|

市場調查報告書

商品編碼

1550478

SEA(東南亞)的數位轉型:市場佔有率分析、產業趨勢、成長預測(2024-2029)SEA Digital Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

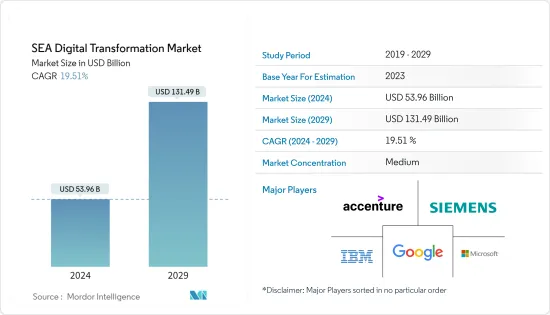

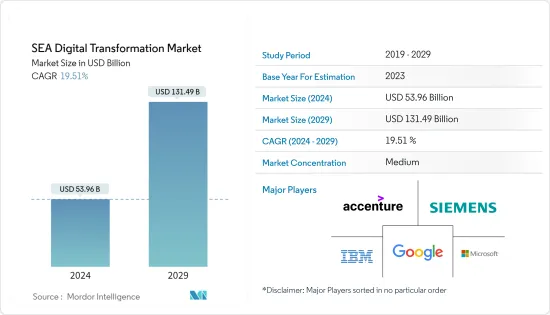

SEA(東南亞)數位轉型市場規模預計到 2024 年為 539.6 億美元,預計到 2029 年將達到 1314.9 億美元,預測期內(2024-2029 年)複合年成長率為 19.51,預計將成長%。

在科技快速採用、網路普及率不斷上升以及政府支持政策的推動下,東南亞(東南亞)的數位轉型市場正在經歷強勁成長。

主要亮點

- 人工智慧、機器學習、物聯網和雲端運算等技術的進步正在推動各個領域的數位轉型。這些創新使公司能夠簡化業務、增強客戶互動並創新經營模式。

- 東南亞(SEA)擁有強大的網路和行動普及率,推動了數位參與和數位服務的使用。連接性的增強推動了電子商務、數位付款和線上服務的成長,加速了該地區的數位化發展。

- 東南亞各國政府正在製定政策和舉措,以促進數位化和培育智慧城市。泰國 4.0、馬來西亞數位經濟藍圖和新加坡智慧舉措等著名計畫正在幫助培育數位友善景觀。

- 在銀行和金融服務領域,我們正在利用數位工具透過數位銀行、金融科技解決方案、區塊鏈等來改變客戶體驗。這個數位化支點正在簡化業務、增強客戶服務並引入創新的金融服務。

- 然而,隨著數位化的發展,網路安全和資料外洩的威脅也隨之增加。這些風險不僅損害對數位服務的信任,也為企業全面擁抱數位轉型設置障礙。

中東和非洲地區數位轉型市場趨勢

巨量資料分析和其他技術的更多採用將推動市場

- 人工智慧和機器學習透過自動化工作、提高效率和降低營運成本正在徹底改變產業。這項轉變釋放了人力資源,使其能夠專注於策略性舉措。人工智慧預測維護和品管對於減少製造中的停機時間和缺陷至關重要。

- 企業正在利用人工智慧和機器學習來提供個人化的客戶體驗,從而提高忠誠度和滿意度。例如,在電子商務中,根據瀏覽歷史和偏好來提案產品。

- 例如,在馬來西亞,從房地產到銀行業,AI的熱潮讓投資者的興趣顯著增加。該國資料中心計劃的激增凸顯了其科技主導的經濟繁榮,並暗示了相關產業的溢出效應。儘管2024年淨流出1.5億美元,但外國投資者正穩步重拾信心,為馬來西亞股市的長期前景描繪出樂觀的景象。

- 將人工智慧和巨量資料分析納入智慧城市計劃將加強城市管理並提高生活品質。這些技術有助於有效的資源配置、最佳化交通流量並增強公共服務。新加坡的智慧國家計劃利用物聯網和人工智慧來實現更有效的城市基礎設施和服務管理。

- 網際網路在這些技術的發展和應用中發揮著重要作用。新加坡提供世界上最好的網路連線。例如,截至 2023 年 11 月,Singtel 在新加坡提供最佳的 5G 覆蓋體驗,得分為 8.3,其次是 StarHub 和 M1。消息資訊來源透露,Simba 的 5G 覆蓋體驗評分最低,得分為 6.2。 2023年初,新加坡5G網路平均峰值下載速度超過700Mbps。新加坡電信不僅提供高品質的 5G 連接,還證明自己是 2023 年 5G 遊戲體驗的領先供應商之一。

分析、人工智慧和機器學習可望推動市場發展

- 企業正在利用進階分析來篩選大量資料,以做出明智的決策。其結果是提高了業務效率、完善了策略規劃並加深了對客戶的了解。特別是在零售業,預測分析對於預測需求、最佳化庫存和客製化行銷技術至關重要。

- 例如,2024年5月,新加坡宣布了一項新舉措——數位企業藍圖(DEB),旨在透過引入人工智慧技術來加強中小企業(SME)的數位轉型。 DEB 是由通訊和資訊部 (MCI)、通訊和媒體發展局 (IMDA) 以及新加坡網路安全局與主要行業相關人員合作推動的。

- 人工智慧和機器學習透過自動化任務和提高效率正在徹底改變產業。人工智慧和機器學習的整合可以最大限度地減少錯誤,降低人事費用,並釋放人力資本來承擔更高層級的職責。在製造業中,人工智慧驅動的機器人和自動品質檢查正在最佳化生產,而在客戶服務中,人工智慧聊天機器人正在管理日常查詢,以提高回應時間和滿意度。

- 新加坡等國家正快速投資以人工智慧技術為基礎的企業。例如,截至 2024 年 6 月,Trax Technology Solutions Pte. Ltd 在新加坡人工智慧企業中名列前茅,資本投資超過 10.7 億美元。值得注意的是,新加坡的創業投資創投在 2021 年達到頂峰,躍升至 25 億美元。

- 人工智慧、機器學習和物聯網技術擴大被納入智慧城市計畫中,以提高城市的生活水準。這些解決方案簡化了交通、能源使用和公共服務,最終提高了居民的生活品質。例如,在新加坡的智慧國家計畫中,人工智慧和物聯網對於有效監督城市基礎設施至關重要,從而顯著增強交通和安全服務。

SEA(東南亞)數位轉型產業概覽

SEA(東南亞)的數位轉型產業市場較為分散,參與者規模龐大且區域參與者數量眾多。市場上的主要企業正在採取合作夥伴關係、協議、創新和收購等策略來增強其服務產品並獲得永續的競爭優勢。

- 2024 年 6 月 TikTok 背後的中國科技巨頭位元組跳動累計約 100 億元人民幣(21.3 億美元)在馬來西亞建立人工智慧中心。此舉符合各大科技公司向東南亞擴張的趨勢。此外,馬來西亞投資、貿易和工業部證實,位元組跳動正在加強其在馬來西亞柔佛州的資料中心業務,並將額外投資 15 億元人民幣(約 1,000 億日元)來擴大業務。

- 2024 年 4 月 緬甸大型私人銀行 KBZ Bank 將與新加坡人工智慧信用評分公司 FinbotsAI 建立策略夥伴關係。此次合作旨在加強 KBZ 銀行的信用風險管理。根據此次合作,KBZ 銀行將整合 FinbotsAI 最先進的信用建模平台 CreditX,以更高的準確性和速度評估零售和小型企業申請人的信用度。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章產業生態系分析

第5章市場動態

- 市場促進因素

- 巨量資料分析和其他技術的更多採用將推動市場

- 行動裝置和應用程式的快速採用

- 市場限制因素

- 對資訊隱私和安全的擔憂

第6章當前市場場景和數位轉型的演變

第7章 關鍵指標

- 科技支出趨勢

- 物聯網設備數量

- 網路攻擊總數

- 技術人員動向

- 網路在每個國家的發展與傳播

- 數位競爭力排名

- 固定和行動寬頻

- 雲端滲透率

- 人工智慧滲透率

- 電商滲透率

第8章市場區隔

- 按類型

- 分析、人工智慧、機器學習

- 擴增實境(XR)

- IoT

- 工業機器人

- 區塊鏈

- 積層製造/3D列印

- 網路安全

- 雲端運算和邊緣運算

- 其他(數位雙胞胎、移動性、連結性)

- 按最終用戶產業

- 製造業

- 石油、天然氣和公共產業

- 零售/電子商務

- 運輸/物流

- 衛生保健

- BFSI

- 通訊/IT

- 政府/公共機構

- 其他最終用戶產業(教育、媒體與娛樂、環境等)

第9章 競爭格局

- 公司簡介

- Accenture PLC

- Google LLC(Alphabet Inc.)

- Siemens AG

- IBM Corporation

- Microsoft Corporation

- Cognex Corporation

- Hewlett Packard Enterprise

- SAP SE

- EMC Corporation(Dell EMC)

- Oracle Corporation

- Adobe Inc.

- Amazon Web Services Inc.(Amazon.com Inc.)

- Apple Inc.

- Salesforce.com Inc.

- Cisco Systems Inc.

第10章 關鍵改造技術

- 量子計算

- 製造即服務 (MaaS)

- 認知過程自動化

- 奈米科技

第11章 市場機會及未來趨勢

The SEA Digital Transformation Market size is estimated at USD 53.96 billion in 2024, and is expected to reach USD 131.49 billion by 2029, growing at a CAGR of 19.51% during the forecast period (2024-2029).

The Southeast Asia (SEA) digital transformation market is experiencing robust growth driven by rapid technological adoption, increasing internet penetration, and supportive government policies.

Key Highlights

- Technological advancements, notably in AI, ML, IoT, and cloud computing, are driving digital transformations across diverse sectors. These innovations empower businesses to streamline operations, elevate customer interactions, and innovate business models.

- In Southeast Asia (SEA), robust internet and mobile penetration rates are catalyzing digital engagement and the uptake of digital services. This heightened connectivity is fueling the growth of e-commerce, digital payments, and online services, thereby expediting the region's digital evolution.

- SEA governments are rolling out policies and initiatives to champion digitalization and foster smart cities. Notable programs like Thailand 4.0, Malaysia's Digital Economy Blueprint, and Singapore's Smart Nation initiative are instrumental in cultivating a digital-friendly landscape.

- The banking and financial services realm is harnessing digital tools to revamp customer experiences through digital banking, fintech solutions, or blockchain. This digital pivot is streamlining operations, enhancing customer service, and introducing novel financial offerings.

- However, as digitalization intensifies, the specter of cybersecurity threats and data breaches looms larger. These risks not only jeopardize trust in digital services but also pose a hindrance to businesses fully embracing the digital shift.

SEA Digital Transformation Market Trends

Increase in the Adoption of Big Data Analytics and Other Technologies to Drive the Market

- AI and ML are revolutionizing industries by automating tasks, boosting efficiency, and cutting operational costs. This shift allows human resources to concentrate on strategic endeavors. AI's predictive maintenance and quality control are pivotal in reducing downtime and defects in manufacturing.

- Companies are leveraging AI and ML for personalized customer experiences, fostering loyalty and satisfaction. E-commerce, for instance, tailors product suggestions based on browsing history and preferences.

- For instance, Malaysia is experiencing a significant uptick in investor interest, spanning sectors from real estate to banking, all thanks to the AI boom. The country's surge of data center projects underscores a tech-driven economic surge and hints at a ripple effect across related industries. Although 2024 saw a net outflow of USD 150 million, foreign investors are showing a steady return of confidence, painting an optimistic picture for Malaysian equities in the long run.

- Integrating AI and Big Data Analytics into smart city projects enhances urban management and elevates the quality of life. These technologies facilitate efficient resource allocation, optimize traffic flow, and bolster public services. Singapore's Smart Nation initiative exemplifies this, leveraging IoT and AI for more effective urban infrastructure and service management.

- The internet plays an important role in developing and applying these technologies. Singapore has one of the world's best and most connected internet services. For instance, as of November 2023, Singtel provided the best 5G coverage experience across Singapore, with a score of 8.3, followed by StarHub and M1. According to the source, Simba had the lowest 5G coverage experience rating, with a score of 6.2. At the beginning of 2023, Singapore had an average peak download speed of over 700 Mbps on its 5G networks. In addition to providing quality 5G connectivity, Singtel has proven itself in 2023 to be one of the leading providers of 5G gaming experiences.

Analytics, Artificial Intelligence, and Machine Learning is Expected to Drive the Market

- Organizations are harnessing advanced analytics to sift through extensive data, empowering them to make well-informed decisions. This, in turn, boosts operational efficiency, refines strategic planning, and deepens customer understanding. Notably, in retail, predictive analytics are pivotal, aiding in demand projections, inventory optimization, and tailored marketing approaches.

- For instance, in May 2024 - Singapore unveiled the Digital Enterprise Blueprint (DEB), a fresh initiative aimed at bolstering the digital transformation of small and medium-sized enterprises (SMEs) through the adoption of AI technologies. The DEB is a collaborative effort between the Ministry of Communications and Information (MCI), the Infocomm Media Development Authority (IMDA), and the Cyber Security Agency of Singapore in partnership with key industry players.

- AI and ML are revolutionizing industries by automating tasks and boosting efficiency. Their integration minimizes errors, slashes labor expenses, and liberates human capital for higher-level responsibilities. In manufacturing, AI-driven robots and automated quality checks are optimizing production, and in customer service, AI chatbots are enhancing response times and satisfaction by managing routine queries.

- Countries like Singapore are witnessing rapid investment in AI technology-based businesses. For instance, by June 2024, Trax Technology Solutions Pte. Ltd held the top spot among Singapore's AI startups, boasting a capital investment exceeding USD 1.07 billion. Notably, Singapore's AI venture capital investment hit its zenith in 2021, surging to USD 2.5 billion.

- AI, ML, and IoT technologies are increasingly being integrated into smart city initiatives, elevating urban living standards. These solutions streamline traffic, energy use, and public services, ultimately enriching residents' quality of life. Take Singapore's Smart Nation initiative, for example, where AI and IoT are pivotal in efficiently overseeing urban infrastructure, leading to notable enhancements in transportation and public safety services.

SEA Digital Transformation Industry Overview

The SEA Digital Transformation Industry market is fragmented, with the presence of major players and numerous regional companies. Key players in the market are adopting strategies such as partnerships, agreements, innovations, and acquisitions to enhance their service offerings and gain a sustainable competitive advantage.

- June 2024: ByteDance, the Chinese tech giant behind TikTok, earmarked approximately CNY 10 billion (USD 2.13 billion) to establish an artificial intelligence hub in Malaysia. This move is in line with a trend of major tech players venturing into Southeast Asia. Additionally, ByteDance is bolstering its data center presence in Malaysia's Johor state, injecting an extra CNY 1.5 billion into the expansion, as confirmed by Malaysia's Ministry of Investment, Trade, and Industry.

- April 2024: Myanmar's premier privately-owned bank, KBZ Bank, forged a strategic alliance with FinbotsAI, a Singaporean AI credit scoring company. This collaboration aims to enhance KBZ Bank's credit risk management. Under this partnership, KBZ Bank will integrate FinbotsAI's cutting-edge credit modeling platform, CreditX, to evaluate the creditworthiness of its retail and SME applicants with heightened precision and speed.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 INDUSTRY ECOSYSTEM ANALYSIS

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Adoption of Big Data Analytics and Other Technologies to Drive the Market

- 5.1.2 The Rapid Proliferation of Mobile Devices and Apps

- 5.2 Market Restraints

- 5.2.1 Concerns About the Privacy and Security of Information

6 CURRENT MARKET SCENARIO AND EVOLUTION OF DIGITAL TRANSFORMATION PRACTICES

7 KEY METRICS

- 7.1 Technology Spending Trends

- 7.2 Number of IoT Devices

- 7.3 Total Cyberattacks

- 7.4 Technology Staffing Trends

- 7.5 Internet growth and penetration in individual countries

- 7.6 Digital Competitiveness Ranking

- 7.7 Fixed and mobile broadband coverage

- 7.8 Cloud adoption

- 7.9 AI adoption

- 7.10 E-commerce Penetration

8 MARKET SEGMENTATION

- 8.1 By Type

- 8.1.1 Analytics, Artificial Intelligence and Machine Learning

- 8.1.1.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.1.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.1.3 Use Case Analysis

- 8.1.1.4 Market Outlook

- 8.1.2 Extended Reality (XR)

- 8.1.2.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.2.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.2.3 Use Case Analysis

- 8.1.2.4 Market Outlook

- 8.1.3 IoT

- 8.1.3.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.3.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.3.3 Use Case Analysis

- 8.1.3.4 Market Outlook

- 8.1.4 Industrial Robotics

- 8.1.4.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.4.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.4.3 Use Case Analysis

- 8.1.4.4 Market Outlook

- 8.1.5 Blockchain

- 8.1.5.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.5.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.5.3 Market Outlook

- 8.1.6 Additive Manufacturing/3D Printing

- 8.1.6.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.6.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.6.3 Use Case Analysis

- 8.1.6.4 Market Outlook

- 8.1.7 Cybersecurity

- 8.1.7.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.7.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.7.3 Use Case Analysis

- 8.1.7.4 Market Outlook

- 8.1.8 Cloud and Edge Computing

- 8.1.8.1 Current Market Scenario and Market Projections for the Forecast Period

- 8.1.8.2 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.8.3 Use Case Analysis

- 8.1.8.4 Market Outlook

- 8.1.9 Others (Digital Twin, Mobility, and Connectivity)

- 8.1.9.1 Key Growth Influencers (Drivers, Challenges, and Opportunities)

- 8.1.9.2 Market Breakdown by Type (Digital Twin, Mobility and Connectivity)

- 8.1.9.3 Use Case Analysis

- 8.1.9.4 Market Outlook

- 8.1.1 Analytics, Artificial Intelligence and Machine Learning

- 8.2 By End-user Industry

- 8.2.1 Manufacturing

- 8.2.2 Oil, Gas, and Utilities

- 8.2.3 Retail & e-commerce

- 8.2.4 Transportation and Logistics

- 8.2.5 Healthcare

- 8.2.6 BFSI

- 8.2.7 Telecom and IT

- 8.2.8 Government and Public Sector

- 8.2.9 Other End-user Industries (Education, Media & Entertainment, Environment etc)

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Accenture PLC

- 9.1.2 Google LLC (Alphabet Inc.)

- 9.1.3 Siemens AG

- 9.1.4 IBM Corporation

- 9.1.5 Microsoft Corporation

- 9.1.6 Cognex Corporation

- 9.1.7 Hewlett Packard Enterprise

- 9.1.8 SAP SE

- 9.1.9 EMC Corporation (Dell EMC)

- 9.1.10 Oracle Corporation

- 9.1.11 Adobe Inc.

- 9.1.12 Amazon Web Services Inc. (Amazon.com Inc.)

- 9.1.13 Apple Inc.

- 9.1.14 Salesforce.com Inc.

- 9.1.15 Cisco Systems Inc.

10 KEY TRANSFORMATIVE TECHNOLOGIES

- 10.1 Quantum Computing

- 10.2 Manufacturing as a Service (MaaS)

- 10.3 Cognitive Process Automation

- 10.4 Nanotechnology