|

市場調查報告書

商品編碼

1550466

日本的數位轉型:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Japan Digital Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

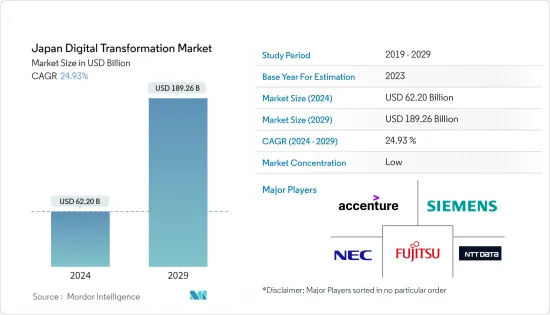

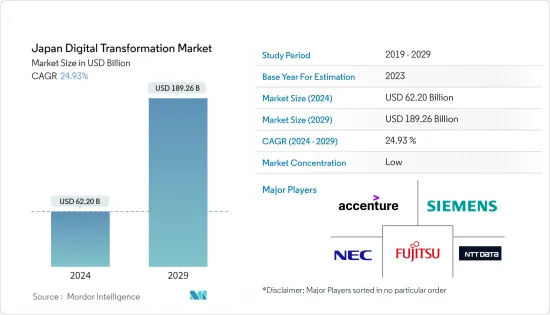

日本數位轉型市場規模預計到 2024 年為 622 億美元,預計到 2029 年將達到 1892.6 億美元,在預測期內(2024-2029 年)複合年成長率為 24.93%。

主要亮點

- 市場成長的主要驅動力是網路安全、人工智慧(AI)、巨量資料分析、商業智慧(BI)和雲端運算等先進技術的日益採用。這些技術正在改變和創新商業環境,從而增加收益。此外,透過電子郵件、協作工具和數位平台開展業務也發生了重大轉變。

- 隨著越來越多的公司採用數位體驗平台 (DXP) 來改善客戶體驗並培養品牌忠誠度,市場呈現出正面的趨勢。 BFSI、零售、IT 與電信以及醫療保健等行業處於整合 DXP 的前沿,以提高客戶參與並加速產品發布。此外,這些最終用戶公司正在與夥伴關係,將 DXP 納入商務策略。

- 英國和日本政府已合作達成協議,以在 2022 年加強政府數位轉型。合作備忘錄 (MoC) 的重點是在英國政府數位服務 (GDS) 和日本數位機構之間架起橋樑。該夥伴關係將涉及相互交流見解和策略,以改善兩國的數位政府工作。這些措施使兩國能夠在當前情況下共用對公務員進行數位教育並建立其技術能力的責任。

- 公司正在投資先進技術工具,以提高日本人民的便利性。例如,2024年5月,都營交通與DENSO WAVE共同開發了全球首個2D碼系統。該系統專用東京都營地鐵淺草線設計,允許月台門無縫打開和關閉。該門是一項重要的安全功能,可防止乘客跌落到軌道上或進入限制區域。都營地鐵在東京的 4 條線路上每天約有 220 萬名乘客使用,並最初在三田線引入了月台門。這項實施顯著減少了與平台相關的事故。

- 到2023年終,日本的數位競爭力世界排名將降至歷史最低點。瑞士商學院國際管理發展學院以其對各國數位化應對力的年度評估而聞名,該機構將日本在評估的 64 個經濟體中排名第 32 位。令人擔憂的一個主要問題是日本對變革的抵制,而資料隱私和安全問題對數位轉型工作構成了主要障礙。此外,資料外洩、未授權存取和濫用個人資訊的增加也增加了消費者、監管機構和企業對資料安全的擔憂。

- 新冠肺炎 (COVID-19) 疫情之後,日本的數位轉型力度不斷加大,企業在各個領域加大了對自動化、人工智慧和物聯網技術的投資。人們也持續關注公共服務的數位化,線上政務服務變得更加便捷和有效率。

日本數位轉型市場趨勢

電信和IT佔最大佔有率

- 在日本,5G 網路的擴張正在取得進展,並進行了大量投資來開發必要的基礎設施。日本正在積極部署5G基礎設施,NTT Docomo、KDDI、Softbank Corporation等主要通訊業者都參與了5G網路的擴展。根據內務部的資料,2023年5G合約數量將達到6,981萬個,未來預計將進一步增加。

- Softbank Corporation和 KDDI 透過 5G JAPAN 各自共同建造了超過 38,000 個 5G基地台。由於這項舉措,資本投資成本減少了 2.9 億美元(約 450 億日圓)。除了增強網路覆蓋和技術之外,通訊業者還致力於標準化 5G 和 4G基地台的建造規範。兩家公司計劃聯合採購設備。此外,兩家公司的願景是在 2024 會計年度開始技術討論和試驗,並在 2026 會計年度擴大合作。

- 日本的智慧城市利用物聯網、巨量資料、人工智慧、自動駕駛和生物識別等以資料為中心的技術。這些技術通常用於交通管理系統、智慧電網和互聯公共服務。先進的交通管理系統利用即時資料來最佳化交通流量、減少擁塞並提高大眾交通工具的效率。

- 2023 年 11 月在巴塞隆納舉行的智慧城市博覽會世界大會 (SCEWC) 為未來城市生活提供了一個平台。在此次活動中,日本參展了日本館,展示了旨在改善城市生活、提高效率和促進環境永續性的各種計劃和舉措。該展館聚集了來自日本領先企業、新興企業和地方政府的代表,以促進與全球合作夥伴的討論。會議涵蓋了各種主題,從大眾交通工具最佳化和物聯網 (IoT) 到廢棄物管理和住宅空間的數位轉型。

- 此外,資料儲存、運算能力和業務應用程式擴大採用雲端服務,促進了組織的遠端工作和協作。企業正在增加投資以提高效率、生產力和客戶體驗。

分析、人工智慧和機器學習預計將成長

- 製造業擴大採用分析、人工智慧和機器學習。這有助於預測性維護、品管和供應鏈最佳化。在日本,智慧工廠和工業4.0的概念正在廣泛傳播。因此,越來越多的公司採用人工智慧來實現流程自動化、降低營運成本並提高效率。根據Internet Initiative的資料,大約有43.4家製造企業計劃投資智慧工廠,以檢測生產設備的故障徵兆。

- 2024 年 3 月,思科系統公司、三井資訊和 KDDI Engineering 宣布合作,專門為智慧工廠部署專用 5G 網路。這三家公司計劃在愛知縣小牧市的 Shinwa Komaki SFiC 實驗室設立「工業 4.0 試驗台」。該計劃旨在為製造商提供一個平台來測試和檢驗利用商用 5G 技術的各種工業應用。潛在的應用範圍從自動導引運輸車(AGV) 到工業機器人、機器視覺系統和其他先進的工廠自動化。

- 日本政府正在透過各種措施和資助計畫積極推動人工智慧研究和開發。數位機構的成立旨在加速人工智慧在公共服務中的採用,並簡化跨部門的數位轉型工作。

- 2024 年 3 月,雲端和營運商中立的資料中心供應商 Digital Realty 宣布將開始在千葉縣印西的 NRT 園區建造第三個資料中心。該中心名為 NRT14,是 Digital Realty 全球資料中心平台 PlatformDIGITAL® 的重要補充,計劃於 2025 年 12 月開幕。 NRT14 是 Digital Realty 全球資料中心 PlatformDIGITAL® 的重要補充,計劃於 2025 年 12 月開放。

- 此外,零售商正在利用人工智慧來增強客戶洞察、供應鏈最佳化和動態定價策略。電子商務平台正在利用人工智慧提供個人化購物體驗並提高客戶維繫。

日本數位轉型產業概況

日本的數位轉型市場較為分散,市場參與者眾多,包括富士通日本有限公司、NEC公司、西門子公司、IBM公司及NTT DATA集團。市場參與者正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2024年7月,富士通與Cohere宣佈建立策略夥伴關係,為企業提供客製化的生成式人工智慧解決方案。兩家公司之間的合作重點是利用富士通的 Kozuchi AI 服務來建立專為私有雲端應用程式設計的先進日語大規模語言模型 (LLM)。此次合作將為該公司提供一流的日語能力,增強客戶服務和員工體驗。

- 2024年7月,軟銀公司與NEC公司宣佈建立以生物識別為核心的策略夥伴關係,旨在推動日本企業和政府機構的數位轉型(DX)。此次合作將 NEC 著名的生物識別套件(以 Bio-IDiom 服務為主導)與Softbank Corporation強大的 5G 網路和安全產品結合。兩家公司都致力於為廣泛的行業提供客製化解決方案。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章產業生態系統分析(數位轉型產業產品/解決方案供應商/解決方案供應商、系統整合商/VAR、連接提供者、監管機構、最終用戶、服務供應商等主要相關利益者的詳細涵蓋)

第5章市場動態

- 市場促進因素

- 日本擴大採用巨量資料分析和其他技術

- 行動裝置和應用程式的快速採用

- 市場限制因素

- 對資訊隱私和安全的擔憂

第6章當前市場場景和數位轉型的演變

第7章 關鍵指標

- 科技支出趨勢

- 物聯網設備數量

- 網路攻擊總數

- 技術人員動向

- 網路普及率

- 數位競技排名

- 固定和行動寬頻普及率

- 雲端採用

- 採用人工智慧

- 電商滲透率

第8章市場區隔

- 按類型

- 分析、人工智慧、機器學習

- 當前市場情景和預測期的市場預測

- 關鍵成長要素(促進因素、挑戰、機會)

- 使用案例分析

- 市場展望

- 擴增實境(XR)

- 當前市場情景和預測期的市場預測

- 主要成長影響因素(促進因素、挑戰、機會)

- 使用案例分析

- 市場展望

- IoT

- 當前市場情景和預測期的市場預測

- 主要成長影響因素(促進因素、挑戰、機會)

- 使用案例分析

- 市場展望

- 工業機器人

- 當前市場情景和預測期的市場預測

- 主要成長影響因素(促進因素、挑戰、機會)

- 使用案例分析

- 市場展望

- 區塊鏈

- 當前市場情景和預測期的市場預測

- 主要成長影響因素(促進因素、挑戰、機會)

- 市場展望

- 積層製造/3D列印

- 當前市場情景和預測期的市場預測

- 主要成長影響因素(促進因素、挑戰、成長機會)

- 使用案例分析

- 市場展望

- 網路安全

- 當前市場情景和預測期的市場預測

- 關鍵成長要素(促進因素、挑戰、機會)

- 使用案例分析

- 市場展望

- 雲端運算和邊緣運算

- 當前市場情景和預測期的市場預測

- 主要成長影響因素(促進因素、挑戰、機會)

- 使用案例分析

- 市場展望

- 其他(數位雙胞胎、移動性、連結性)

- 當前市場情景和預測期的市場預測

- 主要成長影響因素(促進因素、挑戰、機會)

- 按類型分類的市場區隔(數位雙胞胎、移動性、連結性)

- 使用案例分析

- 市場展望

- 分析、人工智慧、機器學習

- 按最終用戶產業

- 製造業

- 石油、天然氣和公共產業

- 零售/電子商務

- 運輸/物流

- 衛生保健

- BFSI

- 通訊/IT

- 政府/公共部門

- 其他(教育、媒體與娛樂、環境等)

第9章 競爭格局

- 公司簡介

- Fujitsu Japan Limited

- NEC corporation

- Accenture PLC

- Siemens AG

- IBM Corporation

- NTT DATA Group

- SAP SE

- Oracle Corporation japan

- Cisco Systems Inc.

- Salesforce.com Inc.

第10章 關鍵改造技術

- 量子計算

- 製造即服務 (MaaS)

- 認知過程自動化

- 奈米科技

The Japan Digital Transformation Market size is estimated at USD 62.20 billion in 2024, and is expected to reach USD 189.26 billion by 2029, growing at a CAGR of 24.93% during the forecast period (2024-2029).

Key Highlights

- The market's growth is majorly due to the rising adoption of advanced technologies like cybersecurity, artificial intelligence (AI), big data analytics, business intelligence (BI), and cloud computing. These technologies have led to transformations and innovations in the business landscape, leading to increased revenues. Moreover, there's a notable shift towards conducting business through email, collaboration tools, and digital platforms.

- The market is witnessing a favorable trend as companies increasingly adopt digital experience platforms (DXPs) to boost customer experiences and foster brand loyalty. Industries like BFSI, retail, IT & telecom, and healthcare are at the forefront, integrating DXPs to enhance customer engagement and expedite product launches. Moreover, these end-use companies are forging partnerships with their industry counterparts to embed DXPs into their business strategies.

- The UK and Japanese governments have collaborated on a deal to enhance digital government transformation in 2022. The Memorandum of Cooperation (MoC) focused on bridging the UK Government Digital Service (GDS) with Japan's Digital Agency. This partnership entails a mutual exchange of insights and strategies to elevate digital government endeavors in both nations. These initiatives helped both countries share the responsibility of giving civil servants digital training and building their technical capabilities in the current scenario.

- Companies are investing in advanced technology tools to enhance the convenience of Japanese people. For instance, in May 2024, Toei Transportation pioneered the world's inaugural 2D-code system in collaboration with Denso Wave. This system was designed specifically for the Toei Subway Asakusa Line in Tokyo, enabling the seamless opening and closing of platform doors. These doors, a crucial safety feature, are instrumental in preventing passengers from falling onto the tracks or accessing restricted areas. Toei Subway, which serves approximately 2.2 million passengers daily across its four Tokyo lines, initially deployed platform doors on the Mita Line. The implementation resulted in a significant reduction in platform-related accidents.

- By the close of 2023, Japan's digital competitiveness hit a record low in global rankings. The International Institute for Management Development, a Swiss business school renowned for its yearly evaluations of nations' digital readiness, placed Japan 32nd out of the 64 economies under review. The major cause of concern was Japan's resistance to change, and concerns over data privacy and security pose major obstacles to digital transformation efforts. Moreover, the growth of data breaches, unauthorized access, and personal information misuse has increased consumer, regulator, and business concerns regarding data safety.

- Post-COVID-19 enhanced Japan's digital transformation initiatives, as organizations increased their investments in automation, AI, and IoT technologies across various sectors. There is a continuous focus on the digitalization of public services, making government services accessible online and improving efficiency.

Japan Digital Transformation Market Trends

Telecom and IT Holds the Largest Share

- The country is experiencing an expansion of 5G networks with significant investments in building the necessary infrastructure. Japan has been actively rolling out 5G infrastructure, with major telecom operators like NTT Docomo, KDDI, and SoftBank, which are involved in expanding the 5G network. As per data from the Ministry of Internal Affairs and Communications (Japan), the number of 5G subscriptions rose to 69.81 million in 2023, which is expected to grow further.

- SoftBank and KDDI, through 5G JAPAN, have collaboratively built more than 38,000 5G base stations each. This effort has notably reduced capital expenditure costs by USD 0.29 billion (JPY 45.0 billion) for each entity. Beyond bolstering network coverage and technologies, the telcos focus on standardizing construction specs, spanning both 5G and 4G base stations. Both companies have planned joint equipment procurement. Moreover, they started to initiate technology discussions and trials in fiscal year 2024, with a vision to broaden their collaborative endeavors by fiscal year 2026.

- Japan's smart cities leverage data-centric technologies such as IoT, big data, AI, automated driving, and biometric authentication. These technologies are generally used in traffic management systems, smart grids, and connected public services. Advanced traffic management systems use real-time data to optimize traffic flow, reduce congestion, and improve public transportation efficiency.

- The Smart City Expo World Congress (SCEWC) in November 2023, held in Barcelona, served as a platform for future urban living. At the event, Japan's spotlight was its "Japan Pavilion," showcasing a spectrum of projects and initiatives designed to enhance urban living, bolster efficiency, and promote environmental sustainability. The Pavilion, featuring collaborations between major Japanese corporations, startups, and representatives from local governments, facilitated discussions with global partners. The topics covered included public transport optimization and the Internet of Things (IoT) to waste management and the digital transformation of residential spaces.

- Moreover, there is increasing adoption of cloud services for data storage, computing power, and business applications, which facilitate remote work and collaboration for organizations. Companies are increasing their investments to improve efficiency, productivity, and the customer experience.

Analytics, Artificial Intelligence and Machine Learning is Expected to Witness Growth

- The manufacturing sector's deployment of analytics, Artificial Intelligence, and Machine Learning is growing. This helps with predictive maintenance, quality control, and optimizing supply chains. Smart factories and Industry 4.0 concepts are gaining traction in Japan. Thus, businesses are increasingly adopting AI for process automation, reducing operational costs and improving efficiency. As per the data by Internet Initiative Japan, around 43.4 manufacturing companies planned to make investments in smart factories to detect signs of malfunction in production equipment

- In March 2024, Cisco Systems, Mitsui Information, and KDDI Engineering announced a collaboration to roll out a private 5G network tailored for smart factories. The trio planned for the establishment of an "Industry 4.0 Testbed" at the Shinwa Komaki SFiC Lab, situated in Komaki City, Aichi Prefecture, Japan. This initiative aimed to provide manufacturers with a platform to test and validate various industrial applications leveraging private 5G technology. Envisioned applications span from automated guided vehicles (AGVs) to industrial robots, machine vision systems, and other facets of advanced factory automation.

- The Japanese government is actively promoting AI research and development through various initiatives and funding programs. The establishment of the Digital Agency aims to foster AI adoption in public services and streamline digital transformation efforts across sectors.

- In March 2024, Digital Realty, a provider of cloud-and carrier-neutral data centers, announced the initiation of construction on its third data center on the NRT campus in Inzai, Chiba Prefecture, Japan. Dubbed NRT14, this center is a pivotal addition to Digital Realty's global data center platform, PlatformDIGITAL(R), which is planned to open in December 2025. Its launch aims to significantly bolster the availability of advanced, AI-ready infrastructure in Japan.

- Moreover, retailers are leveraging AI for enhanced customer insights, supply chain optimization, and dynamic pricing strategies. E-commerce platforms are using AI to provide personalized shopping experiences and improve customer retention.

Japan Digital Transformation Industry Overview

The Japanese digital transformation market is fragmented, with many players present in the market, such as Fujitsu Japan Limited, NEC Corporation, Siemens AG, IBM Corporation, and NTT DATA Group. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In July 2024, Fujitsu and Cohere announced a strategic partnership to offer generative AI solutions tailored for enterprises. Their collaboration centers on crafting an advanced Japanese large language model (LLM) specifically designed for private cloud applications, utilizing Fujitsu's Kozuchi AI services. This joint effort is planned to empower enterprises with top-tier Japanese language capabilities, enhancing both customer interactions and employee experiences.

- In July 2024, SoftBank Corp and NEC Corp unveiled a strategic alliance centered on biometric authentication, with the goal of propelling digital transformation (DX) within Japanese enterprises and governmental bodies. This partnership merges NEC's renowned biometric authentication suite, notably its "Bio-IDiom Services," with the robust 5G network and security offerings of SoftBank. The firms strive to deliver customized solutions to a broad spectrum of industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 INDUSTRY ECOSYSTEM ANALYSIS (Detailed Coverage of Key Stakeholders in Digital Transformation Industry Product/Solution Providers, System Integrators/VARs, Connectivity Providers, Regulatory Bodies, End-users, Service Providers, etc.)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the adoption of big data analytics and other technologies in the country

- 5.1.2 The rapid proliferation of mobile devices and apps

- 5.2 Market Restraints

- 5.2.1 Concerns about the Privacy and Security of Information

6 CURRENT MARKET SCENARIO AND EVOLUTION OF DIGITAL TRANSFORMATION PRACTICES

7 KEY METRICS

- 7.1 Technology Spending Trends

- 7.2 Number of IoT Devices

- 7.3 Total Cyberattacks

- 7.4 Technology Staffing Trends

- 7.5 Internet growth and penetration in the Country

- 7.6 Digital Competitiveness Ranking

- 7.7 Fixed and Mobile Broadband Coverage

- 7.8 Cloud adoption

- 7.9 AI adoption

- 7.10 E-commerce Penetration

8 MARKET SEGMENTATION

- 8.1 By Type

- 8.1.1 Analytics, Artificial Intelligence and Machine Learning

- 8.1.1.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.1.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.1.3 Use Case Analysis

- 8.1.1.4 Market Outlook

- 8.1.2 Extended Reality (XR)

- 8.1.2.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.2.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.2.3 Use Case Analysis

- 8.1.2.4 Market Outlook

- 8.1.3 IoT

- 8.1.3.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.3.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.3.3 Use Case Analysis

- 8.1.3.4 Market Outlook

- 8.1.4 Industrial Robotics

- 8.1.4.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.4.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.4.3 Use Case Analysis

- 8.1.4.4 Market Outlook

- 8.1.5 Blockchain

- 8.1.5.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.5.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.5.3 Market Outlook

- 8.1.6 Additive Manufacturing/3D Printing

- 8.1.6.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.6.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.6.3 Use Case Analysis

- 8.1.6.4 Market Outlook

- 8.1.7 Cybersecurity

- 8.1.7.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.7.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.7.3 Use Case Analysis

- 8.1.7.4 Market Outlook

- 8.1.8 Cloud and Edge Computing

- 8.1.8.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.8.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.8.3 Use Case Analysis

- 8.1.8.4 Market Outlook

- 8.1.9 Others (digital twin, mobility, and connectivity)

- 8.1.9.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.9.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.9.3 Market Breakdown by Type (Digital Twin, Mobility and Connectivity)

- 8.1.9.4 Use Case Analysis

- 8.1.9.5 Market Outlook

- 8.1.1 Analytics, Artificial Intelligence and Machine Learning

- 8.2 By End-User Industry

- 8.2.1 Manufacturing

- 8.2.2 Oil, Gas and Utilities

- 8.2.3 Retail & e-commerce

- 8.2.4 Transportation and Logistics

- 8.2.5 Healthcare

- 8.2.6 BFSI

- 8.2.7 Telecom and IT

- 8.2.8 Government and Public Sector

- 8.2.9 Others (Education, Media & Entertainment, Environment etc)

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Fujitsu Japan Limited

- 9.1.2 NEC corporation

- 9.1.3 Accenture PLC

- 9.1.4 Siemens AG

- 9.1.5 IBM Corporation

- 9.1.6 NTT DATA Group

- 9.1.7 SAP SE

- 9.1.8 Oracle Corporation japan

- 9.1.9 Cisco Systems Inc.

- 9.1.10 Salesforce.com Inc.

10 KEY TRANSFORMATIVE TECHNOLOGIES

- 10.1 Quantum Computing

- 10.2 Manufacturing as a Service (MaaS)

- 10.3 Cognitive Process Automation

- 10.4 Nanotechnology