|

市場調查報告書

商品編碼

1550330

日本商務用暖通空調:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Japan Commercial HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

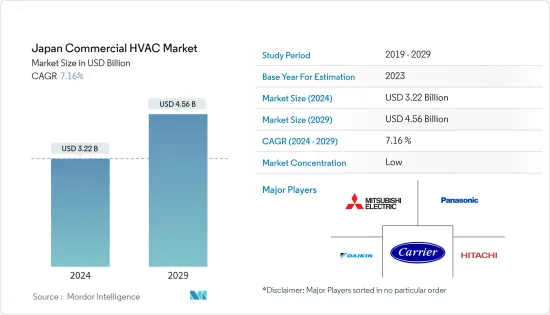

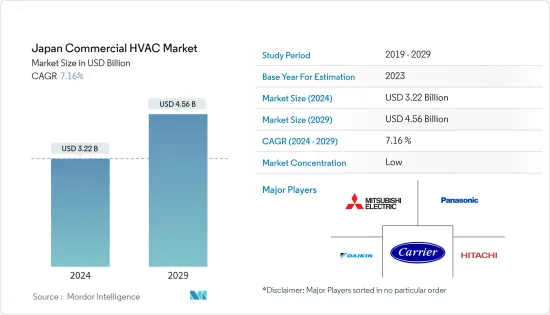

日本商務用暖通空調市場規模預計到 2024 年為 32.2 億美元,預計到 2029 年將達到 45.6 億美元,在預測期內(2024-2029 年)複合年成長率為 7.16%。

主要亮點

- 暖通空調系統對於在商業建築中創造舒適的室內環境是必要的。控制辦公空間的溫度和通風,以提高員工的工作效率和福祉。此外,它還有助於降低與濕度管理不良相關的健康風險。

- 日本日益嚴重的污染問題使環保建築成為人們關注的焦點,為希望在日本市場擴大業務的產業相關人員提供了一系列投資前景。

- 據國際能源總署(IEA)稱,日本將更新其建築規範,要求所有新建建築到 2030 年實現零能耗,現有建築到 2050 年達到這一標準。該標準旨在提高建築物的能源效率,預計將刺激市場需求。

- 此外,開發中國家資料中心、倉庫、購物中心、教育機構和其他設施的增加正在推動對商務用暖通空調系統的需求。國內資料中心建置投資快速增加。例如,2024 年 4 月,ST Telemedia World 資料 Centers (STT GDC) 宣佈在東京建造第二個資料中心設施 STT Tokyo 2,以滿足日本對關鍵數位基礎設施日益成長的需求。資料中心園區將提供高達70MW的IT容量,STT Tokyo 2計劃預計竣工後將產生高達38MW的電力。

- 不斷上漲的能源成本使得節能暖通空調系統越來越有吸引力,並具有潛在的節約潛力。然而,與安裝相關的高昂初始成本可能會阻礙廣泛接受和市場擴張。

- 日本商務用暖通空調市場較為分散,眾多公司則佔較小的市場佔有率。商務用暖通空調市場的主要市場參與企業正專注於新產品開拓、策略聯盟、收購和業務擴張,以滿足客戶不斷成長的需求,進一步推動市場成長。

- 例如,2023年8月,DAIKIN INDUSTRIES工業宣布計畫在茨城縣筑波未來市購買土地,新建一座空調專用製造工廠。這項經過深思熟慮的決定進一步推動了該公司提高國內產能和鞏固其在日本市場地位的目標。

- 此外,該國公共建築的擴建預計將支持市場成長。例如,2024年6月,花旗宣佈在日本設立花旗商業銀行(CCB)。這項舉措是花旗計劃在目標叢集內的策略成長市場建立 CCB 並推動顯著擴張的計畫的關鍵要素。

- 此外,日本的商務用暖通空調產業深受宏觀經濟因素的影響,例如政府法規和旨在促進使用節能設備的新措施。例如,日本設定了 2030 年將溫室氣體 (GHG)排放減少 46% 的目標,並計劃進一步減少 50%。

日本商務用暖通空調市場趨勢

暖通空調設備佔據主要市場佔有率

- 單分流系統是小型商業建築的首選 HVAC 系統。它具有成本效益,並且可以讓您精確控制每個房間的溫度。

- 商務用空間中的 VRF 系統可有效循環加熱和冷卻所需的冷卻劑量。這些先進的空調系統允許企業同時管理其場所內的多個空調區域。

- 此外,空氣調節機(AHU)從外部環境和室內空氣中收集空氣,過濾掉污染物,並調節商業建築內的溫度和濕度。處理後的空氣被循環回到大氣中。由於其設計和操作,AHU 比傳統商店空調機組更有效率。空調機組有潛力降低商業設施內的成本並減少能源使用。

- 在日本,由於遊客增加而導致的酒店業擴張預計將推動對商務用暖通空調系統的需求。在日本,遊客可以選擇多種度假住宿設施,包括城市飯店、商務旅館、渡假飯店、日式旅館和團體住宿設施。根據厚生勞動省統計,截至2023年3月末,日本註冊的旅館、旅館數量約90,700家,較前一年大幅增加。

- 日本入境旅遊成長迅速,市場優先考慮國內旅遊活動。儘管近年來住宿客人數量不斷增加,但只有五分之一的住宿是外國人。

商業建築領域佔據主要市場佔有率

- 商業建築部分包括辦公大樓、零售店、展示室和倉庫等基礎設施。暖氣和冷氣系統對於任何商業建築都至關重要,因為它們為居住者提供舒適的環境。

- 商務用暖通空調系統很複雜,包括暖氣、通風和空調元件。專為滿足大型建築的獨特要求而量身定做,確保卓越的室內空氣品質、能源效率和居住者滿意度。

- 商務用暖通空調系統透過協調三大系統的功能,有效調節室內溫度、控制濕度並維持空氣品質。空調裝置使用冷媒來冷卻室內空間並幫助除濕。暖氣系統使用水、散熱器盤管或瓦斯來提高室內溫度。通風系統透過過濾系統清潔空氣,並透過風扇確保適當的空氣循環。

- 在預測期內,該國辦公空間的擴張可能會推動對暖通空調服務和設備的需求。據國土交通省稱,2023 年日本將啟動約 9,580 個辦公大樓建設計劃。這些辦公大樓的占地面積與去年持平。

- 此外,主要零售商正在擴大在日本的業務,對商務用暖通空調系統和服務產生了很高的需求。高效的 HVAC 系統可以透過改善零售空間的空氣品質來帶來顯著的好處。這包括去除污染物、過敏原和難聞的氣味,最終改善購物體驗並確保顧客和員工的健康。

- 2024年1月,IKEA宣布計劃在北部關東地區開設新店。商店位置優越,旨在滿足當地社區的需求,為人口超過 700 萬的地區提供服務。宜家前橋店展現了宜家對永續性的奉獻精神,並將成為日本最環保的宜家商場。

日本商務用暖通空調產業概況

日本的商務用暖通空調市場較為分散,由多家公司組成。市場上的公司不斷努力透過推出新產品、擴大業務、進行策略併購、聯盟和合作來提高其市場佔有率。主要公司包括開利株式會社、Daikin Industries Ltd.、三菱電機株式會社、日立製作所、Panasonic Corporation等。

- 2024年5月,Midia推出了EVOX G3熱泵系統。 EVOX系列的這一新系列由EVOX G3熱泵和EVOX G3空氣調節機(AHU)組成。美的 EVOX G3 熱泵的尺寸從 1.5 噸到 5 噸不等,配備增強型蒸汽噴射 (EVI) 技術和多層熱交換器,即使在惡劣的天氣條件下也能提供可靠的溫暖,無需補充熱量。

- 2024 年 3 月,Panasonic Corporation宣布推出三款新型商務用空氣對水 (A2W) 熱泵型號,這些型號採用環保天然冷媒,專為多用戶住宅、商店、辦公室和其他輕型商業設施而設計。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19副作用和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 日本商業建築的增加

- 節能設備的需求增加

- 市場挑戰

- 節能系統的初始成本較高

第6章 市場細分

- 依零件類型

- 暖通空調設備

- 加熱設備

- 空調/通風設備

- 暖通空調服務

- 暖通空調設備

- 按最終用戶產業

- 款待

- 商業大廈

- 公共設施

- 其他

第7章 競爭格局

- 公司簡介

- Johnson Controls International PLC

- Midea Group Co., Ltd.

- Daikin Industries, Ltd.

- Robert Bosch GmbH

- Carrier Corporation

- Valliant Group

- LG Electronics Inc.

- Lennox International Inc.

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Hitachi Ltd.

- Danfoss A/S

第8章投資分析

第9章市場的未來

The Japan Commercial HVAC Market size is estimated at USD 3.22 billion in 2024, and is expected to reach USD 4.56 billion by 2029, growing at a CAGR of 7.16% during the forecast period (2024-2029).

Key Highlights

- HVAC systems are necessary for creating comfortable indoor environments in commercial buildings. In office spaces, they regulate temperatures, provide ventilation, and boost employee productivity and well-being. Furthermore, they assist in reducing health risks related to poor humidity control.

- Increasing levels of pollution in Japan have led the country to focus on eco-friendly buildings, presenting various investment prospects for industry players aiming to grow their footprint in the Japanese market.

- According to the International Energy Agency (IEA), Japan has updated its building standards, mandating that all new buildings achieve zero-energy performance by 2030 and existing structures meet this criterion by 2050. These standards, aimed at enhancing energy efficiency in buildings, are projected to stimulate market demand.

- Moreover, the increasing number of data centers, warehouses, shopping centers, educational institutions, and other facilities in developing nations is fueling the demand for commercial HVAC systems. The country is experiencing a surge in investments in the construction of data centers. For instance, in April 2024, ST Telemedia Global Data Centres (STT GDC) revealed plans to begin construction on its second data center facility in Tokyo, STT Tokyo 2, in response to the growing need for critical digital infrastructure in the country. The data center campus is expected to offer a maximum of 70 MW of IT capacity, and the STT Tokyo 2 project is expected to generate up to 38 MW upon completion.

- Energy-efficient HVAC systems are increasingly attractive in the country because of the escalating energy costs, providing potential savings. Nevertheless, the substantial upfront expenses linked to installation could hinder widespread acceptance and market expansion.

- The commercial HVAC market in Japan is fragmented, with a large number of players occupying a small market share. Key market players operating in the commercial HVAC market are focusing on new product development, strategic partnerships, acquisition, and expansion to meet the growing demand from customers, further supporting market growth.

- For instance, in August 2023, Daikin Industries, Ltd announced plans to acquire land in Tsukubamirai City, Ibaraki Prefecture, Japan, with the intention of establishing a new manufacturing plant dedicated to air conditioners. This calculated decision is set to bolster the company's domestic production capacity and further its objective of strengthening its position within the Japanese market.

- Furthermore, the rising expansion of public buildings in the country will support market growth. For instance, in June 2024, Citi revealed the introduction of Citi Commercial Bank (CCB) in Japan. This initiative is a crucial component of Citi's plan to establish CCB in strategic growth markets within targeted clusters to facilitate significant expansion.

- Additionally, the commercial HVAC industry in Japan is significantly influenced by macroeconomic elements like governmental regulations and fresh endeavors aimed at promoting the use of energy-efficient equipment. For instance, Japan has set a target to reduce its greenhouse gas (GHG) emissions by 46% by 2030, with a further ambition to achieve a 50% reduction.

Japan Commercial HVAC Market Trends

HVAC Equipment Holds the Significant Market Share

- The single split system is the preferred HVAC system for small commercial buildings. It is cost-effective and allows for precise control over the temperature in each room.

- VRF systems in commercial space efficiently circulate the precise amount of refrigerant required for heating or cooling purposes. These advanced air conditioning systems enable businesses to manage multiple air conditioning zones within their premises simultaneously.

- Moreover, Air Handling Units (AHUs) collect air from the external environment and indoor air, filter out contaminants, and regulate the temperature and humidity in the commercial building. The treated air is then circulated back into the atmosphere. Because of their design and operation, AHUs are more efficient than traditional retail air conditioning units. They can potentially lower costs and decrease energy usage within commercial establishments.

- The rising expansion of the hospitality sector in Japan due to growing tourism will propel the demand for commercial HVAC systems in the country. In Japan, travelers can choose from various holiday accommodations, including city hotels, business hotels, resorts, ryokan, and group lodgings. According to the Ministry of Health, Labour and Welfare of Japan, as of the end of March 2023, Japan had seen a surge in the number of registered hotels and inns, totaling around 90,700 establishments, which was a significant increase compared to the previous year.

- Despite Japan's rapid growth in inbound tourism, the market prioritizes domestic travel activities. Although the number of lodging guests has continuously increased in recent years, foreign nationals account for only one-fifth of overnight guests.

Commercial Building Segment Holds the Significant Market Share

- The commercial building segment compromises infrastructures, such as office buildings, retail, showrooms, and warehouses, among others. Heating and cooling systems are essential to any commercial building, as they provide occupants with a comfortable environment.

- Commercial HVAC systems are intricate, including elements for heating, ventilation, and air conditioning. They are tailored to meet large buildings' particular requirements to guarantee excellent indoor air quality, energy efficiency, and occupant satisfaction.

- Commercial HVAC systems effectively regulate indoor temperature, control humidity levels, and maintain air quality by coordinating the functions of three key systems. Air conditioning units cool indoor spaces by utilizing refrigerants, which also help in dehumidifying the air. Heating systems raise indoor temperatures using water, radiator coils, or gas. Ventilation systems clean the air with filtration systems and ensure proper air circulation with fans.

- The rising expansion of office space in the country will drive the demand for HVAC services and equipment during the projected timeline. According to the Ministry of Land, Infrastructure, Transport, and Tourism, approximately 9,580 office construction projects commenced in Japan in 2023. The floor area of these office constructions remained consistent with the previous year.

- Moreover, leading retail players are expanding their presence in the country, thus creating high demand for commercial HVAC systems and services. An efficient HVAC system offers a significant benefit by enhancing the air quality in the retail space. This involves removing pollutants, allergens, and unpleasant odors, ultimately improving the shopping experience and ensuring the well-being of both customers and employees.

- In January 2024, IKEA revealed plans to open a new store in the northern Kanto region of Japan. This store has been strategically located to serve the needs of the local communities, encompassing an area with a population of more than seven million individuals. Demonstrating IKEA's dedication to sustainability, IKEA Maebashi is set to become Japan's most environmentally friendly IKEA store, boasting the smallest operational climate impact.

Japan Commercial HVAC Industry Overview

The Japanese commercial HVAC market is fragmented and consists of several players. Companies in the market continuously try to increase their market presence by introducing new products, expanding their operations, or entering into strategic mergers and acquisitions, partnerships, and collaborations. Some of the major players include Carrier Corporation, Daikin Industries Ltd, Mitsubishi Electric Corporation, Hitachi Ltd, Panasonic Corporation, and many more.

- In May 2024, Midea has introduced the EVOX G3 heat pump system. This new iteration of the EVOX series consists of the EVOX G3 Heat Pump and EVOX G3 Air Handling Unit (AHU). Available in sizes ranging from 1.5-ton to 5-ton units, the Midea EVOX G3 heat pumps are equipped with Enhanced Vapor Injection (EVI) technology and a multi-layer heat exchanger, guaranteeing reliable warmth without the need for auxiliary heat, even in extreme weather conditions.

- In March 2024, Panasonic Corporation unveiled three new commercial air-to-water (A2W) heat pump models that utilize eco-friendly natural refrigerants designed for use in multi-dwelling units, stores, offices, and other light commercial properties.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Commercial Construction in the country

- 5.1.2 Increasing Demand For Energy Efficient Devices

- 5.2 Market Challenges

- 5.2.1 High Initial Cost of Energy Efficient Systems

6 MARKET SEGMENTATION

- 6.1 By Type of Component

- 6.1.1 HVAC Equipment

- 6.1.1.1 Heating Equipment

- 6.1.1.2 Air Conditioning /Ventillation Equipment

- 6.1.2 HVAC Services

- 6.1.1 HVAC Equipment

- 6.2 By End-User Industry

- 6.2.1 Hospitality

- 6.2.2 Commercial Buildings

- 6.2.3 Public Buildings

- 6.2.4 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Johnson Controls International PLC

- 7.1.2 Midea Group Co., Ltd.

- 7.1.3 Daikin Industries, Ltd.

- 7.1.4 Robert Bosch GmbH

- 7.1.5 Carrier Corporation

- 7.1.6 Valliant Group

- 7.1.7 LG Electronics Inc.

- 7.1.8 Lennox International Inc.

- 7.1.9 Mitsubishi Electric Corporation

- 7.1.10 Panasonic Corporation

- 7.1.11 Hitachi Ltd.

- 7.1.12 Danfoss A/S