 根據全日本糖果零食協會2024年4月的公告,2023年日本糖果零食產量約2,000噸。日式糖果零食以傳統的日式點心為主,此外還有零嘴零食、餅乾、巧克力等。

- 日本糖果零食業的主要企業早已在該行業佔據了一席之地,包括明治控股、江崎格力高和森永公司。值得注意的是,像朝日這樣以前與糖果零食沒有聯繫的公司正在向糖果零食生產多元化發展,擴大競爭領域。這種多樣化可能會增加日本對包裝薄膜的需求。

日本塑膠包裝薄膜產業概況

日本塑膠包裝薄膜碎片化,碎片化程度中等,如東麗先進薄膜、科斯莫薄膜有限公司、二村化學、凸版等。該市場由提供原料和包裝服務的主要和本地參與者組成。包裝和薄膜材料的最新開拓正在塑造市場。

2024 年 3 月 知名印刷包裝解決方案供應商凸版(總部:日本)宣布推出 GL-SP,一款針對永續包裝的尖端阻隔薄膜。此開創性產品是與印度凸版特種薄膜 (TSF) 合作開發的,採用雙軸延伸聚丙烯(BOPP) 作為基材。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 全行業對輕量、永續包裝的需求不斷成長

- 食品、飲料和製藥業的強勁需求推動成長

- 市場限制因素

- 政府對塑膠使用採取嚴格政策

第6章 市場細分

- 按類型

- 聚丙烯(雙軸延伸聚丙烯(BOPP)、流延聚丙烯(CPP))

- 聚乙烯(低密度聚乙烯(LDPE)、線型低密度聚乙烯(LLDPE))

- 聚對苯二甲酸乙二醇酯(雙向拉伸聚對苯二甲酸乙二醇酯(BOPET))

- 聚苯乙烯

- 生物基

- PVC、EVOH、PETG等薄膜類型

- 按最終用戶

- 食品

- 糖果零食

- 冷凍食品

- 生鮮食品

- 乳製品

- 乾糧

- 肉類、家禽、魚貝類

- 寵物食品

- 其他食品

- 衛生保健

- 個人護理和家庭護理

- 工業包裝

- 其他最終用戶

- 食品

第7章 競爭格局

- 公司簡介

- Toray Advanced Film Co. Ltd

- Futamura Chemical Co., Ltd.

- Cosmo Films Limited

- Toppan Packaging Product Co. Ltd.

- Rengo Co., Ltd

- Kingchuan Packaging

- KISCO LTD

- Gunze Limited

- GSI Creos Corporation

- Unitika LTD.

第 8 章回收與永續性觀點

第9章 市場機會及未來趨勢

The Japan Plastic Packaging Film Market size in terms of shipment volume is expected to grow from 0.44 Million tonnes in 2024 to 0.54 Million tonnes by 2029, at a CAGR of 4.18% during the forecast period (2024-2029).

Key Highlights

- The food industry's growth in Japan is poised to boost plastic film sales. This surge is primarily due to the films' exceptional moisture and oxygen barrier capabilities. The food and beverage sectors are increasingly drawn to polypropylene packaging films, enticed by their appealing chemical and physical attributes.

- Japanese industries frequently demand bespoke packaging solutions for their distinct products. Tailored stretch films, designed for the electronics, personal care, and pharmaceutical sectors, are instrumental in addressing these varied requirements.

- According to Nipro Corporation, its pharmaceutical packaging-related sales in Japan increased in the past years from JPY 35.53 billion (USD 0.22 billion) in 2019 to JPY 51.75 billion (USD 0.32 billion) in 2023. This constant increase in pharmaceutical packaging is expected to continue in the future, consequently driving the demand for packaging films and stretch films.

- Moreover, the surge in e-commerce and retail activities in major commercial hubs has heightened the need for secure packaging solutions, particularly stretch films, to safeguard goods during transit. Ongoing technological advancements in stretch films have resulted in the creation of high-performance variants tailored to meet a wide array of industry requirements.

- Japan's packaging industry has long relied on significant amounts of plastic, prompting a growing demand for sustainable and recyclable packaging films. Major manufacturers continue to favor plastic packaging due to its cost-effectiveness. The increasing popularity of environmentally friendly and recyclable packaging materials, such as stretch films, is a result of consumer choices and regulatory requirements.

- Japan's government has rolled out a fresh plastic circulation strategy, targeting a 60% recycling rate for plastic packaging and a 25% cut in single-use plastics by 2030. This initiative is poised to temper market growth, particularly impacting the demand for single-use shopping bags, sacks, pouches, and sachets crafted from polypropylene films.

Key Highlights

Japan Plastic Packaging Film Market Trends

Strong Demand For Polypropylene (PP) Films Aids the Top-Line

- Polypropylene film, an increasingly favored packaging material, is versatile. Its low density makes it cost-effective and positions it as a substitute for a range of materials, such as polyethylene, polyvinyl chloride, polyester, and cellophane, in numerous packaging applications. This film finds applications across various industries, from food and beverages, pharmaceuticals, and personal care to industrial goods, stationery, cigarettes, and textiles.

- The burgeoning food industry in Japan is poised to bolster the sales of polypropylene films. These films stand out for their exceptional moisture and oxygen barrier capabilities, making them a prime choice for food and beverage companies. Businesses have been drawn to their products for their capacity to prolong shelf life and shield against external elements like moisture and air.

- With a heightened focus on hygiene, Japanese consumers increasingly turn to antiviral and antibacterial products, especially in residential, medical, and commercial settings. Polypropylene packaging films infused with polymeric biocides are at the forefront of this trend, effectively inhibiting the growth of various microorganisms, including fungi and bacteria. These films are engineered with an active antimicrobial agent, bolstering their antifungal capabilities.

- The market is witnessing growth primarily due to the rising adoption of flexible packaging films across diverse industries. Moreover, as awareness regarding the advantages of PP packaging films, especially in comparison to other plastic food packaging films, increases, sales are expected to surge. Notably, the expanding food & beverage, electronics, and cosmetics & personal care markets in Japan are playing a pivotal role in driving the demand for polypropylene packaging films.

- According to Ministry of Finance Japan report in April 2024, the export value of electronics from Japan have been consistently increasing in the past few years from USD 58.59 billion in 2019 to USD 76.87 billion. With the increasing export trade the demand for hight-barrier PP films are also expected to increase across the market.

Demand From Candy & Confectionery Segments To Boost Sales

- Japan boasts one of the largest confectionery markets in Asia. Japanese consumers exhibit a penchant for foreign confectionery, often indulging in sweet treats. Notably, chocolate and sweet confectionery trends shift multiple times within a season, rendering the Japanese confectionery market dynamic and a very significant opportunity for new players.

- Amid a surge in health consciousness and a quest for wellness, consumers favor indulgences that strike a balance between taste and nutrition, leaning towards guilt-free options. This trend isn't just fueling innovation in the confectionery sector and driving consumers to seek sustainable, eco-friendly, and recyclable packaging films for their treats.

- The country's confectionery sector's growing demand for lightweight, protective, visually appealing, and high-barrier packaging is set to drive up sales in the confectionery packaging segment. The sensory appeal of these packages not only entices purchases but also significantly boosts the market's prospects.

- In 2023, Japan produced approximately two thousand metric tons of confectioneries, as reported by the All Nippon Kashi Association in April 2024. The nation's confectionery landscape is dominated by traditional Japanese confectioneries (wagashi), alongside snack foods, biscuits, and chocolates.

- Key players in Japan's confectionery sector, such as Meiji Holdings, Ezaki Glico, and Morinaga & Company, have long been established in the industry. Notably, companies like Asahi, traditionally outside the confectionery realm, have diversified into sweet treat production, broadening the competitive field. This diversification is also poised to drive up the demand for packaging films in Japan.

Japan Plastic Packaging Film Industry Overview

Japan plastic film packaging is fragmented, displaying moderate fragmentation with Toray Advanced Film Co. Ltd, Cosmo Films Limited, Futamura Chemical Co., Ltd., TOPPAN Inc, and more. The market comprises major and local players supplying raw materials and packaging services. The latest developments in packaging and film materials are shaping the market.

March 2024: Toppan, a prominent printing and packaging solutions provider headquartered in Japan, has unveiled its latest offering, GL-SP, a cutting-edge barrier film designed for sustainable packaging. Developed in partnership with India's TOPPAN Speciality Films (TSF), this pioneering product uses biaxially oriented polypropylene (BOPP) as its base material.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of Substitutes

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand For Light-Weight and Sustainable Packaging Across Industries

- 5.1.2 Robust Demand From the Food, Beverage and Pharmaceutical Sector Aids Growth

- 5.2 Market Restraints

- 5.2.1 Stringent Government Policies Against the Use of Plastic

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Polypropylene (Biaxially Oriented Polypropylene (BOPP), Cast polypropylene (CPP))

- 6.1.2 Polyethylene (Low-Density Polyethylene (LDPE), Linear low-density polyethylene (LLDPE))

- 6.1.3 Polyethylene Terephthalate (Biaxially Oriented Polyethylene Terephthalate (BOPET))

- 6.1.4 Polystyrene

- 6.1.5 Bio-Based

- 6.1.6 PVC, EVOH, PETG, and Other Film Types

- 6.2 By End User

- 6.2.1 Food

- 6.2.1.1 Candy & Confectionery

- 6.2.1.2 Frozen Foods

- 6.2.1.3 Fresh Produce

- 6.2.1.4 Dairy Products

- 6.2.1.5 Dry Foods

- 6.2.1.6 Meat, Poultry, And Seafood

- 6.2.1.7 Pet Food

- 6.2.1.8 Other Food Products

- 6.2.2 Healthcare

- 6.2.3 Personal Care & Home Care

- 6.2.4 Industrial Packaging

- 6.2.5 Other End-use Industry

- 6.2.1 Food

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Toray Advanced Film Co. Ltd

- 7.1.2 Futamura Chemical Co., Ltd.

- 7.1.3 Cosmo Films Limited

- 7.1.4 Toppan Packaging Product Co. Ltd.

- 7.1.5 Rengo Co., Ltd

- 7.1.6 Kingchuan Packaging

- 7.1.7 KISCO LTD

- 7.1.8 Gunze Limited

- 7.1.9 GSI Creos Corporation

- 7.1.10 Unitika LTD.